The latest data from the U.S. International Trade Commission (USITC) indicates that Trump’s “Reciprocal Tariff” has led to higher import duties on U.S. apparel imports, although the impact on sourcing appears to be more nuanced than expected. Specifically:

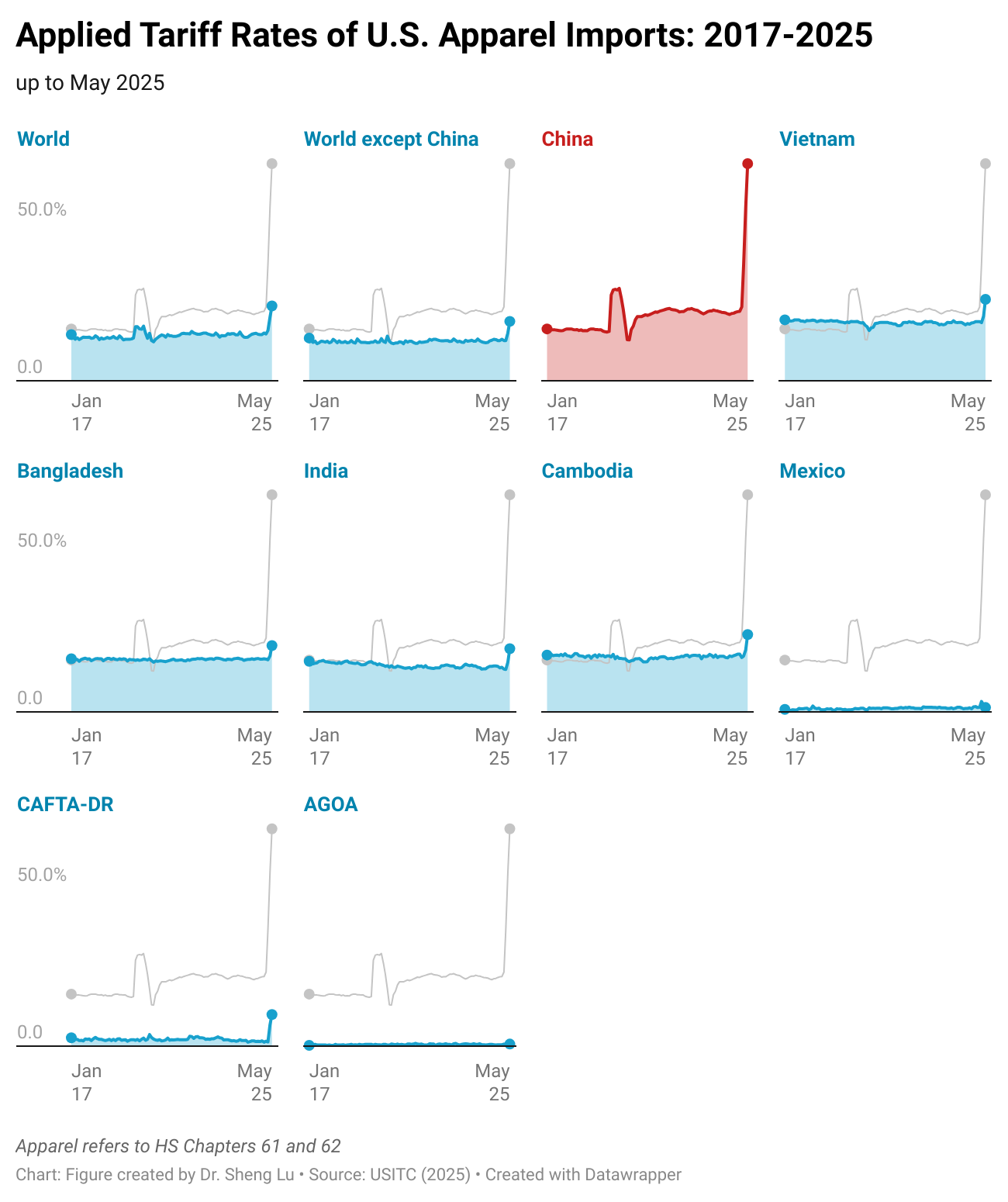

As a result of the reciprocal tariff, the average tariff rate for U.S. apparel imports (HS Chapters 61 and 62) reached 23.8% in May 2025, increased further from 20.8% in April 2025 and much higher than 13.9% in May 2024 and 14.7% in January 2025, prior to Trump’s second term. This tariff rate also hit its highest level in decades. Similarly, while the value of U.S. apparel imports in May 2025 decreased by 7% from May 2024, the import duties skyrocketed by nearly 60% over the same period. [View detailed data HERE]

Due to numerous punitive tariffs beginning in February 2025, the average tariff rate for U.S. apparel imports from China reached an unprecedented 69.1% in May 2025, a further increase from 55.0% in April 2025, 37.0% in March 2025 and 22.1% in January 2025. In theory, U.S. apparel imports from China in May should be subject to a tariff rate of over 145%, as mandated by a series of executive orders. However, as “goods loaded onto a vessel at the port of loading and in transit on the final mode of transit before 12:01 a.m. eastern daylight time on April 5, 2025,“ were excluded from Trump’s reciprocal tariffs, it explains why the actual tariff rate in April and May 2025 appeared lower than the theoretical one.

