The newly released World Trade Organization statistics and data from the United Nations (UNComtrade) suggest several patterns of China’s textile and clothing exports.

Firstly, while China remained the world’s largest clothing exporter in 2023, rising geopolitical tensions and Western fashion companies’ ongoing de-risking efforts pose increasing challenges to its export outlook.

To some extent, 2023 wasn’t too bad for clothing “Made in China.” In value, China’s clothing exports totaled $164 billion, accounting for 31.6% of the world—unchanged from 2022. While China’s clothing exports decreased by 9.7 percent in 2023 compared to the previous year due to weaker market demand, this performance was better than most other top ten suppliers, including Bangladesh (down 16 percent), Vietnam (down 12 percent), India (down 13 percent), and Indonesia (down 17 percent).

However, China’s clothing exporters face significant challenges ahead. Despite maintaining its overall market share, China is losing momentum in nearly all key Western clothing markets, including the United States, the European Union, the UK, and Canada. This trend is primarily driven by perceived heightened sourcing risks associated with China, ranging from concerns over forced labor in the Xinjiang region to escalating geopolitical tensions involving the country.

For example, according to the 2024 Fashion Industry Benchmarking Study released by the US Fashion Industry Association (USFIA) in July, a record 43 percent of surveyed leading US fashion companies reported sourcing less than 10 percent of their apparel products from China in 2024, compared to only 18 percent in 2018. Likewise, nearly 60 percent of respondents no longer use China as their top apparel supplier in 2024, much higher than the 25-30 percent range before the pandemic. Additionally, nearly 80 percent of respondents plan to further reduce their apparel sourcing from China over the next two years through 2026, citing perceived high sourcing risks as the primary concern.

