Discussion question: How has the container shipping crisis affected the fashion apparel industry? While shopping for clothing, do you observe any market trends related to the shipping crisis (e.g., retail price and product availability)? Why or why not do you think the container shipping crisis will go away anytime soon?

Tag: Supply chain management

How COVID-19 has shifted US apparel companies’ sourcing strategies?

The article is available HERE (need Just-Style subscription)

Key findings

First, more US apparel companies prioritize consolidating their existing sourcing base than diversification during the pandemic. Nearly half of the top 30 US apparel companies we examined explicitly say they either sourced from fewer countries or worked with fewer vendors in 2020 than 2017-2019 before the pandemic. In comparison, only about one-third of respondents say they were sourcing from more countries in 2020 than two years.

Second, the desire to form a closer relationship with key vendors and ensure social and environmental compliance are the two primary factors behind US apparel companies’ consolidation strategy. In a time of uncertainty like the pandemic, apparel companies are leaning more heavily on suppliers that have proven reliable, capable, and flexible. Working closely with the suppliers and building an efficient and trust-based supply chain also play a central role in US fashion companies’ COVID-mitigation strategies. Meanwhile, with social and environmental compliance becoming increasingly crucial in apparel sourcing today, companies are cutting ties with vendors that are not adhering to government mandates and proprietary codes of conduct. Notably, US apparel companies’ higher expectations for sustainability as well as social and environmental compliance may have resulted in a smaller pool of qualified suppliers.

Third, the desire to steer away from China and reduce sourcing risks are the two main drivers behind US fashion companies’ recent sourcing diversification strategy. US apparel companies mostly moved their sourcing orders from China to China’s competitors in Asia instead of expanding “near-sourcing. On the other hand, it is not uncommon to see US apparel companies keep a relatively diverse sourcing base to control various sourcing risks in the current business setting.

Fourth, the content analysis further reveals that US fashion brands and retailers commit to sourcing and supply chain innovation in response to COVID-19 and the new business environment. Some specific sourcing strategies are noteworthy:

- Work with “super vendors,” i.e., vertically integrated suppliers that can execute multiple steps in the supply chain or those with production facilities in numerous countries.

- Optimize supply chain process to improve speed to market.

- Adjust fabric and textile raw material sourcing base, although the specific strategies vary from company to company.

By Emma Davis and Dr. Sheng Lu

The State of Apparel Supply Chain Transparency: A Case Study on VF Corporation

With the public’s increasing demand, fashion companies are making more significant efforts to improve their apparel supply chains’ transparency, i.e., mapping where the product is made and knowing suppliers’ compliance with social and environmental regulations.

Recently, VF Corporation, one of the most historical and largest US apparel corporations, released the entire supply chain of its 20 popular apparel items, such as Authentic Chino Stretch, Men’s Merino Long Sleeve Crewe, and Women’s Down Sierra Parka. VF Corporation used more than 300 factories worldwide to make these apparel items and related textile raw materials.

We conducted a statistical analysis (Multivariate analysis of variance, MANOVA) of these factories, aiming to evaluate the state of VF Corporation’s apparel supply chain transparency, including its strengths and areas that can be improved further. The findings of this study will fulfill a critical research gap and significantly enhance our understanding of the nature of today’s apparel supply chain and the opportunities and challenges to improve its transparency.

The results show that VF Corporation’s suppliers in different segments of the apparel supply chain had different transparency performances overall:

- While more than 92% of tier 1 & 2 suppliers shared their environmental or social compliance information with VF Corporation, less than 60% of VF Corporation’s tier 3 & 4 suppliers did so (note: statistically significant).

- A higher percentage of VF Corporation’s tier 2 & 3 suppliers (i.e., mills making fabrics, yarns, or accessories) received environmental compliance-related certification than tier 1 suppliers (i.e., garment factories) (note: statistically significant).

- Meanwhile, VF Corporation’s tier 1 suppliers were more active in pursuing social compliance-related certification than suppliers in other levels (note: statistically significant)

- However, no evidence suggests that whether from a developed or developing country will statistically affect a vendor’s transparency performance.

The study’s findings have several important implications:

- First, more work can be done to strengthen fashion companies’ transparency of tier 3 & 4 suppliers (i.e., textile mills making yarns and fibers). Despite the significant efforts to know their garment factories (i.e., tier 1 suppliers), fashion companies like VF Corporation still have limited knowledge about vendors upper in the supply chain. Notably, even VF Corporation doesn’t have much leverage to request environmental and social compliance-related information from these vendors. According to VF Corporation, often “Supplier was unresponsive to VF’s request for information.”

- Second, the results suggest that vendors at different supply chain levels have their respective transparency priorities. However, it is debatable whether tier 1 & 2 suppliers also need to care about environmental and sustainability-related compliance, and if tier 3 & 4 suppliers should be more transparent about their social compliance record. The growing concerns about forced labor involved in cotton production (i.e., tier 4 suppliers) make the debate even more relevant.

