The full article is published in Just-Style and below is the summary:

India’s Textiles and Apparel Production

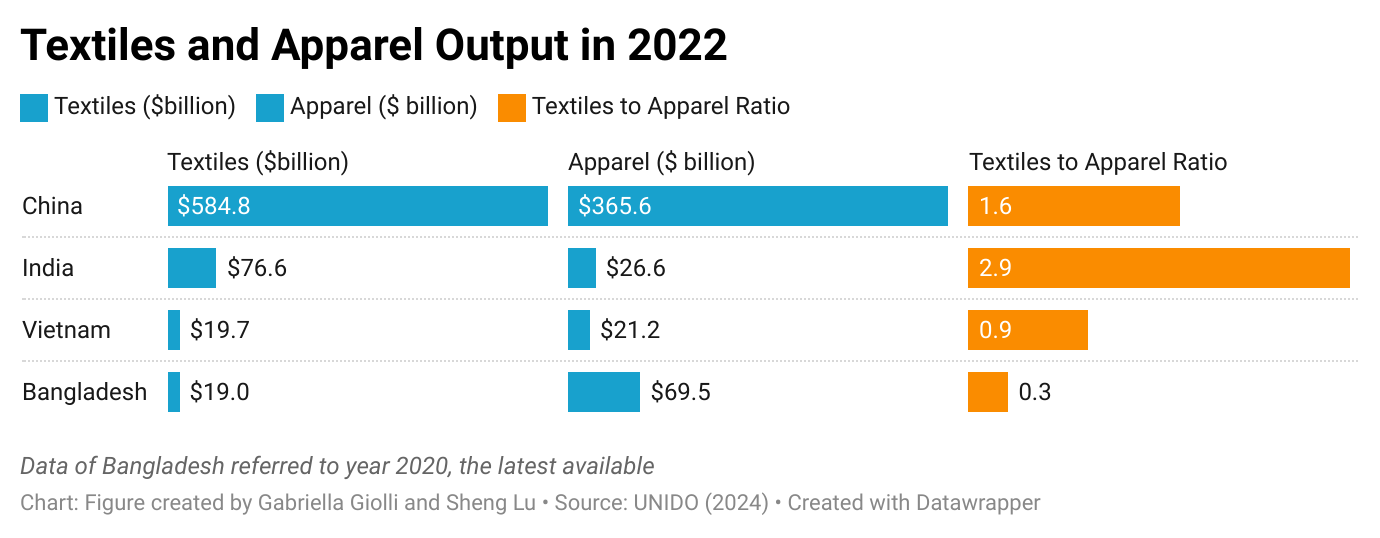

Data from the United Nations Industrial Development Organization (UNIDO) shows that India produced around $76.5 billion in textiles and $26.64 billion in wearing apparel in 2022. Although still smaller than China’s, this production scale has already surpassed that of most other Asian countries, including Vietnam. Behind these numbers were India’s over 4,000 ginning factories, 3,500 textile mills, and around 45 million workers directly employed by the textile and apparel sector.

India is one of the world’s largest textile fiber producers, including regular cotton, organic cotton, silk, polyester, and viscose. India also has more advanced local textile manufacturing capabilities than most other developing apparel-exporting Asian countries, allowing it to benefit from a vertically integrated local textile and apparel supply chain. A recent U.S. International Trade Commission (USITC) study noted that more than 90 percent of India’s textile raw materials needed for its apparel production can be sourced domestically. In comparison, as the World Trade Organization (WTO) global value chain analysis estimated, more than 64 percent of Vietnam’s apparel exports in 2022 contained foreign-made content (i.e., imported yarns and fabrics), 57 percent for Cambodia, 49 percent for Indonesia, and 33 percent for Bangladesh.

