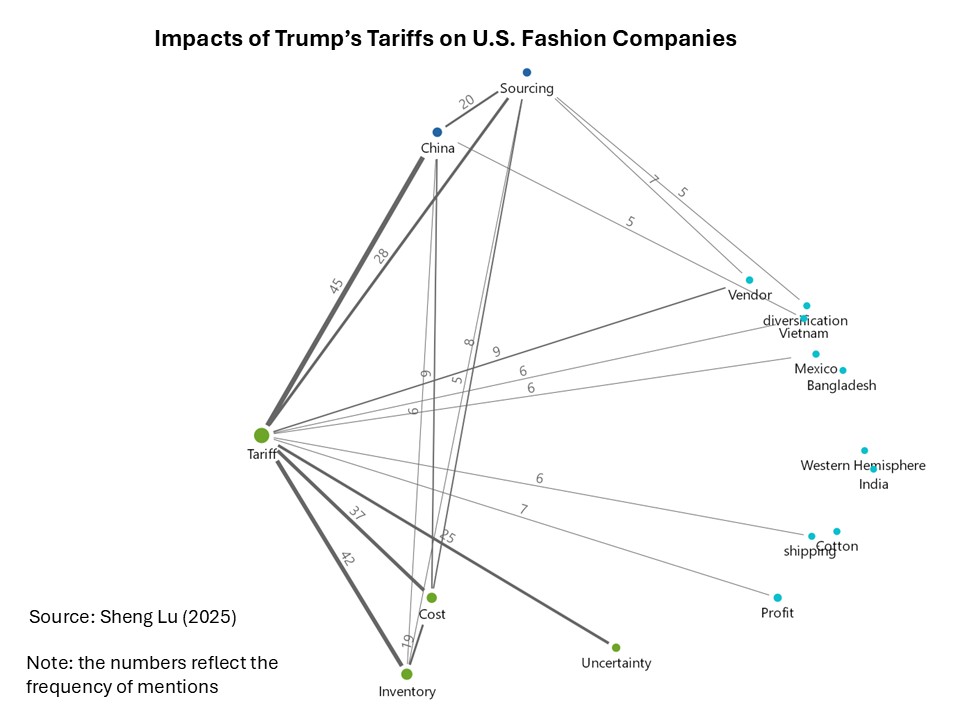

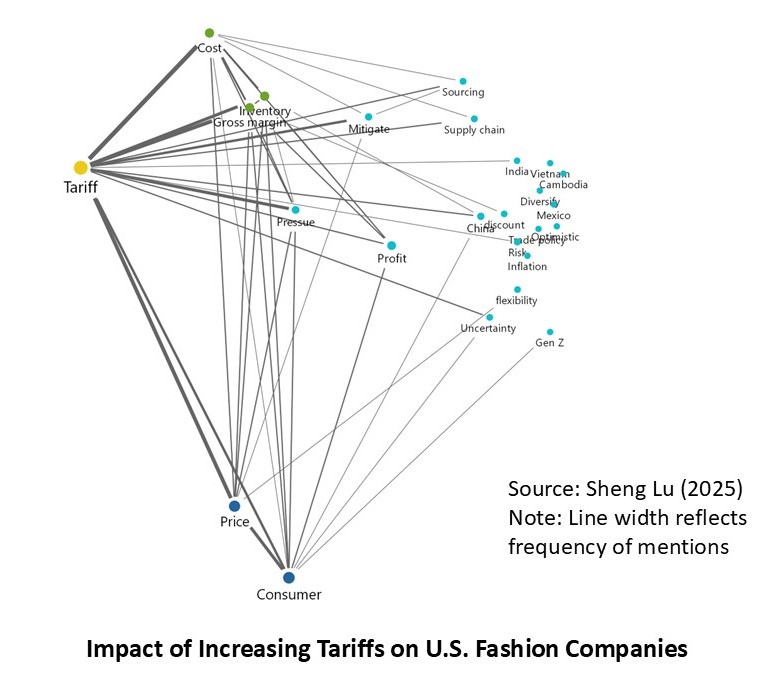

This study aims to examine the impacts of the Trump administration’s escalating tariffs on U.S. fashion companies’ apparel sourcing practices. Based on data availability, transcripts of the latest earnings calls from about 30 leading publicly traded U.S. fashion companies were collected. These earnings calls, held between August and October 2025, covered company performance in the second quarter of 2025 or later. A thematic analysis of the transcripts was conducted using MAXQDA.

Key findings:

First, U.S. fashion companies reported a more significant impact of the increasing tariffs on their financial performance as the tariff increase expands from China to other countries. Many companies regarded tariffs as one of their top-most pressing external challenges to profitability in 2025, especially in the second half and beyond. For example:

- G-III Apparel: “We expect the total incremental cost of tariffs to be approximately $155 million, up from the $135 million original estimate, and this is based on the latest tariff increases implemented for Vietnam, India and Indonesia, among others.”

