Established in 1969, Gap Inc. is a leading American clothing retailer that operates several prominent brands, including Old Navy, Gap, Banana Republic, and Athleta, catering to diverse consumer segments.

The following analysis is based on Gap Inc.’s publicly released factory list. Only factories identified as producing “apparel” products were included in the analysis.

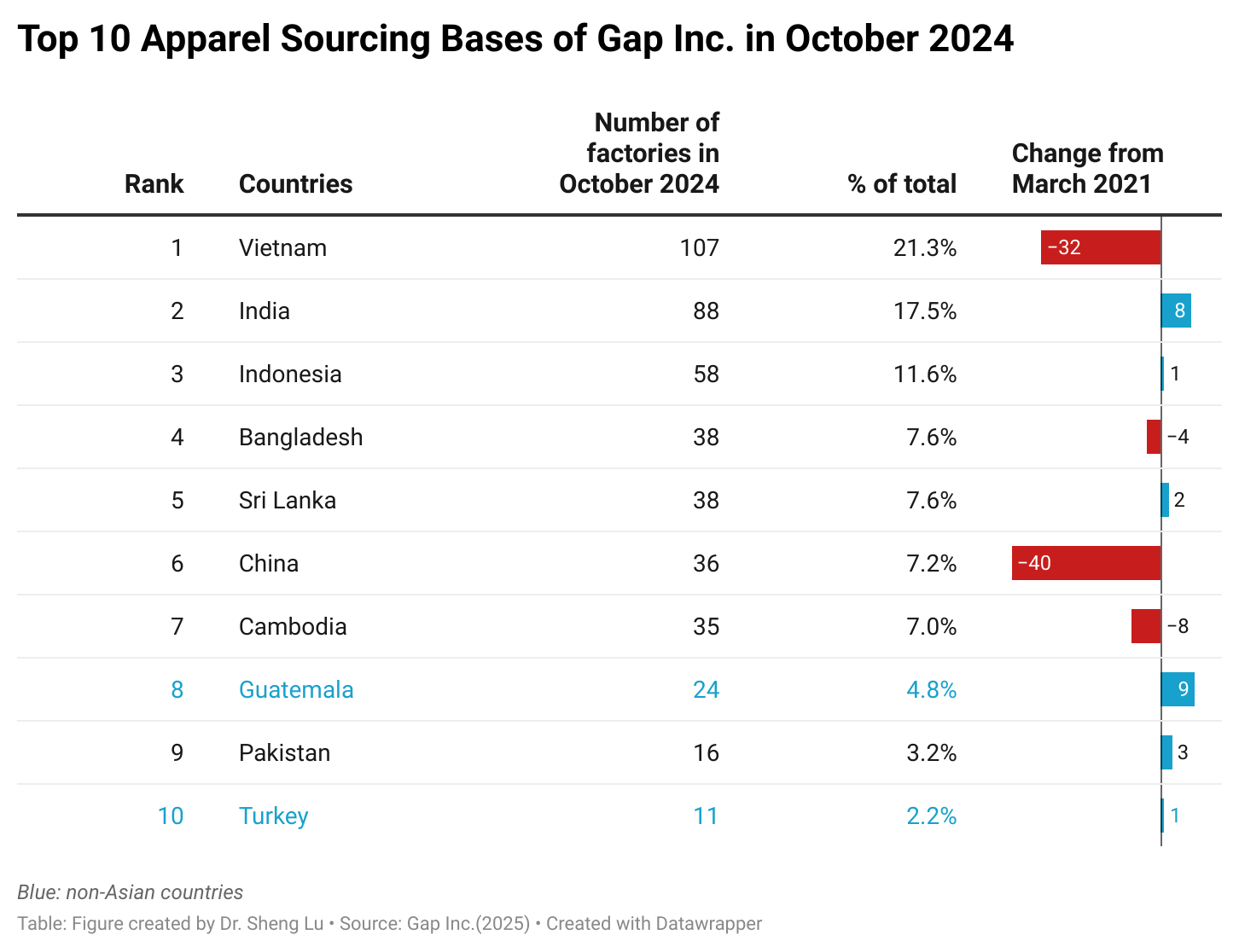

First, like several other leading U.S. fashion companies, Gap Inc. maintained a geographically diverse global sourcing base but reduced the number of factories it sourced from between 2021 and 2024. Specifically, as of October 2024 (the latest data available), Gap Inc. sourced apparel from 24 countries, an increase from 21 countries as of March 2021. Gap Inc.’s apparel sourcing reached almost all continents, including Asia, the Americas, Europe, and Africa.

