(note: please click the section title to access interactive data)

Part 1: U.S. Goods Trade by Industry Sectors and Trading Partners (Source: USITC Trade Shifts 2024 Report)

- Observe the top U.S. export and import trading partners for goods, noting any changing patterns

- Observe the top U.S. export and import product sectors, noting any changing patterns

- Do the trade patterns overall align with the trade theories discussed in class?

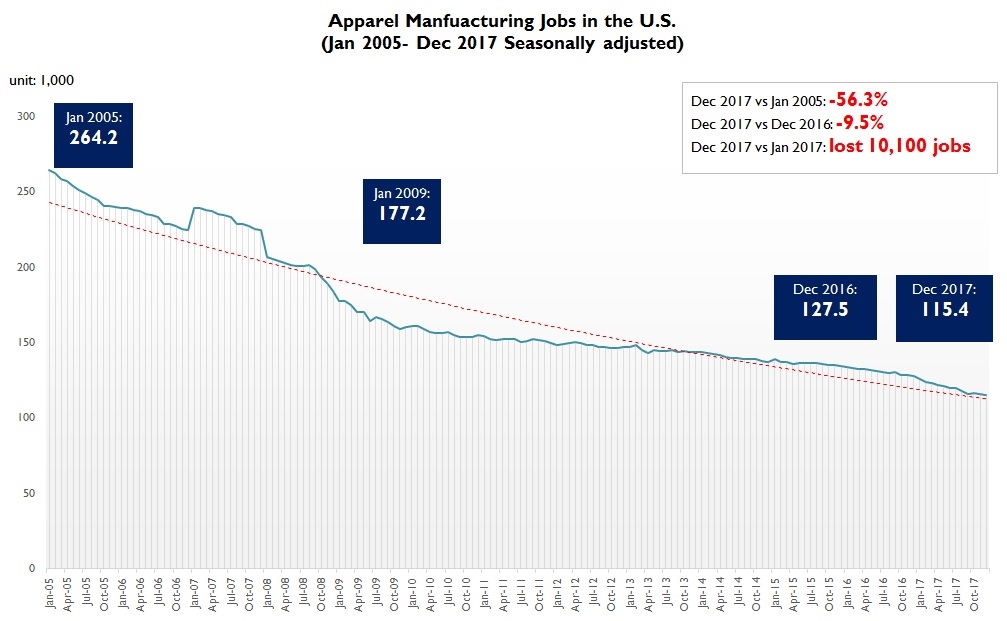

- Should it be a concern that textiles and apparel are NOT among the top US exports of goods?

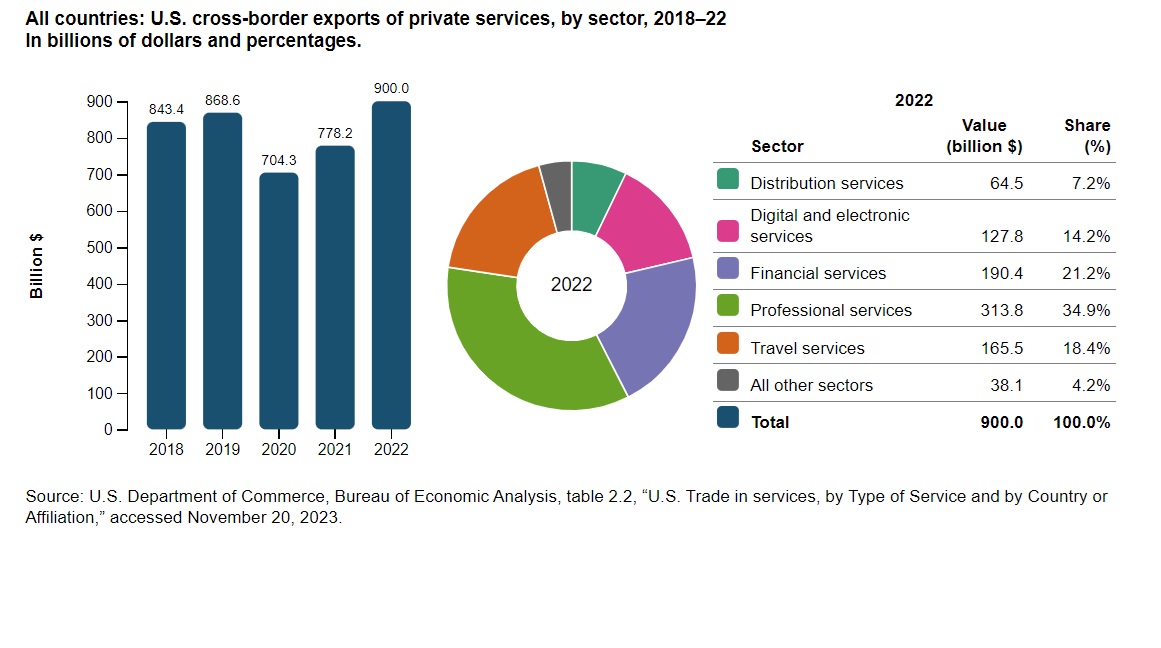

Part 2: U.S. Trade in Services (Source: USITC Recent Trends in US Services Trade 2024 Report)

- Observe the sectors covered by trade in services

- Compare the value of US service exports and imports

- Observe the trading partners of US services trade

- Why do politicians often focus more on trade in goods rather than services? Should they?

Part 3 (Optional): Revealed Comparative Advantage Index (Source: UNCTAD)

Note: The revealed comparative advantage (RCA) index measures a country’s relative export performance of a particular product compared to the world average. It helps identify sectors in which a country holds a competitive edge in international trade. RCA =(Country’s exports of product X/Country’s total exports)/(World exports of product X/World total exports).

- RCA > 1: A value greater than 1 indicates that the country has a revealed comparative advantage in the product, meaning the product has a higher export share in the country’s portfolio compared to the global average. This suggests the country is more competitive in exporting that product relative to the rest of the world.

- RCA < 1: A value less than 1 means the country has a revealed comparative disadvantage in that product. It indicates that the country is less competitive in exporting that product compared to the global average.

Observe the sectors in which the U.S. enjoyed a revealed comparative advantage (i.e., RCA > 1) in 2023. How does this compare with Bangladesh? What is your explanation for the observed differences?