- Additionally, different from the public perception and previous studies, the findings call for equal treatment of suppliers from developed and developing countries when vetting their environmental and social compliance-related transparency.

Because this case study looked at VF Corporation only, future research can continue to investigate other fashion companies’ supply chain transparency based on data availability. It will also be meaningful to hear directly from tier 3 & 4 suppliers to understand their perception about improving the apparel supply chain’s transparency and related opportunities and challenges.

by Sheng Lu and Lora Merryman

Note: The study will be presented at the 2021 International Textile and Apparel Association (ITAA) Annual Conference in November.

China’s Changing Role in the World Textile and Apparel Supply Chain (updated October 2018)

Following the steps of many countries in history, China is gradually shifting its role in the world textile and apparel supply chain. While China unshakably remains the world’s largest apparel exporter, its market shares measured by value fell from 38.6 percent in 2015 to 33.7 percent in 2017. China’s market shares in the world’s top three largest apparel import markets, namely the United States, EU, and Japan, also indicate a clear downward trend in the past five years. This result is consistent with several recent survey studies, which find that fashion brands and retailers are actively seeking alternative apparel sourcing bases to China. Indeed, no country, including China, can forever keep its comparative advantage in making labor-intensive garments when its economy becomes more industrialized and advanced.

However, it is also important to recognize that China is playing an increasingly important role as a textile supplier for apparel-exporting countries in Asia. For example, measured by value, 47 percent of Bangladesh’s textile imports came from China in 2017, up from 39 percent in 2005. We observe similar trends in Cambodia (up from 30 percent to 65 percent), Vietnam (up from 23 percent to 50 percent), Pakistan (up from 32 percent to 71 percent), Malaysia (up from 25 percent to 54 percent), Indonesia (up from 28 percent to 46 percent), Philippines (up from 19 percent to 41 percent) and Sri Lanka (up from 15 percent to 39 percent) over the same time frame.

So maybe the right question to ask in the future is: how much value of “Made in China” actually contains in Asian countries’ apparel exports to the world?

China’s Textile and Apparel Factories Today

Related readings:

- Cheaper to Make Textiles in the United States than in China: Reality or Myth?

- Are Textile and Apparel “Made in China” Losing Competitiveness in the U.S. Market?

- New USCBC Study Suggests Overall Positive Impacts of China on the U.S. Economy

- China’s 13th five-year plan for its textile and apparel industry: Key numbers

Textile and Apparel “Made in the World”

While shopping in SoHo (NYC), Nicole Farese, a student from FASH455, found the label of a Splendid sweater reads “Made of Italian Yarn” and “Made in China”. Splendid is a casual wear store which is known for their high-quality clothing sold at a premium price.

Exercise: Check your wardrobe and can you find any clothing that is also made through a “global supply chain?” Please feel free to submit your picture with a brief description of your item to shenglu@udel.edu.

Sourcing Strategy of Leading U.S. Fashion Brands and Apparel Retailers (updated in May 2018)

The State of the Apparel Supply Chain

- What is the biggest hurdle to “speed to market”?

- What’s more important these days? Dollars or days?

- Is mass customization a nice to have or a need to have?

- How are companies fostering better partnerships with vendors?

- How much has your company been impacted by the “Trump effect”?

- Industry buzzwords: Amazon, sustainability, digitalization, transparency, on-demand manufacturing, data analytics.

- How well are companies executing on their data?

- 2017 is the year of _________? And What will 2018 be known for?

Regional Supply Chain Remains an Important Feature of Global Textile and Apparel Trade (Updated: November 2017)

Regional supply chain (or production-trade network, RPTN) or refers to a vertical industry collaboration system between countries that are geographically close to each other. Within a regional supply chain, each country specialized in certain portions of production or value-added activities based on their respective comparative advantages to maximize the efficiency of the whole supply chain.

There are three primary textile and apparel (T&A) regional supply chains in the world today:

Asia: within this regional T&A supply chain, more economically advanced Asian countries (such as Japan, South Korea, and China) supply textile raw material to the less economically developed countries in the region (such as Myanmar, Cambodia, and Vietnam). Based on relatively lower wages, the less developed countries typically undertake the most labor-intensive processes of apparel manufacturing and then export finished apparel to major consumption markets around the world.

Europe: within this regional T&A supply chain, developed countries in Southern and Western Europe such as Italy and Germany serve as the primary textile suppliers. Regarding apparel manufacturing in the European Union, products for the mass markets are typically produced by developing countries in Southern and Eastern Europe such as Poland and Romania, whereas high-end luxury products are mostly produced by Southern and Western European countries such as Italy and France. Furthermore, a high portion of finished apparel is shipped to developed EU members such as UK, Germany, France, and Italy for consumption.

America: within the region, the United States serves as the leading textile supplier, whereas developing countries in North, Central and South America (such as Mexico and countries in the Caribbean region) assemble imported textiles from the United States or elsewhere into apparel. The majority of clothing produced in the area is eventually exported to the United States for consumption.