However, between March 2021 and October 2024, Gap Inc. decreased the number of apparel factories it contracts with from 548 to 502, a reduction of 46. Most of the cuts occurred in China (down 40 factories), Vietnam (down 32 factories), and Cambodia (down 8 factories). This pattern aligned with the findings of other industry studies, which indicate that many U.S. fashion companies, particularly larger ones, are consolidating their vendor base to prioritize operational efficiency and strengthen the relationships with key vendors.

Second, Gap Inc. has significantly reduced its reliance on China and actively explored emerging sourcing destinations in the rest of Asia, Central America and beyond. According to Gap Inc.’s 2023 annual report (the latest available at the time of writing), its two largest vendors represented approximately 9 percent and 7 percent of the total dollar amount of the company’s purchases. In value terms, in 2023, approximately 29 percent of Gap Inc.’s products were sourced from Vietnam, followed by Indonesia (18 percent).

While China remained the largest source of U.S. apparel imports according to official trade statistics, China now plays a relatively minor role in supplying finished garments for Gap Inc. As of October 2024, the company sourced apparel from 36 factories in China, representing just 7.2 percent of its total apparel sourcing base, making China only the sixth-largest supplier after Vietnam, India, Indonesia, Bangladesh, and Sri Lanka. In an interview conducted in early 2025 (the video above), Gap Inc.’s CEO disclosed that less than 10 percent of the company’s products are sourced from China.

On the other hand, between March 2021 and October 2024, Gap Inc. expanded its sourcing network beyond the traditional top three (China, Vietnam, and Bangladesh), with significant growth in other parts of Asia and Central America, led by India (added 8 more factories) and Guatemala (added 9 more factories). In 2022, Gap Inc. pledged to source around $150 million in apparel products each year from Central America by 2025.