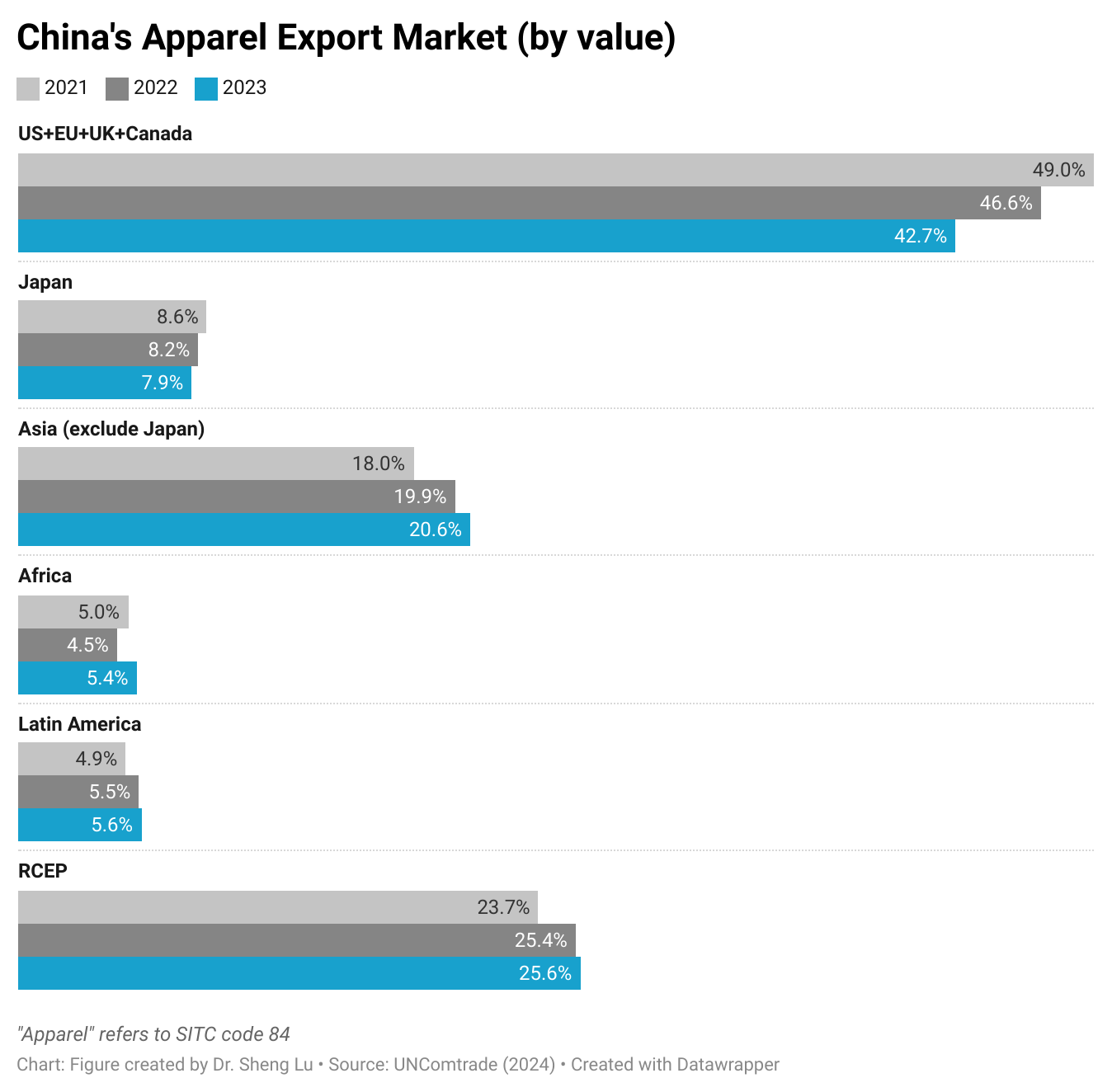

Secondly, China has been diversifying its clothing exports beyond traditional Western markets in response to the “de-risking” movement. For example, the US, EU, UK, and Canada combined accounted for 43-45 percent of China’s clothing exports in 2023, lower than over 50 percent in the past. In comparison, these four Western markets typically accounted for 70 to 90 percent of an Asian country’s clothing exports. Meanwhile, since 2021, Asian economies, especially members of the Regional Comprehensive Economic Partnership (RCEP) and Africa, have become more important export markets for China. Nevertheless, since RCEP members and those in Africa primarily consist of developing economies with ambitions to expand their own clothing production and exports, the long-term growth prospects for their demand for “Made in China” clothing remain uncertain.

Thirdly, China’s weakened economy could lead to an increased supply of low-cost Chinese clothing in the global market.

