Textiles and apparel today are produced through a global supply chain. For clothing labeled as “Made in Vietnam,” it is likely that the textile raw materials, such as yarns, fabrics, and trims, are sourced from elsewhere.

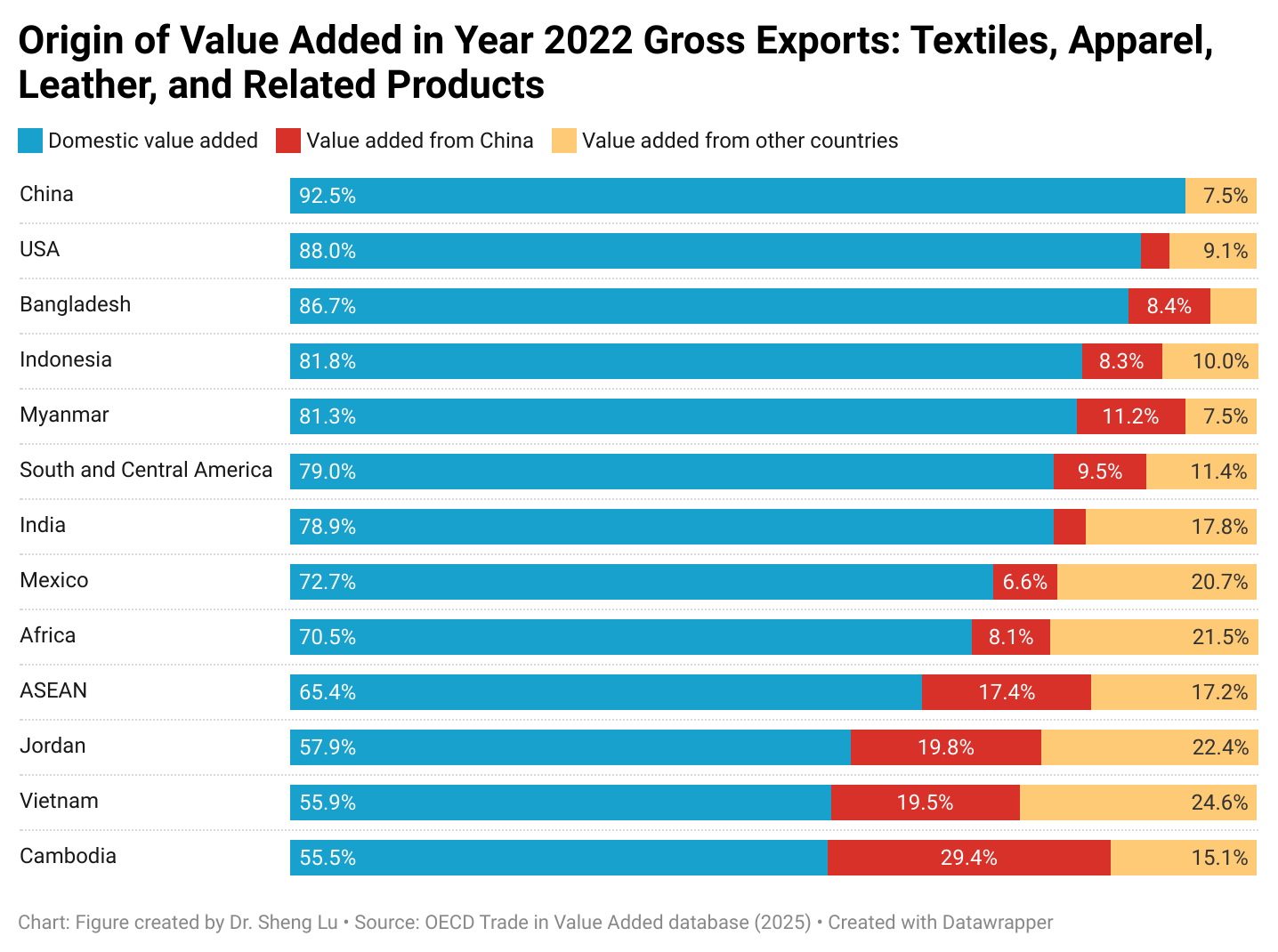

According to the newly released 2025 OECD trade in value added estimation, as of 2022, a country’s apparel exports commonly contain value added created in another country due to the use of imported textile materials and other inputs. This is the case for exports from leading apparel exporting countries in Asia, such as Vietnam (44% foreign value added), ASEAN members (35% foreign value added), Cambodia (45% foreign value added), India (21% foreign value added), and Jordan (42% foreign value added). Other emerging apparel sourcing destinations in North, South, and Central America, as well as the EU, also used substantial imported inputs for their apparel exports, such as Mexico (27.3% foreign value added), Türkiye (23.9% foreign value added), and Egypt (19.7% foreign value added). [See detailed data here]