India’s Apparel Export

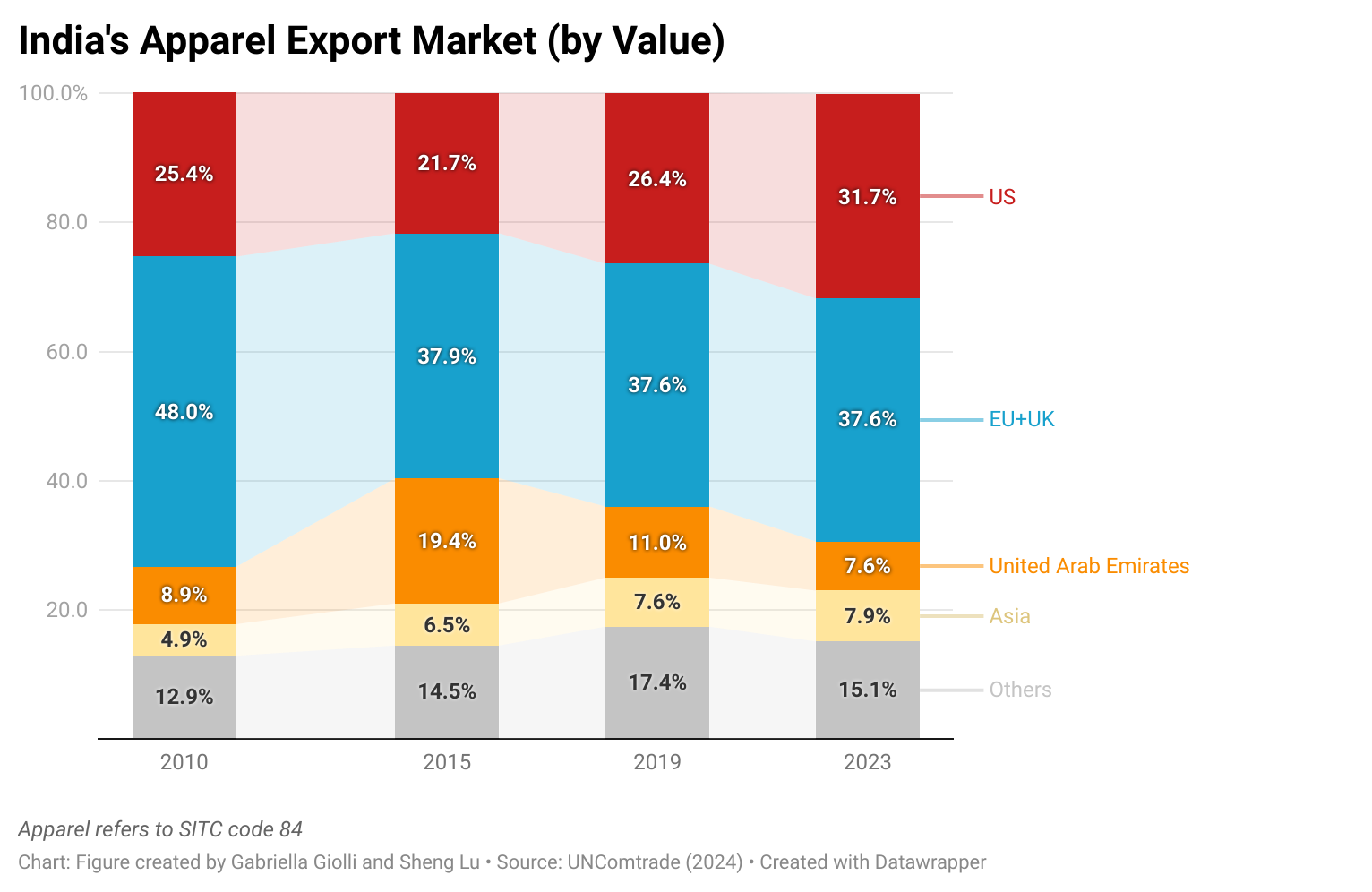

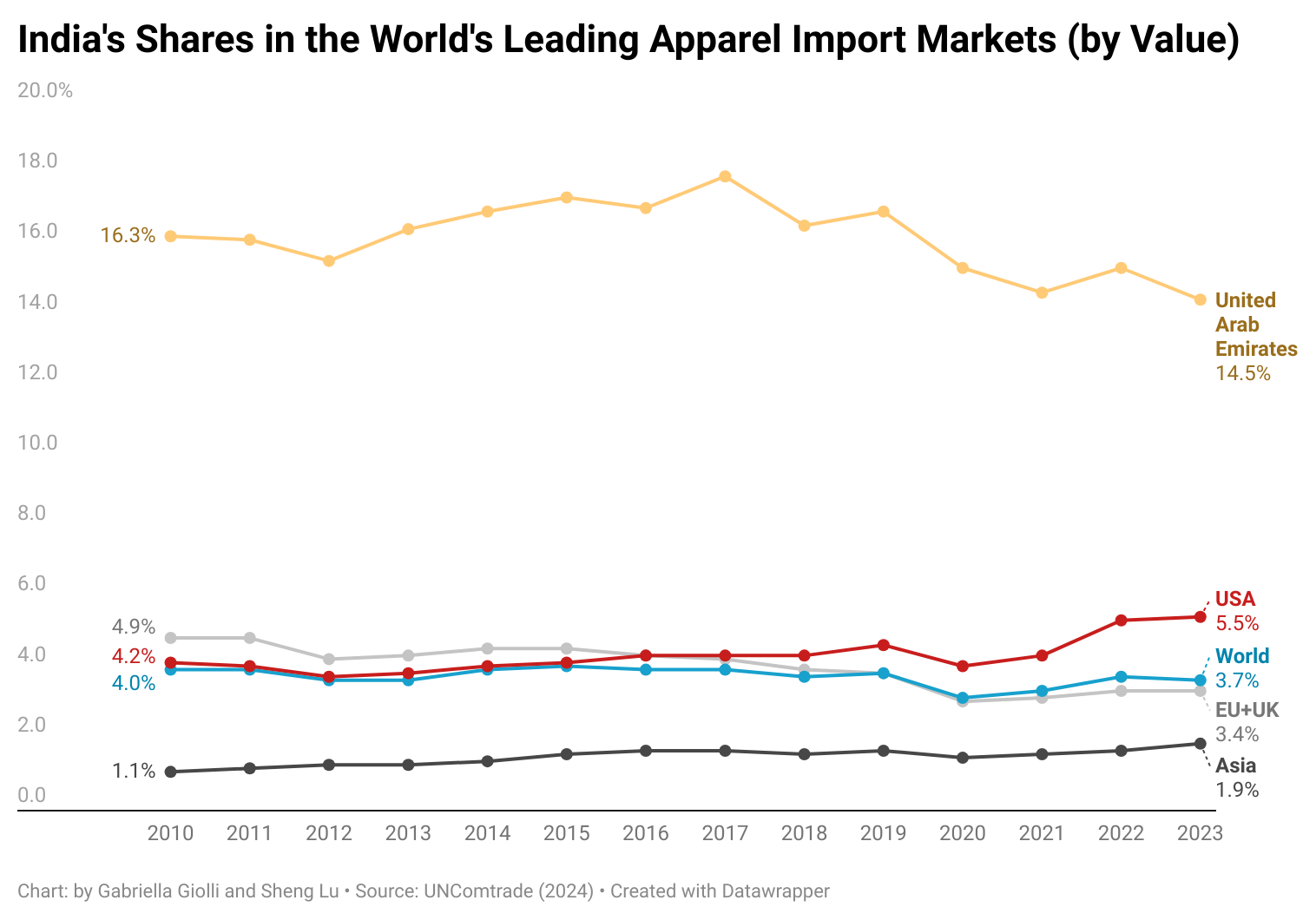

India remained a much smaller apparel exporter than China, Vietnam, and Bangladesh. According to the World Trade Organization (WTO), India exported about $15 billion in apparel in 2023, ranked the world’s sixth largestor 2.8 percent of the global total. Similarly, in 2023, India accounted for 5.5 percent of U.S. apparel imports and 3.5 percent of the EU, showing its position as a significant supplier but not among the largest. However, unlike most other developing Asian countries, India exports less than half of its apparel output due to its massive domestic market with a population of 1.43 billion. This implies that India’s substantial untapped apparel export potential should not be ignored.

Why Sourcing from India?

