(note: please click the section title to access interactive data)

Part 1: U.S. Goods Trade by Industry Sectors and Trading Partners (Source: USITC Trade Shifts 2024 Report)

- Observe the top U.S. export and import trading partners for goods, noting any changing patterns

- Observe the top U.S. export and import product sectors, noting any changing patterns

- Do the trade patterns overall align with the trade theories discussed in class?

- Should it be a concern that textiles and apparel are NOT among the top US exports of goods?

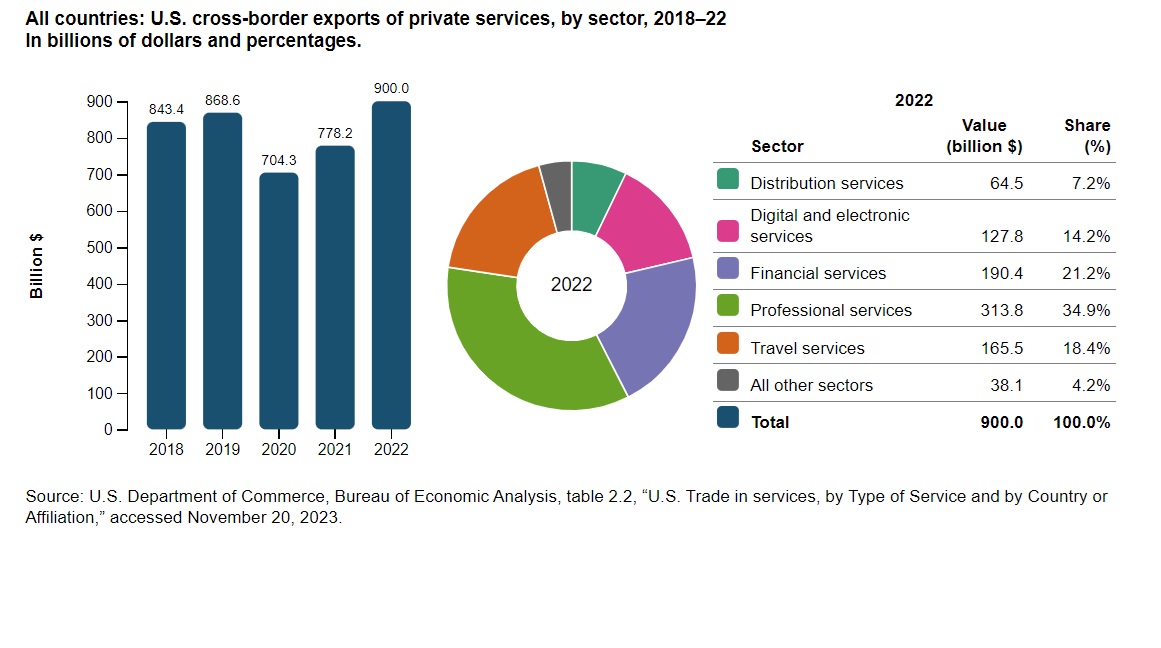

Part 2: U.S. Trade in Services (Source: USITC Recent Trends in US Services Trade 2024 Report)

- Observe the sectors covered by trade in services

- Compare the value of US service exports and imports

- Observe the trading partners of US services trade

- Why do politicians often focus more on trade in goods rather than services? Should they?

Part 3 (Optional): Revealed Comparative Advantage Index (Source: UNCTAD)

Note: The revealed comparative advantage (RCA) index measures a country’s relative export performance of a particular product compared to the world average. It helps identify sectors in which a country holds a competitive edge in international trade. RCA =(Country’s exports of product X/Country’s total exports)/(World exports of product X/World total exports).

- RCA > 1: A value greater than 1 indicates that the country has a revealed comparative advantage in the product, meaning the product has a higher export share in the country’s portfolio compared to the global average. This suggests the country is more competitive in exporting that product relative to the rest of the world.

- RCA < 1: A value less than 1 means the country has a revealed comparative disadvantage in that product. It indicates that the country is less competitive in exporting that product compared to the global average.

Observe the sectors in which the U.S. enjoyed a revealed comparative advantage (i.e., RCA > 1) in 2023. How does this compare with Bangladesh? What is your explanation for the observed differences?

After reading this it’s important to learn that by successfully relating U.S. trade patterns to trade theories such as comparative advantage and factor endowment theory, this analysis provides a comprehensive view of U.S. trade patterns. A solid understanding of the technicians of international trade is demonstrated by the finding that American imports tend to focus on labor-intensive commodities, while exports tend to focus on high-value, capital-intensive items. The worry that clothing and textiles are not among the top exports is especially perceptive since it draws attention to the wider effects of outsourcing and the necessity of sustainable domestic manufacturing practices. It could be helpful to elaborate on the ways in which the United States could tackle these issues, for as by investing in sustainable manufacturing techniques or enacting legislation that encourages innovation in the textile industry.

This post provided graphs and statistics that were easy to follow and understand, giving a good overall map of where all the money truly lies in trade and sourcing. First, the actual numbers themselves are astonishing. Seeing the number 2000 billion dollars truly is too large to wrap my head around. It prompts me to ask where is all of this money actually coming from and how can so much money be properly monitored and are the right people in charge of all these transactions? A striking aspect seen within the graphs is the difference of focus on trade of goods versus services. For me this raises the question of are lawmakers specifically focused on goods for a reason, for example are they after the money and could they potentially be missing out on an opportunity if they undervalue the economic growth potential of services? In addition, after years of fashion merchandising and textile classes I have seen the statistics and number of garments produced every year and the astonishing amount of revenue it brings in, so it’s also very surprising to not see textiles and apparel listed among top U.S export sectors.