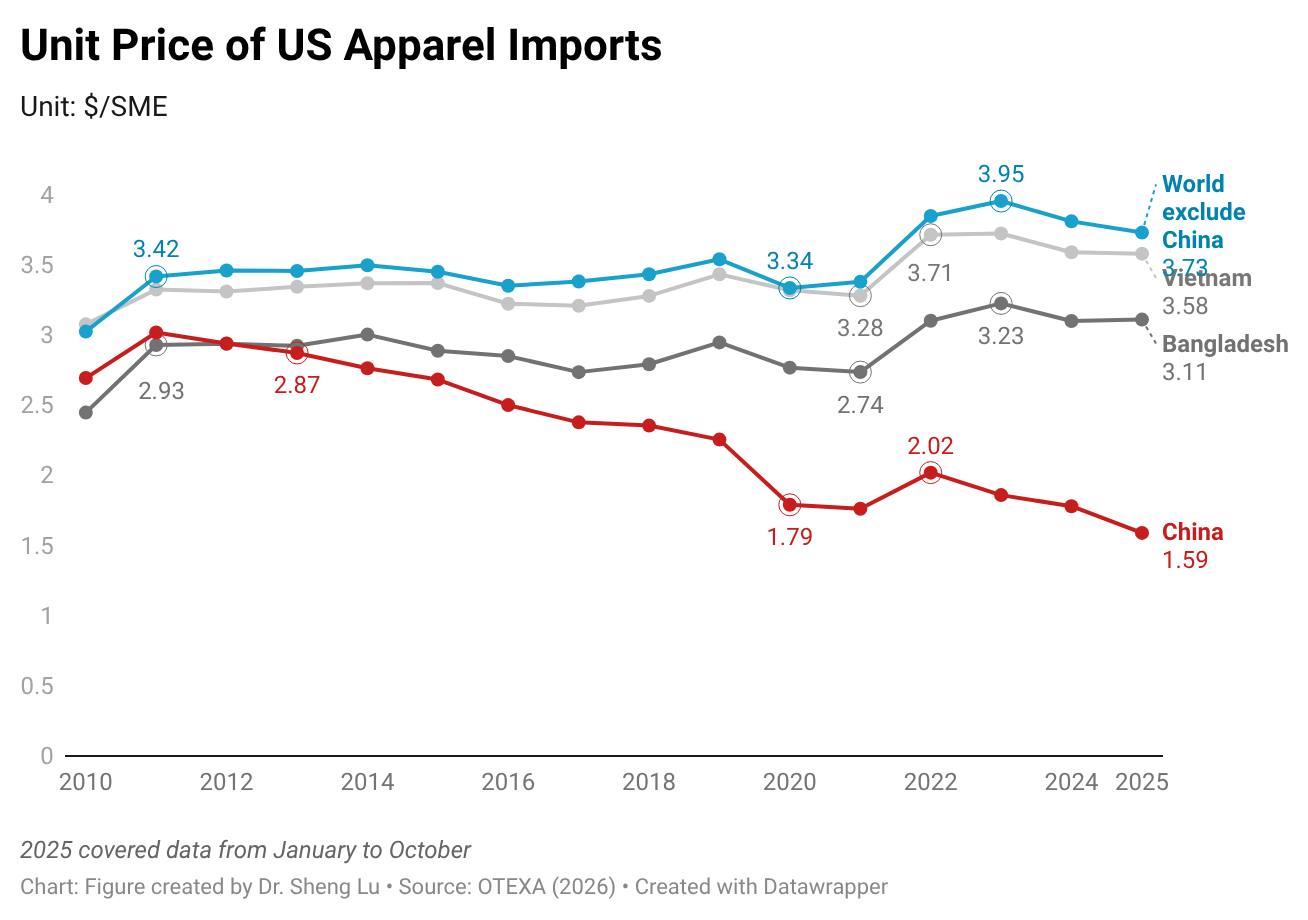

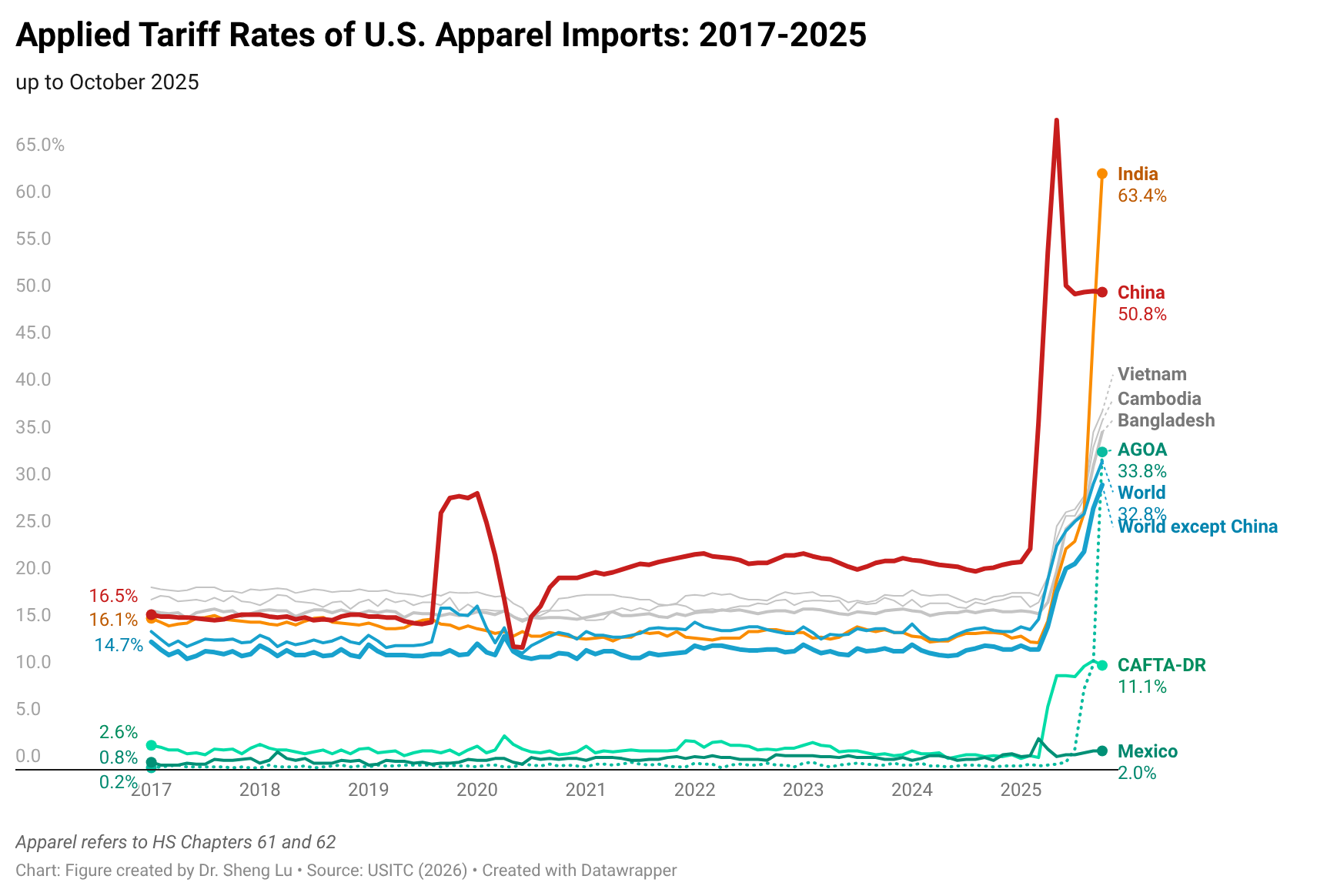

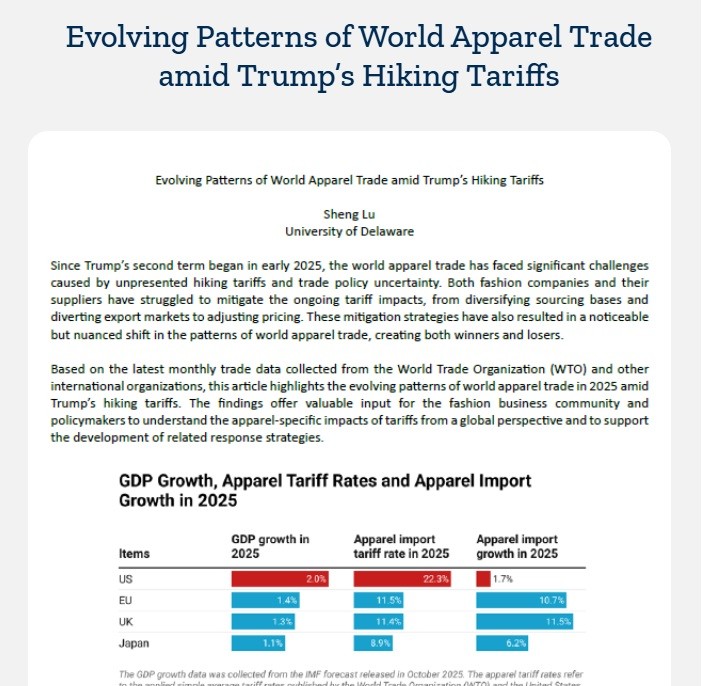

Since Trump’s second term began in early 2025, the world apparel trade has faced significant challenges caused by unprecedented high tariffs and trade policy uncertainty. Both fashion companies and their suppliers have struggled to mitigate the ongoing tariff impacts, from diversifying sourcing bases and diverting export markets to adjusting pricing. These mitigation strategies have also resulted in a noticeable but nuanced shift in the patterns of world apparel trade, creating both winners and losers.

Based on the latest monthly trade data collected from the World Trade Organization (WTO) and other international organizations, this article highlights the evolving patterns of world apparel trade in 2025 amid Trump’s hiking tariffs. The findings offer valuable input for the fashion business community and policymakers to understand the apparel-specific impacts of tariffs from a global perspective and to support the development of related response strategies.

Overall, the findings indicate that Trump’s hiking tariffs have impacted the world apparel trade far beyond the U.S. market. As high tariff rates are expected to remain in 2026, we might see trade diversion and price competition among key suppliers become more evident in the new year. On the other hand, the findings call for greater attention to the tariff’s impacts on small and medium-sized apparel exporting countries, especially those in Asia, South America, and Africa that are less competitive than established, mature suppliers. The ripple effects of the hiking tariffs could increase competition pressures on these small players, resulting in more vulnerability in their export-oriented garment sector and millions of workers.

Key findings:

