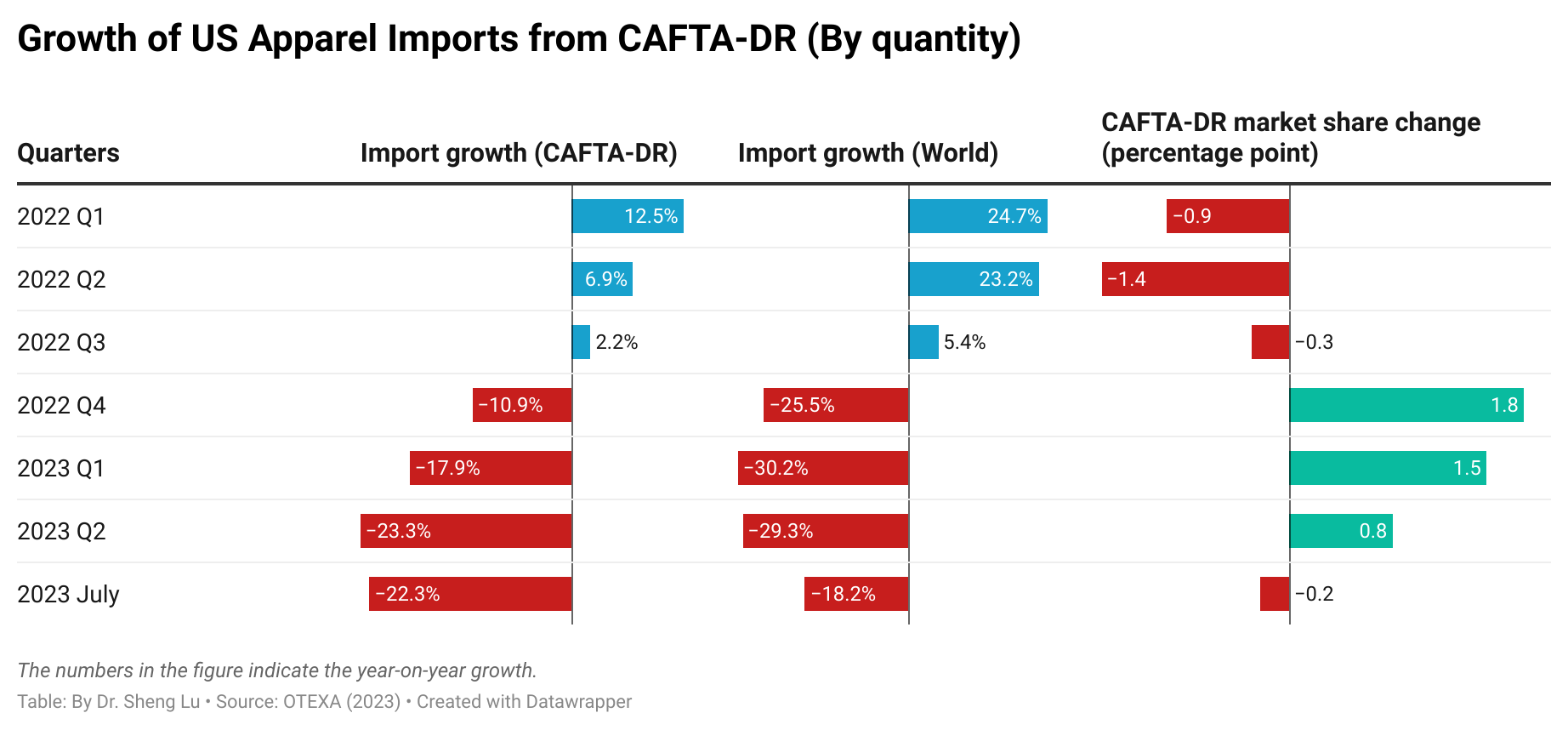

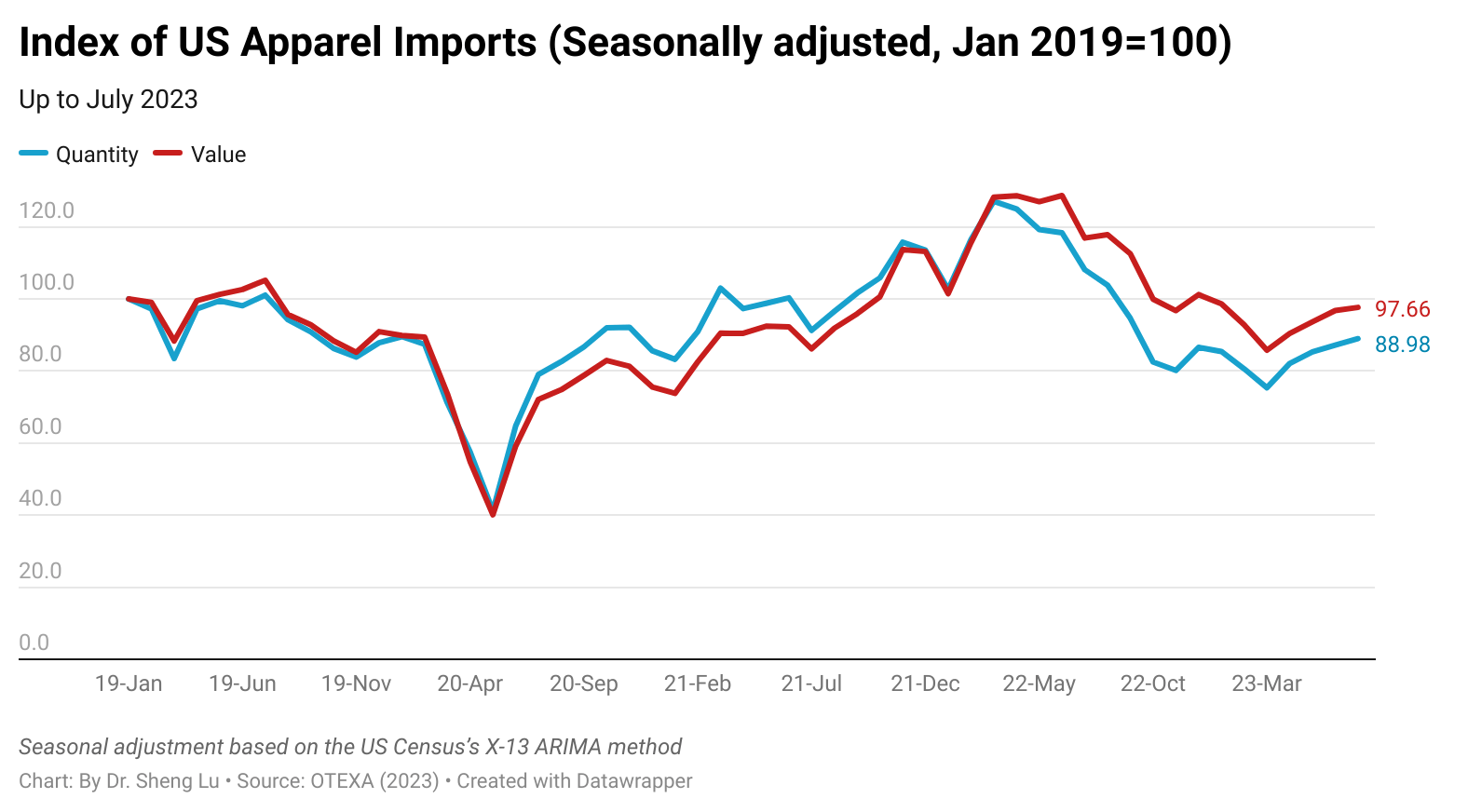

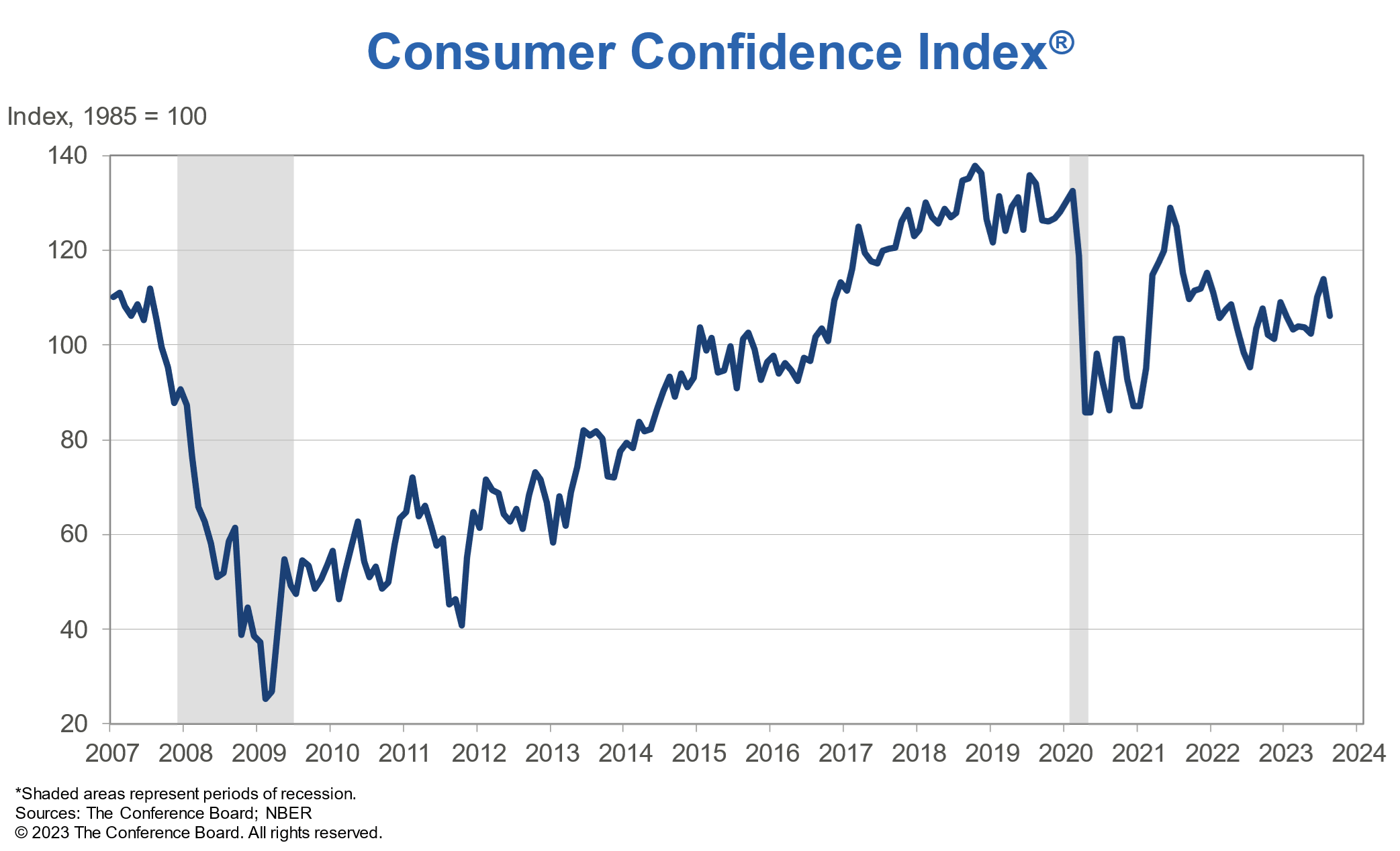

First, while US apparel imports gradually recovered, the import demand remained weak overall. For example, US apparel imports in July 2023 increased by 0.9% in value and 2% in quantity from June (seasonally adjusted). However, the trade volume still experienced a decrease of approximately 17-18% compared to the previous year. Meanwhile, the US consumer confidence index fell again in August 2023, suggesting the economic uncertainties are far from over. Notably, so far in 2023 (January to July), US apparel imports decreased by 22.3% in value and 28% in quantity from the previous year, the worst performance since the pandemic.

