The United States International Trade Commission (USITC) released its new fact-finding report examining the competitiveness of Bangladesh, Cambodia, India, Indonesia, and Pakistan as apparel suppliers to the United States. The study was conducted in 2024 based on input from secondary sources (e.g., trade statistics, public hearings, and desk studies) and fieldwork. Below are summaries of the key findings regarding apparel export competitiveness.

Factors that affect export competitiveness in the global apparel sector

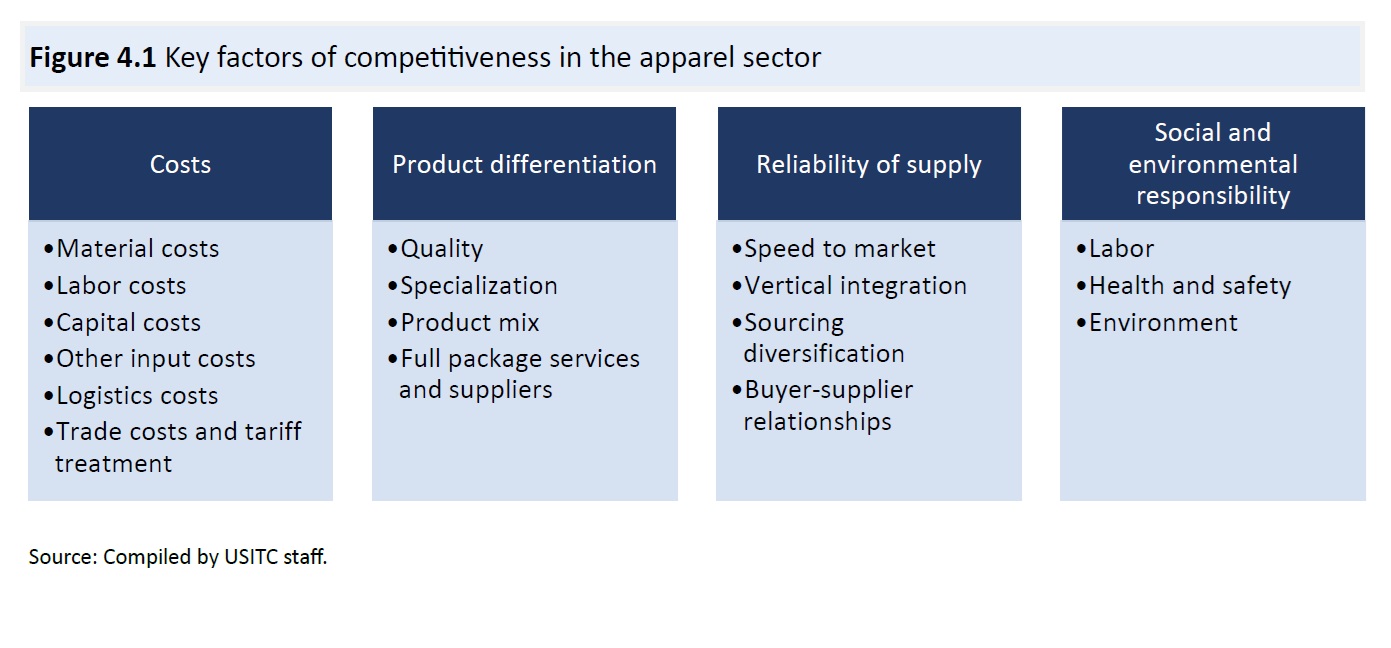

One key issue the study explored is what factors affect a country’s apparel export competitiveness and how to become a preferred apparel sourcing base for U.S. fashion companies.

The studies suggest that four types of factors are most important (see the figure above). However, consistent with existing literature, the USITC report could not determine which factor is decisive in fashion companies’ apparel sourcing decisions. For example, the report found that:

- “cost—the price buyers pay their suppliers—plays a key role in sourcing decisions, although opinions vary regarding the importance of cost relative to other factors.”

- “Depending on the product, target consumer, and identity of a brand or buyer, apparel buyers will place varying degrees of importance on product differentiation factors such as quality, specialization, product mix, and full package offerings, which include design services, finishing, packaging, and logistics.”

