This study aims to examine the impacts of the Trump administration’s escalating tariffs on U.S. fashion companies’ apparel sourcing practices. Based on data availability, transcripts of the latest earnings calls from about 30 leading publicly traded U.S. fashion companies were collected. These earnings calls, held between August and October 2025, covered company performance in the second quarter of 2025 or later. A thematic analysis of the transcripts was conducted using MAXQDA.

Key findings:

First, U.S. fashion companies reported a more significant impact of the increasing tariffs on their financial performance as the tariff increase expands from China to other countries. Many companies regarded tariffs as one of their top-most pressing external challenges to profitability in 2025, especially in the second half and beyond. For example:

- G-III Apparel: “We expect the total incremental cost of tariffs to be approximately $155 million, up from the $135 million original estimate, and this is based on the latest tariff increases implemented for Vietnam, India and Indonesia, among others.”

- American Eagle: “On tariffs, yes, we are providing the guidance here for the third and fourth quarter. About $20 million of impact from Q3. $40 million to $50 million in Q4. So that will pressure gross margin a bit.”

- Hanesbrands: “When you think about tariffs and the impact on our business, first of all, we won’t be really experiencing that cost until Q4 because of the inventory that we have and the way cost flows off of our balance sheet.”

- Victoria’s Secret: “Our projected net tariff impact of $100 million in 2025 is up $50 million versus our assumption embedded in our previous guidance. With approximately $10 million of net tariff impact already recognized in the first half of the year, our guidance assumes approximately $20 million of net tariff pressure in the third quarter with $70 million impact in Q4.”

- Tapestry: “We are facing greater than previously expected profit headwinds from tariffs and duties, with the earlier-than-expected ending of de minimis exemptions being a meaningful factor. In aggregate, the total expected impact on profitability this year from tariffs is $160 million, representing approximately 230 basis points of margin headwind.”

- Carter’s: “We’ve assessed the higher incremental tariffs, which have already been implemented, an additional 10% duty for all countries and higher incremental duties for products from China, Vietnam and Indonesia. Relative to a few months ago, we’re preparing for a world with higher and more permanent tariffs above the over $100 million in duties, which we have paid historically. Our estimate of the additional baseline tariffs is that it would represent a gross additional tariff amount between $125 million and $150 million on an annualized basis.”

Second, despite the higher tariff burdens, most U.S. fashion companies still try to avoid across-the-board price hikes due to concerns about losing consumers. Instead, most companies opt for selective price increases, value-based pricing, and closely monitor consumers’ price sensitivity. However, price increases could be more noticeable down the road. For example:

- Oxford industries: “We’ve not done sort of an across-the-board approach to pricing. We’ve really looked at it on an item-by-item basis and balanced the need to protect our margins and try to recover some of the tariff impact with not wanting to get too far ahead of ourselves because that tariff number…as we get into spring ’26… And on average, that’s led to sort of low to mid-single digit or low mid-single-digit price increases…we’re just being very cautious about increasing the price too much before we really know where things are settled out.”

- URBN: “our pricing strategy…is really to look at some gentle price increases where we feel like there’s the value that contributes to that. So making sure that we’re protecting some of the opening price points that the customer counts on and some programs that we know drive a lot of volume…Recognizing the value equation is really important to all of our consumers.”

- TJX: “I think you’re gonna see a more of a little bit of a gradual increase in pricing as the tariffs come in…I don’t think you’ll see step all of a sudden Right. With the tariffs set,because I don’t wanna, I think, turn off customers immediately by seeing a dramatic price shift. So I think they might they might they might absorb it initially for a little bit, and eventually, they’ll get there.”

- Columbia Sports: “We expect higher prices for many consumer goods will negatively impact consumer demand…In fall ’25, we’re working with our retail partner to deliver value to consumers and keep inventory and dealer margins healthy. As a result, we’re not making any significant price changes to our fall ’25 product line and expect to absorb much of the incremental tariff costs this year…Our goal is to offset higher tariffs over time through a combination of actions, including price increases, vendor negotiations, SG&A expense efficiencies and other mitigation tactics.”