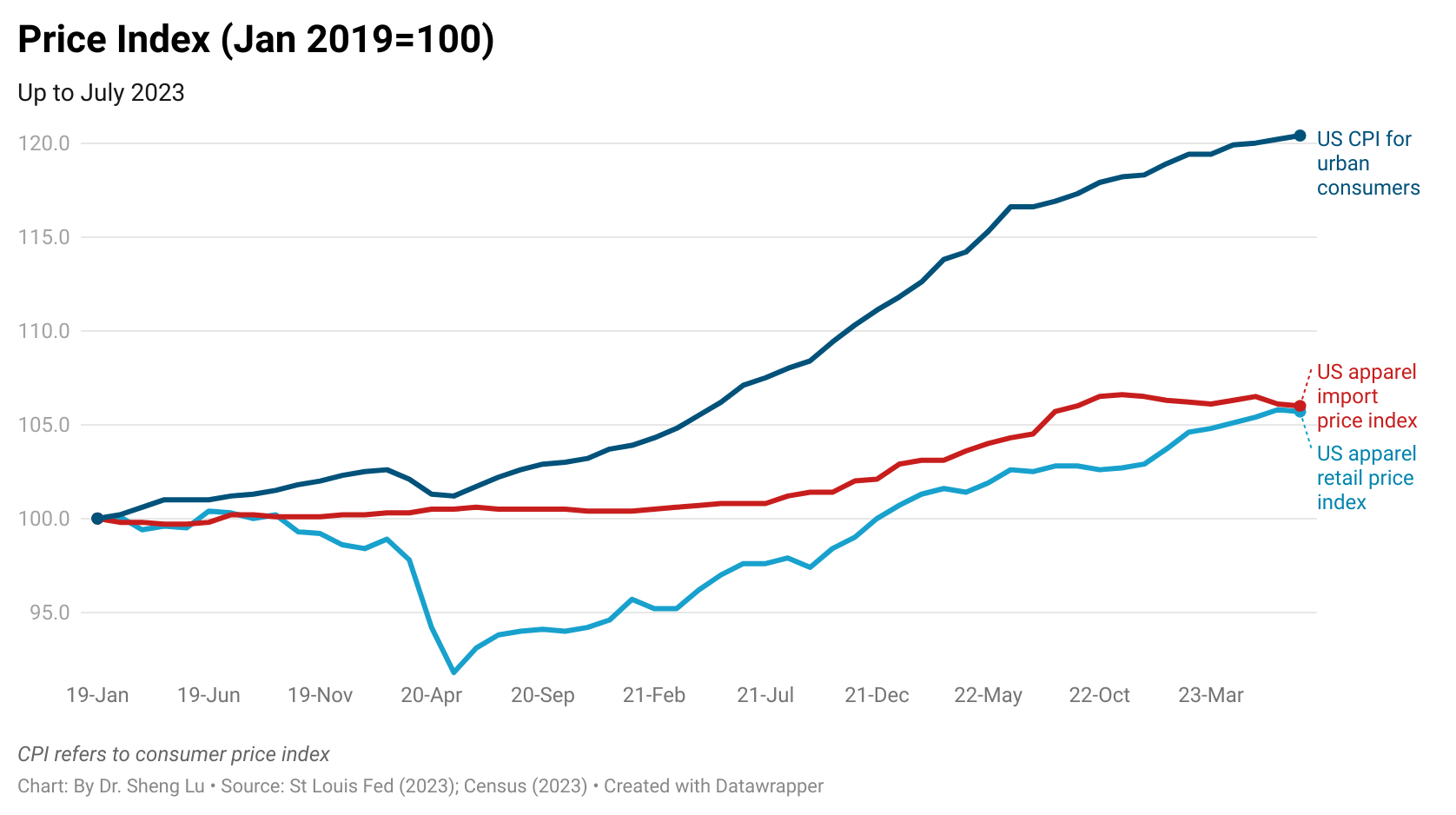

As a silver lining, the price of US apparel imports has stabilized, although inflation remains an issue for the US economy.

Secondly, because of the seasonal pattern, Asian countries were able to capture relatively higher market shares since June. For example, measured in value, China, ASEAN, and Bangladesh accounted for over 64% of total US apparel imports in July 2023, a notable increase from 61% in June and 58% in May 2023.