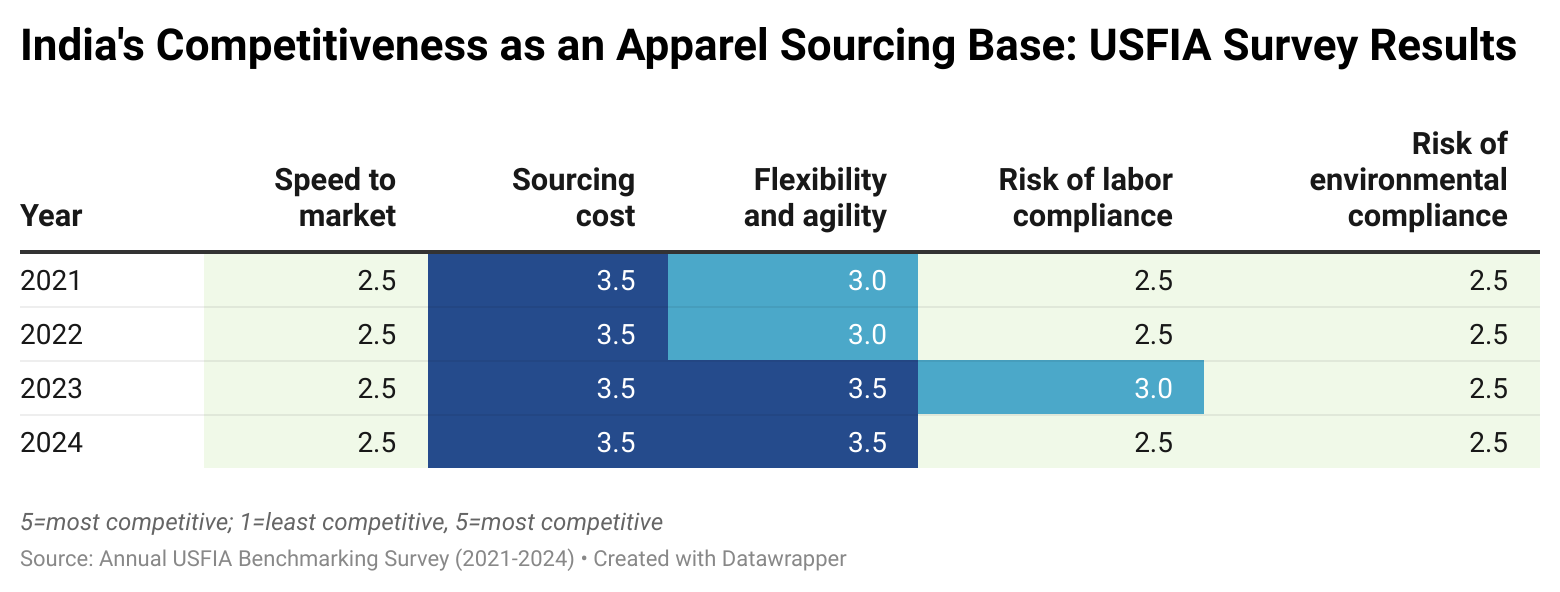

Firstly, aligned with trade statistics, many U.S. fashion companies already source from India, although in a relatively small volume. For example, the USFIA benchmarking survey respondents consistently ranked India as the 3rd or 4th most utilized apparel sourcing base from 2021 to 2024, after China and Vietnam. However, U.S. fashion companies typically place less than 10 percent of their total sourcing value or volume in India. The recent USITC study also raised concerns that India’s apparel factories were primarily small and medium-sized, which could limit their ability to fulfill large-volume sourcing orders.

Secondly, “Made in India” clothing is not necessarily cheap but could be perceived as “worth the value.” Notably, from January to October 2024, clothing labeled “Made in India” sold in the U.S. retail market was, on average, priced much higher than imports from Bangladesh and Vietnam, particularly in the mass market segment. Meanwhile, in the premium market segment, clothing “Made in India” was, on average, priced relatively lower than “Made in China,” such as dresses, tops, and bottoms. These results suggest that U.S. fashion companies do not typically consider India a preferred sourcing base for basic and price-sensitive items. Instead, India may be seen as a more cost-effective alternative to China for high-quality, value-added clothing.

Thirdly, India has been strengthening its competitiveness in export flexibility and agility, enabling its vendors to quickly adjust the delivery, volume, and product of the sourcing order upon customers’ requests. In the latest 2024 USFIA survey, respondents rated India’s sourcing flexibility and agility second only to China, surpassing Bangladesh, Cambodia, and Central American countries. Likewise, India was regarded as one of the few Asian countries that could fulfill apparel sourcing orders with relatively low “minimum order quantity (MOQ)” requirements.

