#1: On April 5, 2024, the US Department of Homeland Security (DHS) released its new enhanced strategy to combat illicit trade and level the playing field for the American textile industry and the estimated over 500,000 US textile jobs*. *note: according to the Bureau of Labor Statistics, as of December 2023, the US textile and apparel manufacturing sector employed about 272,400 workers (seasonally adjusted), including 89.3K in NACIS313 textile mills, 95.6K in NAICS314 textile product mills and 87.5K in NAICS315 apparel manufacturing. As of December 2023, NAICS 4482 apparel retail stores employed about 850,000 workers (seasonally adjusted).

According to DHS, the new enforcement plan will focus on the following areas:

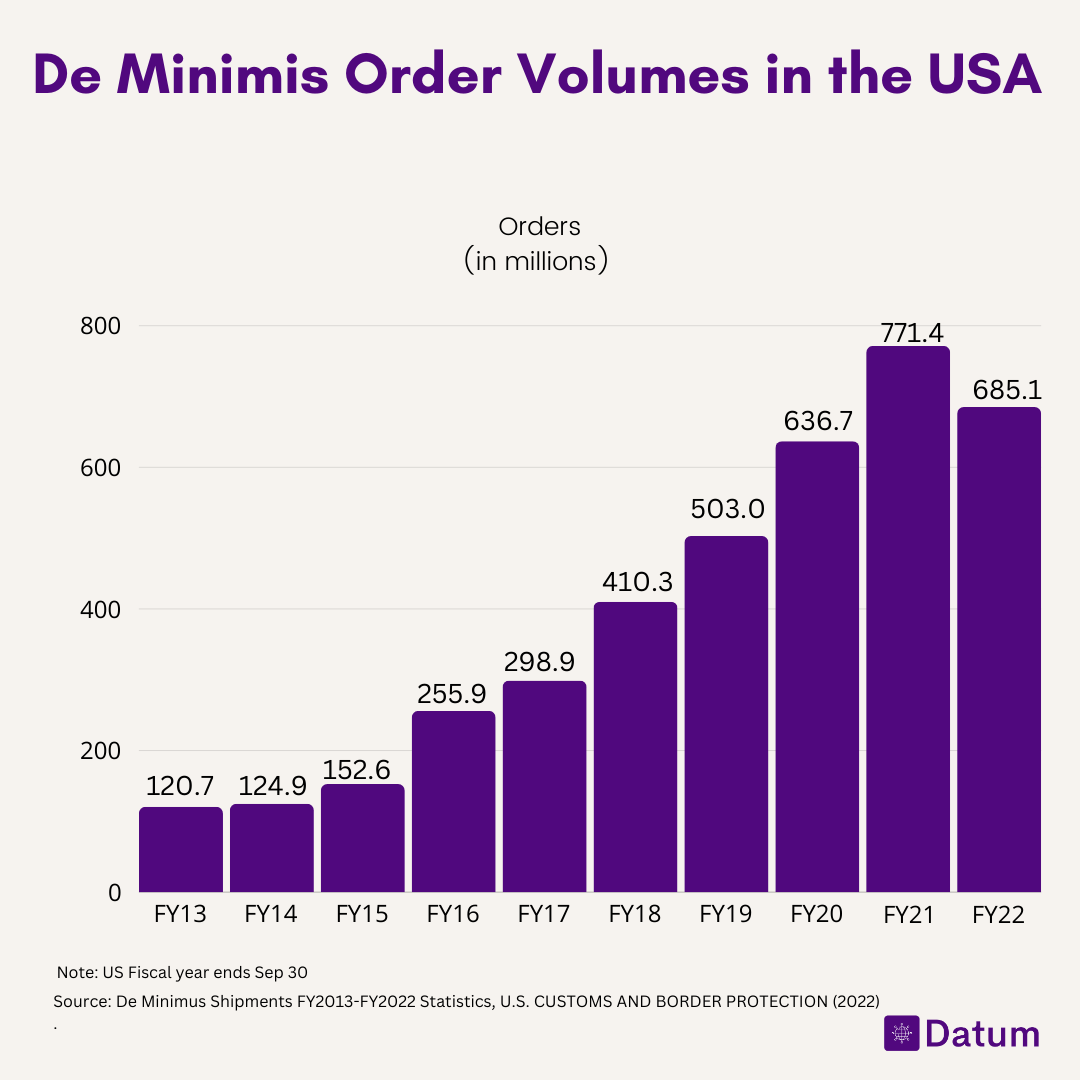

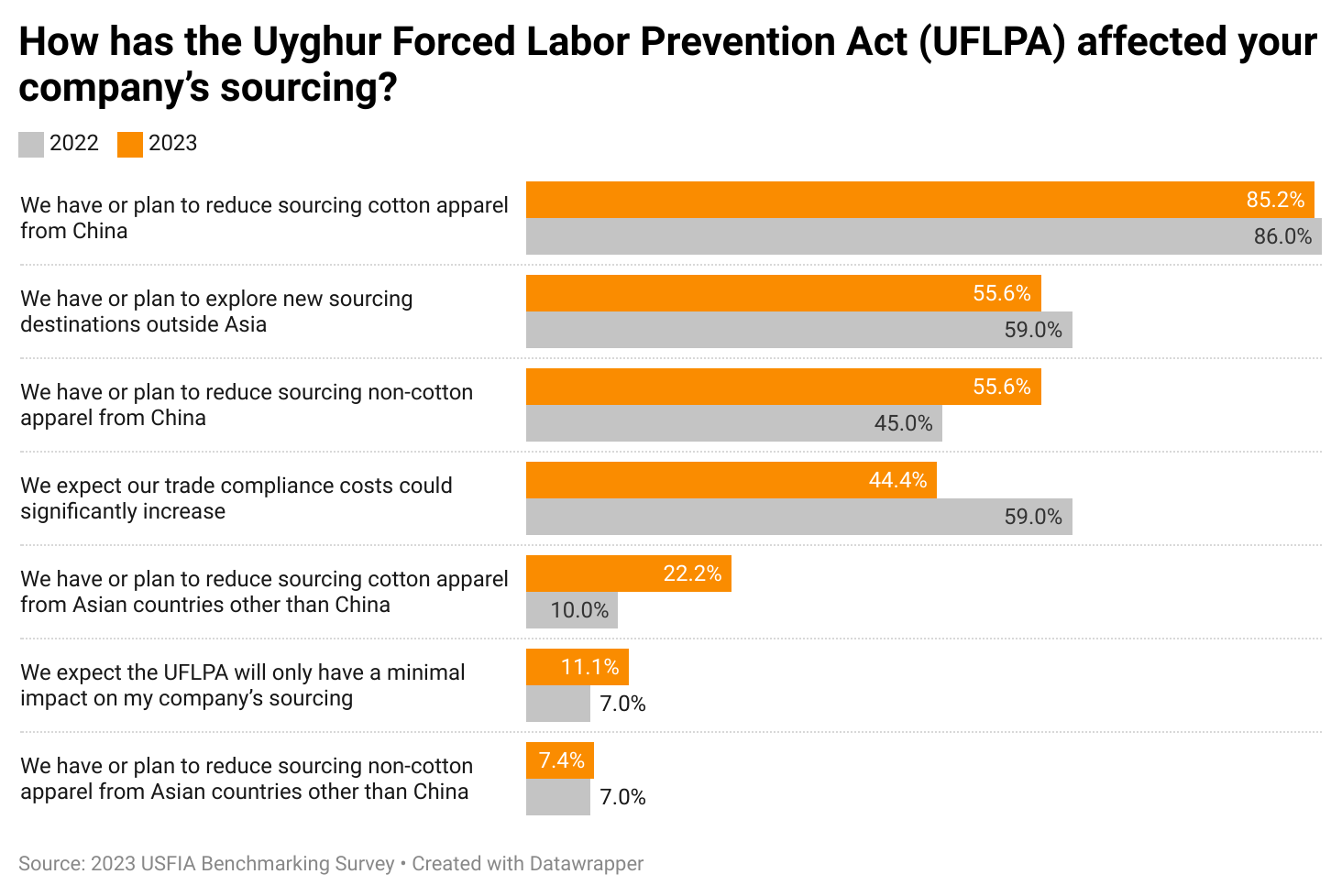

- Cracking down on small package shipments to prohibit illicit goods from U.S. markets by improving screening of packages claiming the Section 321 de minimis exemption for textile, Uyghur Forced Labor Prevention Act (UFLPA), and other violations, including expanded targeting, laboratory and isotopic testing, and focused enforcement operations.

- Conducting joint Customs and Border Protection (CBP)-Homeland Security Investigation (HIS) HSI trade special operations to ensure cargo compliance. This includes physical inspections; country-of-origin, isotopic, and composition testing; and in-depth reviews of documentation. CBP will issue civil penalties for violations of U.S. laws and coordinate with HSI to develop and conduct criminal investigations when warranted.