- Ralph Lauren: “The big unknown sitting here today is the price sensitivity and how the consumer reacts to the broader pricing environment and how sensitive that consumer is. And that’s what we’re watching very closely as we head into the second half.”

- Ross stores: “Some of the India tariffs, especially if the 25 goes to 50…I think that you’ll see this go into next year, and I think we would expect to see price increases. And — but over time…we think it will reach equilibrium, and it will be business as usual.”

- Burlington stores: “we are seeing that competitors are taking up retail prices. So far, though, I would say that those price increases have been quite selective and quite restrained…Part of it may just be the time lag between imports arriving in the country and those goods showing up in stores. But also my sense is that wholesalers and retailers have been reluctant to make decisions on raising prices until they know what the final tariff rates are going to be. Now it does feel like there is more clarity on this now than there was a couple of months ago. So it wouldn’t be surprising if retail prices were to go up across the industry in the back half of the year. Now of course, we know that our customer is very, very price sensitive.”

- VF Corporation: “we have actions in place to mitigate the tariff impact through sourcing savings and pricing actions that will take effect later this year.”

Third, while U.S. fashion companies overall continue to reduce their apparel sourcing from China amid the current tariff and geopolitical tensions, some companies still regard China as a viable sourcing base given its many unique advantages, such as speed to market, production efficiency, and well-developed supply chain infrastructure. For example:

- Carter’s Inc: “We’ve meaningfully reduced our exposure to China manufacturing over the last number of years. And now, as summarized here, our largest countries of origin are Vietnam, Cambodia, Bangladesh, and India.”

- Abercrombie & Fitch: “Our approach and underlying principles for tariff mitigation remain unchanged, supported by a deep playbook and experience. We continue to expect China sourcing share in the U.S. will be in the low single digits for the year.”

- Steve Madden: “Since the last call…We have moved certain production for fall back to China, where we felt it would be difficult to ensure on-time delivery, appropriate product quality and/or reasonable pricing in an alternative country. For fall 2025, we currently expect to source approximately 30% of our U.S. imports from China, down from 71% for the full year 2024..

- Oxford industries: “With the recent tariff increases announced during the second quarter, including increased tariffs in countries like Vietnam and India that were included as part of our shift away from China, largely offset by the mitigation efforts we have undertaken, including accelerated inventory receipts and quickly shifting our sourcing network.”

- American Eagle: “If you start with all the country of origin remixing…China where we know we were at a higher penetration coming into the year is mid-single digit now in a full year.”

Fourth, establishing a geographically diverse sourcing base continues to be a crucial strategy employed by U.S. fashion companies to mitigate tariff impacts and policy uncertainty. U.S. fashion companies are also intentionally adding speed, flexibility, and agility to their sourcing base and supply chain. However, given the complex sourcing factors fashion companies have to consider, plus the broad scope of “reciprocal tariffs, there is no clear winner. For example:

- Kohl’s: “We have a diversified sourcing strategy from a country standpoint. We’re not heavily reliant on any one particular country, and we have the flexibility and agility to actually move production to other countries if necessary.”

- PVH: “We work closely with an established network of global sourcing partners across more than 30 countries, and we continue to leverage our deep long-standingrelationships to further optimize our sourcing and production costs.”

- American Eagle: “If you start with all the country of origin remixing…India is small for us. Rebalancing some things out of Vietnam.”

- Steve Madden: “we were focused on moving a lot of product to Brazil. We’re going to have to wait and see what happens. I think that really goes not just for Brazil, but for a lot of the countries that we work with. So we’ve tried to create a more diversified sourcing footprint. And — but there’s obviously a lot of uncertainty still about where the ultimate tariff rates will land by country. And so we’re going to have to wait and see what happens and then react accordingly. That’s all we can do.”

- Hanesbrands: “when you think about tariffs and the impact on our business…not only do you have the Q4 impact, but you have to think about those other offsets about meaningful U.S. content that we have in our products that are exempt from reciprocal, the good East-West balance that we have in our supply chain…”

- Land’s End: “With regard to sourcing…we have been intentionally repositioning our sourcing network to better serve the business we are building leading to a more balanced supply chain that enables us to bring new solutions to customers with more speed and frequency throughout the year. For example, our licens epartners are becoming part of our sourcing network…By tapping into the full breadth of our sourcing matrix, we are able to swiftly and strategically reposition fabric and manufacturing as tariff conditions evolve.”