- “The emphasis on reliability has particularly grown in response to various recent disruptions to global apparel supply chains such as a global pandemic, geopolitical conflicts, and trade policy.”

- “Although emerging research suggests that compliance programs concerning wages, social inclusion, and climate change mitigation may increase competitiveness, buyers and brands remain divided on the topic…the relative importance, or “weight,” of such compliance in sourcing decisions remains a topic of active study and discussion within the industry.”

Cost and export competitiveness

The USITC report highlighted the complex and nuanced relationship between “costs” and a country’s apparel export competitiveness. Several patterns are noteworthy:

- Apparel is a buyer-driven industry, meaning “the global apparel supply chain gives buyers the power to negotiate based on price, which can push down prices and transfer greater costs to the supplier.”

- The ability to produce textile raw materials locally can provide cost advantages in garment production—“Material inputs are widely recognized as the largest component in the cost of a final apparel product, and these prices are largely determined by the presence of a domestic textile industry or costs of importing textiles.”

- It is difficult to compare wages across countries to measure labor competitiveness. In particular, low labor costs “do not reflect the true cost of doing business (e.g., via wage suppression)” in a country and “they can harm a country’s reputation for social compliance and negatively affect labor productivity.”

Buyer-supplier relationships in apparel sourcing

The USITC report revealed some positive developments in the buyer-supplier relationships involving U.S. fashion companies.

- Fashion companies increasingly recognize the value of building long-term relationships with their vendors. Buyers emphasize that maintaining these relationships is a key factor in sourcing decisions, largely due to the cost and time involved in finding and establishing relationships with new suppliers.

- Fashion companies’ efforts to improve supply chain transparency and traceability also need “suppliers who will act in line with their brand’s values.”

- Suppliers benefit from the long-term relationship, too. As the USITC report noted, some fashion companies guarantee suppliers a particular profit margin to ensure their continued operation. Additionally, some buyers gain a deep understanding of their suppliers’ cost structures, enabling them to calculate the costs of compliance with various standards and assist suppliers in reducing costs where possible.

- Subcontracting is still regarded as necessary for the garment industry. As noted in the USITC report, apparel orders fluctuate seasonally, making it impractical for suppliers to hire additional permanent workers or invest in machinery for peak demand. To meet buyer expectations during busy periods, manufacturers often subcontract parts of orders and increase overtime or rely on temporary contract workers. This practice is seen as essential for ensuring a reliable supply of apparel.

Social and environmental responsibility and apparel sourcing

The USITC report acknowledged the growing importance of social and environmental compliance to a country’s apparel export competitiveness. However, the relationship remains complex.

- The extent to which voluntary social and environmental responsibility programs and their associated auditing practices have influenced outcomes, especially regarding worker rights, remains unclear.

- Suppliers report that the increased frequency of flooding and high temperatures due to climate change negatively affect their ability to meet labor and environmental standards.

- Increased compliance with social and environmental standards raises supplier costs, negatively impacting their cost competitiveness. Many stakeholders note that while brands and consumers demand greater responsibility, this often does not come with a “price premium” for suppliers, who ultimately absorb these increased costs.

Note: The USITC report also evaluated the export competitiveness of each apparel-exporting country it examined, including their respective competitive advantages and issues to address.

I found that the key factors affecting competitiveness were quite explanatory. While all these countries have low labor costs all other factors can vary from country to country. The inclusion of a graph would be nice to see in this article so we can visual comprehend the amount of imports from each country. I feel as though this would explain and backup the arguments in the article and clearly define how these key factors can actually affect imports from different countries.

I found the USITC report very interesting to read about. The report highlights key factors influencing U.S. fashion companies’ apparel sourcing decisions. While cost remains crucial, factors like product differentiation, reliability, and social/environmental compliance are increasingly important. The report emphasizes that cost competitiveness goes beyond wages, involving local textile production and raw material costs. Long-term supplier relationships are valued for reliability, and subcontracting remains necessary due to seasonal demand fluctuations.

The growing emphasis on sustainability and social responsibility raises supplier costs but often lacks price premiums from buyers. Balancing cost pressures with sustainability and reliability is a complex challenge for apparel suppliers.