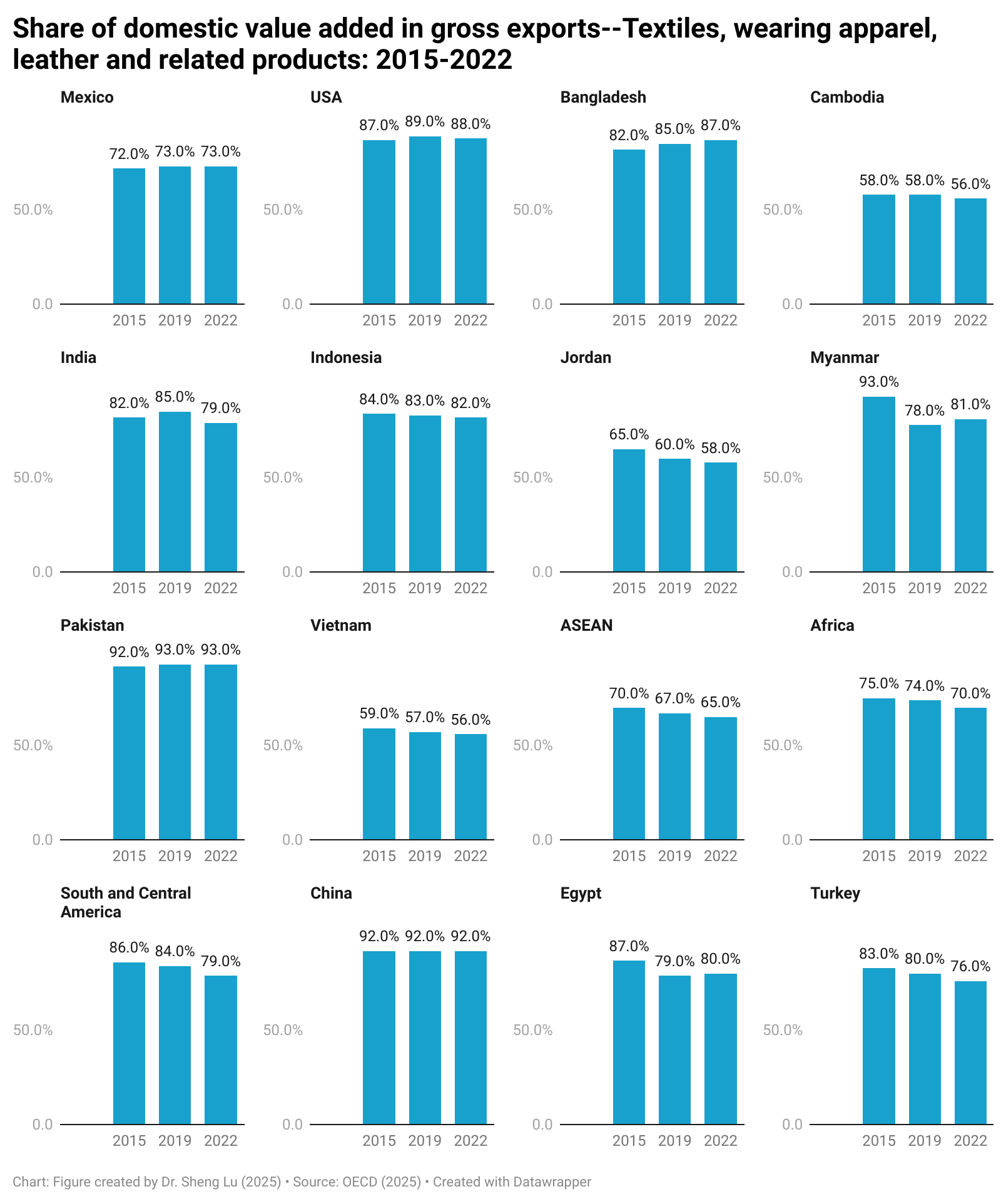

Notably, among the sixteen countries and regions examined, they mostly increased the use of non-domestic value added in textile and apparel exports between 2015 and 2022 (note: paired T-test result was statistically significant at the 99% confidence level). This suggests that co-production through regional or global supply chains, rather than 100% domestic production, has become a more prominent phenomenon in the textiles and apparel industry. [See detailed data here]