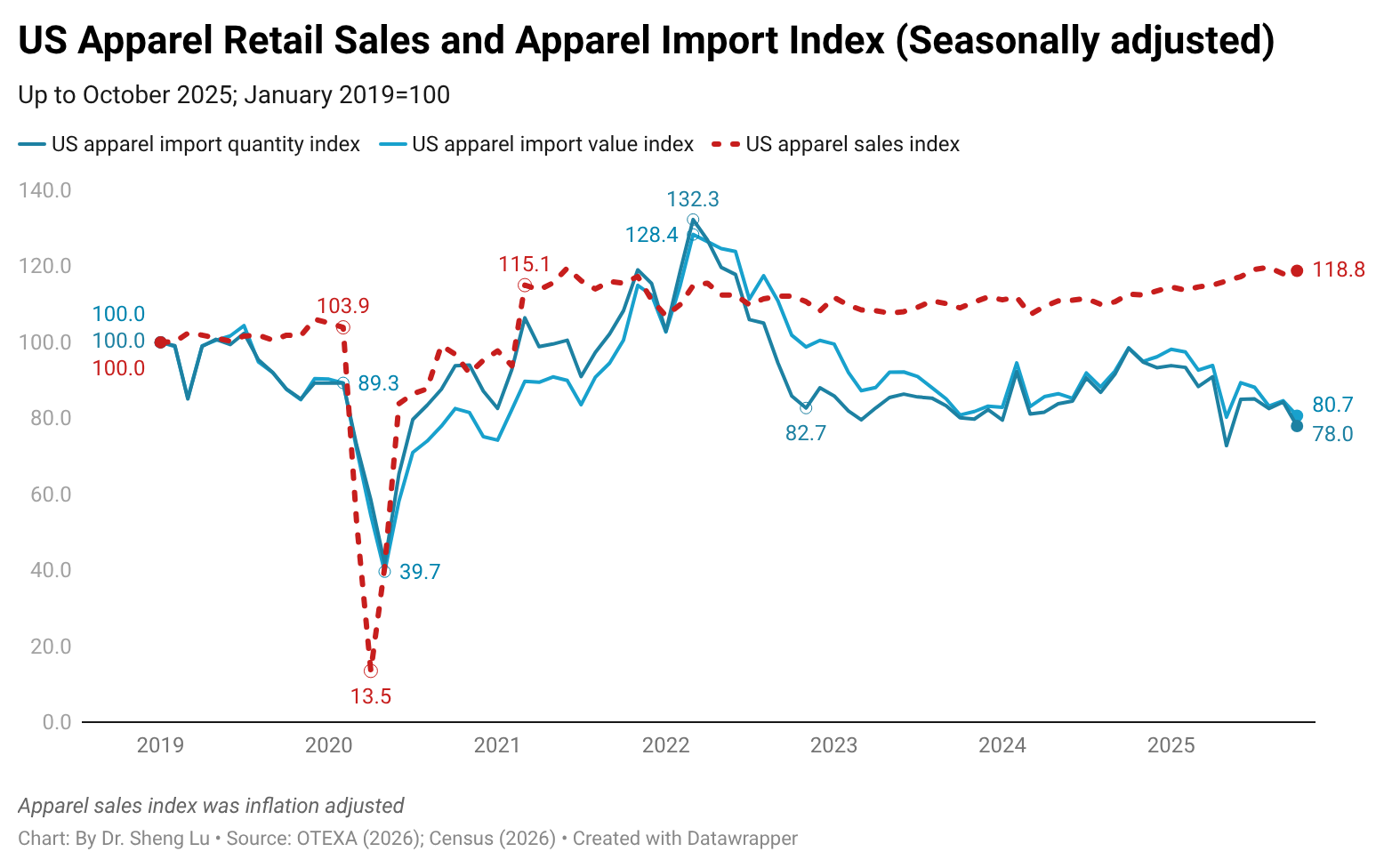

- Pattern 1: Trump’s hiking tariffs appeared to suppress the U.S. import demand for clothing compared with other major import markets.

- Pattern 2: Facing higher tariff barriers in the U.S. market, several leading apparel-supplying countries have been diverting exports to the EU and the UK to mitigate tariff impacts.

- Pattern 3: Except for the case in the U.S., China’s market share remained relatively stable in other key apparel import markets in 2025.

- Pattern 4: Apparel-producing countries in Asia, South America, and Africa faced growing pressure from Chinese products in the domestic market.