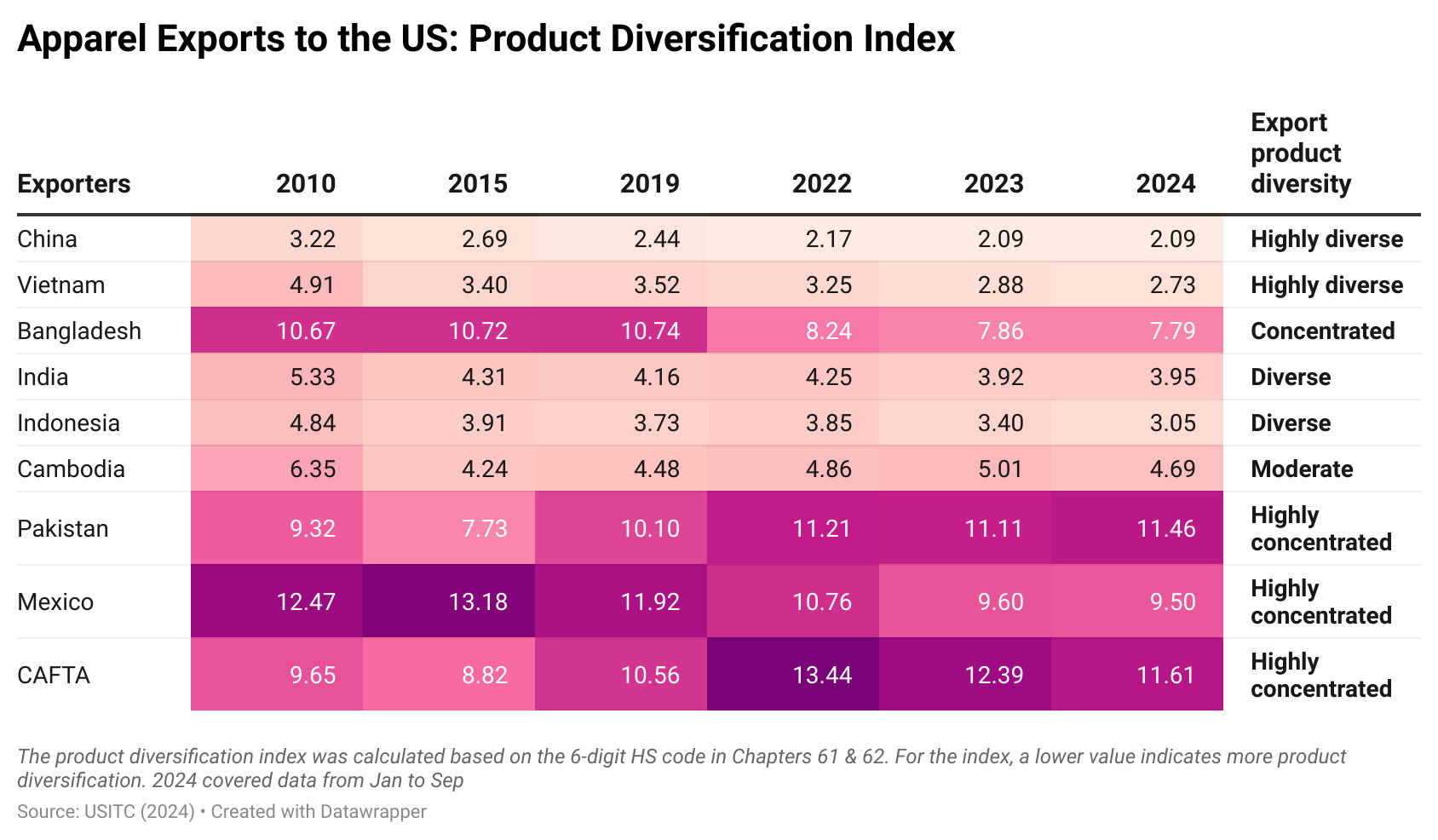

One major factor contributing to India’s perceived advantages in sourcing flexibility and agility is its ability to produce a wide range of apparel products. For example, the Herfindahl-Hirschman Index (HHI) calculated using trade data at the 6-digit HS code level indicates that U.S. apparel imports from India cover more diverse product categories than most Asian countries.

