As the fashion industry faces an unprecedented business and trade policy environment, hearing directly from Gen Z fashion majors—the next generation of both consumers and young professionals—has never been more critical.

In a new Just-Style mini series, students from FASH455 and the FASH department at the University of Delaware shared their valuable Gen Z perspectives on several hot-button apparel trade and sourcing issues as well as their vision for the future of the fashion apparel industry. Several findings are noteworthy:

First, like other consumer groups, Gen Z has felt the increasingly noticeable retail price hike driven by higher tariffs, and they are responding by reducing clothing purchases. Compared to a survey conducted in April, nearly all Gen Z consumers now see higher price tags across a broad range of products, including necessities, outerwear, and footwear in the U.S. retail market. Notably, Gen Z consumers feel most strongly about the price hikes at fast fashion retailers—including Shein. Due to the perceived low quality and use of inexpensive textile materials, it is even more challenging for fast fashion brands to justify price increases. Our students who frequently thrift clothing also noted a price increase in the secondhand clothing market. As a warning sign to fashion companies, many surveyed Gen Z students say they plan to spend less this holiday season, or keep shopping “to a minimum” because of price increases. For example,

- Gabriella Krug, Fashion Merchandising and Management senior: As a shopper, I’ve adjusted by buying fewer items overall, checking sales racks more often, and using platforms like Depop and Poshmark to sell and buy trendy pieces. For the holidays, I think these price increases will push me, and most shoppers like me, to focus more on quality rather than quantity. I’ll definitely be taking advantage of Black Friday and Cyber Monday deals this year. Ultimately, tariffs could cause people to make more intentional and selective purchases this holiday season.

- Cheyenne Weiss, Fashion Design & Product Innovation senior: While the higher tariffs have widespread effects on the fashion industry, I have personally noticed raised prices for outerwear and footwear. I noticed these two categories specifically as they are what I was shopping for going back to school and it is telling of how directly trade policy impacts consumers. The effects of the tariffs are hitting close to home, and I would feel most frustrated to see loungewear and athleisure categories rise in price. While these areas seem to already be feeling the effects of raised tariffs, it would be hard as a consumer to continue purchasing these items if tariffs keep rising, considering these are the fashion categories I buy from the most often. As a shopper, the higher prices discourage me from going out and purchasing new clothing.

- Skye Johnson, Fashion Merchandising and Management senior: I have noticed that prices are rising among all types of clothing. In particular, I have heard that Fast Fashion retailers like H&M or even Shein have increased their prices significantly. While I personally do not shop at fast fashion retailers like Shein, I’ve seen the impact through school research projects and conversations with friends. This is frustrating because these fast fashion items are made with very cheap materials like polyester and nylon.

- Julia Brady, Graduate Student studying Fashion and Apparel with a focus on Sustainability: I mainly shop using online resale sites, such as Depop, and just enjoy browsing higher-end online consignment stores, like Vestaire and theRealReal, for secondhand designer deals. I have seen fewer deals on the site and more high-priced secondhand designer items… Even on Depop, international listings are higher than normal. The category I would be most frustrated to see prices rise in would be footwear… I also expect to buy holiday gifts from local artisans and local stores, due to higher quality and (hopefully) decreased tariff impact.

- Nadia Grosso, Fashion Merchandising and Management senior: I’ve noticed myself becoming even more price-sensitive when shopping because of the rising prices, so I’m always looking to find the best deal to stretch my budget as much as I can. Overall, I think shoppers are trying to limit their spending as much as possible, and being more cognizant of prices when choosing what to purchase and who to purchase from. As a result, come holiday shopping time, I might be more inclined to shop at discount retailers or even decrease how much I purchase compared to previous years.

