About Megan Dawson-Elli

Megan Dawson-Elli graduated from the University of Delaware (UD) in 2016 with a degree in Fashion Merchandising. During her time at UD, she was the winner of the Fashion Scholarship Fund case study, a highly competitive national competition. Early in her academic career, she identified her interest in environmental sustainability within the fashion industry. This inspired Megan to study abroad in Hong Kong in 2014, where she was a Sourcing & Sustainability intern for Under Armour. After graduation, Megan worked in merchandising and sourcing before starting her career in environmental sustainability at PVH in 2018. Presently, Megan holds the position of Product Sustainability Manager at Tapestry, where she leads their work on product impact, environmentally preferred materials, and circularity.

In her free time, Megan enjoys reading, running, and traveling. She lives in NYC with her fiancé, also a UD graduate, and likes spending her weekends in Central Park.

Sheng: What does a Product Sustainability Manager do? Can you walk us through your typical day at Tapestry? Also, what makes you love your job?

Megan: As a Product Sustainability Manager, I work as an internal consultant to our brands to support their progress towards our Environmental, Social and Governance (ESG) goals and their desire to market and evaluate the environmentally preferred attributes of our products. Many initiatives fall under Product Sustainability, but I would bucket most of the work into several categories: marketing claims substantiation, environmentally preferred materials, product impact, circularity, and packaging. Every day can look different in this role, which keeps it exciting! One day I will be working with teams to craft a marketing claim about a product and the next I will be collecting data from suppliers for a life cycle assessment. My work is very dynamic, with some projects lasting days versus months. I love my job because I get to work with teams across the company that are passionate about sustainability, and even though I no longer work to create products, it’s still the focus of my work.

Sheng: Consumers today, especially our Gen Z students, want to see more “sustainable” fashion products in the market. What does “sustainable product” mean in practice? Can “sustainability” be objectively measured?

Megan: The term “sustainable” has become difficult to define as many initiatives can fit under it, like environmentally preferred materials, responsible sourcing, circularity, etc. It can also be seen as a yes/no question, while sustainability is a journey where progress should grow as new innovations become available. At a product level, the most visible sustainability initiatives that can be seen are environmentally preferred materials or social impact claims being made about the item. There are plenty of initiatives that companies are doing across their supply chain and their operations. Checking out a company’s annual Corporate Responsibility report will show a greater picture of its efforts, commitments, and progress.

Sheng: How can sourcing contribute to a fashion company’s sustainability efforts and make more sustainable products available to consumers?

Megan: At Tapestry, we follow an internal framework known as “Style, Performance and Impact.” This ensures all products meet our high standards of craftsmanship. The framework also guides our decision-making around environmentally preferred materials and material innovation investments.

- Style: Does it meet design needs or the intended design function of the product?

- Performance: Does it meet expectations of quality and cost?

- Impact: Does the material or decision have a measurable reduction in environmental impact?

Additionally, suppliers play a critical role in helping companies realize their environmental and social ambitions. We consistently partner with stakeholders across our value chain to work toward more responsible practices that their businesses can incorporate, especially through increased implementation of environmentally preferred manufacturing practices and using preferred materials.

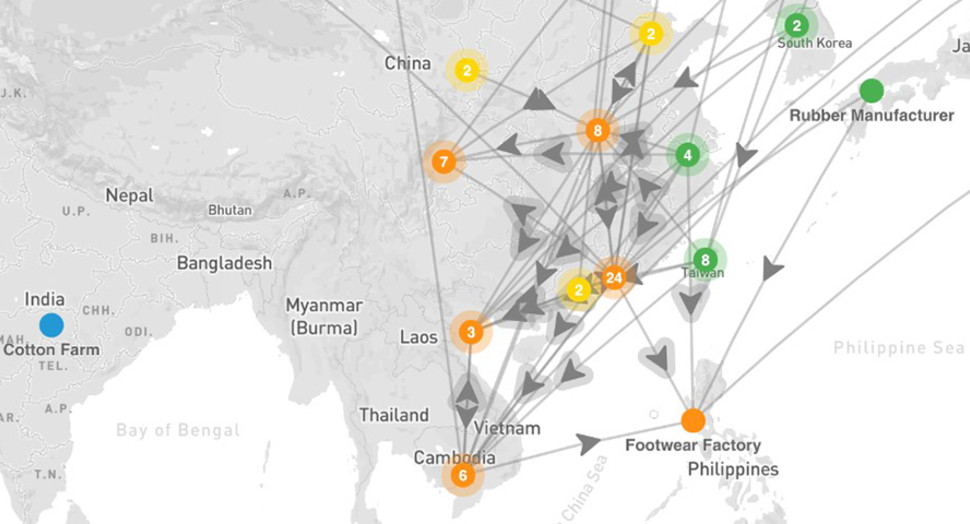

Sheng: Related to sustainability are the buzzwords “supply chain transparency” and “traceability.” What progress has been made, and what are the key steps for fashion companies in achieving greater transparency and traceability in their supply chains and sourcing?