Fifth, as part of their tariff cost mitigation strategy, many U.S. fashion companies have been strategically but cautiously building preemptive stock, adopting a data-driven approach to optimize inventory, and simplifying product assortment. For example:

- Levi’s: “And for Q4, we declared a dividend of 14¢ per share, which is up8% to prior year. We ended the quarter with reported inventory dollars up 12%, driven by purposeful investment ahead of the holiday and higher product cost than a year ago due to tariffs. In unit terms, inventory was up 8% versus last year. As of today (October 9, 2025), we have 70% of the product in the US needed for holiday.”

- Ralph Lauren: “So we feel good about our inventory levels as we head into the fall season. So we ended Q1 (2025), as you know, with inventories up 18% versus Q1 of last year (2024)…if you think about sort of our Q2 revenue guide of up high single digits, relates to the strategic acceleration of largely core inventory receipts into the U.S. in Q1 during the tariff pause period…So if you back out that tariff-related strategic pull up, our inventory growth is actually a little behind our double-digit top line growth for Q1 and right in line with our expected high single-digit top line growth for next quarter, Q2. And…for the year to go, we expect inventories to moderate as we move throughout the fiscal year, and we plan on ending fiscal ’26 with levels generally in line with demand.”

- PVH: “Inventory at quarter end (Q2, 2025) was up13% compared to Q2 last year (2024), including a 1% increase due to tariffs, and reflects a planned improvement compared to up 19% in Q1.”

- Hanesbrands: “we’re leveraging advanced analytics with the use of AI to drive operational improvement around the globe, including inventory and assortment management as well as demand planning and forecasting.”

- Tapestry: “We’re bringing more innovation to the assortment while we streamline our offering, reducing handbag styles by over 30% by fall, allowing us to stand behind our big ideas with clarity and intention.”

by Sheng Lu

This post provided an insightful look at how U.S. fashion companies are adapting to ongoing tariff challenges. I found it especially interesting how brands like Steve Madden are moving some production back to China to maintain quality and on-time delivery, despite earlier efforts to diversify sourcing. It really emphasizes how complex and dynamic global sourcing decisions are for fashion brands right now.

I also thought the section on selective pricing strategies was very realistic. Instead of broad price hikes, companies focusing on value-based pricing and monitoring consumer reactions seem to be finding a better balance between profitability and loyalty. Overall, this analysis does a great job showing how brands are trying to stay flexible while managing costs, consumer expectations, and uncertainty in the global trade environment.

After reading the above data collection and company responses, it is evident that companies are fighting to keep retail pricing down, however, that battle is becoming a challenge, due to shrinking gross margins. For example, American Eagle reports: “About $20 million of impact from Q3. $40 million to $50 million in Q4.” This is also consistent with Victoria Secret, where they reported: “$20 million of net tariff pressure in the third quarter with $70 million impact in Q4.”

With the coming holiday season, it is more important now than ever that these brands maintain a consistent price level, as consumers will shy away from a raised price point in general. However, I also believe that a certain consumer will be willing to pay a higher price point during the holiday season, for the sake of gift giving. Largely, I have come to realize that this event presents a challenge for brands across the board, regardless of size or status.

One key concept from our class that relates to this blog post is sourcing diversification and using alternative strategies. In class, we discussed how fashion companies reduce their exposure to tariffs and political uncertainty by spreading production across multiple countries instead of relying heavily on one sourcing base. This approach helps firms stay flexible when trade policies change.

In this blog post, many companies clearly demonstrate this strategy. For example, Carter’s and Abercrombie & Fitch have significantly reduced their sourcing from China, while companies like Kohl’s and PVH emphasize having diversified supplier networks across many countries. However, the post also shows that diversification is becoming more complicated as tariffs expand beyond China to places like Vietnam and India. This explains why companies are still experiencing major profit pressure even after shifting production.

