The following analysis was based on the latest trade statistics from the Office of Textiles and Apparel (OTEXA) under the U.S. Department of Commerce.

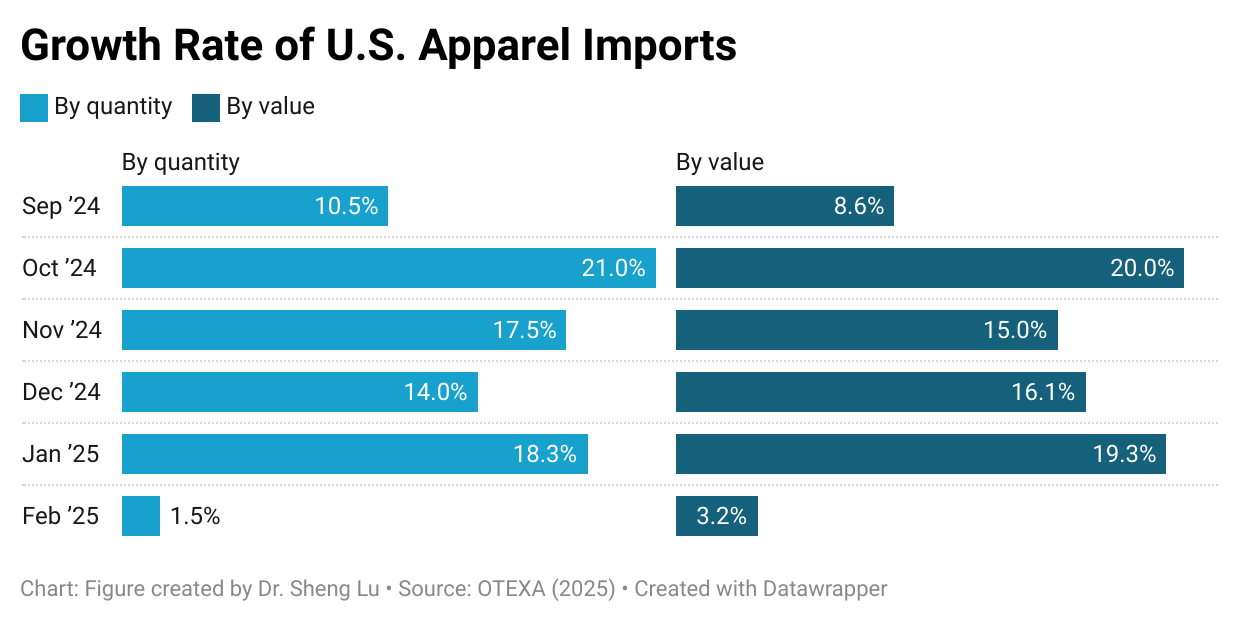

First, the growth of U.S. apparel imports significantly slowed as fashion companies shifted from eagerly piling up stock to the wait-and-see mode. Specifically, in February 2025, U.S. apparel imports moderately went up 3.2% in value and 1.5% in quantity, much lower than the 18-19% increase seen in late 2024 and January 2025. The much-slowed growth confirmed that the earlier U.S. apparel import surge was largely driven by fashion companies’ worries about the upcoming tariff hikes rather than an actual increase in consumer demand.

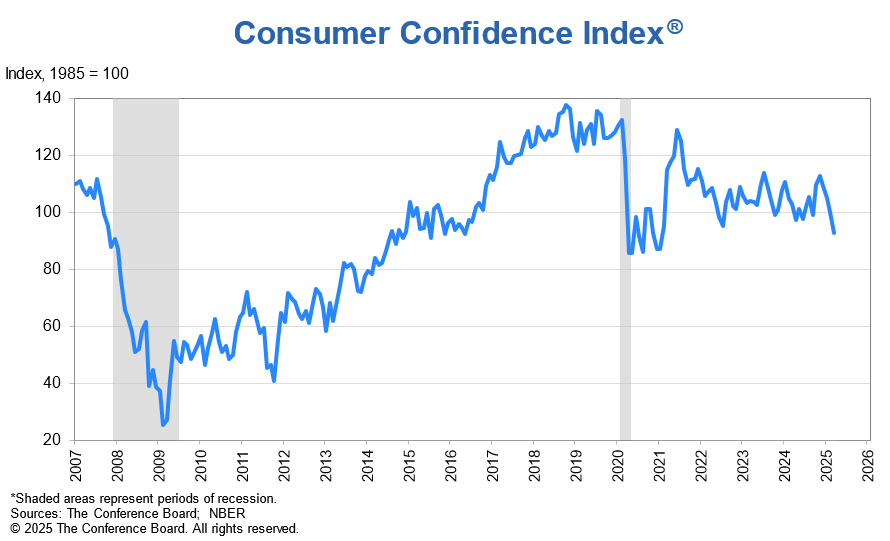

Adding to the concern, U.S. consumer confidence fell sharply, which could lead to a steep drop in U.S. apparel imports ahead. For example, the Consumer Confidence Index dropped to a two-year low of 92.9 in March 2025, down from 100.1 the previous month (1985=100). Similarly, the Expectations Index—which measures consumers’ short-term outlook for income, business, and labor market conditions—plunged to 65.2, marking its lowest level in 12 years. With the announcement of reciprocal tariffs and the growing likelihood of an economic recession, U.S. consumer demand for clothing may decline significantly, potentially leading to the cancellation of many sourcing orders.

