Primark’s sourcing strategies

According to Primark, it does not own any factories but sources all apparel products from contracted factories. Any contracted factory that manufactures products for Primark must meet internationally recognized standards before receiving the first sourcing order.

As of October 2022, Primark sourced from 883 contracted factories in 26 countries (note: it was a slight decline from 928 contracted factories in 28 countries as of May 2021). Of these factories, 85.5 percent were Asia-based because of the region’s massive production capacity and a balanced offer of various sourcing factors, from cost, speed to market, and flexibility to compliance risks.

Like many other EU-based fashion companies, near-shoring from within the EU was another critical feature of Primark’s sourcing strategies. About 14 percent of Primark’s contracted garment factories were EU-based (including Turkey).

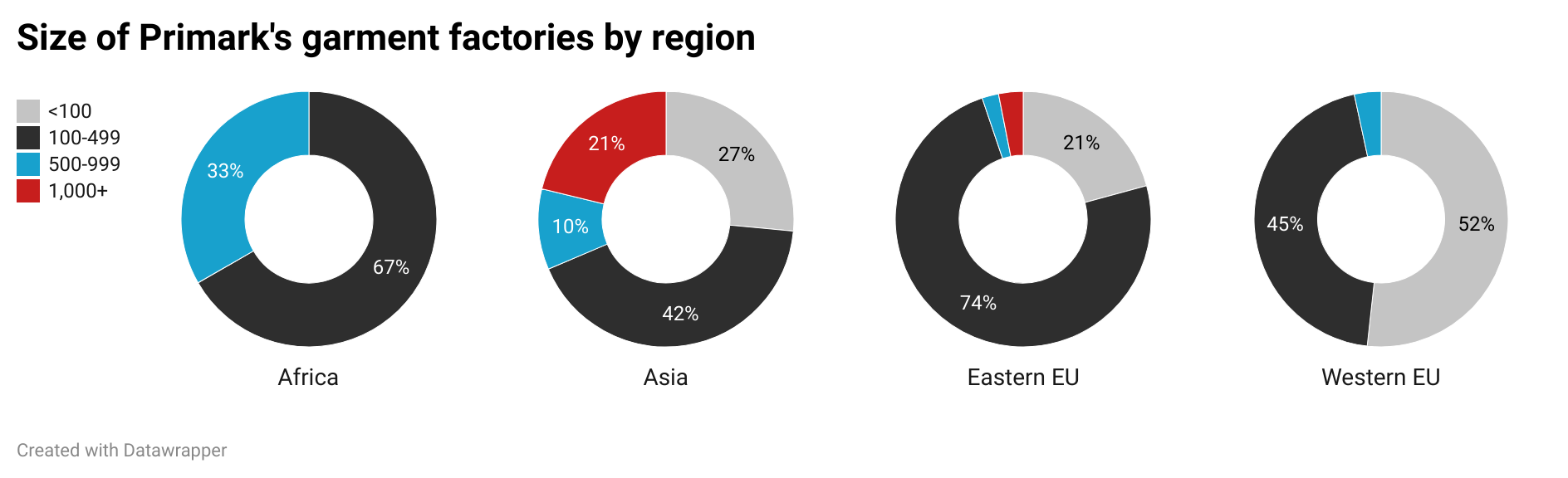

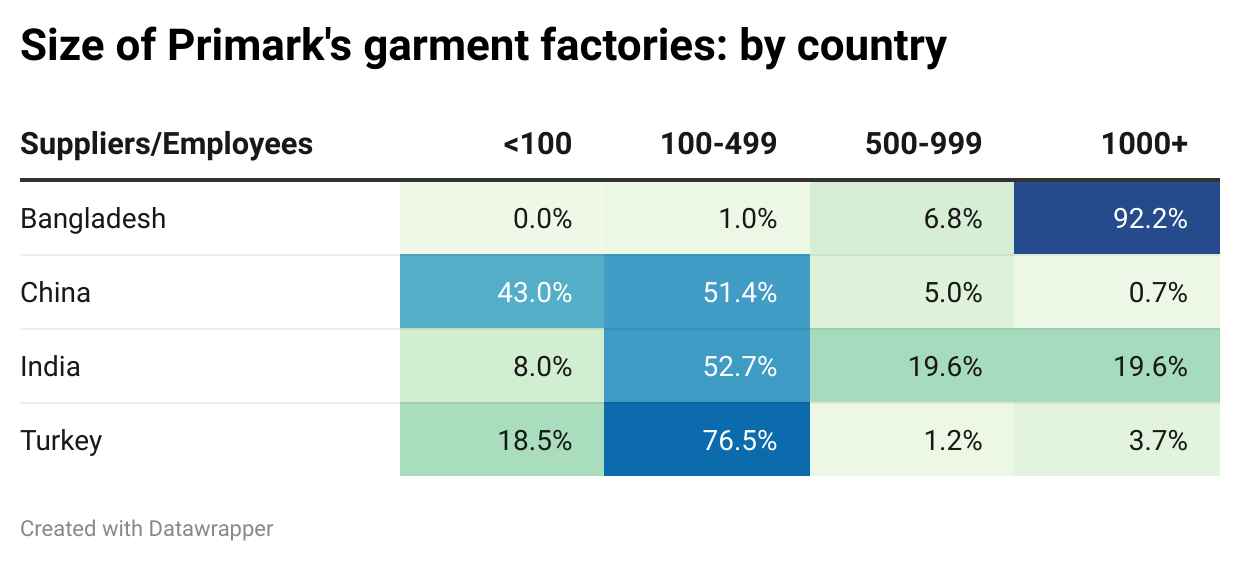

Measured by the number of workers, Primark’s Asian factories were larger than their counterparts in other parts of the world. For example, while Primark’s factories in Pakistan and Bangladesh typically have more than 2,500+ workers, its factories in Western EU countries like the UK, Germany, Italy, and France, on average, only have 64-200 workers. This pattern suggests that Primark mainly uses Asian factories to fulfill volume sourcing orders, and its EU factories mainly produce replenishment or more time-sensitive fashionable items.

Meanwhile, similar to the case of other retailers like PVH, Primark’s contracted garment factories in China were smaller than their peers in the rest of Asia. For instance, while over 90% of Primark’s garment factories in Bangladesh employ more than 1,000 workers, around 43% of their contracted factories in China have fewer than 100 workers. This pattern suggests Primark could use China as an apparel sourcing base primarily for orders requiring greater flexibility and agility and those involving a wider variety of products but in smaller quantities.