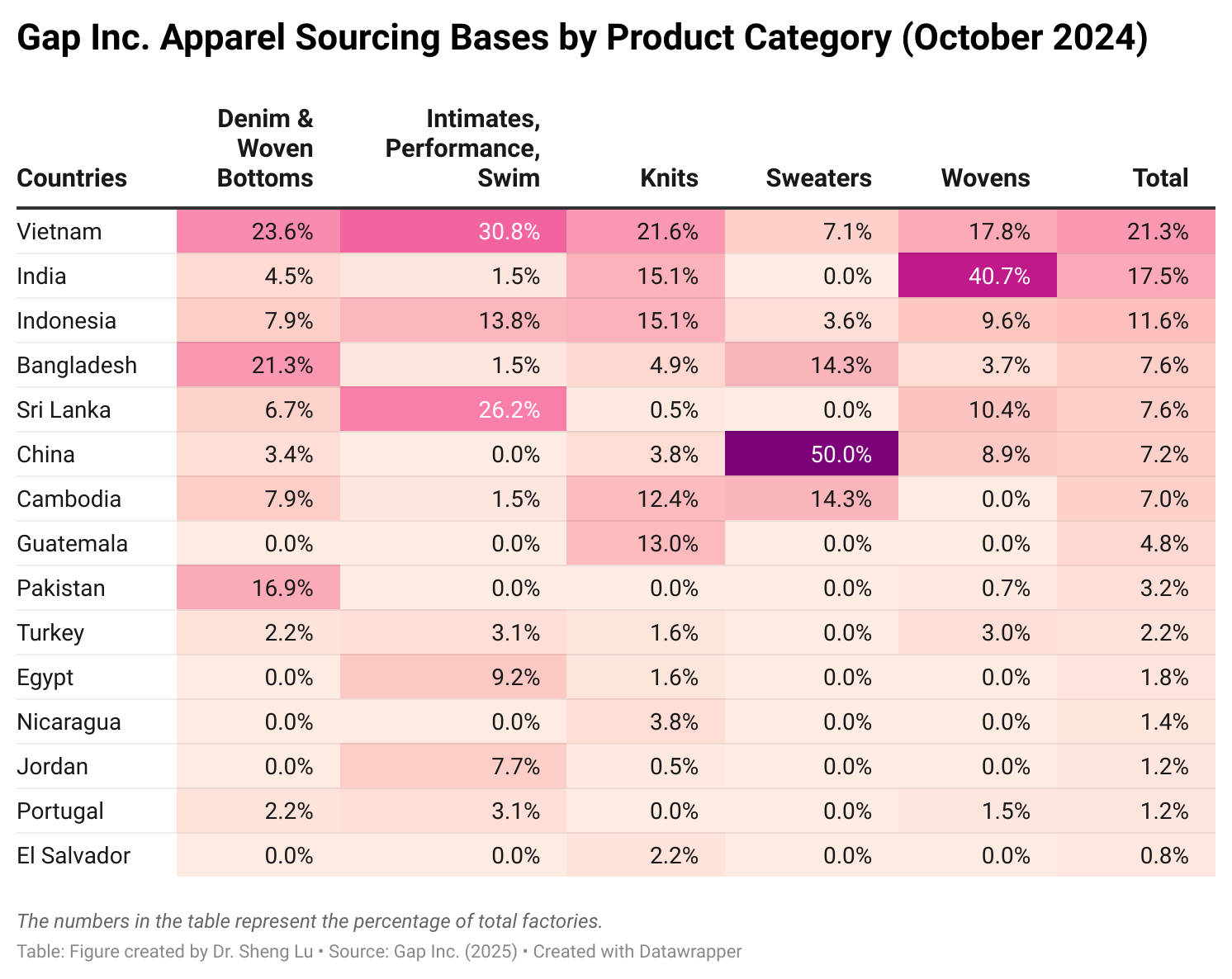

Third, Gap Inc.’s apparel sourcing base varies by product category. For example, approximately 45% of the company’s contract factories producing denim and woven bottoms were located in Vietnam and Bangladesh, likely due to the availability of cotton and a relatively abundant low-cost labor force. In contrast, factories in Sri Lanka primarily manufactured intimates, performance wear, and swimwear (IPSS) for Gap Inc. Meanwhile, half of the company’s sweater factories were located in China, largely due to the complex manufacturing process and raw material requirements for these products. Additionally, India played a critical role as a sourcing base for Gap Inc.’s woven apparel.