Second, Gen Z fashion majors view globalization and international trade as generally beneficial for the fashion industry. At the same time, they emphasize the need to enhance sustainability and social responsibility in the global apparel trade. For example, while most survey respondents supported leveraging apparel trade to promote economic development in developing countries, they also stressed that trade volume alone should not define success. Instead, many highlighted the importance of ensuring that garment workers in developing countries directly benefit from trade and Western fashion brands and retailers have a responsibility to help make this happen. For example,

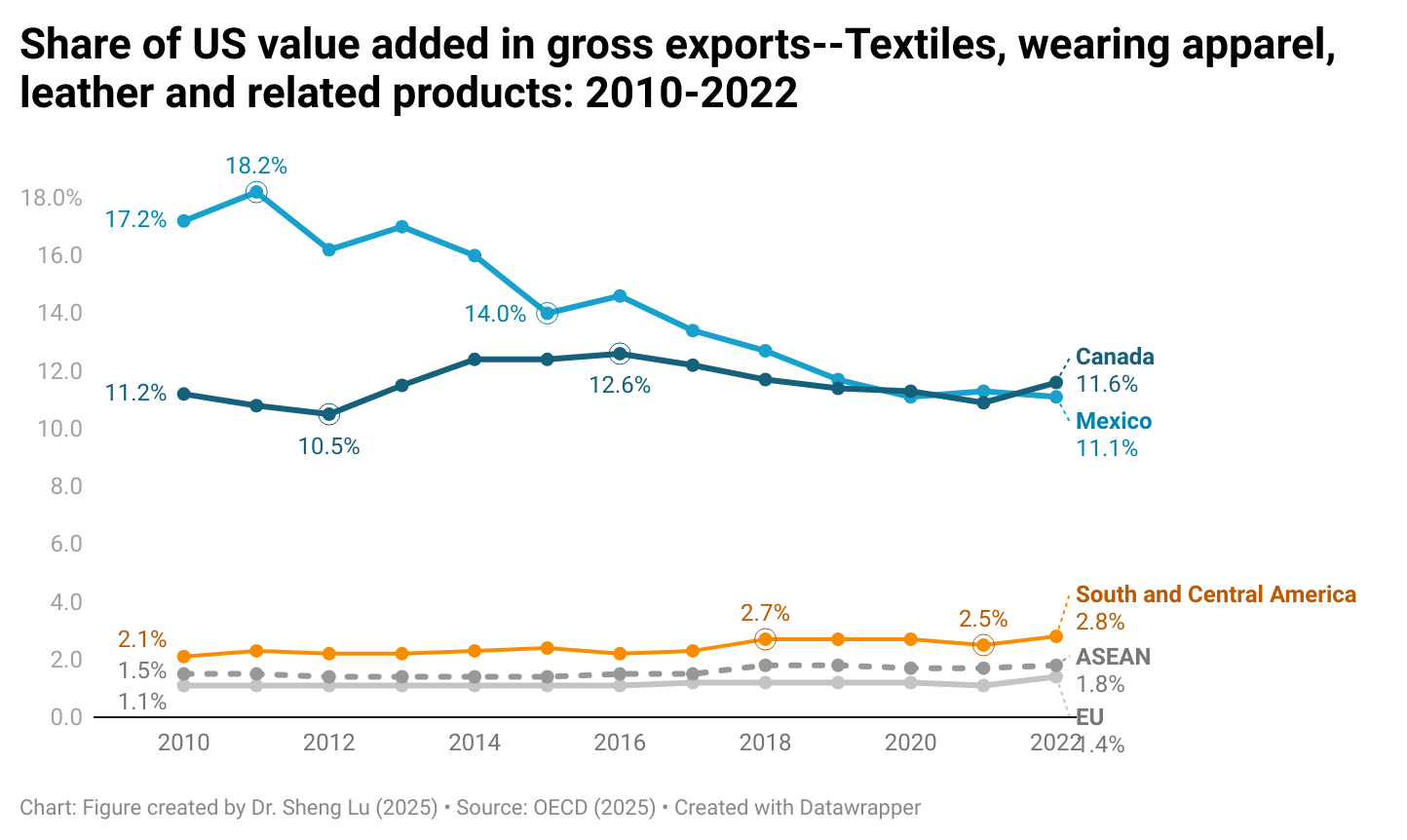

- Emilie Delaye, Master’s student in fashion and apparel studies: I believe that it is almost virtually impossible to move manufacturing fully back into the US. Nearshoring could really help sustainability (as fewer emissions would be released), but nearshoring would require investment and savvy trade deals to ensure that many different kinds of products can be produced there. I don’t really think it is that important that the US maintains a “strong” textile and apparel sector. As we know from the innovation or economic development timeline, the textile and apparel sector is an entry point for less developed economies. It could actually be perceived as a positive that we aren’t largely in this market. I think that there are other more critical sectors to focus on for the US. Plus, we simply do not have the skilled labor or machinery needed to do this. I support the leveraging of the clothing trade to support economic development in the countries that need it. I believe that if done sustainably and socially responsibly, the apparel sector could help millions of individuals in these countries.