From a managerial perspective, diversification alone may not be enough. Brands will likely need to focus more on agility, data-driven inventory planning, and long-term supply chain restructuring to remain competitive in this uncertain trade environment.

This study gives a really interesting look at how U.S. fashion companies are dealing with the new round of tariffs, and it’s clear the impact is bigger and more complicated than I expected. What stood out most to me is how quickly costs are rising, especially as tariffs expand beyond China into places like Vietnam and India. Even though companies are facing huge financial pressure, many are still hesitant to raise prices too much because they know consumers are extremely price sensitive right now. I think this shows how tricky it is for retailers to protect margins without risking demand.

Another point I found important is the sourcing shift. While companies are reducing their exposure to China, they still rely on its speed and strong supply-chain advantages. Overall, the study shows an industry trying to stay flexible, but the uncertainty makes long-term planning really difficult.

The increasing tariffs are leading to sourcing uncertainty for many large brands, according to the study. With pressure mounting for companies to strike a balance between profits and consumer retention, no one wants to make any drastic decisions before policies and tariff rates are set in stone. The data emphasizes the complexity of global apparel and textile sourcing due to geopolitical tensions. In this uncertain time, the data reflects companies opting for more agile decision-making and diversification options. The companies studied want to mitigate risk through diversification and ensure minimal cost increases, for the time being, without completely moving production and sourcing out of China. It will be interesting to see how the effects of higher tariffs will be seen in the financial reports for the next 1-2 years and how supply chain agility will continue to develop on a larger scale.

I thought this study really showed how chaotic the tariff situation has become for fashion companies. What stood out to me most was how every brand, no matter their price point, is feeling the squeeze, but they’re still terrified to raise prices too fast because consumers are already so price-sensitive. The quotes honestly made it feel like everyone’s just trying to buy time. Absorbing costs, slowly nudging up prices, or shifting production around even though moving out of China clearly isn’t as simple as people pretend it is. I also thought it was interesting how some companies have actually moved production back to China because of speed and quality, which totally goes against the political narrative that decoupling is happening cleanly. The inventory strategies were interesting like building stock early, leaning on AI, and stripping down assortments just to protect margins.

This blog post provided great insight into how US fashion companies are responding and adapting to escalating tariffs. One particular point that really interested me was how US fashion companies are approaching pricing strategy. For example, URBN has focused on meeting the consumers’ price sensitivity by protecting the opening price points. Although they are focused on meeting the needs of their customers, there have been gentle price increases. This stood out to me because it showed how consumer preferences can play a role in how US fashion companies approach pricing strategy despite their being price hikes. The responses highlighted how these companies want to maintain loyalty to customers, which influences their decisions. Another aspect that I found interesting was how US fashion companies still see China as a viable sourcing base despite tariffs. For example, Steve Madden continues to source 30% of its US imports from China to maintain on-time delivery and quality. This shows that although tariffs play a big role in US fashion companies moving out of China, they still see value in sourcing a major portion of imports from this country.

This post helped me see how much the tariff increase is affecting US fashion companies and their finances. One thing that stood out to me was how sourcing strategies are changing but companies are still trying to avoid major price increases because they don’t want to lose customers. For example, URBN stated that they are gently increasing prices. This strategy can connect with what we learned in class about tariffs and price sensitivity. Companies like URBN are being very cautious because consumer perception is very important, especially during times of tariffs and policy uncertainty within the government. In addition, I also noticed how many companies used strategies like inventory timing and data-driven inventory management to respond to the pressure of tariffs. These strategies show how companies must be able to adapt quickly and face the issue head on when challenges arise. I’m curious to see if these strategies will be able to protect profit margins within companies or if some companies might have to increase prices even more aggressively. Although this can have a negative affect on consumers, sometimes it’s the only way for companies to maintain business.

This article was really insightful for me because it shows how the Trump administration’s rising tariffs have been affecting U.S. fashion brands in 2025. The study found that brands are dealing with much higher costs as tariffs expand beyond China to countries like Vietnam, India, and Indonesia. Many companies reported millions in dollars of extra tariff expenses and said tariffs are one of their biggest challenges this year. Most brands are hesitant to raise all their prices at once because they’re afraid of losing customers, so they’ve been doing small, increases while watching consumer price sensitivity. The study also found that some US companies still rely on China because of its speed, efficiency, and strong supply chain. These tarrifs have made US companies have to rethink their pricing, sourcing, and inventory planning in order to continue thriving as a fashion brand in the US.