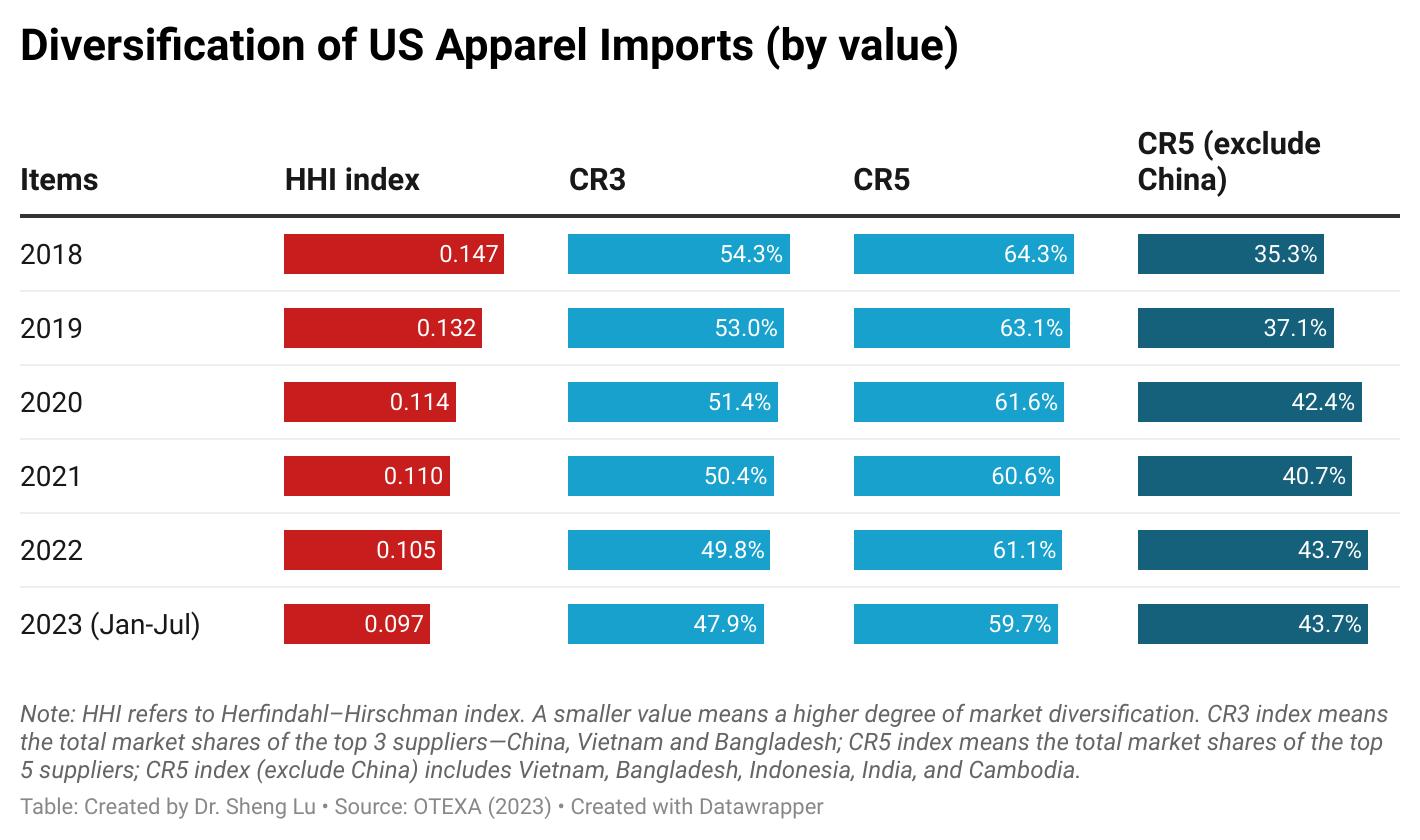

Nevertheless, US fashion companies continue diversifying their sourcing base to mitigate various supply chain risks and rising geopolitical tensions. For example, the HHI Index for US apparel imports dropped to 0.097 in the first seven months of 2023, which is lower than the 0.106 recorded in the same period the previous year (January to July 2022), indicating a greater diversity in the sources of imports.

