PVH Corporation (PVH), which owns well-known brands including Calvin Klein, Tommy Hilfiger, Van Heusen, Arrow, and Izod, is one of the largest US fashion companies with nearly $9.2 billion in sales revenues in 2022.

By leveraging PVH’s publically released factory lists, this article analyzes the company’s detailed sourcing strategies and changes from 2021 to 2022. Key findings:

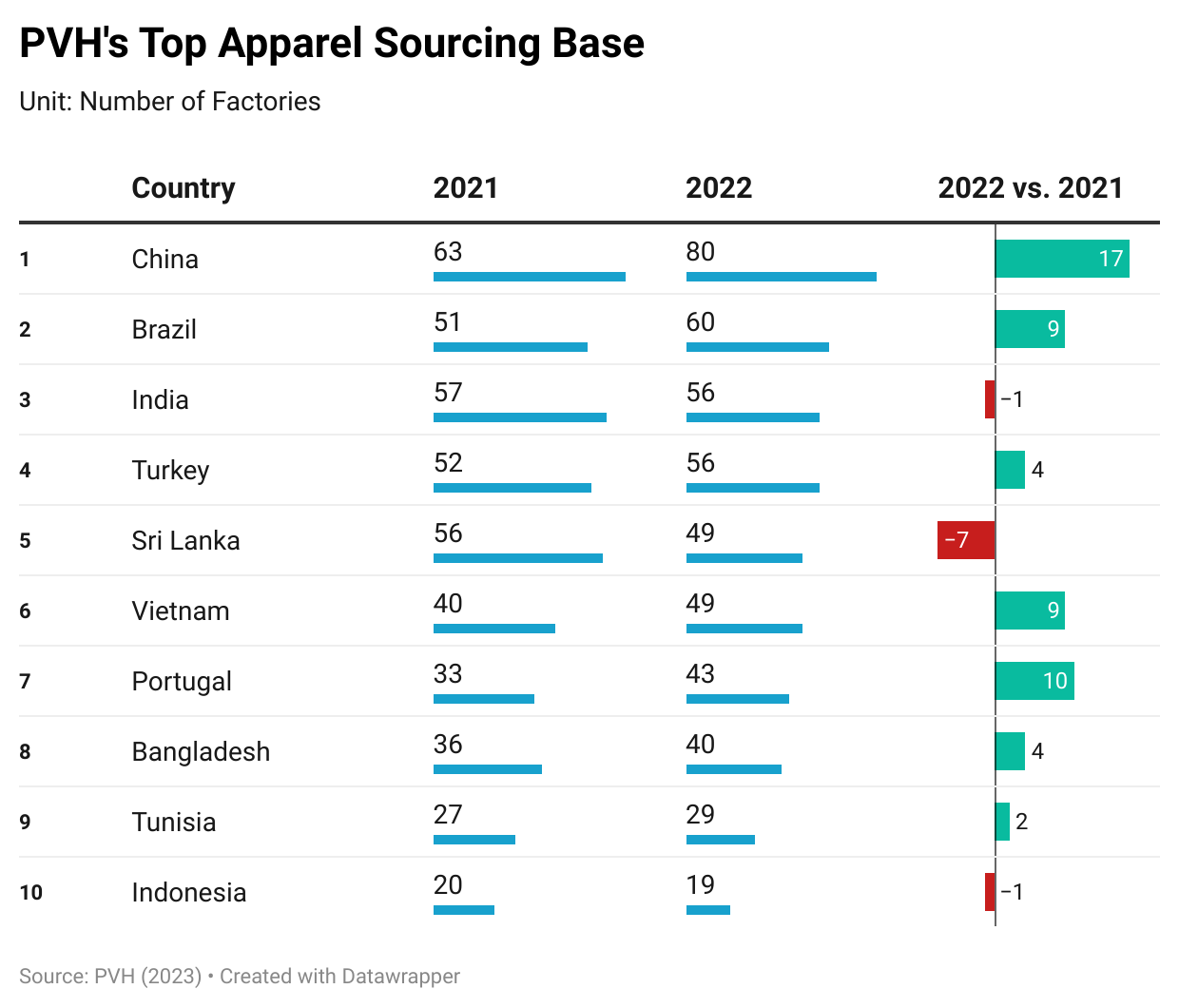

Trend 1: PVH adopts a diverse apparel sourcing base and continues to work with more vendors. Specifically, in 2022, PVH sourced apparel from as many as 37 countries in Asia, Europe, America, the Middle East, and Africa, the same as in 2021. Despite not expanding the number of countries it sources from, PVH increased its total number of vendors from 503 in 2021 to 553 in 2022, highlighting the company’s ongoing commitment to diversifying its sourcing base.