What stands out to me is how these tariff shifts are forcing brands to re-examine the balance between cost, speed, and sustainability. With higher import costs, I imagine companies might cut corners, raise prices, or even compromise on ethical sourcing standards and all of which could affect consumer perception and brand loyalty. This article underscores the critical tension between profitability and responsibility in the fashion industry. It’s interesting to me how it seems like a challenge, but also an opportunity for companies to innovate and adapt responsibly.

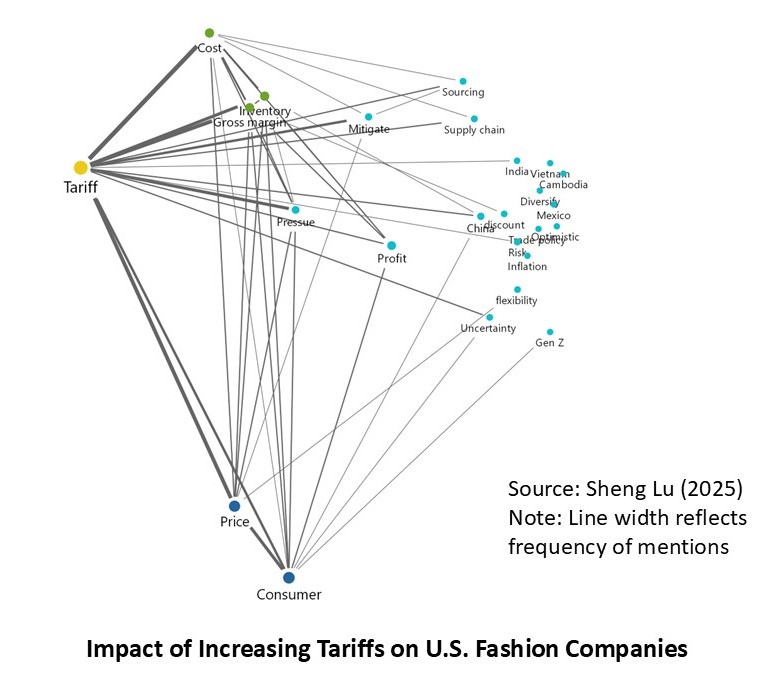

The graphic included in the article really shows a ripple effect from tariffs and their impact across the entire apparel industry. Some concerning impact include higher prices, supply chain disruptions and consumer pressure. So many issues link back to cost and tariffs. This shows to me that trade is not only a concern for business aspects, but every single dimension of sourcing and retail. There is so much uncertainty and risk that fashion companies must manage with trade policies and it may eventually lead companies to rethink their strategy.

Something from this article that caught my attention, especially nowadays with everyone’s growing concern for sustainability and transparency, is as brands try to cut costs or find new suppliers, they end up putting more pressure on their suppliers in turn. This could lead to lower labor standards, poor quality materials, or even unsafe working conditions. So i’m wondering if theres the opportunity for brands to invest more in producing things locally or in-house, instead of always looking for the cheapest option overseas. That way they can build long-term resilience, ethical supply chains, and be more responsible for what they do. The analysis shows that tariffs are more than just a headline or hot topic, they are a major shock to sourcing, supply chain strategies, and profitability.

It is no surprise that companies regard tariffs as one of their “top-most pressing external challenges to profitability in 2025” – the interesting component of this issue of the tariffs, is how companies are going to move forward with balancing their profitability and sustainability/ethical standards. It was interesting to see how each country responded to where they may keep or turn their sourcing to in the future – I believe Kohl’s had a great response to this topic, stating that they have a diversified sourcing strategy and that they are not heavily reliant on a particular country. While transparency is extremely important, I think at this point for a company to disclose for certain what countries they will continue to “do business with” may not be the smartest move, as there are still ongoing changes to come with tariffs.