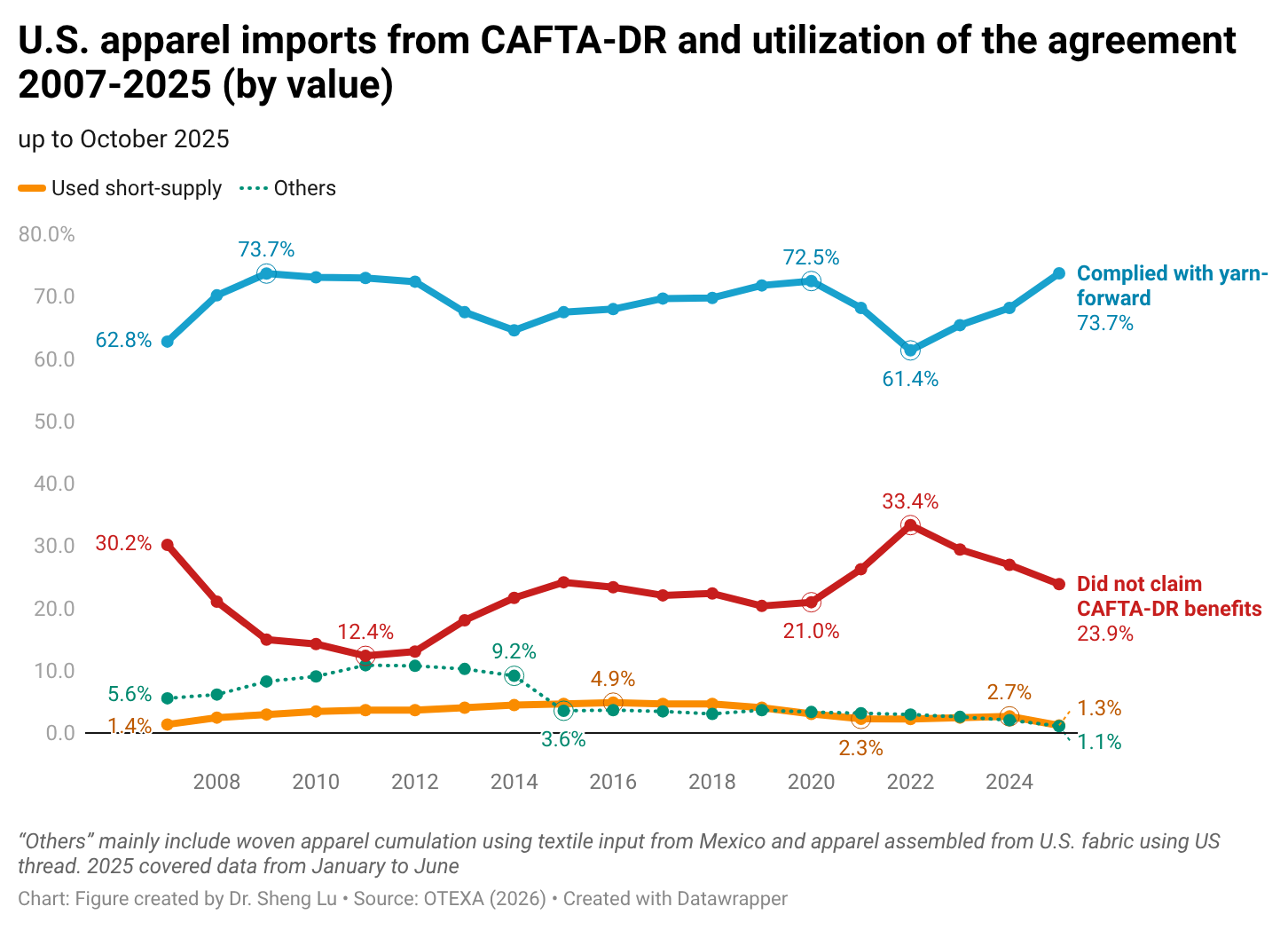

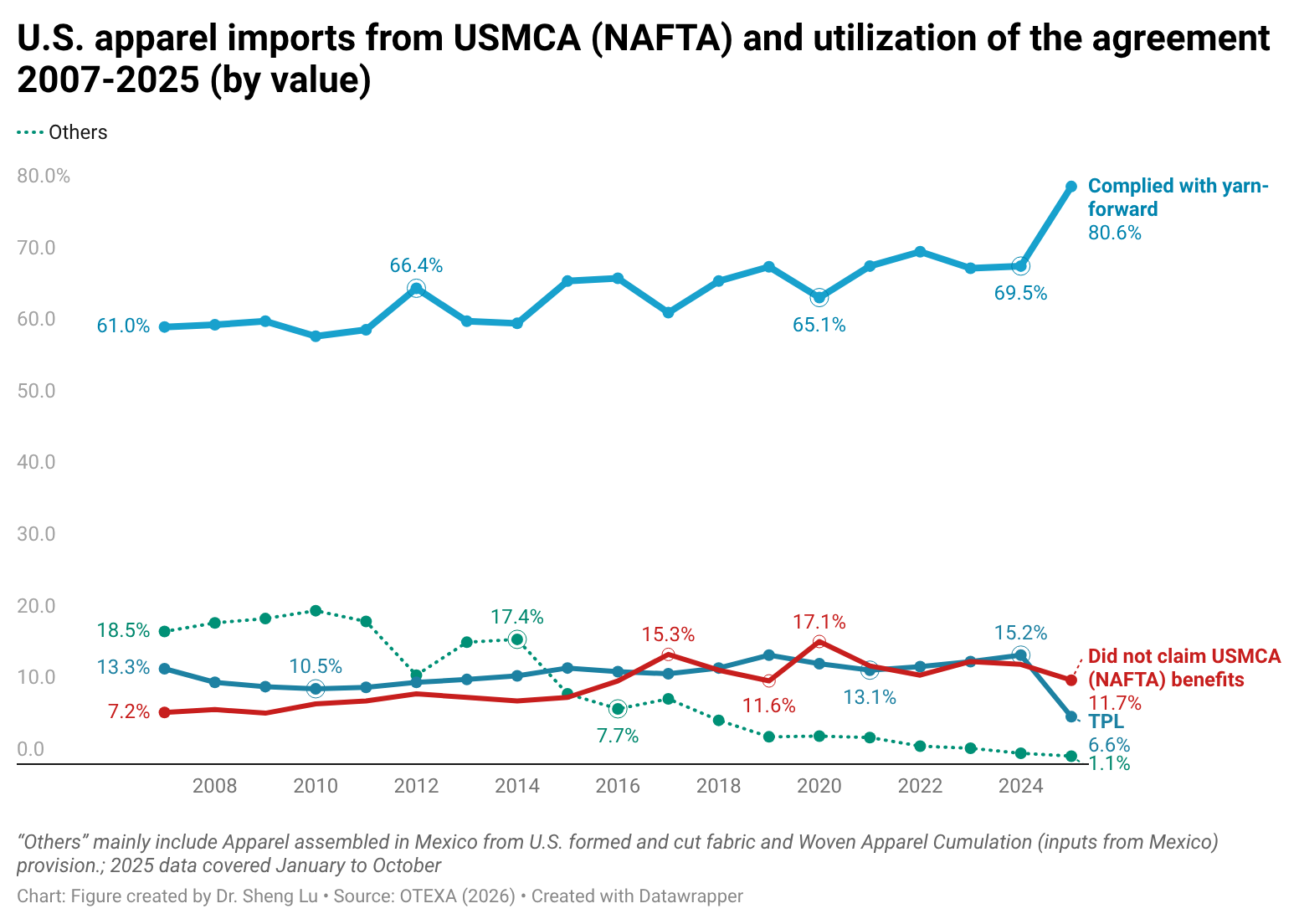

- Pattern 5: No evidence suggested that Trump’s hiking tariffs have benefited near-shoring.

Read the full paper HERE (Global Textile Academy, International Trade Centre, Geneva, Switzerland)