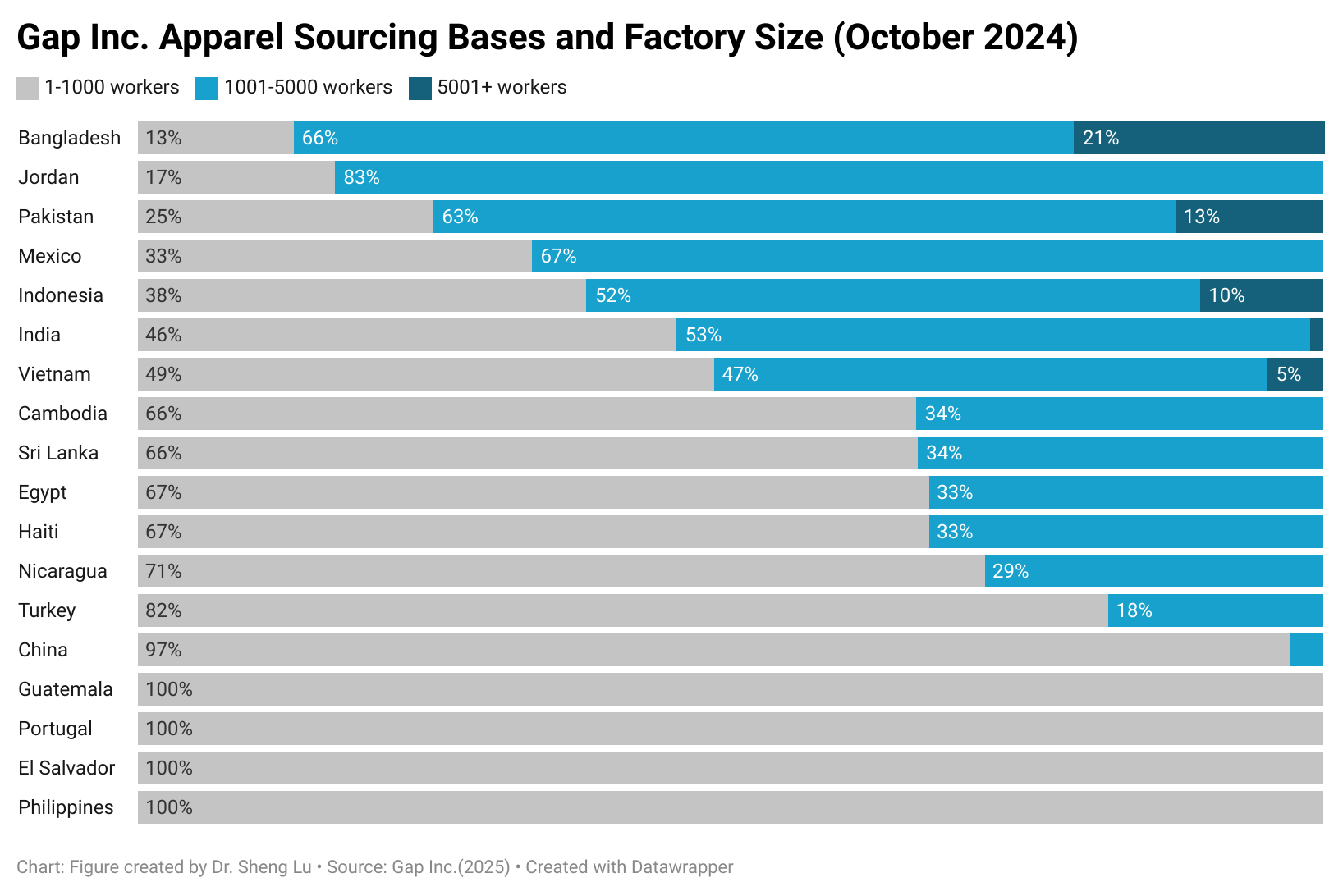

Furthermore, Gap Inc.’s contract garment factories worldwide vary in size, reflecting the company’s diverse sourcing needs. Specifically, in Asia, garment factories in China are typically small or medium-sized, with fewer than 1,000 workers (94.3%). In contrast, nearly 80% of Gap Inc.’s contract garment factories in Bangladesh have more than 1,000 workers, with similar patterns observed in Vietnam (48.7%), India (50%), Indonesia (63.2%), and Pakistan (57.1%). This pattern aligns with other industry studies suggesting that U.S. fashion companies source apparel products from China primarily for orders with relatively small minimum order quantities (MOQs) and those requiring a great variety.

Meanwhile, most garment factories in Central American countries producing products for Gap Inc. have fewer than 1,000 workers, such as Guatemala (100%), Nicaragua (71%), Haiti (67%), and El Salvador (100%). A similar pattern is observed in other regions, such as Egypt (67%) and Turkey (82%). This result suggests that Gap Inc. may still need to rely on Asia to fulfill orders for large-volume items, as it takes time to expand production capacity in other regions.

by Sheng Lu

I think that it is a huge step for Gap Inc to evolve their apparel sourcing bases. A point made in the article was that U.S. fashion companies that need smaller quantities of products made will source their apparel products from China. This made me think about another article that we read in this class that talked about how much easier it is for bigger companies to source in the U.S. rather than overseas due to how much bigger the quantities of products they need manufactured. I think it is important to note that smaller companies have a harder time with this issue due to not only the quantities they need produced but also the pricing of it. As Gap Inc is a huge company, I think it’s good that they’re expanding who they’re sourcing from and that they’re cutting back on importing from China (they have less than 10% of their imports coming from them).In the video I liked how the CEO spoke about how over the decades Gap Inc has been through so many different phases of growth and struggle. I think as a big company to address this shows that they really are in it for the long run and are willing to continue to grow and find different strategies to continue to make their company better and more successful. Some of the notable mentions that the CEO touched on during this interview was how Gap Inc is currently trying to make their comeback by making more cost cuts, better styles, improved their investment thesis, making sure to manage their inventory really carefully- thinking about timing issues and making sure to have the right amount of inventory, and having less promotions then you would typically see on their e-commerce website and in stores. Another interesting point the CEO said was that “retail is detail”- because they have so many stores in so many different places, so executing the products is really important in order to be successful. I think it’s good that Gap has been able to keep as many brick and mortar stores open as they do, due to the rise in e-commerce shopping and the decline in in-person shopping. He also did mention how they are using new marketing strategies to keep up with new trends to recognize and attract new customers.

I agree with your point that Gap Inc.’s shift in sourcing is a major step, especially because the article shows how their strategy has evolved! One thing that stood out to me was the explanation that U.S. brands typically use China for smaller-MOQ, variety-heavy orders. Said here, “This pattern aligns with other industry studies suggesting that U.S. fashion companies source apparel products from China primarily for orders with relatively small minimum order quantities (MOQs) and those requiring a great variety.” That reminded me of the other class reading about how only the biggest companies can realistically source in the U.S. because they need such large production runs and smaller brands simply can’t meet those volume or cost requirements. With Gap’s size, it makes sense that they’re able to have multiple options with their sourcing in ways smaller brands can’t. It also caught my attention that China now accounts for less than 10% of their sourcing. That ties into the industry-wide shift we’ve discussed spreading risk, avoiding tariff exposure, and strengthening relationships with key vendors outside the traditional “big three.” Their expansion into India and Central America shows they’re thinking long-term, not just reacting. The CEO’s comments reinforced that. I liked how transparent he was about Gap’s cycles of growth and struggle, and how their comeback plan focuses on better styling, tighter inventory control, fewer promotions, and smarter marketing. His phrase “retail is detail” really connects sourcing to how they want their store to look.. Overall, their sourcing evolution feels like the start of a much more intentional strategy that will get them far.