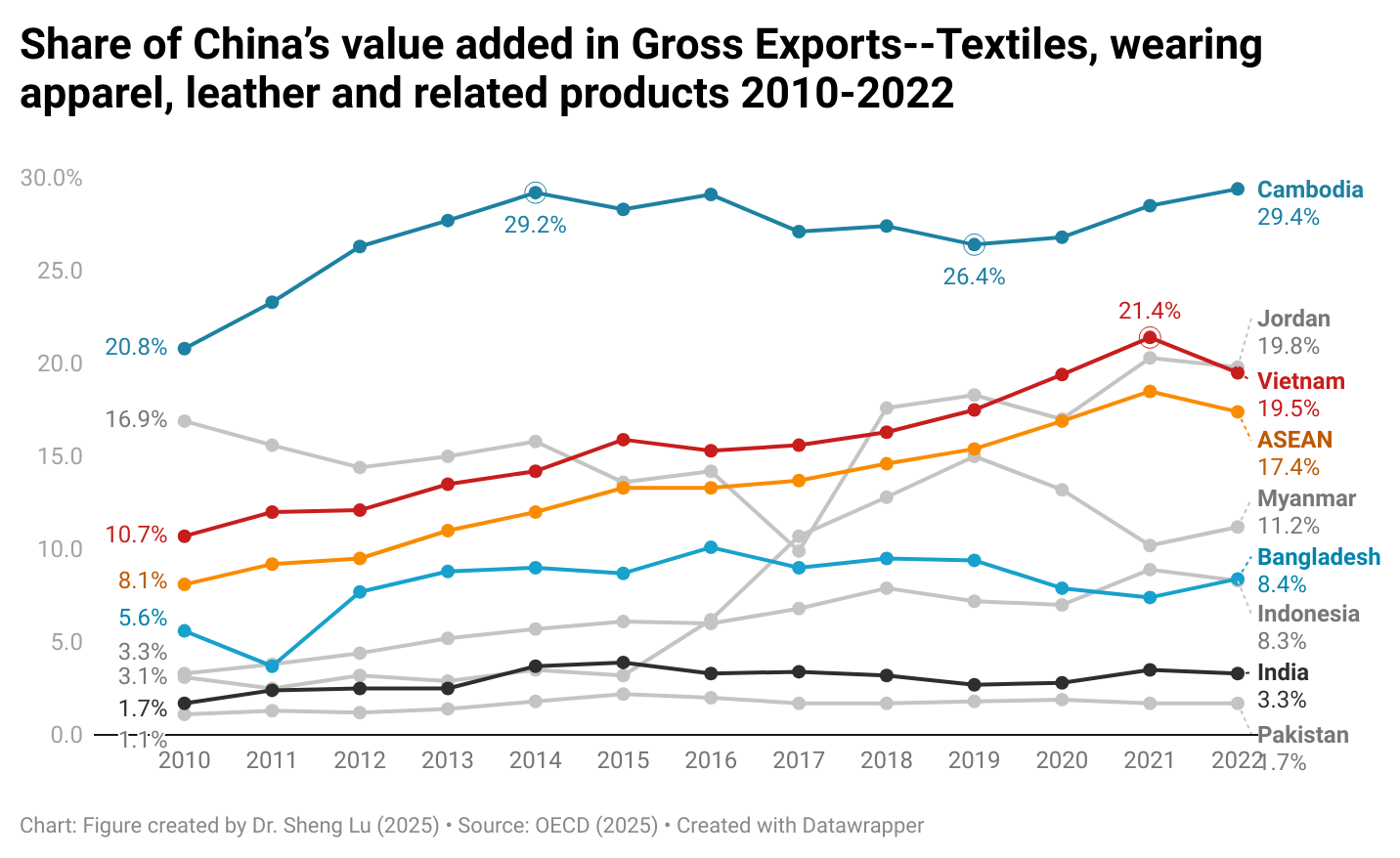

Furthermore, the value added from China appears to be increasing in the textile and apparel exports of many countries. Specifically, between 2015 and 2022, textile and apparel exports from several countries contained a higher percentage of value added from China, including not only Asian countries such as Vietnam (up 6 percentage points), ASEAN (up 4.1 percentage points) and Jordan (up 6.1 percentage points), but also those in other regions such as Egypt (up 3.3 percentage points), Mexico (up 1.7 percentage points), and South & Central America as a whole (up 4.7 percentage points). [See detailed data here] This result reflected China’s deliberate effort to expand its global economic presence through foreign direct investment, Belt and Road initiatives, and new trade agreements in recent years.

