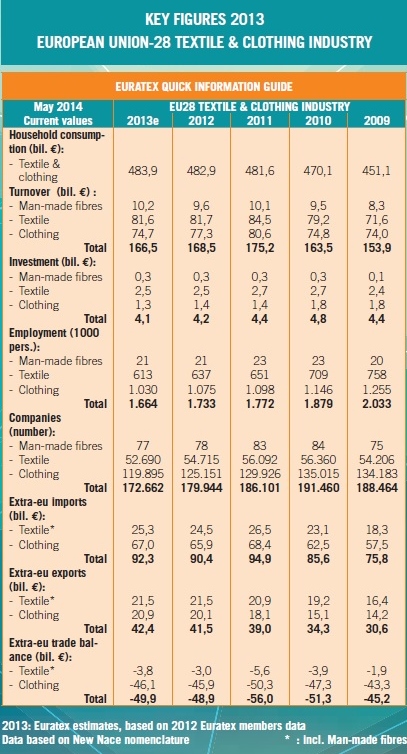

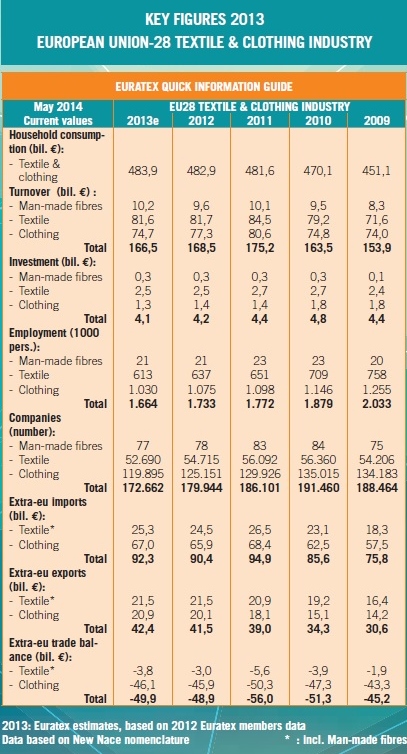

In its annual release, the European Apparel and Textile Federation (Euratex) provides a skeletal statistical profile of the EU textile and apparel (T&A) in 2013. Most statistics cited in the report comes from the Eurostat.

Production

In 2013, T&A production in EU overall remains stable. Output of Man-made fiber (MMF) enjoyed a 6.8 percent growth from a year earlier, although production of textile (yarns, fabrics and made-ups) and apparel respectively declined 0.1 percent and 4.2 percent. Accumulatively, from 2010 to 2013, production of MMF, textile and apparel in EU has down 15.2 percent, 8.1 percent and 13.3 percent respectively.

Employment

Employment in the EU T&A industry continues to move downward in size, shrinking from 1.73 million in 2012 to 1.64 million in 2013. The most significant drop happened in the apparel subsector, which suffered a 4 percent job loss from 2012 to 2013. The number of employment in the textile and MMF subsectors goes down 3.7 percent and 1 percent respectively.

Consumption

Affected by the slow economic recovery in the region, EU consumers seem still hesitant in expending more money on T&A products in 2013. Value of T&A consumption in EU (28) stood at €483.9 billion in 2013, only a slight increase of 0.2 percent from 2012.

Trade

The two-way EU T&A trade enjoyed a modest growth from 2012 to 2013. Particularly, despite reported decline in production, value of EU apparel exports in 2013 increased 4 percent, reflecting the growing demand for “made in EU” apparel products in other parts of the world. In terms of import, consistent with the pattern of consumption, EU apparel imports slightly increased 1.7 percent from 2012 to 2013. It should be noted that China is gradually losing market share in the EU apparel import market. From 2012 to 2013, value of China’s apparel exports to the EU declined 4 percent, compared with 10 percent growth of Bangladesh.