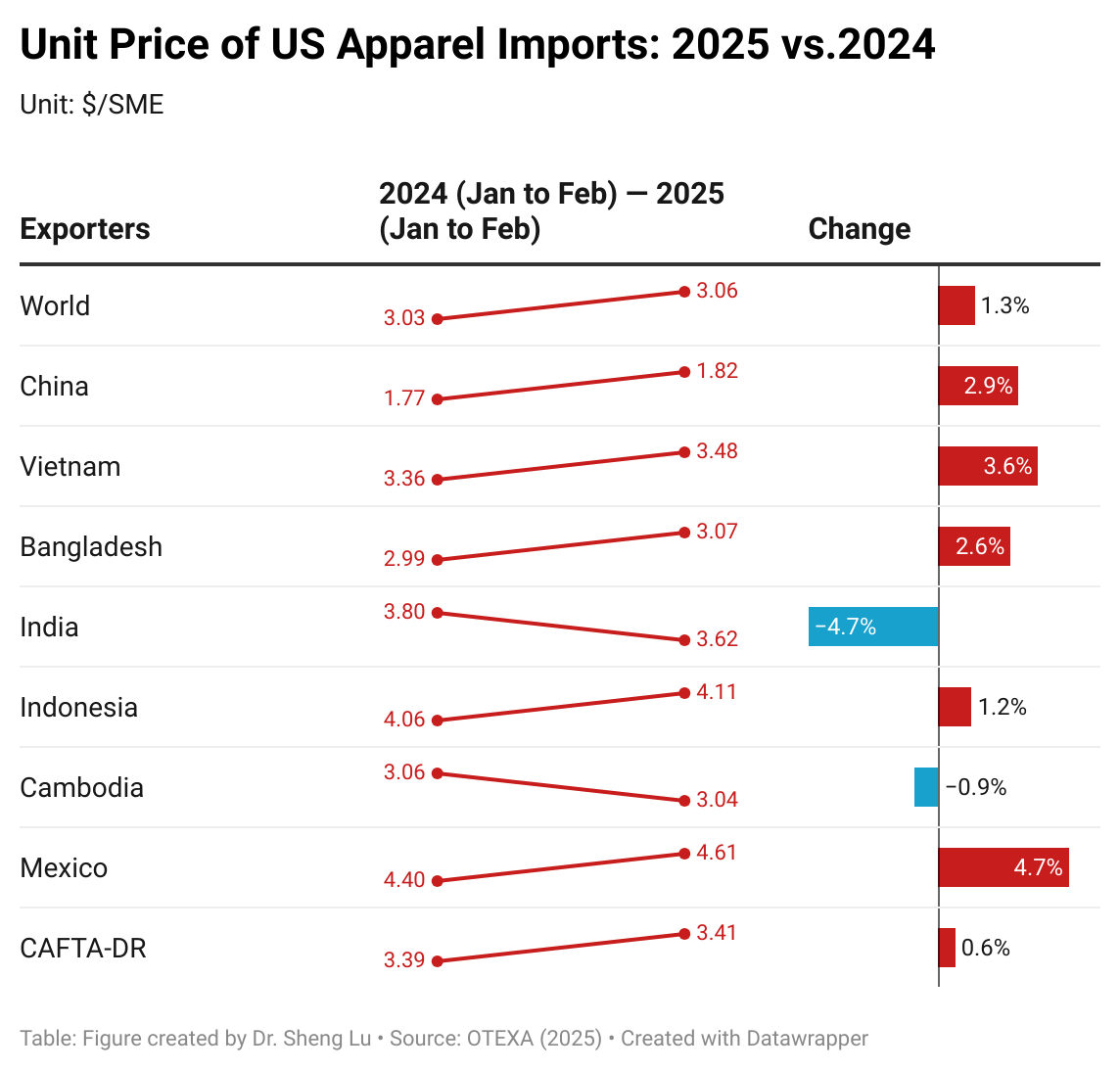

Second, apparel imports have become more expensive. Measured in dollars per square meters equivalent (SME), the unit price of U.S. apparel imports averaged $3.06/SME in the first two months of 2025, up from $3.03/SME a year ago (or a 1.3% increase). The unit price of U.S. apparel imports from many leading Asian countries rose at a notably higher rate, including China (up 2.9%), Vietnam (up 3.6%), and Bangladesh (up 2.6%), as well as those from Mexico (up 4.7%) and CAFTA-DR (up 0.6%). This result reflected the growing pressure of sourcing and production costs facing U.S. fashion companies and their suppliers, driven by rising labor costs and raw material prices among other factors. Indeed, if Trump’s reciprocal tariffs ultimately take effect, import prices could increase even more significantly.