While the factors themselves were not extraordinarily new or surprising, the breakdown included in the summary does raise some questions. Mainly, the balance between the importance of cost and the importance of utilizing sustainable and ethical manufacturing. It was interesting to read about how the effects of climate change negatively affect suppliers’ ability to meet environmental standards, and that pressures of compliance with standards remains not cost-effective to suppliers. It helps me understand the complexities surrounding the issue; while it’s widely reported that the negative effects of climate change will predominantly affect areas in Southeast Asia and Africa, I never considered the expense of rebuilding to meet standards as a difficulty that would be faced. Especially due to pressures of meeting deadlines and maintaining a consistent output, it makes sense that companies would push to remain as operational as possible, even with the option of subcontracting. And seeing as many subcontractors are based in these heavily affected countries, I think there would be even more pressure faced to remain as operational for as long as possible. Perhaps the mentioned guaranteed profit margin provided by some brands may become more widespread in usage and help incentive a broader shift towards consistently meeting social and environmental standard, but that remains to be seen.

Hi Vivian, your comment raises an interesting point about the balance between cost efficiency and sustainable, ethical manufacturing. The blog post highlights that compliance with environmental and social standards often comes at a cost suppliers must absorb, which becomes challenging in regions heavily affected by climate change. As you noted, the need to rebuild and adapt while maintaining output is a significant challenge, especially for subcontractors who may lack the resources to meet these standards. This aligns with the blog post’s observation that climate disruptions, like flooding and extreme temperatures, hinder suppliers’ ability to remain aligned. Subcontracting, while necessary for meeting seasonal demand, can exacerbate these issues by shifting production to facilities with less oversight and fewer resources for sustainable practices.

Your idea of guaranteed profit margins as a potential solution is a great idea, but the scalability of this could be complicated. While some brands provide financial support to help suppliers maintain compliance, the buyer driven nature of the industry means many prioritize cost savings over investments in sustainability. To make impact, systemic changes are needed like incentivizing sustainable practices and encouraging transparency in the supply chain. These efforts would not only help pressures on suppliers but also ensure a more equitable distribution across the industry. Without this, the tension between cost and compliance will likely continue, leaving suppliers in a difficult position to balance operational demands with ethical and environmental standards.

It was really interesting to read about the report from the USITC. The four factors I found to be quite obvious almost, but it was still insightful in terms of all the costs that can affect the competitiveness of a country as a sourcing destination. They also discuss some of the positive developments in the buyer-supplier relationships involving US fashion companies. The main detail that stuck out to me was how subcontracting is still regarded as necessary for the garment industry. I found this interesting because in my head this is not super important because we can always hire someone to do the job at hand, however, they raise a good point by saying that although possible, it is impractical for suppliers to hire additional permanent workers or invest in machinery for peak demand.

The study emphasizes that sourcing choices are impacted by a number of variables, such as product quality, dependability, and compliance, and are not solely determined by cost. This is in line with consumer demands for more sustainable and ethical business practices, which forces companies to weigh costs against other factors like social responsibility and environmental effect. I also think that reading this, the focus on dependability is important and current especially in light of the pandemic and global crises. This element reflects actual patterns in which companies give supply chain resilience top priority, frequently choosing local or reliable providers which I found interesting.

One thing that stood out to me when reading about the USITC is buyers and their vendor relationships. I think that there are some countries that can really thrive if they get these strong relationships and really connect with certain buyers. I also think that in this day and age, social justice issues are also a huge part of choosing a vendor to work with a build a connection with. With all of the social injustice that has come forward in regard to unjust working conditions and overall ill-treatment of people, this is something that should be one of the forefronts of whether or not a buyer will work with a vendor. When I think about Bangladesh I think about Rena Plaza, and the tragedy that occurred just a little over a decade ago. It also brings environmental impact up as well, as we need to measure how these factories are effecting the environment and what their impact with water usage, gasses, and climate change. Because these topics are so relevant I do think that this is something the USITC should work on regulating more and should really be top deciding factors for buyers on whether or whether not they will chose to move forward with a vendor.