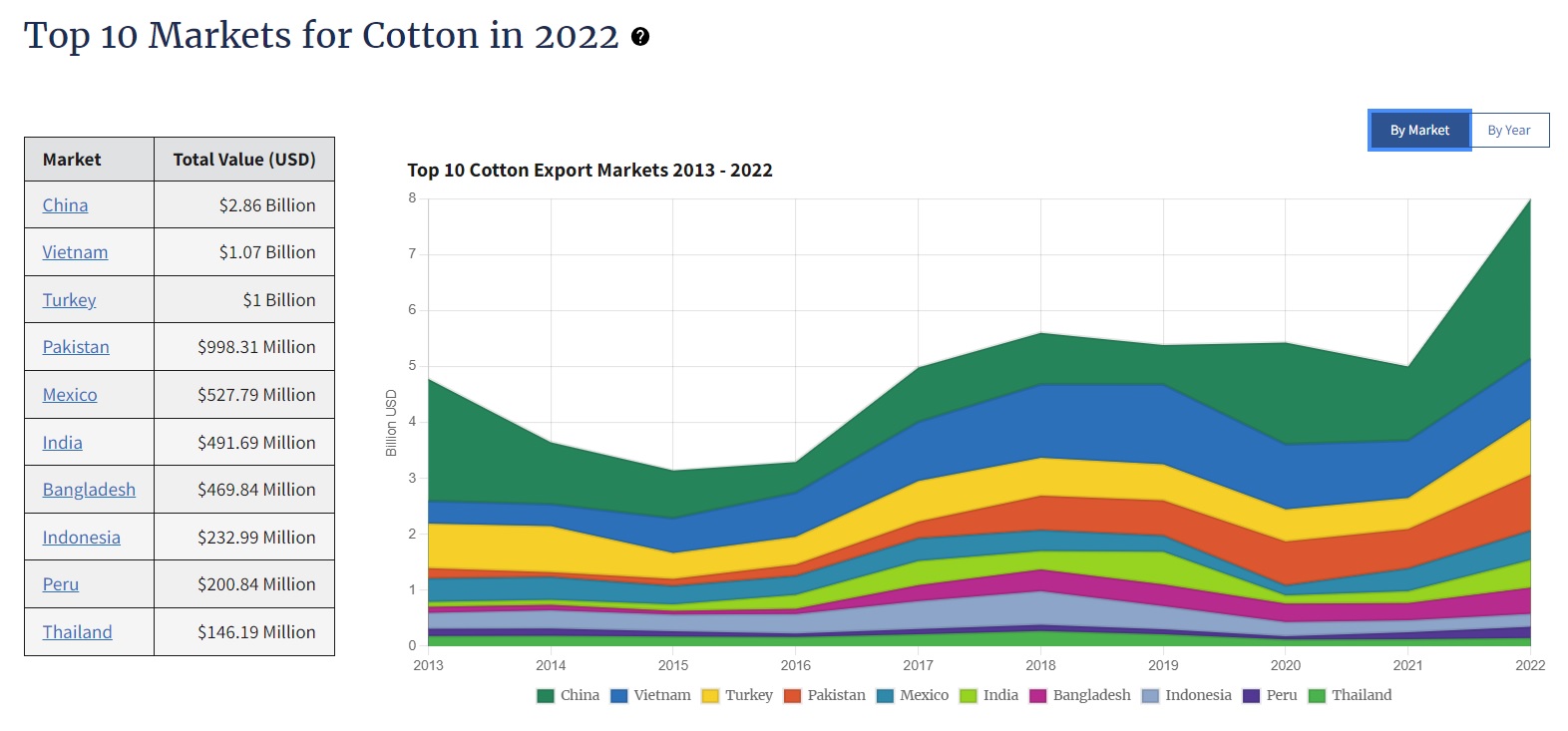

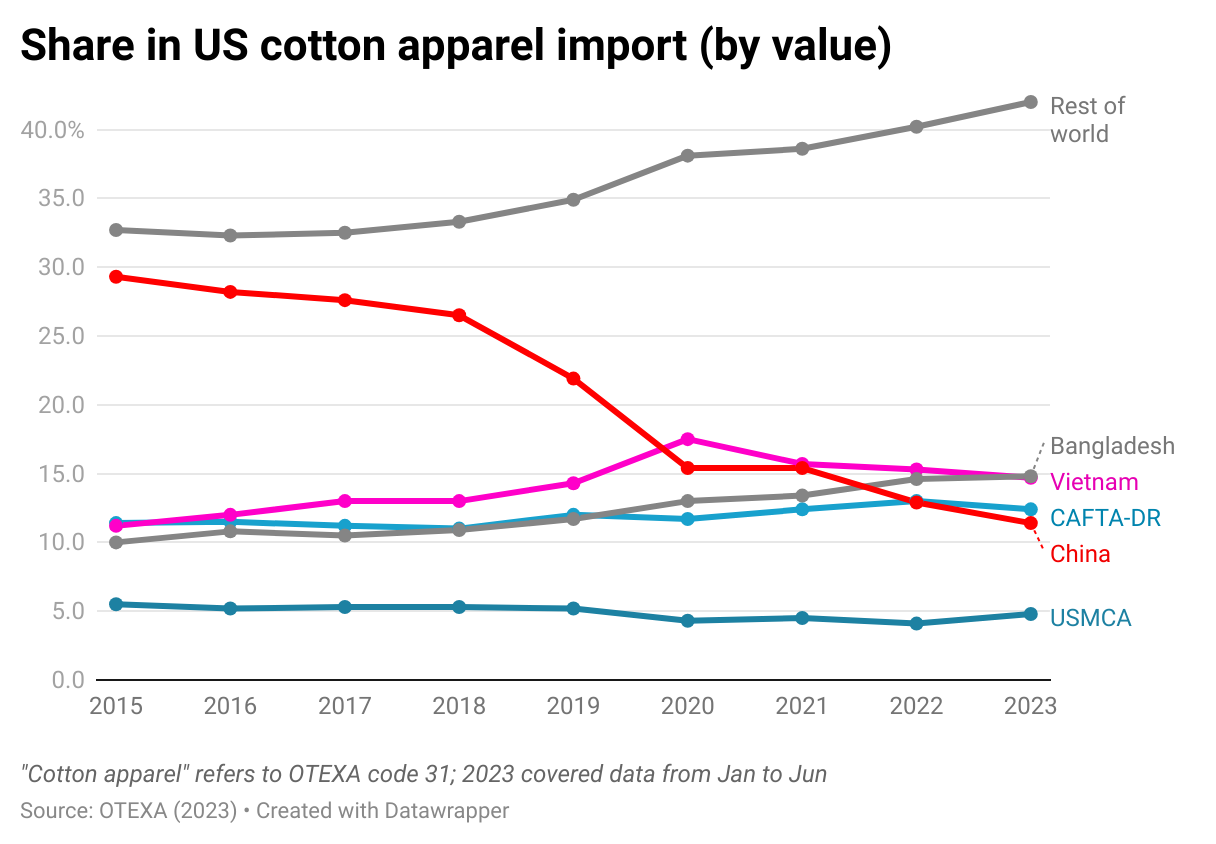

- Better assessing risk by expanding customs audits and increasing foreign verifications. DHS personnel will conduct comprehensive audits and textile production verification team visits to high-risk foreign facilities to ensure that textiles qualify under the U.S.-Mexico-Canada Agreement (USMCA) or the Central America-Dominican Republic Free Trade Agreement (CAFTA-DR). (note: As CBP noted, most US free trade agreements and trade preference programs have complex textiles and apparel-specific rules of origin requirements. CBP is “responsible for ensuring that the trade community complies with all statutory, regulatory, policy, and procedural requirements that pertain to importations under free trade agreements and other trade preference programs.”)