- American Eagle: “On tariffs, yes, we are providing the guidance here for the third and fourth quarter. About $20 million of impact from Q3. $40 million to $50 million in Q4. So that will pressure gross margin a bit.”

- Hanesbrands: “When you think about tariffs and the impact on our business, first of all, we won’t be really experiencing that cost until Q4 because of the inventory that we have and the way cost flows off of our balance sheet.”

- Victoria’s Secret: “Our projected net tariff impact of $100 million in 2025 is up $50 million versus our assumption embedded in our previous guidance. With approximately $10 million of net tariff impact already recognized in the first half of the year, our guidance assumes approximately $20 million of net tariff pressure in the third quarter with $70 million impact in Q4.”

- Tapestry: “We are facing greater than previously expected profit headwinds from tariffs and duties, with the earlier-than-expected ending of de minimis exemptions being a meaningful factor. In aggregate, the total expected impact on profitability this year from tariffs is $160 million, representing approximately 230 basis points of margin headwind.”

- Carter’s: “We’ve assessed the higher incremental tariffs, which have already been implemented, an additional 10% duty for all countries and higher incremental duties for products from China, Vietnam and Indonesia. Relative to a few months ago, we’re preparing for a world with higher and more permanent tariffs above the over $100 million in duties, which we have paid historically. Our estimate of the additional baseline tariffs is that it would represent a gross additional tariff amount between $125 million and $150 million on an annualized basis.”

Second, despite the higher tariff burdens, most U.S. fashion companies still try to avoid across-the-board price hikes due to concerns about losing consumers. Instead, most companies opt for selective price increases, value-based pricing, and closely monitor consumers’ price sensitivity. However, price increases could be more noticeable down the road. For example:

- Oxford industries: “We’ve not done sort of an across-the-board approach to pricing. We’ve really looked at it on an item-by-item basis and balanced the need to protect our margins and try to recover some of the tariff impact with not wanting to get too far ahead of ourselves because that tariff number…as we get into spring ’26… And on average, that’s led to sort of low to mid-single digit or low mid-single-digit price increases…we’re just being very cautious about increasing the price too much before we really know where things are settled out.”

- URBN: “our pricing strategy…is really to look at some gentle price increases where we feel like there’s the value that contributes to that. So making sure that we’re protecting some of the opening price points that the customer counts on and some programs that we know drive a lot of volume…Recognizing the value equation is really important to all of our consumers.”

- TJX: “I think you’re gonna see a more of a little bit of a gradual increase in pricing as the tariffs come in…I don’t think you’ll see step all of a sudden Right. With the tariffs set,because I don’t wanna, I think, turn off customers immediately by seeing a dramatic price shift. So I think they might they might they might absorb it initially for a little bit, and eventually, they’ll get there.”

- Columbia Sports: “We expect higher prices for many consumer goods will negatively impact consumer demand…In fall ’25, we’re working with our retail partner to deliver value to consumers and keep inventory and dealer margins healthy. As a result, we’re not making any significant price changes to our fall ’25 product line and expect to absorb much of the incremental tariff costs this year…Our goal is to offset higher tariffs over time through a combination of actions, including price increases, vendor negotiations, SG&A expense efficiencies and other mitigation tactics.”

- Ralph Lauren: “The big unknown sitting here today is the price sensitivity and how the consumer reacts to the broader pricing environment and how sensitive that consumer is. And that’s what we’re watching very closely as we head into the second half.”

- Ross stores: “Some of the India tariffs, especially if the 25 goes to 50…I think that you’ll see this go into next year, and I think we would expect to see price increases. And — but over time…we think it will reach equilibrium, and it will be business as usual.”

- Burlington stores: “we are seeing that competitors are taking up retail prices. So far, though, I would say that those price increases have been quite selective and quite restrained…Part of it may just be the time lag between imports arriving in the country and those goods showing up in stores. But also my sense is that wholesalers and retailers have been reluctant to make decisions on raising prices until they know what the final tariff rates are going to be. Now it does feel like there is more clarity on this now than there was a couple of months ago. So it wouldn’t be surprising if retail prices were to go up across the industry in the back half of the year. Now of course, we know that our customer is very, very price sensitive.”

- VF Corporation: “we have actions in place to mitigate the tariff impact through sourcing savings and pricing actions that will take effect later this year.”

Third, while U.S. fashion companies overall continue to reduce their apparel sourcing from China amid the current tariff and geopolitical tensions, some companies still regard China as a viable sourcing base given its many unique advantages, such as speed to market, production efficiency, and well-developed supply chain infrastructure. For example:

- Carter’s Inc: “We’ve meaningfully reduced our exposure to China manufacturing over the last number of years. And now, as summarized here, our largest countries of origin are Vietnam, Cambodia, Bangladesh, and India.”