Trend 2: Asia is PVH’s dominant sourcing base for finished garments and textile raw materials.

Specifically, about 56.2% of PVH’s apparel suppliers were Asia-based in 2022, followed by the EU (20.3%). Compared with a year ago, PVH even added twenty new Asia-based factories to its supplier list in 2022, suggesting no intention of reducing sourcing from the region. Moreover, From 2021 to 2022, as many as 83% of PVH’s raw material suppliers were Asia-based, far exceeding any other regions.

Trend 3: PVH’s China sourcing strategies are evolving and more complicated than simply “reducing China exposure.”

- First, PVH continued to work with MORE Chinese factories. Specifically, between 2021 and 2022, PVH added 17 Chinese factories to its apparel supplier list, more than other countries. However, the expansion could be because of PVH’s growing sales in China.

- Second, PVH’s garment factories in China are smaller than their peers in other Asian countries. For example, in 2022, most PVH’s contracted garment factories in top Asian supplying countries, such as Bangladesh (87.5%), Vietnam (63.3%), and Sri Lanka (65.3%), had more than 1,000 workers. In comparison, only 11.3% of PVH’s Chinese vendors had 1,000 workers, and more than 62.5% had fewer than 500 workers. The result suggests that PVH treats China as an apparel sourcing base for flexibility and agility, particularly those orders that may include a greater variety of products in relatively smaller quantities.

- Further, PVH often priced apparel “Made in China” higher than those sourced from the rest of Asia.

Trend 4: PVH actively used “emerging” sourcing destinations outside Asia. Other than those top Asian suppliers, PVH’s apparel sourcing base includes several countries in America, the EU, and Africa that deserve more attention, including Portugal, Brazil, Tunisia, and Turkey. Overall, PVH sourced from these countries for various reasons, from serving local consumers, seeking sourcing flexibility, accessing raw materials, and lowering sourcing costs.

by Sheng Lu and Ally Botwinick

Further reading: Lu, Sheng & Botwinick, Ally (2023). US fashion companies’ evolving sourcing strategies – a PVH case study. Just-Style. Retrieved from https://www.just-style.com/features/us-fashion-companies-evolving-sourcing-strategies-a-pvh-case-study/