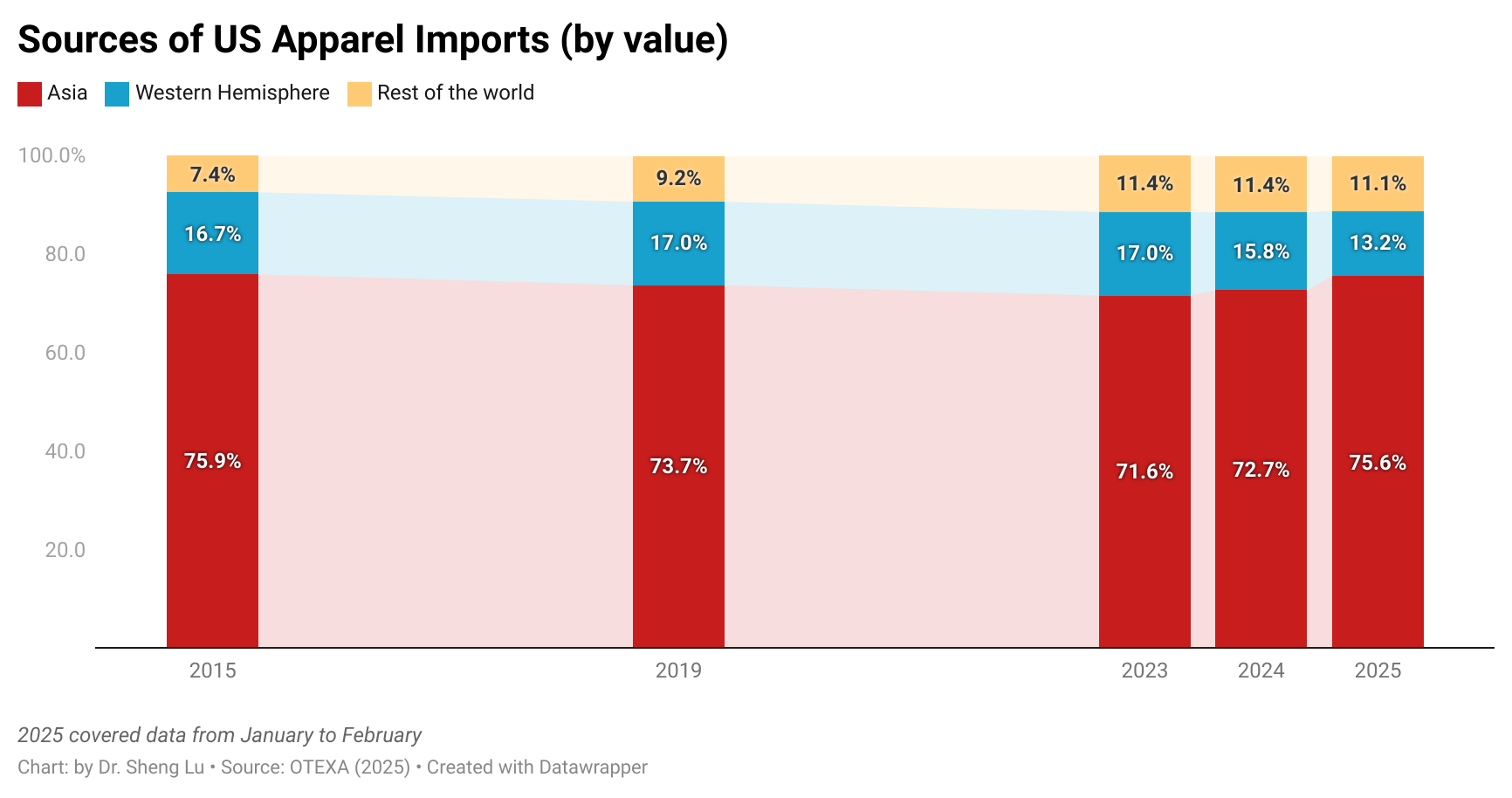

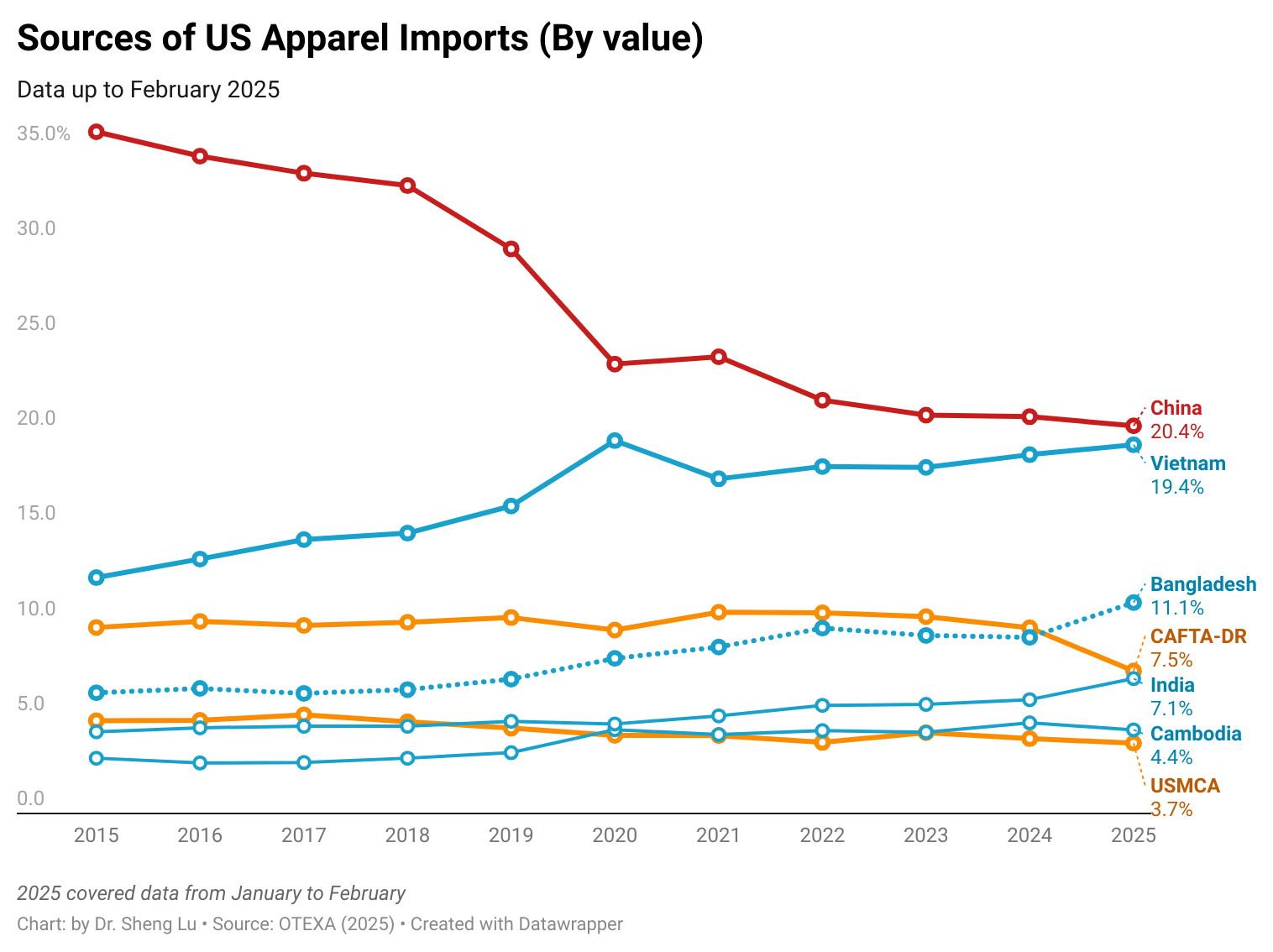

Third, U.S. fashion companies’ sourcing diversification efforts appeared to slow amid rising uncertainty. In February 2025, Asian countries collectively accounted for 71.5% of the total value of U.S. apparel imports—unchanged from a year earlier. Similarly, in the first two months of 2025, the top five suppliers (China, Vietnam, Bangladesh, Cambodia, and India) made up 63.7% of total apparel imports by value, up from 59.7% during the same period in 2024. Even China’s market share remained largely stable at 18.4% in value and 32% in quantity, compared to a year ago.

These figures suggest that U.S. fashion companies somehow have become more hesitant to adjust their sourcing base in response to the universal tariffs imposed by the Trump administration, which target nearly all U.S. trading partners. As a result, U.S. fashion companies may find the sourcing diversification strategies no longer as effective as in the past in effectively mitigating their sourcing risks.