This article provided insight into how US fashion companies are navigating the Trump administration’s escalating tariffs. Something that stood out to me was how companies are trying to avoid across the board price hikes, and instead opting for selective price increases and value based pricing to monitor consumers price sensitivity.

I thought it was interesting that some companies are continuing to source in China regardless of the geopolitical tensions and tariffs. Steve Madden stated that they couldn’t ensure on-time delivery or product quality if they moved sourcing to an alternate country. I am curious to see if continuing to source in China due to those reasons will hold up in the long run, and if they will eventually have to move their sourcing to another country.

The biggest thing I noticed was how fast costs are going up and how that puts companies in a really hard spot. They don’t want to raise prices too much because shoppers are already super price sensitive, but they also can’t handle all the extra costs. It shows that balance is stressful for retailers. Another thing that really stood out to me is how even when companies try to move sourcing, they still end up depending on China in some way. It feels like they want to branch out, but it’s not as simple as just picking a new country. The whole situation seems confusing for brands because nothing feels stable right now with tariffs constantly changing. It definitely showed me how messy sourcing gets behind the scenes.

After having just gone Black Friday shopping for this holiday season, I want to make a comment on fashion retailers pricing as a result of tariff impacts. Although noted in the study that most fashion companies reported trying to avoid price increases, I noticed that the Black Friday deals and discounts that were offered were of much less value or lower markdowns than what I’ve experienced in past years, which I think is reflective of how retailers are trying to maintain profits without raising prices, as the impact of tariffs are squeezing margins. Additionally, in some stores that I shopped in, I noticed stickers on tags displaying a new higher price compared to the one originally put on the tag, which I believe is due to the effect of tariffs on retailers. One retail worker even said to me, “I’ve seen prices go up each week”. I’m curious to see how tariffs will continue to impact retailers’ pricing strategies and the prices we see in stores in the coming months.

I think it makes sense that companies are reporting heavy financial strain from rising tariffs across multiple countries. This is because the tariffs are forcing them to raise prices while trying not to drive away consumers. Many brands have reduced sourcing from China but some still rely on it for aspects that make the country appealing like its speed, and efficiency. Most brands are diversifying production across multiple countries to stay flexible amid uncertainty. They’re also stockpiling inventory, simplifying product lines, and using data tools, including AI, to manage supply, demand, and costs more strategically. The information in this article leaves me wondering what the future will look like, and will China be able to keep its reputation after this blows over?

Tariffs are a singular concept with various effects all having different frequencies of impact. While consumers don’t fully understand tariffs complexity, the graphic in this article effectively displays its impact on the processes of sourcing and business within the fashion industry. From the line weights in the graphic its evident that price, consumer, pressure, gross margin, inventory, and cost are the most relevant components associated with tariffs. This data reveals that trade goes beyond the process of buying and selling, and expands into other areas for concern. While tariffs were implemented for one purpose, its impacts transcend into various aspects of the fashion industry, causes companies to adjust their strategies, whether that mean hault production operations in foreign companies, change locations where tariffs aren’t as intense, or consider domestic manufacturing. This article enhanced my understandings of tariffs and their complexity in relation to the textile and apparel industry.

I really enjoyed reading this post because it gave a detailed explanation of how the tariff has impacted U.S. fashion companies. What most stood out to me was how many brands all report that tariff increases are not just affecting China solely anymore. I also enjoyed reading about sourcing and how companies are making complete shifts out of China completely. It is interesting that despite this, many companies still reply on China for its speed and reliability. I also liked how they discussed how it is not so simple to just leave China when tariffs are hitting multiple countries at the same time. This goes to show how complicated sourcing decisions can be and it is not so black and white.

This study further explained the impacts of tariffs that Trump administration’s put-on products and how it affected fashion companies sourcing strategies. I think it’s interesting because it shows how companies have to be smart and strategic about where they source from. Tariffs force U.S. companies to be smarter and more flexible with their sourcing. It’s also interesting to read that even though tariffs are increasing costs, companies are trying not to raise prices too much, so they do not lose customers. Many brands are also reducing their dependence on China but keeping some productions because of China’s speed. I hate to hear that brands are preparing for higher tariffs and more permanent tariffs such as Carter’s. The article shows how companies are using diversified suppliers to handle the uncertainty of the future. In my opinion, this shows that U.S. companies are able to adapt quickly to global trade challenging while staying competitive.

