Below are selected comments by US Trade Representative Katharine Tai (Tai) and WTO (World Trade Organization) Director-General Dr. Ngozi Okonjo-Iweala (Ngozi).

What kind of global trade do we want today?

“For decades, the United States has been proud to champion the international rules-based order and the multilateral trading system…But the functioning and fairness of this order are now in question and that is why all of us need to adapt to a more challenging era marked by rapid technological change, increasing extreme climate events, vulnerable supply chains, intensifying geopolitical friction, widening inequality” (Tai)

“The United States is writing a new story on trade. We are pursuing fair competition, addressing the climate crisis, promoting our national security, and ensuring the rules-based system helps all economies, not just the biggest ones.” (Tai)

“how can we harness the effectiveness of our trade tools to be promoting not just efficiency and liberalization, but using those tools to promote what we consider certainly today to be higher goals. And those goals are resilience for our economy and the word economy, sustainability, again, for our economy in the world economy, and inclusivity… we started to see where the concentrations in supply and production started to impact this and spike this economic insecurity on a macro level and also for individuals” (Tai)

Trade and climate change

“trade is necessary to disseminate green technologies and through competition and scale efficiencies to drive down the cost of decarbonization. Another reason is that trade amplifies the impact of environmental policy action. Recent research at the WTO demonstrate that just as countries can reap economic gains by focusing on what they are relatively good at, the world can reap environmental gains if countries focus on what they are relatively green at” (Ngozi)

Is trade diversification the future?