In class today 3/13 we had a wonderful presentation by Aine Roberts, VP of Sourcing and Raw Material at Kohls. She discussed that sourcing in multiple countries is crucial for supply chain efficiency and the best way to mitigate risk is to spread business globally. As Gap reduced dependance on China, it expanded into Vietnam and Bangledesh with around 40% of Gap’s denim and woven bottoms being sourced there. Gap also expanded to Sri Lanka for performance wear and swimwear, emphasizing what Aine Roberts stated about spreading business globally to mitigate risks. Sourcing from Central America offers several advantages such as allowing Gap to respond to consumer demand quicker with faster delivery times and benefiting from trade agreements such as CAFTA-DR. In the presentation we also discussed how brands are being affected by the new tariffs, by expanding globally Gap is navigating this by not relying heavily on a single country or region.

In reading this blog article, I am pleased to know that Gap has made improvements to their sourcing practices. From class discussion, it becomes more and more evident how much of a role sourcing plays in companies adapting better practices. In the article, it is mentioned that Gap Inc. has reduced its reliance on China in an effort to explore new destinations in other parts of both Asia and Central America. Cuts from major countries like China affect supply chain dynamics, however, in turn makes sourcing (production opportunities) more efficient. Something else that was mentioned in the article that I found interesting was the idea that Gap Inc.’s product offerings are beginning to be sourced in different countries, based on that countries specialities (essentially an example of comparative advantage); for example, intimates, performance and swimwear are mainly produced in Sri Lanka, while woven wear is widely produced from India; the company also is prioritizing less workers in these factories as well. In thinking of this, I am recognizing how much of an improvement this is from where companies have started. The article we referenced for the exam regarding sourcing from Bangladesh, despite a history of unsafe working conditions for their workers, is one of many where companies have overlooked safety for the sake of quantity and over-consumerism. Events like the Rana Plaza Collapse of 2013, something that many of us are familiar with, is just one instance that has occurred where the effects of unsafe working conditions led to catastrophes. Efforts to make sourcing both more ethical and sustainable for everyone involved, by expanding sourcing efforts (moving from relying on just one place for a mass-production of goods) is one step in helping companies grow and improve production.

Hi Gabrielle! I definitely think you are correct in recognizing how significant a role sourcing plays in shaping both the ethical and operational dimensions of global apparel companies. Gap Inc.’s move to diversify sourcing locations while also aligning production with regional strengths is a great example of applying comparative advantage in a modern, socially responsible way. As you mentioned, the tragedy of the Rana Plaza collapse remains a prominent result of the human cost when safety is overlooked. By spreading out production and choosing partners based on both capability and ethical standards, companies like Gap are not just reducing supply chain risk. They are also contributing to better labor practices. The focus on fewer workers per factory could indicate a shift toward more skilled labor and better oversight. Your point about the evolution from mass production with little oversight to a more diversified model shows how far the industry has come.

great thoughts. It would be interesting to see whether the reciprocal tariff would somehow slow down US fashion companies’ diversification efforts–all leading sourcing bases are subject to a 30%+ tariff.

Hi Gabrielle, I appreciated your reflection on Gap Inc.’s evolving sourcing strategy. it’s so important to recognize how far companies have come in addressing the ethical and logistical challenges of global sourcing. Like you mentioned, shifting away from a heavy reliance on China and diversifying across regions like Sri Lanka and India shows how Gap is leaning into the comparative advantages of each country, which is a much smarter and more sustainable approach. I also thought your connection to the Bangladesh sourcing article and the Rana Plaza tragedy was powerful. It’s a reminder that behind every strategic shift are real people whose safety and well-being need to be prioritized. Gap’s move toward smaller, more specialized factories suggests a deeper awareness of this, and hopefully a long-term commitment to safer, more responsible manufacturing. It’s encouraging to see brands take these steps—especially when they reflect the broader industry push toward transparency, ethical labor, and sustainability.