- Abigail Loth, Fashion Merchandising and Management senior: As a consistent consumer in the US fashion industry, I believe that globalization and international trade is vital for our success. Not only does it keep trends fresh, globalization and international trade encourage styles to remain diverse and costs to be cheap… Maintaining a strong domestic textiles and apparel sector in the US is also extremely important. This is because it provides an abundance of jobs/opportunities, innovation and sustainability practices. So, in order to leverage the clothing trade and support workers in developing countries as ethical sourcing and fair labor practices help ensure that globalization benefits more than just corporations.

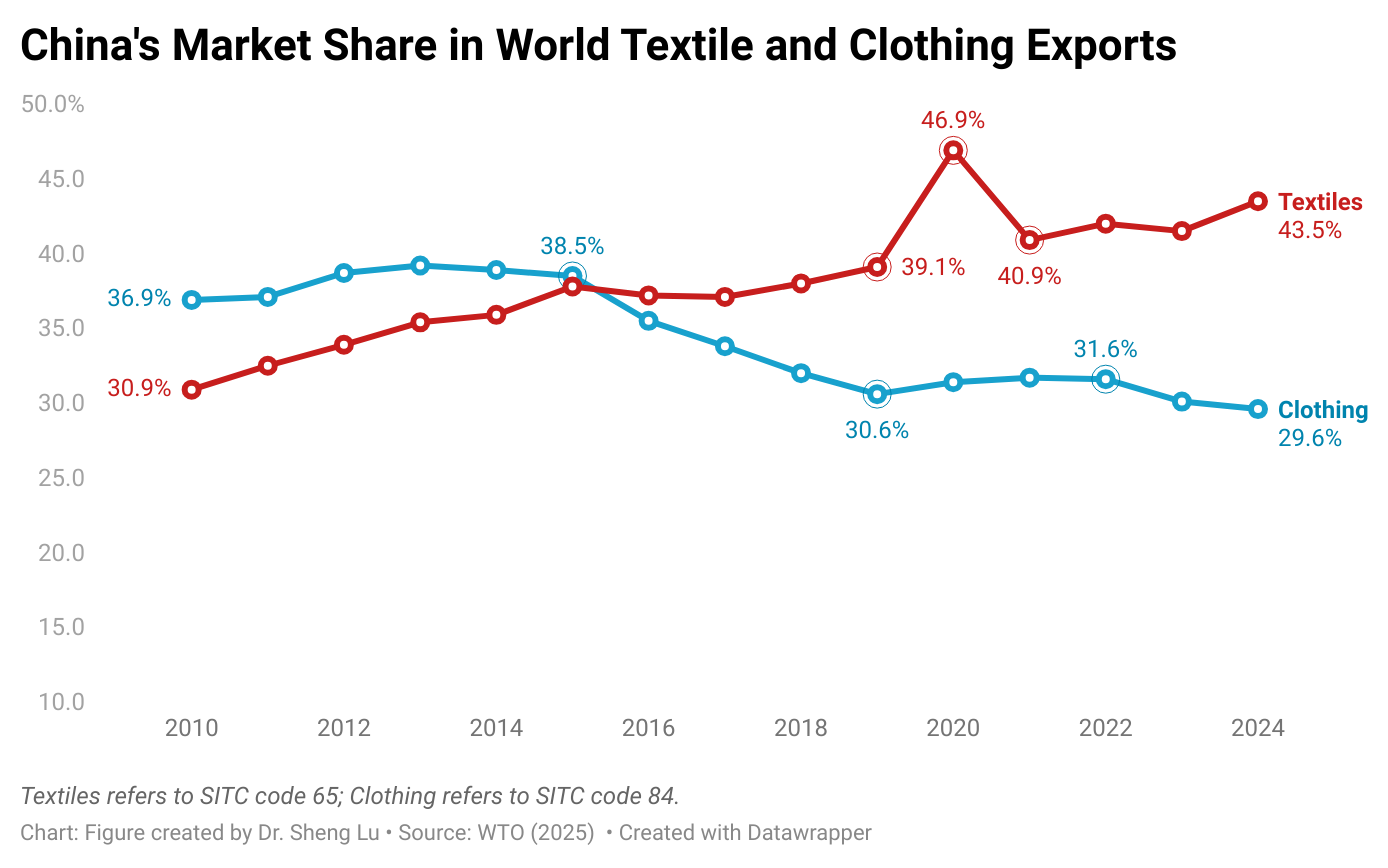

- Ekaterina Forakis, Fashion and apparel studies 4+1 graduate student: Globalization and international trade are crucial aspects of the U.S. fashion industry. It is these that keep the U.S. fashion industry running. Trade theory explains why globalization benefits countries like the U.S. and allows them to focus on textile manufacturing, one of the country’s strong suits. Higher tariffs and import restrictions are not necessary to maintain U.S. manufacturing because the U.S. is already a top textile exporting country and does not specialize in apparel production. The country’s capacity for automation is what makes it reliable in the textile sector. Automation allows for more standardized production of textiles which are necessary for developing countries to produce apparel.

- Emma Lombardi, Fashion Design and Product Innovation senior: I view globalization and international trade as a double edged sword for the U.S. fashion industry, because on the one hand, while it doesn’t benefit the creation of jobs in rural areas that many covet, it also shifts the emphasis towards more sophisticated industries in technology development and innovation both in mechanical and textile sectors.

- Julia Brady, Graduate Student studying Fashion and Apparel with a focus on Sustainability: I think tariffs and import restrictions are necessary, but not just to protect U.S. domestic manufacturing. Tariffs could help regulate the amount of toxic chemicals along the textile manufacturing value chain. An alternative route for the U.S. to take would be to scale up flax for fibers to be used in domestic textile manufacturing. Perhaps tariffs will force companies and the federal