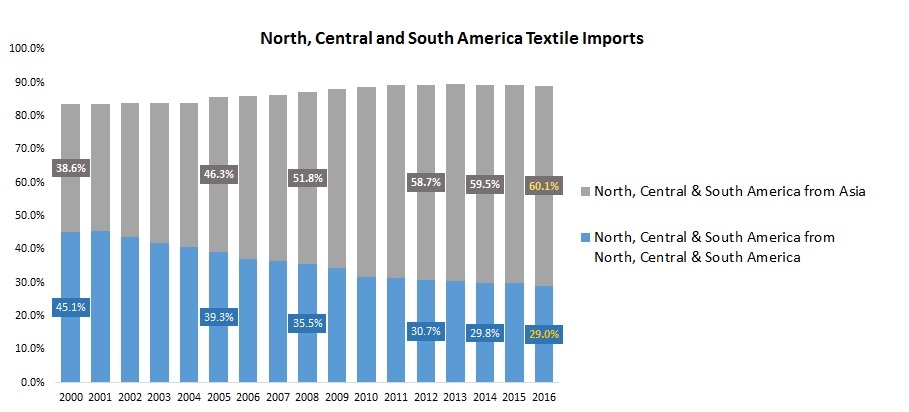

Data from the World Trade Organization (WTO) shows that regional supply chain remains an essential feature of today’s global textile and apparel trade. Notably, three trade flows are worth watching:

First, Asian countries are increasingly importing more textiles from within the region. In 2016, around 91.2% of Asian countries’ textile imports came from other Asian countries, up from 86.8% in 2006. This change reflects the formation of a more integrated T&A supply-chain in Asia. The more efficient regional supply chain also helps improve the price competitiveness of apparel made by “factory Asia” in the world marketplace. Particularly in the past few years, T&A exports from Asia is posting substantial pressures on the operation of the T&A regional supply chains in the Western Hemisphere.

Second, the intra-region T&A trade in EU remains stable. In 2016, 64.1% of EU countries’ textile imports and 55.6% of EU countries’ apparel imports came from within the EU region. Over the same period, 73.3% of EU countries’ textile exports and 81.6 % of their apparel exports also went to other EU countries.

Third, the Western-Hemisphere T&A supply chain, which involves countries in North, South and Central America, is facing substantial challenges from the increasing competition from Asian T&A exporters. In 2016, only 29.0% of North, South and Central American countries’ textile imports and 18.6% of their apparel imports came from within the region, a record low in the past ten years. Meanwhile, in 2016 Asian countries supplied 60.1% of textiles and 73.7% of clothing imported by countries in the Western Hemisphere, a record high in history. Understandably, if regional free trade agreements, such as NAFTA and CAFTA-DR, no longer exist, it would be even more difficult for the Western-Hemisphere T&A supply chain to survive. The potential losers of the collapse of the Western-Hemisphere T&A supply chain will include not only US textile exporters but also apparel exporters in North, South and Central America. Notably, in 2016, 89.3% of apparel exported by countries in the Western Hemisphere were destined for the region.

Data Source: World Trade Organization (2017)

by Sheng Lu

The Future of the Asia-Pacific Region as a Textile and Apparel Sourcing Destination: Discussion Questions Proposed by FASH455

#1 How have US importers/retailers/fashion brands which source from China reacted to China’s rising labor cost in recent years? Any specific examples of companies’ practices and strategies?

#2 It is widely reported that China’s labor cost has been rising quickly in recent years (around 14% annually between 2010 and 2014). But trade data didn’t show a significant drop of China’s textile and apparel exports to the US. Why is that?

#3 Why do you think people have a conception of China being a “highly reliable” sourcing destination for textile and apparel? What is China’s unique competitiveness?

#4 Many domestic and foreign firms have started investing in textile/fiber factories in Vietnam because of the yarn forward rules of origin in TPP. Would it be in the United States’ best interest to become one of these investors? Why or why not?

#5 In the class we discussed the “flying geese model” and the phenomenon of “Factory Asia”. Particularly, Asian countries are forming an ever more integrated textile and apparel supply chain—for example, apparel manufacturers in Asia are gradually using more textile inputs made in Asia rather than made outside the region. Does it mean that the United States has no role to play in Asia-based textile and apparel supply chain? Will the TPP make a difference?

#6 Should US allow China to join the TPP? Why or why not? If China joins the TPP, what will be the implications for the pattern of textile and apparel trade in the Asia-Pacific region?

#7 What is the relationship between the Regional Comprehensive Economic Partnership (RCEP) and the Trans-Pacific Partnership (TPP)? Alternatives? Competitors? Friends? Foes? Why are there so many different free trade agreements (FTA) in the same region?

Please feel free to share your thoughts and recommend any additional articles/readings/resources relevant to the discussion. Please mention the question # in your reply.

African Growth and Opportunity Act and Textile & Apparel

(In the video: Gail Strickler, former Assistant US Trade Representative for Textiles, highlights the immense opportunities created by the renewal of AGOA for duty-free access to the massive US market for African textile and apparel producers.)