Recently in class, we have heavily discussed the trend of emerging sourcing destinations like Vietnam and other smaller Asian countries as many corporations are looking to move sourcing out of China- due to tariffs, high costs, unfair labor practices, and various other reasons. Gap Inc seems to be following the industry trend of companies reducing the number of factories it sources from, but increasing portfolio diversity to mitigate risk through exploring emerging sourcing destinations. Moving out of China, specifically for Gap, is a difficult toss up because it has a lower cost than the US for production of complex manufacturing pieces and raw materials. For Gap, the company’s sweater factories are located in China because of the complexity of production, which makes up a large amount of its product base, although the company’s sourcing from China is at a minimum. Moving forward, I am curious to see how this evolves and if Gap will remain sourcing these complex materials from China for their sweater lines, given that there is minimal alternatives except for the US. Given that there are heavy tariffs on China, this will increase the cost of sweaters tremendously for the brand, so the sourcing team will have to reevaluate if their sourcing plans are profitable and sustainable. If not, I am curious what country they will look to source these complex materials from other than the US. The rise of Central America in Gap’s sourcing strategy has been prominent, so possibly a country down south- or is it just smart to keep production in the US to avoid heavy tariffs?

This article gives an insightful look into how Gap Inc. has been reshaping its global apparel sourcing strategies between 2021-2024 and how they have been navigating the tariff pressures and the current industry trends. Specifically, by Gap steering away from China and relying less on them in a sourcing aspect, this enhances their efficiency and forms more relationships with other sourcers. I think that by adding this diversification into their brand, it has made more opportunities as a whole as well as incorporating more aspects rather than putting all of their eggs in one basket. It is also interesting how the article also discusses how Gap Inc. has divided its sourcing of products depending on different strengths. By dividing up different apparel in different locations, it adds to the diversification aspect. It seems that over these past few years Gap’s diversification aspect has been extremely beneficial towards the brand and other brands should start following in their lead. I found this to be one of the most intriguing parts of the article and something that we will be seeing increase in many brands today that want to steer away from China as a primary sourcing and add diversity towards their brands as well.

Gap Inc. ‘s has held an evolving apparel sourcing strategy from 2021 to 2024 which shows the company’s strategic shift toward diversification, efficiency, and with risk in a changing global trade environment. Gap’s reduction in total factory partnerships, with a clear focus on combining its vendor base to strengthen relationships and streamline operations. This shift is evident in their significant move away from China, reducing factory use there by 40 locations, which aligns with broader industry trends caused by rising costs and trade tensions. While China remains an important supplier for categories like sweaters due to its manufacturing capabilities, Vietnam, Indonesia, and India have emerged as leading suppliers, with growing contributions from Central America, like Guatemala. The difference in factory size and sourcing by product category shows that Gap is being strategic, matching factory capacity with product type and order size. The company’s efforts to source denim and woven garments from Vietnam and Bangladesh, with going to Sri Lanka for performance wear and India for woven apparel, shows us a nuanced approach. Overall, Gap Inc.’s sourcing evolution positions the company well to navigate global uncertainties while meeting demand efficiently and sustainably.

This reading illustrates how much Gap Inc. has evolved in shifting its global sourcing strategy. The company’s diversification to other parts of the world, such as South Asia and Central America, and de-emphasizing China is an evident risk mitigation and supply chain resilience action. Gap is successfully implementing the concept of comparative advantage by matching product lines with local manufacturing capabilities. For instance, the company imports Sri Lankan performance wear and intimates, woven in India, from Bangladesh and Vietnam. Another example that can be seen is Gap vendor consolidation, which is a signal of improved partnerships and operating efficiency. With fewer in Central America and more in Asia, regional variation in factory size is an echo of the made-to-order approach to fulfilling some manufacturing and volume of orders. The shift mirrors that Gap is embracing a more differentiated and possibly more ethical sourcing approach, in addition to overcoming trade and economic constraints like tariffs. Overall, Gap Inc.’s strategy indicates that big fashion retailers can align and scale upwards by treading that thin line of cost, velocity, expertise, and responsibility in buying behavior.

Gap Inc.’s changes in apparel sourcing from 2021 to 2024 show how big fashion companies are adjusting their global supply chains. Even though Gap now sources from more countries (24 in 2024 compared to 21 in 2021), it actually works with fewer factories overall. Most of the cuts were in China, Vietnam, and Cambodia, which matches the trend of companies focusing on fewer, more trusted factories to improve efficiency. Gap has also moved away from relying heavily on China and is now working more with factories in places like India and Guatemala. Still, most of its large-scale production is based in Asia, where factories have the space and labor to handle bigger orders. This shift reflects how companies are responding to trade challenges while trying to balance cost, quality, and production needs. It seems like, overall, Gap’s changes to their apparel sourcing methods are good steps to mitigate global uncertainty.

