(photo courtesy: Amcham Vietnam)

Herb Cochran is the Executive Director at the American Chambers of Commerce (AmCham) Vietnam. He has helped transform AmCham Vietnam into an influential organization that promotes trade and investment between Vietnam and the United States, with a focus on developing networking, information-sharing, and advocacy activities to improve the business environment.

Herb mobilized AmCham Vietnam members’ substantial efforts to conclude negotiations on the Vietnam-U.S. Bilateral Trade Agreement and Vietnam’s WTO Accession, and to have these two agreements approved by the U.S. Congress. As a result, trade between Vietnam and the U.S. increased from $1.2 billion in 2000 to about $36 billion in 2014. And Herb expects that total Vietnam-U.S. trade will reach $ 72 billion in 2020.

With Herb’s leadership and support, AmCham Vietnam’s committees and industry sector experts have helped improve mutual understanding on key issues in U.S.-Vietnam trade and investment, including implementation of trade agreements, preserving Vietnam-U.S. apparel trade, strengthening governance and anti-corruption efforts, improved industrial relations, Project 30 (simplification of Vietnam’s administrative procedures), work force development for modern manufacturing, promoting trade and investment between the U.S. and Vietnam’s Southern Key Economic Region, and the Asia Development Bank’s strategy for the economic and social development of Vietnam and the Greater Mekong Subregion.

Prior to joining AmCham, Herb was Commercial Attaché at the U.S. Embassy in Hanoi and Principal Commercial Officer at the U.S. Consulate General in Ho Chi Minh City. He helped establish the commercial office of the U.S. Embassy in Hanoi, hiring staff and establishing trade and finance programs, including the U.S. Export-Import Bank, Overseas Private Investment Corporation (OPIC), and U.S. Trade and Development Agency (USTDA). In 1998-99 he established the commercial office of the U.S. Consulate General in Ho Chi Minh City.

Herb also served as Regional Director, East Asia and Pacific, U.S. Commercial Service, based in Washington DC. His responsibilities included program, personnel, and budget support for the commercial departments of 15 United States Embassies in the Asia/Pacific region, from Tokyo, Seoul, and Beijing in Northeast Asia, to all the countries of Southeast Asia, and down to Australia and New Zealand. Other international working experiences of Herb include: Commercial Counselor at the U.S. Embassy in Bangkok, Thailand, Commercial Attaché at the U.S. Embassy in Tokyo, Japan, U.S. Consulate General in Osaka, Japan, and Action Officer at the State Department’s Office of Japanese Affairs.

Born in North Carolina, Herb earned a B.A. from the University of North Carolina at Chapel Hill (History), and a Certificat from the Institut d’Études Politiques (Sciences Po) in Paris. He is also a graduate of the Industrial College of the Armed Forces in Washington DC (National Defense Strategy).

Interview Part

Sheng Lu: Can you provide us an overview about the US-Vietnam business ties?

Herb Cochran: Vietnam has succeeded at attracting foreign direct investment (FDI) and increasing trade. U.S. – Vietnam trade in 2015 will likely reach over $45 billion, another annual increase of over 20%. Vietnam accounts for 25% of all U.S. imports of goods from the Association of Southeast Asian Nations (ASEAN). The numbers are likely to reach $80 billion and a 33% market share by 2020.

More details can be found from a few recent AmCham statements to government officials and to press inquiries:

Note: Vietnam Business Forum a “structured dialogue” of about three hours 2 times a year, in June and in December, where the business associations present their views of the business ties and business environment and suggest areas for improvement.

Sheng Lu: What are the main reasons that U.S. companies come to invest in Vietnam? Are most U.S. business operations in Vietnam profitable?

Herb Cochran: Foreign Direct Investment into Vietnam has been increasing recently, as companies prepare for ASEAN integration, for the Trans-Pacific Partnership (TPP), and for the expectation that 59% of global middle class consumer spending will be in the Asia – Pacific region by 2030, up from 23% in 2009. For example:

These are all world-class factories, by global companies, for export to ASEAN, TPP, and Asia-Pacific markets. Not to mention the high-tech investments by Intel, Samsung, Apple, and others in the microelectronics and consumer electronics sector.

