Reading material

- Part 1: Where Textile Mills Thrived, Remnants Battle for Survival [New York Times | January 2024]

- Part 2: What you need to know about Section 321 (short video; RT≠endorsement)

- Part 3: Additional notes (below)

How the “de minimis” rule (also referred to as Section 321 imports)* might change will be a critical issue to watch in 2024. Under US customs law, specifically the Trade Facilitation and Trade Enforcement Act of 2015, import duties are generally waived for goods valued at $800 or less per person per day, marking an increase from the previous de minimis threshold of $200.

Generally, the reasons for raising the de minimis threshold include: 1) facilitating the clearance of low-value packages and supporting the e-commerce industry (e.g., small-value shipments from online shopping and e-commerce). 2) allowing customs agencies to focus their limited resources on higher-value and higher-risk shipments; 3) lowering compliance and importing costs for importers, especially small businesses.

However, some stakeholders are increasingly concerned about the “de minimis” as a loophole in practice. For example, US textile industry representatives argued that the rule “providing a backdoor to Chinese goods produced with forced labor. The loophole has not only fueled the rise of imports from foreign e-commerce companies and mass distributors, but it has also put our domestic manufacturers and workers at a competitive disadvantage.”

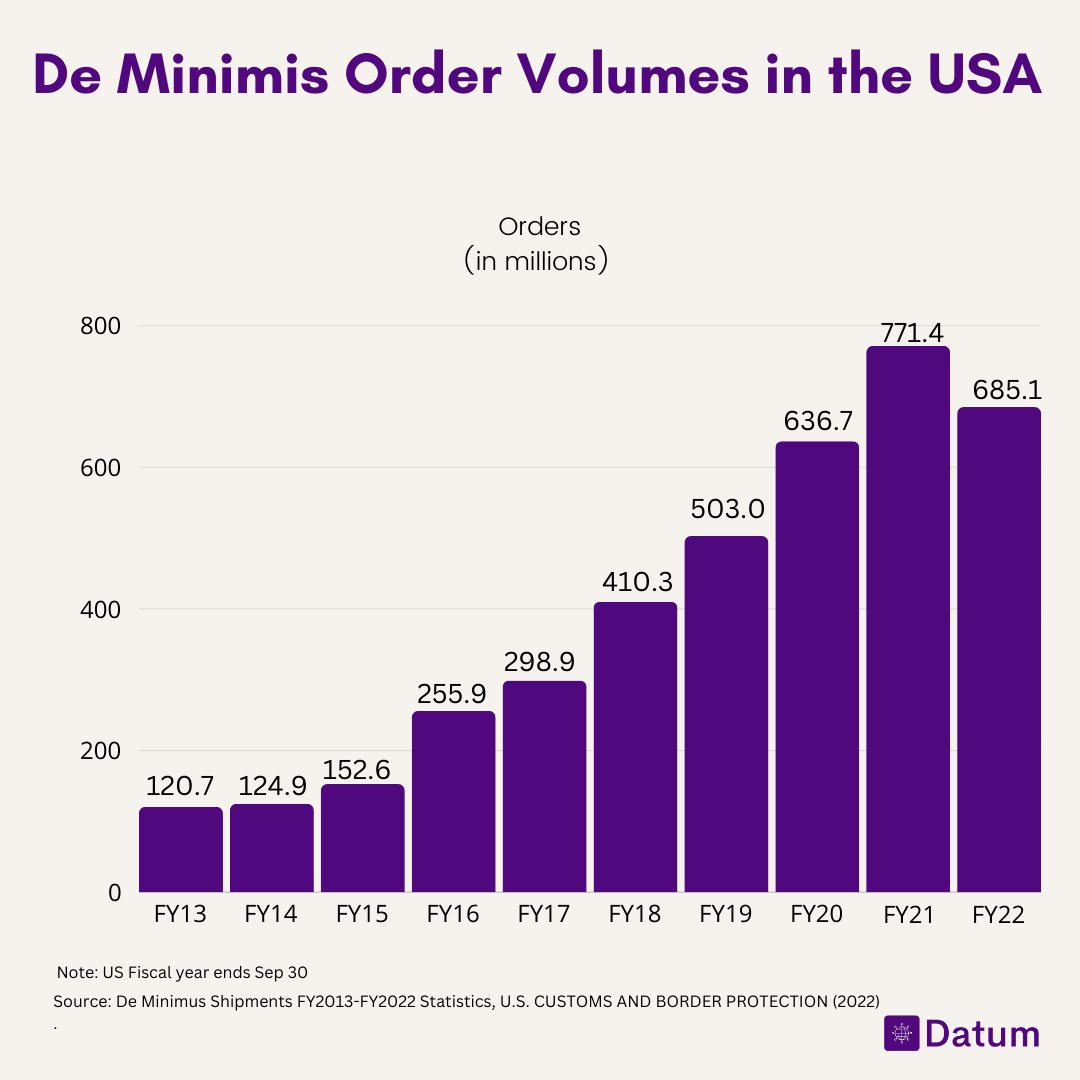

According to CBP’s statistics, the volume and value of U.S. de minimis imports have been surging in recent years, particularly with the booming of e-commerce.

While reforming the “de minimis” rule is likely, its outlook remains uncertain.

- The “de minimis” rule can only be changed through actions by US Congress. Several bills (e.g., Import Security and Fairness Act and De Minimis Reciprocity Act of 2023) have been introduced recently, calling for lowering the de minimis thresholds or closing the “loophole” to keep shipping from specific countries like China from taking advantage of the benefits. However, the election-year politics, a divided Congress, and their already packed agenda will make the legislative process challenging. That being said, tactically, Congress might include reform of the “de minimis” rule as part of a broader trade package in the future.

- Not everyone agrees on how to reform the “de minimis.” For example, while some legislation favors lowering the threshold, others prioritize excluding non-market economies like China to benefit from the rule. Furthermore, US e-commerce businesses and influential logistics companies that benefit from the de minimis rule may oppose attempts to revoke the benefits they currently enjoy.

- As “de minimis” shipments were exempted from CBP review, it also means that policymakers could lack sufficient data to support potential rule changes and evaluate the impacts. For example, while there is suspicion that companies like Shein and Temu exploited the de minimis rule or even that imports containing forced labor did so, it is challenging to present accurate and reliable data to understand their impacts. Thus, data collection “homework”, such as CBP’s section 321 data pilot program, will be necessary for meaningful discussions on reforming the de minimus rule.

- *Section 321 refers to a part of U.S. law (19 U.S.C. § 1321) that allows duty-free entry of goods valued at $800 or less per shipment, per day, from foreign suppliers to U.S. customers. This is often called the de minimis exemption. Entry Type 86 is one method for filing Section 321 de minimis entries electronically through U.S. Customs and Border Protection (CBP). Entry Type 86 was initially launched as a pilot test by U.S. Customs and Border Protection (CBP) in September 2019.

Discussion questions:

#1: Please assess the arguments presented in the NY Times article regarding the de minimis rule’s impact on US textile and apparel manufacturers. What evidence or examples support their claims?

#2: Consider the defenders of the de minimis rule who argue that it does not harm the competitiveness of the US textile and apparel industry. What counterarguments and supporting evidence could they present?

#3: What additional information can help us better understand the trade impact of de minimis rules?

#4: Do you support eliminating or lowering the de minimis threshold? Why or why not?

[Instructions: For students in FASH455, please address at least two of the questions above. Additionally, feel free to share any other thoughts on the debates and resources you found relevant and informative.]