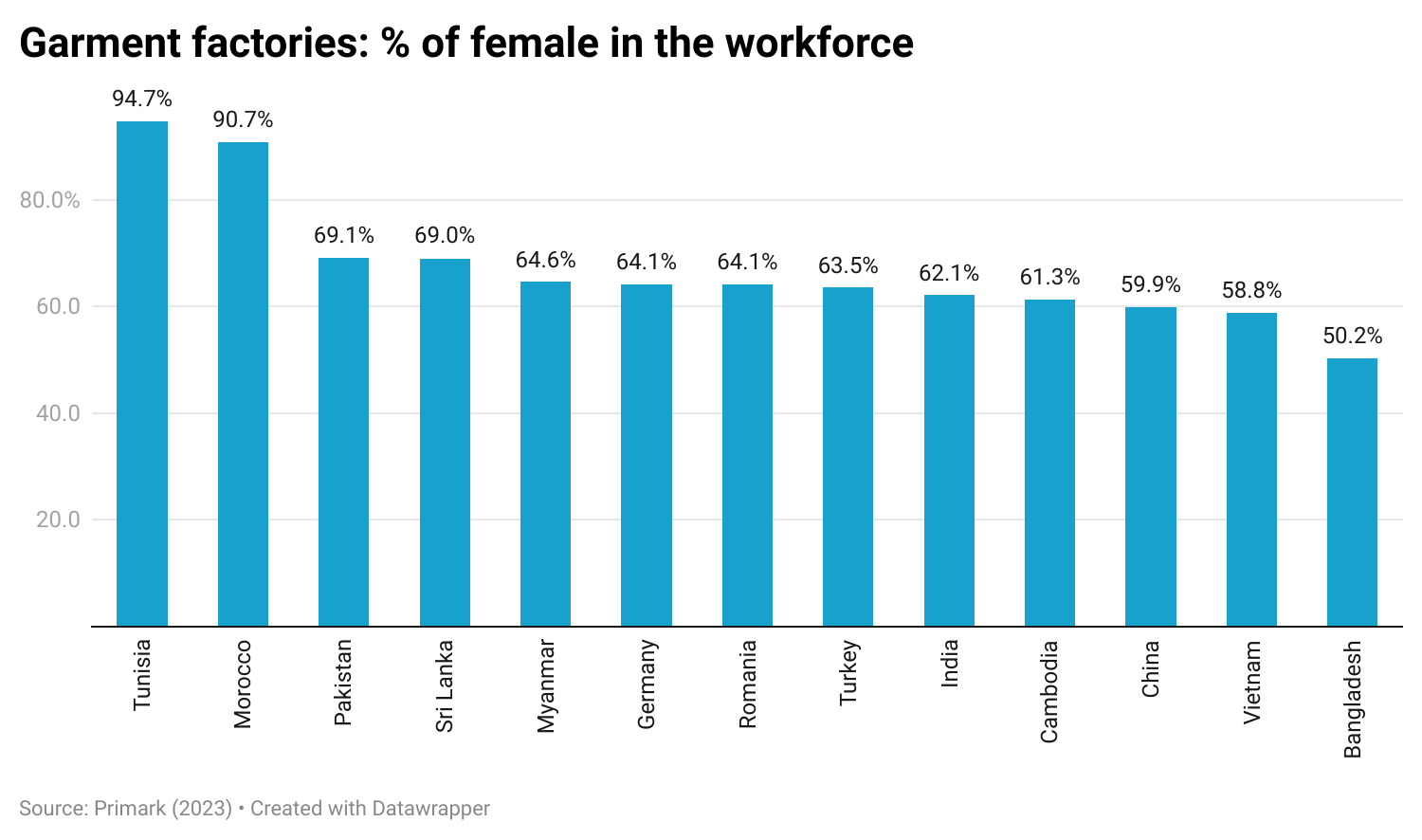

Further, reflecting the unique role of the garment industry in creating economic opportunities for women, females account for more than half of the workforce in most garment factories that make apparel for Primark. The percentage was exceptionally high in developing countries like Tunisia (94%), Morocco (91%), Pakistan (69%), Sri Lanka (69%), Myanmar (64%), India (62%), and Vietnam (59%).

According to Primark (as of September 2023), its Ethical Trade and Environmental Sustainability team comprises over 120 specialists based in key sourcing countries. The team conducts around 3,000 supplier audits a year to monitor compliance (i.e., fair pay, safety, and healthy working conditions.) Additionally, Primark says its factories were in line with the company’s environmental code of conduct, and the company “donated any unsold merchandise to the Newlife Foundation in Europe and KIDS/Fashion Delivers in the US.

by Sheng Lu

Discussion questions:

What are the unique aspects of Primark’s apparel sourcing strategies? What role does sourcing play in supporting Primark’s business success? Any questions or suggestions for Primark regarding its sourcing practices?

Primemark’s use of brick and mortar focused shopping is incredibly bold in today’s fashion industry. Their commitment to saving expenses from making a full e-commerce site has allowed for them to put their resources elsewhere, by investing time in using specific factories for production. By using Asia for their main sourcing and production and then Europe to produce re-stocked items, Primemark’s strategy for apparel production is strategic and strong. Their entire business model is not completely unique compared to brands like Ross or TJMaxx, but their brick and mortar business paired with their sourcing practices makes them a strong competitor against other brands.

Personally, I have never heard very much about the company Primemark, so I found the information I listened to be very interesting and quite surprising. The video mentions how 80,000 stores will be expected to close in the next five years, while Primark is expected to expand 60 more stores, of course, all brick and mortar. Primemark’s approach is so different