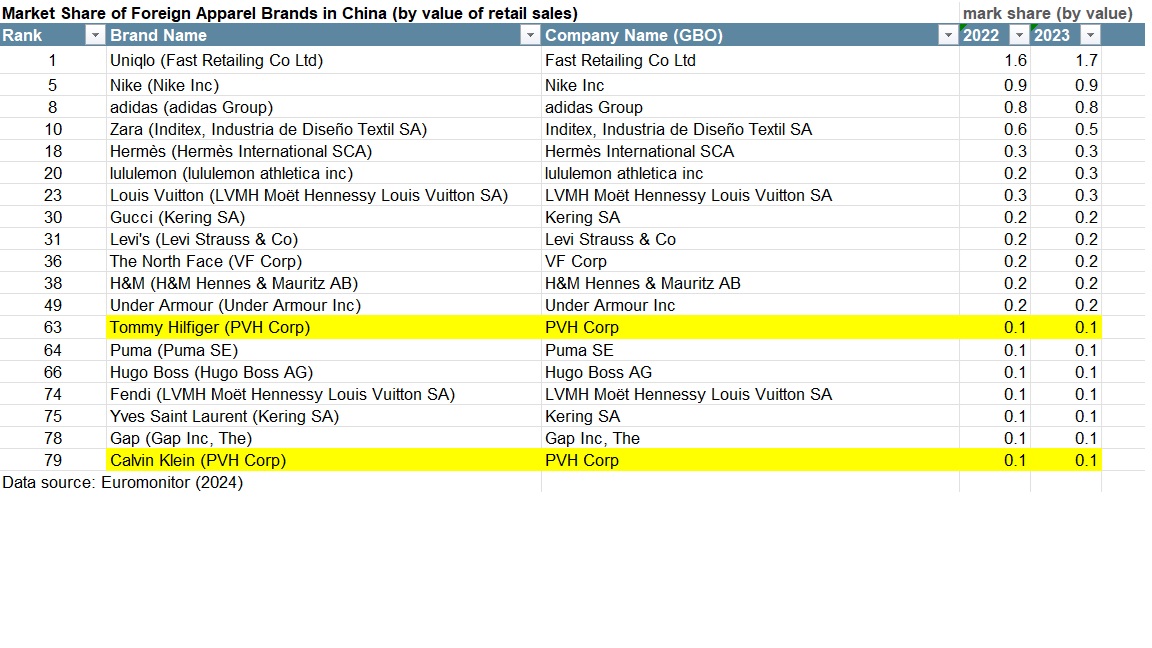

PVH’s market shares in the China apparel retail market

(discussion for this post is closed)

This article was very interesting to me after reading the Fashion Industry Benchmarking Study for one of our assigned readings. In the Fashion Industry Benchmarking Study, it touched upon similar themes mentioned in this article, including the fact that many retailers are diversifying their sourcing portfolio and shifting away from China as a main sourcing location. It is interesting to see a company with some of the most well-known brands following exactly what was talked about in the other article.

Besides that, I find the fourth trend to be incredibly interesting, with PVH looking outside the usual countries to source from. I remember in class touching upon Turkey as a potential new sourcing destination, and I find it smart for PVH to continue to diversify their sourcing locations to get the best products. I am interested to see if more well known or large companies will follow suit with choosing to source from more “emerging” sourcing destinations.

Thank you for sharing your great thoughts. When analyzing the data, we found it interesting that PVH worked with MORE factories in China from 2021 to 2022. This differs from the perception that US companies are “reducing China exposure.” However, the result makes sense after checking PVH’s corporate strategy, which still sees China as an emerging sales market. Increasingly, US companies may choose to develop a sort of “dural” supply chain, i.e., “Made in China for China,” and “Made in the rest of the world” for the main US and EU markets.

I would love to see more fashion companies release more detailed factory-level data, which provides new opportunities to understand the supply chain beyond the macro trade data.

This article has definitely made me think about our in class discussion on how diversifying sourcing factories has positive benefits to a company and its long term functions. I think its important that this article mentions while PVH’s sourcing expansion has mostly occured in China in number of factories, that size of factories also come into play. This signifies that while although there has been seen as a numerical increasing projection for 2022 in factories added to their sourcing base, PVH is not specifically targeting single factories for its demand. We have also learned that PVH has a large consumer base in China which could be considered convenient for wholesalers as well as benefit from low transportation costs rather than source in another company and then have to suffer costs for shipments. Overall, this article provided me with further thoughts and findings that have enhanced my learning capabilities in understanding how complex decision making in sourcing and trading apparel can be, and how broad of a topic sourcing really is. There are many layers to understanding diversification in sourcing and what the pros and cons are for doing business in each individual factory.

Learning about PVH’s sourcing expansion is very interesting, as it puts what we learned in the lecture about sourcing into real-life company decisions. There are many pros and cons to expanding sourcing locations, and PVH’s decisions seem to be strategic that will benefit their brands. Trends 3 and 4 particularly stood out to me. PVH’s decision to expand even more into China is interesting, yet it seems that they are utilizing China well. The article mentions growing sales in China and how the company treats China as a sourcing base for orders that may include a greater variety of products in smaller quantities. Additionally, with goals to access more raw materials and lower costs, PVH’s expansion into other countries such as Portugal, Brazil, Tunisia, and Turkey is a great way to diversify its sourcing bases. It is important for companies to explore other opportunities. Overall, I believe PVH is on the right track with expanding sourcing decisions. This article made me reflect on what important decisions are made for apparel suppliers.

