The study is available HERE (published by the Government of the Netherlands). Key findings:

Size of used textiles trade:

- In 2022, the Netherlands exported 248,000 tons of used textiles (or over €193 million), the highest in the past five years. This trend aligned with the EU’s broader used clothing exports, which reached 1.7 million tons in 2019. The average European price for used textiles was around €0.76 per kg in 2019.

- In 2018, 84% of used textiles collected in the Netherlands were exported, with 53% being suitable for re-wearing, 33% recycled, and 14% being nonrecyclable and non-renewable.

Destinations of the used textile exports

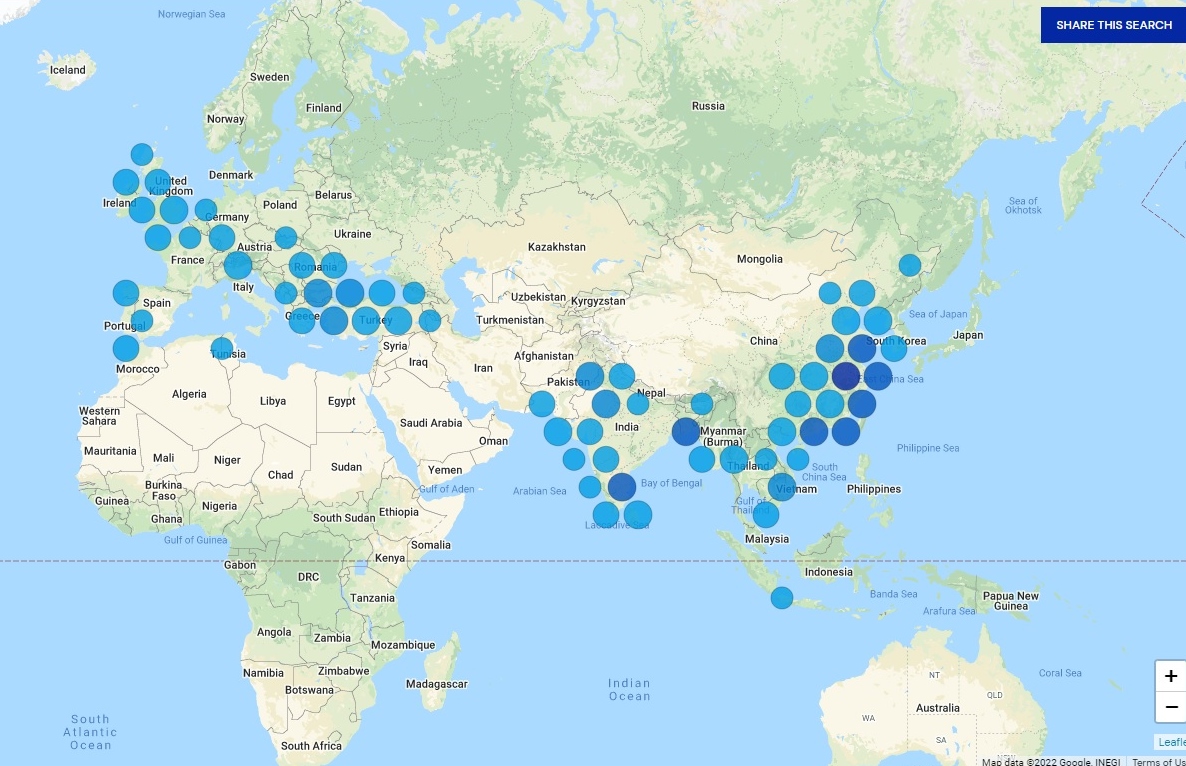

Trade data analysis (HS6309 and HS6310 from 2017 to 2022) and interviews revealed several key export destinations for used clothing exports from the Netherlands:

- Poland and Pakistan as Import-export hubs. The high volumes of HS 6309 (used textiles) exports from the Netherlands to Poland likely reflect the lower labor costs for labor-intensive manual sorting in Poland. For the last five years, Pakistan has also been a top-five destination for Dutch used textile exports (under HS6309). Four of the six Dutch collector-sorters interviewed confirmed that Pakistan is a primary export destination, noting that the lowest quality textiles were usually sent there. However, Pakistan is also the world’s sixth largest used clothing exporter, suggesting Pakistan is unlikely to be the final destination for the Dutch used textile exports but an import-export hub.