The African Growth and Opportunity Act (AGOA) is a non-reciprocal trade agreement enacted in 2000 that provides duty-free treatment to U.S. imports of certain products from eligible sub-Saharan African (SSA) countries. AGOA intends to promote market-led economic growth and development in SSA and deepen U.S. trade and investment ties with the region. (note: non-reciprocal means SSA countries do not need to offer equivalent benefits to imports from the United States.)

Because apparel production plays a dominant role in many SSA countries’ economic development, apparel has become one of the top exports for many SSA countries under AGOA. Like many trade agreements and trade preference programs, AGOA also set unique rules of origin for textile and apparel (T&A):

First, to enjoy the duty-free and quota-free treatment in the US market, eligible T&A products made in qualifying AGOA countries need to be one of the following categories:

- Apparel made with US yarns and fabrics;

- Apparel made with Sub-Saharan African (SSA) regional yarns and fabrics, subject to a cap;

- Apparel made with yarns and fabrics not produced in commercial quantities in the United States;

- Certain cashmere and merino wool sweaters; and

- Eligible hand-loomed, handmade or folklore articles and ethnic printed fabrics.

Second, under a special rule called “third-country fabric” provision, AGOA countries with lesser-developed countries (LDBC) status can further enjoy duty-free access in the US market for apparel made from yarns and fabric originating anywhere in the world (such as China, South Korea, and Taiwan). This special rule is deemed as critical because most SSA countries still have no capacity in producing capital and technology-intensive textile products. [Note: Although the US imports of apparel made with third-country fabric are subject to a cap, the cap has never been reached].

According to a 2014 comprehensive study conducted by the USITC, the “third-country fabric” provision has three major benefits to the AGOA members:

1) Increase exports of apparel. This can be evidenced by the fact that most US apparel imports under AGOA came from those countries that are eligible for the “third-country fabric” provision, such as Lesotho, Kenya, Mauritius, and Swaziland. In comparison, because South Africa is not eligible for the “third-country fabric” provision, its apparel exports to the United States had significantly dropped since 2003 and only accounted for 0.6% among AGOA countries in 2013.

2) Encourage foreign investment. From 2003 to 2013, a total 21 T&A FDI projects were made in SSA, among which 18 projects (or 85.7%) were greenfield FDI. The third-country fabric provision is the main driver for these FDI projects. For example, many Chinese and Taiwanese investors had opened apparel factories in Ghana, Kenya, Lesotho, Madagascar, Malawi, Mauritius, Namibia, Nigeria and Tanzania as a source of exports to the United States and the EU.

3) Enhance trade diversification. Theoretically, relaxing rules of origin (RoO) such as the third-fabric provision can free up companies’ resources and allow them to expand export product lines. As observed by a few empirical studies, AGOA’s third-country fabric provision helped related countries increase the varieties of apparel exports between 39 and 61 percent.

AGOA receives new authorization in 2015, which will last for 10 years until 2025 (including the 3rd country fabric provision). This ten-year renewal of AGOA is regarded as critical and necessary to encourage more long-term investment in the region. As put by Florizelle Liser, Assistant US Trade Representative for Africa “What we know is that African producers of apparel, like producers of apparel all around the world, need to have the flexibility to source their input from wherever of those can be produced most effectively, cost effectively for the products that they are sewing. So we want through the “third country fabric” provision to give the African producers of apparel that flexibility. We do know in terms of establishing textiles business on the ground producing those inputs right there in Africa and that more of that indeed is going to happen. The reason is that as U.S. buyers of apparel and this is an enormous market for apparel… as U.S. buyers of apparel source more of their apparel from Africa, then investors in textile mills, which are very expensive, will be incentivized and are being incentivized to actually establish those fabric mills right there in Africa, and then be able to save time, in terms of getting those inputs that are needed for the clothing that is being produced. So we see that happening already: it’s happening in Kenya, it’s happening in Ethiopia and around the continent. And that is what we need to have more of as we go forward in this ten-year extension of AGOA.”

The Future of “Made in China”: Robots are taking over China’s Factory Floors

The video echoes one recent Wall Street Journal article about Levi Strauss using automation technologies to revamp their apparel production in China:

“In an apparel factory in Zhongshan, a gritty city of three million stuffed with industrial parks across the Pearl River from Hong Kong, lasers are replacing dozens of workers who scrub Levi’s blue jeans with sandpaper to give them the worn look that American consumers find stylish. Automated sewing machines have cut the number of seamstresses needed to stitch arc designs into back pockets. Digital printers make intricate patterns on jeans that workers used to do with a mesh screen.”

One important factor that gives a push to adopting robots in China’s factory floor is the end of very cheap labor in China. China’s wage level has been rising in double-digit percentages for the past decades. And as a consequence of its “one-child policy”, by 2050, the working-age population in China could decline by 212 million according to estimation from the United Nations.