Main reasons that U.S. companies come to invest in Vietnam include:

- Availability of low cost labor

- Availability of trained personnel

- Stable government and political system

Regarding Vietnam’s business and investment environment, please also see the summary below from ASEAN AmChams’ Business Outlook Survey 2016.

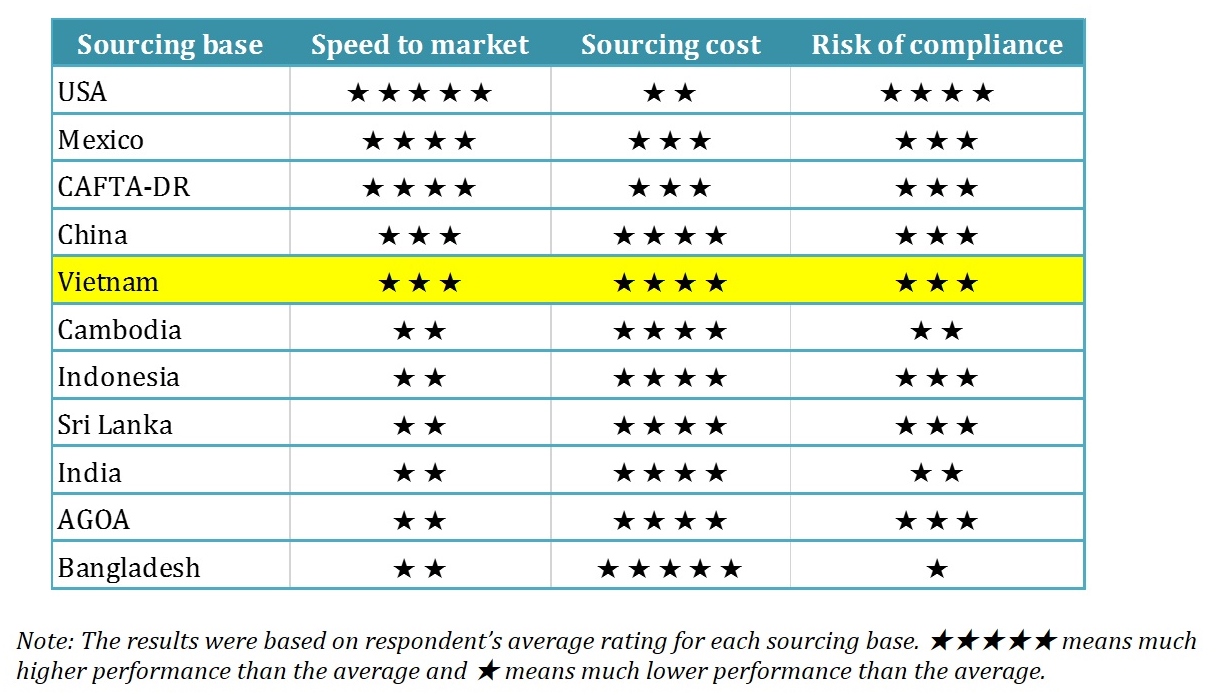

Sheng Lu: Given the increasing labor cost in China, many people see Vietnam as an alternative sourcing destination for labor-intensive products such as apparel and footwear. What’s your view on this trend?

Herb Cochran: I agree. In Aug 2013, we had a delegation visit AmCham HCMC from AmCham Hong Kong, Footwear and Apparel Committee. They said, “We represent 80% of the apparel and footwear sourcing in the world. We are in Hong Kong because most of our sourcing is in China. But we are leaving China, for various reasons. Vietnam’s participation in TPP is certainly an attraction, but we are leaving China with or without TPP. We want to know if Vietnam will welcome us.”

