Textile and apparel manufacturing in the U.S. has significantly shrunk in size over the past decades due to multiple factors ranging from automation, import competition to the shifting U.S. comparative advantages for related products. However, U.S. textile manufacturing is gradually coming back. The output of U.S. textile manufacturing (measured by value added) totaled $16.59 billion in 2021, up 23.8% from 2009. In comparison, U.S. apparel manufacturing dropped to $9.5 billion in 2019, 4.4% lower than ten years ago (Bureau of Economic Analysis, 2021).

Meanwhile, like many other sectors, U.S. textile and apparel production was hit hard by COVID-19 in the first half of 2020 but started to recover in the 3rd quarter. Notably, as of December 2021, U.S. textile production had returned to its pre-COVID level.

On the other hand, as the U.S. economy is turning more mature and sophisticated, the share of U.S. textile and apparel manufacturing in the U.S. Gross Domestic Product (GDP) dropped to only 0.12% in 2020 from 0.57% in 1998 (Bureau of Economic Analysis, 2021).

The U.S. textile and apparel manufacturing is changing in nature. For example, textile products had accounted for over 66% of the total output of the U.S. textile and apparel industry as of 2019, up from only 58% in 1998 (Bureau of Economic Analysis, 2020). Textiles and apparel “Made in the USA” are growing particularly fast in some product categories that are high-tech driven, such as medical textiles, protective clothing, specialty and industrial fabrics, and non-woven. These products are also becoming the new growth engine of U.S. textile exports. Notably, “special fabrics and yarns” had accounted for more than 34% of U.S. textile exports in 2019, up from only 20% in 2010 (Data source: UNComtrade, 2021).

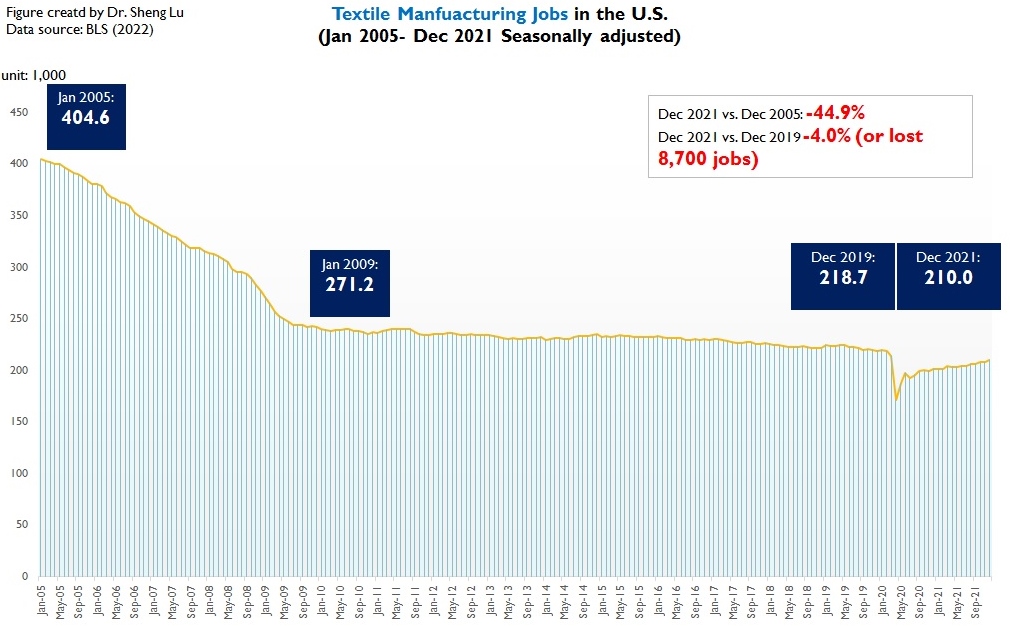

Compatible with the production patterns, employment in the U.S. textile industry (NAICS 313 and 314) and apparel industry (NAICS 315) fell to the bottom in April-May 2020 due to COVID-19 but started to recover steadily since June 2020. From January 2021 to December 2021, the total employment in the two sectors increased by 4.5% and 4.2%, respectively (Seasonally adjusted). However, the employment level remains much lower than the pre-COVID level (benchmark: December 2019).

To be noted, as production turns more automated and thanks to improved productivity (i.e., the value of output per worker), U.S. textile and apparel factories have been hiring fewer workers even before the pandemic. The downward trend in employment is not changing for the U.S. textile and apparel manufacturing sector. Related, how to attract the new generation of workforce to the factory floor remains a crucial challenge facing the future of textile and apparel “Made in the USA.”