But Levi executives say they have largely abandoned a strategy of relocating production to one impoverished country after another, known as “chasing the needle,” in favor of other forms of cost-cutting.” “Labor is getting more expensive and technology is getting cheaper,” says Andrew Lo, chief executive of Crystal Group, one of Levi’s major suppliers in China.

“Levi is adapting its laser technology so it can etch different patterns to make one type of denim look like another, reducing costs by buying less fabric. For a new line of women’s wear, Levi said it needed only 12 fabrics, rather than 18. In the past three years, Levi said, it cut the number of its suppliers by 40% and the number of fabrics by 50%.”

“The changes also give Levi greater flexibility, said Ms. O’Neill, the 44-year-old executive who helps oversee the company’s supply chain. If a pair of jeans using a particular fabric is selling well, she says, Levi can use lasers to produce more of the desired look, and pare back designs that are losers. “The idea is to delay decision-making for as long as possible,” said Ms. O’Neill.”

And this is only the beginning! Some technologists think that inventions such as 3-D printing—essentially printers that replicate solid objects like copiers reproduce printed pages—will have a big impact by 2050. In such a world, printers could spew out clothing, food, electronics and other goods ordered online from a nearly limitless selection, with far fewer workers involved in production.

“In 2050, you could potentially have a 3-D printer at home that could produce all the fabrics you want,” said Roger Lee, the chief executive of Hong Kong’s TAL Group, which makes 1 of every 6 dress shirts sold in the U.S. for brands from Banana Republic to Brooks Brothers. “That would make us obsolete.”

Ironically but not surprisingly, automation also keeps wages down. Levi said it expects China production to rise only “modestly” next year; new orders are up for grabs. Apparel InternationaI’s president, Oscar Gonzalez, says the company now boasts an advantage over China—a large pool of apparel workers who were laid off in past downsizings. Excess labor has helped him keep wage increases to 2% or 3% a year he says. “Every Monday when we recruit,” he adds, “there are long lines of applicants.”

Welcome for any comments and discussion questions.

Outlook for the U.S. Textile Industry in 2015

In its annual industry analysis report, the Textile World (TW) presents another optimistic outlook for the U.S. textile industry in year 2015.

First, the U.S. textile industry is predicted to be in a good shape economically this year. For example, according to TW, shipment of textile mills (NAICS 313 &314) is expected to increase 3-4 percent in 2015 from last year. Value of apparel manufacturing (NAICS 315) may also increase 5 percent. Additionally, market demand for basic mill products (fibers and fabrics), nonwoven fabrics and fabrics designed for activewear could be particularly strong this year.

Second, the U.S. textile industry will continue to bring back “made in USA” through capitalization. As observed by TW, new plant and equipment spending is widespread in the U.S. textile industry in recent years, covering activities ranging from fibers, spinning, nonwovens, composites, technical fibers to textile chemical. TW further estimates that some 2.2 percent of mill shipment dollars will be spent on new investment in 2015, a level much higher than a few years ago.

Third, trade deficit in the U.S. textile industry is gradually shrinking. On one hand, TW estimates that due to China’s decreasing market share, imports of T&A to the United States will down 1 percent in 2015. This trend may continue in the years ahead. On the other hand, TW estimates that the U.S. textile exports will continue to grow for the straight 5th year in 2015. However, TW doesn’t believe textile and apparel manufacturing will have any big near-term shift back to the U.S, nor the total employment in the industry (because increased production is to be made by machines).

Fourth, sustainability and supply chain management will attract even more attention by the industry in 2015. As mentioned by the TW report, consumers nowadays have become more aware of the environmental impact of textile and apparel manufacturing. This pushes companies to make more efforts to address issues such as toxins, waste and the amount of water used for production. On the other hand, supply chain management has started to play even more important roles in controlling cost and increasing profit. For example, quoted by TW, performance of supply chain management may result in 10 percentage point differences in profit margin in the textile industry nowadays.

Fifth, trade policy will continue to have a substantial impact on the the U.S. textile industry. 2015 could be a big year for trade policy in the United States. Things that are on the top watch list in 2015 include details of the Trans-Pacific Partnership negotiation and whether the Trade Promotion Authority (TPA) bill can be passed by Congress.

China Apparel Retail Market (updated in December 2014)

According to Fung Group’s latest China apparel market report:

1. China’s apparel retail market remains strong despite slower growth. China’s apparel retail sales reached 1,141billion RMB (or $187 billion USD) in 2013, rose by 11.6 percent from 2012. On average, each urban household in China spent 1,902 RMB (or $306USD) on clothing in 2013, accounting for 10.6 percent of their total annual expenditure. [note: in the US, clothing accounts for around 3 percent of household annual expenditure]. It is estimated that China will replace the United States and become the world’s largest apparel retail market in 2017.

2. Women’s wear is the largest contributor to China’s total apparel sales. A survey of 100 major retailers in China shows that women’s wear accounted for 32.7 percent of their clothing sales from 2012 to 2013. However, women’s wear is a highly fragmented and competitive market in China. For example, the top ten brands altogether only accounted for 21.43 percent of market share in 2013.