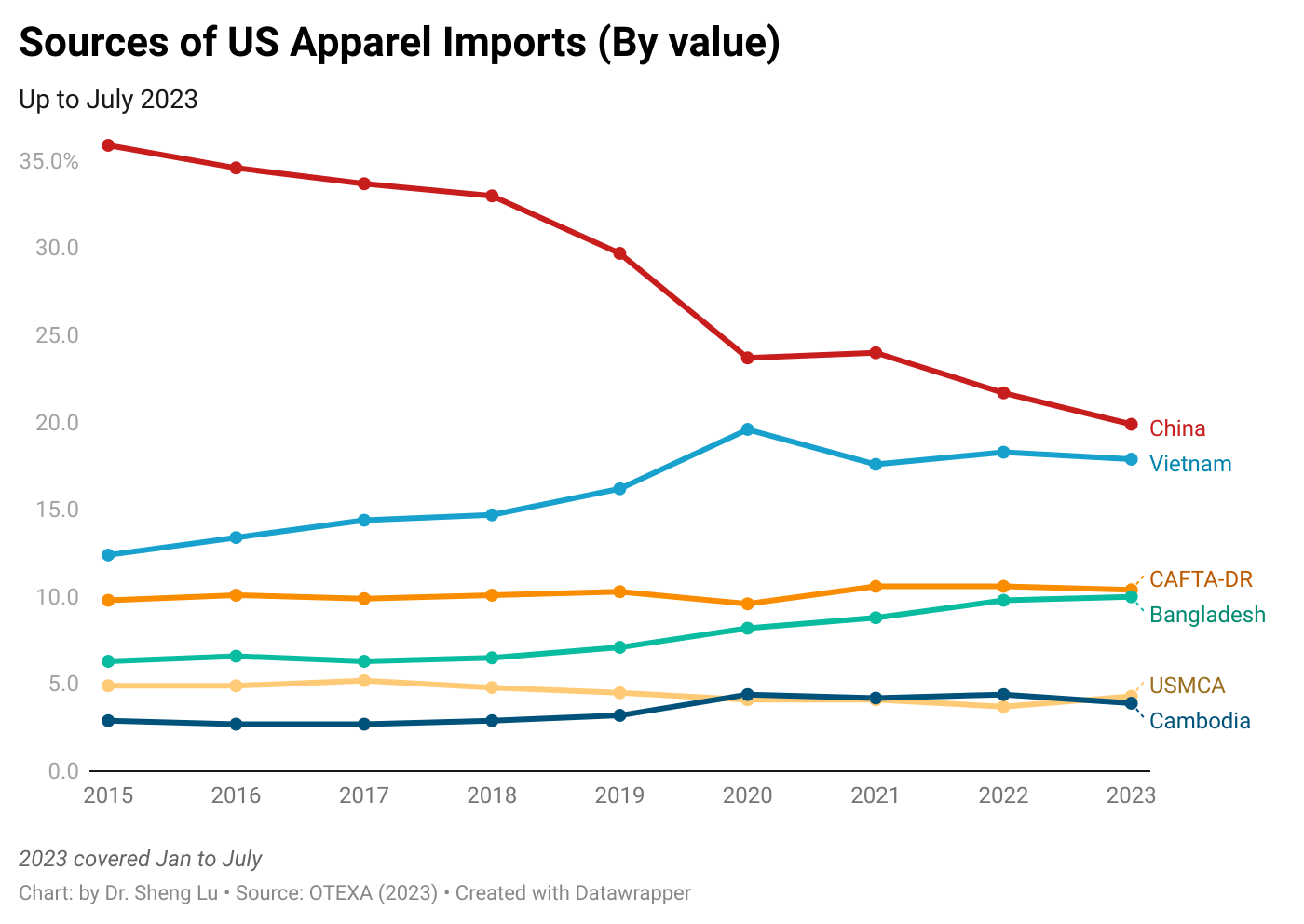

Third, despite an apparent rebound in exports to the US, China continued to experience a further decline in its market share. For instance, in July 2023, China’s market share was more than 3 percentage points lower in value (27.2% in July 2022 vs. 24.1% in July 2023) and 2.5 percentage points lower in quantity (43.1% in July 2022 vs. 40.6% in July 2023). This marked the worst performance since April 2023. In other words, consistent with recent industry surveys, US fashion companies continue to reduce their China exposure given the adverse business environment.