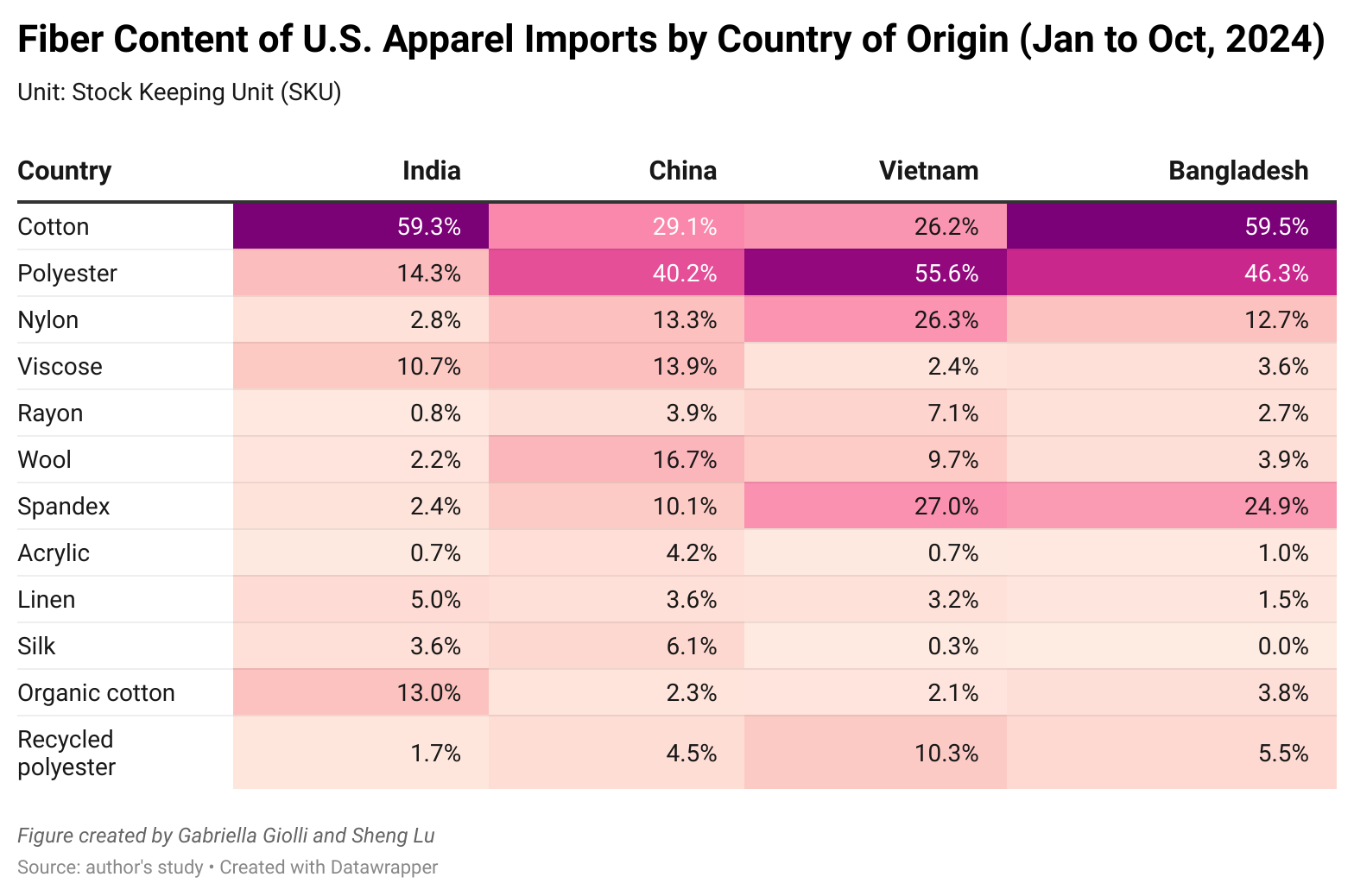

Moreover, due to India’s position as one of the world’s leading cotton producers, in the first ten months of 2024, nearly 60 percent of U.S. apparel imports from India contained cotton fibers, including 13 percent using organic cotton. This percentage was much higher than imports from other Asian suppliers such as China and Vietnam. In comparison, over the same period, U.S. apparel imports from India appear less likely to contain man-made fibers like polyester, nylon, spandex, and recycled polyester. This fiber composition explains why India has yet to become a leading supplier of certain apparel product categories, like outerwear, which more commonly uses man-made fiber than cotton.

Additionally, in the first ten months of 2024, over 45 percent of India’s apparel newly introduced to the U.S. market targeted the luxury and premium segment, closely matching China’s nearly 50 percent and exceeding other Asian suppliers such as Vietnam (20 percent), Bangladesh (13 percent), Cambodia (5 percent), and Indonesia (18 percent). This result explains why U.S. fashion companies increasingly consider India a strategic alternative to sourcing from China, given the similarities in their product offerings.