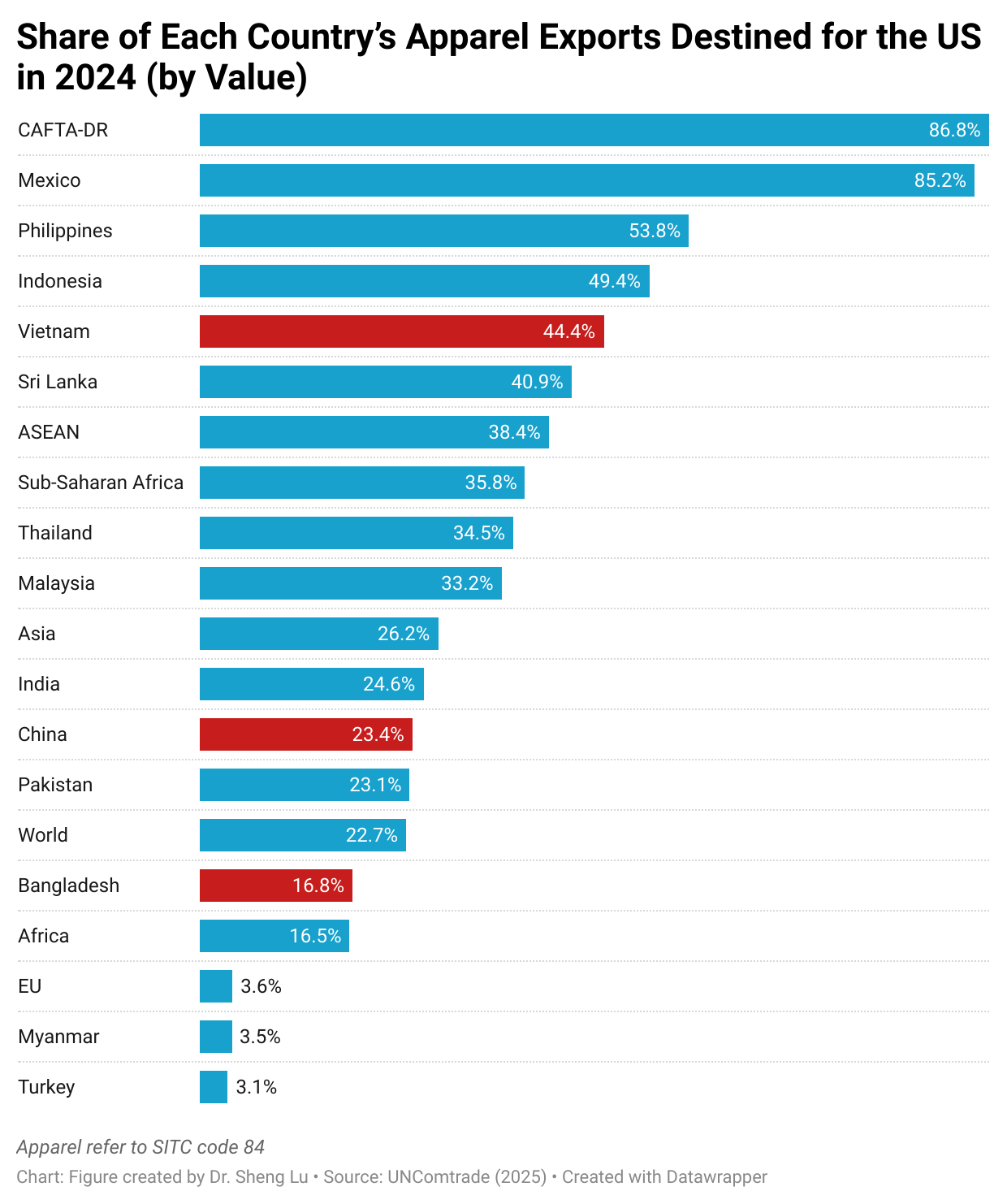

Meanwhile, data from the United Nations (UN Comtrade) show that Asian countries’ dependence on the U.S. market for apparel exports varied. In 2024, Vietnam, Sri Lanka, and ASEAN members exported about 40% of their apparel to the U.S., whereas the U.S. accounted for only about 20% of China’s and Bangladesh’s total apparel exports to the world. At the same time, the U.S. remained the single largest export market for Mexico and CAFTA-DR members, due to the integrated Western Hemisphere textile and apparel supply chain.