Reading about PVH’s evolving sourcing strategies was very interesting to me as PVH is a largely known corporation within the fashion industry. This article relates back to our discussion in class about diversifying sourcing factories. I think that PVH’s intentions to expand sourcing from other countries is a good thing as it provides opportunities for not only the company but also for the economies of the countries they are looking to expand sourcing too as it provides jobs. Other companies may also want to follow suit in PVH’s sourcing strategies. With the possibilities of other companies diversifying their sourcing, these countries will have more jobs created and possible improving economies. However, I did find it surprising that PVH was increasing work with China since there are many other U.S. companies are making an effort to not produce products that are made in China.

agree. and from my observation,“Made in China for China” strategy could become more popular among Western fashion companies. you may find this blog post relevant too: https://shenglufashion.com/2023/03/14/new-study-pvh-corporations-evolving-apparel-sourcing-strategies/#comment-66712

Hearing the diversification plans from such a dominate fashion corporation makes me see a lot of hope for the apparel sourcing industry as a whole in the future. As we all know from lecture and readings, when one large player makes a move within the industry, others will consider doing the same. With other fashion corporations considering how they may follow in response to PVH, it is sure to bring along other unique strategies that will benefit the growing economy along with building global relations and connections. With a corporation who has seen so much success, it allows them to make these leaps as they may be able to pivot easier than those with less monetary resources. A dominate corporation leading in diversifying their apparel sourcing is necessary and can bring a more realistic perspective for other companies considering doing the same. I think it is very smart for PVH corporation to continue looking elsewhere to source in addition to their growth in China to not limit themselves.

I find it very interesting to hear that such a huge fashion house is started to evolve their sourcing strategies. With PVH adopting a more diverse apparel sourcing base, continuing to work with more vendors, and actively using “emerging” sourcing destinations outside Asia, there is much more hope for other popular brands and the fashion industry as a whole to evolve and improve as well. PVH is not only diversifying their sourcing but strengthening their sourcing out of China by working with more Chinese factories and making their garment factories in China smaller than their peers in other Asian countries. They are adapting both strategies all while anticipating the risks that come along with them but they seem to be exceeding and leading a path for other brands to follow in the near future.

As PVH is already such a significant and large company, I appreciated getting to read about how they continue to improve and grow despite being so dominant and such an old company. Diversifying their sourcing base seems like a good idea, especially in the aftermath of Covid when companies that sourced primarily from China had an even harder time accessing textiles and apparel. While they are still adding to their manufacturing in China, having more in a wider variety of places will likely help the company avoid a crisis if a country is having large supply chain issues.

Additionally, I found it unsurprising that their primary sourcing base as there is such a strong textile as well as apparel industry there. I will be interested to see whether PVH continues to expand into other emerging apparel production markets such as Tunisia, Turkey, and Brazil. Specifically with Turkey, after the earthquake, it will be interesting to see how that affects their apparel production.

good thought. One remaining question after I looked at the data is PVH’s China sourcing strategy. It is interesting to me that the company sourced from MORE factories there from 2021 to 2022 despite the “reducing China exposure” industry trend. Also, Brazil was not among the leading apparel sourcing base for US fashion companies. Look like PVH is localizing its supply chains, i.e., made in China for China, made in Brazil for Brazil.

This post particularly stood out to me due to the fact that I have just had the opportunity to tour PVHs headquarters in NYC and have just submitted and application for their entry level merchandising position. As I go about my job search it is very important to me that I know about my potential employers. I am grateful I was able to read this post and gain some greater insight into PVH as a brand. Of the four trends I found both trends two and three the most interesting. I think we have seen sourcing diversification as a recent overarching trend as so I was to too surprised to see PVH doing the same. As for trend two how could Asia still be PVH’s dominant sourcing base for finished garments and textile raw materials and why are the continuing to add asian based factories with their push towards diversification. I understand that draw towards asian manufacturing. There are cheaper costs and fast turnover, however, I was under the impression that many U.S. based fashion brands saw more negatives than positives from this and so diversification had become the new trend. I was surprised and confused to see such a large corporation like PVH make a different move. Similarly I was also intreated by trend three. I was particularly surprised to see that they had more contact with china and asian manufacturers during covid. This seems off trend to me. I was also surprised that Chinese garments were priced higher than other asian made garments. I can’t really imagine why this might be. Maybe due to the fact that their Chinese factories are smaller. They do not have as fast of a turnaround in this case. Smaller factories, however, did lead me to assume better working conditions. I’m not sure if this the right assumption to make but I would hope that as such a large company choosing to still manufacture in china they would do so as sustainably as possible.