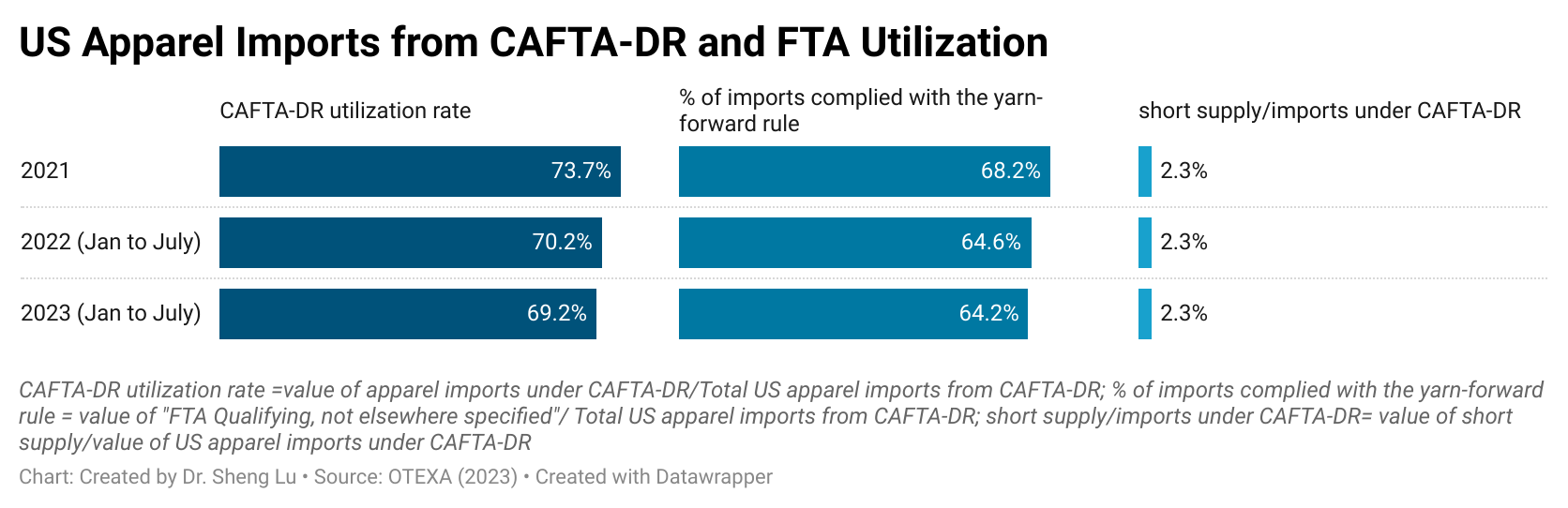

Fourth, the latest data suggests that US apparel imports from CAFTA-DR members remain stagnant, and some critical problems, such as the underutilization of the agreement, even worsened. For example, about 9.5% of US apparel imports in value and 8.5% in quantity came from CAFTA-DR members in July 2023, lower than 10.2% and 9.0% in the previous year (i.e., July 2022). In absolute terms, US apparel imports from CAFTA-DR in 2023 were about 20% lower than in 2022.

Additionally, CAFTA-DR’s utilization rate (i.e., the value of imports claiming the duty-free benefits under CAFTA-DR divided by the total value of imports from CAFTA-DR) fell from 70.2% in 2022 (Jan to July) to a new low of 69.2% in 2023 (Jan to July). Likewise, the value of imports utilizing CAFTA-DR’s short supply decreased by more than 20%. Thus, how to leverage CAFTA-DR to meaningfully encourage more US apparel imports from the region, particularly in light of US fashion companies’ eagerness to reduce their exposure to China, calls for sustained efforts and probably new strategies.

by Sheng Lu

It is possible that companies might not be fully utilizing the duty free benefits due to challenges in meeting the rules of origins that are outlined by the existing CAFTA-DR. Making CAFTA-DR’s apparel-specific rules of origin less restrictive could offer benefits such as leveraging duty-free benefits, sourcing diversification, and enhancing competitiveness. Many companies want to take advantage of duty free benefits when importing apparel from CAFTA-DR, but face barriers because the region does not have the right fabrics. Making the rules of origin less restrictive could make it easier for companies to claim these benefits and reduce costs. CAFTA-DR members also have certain strengths, such as their production of basic items like T-shirts, which should be taken advantage of. By making rules less restrictive, companies may be encouraged to source a wider range of products from the region and diversify their supply chains. Finally, by allowing companies to use more products from CAFTA-DR, it may help improve the competitiveness of the region’s apparel production and exports because it would allow for more varied and sophisticated products to be made in the region. At this time, the biggest threat to CAFTA-DR is Asian manufacturers. Asian countries have leverage to produce a diverse range of textile and apparel products, from basic to high-end that US companies are looking for. Asian manufacturers’ biggest concern is really about improving and maintaining ethical labor practices and ensuring safe working conditions for their employees. While demand for “Made in China” is decreasing, it does not mean suppliers are leaving Asia altogether. Ongoing global geopolitical shifts are influencing supply chain dynamics, leading to diversification in sourcing locations within Asia to mitigate risks. US companies are divesting from China manufacturers and sourcing from Bangladesh instead because of the tumultuous political standings between the US and China. Bangladesh is becoming the newest threat for the CAFTA-DR region because there low wages and large labor count outweighs the duty-free benefits. By making adjustments to the rules of origin of CAFTA-DR and making it less restrictive, I think the US will see more companies utilizing the free trade agreement and less sourcing from Asia.