3. Children’s wear and sportswear are the two growing areas in China’s apparel market. Specifically, retail sales of children’s wear in China reached 6.3 billion RMB (or $1 billion USD) in 2013, registered growth of 12.7 percent. Because Chinese government has relaxed its “one-child policy”, China is estimated to add 1-2 million extra kids over the next few years, suggesting further market expansion possibility. Thanks to Chinese consumers’ increasing interest in sports and outdoor activities, sales of sportswear enjoyed 35 percent growth from 2012 to 2013. Functional products with fashionable designs are the key to win the market. While international brands (such as Nike and Adidas) are mainly concentrated in tier 1 and tier 2 cities, domestic brands are still dominating the lower-tier cities where more growth potential is involved.

4. Department stores and specialty stores remained the main channels for apparel distribution in China, accounting for 36.3 percent and 29.7 percent of market share respectively in 2013. Specifically, department store remains the main channel for mid to high-end apparel sales in China, although specialty stores are increasingly preferred by apparel brand owners. As a common business practice in China, apparel brand owners manage their self-operated specialty stores in key cities while leaving other locations to franchisees as distributors. On the other hand, hypermarkets and supermarkets are popular retailing channels for lower-priced apparel, many of which are with poor brand recognition or unbranded.

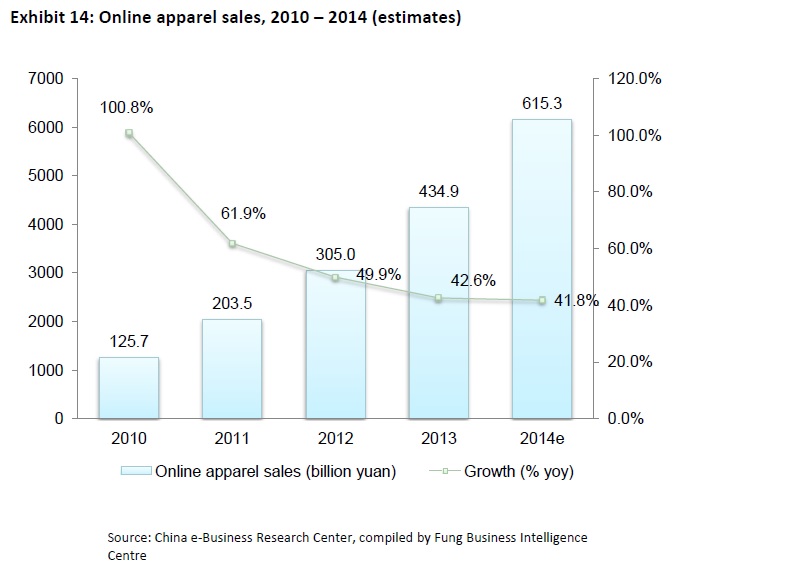

5. Online retailing is the fastest growing retail channel in China for apparel. According to one source, the total online apparel transaction value in China reached 434.9 billion RMB (or $36.2 billion USD) in 2013, increased by 42.6 percent from 2012. Similar as the emerging of “omni-channel retailing” in the US, apparel companies operating in China are making more efforts to explore“O2O” (online and offline integration). It shall be noted that more and more overseas apparel brands see e-commerce as a strategic means to reach Chinese consumers. For example, even luxury brands such as Burberry and Hugo Boss have opened online store through a B2C platform (like Tmall) in China.

Some additional personal thoughts:

Some additional personal thoughts:

- Western apparel brands and retailers shall realize that China is a highly fragmented market with diverse market characteristics from region to region (for example, tier 1 v.s. tier 3 &4; urban v.s. rural; north v.s. south).

- Chinese consumers are getting more and more sophisticated, yet price is still a key factor to win this market.

- Given the size and sophistication of China’s apparel market, western apparel brands and retailers may consider building an independent China operation system (from design to distribution). Also, successful business models at home market may not work in China at all.

Outlook for the US Textile Industry in 2014

In its latest industry analysis report, the Textile World (TW) presents a fairly optimistic outlook for the US textile industry in year 2014. According to the report:

- Output of the US textile mills may increase 2 percent for basic products like fibers, yarns and fabrics; more highly fabricated items like industrial textiles could achieve an even higher growth rate.

- US Imports of textiles may continue the pattern of flatness (i.e. limited growth) over the next 12 months whereas exports of US-made textiles will remain modest growth. As results, the US textile industry may see some fractional decline in trade deficit in the year ahead.

- US textile mills may avoid meaningful upward fiber cost pressure, which includes cotton, rayon staple, acrylic staple, textured nylon and polyester. High cotton stock level worldwide and the weak demand for natural gas and petroleum are cited as the two major reasons for the minimum price change.

