Reading material

- Part 1: Where Textile Mills Thrived, Remnants Battle for Survival [New York Times | January 2024]

- Part 2: What you need to know about Section 321 (short video; RT≠endorsement)

- Part 3: Additional notes (below)

How the “de minimis” rule (also referred to as Section 321 imports)* might change will be a critical issue to watch in 2024. Under US customs law, specifically the Trade Facilitation and Trade Enforcement Act of 2015, import duties are generally waived for goods valued at $800 or less per person per day, marking an increase from the previous de minimis threshold of $200.

Generally, the reasons for raising the de minimis threshold include: 1) facilitating the clearance of low-value packages and supporting the e-commerce industry (e.g., small-value shipments from online shopping and e-commerce). 2) allowing customs agencies to focus their limited resources on higher-value and higher-risk shipments; 3) lowering compliance and importing costs for importers, especially small businesses.

However, some stakeholders are increasingly concerned about the “de minimis” as a loophole in practice. For example, US textile industry representatives argued that the rule “providing a backdoor to Chinese goods produced with forced labor. The loophole has not only fueled the rise of imports from foreign e-commerce companies and mass distributors, but it has also put our domestic manufacturers and workers at a competitive disadvantage.”

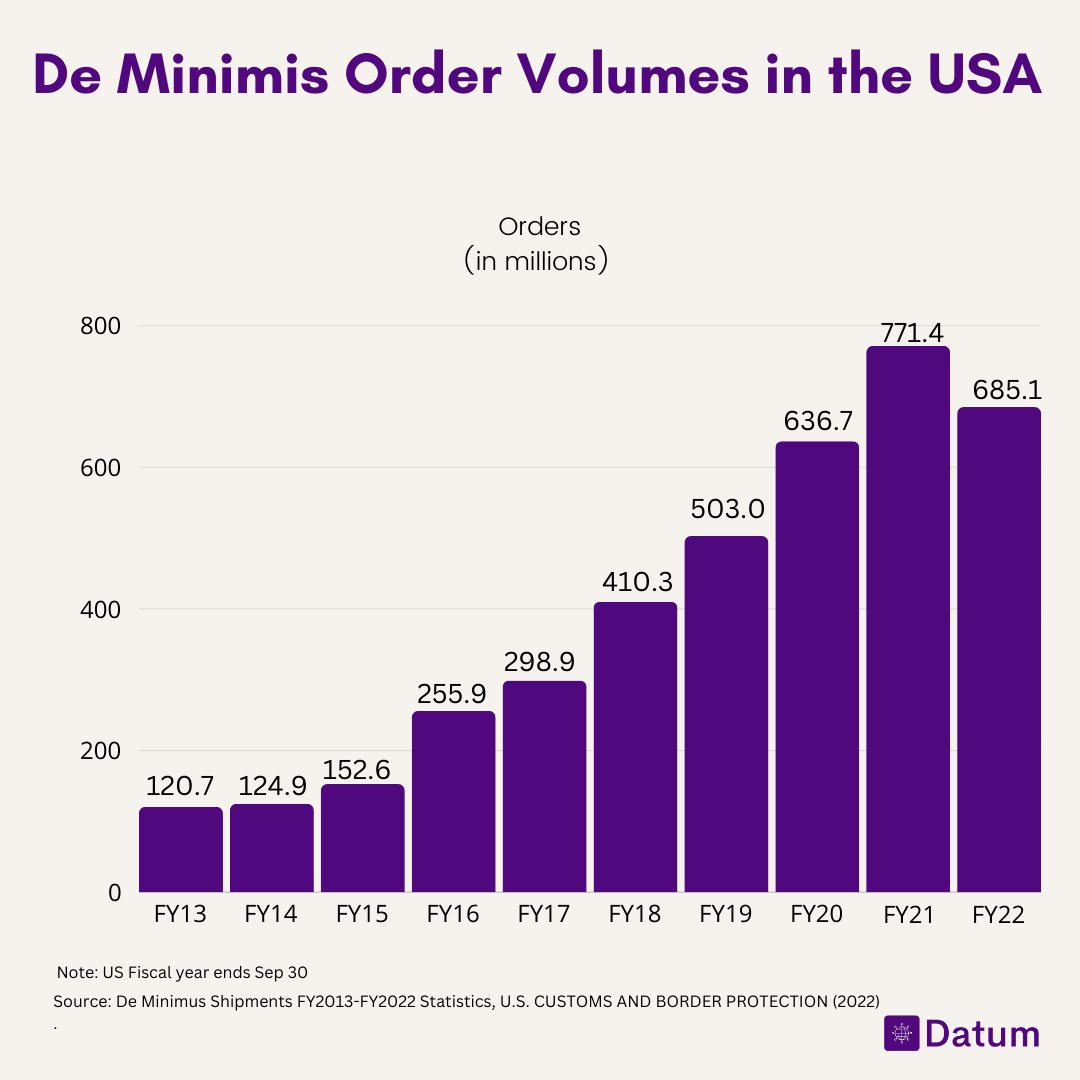

According to CBP’s statistics, the volume and value of U.S. de minimis imports have been surging in recent years, particularly with the booming of e-commerce.