First key take-way from this article and overview is that US fashion companies are facing a strategic dilemma. On the one hand, due to geopolitical and commercial concerns, there is an ongoing drive to diversify sourcing bases and minimize exposure to China. However, there is a problem with the weak demand and difficulties in some alternative sourcing regions. Fashion businesses have to carefully strike a balance between the need to meet customer demands and control costs while managing supply chain risks. This poses interesting questions regarding the best way to strike a balance between cost-effectiveness and risk reduction in a world trade environment that is changing quickly.

The second take away is that the conduction of trade agreement must be challenged. The decline in US apparel imports from CAFTA-DR members raises important questions about the efficacy of trade agreements. The policy may not be having the desired effect, as evidenced by the underutilization of CAFTA-DR and a decline in its utilization rate. Thought-provoking questions might center on whether the agreements in place are doing enough to encourage more imports, and if not, what changes or creative approaches might make them more successful in fostering a diverse supply chain for the US apparel industry. This problem applies to many patterns with the US and trading relationships such as the 301 section tariffs, another agreement that is not causing real change.

I am surprised that CAFTA-DR imports have decreased in the last year, even though US brands have started decreasing importing from China. These orders have been taken over by other Asian countries, such as Vietnam. Apparel imports from CAFTA-DR shrunk by 20% from 2022 to 2023, which is a shocking statistic. This could be due to the fact that infrastructure in CAFTA-DR region still needs to be build up. Even though we have seen billions invested into the region in recent years, it takes years to build the factories, employ workers, and become efficient. Also, CAFTA-DR factories cannot make complex apparel yet because the industry is new to the region. Asian countries have more developed apparel production systems, and CAFTA-DR is still catching up. Vietnam has very developed and complex technology. Also, CAFTA-DR benefits can be hard to understand, and there are so many regulations regarding yard-forward rules of origin. Some brands are more likely to pay a little bit extra for products from Asia, rather than dealing with all the legalities that come with CAFTA-DR products.

One key takeaway that immediately caught my attention was the performance of trade in the CAFTA-DR region. This region has experienced a decrease in trade over the past year. This decrease is surprising to me as there has been a greater push for manufacturing in the Western Hemisphere, especially in the CAFTA-DR region. The region’s manufacturing facilities are also not being fully utilized, which may be due to high costs or outdated machinery. Another key takeaway that I discovered was the decrease of demand for trade from China. China has always been a powerhouse for manufacturing by US retailers, and the decrease may be due to the Section 301 act and the additional tariffs on imports from China.

I found it shocking that apparel imports decreased in value 22.3% this past year which was the worst performance since the pandemic. One possible explanation could be the ongoing need for infrastructure development in the CAFTA-DR region. Additionally, the CAFTA-DR region’s factories are not yet equipped for the production of complex apparel, as the industry is relatively new. In contrast, Asian countries boast more advanced apparel production systems, putting CAFTA-DR in a catch-up phase.

I find it somewhat concerning that the value of US apparel imports from the CAFTA-DR regions is only 9.5% and this number has been fairly stagnant over the past few years. Even though apparel imports from China have decreased, we are now seeing fashion brands utilize other Asian countries a means for sourcing, such as Bangladesh and Vietnam. I do not think we will see an increase in utilization of CAFTA-DR within the next few years. As the article mentioned, a new strategy must be taken to incentivize US fashion brands to source from CAFTA-DR regions but is hard to think of a new strategy that does not have to do with lowering costs or making the FTA agreements less restrictive. I also believe that the Section 301 tariffs are essentially ineffective if there is no increase in apparel imports from CAFTA-DR. It will be interesting to see if the US government will further implement punitive tariffs to limit apparel imports from Asia as a whole in order to promote this FTA.