government to invest in agricultural advances in this field…I would never want to advocate taking away work in developing countries; however, for the sake of our environment, we may need to shift the way the fashion supply chain currently operates. It is important to me that the U.S. maintains a strong textiles and apparel sector because we are a big part of the problem. We must take control over the way we consume and dispose of textiles. There could be so many opportunities for economic growth if we shift toward domestic manufacturing, prioritizing the use of materials we already have.

Third, associated with the debate on the future of textiles and apparel “Made in the USA,” most Gen Z fashion majors show little interest in factory jobs. On the one hand, unlike most developing countries, today’s U.S. fashion industry provides Gen Z fashion majors with many exciting and promising non-manufacturing job opportunities, ranging from apparel design, product development, sourcing, trade compliance, and merchandising to marketing. By contrast, factory jobs are often perceived as “low paid,” “repetitive,” and “poor working conditions.” Our Gen Z fashion majors particularly emphasized that their preferred employers should provide both financial and career progress opportunities, and they want to see keywords such as “innovation,” “sustainability,” “room to grow,” and “inclusiveness” associated with their future jobs. In other words, to attract more Gen Z workers to factory jobs, companies need to do more than just offer competitive pay. For example,

- Gabriella Krug, Fashion Merchandising and Management senior: At this point in my career, I have not pursued an interest in textile or apparel manufacturing or factory-related jobs. My internships have exposed me to different sides of the industry…That said, I think my generation could see these roles as more appealing if companies focused on innovation, sustainability, and clear opportunities for growth. For example, if factories showcased their role in a circular fashion and created a more modern, flexible work environment, I think more Gen Z talent would be drawn in since we’re motivated by making a positive impact. Personally, I’m most interested in jobs that mix creativity with business—like sales, buying, or trend forecasting. When it comes to an employer, I value opportunities to learn and grow, strong mentorship, and a culture built on collaboration and inclusivity.