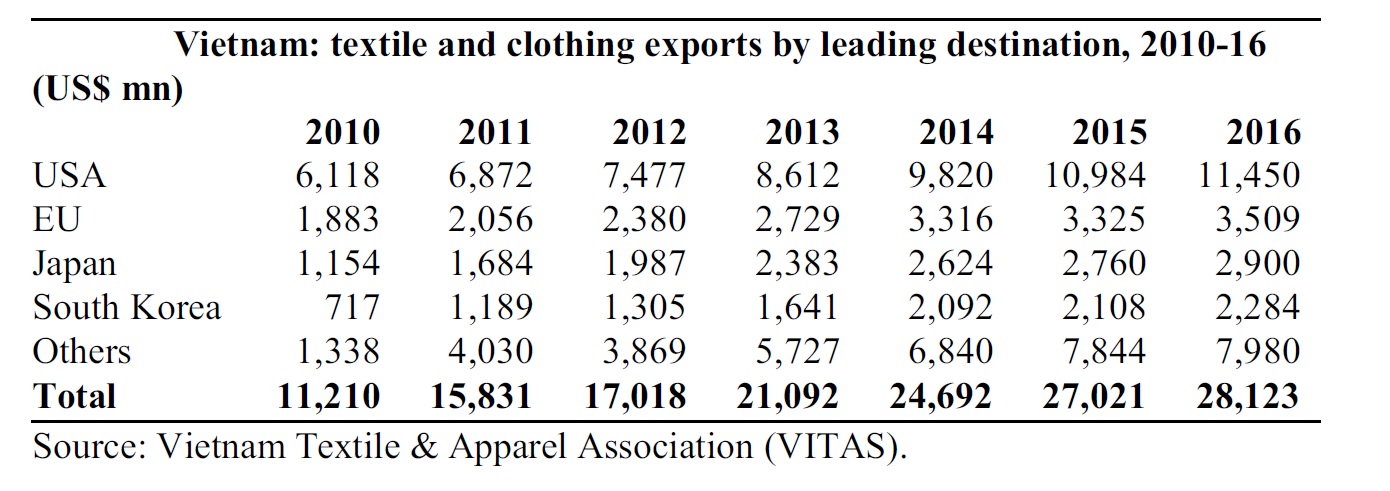

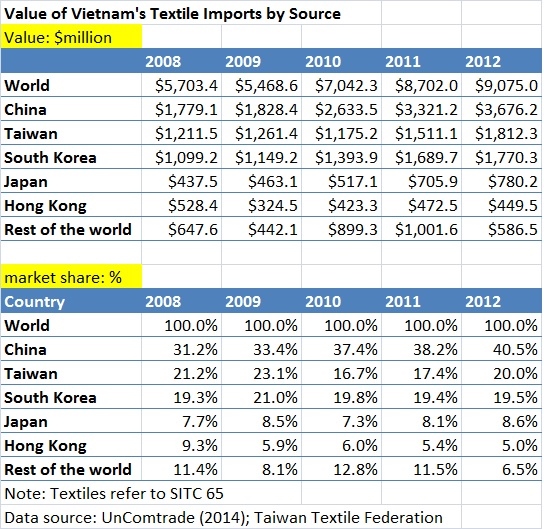

It should be particularly noted that between 2013 – 2015, about $3 billion was announced in FDI in textiles to meet the yarn-forward rules of origin requirements of TPP. One estimate projects Vietnam’s apparel exports to the U.S. under TPP “… would be as high as US$ 22 billion” by 2020. Another projects that Vietnam’s apparel and footwear exports would increase by 45.9% over the baseline by 2025. A third expert said she expects the TPP will “change the sourcing landscape drastically;” and Vietnam’s share of the U.S. apparel import market could go from 10% to 35% very quickly.” [Note: 35% of the U.S. apparel imports market is $35 billion. I think this is the most interesting estimate, a microeconomic estimate from an industry expert and not a “macroeconomic model estimate.”] And Mr. Le Tien Truong, Deputy Director of VINATEX, expects that Vietnam’s exports of textiles and apparel could reach $50 billion by 2025. [I think this estimate is overoptimistic.]