After having many interviews with the company, PVH, it was really fascinating to read about their evolving apparel sourcing strategy. Being such a well known manufacturing company for such well known brands, this company is making great strides to stay on top from 2021 to 2022. After speaking with the product development manager and learning about all their vendors, it was very interesting to see that the first key finding was that PVH adopted a more diverse apparel sourcing base and continued to work and expand with more vendors. This is a great strategy for such a big corporation especially to diversify its sourcing base and attract more customers. Overall, I really enjoyed how in class we learned and talked about brands reducing their China exposure and it was really interesting to learn that this widely known manufacturer is trying to achieve a goal we explored in class. This brand overall is doing a great job by sourcing from various countries to benefit their company in numerous ways.

It is really interesting to see how a lot of concepts we learning in FASH455 this semester are being applied to PVH’s business model and production plans. Concepts such as diversification, and reducing China exposure are ones we’ve become very familiar with so seeing how such a big organization is very insightful. While Asian countries are still at the forefront of the organization’s production, they also have production sights in countries including, America, Europe, the Middle East, and Africa, and have increased their total number of vendors from 503 to 533, portraying that they are dedicated to diversifying their production process. We learned from lecture that there are many pros and cons of diversification depending on the situation, however, I feel as if PVH is moving in the right direction when it comes to their sourcing strategies. As PVH sources from these countries and continue to diversify they are benefiting by serving local consumers, seeking sourcing flexibility, accessing raw materials, and lowering sourcing costs.

It’s nice to see how such a large brand is making efforts to diversify their sourcing base and recognizes the negatives of production and sourcing from China. While they do still source from China, they are doing better than their peers by reducing it along with sourcing from new destinations outside of Asia. I hope that other brands will follow and source from other countries both in Asia and outside. Its nice to see Brazil in the mix considering many countries don’t source form South America. I would like to know more about what specifically PVH sources from China and why they cant find another country to do the same. I want to see factory data including machines, and amount of employees for all factories especially Chinas.

I really enjoyed reading this article, especially since just a few weeks ago I went on a fashion trip with the school to meet with three companies, one being PVH. I think that diversification is incredibly important, such as moving away from China and expanding to other countries like Asia for sourcing. Expanding sourcing locations has great benefits, but it is also important to maintain, as well as develop relationships with the vendors. It seems like this is allowing for the possibility to create more opportunities, growth, and improvement in sourcing, yet there are still both positives and negatives to doing this.

I found this article very interesting as PVH is such a large and prevalent company that is taking efforts to diversifying where their company sources from into countries like Turkey, Portugal, Brazil, and Tunisia. It’s interesting that the concepts we learn in class are being applied to such a large brand’s business model as well as their production plans. In my opinion, since PVH is such an influential company in the industry, since they are using sourcing destinations and vendors outside of Asia, that other brands and companies will begin to follow in their footsteps. With the possibility of other companies beginning to diversify their sourcing, it will allow for more job opportunities in those countries as well as improve their economies. I think since PVH is such a large company, they shouldn’t limit themselves to just source from Asia, I feel that since they have such an influence to other fashion companies, they should use it to their benefit. Not only will diversifying their sourcing destinations help other countries economies, it allows the brand to build more reliable and effective global relations and connections.

Good thoughts. It also seems PVH is building capacity to better serve the local markets, such as made in Brazil for Brazil and made in China for China. Such a strategy may also help reduce the supply chain risks.

It was great to learn a company as big and popular as PVH Corporation is diversifying their sourcing base. Throughout this semester in FASH455, we’ve learned about how many brands are trying to reduce and move away from sourcing in China. PVH Corporation is such a huge and influential name in the fashion industry, so in diversifying their sourcing base, they are definitely inspiring others to do the same. We almost always see Asian countries dominating the sourcing industry, so it is great to see countries such as Portugal, Brazil, Tunisia, and Turkey that we do not see as often. I think Asian countries will always dominant the sourcing industry, however I think many big companies straying away is a great way to encourage diversity and expand their horizons.