from other retailers, that it makes consumers wonder why other companies aren’t following in their footsteps. Considering how successful they have been in recent years, in spite of everything globally that has been happening, Primemark has reigned supreme. It may be even fair to say that Primemark is the strongest competitor in the brick-and-mortar world. As a consumer, after finding out how successful Primemark is, it makes me more appealed to the company and more intrigued to find more out about it.

What role does sourcing play in supporting Primark’s business success?

Sourcing plays a huge role in supporting Primark’s success. As described in the first video, Primark’s business model is very different compared to its competitors. The company does not spend a lot on marketing, they buy in bulk, and they have low margins. But none of these differentiators would be possible without Primark’s sourcing strategy. First of all, 85.5% of their contracted factories are based in Asia due to the region’s massive production capacity in addition to other beneficial factors such as low costs, speed to market, and flexibility to compliance risks. Keeping margins low in addition to their already low production costs keeps products extremely cheap for consumers. Additionally, the Asian factories tend to have higher capacities as factories in Pakistan and Bangladesh typically have more than 2,500+ workers, while factories in the UK, Germany, Italy, and France, only have around 64-200 workers. Although Primark uses nearshoring strategies with about 14% of their factories being EU-based, it is doubtful that this percentage will see significant increases as the EU factories are predominately used for replenishment orders or more time-sensitive fashion products. Meanwhile, Asian factories are able to fulfil volume sourcing orders much more cheaply and quickly due to their capacity, keeping prices low and quantities high. This is the model that has been working for Primark and it does not seem like the company is open to change or new strategies as exemplified by their refusal to jump on the e-commerce bandwagon. It is also not evident based on these videos and the data that they are changing their sourcing strategies due to UFLPA.