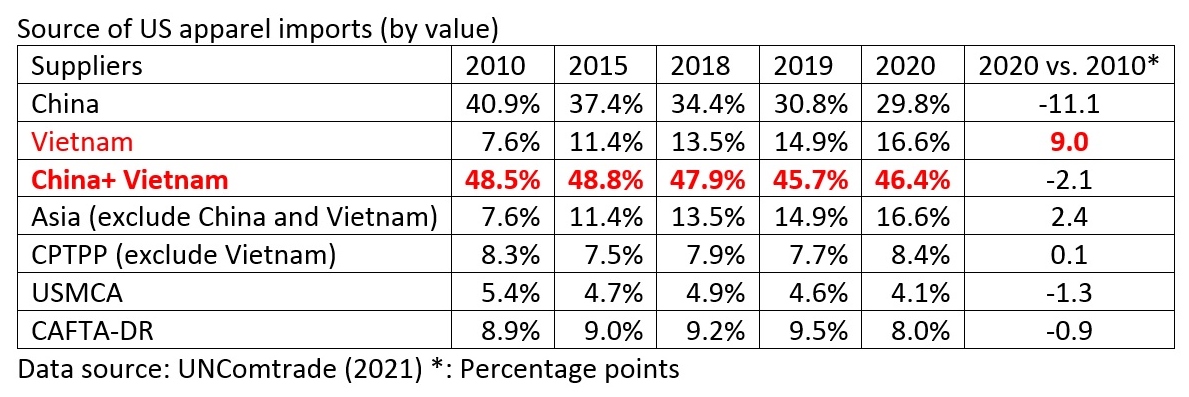

Below is a historical comparison of U.S. imports of apparel from China, “2nd Tier Countries,” and “Other.” from 2005 to 2025. The actual trade statistics from 2005 to 2015 show that U.S. Imports of Apparel from China doubled from 2005 (when quotas on WTO members were lifted) to 2010, but they have been “flat” since then. Value of imports from 2016 to 2025 are forecasted numbers.

Sheng Lu: In your view, what commercial opportunities does the Trans-Pacific Partnership (TPP) present to U.S. companies in Vietnam, especially in the textile and apparel industry?

Herb Cochran: The most authoritative study was done by Professor Peter Petri of Brandeis University and the Peterson Institute. According to the findings:

The TPP would increase Vietnam’s exports from the expected “baseline” in 2025 without TPP of $239.0 billion (of which apparel and footwear exports would total $113 billion) by $67.9 billion to $307 billion (of which apparel and footwear exports would increase by $51.9 billion to $165 billion). In percentage terms, total exports would increase by 28.4% over the baseline, and apparel and footwear exports would increase by 45.9% over the baseline. Total Net Exports increase: 67.9 / 239.0 = 28.4%.

In addition, the expected Gross Domestic Product (GDP) growth benefits are substantial, Vietnam’s GDP in 2025 with TPP, would be 10.5% higher than the baseline estimate. This is particularly important now that Vietnam is in a “structural growth decline” period, according to the World Bank. Those are economic projections that give a general idea.

Sheng Lu: How is TPP discussed in Vietnam such as its local media?

Herb Cochran: Very positively. For example, see the below link: “89% of public in Vietnam thinks the TPP is “ … a good thing.” http://www.amchamvietnam.com/30448353/89-of-public-in-vietnam-supports-tpp-pew-research/

Part of the reason for this positive viewpoint is the series of seminars that we in AmCham HCMC organized in 2013 to explain about the TPP, create better understanding of and support for the TPP especially in the Vietnam business community.

Sheng Lu: What is the outlook for TPP ratification in Vietnam?

Herb Cochran: Very good. At the closing ceremony of the 14th Plenum of the 11th Party Central Committee, the Party General Secretary, Nguyen Phu Trong, said members of the Party Central Committee reached consensus on the signing and ratification of the Trans-pacific Partnership Agreement in conformity to laws on signing and joining international treaties. Mr. Trong said: “The TPP will bring great benefits but also opportunities and challenges to Vietnam. These challenges have been identified during Vietnam’s 30 years of renewal and international integration. With efforts, creativity, and determination of the Party, army, people, and the business community, we are confident that we will overcome all challenges and grasp opportunities created by the TPP to achieve rapid, sustainable growth.”

Sheng Lu: While living in Vietnam, have you encountered any culture shock? Can you share some stories with our students?