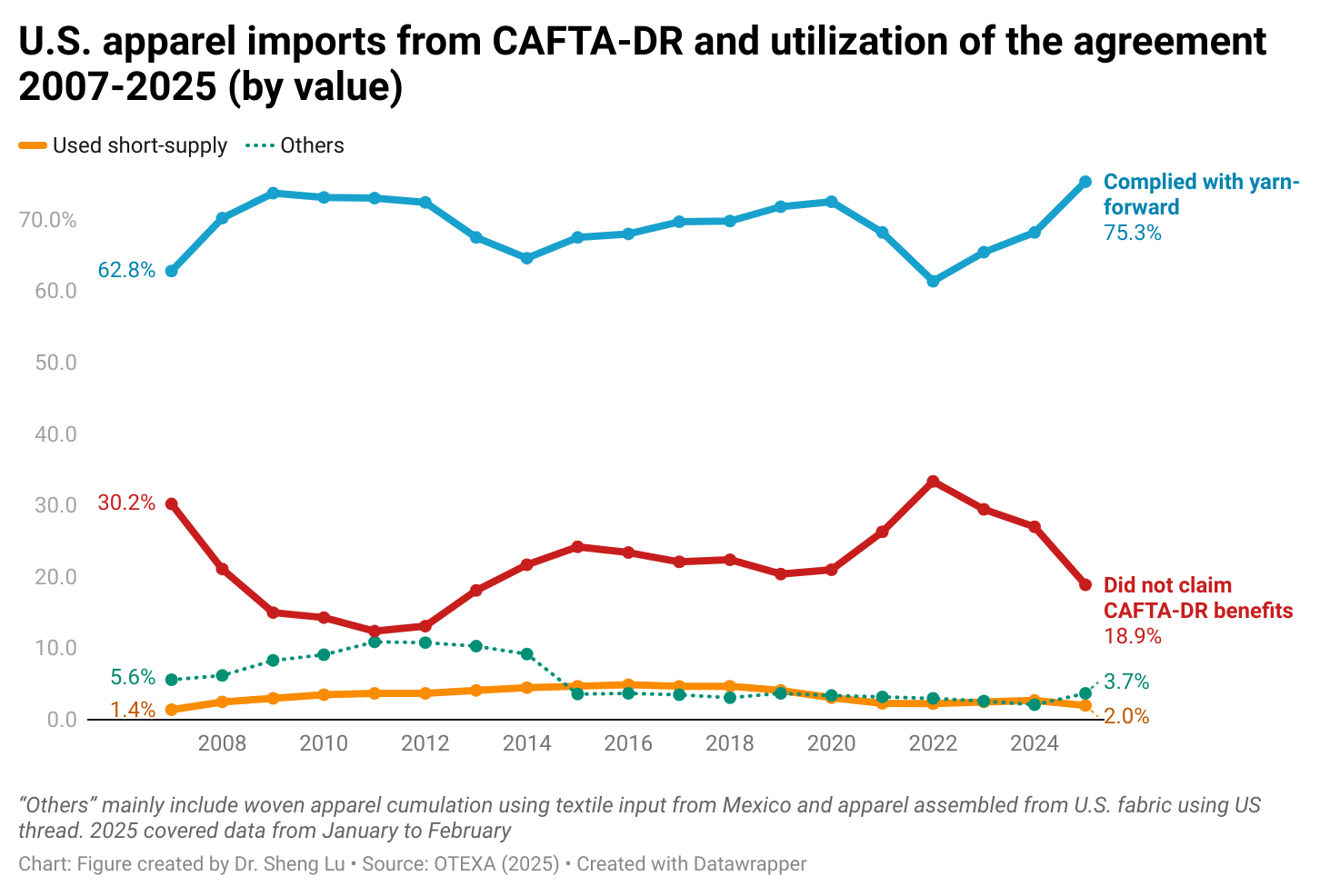

Fourth, no evidence shows that the current trading environment has benefited from near-shoring from the Western Hemisphere. On the contrary, measured in quantity, in February 2025, only 7.6% of U.S. apparel imports came from CAFTA-DR members, a notable drop from 9.6% a year ago. Similarly, Mexico accounted for 2.3% of U.S. apparel imports in February 2025, also lower than 2.4% a year earlier.

As a silver lining, the utilization rate of CAFTA-DR reached 81.1% in 2025 (January to February), much higher than 73.8% over the same period in 2024. About 75.3% of U.S. apparel imports from CAFTA-DR in 2025 (January to February) complied with the yarn-forward rules of origin compared to 67.4% a year ago. However, the use of “short-supply” remained low–only about 2.0% in 2025 so far.

by Dr. Sheng Lu

Related analysis: Lu, S. (2025). Patterns of U.S. Apparel Imports in 2024. Global Textile Academy, International Trade Centre, Geneva, Switzerland.

This blog post brought to my attention that U.S. apparel sourcing diversification has seen very little real development. Asian nations account for more than 70% of the value of U.S. imports while the five leading suppliers expanded their market shares from the previous year. Current high concentration levels become risky to sustain when production expenses and labor costs increase together with tariff uncertainties and diminished consumer confidence.

Despite CAFTA-DR utilization rates going up, U.S. import volumes from this region did not increase. The observed trade advantages alone seem insufficient in addressing the production capacity and efficiency challenges. Businesses also focus on short-term cost cuts instead of long-term risk management which leads them to seek immediate financial savings. I believe brands that establish regional partnerships today will demonstrate their success in the future when tariffs rise and predicting market demand becomes more difficult.

Hi Emma I agree with your points especially how high reliance on a few Asian suppliers creates long-term risks for U.S. fashion companies. It’s interesting that even with better CAFTA-DR utilization, actual import volumes didn’t grow, which shows how limited capacity can hold back nearshoring. I also think you’re right that many brands focus too much on short-term savings instead of building more stable, regional partnerships. In the long run, companies that invest in more diverse and flexible supply chains will likely be in a stronger position to handle future disruptions.

After reading this insightful analysis, I have observed several key metrics shaping the apparel sourcing landscape of 2025 within the US. Metrics such as consumer behaviors, macroeconomic factors, tariff anxieties, and global inflationary pressures have impacted the strategies companies have implicated in their recalibration methods. Consumer confidence has declined, which has impacted the inventory strategies companies implement. Due to predicted rising tariffs, there was a previous surge in imports, but they were not so much aligned with the actual consumer demand for inventory. Brands must likely implement sales data and demand forecasting to mitigate risk and overstock circumstances.Additionally, the rising unit costs of imports add to the complexity. It is important to note that diversification and nearshoring trends contribute to the evolving landscape. Although companies see benefits in diversifying their sourcing, they seem hesitant to shift away from Asia. This is likely because of the region’s abundant labor and developed infrastructure. Nearshoring from Mexico and CAFTA-DR has improved. However, the overall share of imports from the Western Hemisphere has decreased. This suggests that utilizing nearshoring strategies from CAFTA-DR is valuable but is not significant enough to result in a complete shift in sourcing strategies. Investing in the regional supply chain may enhance workforce development, manufacturing, and sustainable sourcing to incentivize the alternatives.

This blog post really made me think about how little progress has actually been made when it comes to diversifying U.S. apparel sourcing. Even with all the talk about reducing reliance on Asia, countries like China, Vietnam, and Bangladesh are still dominating U.S. import value—and their market shares are even increasing. It seems like companies are hesitating to make real changes, even with rising costs and uncertain trade policies.