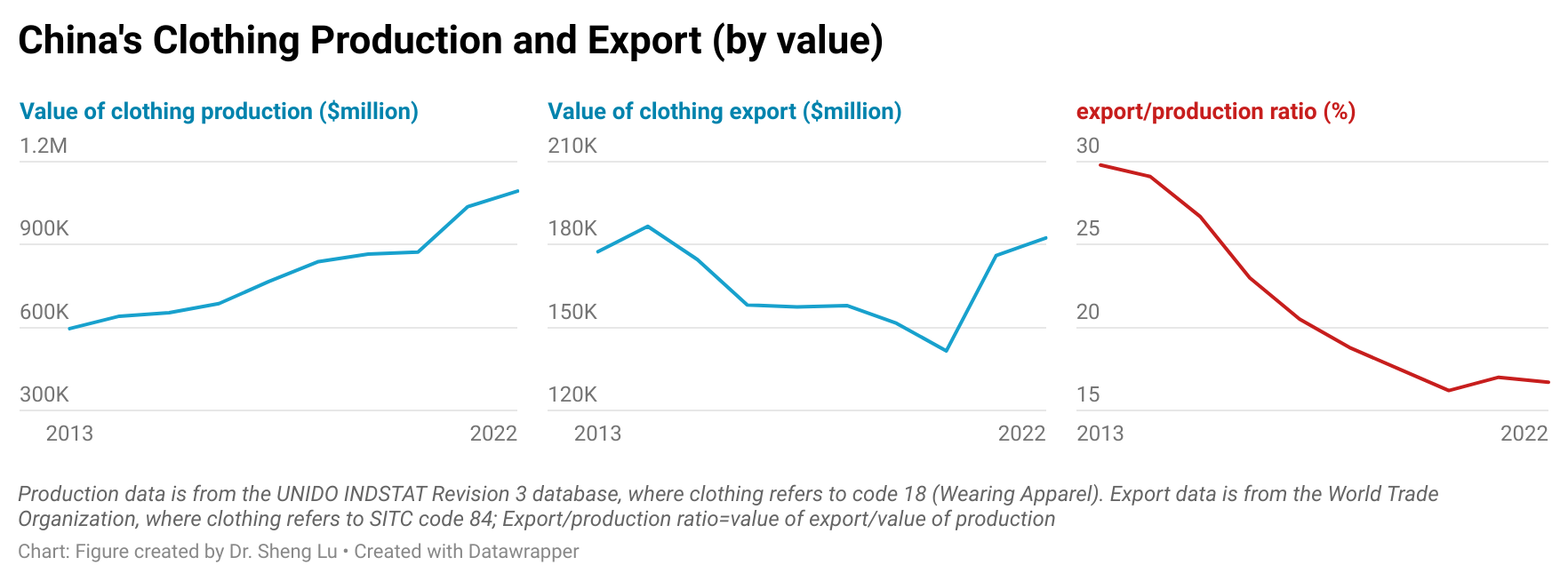

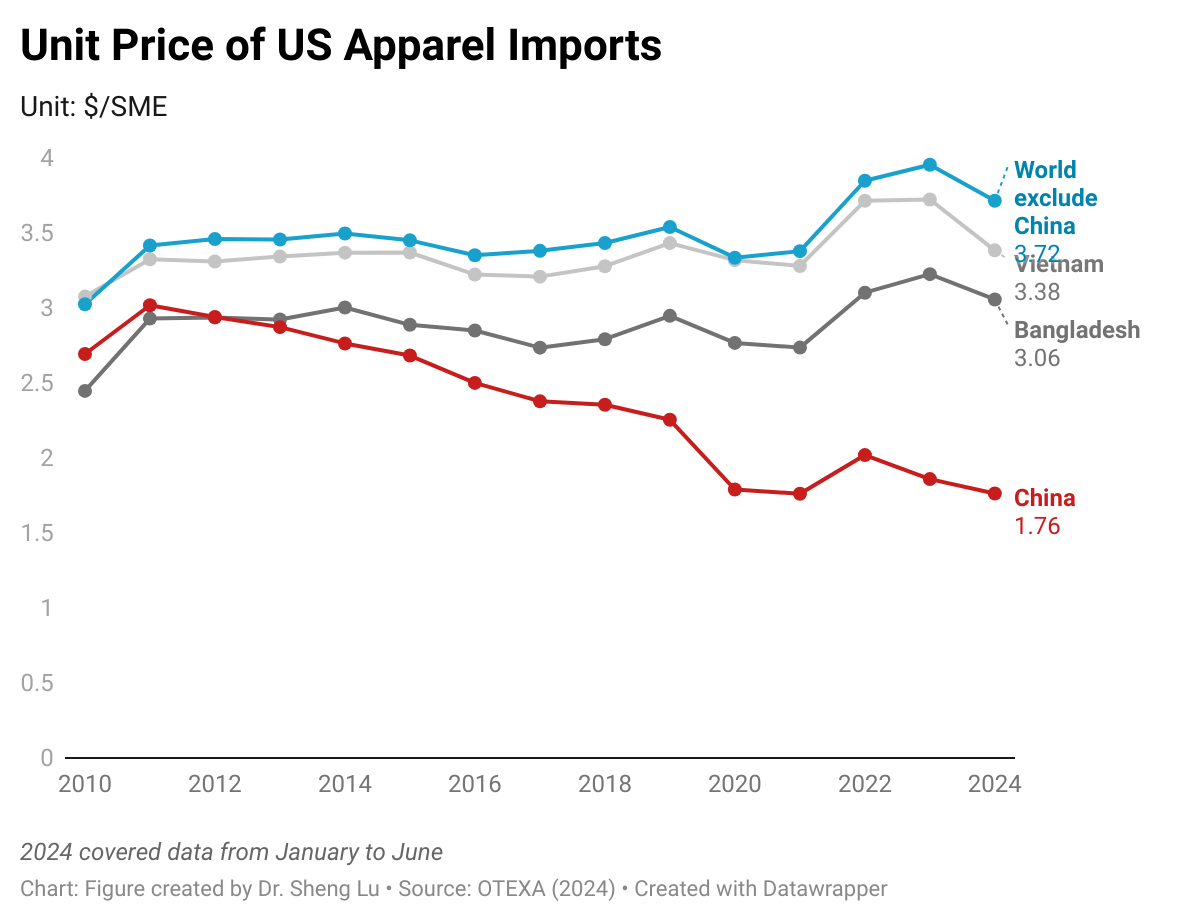

Despite being known as the world’s largest clothing exporter, between 2013 and 2022 (the latest available data), over 70%–80% of clothing produced in China was consumed domestically, with only about 20%–30% being exported. However, as China’s economic growth has slowed and consumer spending on clothing has stalled, more clothing made in China could enter the international market and intensify the price competition. Notably, between June 2023 and June 2024, the average unit price of US apparel imports from China decreased unusually by 7.6 percent, signaling that an increased supply of Chinese clothing began to suppress market prices. Likewise, it doesn’t seem reasonable that the unit price of U.S. apparel imports from China was 40% lower than that of imports from Bangladesh in the first half of 2024. Thus, the growing influx of cheap Chinese products raises the risk of market disruptions, potentially leading to additional trade tensions and restrictive measures against Chinese products.