Herb Cochran: No culture shock. During my career as a U.S. Foreign Service Officer, I lived in Vietnam, Japan, and Thailand for about 22 years, so I am used to living abroad. And I have lived in Vietnam since Jan 1997. I guess rather than “culture shock,” you might say that I have “culture insights” from time to time. The most common insight here in Vietnam is how polite, warm and gracious most people are. It is still a traditional society, very family oriented. One cultural insight is how they celebrate “death anniversaries” for many years, with special celebrations on certain multi-year anniversaries, to keep family ancestors in their memories, called lễ giỗ.

Sheng Lu: Last but not least, for our students interested in working/interning in Vietnam, do you have any suggestions?

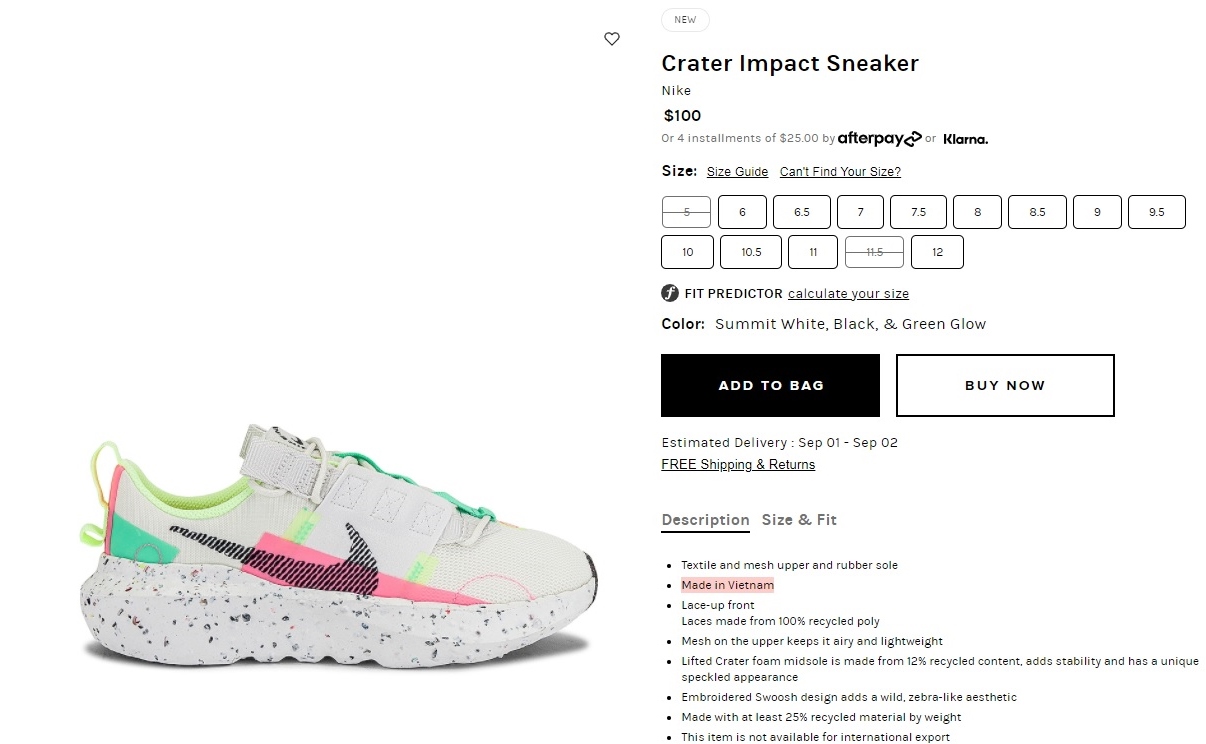

Herb Cochran: It’s very tough to get started. Click the below link for some comments that I have put together in response to many questions: http://www.amchamvietnam.com/faqs/faq-how-do-i-find-employment-opportunities-with-amcham-member-companies/. A short commentary is that I think it is probably better to start in the U.S. with a large organization that has global operations, e.g. Walmart, Nike, etc., and learn about that organization’s international operations and get started that way. Especially when your students are younger, maybe not yet married, no children, etc. One real problem for American citizens is that they are taxed in the U.S. and in the country of employment, so that they are generally 25% to 50% more expensive than U.S. non-citizens.

–The End–