Reflections

India’s large country size and population, the presence of an already highly integrated and sophisticated textile and apparel supply chain, and its ability to make a great variety of high-quality products suitable for various market segments position it well in the export competition. U.S. fashion companies’ eagerness to reduce sourcing from China due to rising geopolitical concerns and the limited sourcing capacity elsewhere created historical opportunities for India to expand its apparel exports to the U.S. market further.

Nevertheless, it remains a question mark whether India is fully committed to expanding labor-intensive apparel production and exports, given the country’s economy is moving toward more capital and technology-intensive sectors. Notably, in value, apparel only accounted for about 5.6 percent of India’s total merchandise exports in 2023, similar to China’s 5.3 percent but much lower than other lesser-developed Asian countries, including Vietnam (10 percent), Bangladesh (88 percent), and Cambodia (44 percent).

Moreover, while India is not a primary focus for compliance issues like forced labor, sourcing from the country still carries general social and environmental compliance risks similar to those in most developing countries (note: see the 2024 USITC report). It remains to be seen whether India’s textile and apparel mills are technically and financially prepared to meet more stringent social and environmental standards being adopted in the U.S. and can effectively compete in the growing market for “sustainable apparel.”

by Gabriella Giolli (Honors Marketing major & Fashion management minor, University of Delaware) and Sheng Lu

I think the Excellent higher education in Textiles and availability of talented Textile professionals is an important positive aspect for competitiveness of Textile Industry in India.

On negative side, due to frequent Elections, Govt Policies favour small scale industries and farmers which affect negatively to the competitiveness of larger industries. For Ex Import duty on cotton.

India’s textile and apparel industry is growing as a key player in global sourcing, especially with its strong local supply chain and production capacity. What stands out is its potential to be an alternative to China, especially in the premium and luxury segments with its competitive edge in producing high-quality cotton apparel. India still faces challenges which could limit its availability to expand its market in mass-produced, low-cost apparel due to the smaller factory sizes, higher production costs, and shift toward more capital-intensive industries. Sustainability is also becoming more important, so it will need to meet strict social and environmental standards to compete. It will be interesting to see if India can keep up with the demands of the evolving global fashion industry.

I think this article explains why India is a good apparel sourcing base for U.S. fashion companies mainly because of their sustainability practices. The major highlights for this are the fact that 59.3% of the U.S. cotton imports are from India, and 13% of these are organic cotton. These numbers vastly stand out against other countries and other fibers that are used that are not as sustainable. Another benefit of India as an apparel sourcing base is their diverse amount of products at lower minimum order quantities. I think this is a much more responsible way to go about production to ensure there is not too much inventory and products won’t go to waste. This further proves India’s commitment to sustainability. Although there are still issues in terms of both social and environmental compliance for India, by being more transparent and doing the best to be as environmentally conscious as possible, I believe that India will continue to improve as an apparel sourcing base for the U.S. This may even help bring them to the top, as more companies are becoming even more concerned with sustainability.

This article shows that India is becoming a more important player in global apparel sourcing, especially for U.S. fashion companies. While it exports less clothing than countries like China or Vietnam, sourcing from India has major advantages. It produces a wide variety of textile fibers, has a large domestic supply chain, and can source most of its own materials. Unlike many other countries, India doesn’t rely heavily on imports for its fabric and yarn needs, which adds to its efficiency.

India is also known for its flexibility, producing many types of clothing and meeting smaller orders, which is an advantage in today’s fast-changing fashion market. While its apparel prices aren’t always the lowest, “Made in India” is often seen as high-quality and good value. These strengths make India a good alternative to China for U.S. brands. However, its long-term role in apparel sourcing remains uncertain, as the country shifts more toward technology and capital-intensive industries.

This article adds a great perspective as to how India has evolved and continues to evolve in the global textile and apparel industry. It describes how India has great potential in the future when it comes to expanding their knowledge and experience in the industry. A main part of this article that stood out to me was the debate on how India is a better sourcing alternative than China. The geopolitical tensions that are increasing has proven to be heavily affecting China and emphasizing India as a strategic alternative. India has shown to provide flexibility and with less risk. This is interesting because it shows how brands are less reliant on China and how India is becoming more discussed as a supplier. Another part of the article that really stood out to me was the discussion on the upcoming shift in economic priorities. They state how India’s economy is shifting toward tech and capital intensive industries which starts the topic of more labor sectors in apparel. They also dive into the topic of investing in these labor heavy industries and raises uncertainty within the economic perspective overall. Ultimately, this article was extremely intriguing to see how India is becoming more of a competitive player and how global apparel sourcing is transforming.