I also found it surprising that near-shoring hasn’t picked up more momentum. Even though CAFTA-DR’s utilization rate improved, overall import volumes from the region went down. That suggests companies might still be prioritizing short-term cost savings over long-term stability. I think that as trade tensions rise and consumer demand becomes harder to predict, brands that invest in regional partnerships and more flexible sourcing strategies now will be better prepared for whatever comes next.

This analysis shows that fashion companies are slowing down on imports after a big import surge driven by fear of tariffs. Consumer confidence is also dropping which could lead to even fewer imports.

Because of this, I find it interesting that U.S. fashion brands still really aren’t changing where they source their products from. Imports from Asia are still dominating and there is very little movement toward near-shoring. I wonder if these companies are just stuck on their existing supply chains and waiting to change until absolutely necessary. That brings up the question of when will change actually happen. Tariffs, rising costs, and weak consumer demands adds much pressure to these companies. Eventually, companies will likely have no choice but to reevaluate their strategies.

After reading this blog and everyone’s responses, it made me think about how stuck companies still are when it comes to sourcing. Even though there’s been so much talk about diversification, the numbers show that not much has changed. Asia is still dominating, and it feels like brands are more focused on saving money right now instead of considering long-term risks. Even with CAFTA-DR getting used more, it hasn’t made a big enough difference yet. I get that shifting production is a huge investment, but with rising costs, tariffs, and consumer demand being so up and down, brands are eventually going to have no choice. I really think the ones that start building stronger regional partnerships now are going to be way better off when things get even harder to predict.

This post provides a detailed analysis of current trends in the US apparel industry. From this post, I picked up on the fact that the early apparel import surge was driven by anticipated tariffs instead of consumer demand. I thought it was interesting that the consumer’s confidence then fell, which will affect US apparel imports. The Consumer Confidence Index dropping to 92.9 in 2025 is important to note, it shows that trust is being lost. It also shows that trade tension along with consumer demands are hard to predict. Another key point I picked up on the rising import costs, with the unit price of US apparel imports averaging $3.06/SME in 2025. This helps to show the growing pressure of sourcing costs against US brands. This can be due to rising labor costs or rising raw materials prices. This also shows that there are complex challenges, including trade tensions and tariffs that face fashion companies today.

The current state of U.S. apparel sourcing, reflects a shift from aggressive stockpiling to a cautious “wait and see” strategy among U.S. fashion companies due to increased tariff threats and declining consumer confidence.The slowed growth in early 2025 reveals that this increase was largely preemptive. Companies feared future tariffs would go up more than they anticipated a rise in demand, especially as the Consumer Confidence Index fell to a two year low. Apparel imports have become more expensive, from major Asian suppliers like China, Vietnam, and Bangladesh, the pressure on brands navigating rising production costs. Even as diversification has been promoted as a risk reduction , most fashion companies have stuck with established sourcing hubs. Asia still dominates U.S. apparel sourcing, and China’s position has remained relatively stable, signaling hesitation to shift sourcing due to the uncertain trade environment. Moreover, the hope for nearshoring benefits from the Western Hemisphere hasn’t materialized, as both CAFTA-DR and Mexico have seen their shares decline. While CAFTA-DR’s higher utilization rates and improved rule-of-origin compliance suggest some structural improvements, the overall impact remains limited. These trends highlight the complexities of balancing cost, reliability, and risk in today’s global apparel supply chain.

Why do you think “These trends highlight the complexities of balancing cost, reliability, and risk in today’s global apparel supply chain”?

The April 2025 update on the US apparel sourcing shows many different shifts in the industry. Notably, the overall growth of US apparel imports has decreased, with the data from February 2025 showing a 3.2% increase in value and a slow 1.5% increase in quantity. This is a stark difference compared to the 18% increase observed in late 2024 and early 2025. This decrease can be attributed to US fashion companies shifting from lots of stockpiling to a more cautious approach. This has been influenced by the decreasing consumer confidence and the anticipation of tariffs. Also, the cost of apparel imports have slowly increased, with the average unit price reaching $3.06 per square meter equivalent in early 2025. This is a $3.03 increase from the previous year.

I find it very interesting that the article states that apparel companies were over buying in January 2025 versus February 2025 due to fear of tariffs. This is interesting because typically January sees a lull in sales after the holidays so, being willing to purchase that much extra clothing shows how concerned apparel companies are about their profits being affected. I find it very interesting that before the tariffs were put in place prices were already increasing. I think increased prices for sourcing can be positive though we talk a lot in class about sustainable sourcing and that requires better treatment and pay of workers. Hopefully an increase in cost of items translates to increased wages for apparel production workers. I find it also very interesting that diversification of sourcing decreased as tariffs approached. I would imagine an increase would occur as companies attempted to source from nations with lower tariffs. Perhaps though with uncertainty in the price of tariffs companies wanted to continue sourcing from factories they knew and trusted to mitigate the amount of uncertainty. This is interesting because it is the opposite of what I believe the goals of the tariffs are. I also find it very interesting in this article that China only relies on the United States for 23.4% of their exports. This shows that the United States is more disposable to China than they are to us which makes the new tariffs seem like less of a threat to the nation. I think that it seems based on the article that a lot of fashion companies are waiting to make any major sourcing decisions until after there is more stability.