In the class, we learned that after 2018, American brands have been shifting their sourcing bases from China to other Asian countries. Case study 2 introduced that Asian countries like Vietnam and Bangladesh have taken most of China’s lost market in the US from 2018 to 2021. Gap Inc. followed the same path. It is shifting away from China and has adopted a sourcing strategy of China + many. In the past, China was the top sourcing destination. Now, it only accounts for a small share of Gap’s suppliers. On the one hand, this shift reflects rising labor costs in China and the effect of the U.S.-China trade war, like the Section 301 tariffs. On the other hand, it also shows that Gap Inc. is searching for more resilient and flexible supply chains in a context of geopolitical uncertainty. I also found it interesting how Gap is expanding sourcing from Central America, especially Guatemala. This shows that Gap is following a near-shoring strategy. Many fashion brands may use these diversification strategies to maintain their competitiveness in the U.S. market.

It’s interesting how much Gap Inc has changed the way it sources its clothing over the past few years. Like other big U.S. fashion companies, Gap used to rely heavily on China for production. But between 2021 and 2024, they cut sourcing from many of the factories they used in China and began working with more factories in places like Vietnam, India, and Bangladesh. Something that was interesting to me was how Gap now picks where to make certain products based on what each country does best. For example, Sri Lanka produces most of their intimates and swimwear, while India makes a lot of woven apparel. It ‘s smart because it makes production easier and more predictable. I also liked when the CEO said in the interview how the company has had ups and downs but remains determined to improve as well as trying to save on costs, produce better styles, and pay closer attention to how much inventory they keep. Overall, Gap Inc has shown that they have a plan to try and continue growing in a more sustainable and smarter way by shifting how and where they source their products from.

It is nice to see such a major brand like Gap taking action to make meaningful steps to improve its sourcing practices. Our class discussion earlier this semester and lectures have made it very clear how crucial sourcing is in helping companies move to more ethical and sustainable options. With Gap reducing its reliance on China, it can diversify its supply chain, which seems to be the smarter and safer route with the current tariff war. Although it is easier said than done to motivate brands to stop sourcing from China, there may be a point where it is no longer possible. Brands need to start preparing now, and Gap is ahead of the game. One point that stood out to me was how Gap is basing its sourcing on the strengths of each country, which is an example of comparative advantage. For example, Gap is sourcing denim and woven garments from Vietnam and Bangladesh. Overall, it is clear how far this industry has come along and brands are slowly starting to make changes that will not only benefit their own brand but the factory workers/environment.

Thoroughly enjoyed this video and article because I frequently purchase denim jeans at Gap because they are high quality and last forever. It was interesting to see how they are shifting their sourcing due to recent tariffs and are still developing their sourcing strategy and diversifying to other Asian countries. I have noticed an significant increase in Gap’s products over the past few years, however, the garments are more high quality, making it worth it. When Gap first started in 1996, they heavily relied on China for mass market apparel and affordable garments for low-income consumers. While prices have gone up, it seems like they are targeting a new type of consumer, such as middle class working consumers who value high quality products but at a somewhat affordable price. I like that Gap knows the strengths and weaknesses of each country in apparel manufacturing to ensure the quality matches the price of its products.

I really liked this analysis, specifically concerning Gap Inc.’s changes with their sourcing strategy. I think they have a strong sense of transparency, especially since many brands tend to keep information to themselves when it comes to the production process. By sharing specific information about their factory such as size, location, and specialization, Gap Inc. establishes trust with their consumers. This, in turn, allows for more discussions about the future of their sourcing. Their approach of reducing the amount of vendors and expanding their geographic presence demonstrates a shift to becoming more efficient and having less risk involved. Additionally, shifting sourcing from China and more towards Central America and India was a very smart move. I think that more companies should look at Gap Inc. for an example of a successful sourcing strategy. This level of transparency allows people to feel like they are being communicated with and, therefore, have a stronger connection to the brand itself.

After reading this article, I believe it’s very clear that GAP is going through a major transformation. I definitely think GAP is a brand that has been able to adapt to modern challenges. Richard Dickson brings creativity to the company while also enhancing the overall operations. His focus on brand storytelling will allow GAP to further connect with their customers. In my opinion, this article shows the importance of knowing your audience and how you can tailor a brand to reach various audiences. When getting into the fashion industry upon graduation, I will remember to adapt to changes. As well as knowing the target audience in order to create more authenticity with the customers.