While reforming the “de minimis” rule is likely, its outlook remains uncertain.

- The “de minimis” rule can only be changed through actions by US Congress. Several bills (e.g., Import Security and Fairness Act and De Minimis Reciprocity Act of 2023) have been introduced recently, calling for lowering the de minimis thresholds or closing the “loophole” to keep shipping from specific countries like China from taking advantage of the benefits. However, the election-year politics, a divided Congress, and their already packed agenda will make the legislative process challenging. That being said, tactically, Congress might include reform of the “de minimis” rule as part of a broader trade package in the future.

- Not everyone agrees on how to reform the “de minimis.” For example, while some legislation favors lowering the threshold, others prioritize excluding non-market economies like China to benefit from the rule. Furthermore, US e-commerce businesses and influential logistics companies that benefit from the de minimis rule may oppose attempts to revoke the benefits they currently enjoy.

- As “de minimis” shipments were exempted from CBP review, it also means that policymakers could lack sufficient data to support potential rule changes and evaluate the impacts. For example, while there is suspicion that companies like Shein and Temu exploited the de minimis rule or even that imports containing forced labor did so, it is challenging to present accurate and reliable data to understand their impacts. Thus, data collection “homework”, such as CBP’s section 321 data pilot program, will be necessary for meaningful discussions on reforming the de minimus rule.

- *Section 321 refers to a part of U.S. law (19 U.S.C. § 1321) that allows duty-free entry of goods valued at $800 or less per shipment, per day, from foreign suppliers to U.S. customers. This is often called the de minimis exemption. Entry Type 86 is one method for filing Section 321 de minimis entries electronically through U.S. Customs and Border Protection (CBP). Entry Type 86 was initially launched as a pilot test by U.S. Customs and Border Protection (CBP) in September 2019.

Discussion questions:

#1: Please assess the arguments presented in the NY Times article regarding the de minimis rule’s impact on US textile and apparel manufacturers. What evidence or examples support their claims?

#2: Consider the defenders of the de minimis rule who argue that it does not harm the competitiveness of the US textile and apparel industry. What counterarguments and supporting evidence could they present?

#3: What additional information can help us better understand the trade impact of de minimis rules?

#4: Do you support eliminating or lowering the de minimis threshold? Why or why not?

[Instructions: For students in FASH455, please address at least two of the questions above. Additionally, feel free to share any other thoughts on the debates and resources you found relevant and informative.]

This was a very interesting article to read because I recently just read an article by The NY Times about the loophole in the De Minimis Rule. As mentioned in this article it is very interesting how the De Minimis is used as a loophole for Chinese goods made with forced labor. This is a very relevant issue as the new information about the Uyghur people being in forced labor has now become more prominent and resurfaced. I think it is interesting that some legislators want to raise the De minimis rule and some want to exclude certain countries such as China from benefitting from this. I am not quite sure if raising the de minims by a few hundred, as they did last time, will have a great impact on the amount of exporting entering the US through this rule. I think this is one of the Legislative issues I will be continuing to watch in the next few months as presidency could change and new geopolitical issues arise.

#3: What additional information can help us better understand the trade impact of de minimis rules?

I believe that large retailer’s data from before and after the de minimis rule could help us farther understand its impacts. During the panel in class Zoom meeting, retailers from PVH, Walmart, and GAP each complained about its affects on their companies. I believe that their data about how they have been affected can provide lawmakers with a viable reason to lower the de minimis threshhold, especially in controversial locations such as China.

#4: Do you support eliminating or lowering the de minimis threshold? Why or why not?

Personally, I am in support of lowering the de minimis threshold. Many fast fashion and e-commerce retailers do not source ethically and utilize these loopholes to enhance their demand. I would like to see fashion shift away from these retailers and back to the name brand companies. I think that lawmakers should prioritize their US fashion retailers who have established a presence in the industry and have an obligation to protect them from the harmful effects of the de minimis loophole.

To answer #4, and as Gabriella mentioned above, I am also in support of an adjustment to the de minimus threshold to conserve the competitiveness of US T&A manufacturers. While the current rule has loopholes and fairness is undermined, items made with poor labor conditions enter the US duty-free. If the threshold is lowered, this loophole can be better regulated and help even out the competitive playing field among manufacturing countries.

4. I also support lowering the de minimis threshold. Brands already feel under economic threat with the tariffs and the de minimis loophole that allows countries, like China, to engage in duty free shipments. They’re competing with brands like Temu or Shein who take advantage of cheap labor and evade taxes on their shipments, which is unfair and gives these brands an unfair competitive advantage when it comes to trade. By lowering the de minimis loophole, it gives NAFTA-based manufacturers a better advantage at the global economic market.