Hi Madeline! The Rena Plaza tragedy in Bangladesh is a great example when discussing the detrimental impacts on unsafe working conditions.

I really enjoyed this blog specifically because it provided elaboration on some of the topics we’ve already covered in class. As we’ve discussed cost is not the singular driving factor when it comes to locations to be sourced from. As our cultural continues to evolve, aspects like sustainability, ethics, quality, and reliability become just as important, if not more so. This report focuses on the importance of long time relationships built between the countries sourcing and the countries being sourced from. As I stated above, reliability is a large part of these decisions now, and having a long standing agreement with a country that continuously produces quality product in a timely and sustainable manner is more valuable to many brands than saving a few bucks. However, this is a very simplified perspective. It is true that many brands today, while claiming sustainable, battle between these factors. The competiveness between sourcing countries makes it difficult for brands to decide what truly is the best deal. Investing more in sourcing and manufacturing would lend itself to higher prices in retail, but depending on the economy of the country sourcing these products, this may not be realistic or even possible in their economy.

After reading this article, I found some of the findings to be very interesting and surprising. While cost is a critical factor, the study highlights that low wages may not translate into competitiveness because of concerns with reputation and and productivity concerns, challenging the perception that labor cost is a straight forward advantage. Continuing, the emphasis on building long term buyer and supplier relationships and offering profit margins to suppliers shows a shift towards more collaborative sourcing models, which can be considered unexpected, given the typical price driven nature of the apparel industry. Additionally, the rising importance of environmental and social compliance programs, putting aside the unclear impact on competitiveness, shows a growing industry focus being brought by brand and consumer expectations.

I actually found a lot of the findings to make complete sense to me, with nothing really standing out. It’s good to see that many countries take into account the 4th factor, that being social and environmental responsibility. Sometimes it seems that the world and industry doesn’t take these kinds of concerns seriously. Honestly though, if looking at this from a more pessimistic view, it’s worth saying that many companies may claim this but will not actively seek out better options. A big problem I have with industry in general is that it puts those concerns to the side, and says it doesn’t. I’d like more active work against such issues but there is only so much a company can do.

The increasing importance of long term buyer supplier relationships in the clothing industry drew my attention. In the report, American fashion companies are placing a greater value on long term alliances in order to cut down on the time and expense of finding new suppliers. It was interesting to discover that some companies even provide suppliers with profit margin guarantees, promoting trust and guaranteeing their sustainability. Since buyers are looking for vendors who share their brand values, making the emphasis on supply chain transparency is particularly noticeable. This emphasis on teamwork is great of a move toward more strategic and ethical sourcing. It got me to thinking about how these partnerships might strengthen supply chain resilience during times of worldwide changes.

This article on the USITC report was insightful when comparing the different factors that influence the competitiveness of Bangladesh, Cambodia, India, Indonesia, and Pakistan as suppliers to the United States in the apparel industry. As we discussed in class, apparel sourcing is incredibly complex due to various factors, one being cost competitiveness. We discussed the benefits of locally produced textile imports which was evident in this report. Producing textile imports locally is a key factor in reducing costs for everyone involved (consumers, manufacturers, etc.). Countries who are reliant on imports from other nations face the challenge of high production costs leading to an overall higher cost of the end product. It was extremely interesting to learn how this is affecting apparel exports as a whole.

Looking at the report, something that I found interesting is that though many major supplier to the US changed throughout the decade between 2013, and 2024, however China remained the largest supplier through the entire decade. I think that this shows that as a supplier, China is predictable and reliable, as there have been many things that went on in the past decade (COVID-19, etc) and China remained on top. Though we recently learned that China is leaning towards more of a textile manufacturer rather than apparel supplier (supporting the flying geese method). Countries like Vietnam (who are currently a close second) could be a potential larger supplier.

I also found it interesting that though we talked alot in class and for homework, about guatemala being a good potential supplier for the US instead of China, that when on the Global apparel exports rank in 2022, they are ranked 32, in comparison to China who is ranked 1. I think that there are many other suppliers that serve a better competitive advantage currrently in comparison to Guatemala when it comes to being an alternative sourcing location.