As we have learned in class previously, diversifying sourcing is a growing benefit of companies. And this article goes right along proving that. As well as seeing that PVH jumped into making these changes in 2021, which was pretty close still to the start of the pandemic and making these great strides early for themselves. While they do continue to have quite a bit of sourcing within Chine, they have made the move to making these locations small, an increasing the size of there locations elsewhere. Such as their sourcing locations in Portugal, Brazil, Tunisia, and Turkey. For a big company such as PVH giving these countries more business early on in this continual shift is great for paving the way for other brands to do just the same.

It is very interesting reading about the sourcing diversification of PVH. This article truly ties what we learn about and discuss in class to real-world situations in the fashion industry. PVH is such a big corporation and it is refreshing to see them do this. The expansion decisions seem to be very tactical and done in ways that the company knows will provide benefits. For example, a lot of brands have been moving their sourcing out of China due to many negative factors, but PVH is moving in because they have growing sales in this region. The company knows not only the negative effects of sourcing in China, but the potential backlash, and they are successfully working around this. The factories in use employ fewer people than most factories in China, and it is good to see that the prices are higher for “Made in China” pieces.

While the diversification of PVH’s diversification is fascinating, I am not surprised they are doing this. This is because diversification is a huge current sourcing trend. Since PVH is a huge company, I am not surprised by their actions of diversifying since they have a lot of resources. One specific note about this post, I wonder if a big reason why their prices on products that have the tag ‘Made in China’ are higher is because of the Section 301 tariff that we discussed in class. It is also not surprising that they are sourcing to all of these Asian countries because of the growth in technological advancements that are occurring in these countries. I think it is great that PVH is diversifying because while it not only helping itself, it is helping other Asian countries in terms of creating new jobs.

According to the PVH case study on US fashion companies evolving sourcing strategies, PVH is now adopting a diverse apparel sourcing base continuing to adopt more vendors. Asia is the main sourcing base for apparel for PVH with more than half of their apparel being sourced from there. Learning about their source expansion was very interesting especially after speaking about it in class. Based on the trends and strategies PVH’s expansion into China seems beneficial and like a strong strategy, as well as their strategy of diversifying their sources. This diversification allows for more job opportunities to open up in the developing countries.

As a previous employee for PVH, I found it very interesting to learn more about the company and the sourcing factories that make up the ins and outs of their company. I found it shocking that most of PVH’s sourcing expansions have occurred in China. I think that this shows that PVH does not have a very diversified sourcing strategy since they are only focused on China. However, their strategy does seem to be smart because the article dives into explaining how there are a lot of growing sales in China and how it is a great sourcing base for a variety of different products. Overall, I have great respect for PVH as a company and based on the article it seems like they have a great strategy in terms of sourcing and apparel suppliers.

I agree that PVH is making a very smart decision by sourcing from China in this way. While I truly believe U.S. imports from China should be slowed down due to the country’s unfair policies, I can also understand how this is the best decision for PVH. This article provided super valuable insights on how important sourcing diversification is.

Diversifying sourcing strategies is a very tactical decision, especially for large companies such as PVH. PVH has expanded its sourcing partnerships across 37 countries. This is a very beneficial business decision. It allows them to not be reliant on one specific country to source from. It also allows comparative advantage to play a role, allowing for each country to produce products that they specialize in making. I found it very interesting that PVH has actually expanded its vendors in China by 17. While most companies are attempting to limit their sourcing from China, PVH is taking advantage of China’s excellent agility and flexibility in a tactical way. They are mainly sourcing from Chinese factories with less than 500 workers. From these factories, they are sourcing orders that require greater variety of products in relatively smaller quantities.

I think it’s interesting how PVH tries not to source from popular sourcing locations. I think in the future, PVH will continue to source in low cost countries outside of Asia in the next 2 years. Based on the article, I gathered that their goal is to gain as many advantages as they can including, lower sourcing costs, sourcing flexibility, and different raw materials. No country will have all these factors but by venturing out PVH can find the perfect strategy for them.