#3. To try to better understand the trade impact of de minimis rules, I decided to dive into another article. Investigating this article emphasized the fact that there is a lack of data on the minimis shipments which makes it very difficult to understand its full effects. The article I found, “When Pennies Become Thousands of Dollars”, specifically made it clear that data is needed on the types of goods, its volume and the value in which is entering the U.S. It is also crucial to know where the goods are coming from. All of this information would allow policymakers to evaluate the rule’s impact on consumer behaviors and trade patterns. Without this data, it is extremely difficult to determine how effective reforms and policy decisions on the minimis rule would be.

ARTICLE LINK: https://www.honigman.com/Employers-Wage-and-Hour-Advisor/when-pennies-become-thousands-of-dollars-are-courts-eroding

#4. I support lowering the de minimis threshold because I believe that companies can, will, and currently are taking advantage of it to maximize their profits with unfair labor and environmental practices. The de minimis rule allows goods valued under $800 to enter the U.S. duty-free which can incentivize retailers to try to source cheaper goods from overseas. These are often countries with less stringent labor and environmental regulations. While many supporters argue that the rule creates trade for small businesses, others argue that it undermines competitiveness. Personally, based on discussions in class and my knowledge, it is clear that capital and consumer demand runs the industry. There are many in the industry that are willing to advantage of rules such as the minimis to capitalize on both, in turn harming many within the industry. It is our job to find the perfect balance for the minimis threshold to deter these practices, in which I believe is lower than $800.

(1)The de minimis rule has a huge impact on US textile and apparel manufacturers. It creates an unfair competition because it allows foreign e-commerce companies to bypass import duties and undercut domestic producers on price. Examples of this are Shein and Temu which saturate the US market with low-cost products.

(4) The de minimis rule has advantages for e-commerce and small business however its consequences on US textile and apparel manufacturers must be addressed. Either lowering the threshold or enforcing stricter regulations could benefit domestic producers by balancing trade facilitation with labor protections.

#1: Please assess the arguments presented in the NY Times article regarding the de minimis rule’s impact on US textile and apparel manufacturers. What evidence or examples support their claims?

As per the New York Times report, US fashion and apparel businesses have the biggest problem with the effect of the de minimis rule. They are of the opinion that the law has been twisted into a loophole where huge amounts of cheap goods enter the US tariff-free and outside normal customs examination, mostly from online Chinese stores like Shein and Temu. Foreign companies are able to eradicate these expenses entirely, and domestic manufacturers have to adhere to high labor, environmental, and regulatory standards, so it is an asymmetrical playing field. Foreigners’ control over de minimis shipments, as can be seen by the surge on the chart, from 120.7 million in FY2013 to 771.4 million in FY2021, is evidence in their favor. This explosion suggests how the regulation has created the chance for foreign businessmen to use the system for themselves at the expense of American producers and signals the explosive growth in e-commerce. Problems regarding getting in goods manufactured with forced labor are also created on the basis of there not being regulations regarding such imports, and further add to the ethical and competition issues of the US apparel industry.

#4: Do you support eliminating or lowering the de minimis threshold? Why or why not?

In my opinion, the de minimis threshold must be reduced, however, it should not be removed. The $800 threshold is excessive, particularly when compared with other countries’ levels, even if the provision was initially created to expedite customs processing and facilitate e-commerce. This has given foreign big retailers a clear cost advantage over U.S. companies by allowing them to divide shipments and avoid import charges. Restoring the playing field to level competition and increasing the opportunity for customs officials to inspect what is being brought in are two benefits of lowering the threshold. By allowing more room for U.S. Customs and Border Protection to inspect for compliance with forced labor regulations, it would also address national security and labor issues. A full repeal would be harmful to consumers and small businesses that depend on quick, cheap access to foreign merchandise. A multi-level system, with tighter controls on frequent commercial shipments from large suppliers and duty-free on occasional personal shipments, would be a more equitable alternative. The system would plug the loophole in the current system while continuing to preserve the advantages of e-commerce.

#3

Understanding that the de minimis rule has created a loophole of unfair trade and forced labor, it is important to grasp the real statistics of what this is doing to the economy and the people undergoing these harsh working conditions. It is important that we know the origin of these products and where they come from and especially the volume in which they come in. I took a look at the article Gabriella posted about a year ago and found some valid viewpoints however I felt the need to find real statistical proof. https://www.cbp.gov/trade/basic-import-export/e-commerce

In this article it gives you a year by year playback of the numbers that are true to the rule.

#4 My Position on Reforming the Rule

If I had the authority I would hope to lower the de minimis rule. Due to this policy, the world of trade is unfair and makes the ability of registering bad trading habits. It also discounts the other countries that are correctly trading, and while China gets rewarded, other countries are forgotten and not counted for.

Great post! I really appreciate how you explained the details about entry type 86 and its benefits for e-commerce shipments. This customs entry method truly simplifies the import process for low-value goods, making cross-border trade faster and more efficient.