- As another encouraging sign, the operating rate (production as a percentage of capacity) in the US textile industry has rebounded to above 70% which is accompanied with a robust growth of capital investment. As quoted in the report “US textile mills spent more than $1 billion each year to replace obsolete facilities and to take advantage of new, state of the art technology aimed at turning out new products and increasing overall efficiency”.

- In terms of the job market, the picture seems to be mixed. Productivity growth as results of capitalization both reduces the real production cost as well as the overall demand for labor. According to the report, labor had only accounted for 19% of textile mills revenue dollars in 2013, implying the highly capital-intensive nature of the industry.

- Additionally, the rising demand for product innovation and improvement create brightening growth opportunities for the US textile industry. According to the TW report, US consumers seem willing to pay a premium for “pluses functions” of the fabrics. Some 50 percent said they’d pay extra for wrinkle resistance, 51 percent for stain protection, 50 percent for easy care, 46 percent for fade resistance, and 45 percent for stretch. A number of US firms are further weaving sophisticated electronic extras into the fabric of garment sensors that can monitor a variety of personal vital signs.

Other highlighted issues to watch in 2014 include: made-in-USA factor, improved supply chain management, energy cost advantage and government policy support.

Re-shoring, Jobs and Globalization–Perspectives from David Cameron

- How to make a success of globalization and ensure our businesses, our peoples and our societies can benefit from the next phases of globalization?

- What are the opportunities of re-shoring for the West and how to seize them?

- How to secure sustainable and well-paid jobs and give people pride in using their skills?

- Is re-shoring going to bring back all the jobs that were off-shored in the first place?

- What are the factors that are driving re-shoring?

- Does reshoring mean the West wins and the East loses?

- Is there a chance for Britain and US to become the “Re-shore Nations”?

If you care about the questions above, please enjoy the speech given by David Cameron, Prime Minister of the United Kingdom at the 2014 World Economic Forum in Davos. The speech is a great supplement to our discussions this week on globalization.

Apparel Issues to Watch in 2014

In the year ahead, the following issues are suggested to watch for the apparel industry according to the latest just style management briefing:

Responsible sourcing: a variety of different themes inclusive of sustainability, compliance, chemical safety and product safety. In the past, the apparel industry has been very reactive in these areas, and efforts have accelerated to move to a more proactive model in 2014.

Demand for greater supply chain visibility: a higher level focus and a lot more time will be required to look at the supply chains from end to end, especially for tier 2 and 3 component suppliers. Apparel industry needs to be focused on preparing to be more transparent on what goes into making its products and the carbon and water footprint it leaves behind. There will also be a stronger emphasis on quality, and more intelligence and agility in the supply chain, including how to achieve global flexibility in supply to maximize advantages and benefits offered by different regions.

Adjust to the industry “new normal”: speed, efficiency and cost management. ‘Quick response’ or ‘fast fashion’ is no longer a catch phrase, it’s a business reality. Speed is king. Retailers have learned to manage with smaller inventories and to quickly react to consumer needs. Additionally, there are no more low cost countries (with capability and capacity) to tap into, which requires more efficient cost control through supply chain design and management.

Internet and omni-channel retailing. The internet continues to upend the apparel industry. Brick and mortar companies are still struggling to figure out how to harness the power of the internet – and struggling to figure out how big of a threat pure-play internet companies are. Meanwhile, the proliferation of internet-only companies continues, increasing the competitive pressure on everyone (including the older internet-only companies!). All of this will end up resulting in a much stronger industry overall – but in the meantime there will be a lot of hand-wringing and heartache.

Economic outlook. Overall, 2014 will be a year better off than 2013. The US economy continues to improve, the Eurozone recession has stabilised and there is the huge opportunity Asia offers.

Country risk. Whatever happens in the real economy, political tensions throughout developing countries (except possibly China and Vietnam) are growing. They are about more than working conditions in garment factories – and we cannot expect the garment industry to remain immune from them.

International market expansion. Global vertical retailers and brands need to balance the efficiency of global assortments with being able to cater to a broad range of consumer purchasing preferences across cultural groups. Winners manage to preserve their brand identity while offering attractive choices to this diverse customer group.

Trade policy and trade politics. 2014 is an election year for US Congress. It will only be tougher to find bipartisan consensus. Things to watch include whether the Obama Administration is going to finalize the Trans-Pacific Partnership (TPP) during 2014, whether the Trade Promotion Authority (TPA) can get passed as well as the renewal of the Generalized system of Preferences (GSP) and African Growth and Opportunity Act (AGOA).

China’s role in the global apparel supply chain. China’s productivity miracle has been the single major influence on global sourcing over the past five years. While this cannot go on forever it is hard to see a significant change in its share in 2014. China’s dominance of upstream textile production (spinning, weaving and knitting) is under greater threat. Its main operators are making substantial overseas investment, and while the timing of major upstream projects means this will have little impact on fabric and yarn manufacture in 2014, the subject will preoccupy observers. Onshore garment development in Japan, Germany, the UK and US will continue to create much publicity, but limited amounts of garments. Nearshoring continued to lose market share in the EU and US during 2013, though many buyers express growing interest, and there are signs of growth in some categories. It will be surprising if it shows any significant increase in 2014.