- Abercrombie & Fitch: “Our approach and underlying principles for tariff mitigation remain unchanged, supported by a deep playbook and experience. We continue to expect China sourcing share in the U.S. will be in the low single digits for the year.”

- Steve Madden: “Since the last call…We have moved certain production for fall back to China, where we felt it would be difficult to ensure on-time delivery, appropriate product quality and/or reasonable pricing in an alternative country. For fall 2025, we currently expect to source approximately 30% of our U.S. imports from China, down from 71% for the full year 2024..

- Oxford industries: “With the recent tariff increases announced during the second quarter, including increased tariffs in countries like Vietnam and India that were included as part of our shift away from China, largely offset by the mitigation efforts we have undertaken, including accelerated inventory receipts and quickly shifting our sourcing network.”

- American Eagle: “If you start with all the country of origin remixing…China where we know we were at a higher penetration coming into the year is mid-single digit now in a full year.”

Fourth, establishing a geographically diverse sourcing base continues to be a crucial strategy employed by U.S. fashion companies to mitigate tariff impacts and policy uncertainty. U.S. fashion companies are also intentionally adding speed, flexibility, and agility to their sourcing base and supply chain. However, given the complex sourcing factors fashion companies have to consider, plus the broad scope of “reciprocal tariffs, there is no clear winner. For example:

- Kohl’s: “We have a diversified sourcing strategy from a country standpoint. We’re not heavily reliant on any one particular country, and we have the flexibility and agility to actually move production to other countries if necessary.”

- PVH: “We work closely with an established network of global sourcing partners across more than 30 countries, and we continue to leverage our deep long-standingrelationships to further optimize our sourcing and production costs.”

- American Eagle: “If you start with all the country of origin remixing…India is small for us. Rebalancing some things out of Vietnam.”

- Steve Madden: “we were focused on moving a lot of product to Brazil. We’re going to have to wait and see what happens. I think that really goes not just for Brazil, but for a lot of the countries that we work with. So we’ve tried to create a more diversified sourcing footprint. And — but there’s obviously a lot of uncertainty still about where the ultimate tariff rates will land by country. And so we’re going to have to wait and see what happens and then react accordingly. That’s all we can do.”

- Hanesbrands: “when you think about tariffs and the impact on our business…not only do you have the Q4 impact, but you have to think about those other offsets about meaningful U.S. content that we have in our products that are exempt from reciprocal, the good East-West balance that we have in our supply chain…”

- Land’s End: “With regard to sourcing…we have been intentionally repositioning our sourcing network to better serve the business we are building leading to a more balanced supply chain that enables us to bring new solutions to customers with more speed and frequency throughout the year. For example, our licens epartners are becoming part of our sourcing network…By tapping into the full breadth of our sourcing matrix, we are able to swiftly and strategically reposition fabric and manufacturing as tariff conditions evolve.”

Fifth, as part of their tariff cost mitigation strategy, many U.S. fashion companies have been strategically but cautiously building preemptive stock, adopting a data-driven approach to optimize inventory, and simplifying product assortment. For example:

- Levi’s: “And for Q4, we declared a dividend of 14¢ per share, which is up8% to prior year. We ended the quarter with reported inventory dollars up 12%, driven by purposeful investment ahead of the holiday and higher product cost than a year ago due to tariffs. In unit terms, inventory was up 8% versus last year. As of today (October 9, 2025), we have 70% of the product in the US needed for holiday.”

- Ralph Lauren: “So we feel good about our inventory levels as we head into the fall season. So we ended Q1 (2025), as you know, with inventories up 18% versus Q1 of last year (2024)…if you think about sort of our Q2 revenue guide of up high single digits, relates to the strategic acceleration of largely core inventory receipts into the U.S. in Q1 during the tariff pause period…So if you back out that tariff-related strategic pull up, our inventory growth is actually a little behind our double-digit top line growth for Q1 and right in line with our expected high single-digit top line growth for next quarter, Q2. And…for the year to go, we expect inventories to moderate as we move throughout the fiscal year, and we plan on ending fiscal ’26 with levels generally in line with demand.”

- PVH: “Inventory at quarter end (Q2, 2025) was up13% compared to Q2 last year (2024), including a 1% increase due to tariffs, and reflects a planned improvement compared to up 19% in Q1.”

- Hanesbrands: “we’re leveraging advanced analytics with the use of AI to drive operational improvement around the globe, including inventory and assortment management as well as demand planning and forecasting.”

- Tapestry: “We’re bringing more innovation to the assortment while we streamline our offering, reducing handbag styles by over 30% by fall, allowing us to stand behind our big ideas with clarity and intention.”

by Sheng Lu