International trade supports textiles and apparel “Made in the USA.” Notably, nearly 42% of textiles “Made in the USA” (NAICS 313 and 314) were sold overseas in 2019, up from only 15% in 2000. A recent study further shows that product category and the size of the firm were both statistically significant factors that affected the U.S. textile and apparel manufacturer’s likelihood of engaged in exports.

It is not rare to find clothing labeled “made in the USA with imported fabric” or “made in the USA with imported material” in the stores. Statistical analysis shows a strong correlation between the value of U.S. apparel output and U.S. yarn and fabric imports from 1998 to 2019.

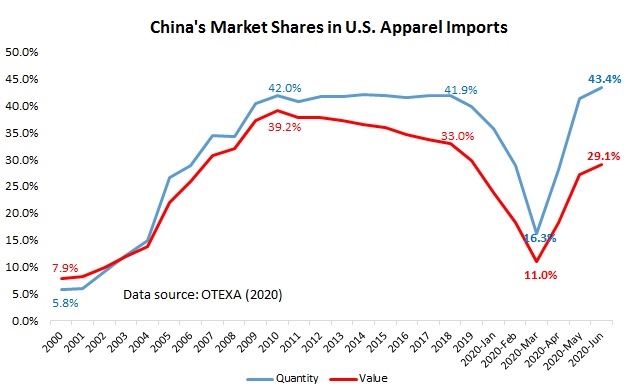

Like many other developed economies whose textile and apparel industries had reached the stage of post-maturity, the United States today is a net textile exporter and net apparel importer. COVID-19 has affected U.S. textile and apparel trade in several ways:

- Trade volume fell and yet fully recovered: Both affected by the shrinkage of import demand and supply chain disruptions, the value of U.S. textile and apparel imports dropped by as much as 19.3% in 2020 from a year ago, particularly apparel items (down 23.5%). Likewise, the value of U.S. textile and apparel exports in 2020 decreased by 15.6%, including an unprecedented 26% decrease in yarn exports. Further, thanks to consumers’ robust demand, the value of US apparel imports enjoyed a remarkable 27.4% growth in 2021 from a year ago and but was still 2.5% short of the level in 2019.

- Trade balance shifted: Before the pandemic, U.S. was a net exporter of fabrics. However, as the import demand for non-woven fabrics (for making PPE purposes) surged during the pandemic, U.S. ran a trade deficit of $502 million for fabrics in 2020; the trade deficit expanded to $975 million in 2021. Meanwhile, as retail sales slowed and imports dropped during the pandemic, the U.S. trade deficit in apparel shrank by 19% in 2020 compared with 2019. However, the shrinkage of the trade deficit did not necessarily boost clothing “Made in the USA” in 2020, reminding us that the trade balance often is not an adequate indicator to measure the economic impact of trade.

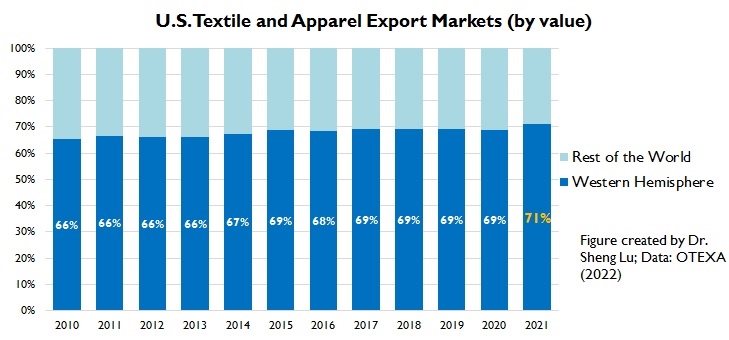

- No change in export market: More than 70% of U.S. textile and apparel export went to the Western Hemisphere in 2021, a pattern that has stayed stable over the past decades (OTEXA, 2022). More can be done to strengthen the Western Hemisphere supply chain and textile and apparel production in the region by leveraging regional trade agreements like CAFTA-DR and USMCA.

By Sheng Lu

Further reading:

- The Shifts in US Textile Manufacturing Raise Questions About the Availability of US-made Textile Inputs for the Western Hemisphere Apparel Supply Chain

- 2022 State of the US Textile Industry (National Council of Textile Organizations, NCTO)