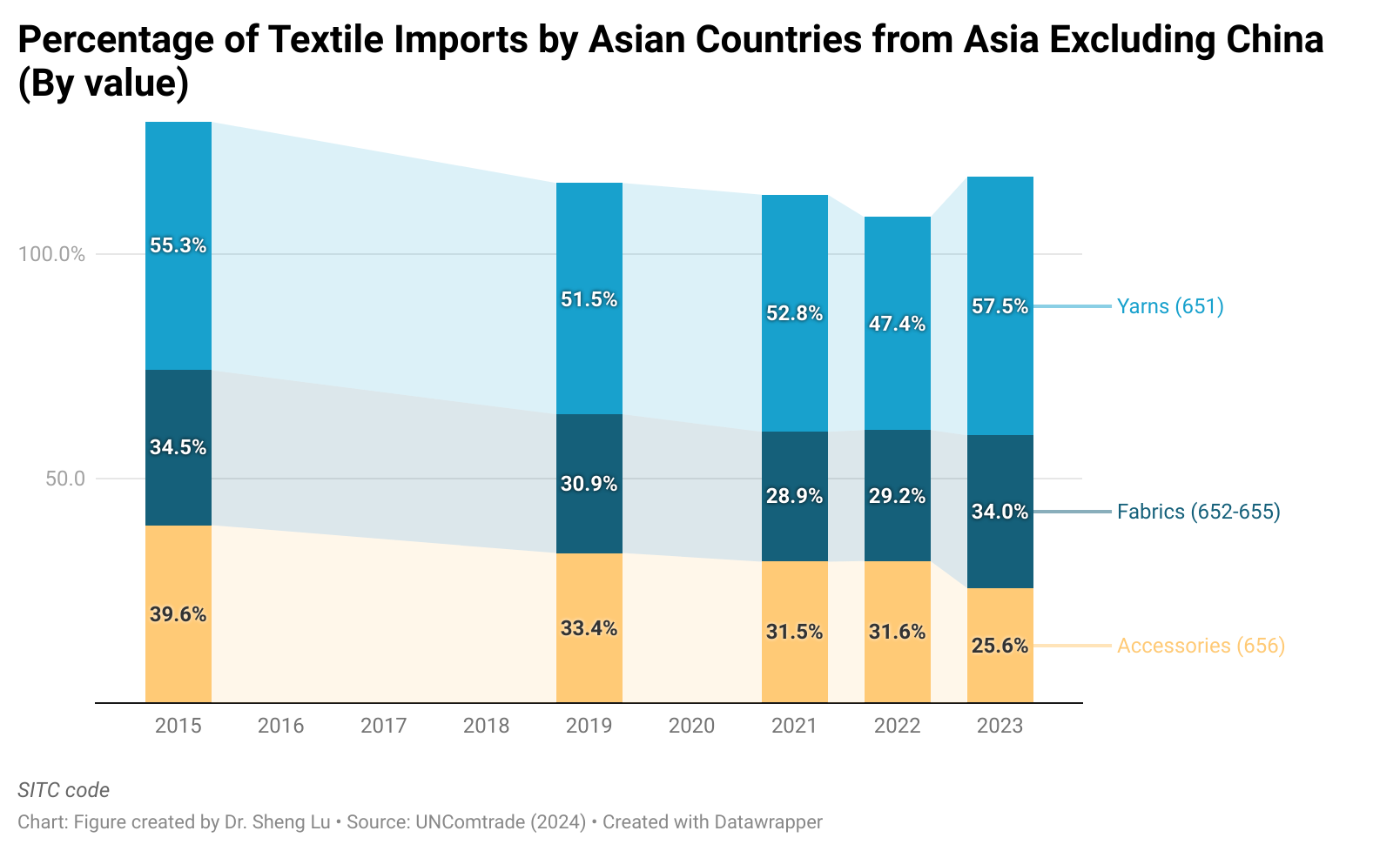

Fourthly, there is an early sign that Asian countries have become more cautious about using Chinese yarns and fabrics. China remained a key supplier of textile raw materials to leading apparel-exporting countries in Asia. However, Asian countries appeared to be sourcing fewer yarns and fabrics from China in 2023, possibly due to the enforcement of anti-forced labor laws, such as the Uyghur Forced Labor Prevention Act (UFLPA), and the perceived risks associated with sourcing Chinese cotton. Instead, more Asian countries’ yarns and fabrics now came from regional suppliers other than China.

by Sheng Lu

Additional reading: China has turned inward to sell Xinjiang cotton after a trade ban. Will it be enough? (South China Morning Post, August 11, 2024).