- Building stakeholder awareness by engaging in an education campaign to ensure that importers and suppliers in the CAFTA-DR and USMCA region understand compliance requirements and are aware of CBP’s enforcement efforts.

- Leveraging U.S. and Central American industry partnerships to improve facilitation for legitimate trade. (note: The Biden Administration aims to leverage textile and apparel trade as part of the solution to address “root causes of migration in Central America. According to the White House Fact Sheet released in March 2024, the Office of the U.S. Trade Representative and Central American Trade Agencies and textiles and apparel industry stakeholders will work together to build a directory with detailed profiles of manufacturing and sourcing companies in the region, including information on business practices and production capabilities, to facilitate transparent sourcing, and bolster the region’s supply chain.)

- Expanding the Uyghur Forced Labor Prevention Act (UFLPA) Entity List to identify malign suppliers for the trade community through review of additional entities in the high-priority textile sector for inclusion in the UFLPA Entity List. (note: Once an entity is on this list, in general, it is prohibited from exporting its goods to the United States. Importers are required to ensure the supply chains of their imported products are free from entities on the Entity List).

#2: Several US textile and apparel industry stakeholders have publicly responded to DHS’s new strategy.:

The National Council of Textile Organizations (NCTO), representing the US textile manufacturing sector, made several points in its statement:

“We strongly commend DHS for the release of a robust textile and apparel enforcement plan today. We also greatly appreciate Secretary Mayorkas’ personal engagement in this urgent effort and believe it’s a strong step forward to addressing pervasive customs fraud that is harming the U.S. textile industry.”

“The essential and vital domestic textile supply chain has lost 14 plants in recent months. The industry is facing severe economic harm due to a combination of factors, exacerbated by customs fraud and predatory trade practices by China and other countries, which has resulted in these devastating layoffs and plant closures. DHS immediately understood the economic harms facing the industry and deployed the development of a critical action plan.”

“The industry requests include

- Ramped up textile and apparel enforcement with regard to Western Hemisphere trade partner countries, including onsite visits and other targeted verification measures to enforce rules of origin as well as to address any backdoor Uyghur Forced Labor Prevention Act (UFLPA) violations.

- Increased UFLPA enforcement to prevent textile and apparel goods made with forced labor from entering our market, including in the de minimis environment.

- Immediate expansion of the UFLPA Entity List, isotopic testing, and other targeting tools. Intensified scrutiny of Section 321 de minimis imports and a review of all existing Executive Branch authorities under current law to institute basic reforms to this outdated tariff waiver mechanism. “

“We appreciate the Department of Homeland Security (DHS)’s announcement today outlining enhanced enforcement activities to prevent illicit trade in textiles. Our members support 55 million (more than one in four) American jobs and invest considerable time and resources in their customs compliance programs. Many of our members are Tier 3 participants in Customs-Trade Partnership Against Terrorism (C-TPAT). They are trusted traders and meet the high standards required to receive that designation by U.S. Customs and Border Protection and DHS. Our members are on the front lines for ensuring that they have safe and secure supply chains.

“While DHS launches this enforcement plan, we urge it to partner with our associations and our associations’ members. A successful enforcement plan must include input from all stakeholders, clear communication with the trade, and coordinated activities with importers, especially if DHS finds illicit activity happening in the supply chain. The results of any illicit activities must be shared so that our members and other importers can act quickly to address the issue. As our members look to diversify their supply chains, especially back to the Western Hemisphere, we must make sure efforts are included to incentivize and not deter new investments.”