This article proves that tariffs affects every brand, even big companies like Ralph Lauren and Steve Madden. Even though they are such big brands, they still struggle with the issues that tariffs bring. This is worrying because essentially no brand is safe from the repercussions of tariffs, and there is a new level of uncertainty in the industry that there hasn’t been before. There is also no correct way to go about this, especially when it comes to what countries to source from, making it hard for brands to plan for the future. It leaves me curious to see what brands are going to do moving forward and how they navigate these troubling times. Overall, it just shows how fragile the fashion industry is and how quickly things can change, emphasizing how important it is for brands to be prepared for anything.

This was super interesting to read, and honestly not surprising at all. The tariff situation has gotten so messy that it makes sense fashion companies are feeling the pressure from every direction. What stood out to me most was how brands are trying so hard not to raise prices too fast, even though their costs keep jumping. It really shows how cautious everyone is about consumer reaction right now. I also thought the sourcing part was really realistic, yes, companies want to leave China, but it’s not that simple when China still has the strongest supply chain. The whole thing feels like a constant balancing act, and you can tell brands are just trying to stay flexible and make the smartest moves they can in a pretty unpredictable environment.

This study makes illustrates just how severely the latest wave of tariffs is reshaping U.S. fashion companies’ sourcing decisions and financial performance. What stood out most to me was the sheer scale of the added costs, many brands now face hundreds of millions in tariff expenses, yet they remain cautious about raising prices because of consumer sensitivity. Even companies reducing China exposure still rely on China strategically when speed, quality, or capacity can’t be matched elsewhere. The trend toward diversified sourcing, stronger inventory planning, and more data-driven decision-making shows how firms are trying to stay agile in an unpredictable trade environment. The findings highlight how geopolitics, policy uncertainty, and cost pressures are pushing U.S. fashion companies to rethink resilience across their entire supply chain.

This article gave a great look at how U.S. fashion companies are dealing with the Trump administration’s rising tariffs. What I noticed was how brands are trying to avoid big price jumps across all products. Instead, they’re raising prices selectively and using value based pricing to see how sensitive customers are to higher costs. Also, I found it interesting that some companies are still sourcing from China despite the tensions and tariffs.

After reading this post, I was honestly surprised by how much the tariff increases are affecting fashion companies right now. I knew tariffs were expensive, but seeing companies share that they are losing hundreds of millions due to these new tariffs is unbelievable. What stood out to me most is how unpredictable sourcing has become with tariffs hitting so many different countries at once. I knew China was always the biggest topic when it comes to tariffs, but seeing brands now worry about Vietnam, India, and Indonesia shows how there really isn’t an easy “move production somewhere else” solution. I also thought it was interesting how companies are trying so hard not to raise prices too fast, even though the tariff numbers are huge. They’re doing selective price increases and watching consumer behavior almost week by week, which really points to how price-sensitive shoppers are right now. Overall, this made me think about how many moving parts go into sourcing decisions, and how much brands are forced to balance cost, timing, and customer expectations all at the same time.

We have been discussing tariffs and their impacts on international trade and apparel sourcing, especially with our guest speaker, Nate Herman, who discussed common strategies that fashion companies use to respond to tariffs and uncertainty, one being the preemptively purchasing inventory. (A surge of imports are seen before tariffs go into full effect). This phenomenon explains why consumers may not experience the effects of tariffs until much later in the year in which the tariffs were implemented. Companies are able to sell their surplus of products at their normal prices for a while, so they will not need to increase retail prices immediately.

In this blog post, we can see real examples of preemptive buying, such as Hanesbrands, “…we won’t be really experiencing that cost until Q4 because of the inventory that we have…” We are shown that optimizing inventory and building stock is a real-life strategy by real companies to navigate looming tariffs. In cases where there may not be that much time before a tariff ‘kicks in,’ I am curious how companies would implement this strategy; especially with the current U.S. administration, it seems like anything could happen at any rapid rate, and with less time to react, fashion companies may need to pivot even further to respond.