International Trade and Global Supply Chain

Questions to think about:

Why supply chain matters in the 21st century global economy?

What benefits a global supply chain can bring to us?

What unique risks are involved in a global supply chain?

What role the government and policies can play in facilitating the global supply chain?

Are you prepared to embrace the concept of “made in the world”?

Why the General Public Needs to Care About Textiles and Apparel

Expanding Global Trade through Innovation and the Digital Economy

This is the introductory video of this year’s World Trade Organization (WTO) Public Forum hosted from Oct 1 to Oct 3. The WTO Public Forum is an annual event that provides a platform for public debate across a wide range of WTO issues and trade topics. The Public Forum is also an opportunity for us in the WTO to listen and exchange views with non-government organizations (NGOs), academia, the private sector, with those of you who are increasingly participating in shaping the world’s economic and political environment. This year’s Public Forum looks at the future of trade in an era of innovation and digitalization.

As put it by Michael Froman, the U.S. Trade Representative :” The global marketplace has experienced a sea change. Combining globalization with new technology and with new business models has dramatically accelerated the pace of change and innovation. The flow of data is as important as the movement of goods. Services are an increasing share of value-added manufacturing. And the market is determining standards at an increasingly rapid pace.”

U.S. Textile Plants Return, With Floors Largely Empty of People

This is a strongly recommended New York Times article which focuses on the current status of the U.S. textile industry.The article reflects many things we’ve discussed in the class.

First, we still live in a world of “specialization”, in which each country produces something but not everything based on their respective comparative advantage. It is important to realize that the reason why textile manufacturing is coming back to the United States is because the manufacturing process has become more “capital and technology intensive” in nature. Therefore, it makes senses for the United States as a capital and technology abundant country to focus on producing “capital and technology” intensive products. At the same time, with the fast rising labor cost in recent years, some developing countries are gradually losing “comparative advantage” in making labor intensive apparel products. This factor further affects T&A companies’ decision making on where to produce.

Second, textile and apparel industry is NOT disappearing in the U.S., but it evolves constantly in response to globalization and technology advancement. “Made in America” is starting to mean something again, but not the same as what it used to mean. As the business function of the textile and apparel industry in the US becomes more capital, knowledge and technology intensive, it provides even more promising career options and opportunities for our TMD/TM graduates than in the past. That’s also why in the classroom, we emphasize creativity, critical thinking, analysis skills, playing with technology, leadership skills and having a big landscape of the industry in mind.

Third, as we discussed in the class, the “made in ___” label can no longer reflect the whole supply chain of finished textile/apparel products in the 21st century. Instead, we live in a “made in the world” era in which different countries share responsibilities in T&A product development, manufacturing and distribution. Neither is it the case that the U.S. textile and apparel industry is all about “manufacturing” today. Those non-manufacturing functions such as retailing, merchandising, branding and marketing actually contribute much higher added values and result in a U-shape global apparel value chain called “smiling curve”.

3D Printing as a Game Changer for the Global Textile and Apparel Industry

3D printing is an emerging and transformative technology that adopts a fundamentally new approach of “additive manufacturing” to make things. Textile and apparel (T&A) is one major area in which the 3D printing technology is believed can have a wide application. Companies such as N12 and a few designer-researchers have started the pioneering work of using printer to directly print wearable apparel for consumers.

Technology is driving a revolution in manufacturing

A latest comment made by the Economist on Peter Marsh’s book The New Industrial Revolution.

As metioned in our class, globalization does not mean “made in China” or “off-shore production”, but rather a much freeer movement of goods, services, capital and labor around the world, thanks to the economic growth, lowered trade & investment barriers and advancement of technologies.

In today’s global economy, “any firm, anywhere, can hook up to a global supply chain. A product may be designed in one country and assembled in another, using components from dozens more. Even a small local manufacturer can use the best suppliers the world has to offer.”

This concept is associated with the “new international division of labor” concept, which we will discuss this coming Tuesday.

Apparel Market: Landscape of Change

An article from the Textile World. Highlights:

- The global apparel retail industry grew by 3.4% in 2011 to reach a value of $1,175,353.1 million. In 2016, the global apparel retail industry is forecast to have a value of $1,348,098.8 million, an increase of 14.7% since 2011. Americas accounts for 36% of the global apparel retail industry value.

- Technlogy is changing consumers’ shopping behavior as well as preferences (such as redefining value of products). The internet, smartphones and social networking are driving the apparel industry to a greater extent than ever before.

- “Made in USA” is attracting consumers, however, to be more accurate, it means “source in the Western Hemisphere” rather than moving manufacturing totally back in the U.S.. However, in order to have “near sourcing” happen, addtional trade liberalization is required to remove the so much constraints.

- Supply chain transparancy and cooridnation is with growing significance to the success of business in the apparel companies.

- The only constant in the apparel industry is change (enviorment, business model, product innovation, technology…).