- Cheyenne Weiss, Fashion Design & Product Innovation senior: I am not personally interested in pursuing a career in textile or apparel manufacturing as I see myself in a more creativity-based position. I feel as though my skills in fashion would be better suited for a role where I’m working directly with design and developing the fit and aesthetics of garments. Factory-related jobs in fashion could become more appealing to my generation if more rising fashion professionals knew about the opportunities that are available… When considering the qualities of an employer that I would want to work for, an important factor for me is a growth mindset. I value being able to learn and adapt as the industry evolves and I would want my employer to share my same persistence to always be learning and bettering the quality of work I can produce.

- Skye Johnson, Fashion Merchandising and Management senior: I am not interested in pursuing careers in textile and apparel manufacturing or factory related jobs. However, I completely respect the importance of these roles in our fashion industry. I feel that my skills or career goals do not align with these jobs, but there could definitely be ways to make it more appealing to Gen Z. For example, offering safer working conditions, competitive pay, clear paths for professional growth, etc… When considering an employer, I value a workplace that aligns with my values, offers an inclusive environment, open communication, creative freedom, and room to grow in the company. I want to feel like I belong and am making an actual impact where I work.

- Abigail Loth, Fashion Merchandising and Management senior: I personally do not have any interest in pursuing a career in textile or apparel manufacturing and factory-related jobs. These jobs consist of heavy hands on labor, limited creativity and repetitive daily tasks. The job is very cookie-cutter and has limitations for growth and opportunity. In order to make these types of factory jobs more appealing to our generation, the employers should provide safer working conditions, more money, and a sense of change/development in the everyday job. If factory jobs allowed more flexibility for creative thinking and alterations, they would appeal more to Gen Z.

- Julia Brady, Graduate Student studying Fashion and Apparel with a focus on Sustainability: I am interested in pursuing a career related to textile and apparel manufacturing. Specifically, I would love to work towards a more socially responsible fashion industry. I could see myself working for a textile recycling plant in the U.S.; I expect more to be popping up over the next decade. If the factories were focused on green engineering and diverting textile waste, this might be another attractive core value of a potential future employer. I would be more inclined to work a factory job if the conditions in the factory were regulated and protective of the workers’ health. Additionally, if the employer was prioritizing the use of natural materials combined with textile recycling outputs, this would be very appealing to me as a prospective employee.

Fourth, Gen Z fashion majors show a high awareness of AI and are open to increasing its use in the fashion industry. Specifically, our Gen Z students believe that AI can be a powerful tool widely adopted by fashion companies, such as supporting apparel sourcing decisions, generating designs, and conducting data analysis and forecasting. Many also envision bold, creative applications of AI, such as optimizing secondhand clothing use or dynamically altering garments’ colors and textures based on weather conditions or consumers’ moods. These findings underscore the growing importance of deliberately integrating AI into fashion education and strengthening collaborations between industry and academia. For example,

- Emilie Delaye, Master’s student in fashion and apparel studies: I think that AI could help understand and simplify the complex supply chains we have. Perhaps by incorporating AI into sourcing decisions, it could help determine the most efficient and eco-friendly path for the garment.

- Gabriella Krug, Fashion Merchandising and Management senior: If there were no limits in terms of technology or resources, I would love to see AI used to create a truly circular fashion system. Garments would be designed with little to no waste from the very beginning with AI predicting the most sustainable production methods. Also, I think AI should account for each garment’s end-of-life by tracking how items can be reused, recycled, or repurposed.

- Skye Johnson, Fashion Merchandising and Management senior: I still feel that AI will not be able to completely take over in the fashion industry, we still need that human touch. That human aspect is what makes the industry go round, especially when it comes to designers…If I could pick a bold AI-driven innovation to see in the fashion industry, I would love to see garments that change color or texture based on your mood or the weather. The AI technology could read your personal style and predict what looks best on you. That would definitely take years to make, but it would further blur the lines between fashion, technology and art.