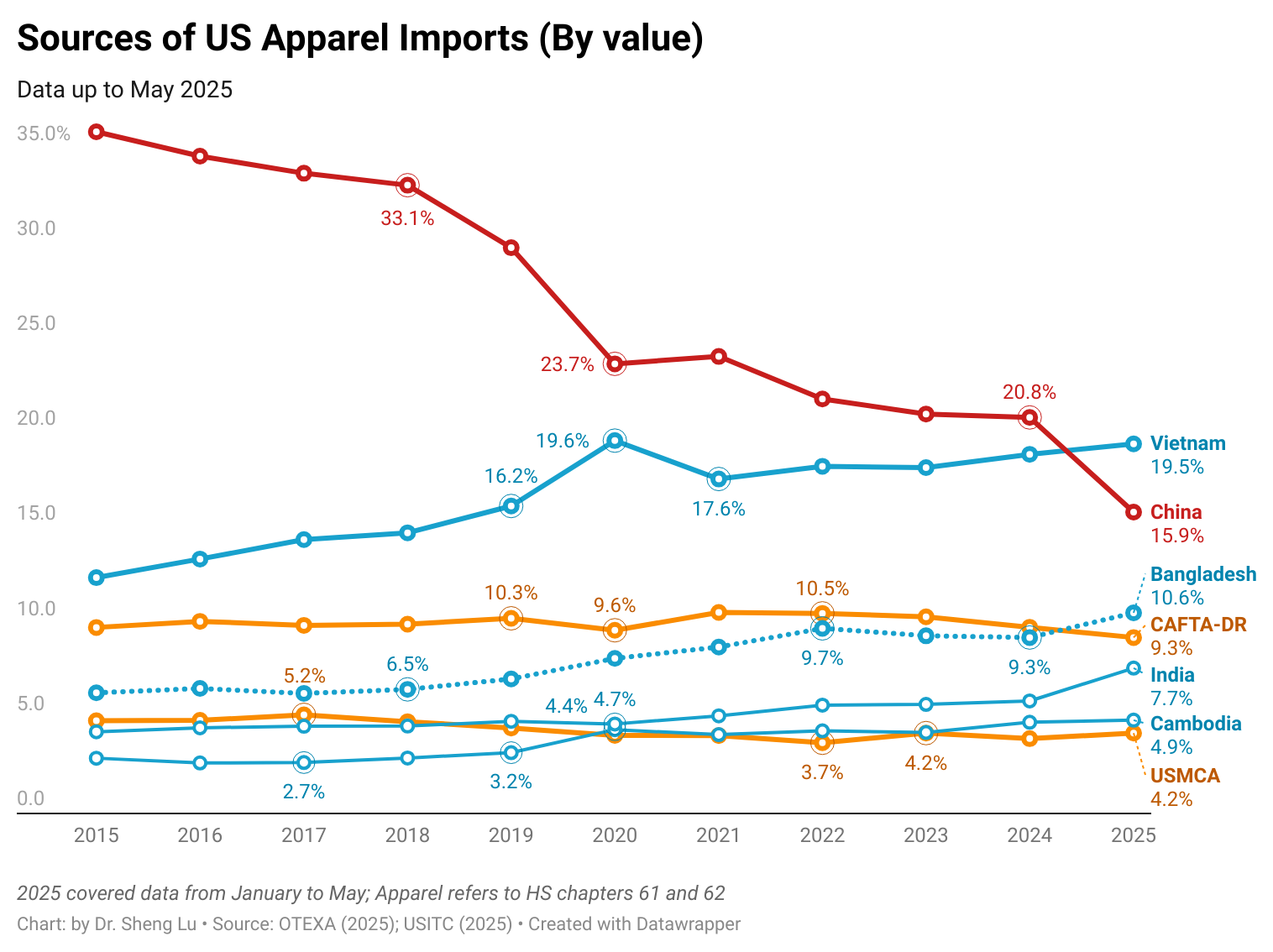

Nonetheless, affected by the high tariffs, the value of US apparel imports from China in May 2025 was cut by more than half from a year ago (down 52%). China’s market share in US apparel imports in May 2025 also dropped to 9.9%, a new low in decades (note: was 19.9% in May 2024). [View detailed data HERE]

Additionally, the average tariff rate for U.S. apparel imports from countries other than China reached 18.9% in May 2025, up from 15.2% in April 2025. Although this rate was higher than approximately 12-13% before Trump’s second term in early 2025, the increase was still much more modest than the theoretical 10% universal reciprocal tariff rate announced by the Trump administration. The average tariff rates for U.S. apparel imports from leading Asian suppliers such as Vietnam, Bangladesh, and Cambodia followed similar patterns (i.e., higher tariff rates but well below a 10% increase). Similar to China’s case, it appears that U.S. apparel imports from other countries in April 2025 included a significant proportion of products that were exempt from reciprocal tariffs because they were “loaded onto a vessel” early enough. [View detailed data HERE]

It is interesting to note that the reciprocal tariff resulted in the most significant increase in tariff rates on U.S. apparel imports from CAFTA-DR members. While imports from these countries were supposed to be duty-free under the trade agreement, the average tariff rate reached 10% in May 2025, up from 6.7% in April 2025. In other words, the short shipping distance unintentionally “disadvantaged” near-shoring imports from being exempted from the reciprocal tariffs, as they could be mostly loaded after the deadline.

Overall, it remains uncertain how the U.S. apparel tariff rates will continue to evolve in response to Trump’s shifting tariff policy. It appears that the trade volume and timing of shipment will be highly sensitive to short-term tariff rate changes, whereas adjusting sourcing bases and product structures will be a consideration for U.S. fashion companies in the medium to long term.

By Sheng Lu

Additional reading: Apparel Tariffs Climbed to Historic Highs in April (Sourcing Journal, June 13, 2025)

[This blog post is no longer open for discussion and comment]