Primemark is not the most relevant retailer in the US, thus I am not so familiar with their business and sourcing structures. I found much of what they state they do interesting knowing that Primark can still be considered fast fashion. Though their sourcing aligns with fast fashion practices. As stated Primark opts not to own any factories but relies on contracted ones. The brand’s global sourcing network spans 883 contracted factories across 26 countries, with a notable emphasis on Asia, constituting 85.5% of its network. This reflects the region’s production capacity and diverse sourcing factors, including cost, speed to market, and compliance. The near-shoring strategy Primark practices especially within the EU, where 14% of contracted garment factories are based really allows Primark to balance the benefits of speed within the European region. This really allows Primark to emphasize their fast fashion structure and may be a reason as to why they are so succesful as a brick-and-motar structure. In all, Primark’s global sourcing strategy is interesting and can be characterized by diversity, and a nuanced approach to factory size and specialization based on geographical considerations. This comprehensive approach reflects the brand’s commitment to fulfilling consumer needs in the dynamic landscape of apparel sourcing.

What immediately stands out about Primark’s business model is the fact that they choose to only sell clothing using brick and mortar stores, which is incredibly unique for current fast fashion companies around the world. This method, although appears to be counterproductive in a time in which technology and e-commerce is so pertinent, has proven to be extremely productive for the company. I believe their decision to solely sell clothing through stores has further allowed them to price their items are such low points. Because Primark does not have to think about spending money to fund the logistics that come with e-commerce, they’re able to spend more on charging less for their products.

The unique sourcing strategy of Primark includes nearshoring while also sourcing out Asian countries. Their strategy utilizes each sourcing destination for different products or reasons. For example, most factories in Bangladesh and Pakistan have more than 1500 workers per factory, while less than 100 in China. This is not usual for the US but is seen in many EU countries’ sourcing strategies. This allows Primark to capitalize on each product by having it manufactured in the country best for its characteristics. For example, the large factories in Bangladesh have orders that are for mass manufacturing, while the China factories are used for flexibility. I visited Primark at King of Prussia a couple of years ago and was surprised that they did not have an e-commerce website. Learning more about it in this article helps connect the brand’s success and how they can have brick-and-mortar stores without an e-commerce site.

It is very fascinating and refreshing to see a big fast fashion company take a stance on not providing online retailing and only providing brick-and-mortar in-person shopping experiences that don’t push consumers for their store to constantly purchase with the ease of a click of a button they have to go in person to get what they want instead. Because of this shift, they were able to make money that they would be losing in shipping and selling goods online and spend it on their sourcing.

Primark uniquely contracts factories all over the world rather than owning and vertically integrating their company to own every step of their production process. They use the benefits of Asian countries for their capacity, speed, and flexibility but also use nearshoring of Western European countries for time-sensitive items. Because they are able to keep their production costs low, they are able to remain very competitive against other retailers that provide online retailing. Due to Primark diverse range of suppliers and manufacturers, they are able to provide their customers with low priced products in their stores.

How does Primark ensure transparency and ethical business practices if they are a fast-fashion company that requires their products to be made in mass quantities and quickly?

If Primark is planning to source a lot of its goods from countries such as Bangladesh, Myanmar, Tunisia, etc. it should invest resources to improve working conditions and provide resources.

What really stood out to me about the discussion of Primark’s sourcing for apparel is that they focus on 14% of the sourcing with near-shoring sourcing with EU and offshoring with Bangladesh and China. This explains why Primark has been a successful retailer because they are diverse with their globalization from sourcing from 883 factories and 26 different countries. They are successful with this sourcing strategy also because this allows them to receive items efficiently and in bulk, while still getting quality products from EU.

I found Primark to have unique aspects on apparel sourcing strategies. For one, they strategically participate in both sourcing from countries in Asia and nearshoring. This allows them to use both destinations in the most beneficial way for them. With this being said, the majority of Primark’s garment factories are in Bangladesh and have over 1,000 employers. Primark only has less than 50% of their garment factories in China, employing less than 100 people. This could imply that Primark utilizes China and Bangladesh for different reasons, China could be used for their complaisance with more of a variety of different garments/ items- just in smaller orders whereas Bangladesh could be cheaper for more of the less complex garments/items.

Primark sources all of its apparel and related products from 883 different contracted factories in several different countries, which means those factories have to meet internationally recognized standards before they receive their initial sourcing order. Primark’s main sourcing strategy is near-shoring from within the EU, being that 14% of their apparel factories were EU-based. Sourcing from Asia-based countries plays a pivotal role in the success of their business because using China as their main apparel sourcing base means low cost, greater flexibility, large quantities, and faster speed to market for them and their consumers. The only suggestion I have would be greater diversification of their supply chain, mainly to derisk the company in case anything goes wrong.

Primark’s sourcing strategy stands out for its reliance on contracted factories, predominantly in Asia, which offer cost efficiency, high production capacity, and flexibility. Larger factories in countries like Bangladesh and Pakistan handle bulk orders, while smaller factories in China focus on more agile, smaller-scale production. Near-shoring from the EU adds responsiveness for replenishment and trend-driven items. To enhance its strategy, Primark could diversify beyond Asia to reduce risks, increase transparency in its audits, and scale sustainability initiatives like using recycled materials.