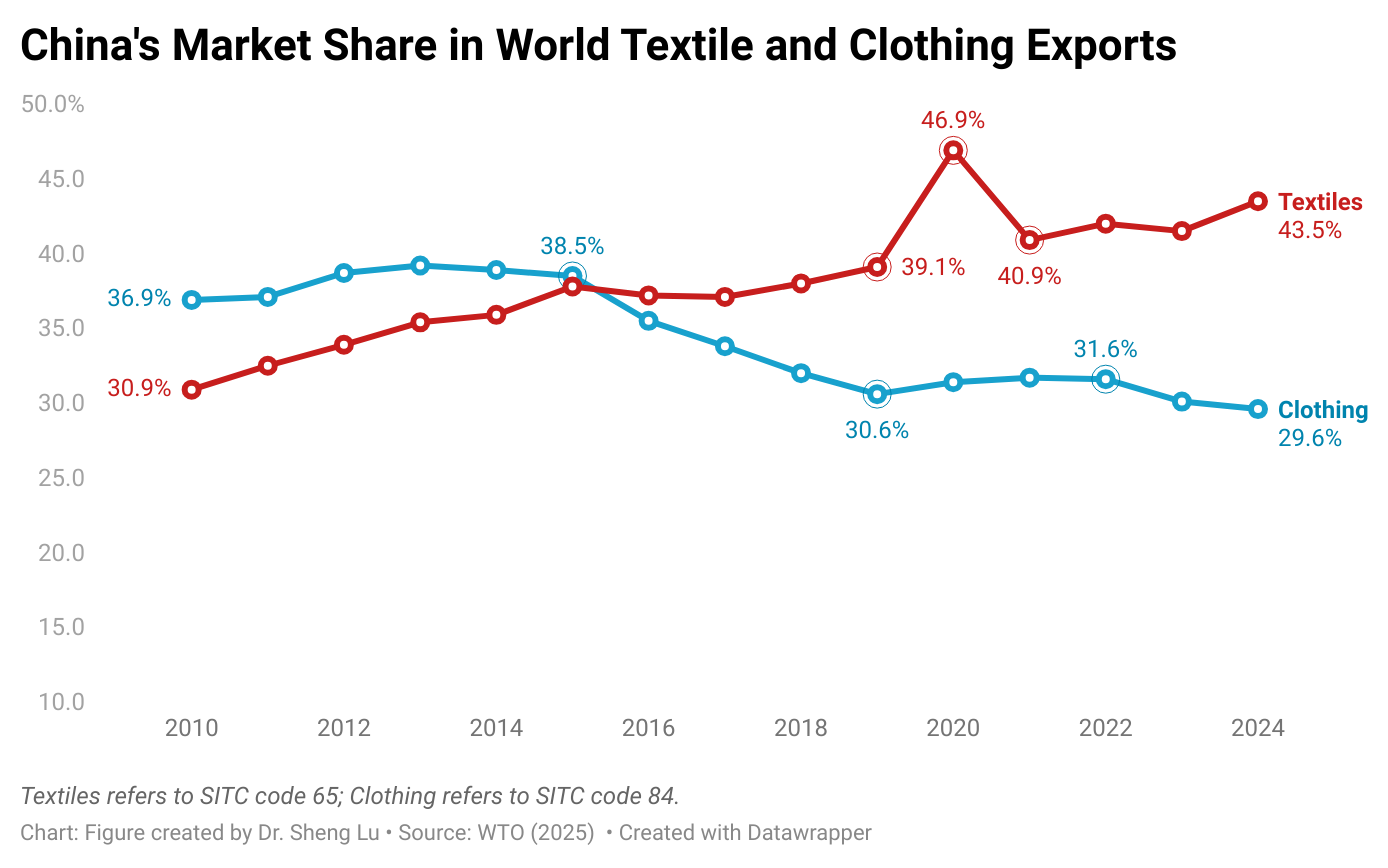

The latest data from the World Trade Organization (WTO) also shows that while China’s market share in the world clothing exports fell to 29.6% in 2024—the lowest level since 2010—China’s market share in textile exports increased to 43.3% in 2024, up from 41.5% a year earlier. In other words, consistent with the stage of development theory, China’s role as a major textile supplier to other apparel-exporting countries continues to grow, despite a decline in its finished garment exports. [See detailed data here]