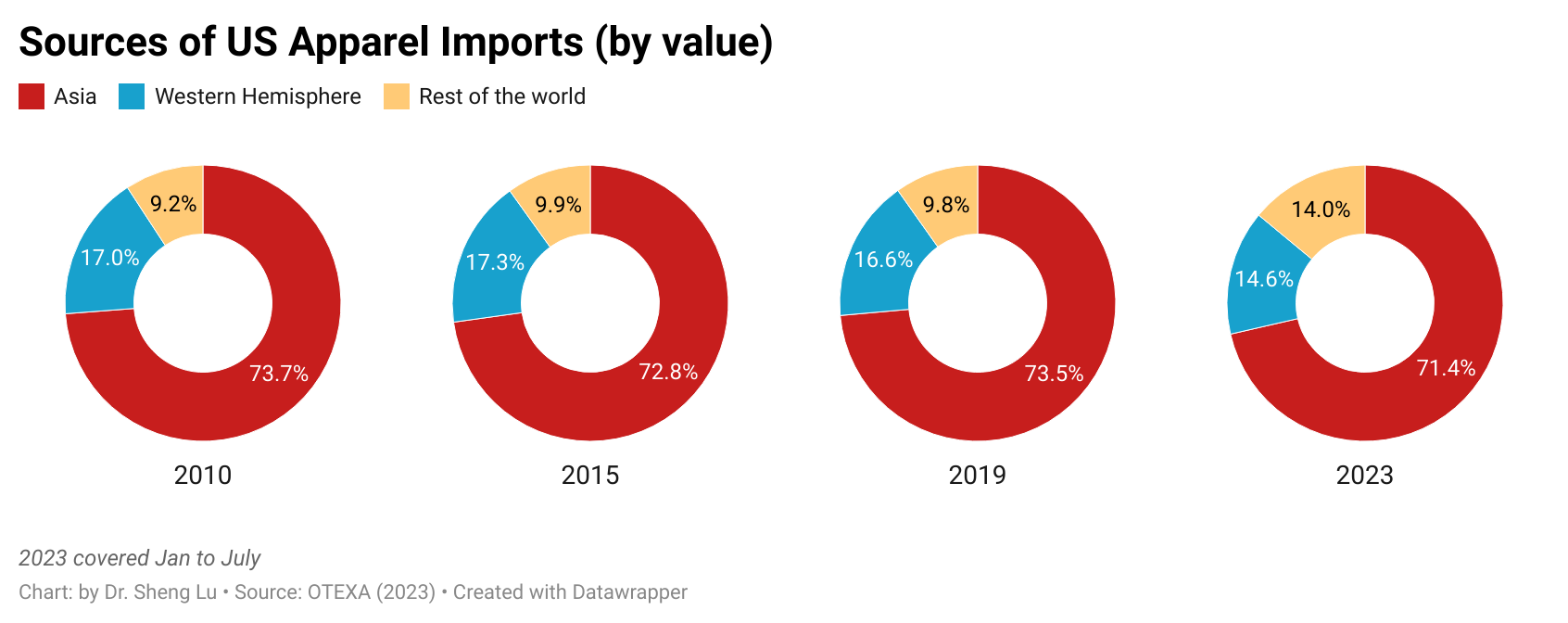

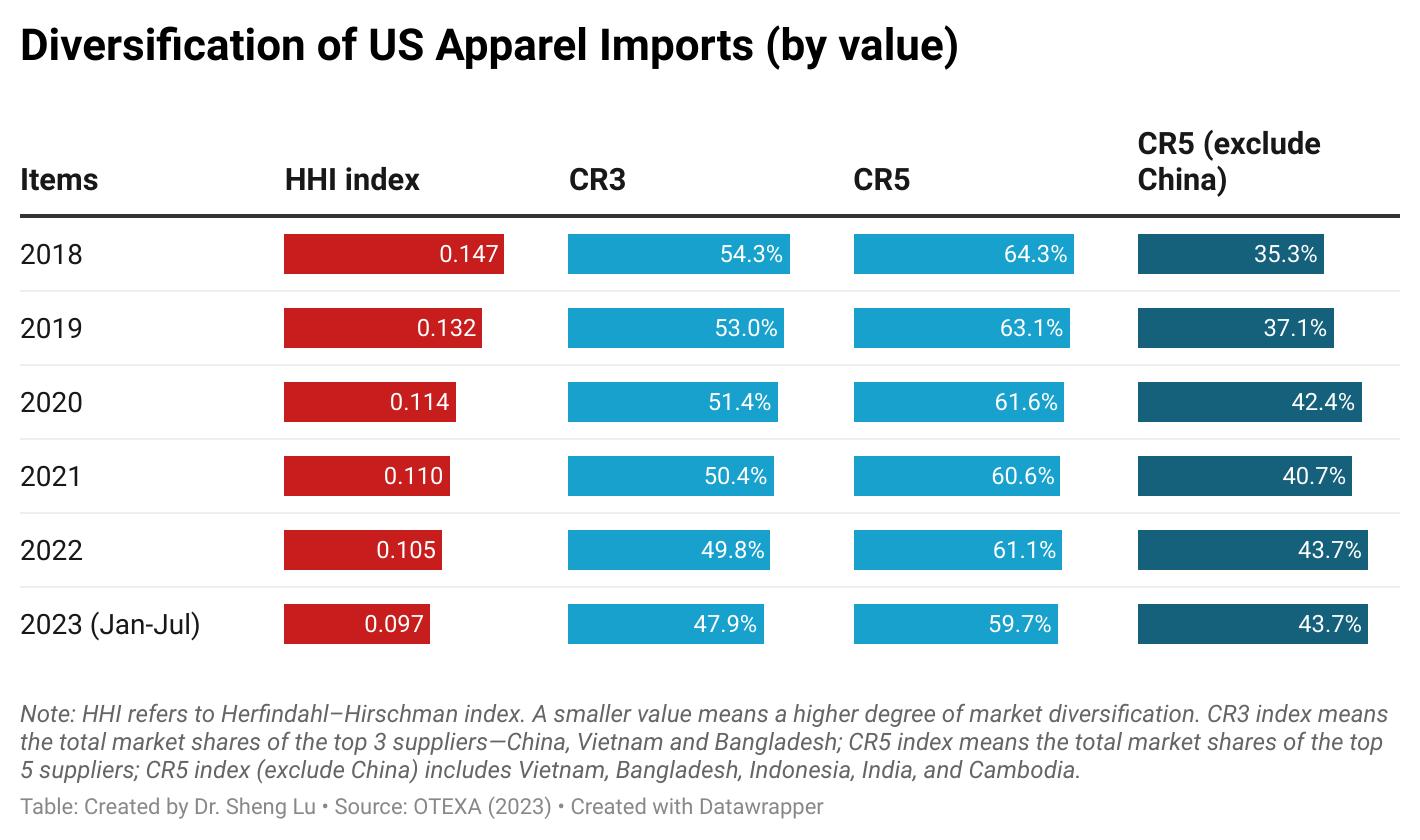

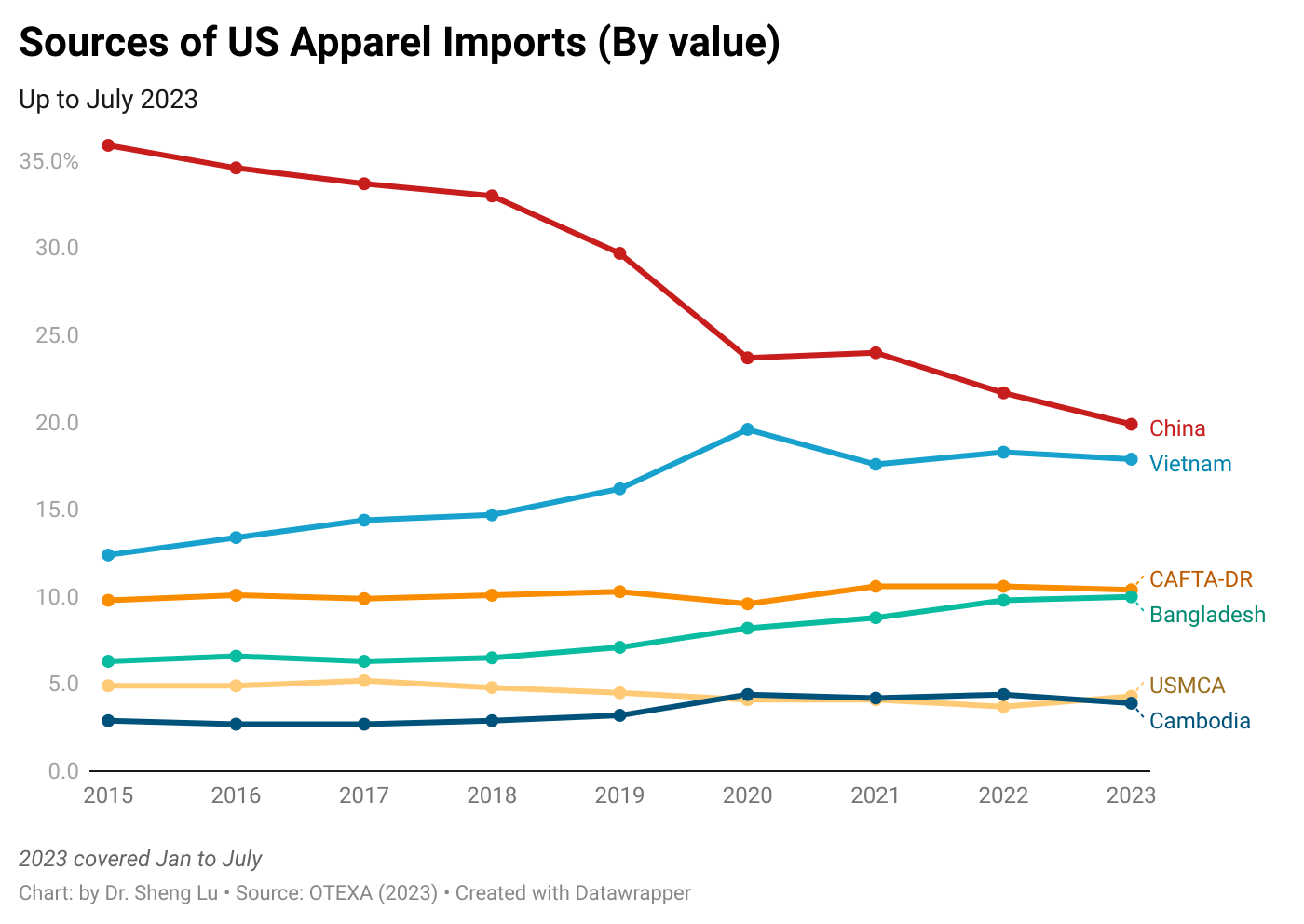

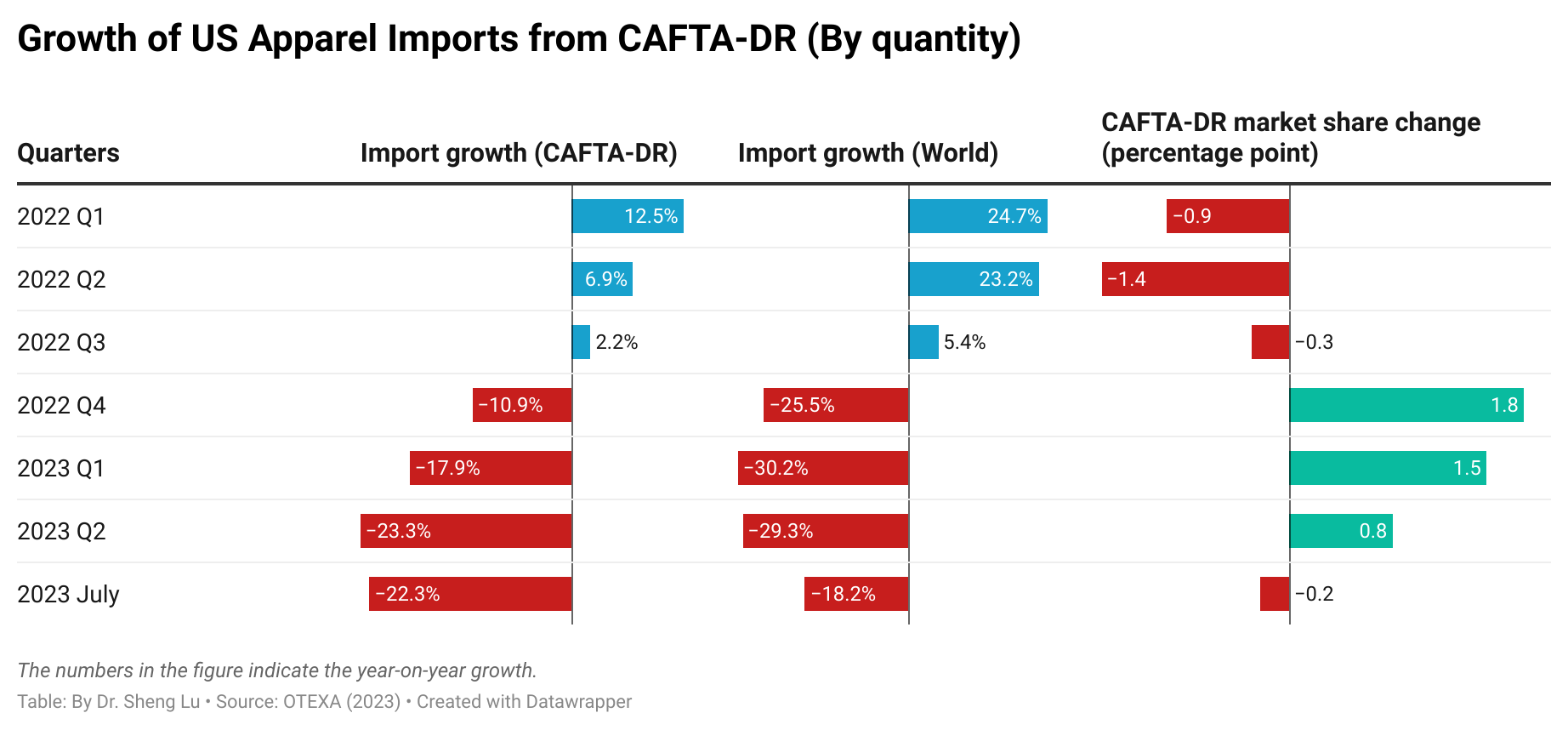

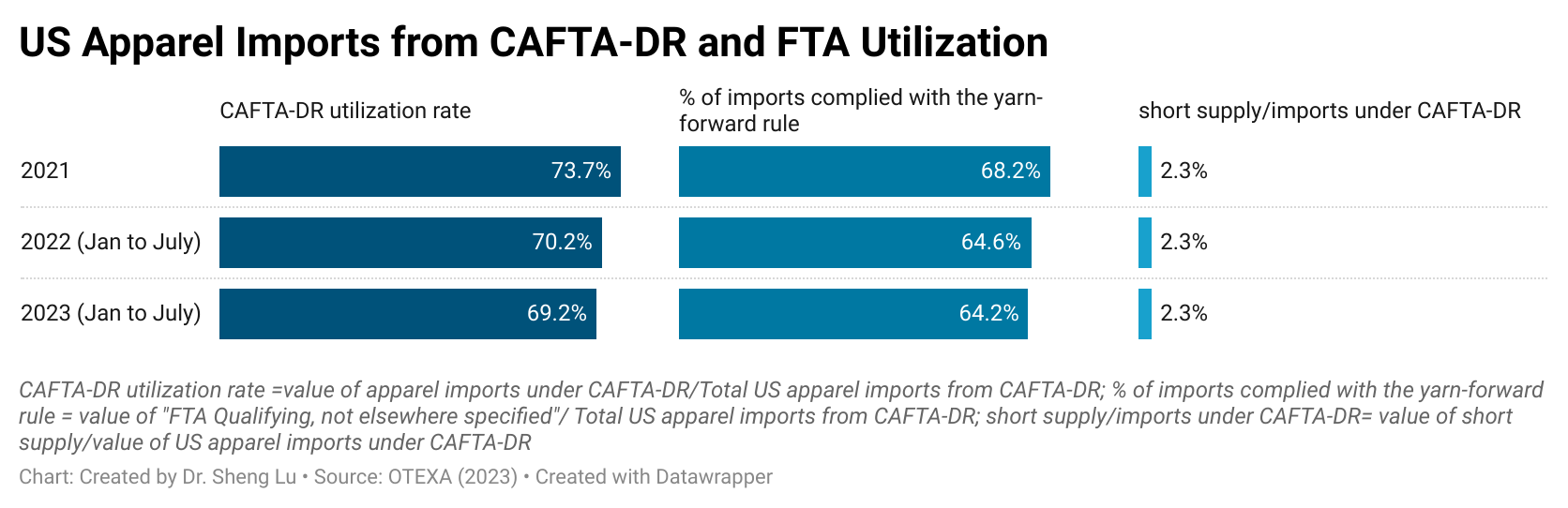

“A fragmented world economy would not just be bad for already-squeezed household budgets. Without trade, it would become harder, even impossible, to meet the big challenges of our time – resilience, socioeconomic inclusion, and climate change… The problems we encountered in the trading system were less about trade per se and more about excessive concentration for some products and supply relationships. The smart response is to deepen, diverse, and deconcentrate production so there are fewer potential bottlenecks” (Ngozi)

“we believe we can solve the problem by diversifying the supply chains not just to ourselves or to friends but to all over the world where the opportunity exists. Business should look at the possibility of not just doing China+1. It means China plus Vietnam or Indonesia. But they can do Bangladesh. They can do Laos. They can do Rwanda. They can do Senegal. They can do Nigeria. I’m just – Morocco” (Ngozi)