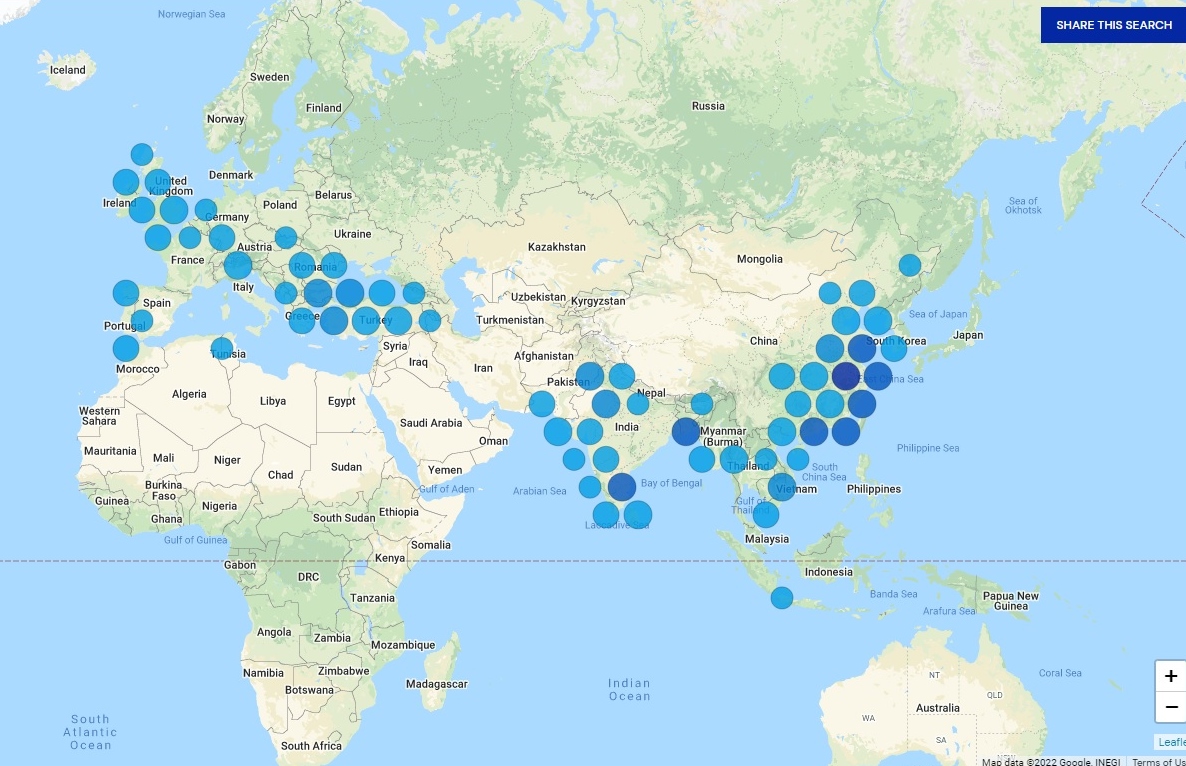

Megan: To ensure a more responsible and transparent supply chain, it is critical to map supply chains and the relationships between suppliers. At Tapestry, we have begun the process of onboarding suppliers to join TrusTrace, a cloud-based web platform for sustainability, where we intend to conduct more upstream supply chain mapping and the collection of documentation to establish material and product traceability. We envision the platform will help us meet enterprise-wide sustainability commitments and goals, and help us align with upcoming regulatory requirements and industry best practices.

We have also improved downstream traceability by launching a digital product passport program, most notably through Coachtopia products. Customers can hold their smartphones against the cloud emblem on their Coachtopia product until the pop-up appears and then learn the total environmental impact of the product, along with all the potential avenues to extend its useful life under the sub-brand’s circular principles.

Sheng: As legislation related to fashion companies’ sustainability practices continues to be newly implemented or is on the horizon, are there any specific regulations you would recommend our students closely monitor?

Megan: There are many emerging ESG regulations, especially in Europe. Below are some that would be interesting to review.

Europe:

- Corporate Sustainability Reporting Directive (CSRD)

- Green Claims Directive

- Extended Producer Responsibility (EPR)

USA:

- Updates to the Federal Trade Commission Green Guides

- PFAS state regulations (New York, Maine, Minnesota, California, etc.)

Sheng: Any reflections on your experiences at UD and FASH? What advice would you offer to current students preparing for a career in fashion sustainability after graduation?

Megan: My “lightbulb moment” for wanting to pursue a career in sustainability happened while I was at UD, specifically from taking the ethics and sustainability in the fashion industry class. After identifying environmental sustainability as my focus and passion, I found ways to include it in every project, case study, and internship during school. The great thing about sustainability is that every department in a company can be part of the collective efforts, so even if you aren’t on an ESG (Environmental, Social, Governance) team, you can make an impact. If you are specifically interested in pursuing a role on an ESG team, I recommend networking with people in the industry that have those roles to learn more about what the job looks like and staying up to date on the latest news, innovations and regulations in the space. Also, there are plenty of college courses and industry certifications in sustainability that can be a great learning resource.

–END–