I think this post did a good job of showing the challenges U.S. fashion companies are dealing with right now. It has been much slower in early 2025 after a surge in imports in late 2024, which was driven by concerns over tariffs. The thing that really stood out to me was how much consumer confidence dropped, hitting a two-year low in March. While demand has been weakening and the economy has been so uncertain, it’s understandable that brands are beginning to cancel their orders and reconsider inventory plans. It’s just surprising how little progress there has been in terms of diversifying where companies are sourcing from. Despite higher labor costs and trade risks, more than 70% of apparel entering the United States is still made in Asia, with China, Vietnam, and Bangladesh remaining the same or even increasing. I thought more companies would be moving to other locations at this point. Nearshoring also hasn’t increased as much as many people expected. The utilization rate for CAFTA-DR increased, but the amount of imports from the region actually fell. Brands seem to be choosing short-term profit instead of long-term stability, which may be an issue in the future. I really do believe that the brands that start to build stronger regional partnerships and more flexible sourcing options now will be in a much better position as things get worse.

This article and its graphs were really interesting and provided a lot of quantitative data to oppose Trump’s tariffs. With decreased consumer confidence, increased prices of imports, decreased diversification of sourcing strategies, and a drop in CAFTA-DR near-shoring, there is an overall instability in the U.S. market that creates a lack of confidence in the region and in its tariff policies. I think it’s interesting that China doesn’t rely on us as heavily as this country relies on them. As well as it’s worth noting that prices from India and Cambodia still remain low which may make it worth it for companies to outsource production there.

The April 2025 update on US apparel sourcing reveals how market dynamics shift when consumer sentiment, geopolitics, and production costs intersect. One of the most important takeaways is how a recent import surge was about fear, specifically the fear of looming tariffs. Since consumer confidence is falling, fashion companies may face extensive inventories as spending tightens. The data highlights the real consequences of trade policy on sourcing costs. Import prices have increased across nearly every major supplier, especially Mexico and Vietnam. It includes material costs, rising wages, and general instability, not just tariffs. This reminds me how vulnerable sourcing strategies are to these external factors and how companies balance costs with compliance, speed, and product availability. The most surprising is the stagnation in sourcing diversification. Companies, especially the “big five” countries, still heavily rely on Asia. A universal pattern of tariffs makes it more challenging to diversify meaningfully. Moving sourcing locations may not be the solution. I would have anticipated more companies to utilize nearshoring, especially with all the discussion around Mexico and CAFTA-DR.

This blog post particularly highlights how global trade and politics can directly affect the available clothing to consumers, however, what was shocking was realizing how much clothing companies were importing prior to the tariffs, avoiding higher prices. Learning about how consumer confience can impact the fashion industry was an unlikely aspect that negatively afffects businesses and the industry as a whole. As ecommerce continues to grow, the retail industry’s reliance on consumer confidence continues to grow as well. Especially as ecommerce lacks the ability to have consumers try-on clothing, feel the clothing, and deciede in-person whether they are confident in their purchase. With growing tariffs and increasing prices on goods, I am interested to see how consumer confidence switches and if this will negatively impact ecommerce.

After looking at these updated April graphs, you can see many changes. Additionally, China has remained pretty stable, mainly due to the uncertainty of the tariff war, especially when things are constantly changing. I noticed that even though these policies have been in favor of near-shoring, the current trade data suggests that the U.S. apparel industry is not shifting significantly toward sourcing regions like Mexico or CAFTA-DR countries. Instead, the reliance on Asian suppliers continues to have the US in a chokehold. This trend challenges the argument that proximity is a major decisive factor in sourcing decisions. At the end of the day, scale and established global networks may still outweigh geographic closeness in apparel trade.

This article made it clear that U.S. apparel imports are slowing down because companies are being more cautious due to rising costs and uncertainty around tariffs. I thought it was interesting how even though prices are going up, companies aren’t shifting their sourcing strategies as much as expected, and Asia is still the dominant supplier. The drop in consumer confidence also stood out to me. It shows how economic fear can directly affect fashion imports and production plans. While there was a small positive sign in CAFTA-DR utilization improving, it’s clear that near shoring still isn’t making a big impact on the overall trade landscape.

After reading the analysis, it’s clear that U.S. apparel sourcing is in a weird holding pattern right now. Fashion companies were on edge about tariffs, so they went hard on imports late last year, but now they’re tapping the brakes and taking a more cautious, “wait and see” approach. The slowdown in import growth and drop in consumer confidence makes total sense, people aren’t spending as much, so companies aren’t stocking up like before. Prices are creeping up too, especially from Asia, which only adds more pressure. What really stood out to me was how diversification has stalled, even though everyone’s talking about near-shoring and getting out of China, the numbers show the opposite. Asian countries are still dominating, and Western Hemisphere sourcing isn’t picking up steam like we’d expect. Honestly, with tariffs hitting everywhere, it feels like companies are stuck between a rock and a hard place, diversification sounds great, but the global sourcing map is kind of a mess right now. It’ll be interesting to see if this uncertainty forces companies to finally get creative and find new strategies that actually stick.