- India is positioned as a significant recycling hub, particularly for HS 6310 (sorted and unsorted used rags and textile scraps) imported from the Netherlands. India also receives a substantial volume of HS 6310 textiles originating from the Netherlands via France. Notably, India enforces trade restrictions requiring textiles under HS 6309 (used textiles) to be imported only through the Kandla Special Economic Zone (KASEZ), with a mandate for at least 50% to be re-exported. Panipat in India is home to numerous spinning companies, ranging from large to small. These companies specialize in cleaning and sorting textile waste to produce recycled yarn, which is then supplied to weaving and manufacturing units in Panipat and beyond. Most of India’s used textiles re-exports went to African countries.

- Ghana and Kenya were significant recipients of used textiles from the Netherlands, yet their export volumes for HS6309 (used textiles) and HS 6310 (sorted and unsorted used rags and textile scraps) were comparatively low. The high import-to-export ratios underscore these two countries’ role as the reuse and disposal destinations of used textiles from the Netherlands.

Characteristics of the used textile exports

- The report highlights divergent perspectives on the quality and rewearability of textile exports to African countries. Dutch collectors and sorters assert that all exports from the Netherlands to Africa consist of good-quality rewearables. They distance themselves from the problem of textile waste exported to Africa, attributing it to the unregulated practices of certain parts of the used textiles trade that involve illegal contractors and exports.

- According to the study, textiles deemed suitable for currently viable closed-loop recycling technologies include those made of pure cotton, pure wool, pure acrylic, and cotton-rich and wool-rich blends exceeding 80%. However, the study noted a concerning decline in the proportion of collected textiles suitable for rewear, coupled with a rise in textiles containing synthetic fibers. Most interviewees explicitly attribute the degradation in the quality of used textiles over time to the influence of “ultra-fast fashion.”

Environmental and social impacts of used textile exports

- Interviews revealed a significant variation in the perceived environmental impacts of the used clothing trade. For example, participants from import-export hubs like Pakistan and recycling hubs like India emphasized minimal environmental harm, focusing on the positive contributions of used textile imports. In contrast, interviewees from reuse and disposal countries, such as Kenya and Ghana, discussed environmental harms and their localized impacts. Interviewees also expressed concerns that “certain sustainability solutions may be developed in such a way that generates additional problems further away” and benefit actors in Europe and the West only.

- The study also found that 99% of fashion brands “do not disclose a commitment to ultimately reduce the number of new items they produce,” and only 12% of fashion companies have even disclosed the quantity of products produced annually in 2023, down from 15% in 2022.

- The involved parties acknowledge the considerable difficulty in completely disassociating any participant in the reverse supply chain from the adverse impacts of textile exports. Despite efforts, achieving complete transparency beyond EU borders is deemed nearly impossible, as highlighted by one used textiles collector.

Job creation

- The used textiles value chain unambiguously generates a huge amount of employment, particularly for women, in the sorting, recycling, selling, cleaning, repairing, re-styling, and distributing processes.

- A 2023 International Labour Organization (ILO) study showed that new recycling and reprocessing activities could create over 10 million jobs in Latin America and the Caribbean and around 0.5 million jobs in Europe.

- However, concerns related to job quality and social risks were also raised in interviews, particularly concerning reuse and disposal countries. Even where waste management systems for used textiles are formalized and managed, they often rely on the “labors of informal actors” for various functions such as distribution, resale, and disposal processes. Gender-based disadvantage may also be a concern. For example, the study found that whereas recycling and sorting enterprises are overwhelmingly owned and operated by men, women perform the majority of lower-wage, non-technical, and manual labor-intensive tasks.

Regulations

- The Dutch government’s Circular Textiles Policy Programme for 2020–2025 outlines a commitment to enhance the proportion of recycled materials in textiles and apparel products available in the Dutch market, including achieving a 10% reuse and 30% recycling rate of sold textiles and apparel by 2025.

- The Dutch Extended Producer Responsibility (EPR) for textiles was officially implemented on July 1, 2023. Onwards, producers are responsible for “recycling and reusing of textiles…including an appropriate collection system, recycling and reusing of clothing and household textiles and financing this entire system.”

- The policy landscape for managing and exporting used textiles in Europe has evolved to align with environmental goals, with key milestones such as the EU Strategy for Sustainable and Circular Textiles in March 2022. While this strategy aims to create a greener and more resilient textiles sector, the report suggests a need for a bolder vision and more international orientation, emphasizing responsibility for socioenvironmental impacts beyond Europe.

- The EU Waste Framework Directive (WFD) is another crucial instrument to tackle the environmental challenges of high textile consumption. The WFD regulates all aspects of textile waste management, including the specific obligations to ensure separate collection, treatment, and reporting requirements. The directive calls for all EU Member States to establish separate collection systems for used textiles by the beginning of 2025.