I really enjoyed watching the video, and I thought the article was super interesting because it showed how Gap Inc. is shifting its sourcing strategy smartly and thoughtfully. It was surprising to see how much they’ve reduced their reliance on China and are now focusing more on countries like Vietnam, India, and Guatemala. I also found it interesting how different countries are used for different types of products, like sweaters being made in China and performance wear coming from Sri Lanka. Overall, it gave me a better understanding of how complex and strategic global sourcing really is.

The part that stood out to me the most was when sustainability was being discussed. Specifically, about how much Gap Inc. has been shifting its sourcing strategy to align with more responsible practices. I agree that the idea of diversifying sourcing away, from relying too heavily on one counjtry is significant, but what really made the mose sense was how sustainability is becoming bigger in their decisions. When the article explained that Gap is increasingly prioritizing suppliers with a stronger environemntal anbd social performance, I believced that was a really positive step, since the industry creats so much waste and pollution.

I found this article encouraging because it shows that Gap is actively working to improve its sourcing practices in a more thoughtful and responsible way. I like that they are reducing heavy reliance on China and branching out into places like India, Sri Lanka, and Central America, which seems to make sourcing more efficient and balanced. The part about choosing sourcing locations based on each country’s comparative advantage, such as Sri Lanka producing performance and swimwear, or Bangladesh and Vietnam supplying denim. This was especially interesting and reinforces how specialized global manufacturing really is. It feels like a step forward from the old model of simply chasing the cheapest mass-production location without considering safety or sustainability. While there’s still progress to be made, these shifts toward more diversified, ethically-informed sourcing suggest companies are starting to learn from past tragedies and move toward more stable, human-focused supply chain strategies.

According to this article, it is clear that Gap Inc. is signaling a firm commitment to consolidating its vendors and diversifying risk. Gap has reduced its sourcing factories by 46 while simultaneously increasing the number of countries in which it sources. There is also a clear shift away from China by carving out specialized roles for other regions like India and Guatemala. Overall, it seems that Gap Inc. is chasing strategic value over lowest cost. This evolution will better position Gap Inc. to navigate any future geopolitical tensions and issues with tariffs. I’m curious to see if other US apparel retailers will acquire the same type of model.

It is interesting to see how Gap’s sourcing strategy has changed since 2021, and a lot of things in this strategy stand out to me. I think the biggest stand out is how they changed in response to industry trends seen in the reports. The shift reflects the industry’s change towards China and turning to other countries or nearshoring.

As discussed in our lecture, many U.S. textile mills are moving their investments into Central America. An article covered in our lecture discusses a yarn spinning company called Parkdale Mills and their expansion into Honduras, similar to Gap Inc. After reading this article, I am pleasantly surprised by Gap Inc.’s dedication for expansion into into less developed areas like Central America, and their exit from areas like China, Bangladesh, and Vietnam. While still maintaining ties with these countries, Gap has made an effort to expand into areas that have less garment workers. My take on this article is that Gap is helping further develop countries that are financially, socially, technologically, and politically less developed. For instance, the article states that factories in Central America, such as Guatemala, Nicaragua, Haiti, and El Salvador have less than 1,000 garment workers in comparison to China, where most factories have 1,000 or more garment workers. This shows that the garment industry hasn’t been able to expand as widely in Central America, leaving less jobs and money for the countries there. Because Globalization intensifies market competition, it leads to a war of winners and losers. If lower income/less developed countries in Central America are given ore opportunities to contribute to the garment industry, then other countries that are big in the garment industry may feel the pressure of the competition. With pressure of losing business, we could alter the trajectory of these garment workers lives. For instance, if garment workers are forced into unethical working conditions, moving business elsewhere will not only help the countries we are moving into, but potentially help encourage current countries to adjust their ethical practices in order to keep their U.S. customers. To further expand on our lecture’s discussion, “If market competition is a zero-sum game, who shall be given the opportunity to develop?” This point deepens the understanding of globalization as it correlates to developing ethical standards for workers and also giving other countries the opportunity to thrive in this market. My question to further this discussion is, How can we balance expansion into new territories without depleting the finances of countries who depend on U.S.’s sourcing, like China, Bangladesh, and Vietnam? Overall, if more countries can move their sourcing into less developed areas like Central America, there could be room to grow their countries while implementing ethical working conditions for existing sourcing countries.