Debate the impact of trade

“Technology was generally a big culprit in job losses…U.S. manufacturing output, the volume of products produced here, is about as high as it has ever been. But the sector employs more machines and fewer people than it used to. Nevertheless, import competition was a significant factor and an easier focus, I think, for political anger.” (Ngozi)

“…between 1995 and 2011, while increased goods import from China did eliminate 2 million jobs in the United States, increased exports to China and elsewhere added 6.6 million jobs to the U.S. economy, 4 million of them from higher-services exports…These numbers illustrate the power of trade for job creation. But as we know, those new jobs were not created in the same places. Neither did they go to the same people. That a backlash would result from those left out was perhaps predictable, but it was not inevitable. There are countries that use domestic-policy levers to translate gains from trade into broadly shared growth by providing people security against income loss and support to seize new opportunities.” (Ngozi)

Renew or update the African Growth and Opportunity Act?

“The world is really different from when AGOA was first created…So I think copy-paste is to really lose an important opportunity…we should be practical. Also, we’re on a timeline…The AfCFTA, the African Continental Free Trade Area, that has been concluded, that has that has been brought into being by the countries on the continent. And those continental integration aspirations should absolutely be reflected in our offer to Africa, and something we should try to figure out how to incorporate” (Tai)

“African countries appreciate AGOA. They would like to see an agreement that is, you know, at least a decade out so that they have some predictability. What they’re hearing from investors is that with this up in the air, they can’t make up their minds whether to invest or not because they don’t know what will happen. So I think if we can reform and get it done, and people can have a predictable time horizon for AGOA, it would really help” (Ngozi)

How to reform the World Trade Organization?

“The United States wants a WTO where dispute settlement is fair and effective, and supports a healthy balance of sovereignty, democracy, and economic integration where all members embrace transparency, where we have better rules and tools to tackle non-market policies and practices, and to confront the climate crisis and other pressing issues.” (Tai)

“We must recognize the diversity of developing members. We should have flexibilities in the rules that reflect actual needs. But we cannot have economic and manufacturing powerhouses gaming the system by claiming the same development status and flexibilities intended for less-advantaged members.” (Tai)

“people ask me all the time, oh, are you worried because there are so many [Free trade agreement, FTA]? I’m not. Like I said, 75 percent of trade still goes on WTO terms [MFN tariff rates]. And we can learn from them.” (Ngozi)

“I don’t have enough time and money to waste resources in Geneva on a process that we don’t actually believe in…When President Biden talks about it from the floor of the United Nations General Assembly, if we still have trading partners who want to question our seriousness, then I think the problem is those partners and it’s not us” (Tai) [note: this comment was mentioned by Politico]

–END–