PVH Corporation’s evolving apparel sourcing strategies differ from a most countries because numerous companies are trying to decrease the number of sourcing bases and dependence they have in China. From 2021 to 2022 PVH Corporation added 17 Chinese factories ro its apparel supplier list. Although, it does appear that these factories in China are smaller than those in other Asian companies. PVH not only increased sourcing in Asia, but expanded their sourcing bases to multiple countries in the EU, Africa, and America. I think it is smart that PVH is diversifying their sourcing bases because you never know what can happen, for example COVID-19 or the Russia Ukraine war.

Hi Bridget. I completely agree with your statement and said something similar myself in mine. I found it quite intriguing that PVH is choosing to increase its souring bases on top of providing jobs to employees in a variety of locations so that they will have an easier time with travel. I think not only is this a smart decision on their part but also a great outline for other companies to follow, decreasing the size of factories while increasing the quantity and quality of factories. It seems as though it is the more feasible human rights solution that has been implemented while remaining within these sorts of countries.

This is an interesting take I find it interesting they chose to incorporate more Chinese suppliers. However I do agree with your idea of trying to diversify their supply chain and not have “all their eggs in one basket”. If the supply chain in a way was to come disrupted at some point it would be easier for PVH to recover.

This study, while rather short, had alot of information condensed within 4 trends. The one that stuck out to me the most however was trend 3: PVH’s China sourcing strategies are evolving and more complicated than simply “reducing China exposure.”. This trend I found to be rather unique as it seems as though while they are adding around 17 factories into China, they are increasing the size of the factories. On top of this, they stated that they are going to begin placing factories in other locations that ‘deserve more attention’. This sort of shocked me. It seemed as though their goal was to provide more regions with jobs and place them in locations that are beneficial to the worker, something that doesnt seem to have been done in the past. PVH seems as though their goal is to maintain/slightly increase their production while also providing a solution to a question we have been trying to answer in case studies such as the one we discussed regarding the Rana Plaza tragedy ‘How to support the workers who produce the clothes and create a safe workplace for them?” and it seems as though PVH came up with a solution to this in a way I wold have never expected more thought of due to how out of the box it seems. I applaud them on their ability to provide a solution for this without drastically changing how much profit comes in and how much they produce within a given year.

Here is my response, sorry I am having trouble submitting it because I wrote it in a Google Doc.

PVH’s sourcing strategy shows a balance between flexibility, cost-efficiency, and global reach. While they’re still mainly focused on Asia, especially China, they’ve moved to using smaller, more agile factories which are more, likely to adapt quickly to changing demand. PVH’s addition of new vendors and factories outside Asia, like in the EU, Africa, and the Americas, shows that they’re not just looking to for lower costs but are looking to reduce potential supply chain disruptions. By sourcing from a mix of regions, PVH is spreading out risk, which could help them stay resilient. This approach might help influence a model for other big U.S. fashion brands looking to secure a sustainable supply chain without relying so much on any one area. Overall, I think this article helps show a clear competitive advantage in the industry and sets the tone for how other countries should be sourcing.

First and foremost, it’s exciting to see the way that PVH owned brands (brands that aren’t traditionally known for their upstanding ethics or well-rounded business practices) are implementing a slew of new and respectable sourcing strategies. This article proves that diversification is not only a trend among US apparel retailers, but it is seemingly becoming the norm, or an industry benchmark. Throughout this course, we’ve explored a variety of resources and materials (2024 benchmarking survey, SSA as a potential sourcing destination, the evolution of the yarn-forward rule) that have all pointed to the idea that if you’re a fashion retailer that is not considering expanding your sourcing locations, you’re in the minority. What was most interesting to me, is that while much of this discussion has been centered on the idea of leaving China, or at the very least manufacturing in China less, PVH’s approach is different. The company has instead focused on expanding sourcing locations within Asia (adding 20 new Asia-based factories in 2022, and 17 of which were in China alone). It’s hard to tell whether these efforts are to distract consumers and industry professionals from the fact that they have no plans of leaving Asia, or if this expansion will actually be beneficial to company and to the livelihood of garment workers in the region, but I’m curious to see how this decision will play out. It is promising that these new Asian factories are smaller than the ones that PVH’s peers are operating, but to me, this concept still raises concerns. I understand the logic, but I don’t necessarily believe that these sourcing expansion efforts can be considered diverse, or morally yprught.