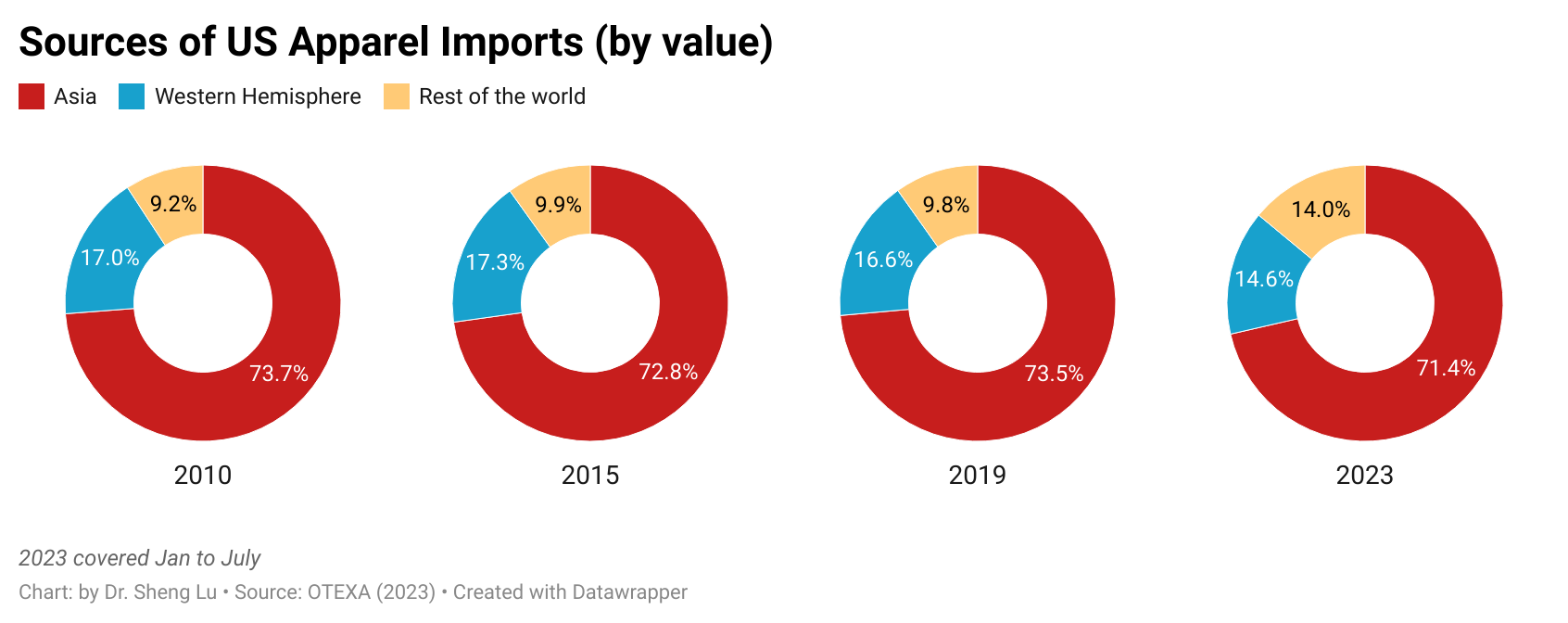

I find it interesting how the US free trade agreements (USMCA and CAFTA-DR) are the only stagnant sources of US apparel imports while Asian countries like Bangladesh, Vietnam, and Cambodia have various positive increments throughout. In addition, fewer Western Hemisphere countries are utilized in 2023 than in 2010. It is meaningful for US fashion companies to seek out more free trade agreements and practice nearshoring. However, it will be tricky to get to this position due to established reliance and sought characteristics that Western Hemisphere countries do not share. After learning how difficult negotiating and amending free-trade agreements are, I do not know how US companies will get here.

In 2010, the US apparel imports sourced from the Western Hemisphere made up 17.0%. However, in 2023 that percentage has gone down to 14.6%. Yet, apparel imports from Asia also decreased by 2.3% to 71.4% in 2023. If apparel would move offshore, it would likely go to Asia which has not been the case as the rest of the world grew in its apparel importing percentage for the US. I am surprised that with CAFTA-DR in place, more companies are looking to source elsewhere that is not nearshore or even Asia. With duty-free opportunities and production with CAFTA-DR, I wonder why its utilization rate has dropped to a low of 69.2% this past year. All in all, I am curious of where companies are sourcing from in the rest of the world and what benefits those sourcing locations provide them that can not be done in the Western Hemisphere with CAFTA-DR and USMCA.

I find it interesting how the US apparel imports decreased so dramatically from the previous year. A whopping decrease of 22.3% in value and 28% in quantity. This is said to be some of the worst numbers and I feel like we should be working back up after so much time has passed since the pandemic. However, it is great to see the diversification of these imports to the US. China, Bangladesh, and ASEAN countries were said to total 64% of US total imports. China’s market share is continuing to decrease as shown in the Sources of US Apparel Imports chart and Vietnam is a close second. Also, the CAFTA-DR imports have decreased by 20% since last year. I find this strange because they have shown stagnant numbers for a while but with companies choosing to source from ASEAN countries recently, I can see why this may cause that decline. I think it would be great for diversity purposes to not just focus on sourcing from other Asian countries but from South American countries as well.

I found this article to be very relevant to what we just discussed in class. We understand that US fashion companies want to continue to diversify their sourcing base in order to hopefully lessen the risks supply chains put onto them. In turn this inevitably causes the rise of geopolitical tensions, more specifically with China. This has been causing a decrease in the level of demand for trade from China to the US, which is not something China is used to. Tying in our in class case study #2 discussion, this decrease of demand is now additionally due to the added costs put onto tariffs towards imports from China as well as the Section 301 act (put in place by the US).

This article reminded me of the class discussion about the section 301 act. I would recommend to Biden to limit the section 301 tariff against China because the relationship between the US and China is that it is becoming more costly for the US to have imported goods coming from China This also causes more consumers to pay more for a product that is lower quality. Limiting these tariffs can also lower the big issue with inflation right now, which a lot of people are facing after the pandemic. It seems that now the US is being affected economically by these tariffs and losing money with trading being more costly and should focus on imports in the Western Hempisphere. However, I believe even though limiting imports from China would also give the US textile industry to become more competitive and trade with other global suppliers, it is more unlikely because China is the leading and more affordable textile supplier.