- Abigail Loth, Fashion Merchandising and Management senior: I would love to see AI-driven innovation that would be able to make custom designs depending on preferred colors, style, size, or shape and deliver it based on preferences of style and sustainability.

- Nadia Grosso, Fashion Merchandising and Management senior: AI can be a helpful tool to analyze data and make recommendations on how to apply its findings to real-world situations. Especially with the uncertainty surrounding changing prices and geopolitics, AI could be implemented to help fashion companies navigate difficult sourcing decisions and manage their complex supply chains. I would also love to see AI be implemented more to drive sustainability initiatives such as reducing waste within production or even assisting with the discovery and development of more sustainable materials. However, I don’t think AI can fully replace human intelligence and creativity, so it’s important for it to be used as a tool and not as a replacement.

Additionally, the results show that Gen Z fashion majors overwhelmingly support the increased use of recycled textile materials in clothing and view it as an important opportunity to address the textile waste problem. However, as consumers, they still expect such products to remain financially affordable, match the quality of non-sustainable options, and look stylish. Additionally, with greater knowledge and awareness of sustainability, Gen Z consumers expect fashion companies to provide more transparency regarding their recycling practices and price structures (i.e., what they are actually paying for). This requires fashion companies to continue to improve their supply chain mapping and traceability in the era of textile recycling. For example,

- Emilie Delaye, Master’s student in fashion and apparel studies: The (recycled) garments currently on the market are very expensive and do not appeal to my personal style…And it is very important for fashion companies to provide clear sustainability information. I think providing information on the cost breakdown would be valuable to see and ensure that the money is distributed more evenly.

- Gabriella Krug, Fashion Merchandising and Management senior: Yes, I do care about clothing made from recycled textile materials because it feels like a step in the right direction and it makes me feel like I am making a more thoughtful choice as a consumer…What makes these products most appealing to me is the mix of style and transparency. Especially with Gen Z, the culture is shifting more and more toward eco-conscious consumers, now with the help of Depop, ThredUp, and Poshmark. These platforms give people an easy way to step into the world of sustainable fashion. For me, I want to know that the clothing looks and feels just as high-quality as non-sustainable options, but I also don’t want to feel like I’m overpaying just because it’s labeled as eco-friendly…I want brands to be upfront about what percentage of a garment is actually recycled and how it was made

- Skye Johnson, Fashion Merchandising and Management senior: For me, the appeal of recycled or sustainable fashion products comes from a combination of style, price, and brand transparency. I believe it is very important that fashion companies provide clear sustainability information and have the efforts and data to back it up… Obviously, no brand is perfect, but when I see a brand putting in the work to do better, I respect them a ton more.

- Nadia Grosso, Fashion Merchandising and Management senior: Fashion brands need to do more to educate their consumers and highlight the importance of sustainability, while also incorporating it as a value into all of their business practices. I think that we can make sustainable and recycled products more appealing to consumers by being transparent and educating them on their importance. Fashion brands are becoming increasingly aware that providing clear sustainability and sourcing information to their consumers is necessary to gain their trust and loyalty, especially as a growing number of consumers are considering these practices as influencing factors to make purchases.

FASH students who contributed to the series include:

- Gabriella Krug, Fashion Merchandising and Management senior

- Emilie Delaye, Master’s student in fashion and apparel studies

- Cheyenne Weiss, Fashion Design & Product Innovation senior & 4+1 graduate student

- Skye Johnson, Fashion Merchandising and Management senior

- Julia Brady, Master’s student in fashion and apparel studies

- Abigail Loth, Fashion Merchandising and Management senior

- Nadia Grosso, Fashion Merchandising and Management senior

- Ekaterina Forakis, Fashion and apparel studies & 4+1 graduate student

- Emma Lombardi, Fashion Design and Product Innovation senior

Explore more:

- Gen Z part 1: How fashion tariffs are hitting prices, holiday season prep

- Gen Z part 2: Impact of globalisation, trade on US fashion sector

- Gen Z part 3: Most attractive US fashion and textile jobs

- Gen Z part 4: Why fashion brands should embrace AI’s benefits

- Gen Z part 5: Recycled materials in fashion must be affordable