Hi Olivia, I really like your insights on the evolving role of India in U.S. apparel sourcing are both timely and thought-provoking. As highlighted in the study, while India isn’t the go-to for basic, price-sensitive items, its strength lies in producing high-quality, value-added apparel. The data indicating that “Made in India” clothing commands higher prices in the U.S. mass market, yet remains competitively priced in the premium segment compared to China, underscores this positioning. Furthermore, India’s robust domestic textile infrastructure and its ability to swiftly adapt to sourcing demands enhance its appeal as a flexible and agile partner. As U.S. fashion companies seek to diversify their sourcing strategies amidst global uncertainties, India’s unique blend of quality craftsmanship and adaptability positions it as a compelling alternative to traditional sourcing hubs

This article is a great reflection of India’s competitive advantages it has over countries such as China, Vietnam, and Bangladesh. India is able to produce high quality garments and has appealed to the luxury segment in the fashion industry because of their investment in high quality materials and technology. In 2024, over 45 percent of India’s apparel newly introduced to the U.S. market targeted the luxury and premium segment. However, India cannot meet the consumer demand in the mass market segment, so I think US fashion brands will see India is a sourcing base if they are looking to produce sustainable, high-quality garments. There are risks of forced labor in India, but if India is committed to sustainability, they can also be committed to achieving a transparent supply chain.

I think this study shows that India has a lot more potential as a sourcing base than most people realize. India already produces a huge amount of textiles and apparel, and because they have such a big, vertically integrated supply chain, they don’t depend on imports the way other Asian countries do. Even though India isn’t one of the top apparel exporters yet, it has a big domestic market and potential. What stood out to me is that “Made in India” isn’t necessarily the cheapest, but it is better for higher-quality pieces at the price it is. At the same time, India still has challenges such as they rely heavily on cotton and they’re not as strong in man-made fibers.

This article offers an interesting perspective on India’s position as a growing apparel sourcing base for U.S. fashion companies, and discusses some of its benefits. For example, India can supply many of its raw materials domestically, which greatly reduces dependency on external sourcing. This flexibility is ideal for the fast-passed fashion industry where shortened lead times are essential. However, the article also brings up the risks associated with this, such as that India may not be ideal for low-cost, high-volume fast fashion manufacturing. Overall, I liked how this article brings up both the positive and negative sides of sourcing from India.

The article gives a really timely look at how India’s role in global apparel sourcing is evolving. I found it especially interesting that India isn’t just another low-cost option; its strong domestic textile supply chain, wide fiber variety, and vertically integrated infrastructure make it a compelling choice for higher-quality or more premium apparel. The study also highlights India’s flexibility with smaller orders and diverse product categories, which aligns well with fast-fashion needs or specialized collections. At the same time, it acknowledges ongoing challenges, such as the dominance of small and medium-sized factories and the difficulty of handling large, mass-market volumes. Overall, the article presents a balanced, realistic view of India as an increasingly attractive yet still developing, sourcing base for U.S. fashion companies.

This article shows that India is becoming a strong sourcing option for U.S fashion brands, not only because it is the cheapest, but because it offers high quality cotton fabrics, better flexibility with smaller orders, and more vertically integrated production. Other students pointed out that these strengths make India attractive for brands who focus on more valuable, or well crafted products rather than ultra fast fashion. While India may not be ideal yet for the lowest cost, high volume production, it is an important alternative option for brands looking for reliable quality, ethical sourcing, and value added beyond just a low price.

This blog makes it evident that India is becoming an indispensable strategic alternative in the global supply chain. One of the biggest takeaways is India’s use of vertical integration. India allows for over 90% of raw textile materials to be sourced domestically. This gives them a massive advantage over other Asian suppliers who rely heavily on imported materials. Additionally, research confirms that U.S. brands see India as a location to source high-quality, value-added garments that are more cost-effective in comparison to places like China.

I find it interesting how India is positioned in the market since it focuses on higher quality sectors while still remaining competitive. It has a lot of good resources that makes it stand out, especially with its cotton abundance that sets it apart from other companies like China. Though it has a lot of good resources that could help it grow, it still remains an issue of if ethical practices are involved in production and how this would affect the manufacturing if they chose to expand.