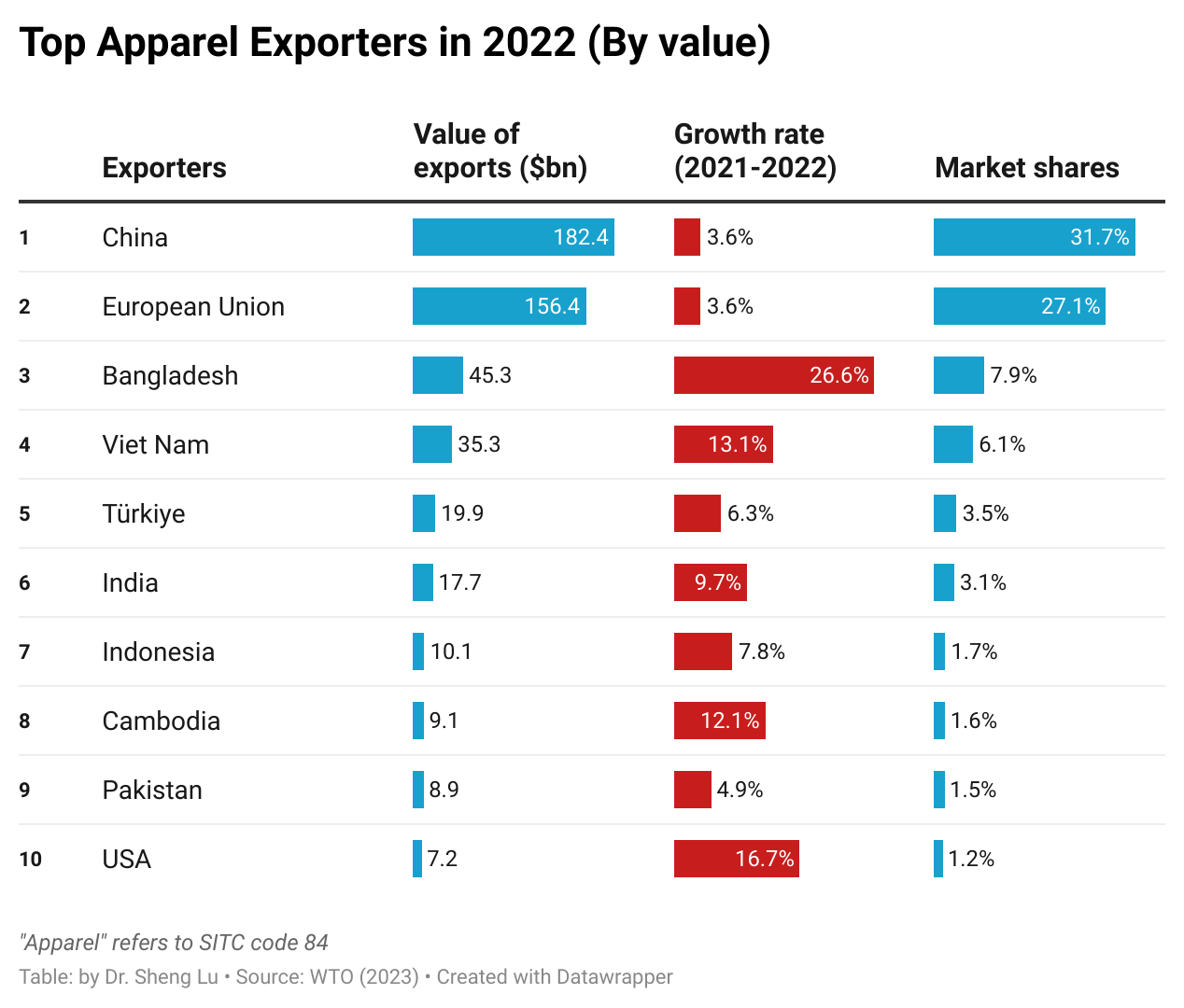

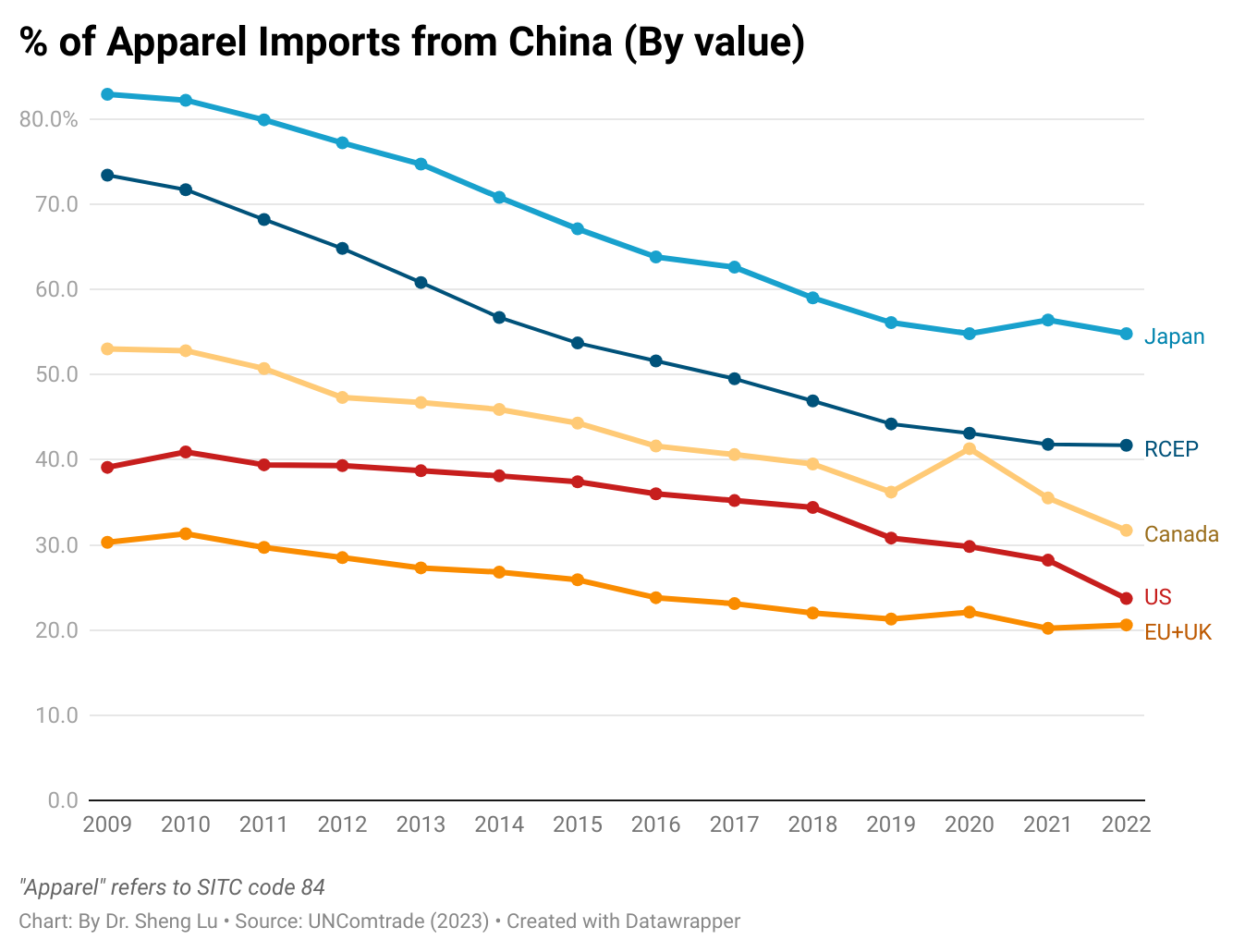

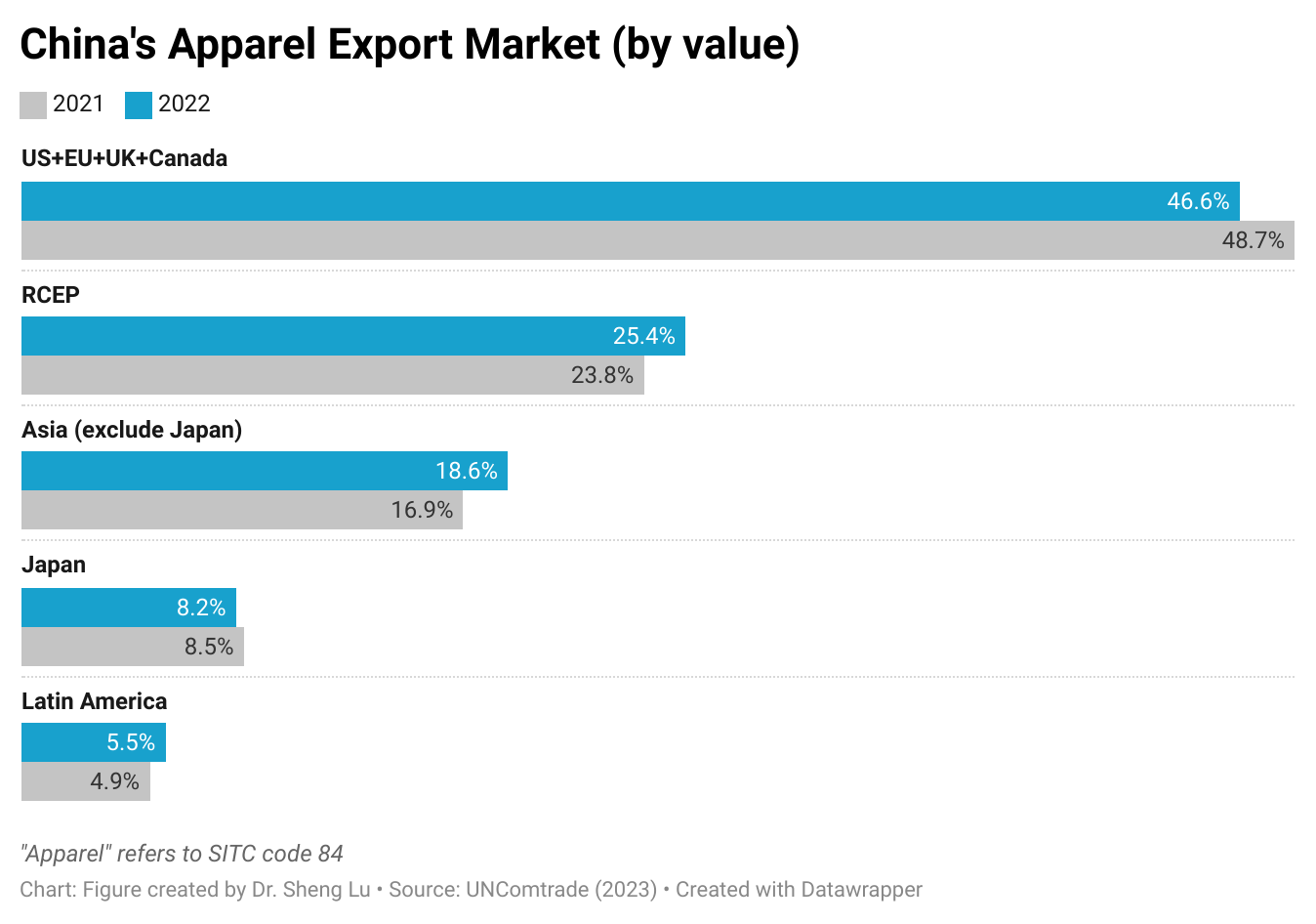

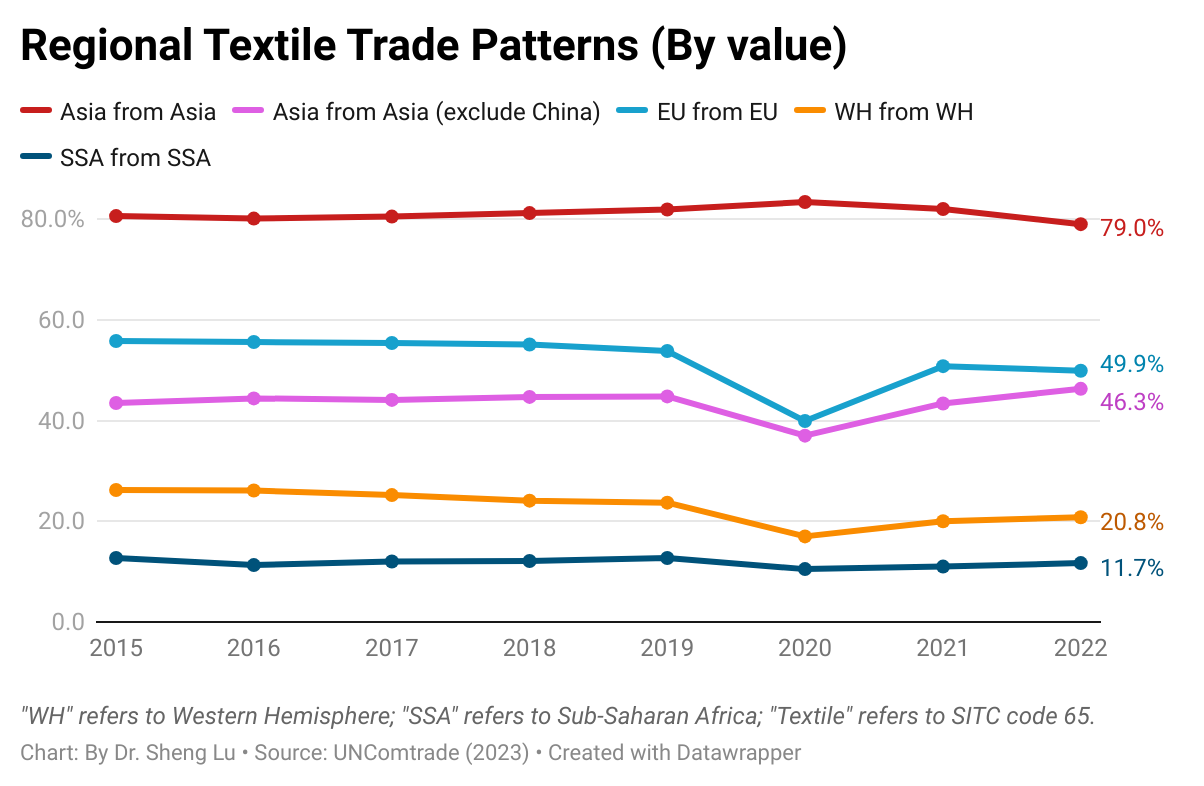

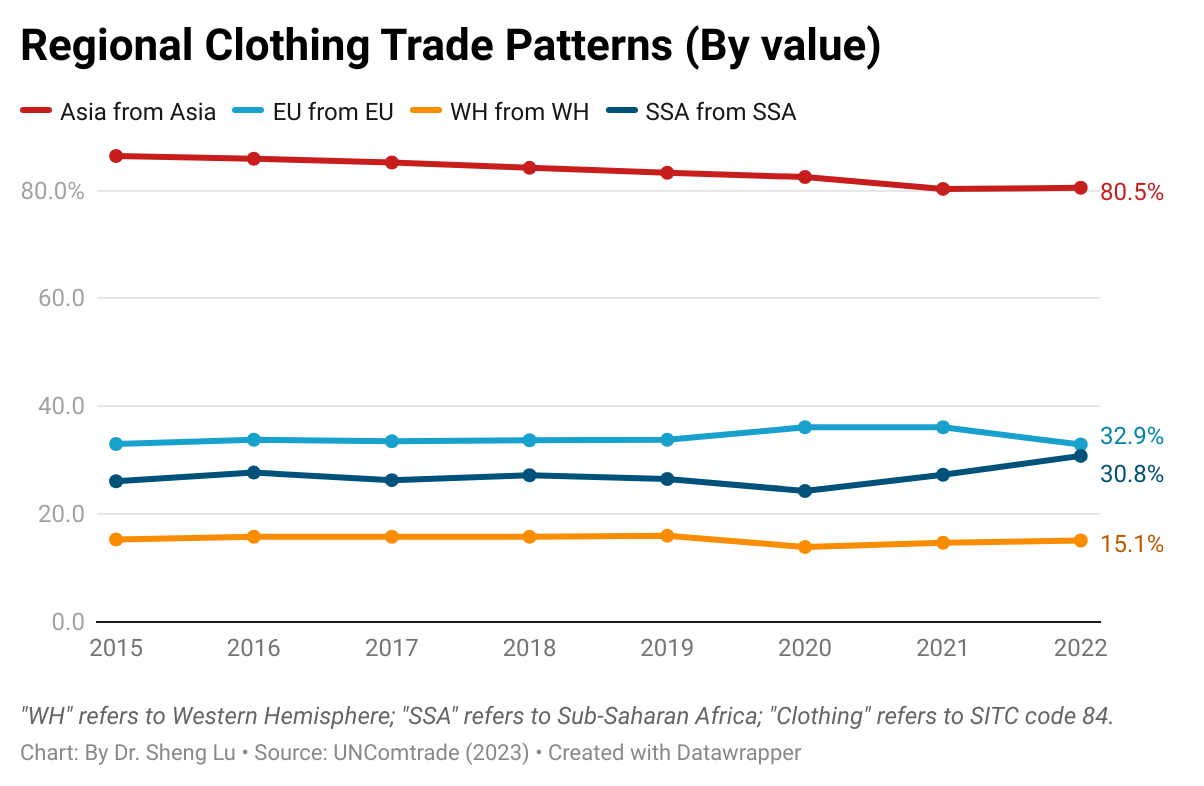

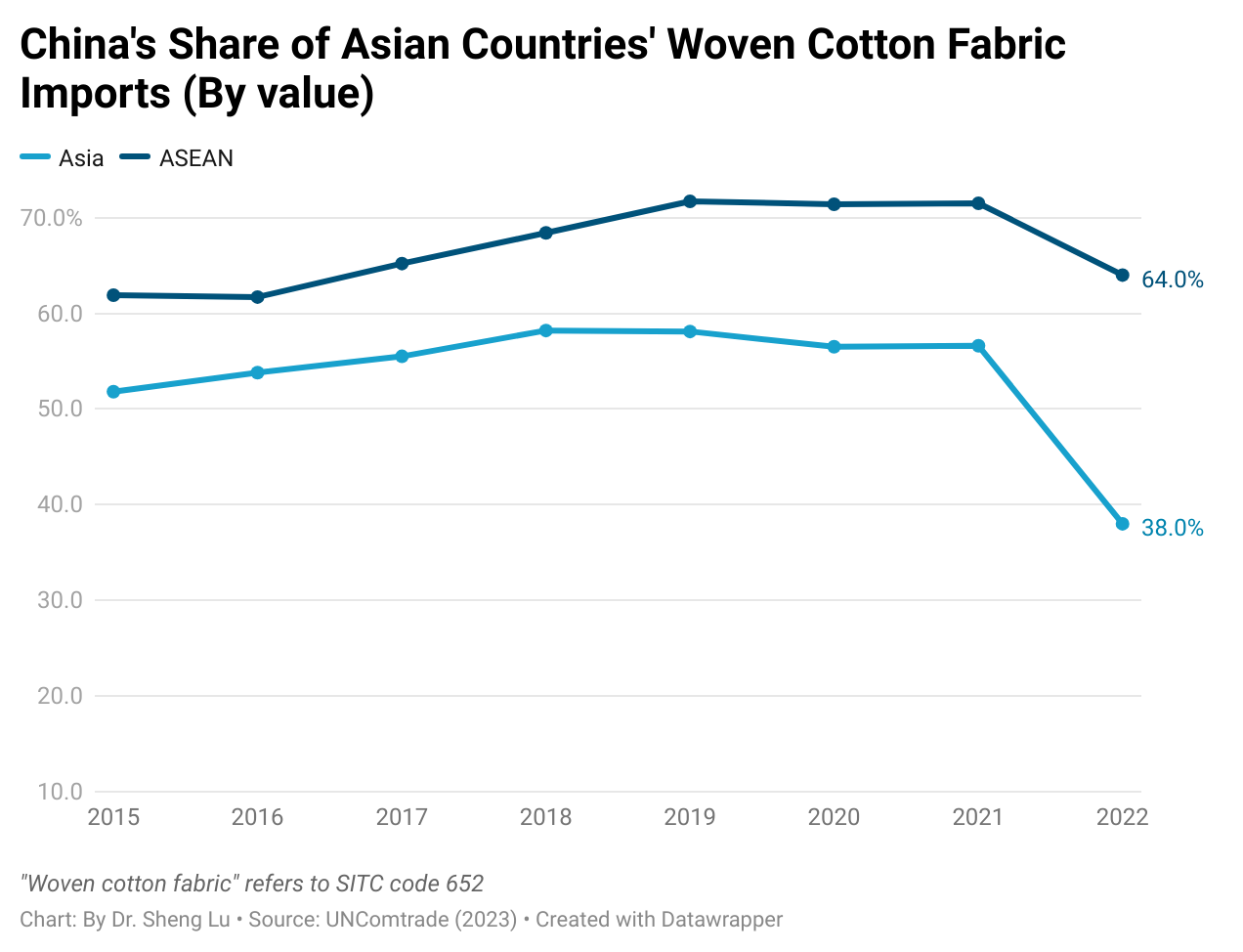

#3 Comments: Overall, the new DHS textile enforcement plan suggests several key US textile and apparel trade policy directions: 1) revisit the current de minimis rules that are used by many e-commerce businesses; 2) further strengthen the UFLPA and forced labor enforcement; 3) expand the Western hemisphere textile and apparel supply chain and encourage more US apparel sourcing from CAFTA-DR members; 4) scrutinize US apparel imports from China and imports from other Asian countries that heavily use textile raw material from China.

Discussion questions for FASH455 (please answer them all):

- How do the perspectives of the US textile industry and US fashion brands and retailers diverge concerning CBP’s new strategy? What are the areas in which they share common ground?

- Building on the previous question, how can the difference between the US textile industry and US fashion brands and retailers be explained regarding their response to DHS’s new enforcement strategy?

- As a sourcing manager for a major US apparel brand with global operations, how do you plan to adjust your company’s sourcing practices in light of DHS’s new strategy? You can list 1-2 detailed action plans and provide your analysis.

Background

The U.S. Customs and Border Protection (CBP) is an agency within the Department of Homeland Security (DHS), responsible for “regulating and facilitating international trade, collecting import duties, enforcing U.S. trade laws, and protecting the nation’s borders.”

Homeland Security Investigations (HSI) is also a division within the Department of Homeland Security (DHS), responsible for “investigating transnational crime and threats, specifically those criminal organizations that exploit the global infrastructure through which international trade, travel and finance move.”