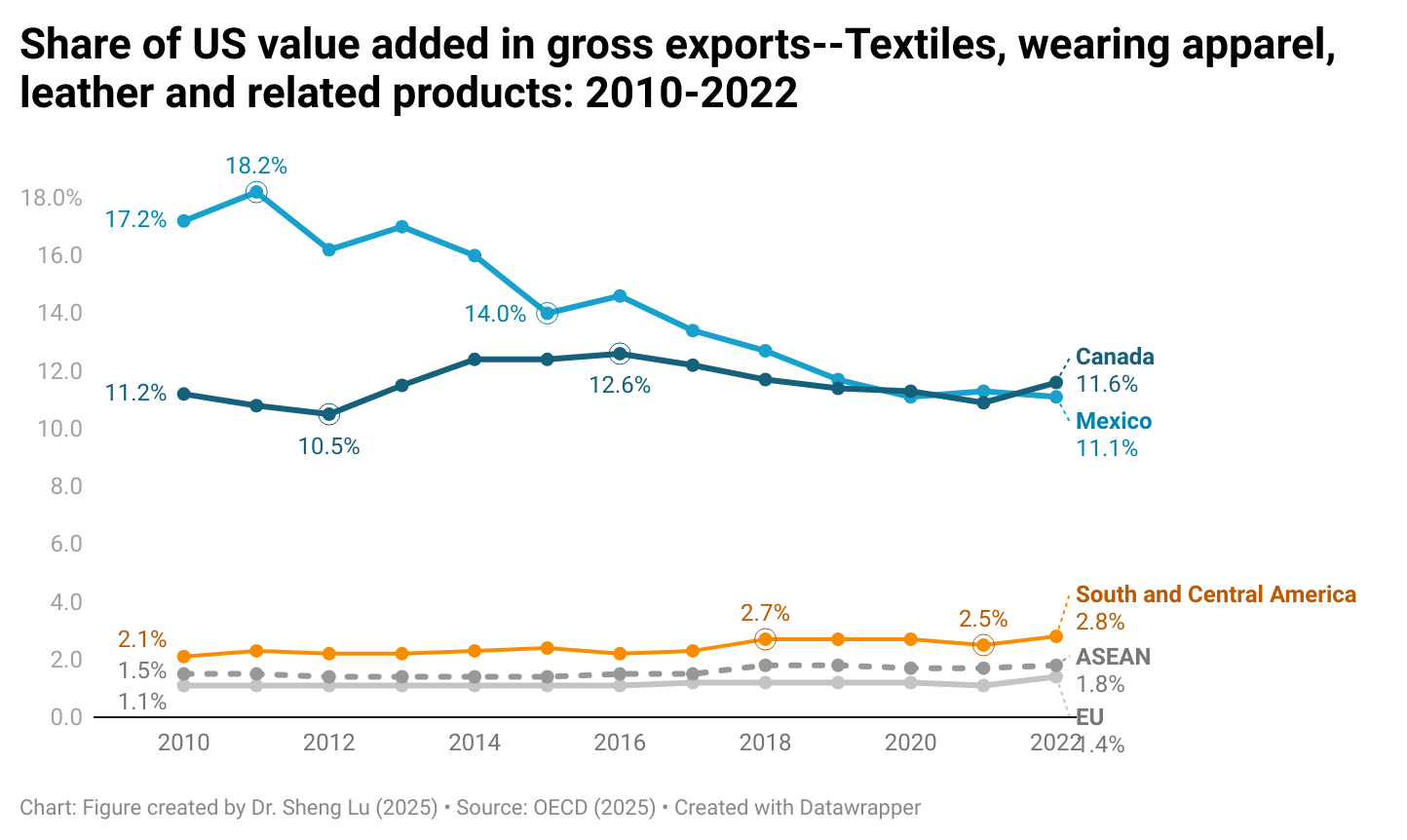

In comparison, while the United States remained an important contributor to the value added of textile and apparel exports from Mexico and Canada, its contribution slightly declined between 2015 and 2022 (i.e., from about 12%-14% to 11%). As the USMCA undergoes its mandated six-year review, it is critical to strengthen, rather than weaken, this North American co-production supply chain, which has a significant impact on the economic interests of the U.S. textile and apparel industry. This is particularly important given that supply chain collaboration between the U.S. and Asian or EU countries for textile and apparel production has been limited, with little indication of growth: According to OECD data, the U.S. value added in Asian and EU countries’ textile and apparel exports remained only around 1.5% [See detailed data here].

by Sheng Lu

(This post is not open for discussion due to its technical nature)