The newly released World Trade Organization statistics and data from the United Nations (UNComtrade) suggest several patterns of China’s textile and clothing exports.

Firstly, while China remained the world’s largest clothing exporter in 2023, rising geopolitical tensions and Western fashion companies’ ongoing de-risking efforts pose increasing challenges to its export outlook.

To some extent, 2023 wasn’t too bad for clothing “Made in China.” In value, China’s clothing exports totaled $164 billion, accounting for 31.6% of the world—unchanged from 2022. While China’s clothing exports decreased by 9.7 percent in 2023 compared to the previous year due to weaker market demand, this performance was better than most other top ten suppliers, including Bangladesh (down 16 percent), Vietnam (down 12 percent), India (down 13 percent), and Indonesia (down 17 percent).

However, China’s clothing exporters face significant challenges ahead. Despite maintaining its overall market share, China is losing momentum in nearly all key Western clothing markets, including the United States, the European Union, the UK, and Canada. This trend is primarily driven by perceived heightened sourcing risks associated with China, ranging from concerns over forced labor in the Xinjiang region to escalating geopolitical tensions involving the country.

For example, according to the 2024 Fashion Industry Benchmarking Study released by the US Fashion Industry Association (USFIA) in July, a record 43 percent of surveyed leading US fashion companies reported sourcing less than 10 percent of their apparel products from China in 2024, compared to only 18 percent in 2018. Likewise, nearly 60 percent of respondents no longer use China as their top apparel supplier in 2024, much higher than the 25-30 percent range before the pandemic. Additionally, nearly 80 percent of respondents plan to further reduce their apparel sourcing from China over the next two years through 2026, citing perceived high sourcing risks as the primary concern.

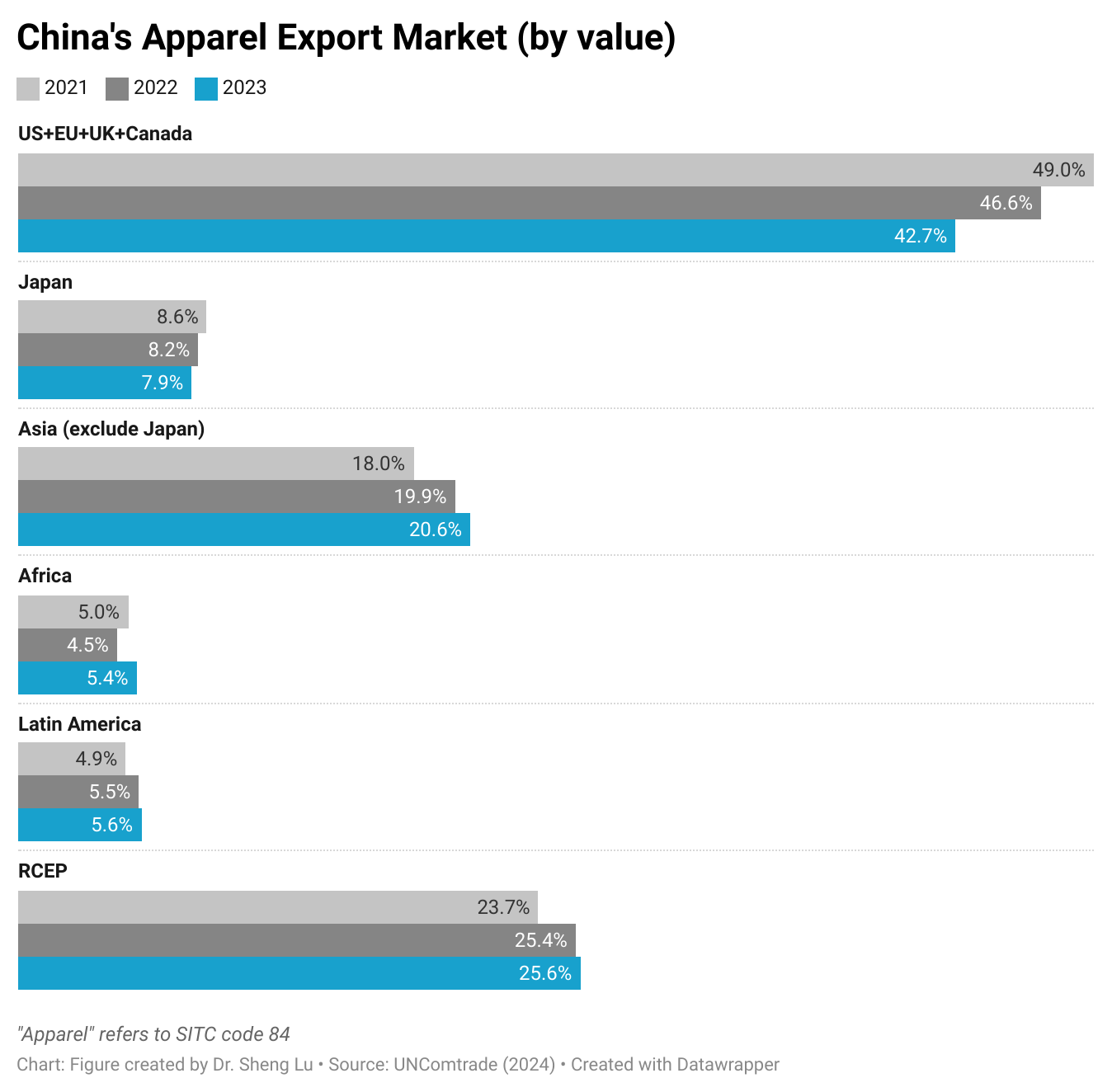

Secondly, China has been diversifying its clothing exports beyond traditional Western markets in response to the “de-risking” movement. For example, the US, EU, UK, and Canada combined accounted for 43-45 percent of China’s clothing exports in 2023, lower than over 50 percent in the past. In comparison, these four Western markets typically accounted for 70 to 90 percent of an Asian country’s clothing exports. Meanwhile, since 2021, Asian economies, especially members of the Regional Comprehensive Economic Partnership (RCEP) and Africa, have become more important export markets for China. Nevertheless, since RCEP members and those in Africa primarily consist of developing economies with ambitions to expand their own clothing production and exports, the long-term growth prospects for their demand for “Made in China” clothing remain uncertain.

Thirdly, China’s weakened economy could lead to an increased supply of low-cost Chinese clothing in the global market.

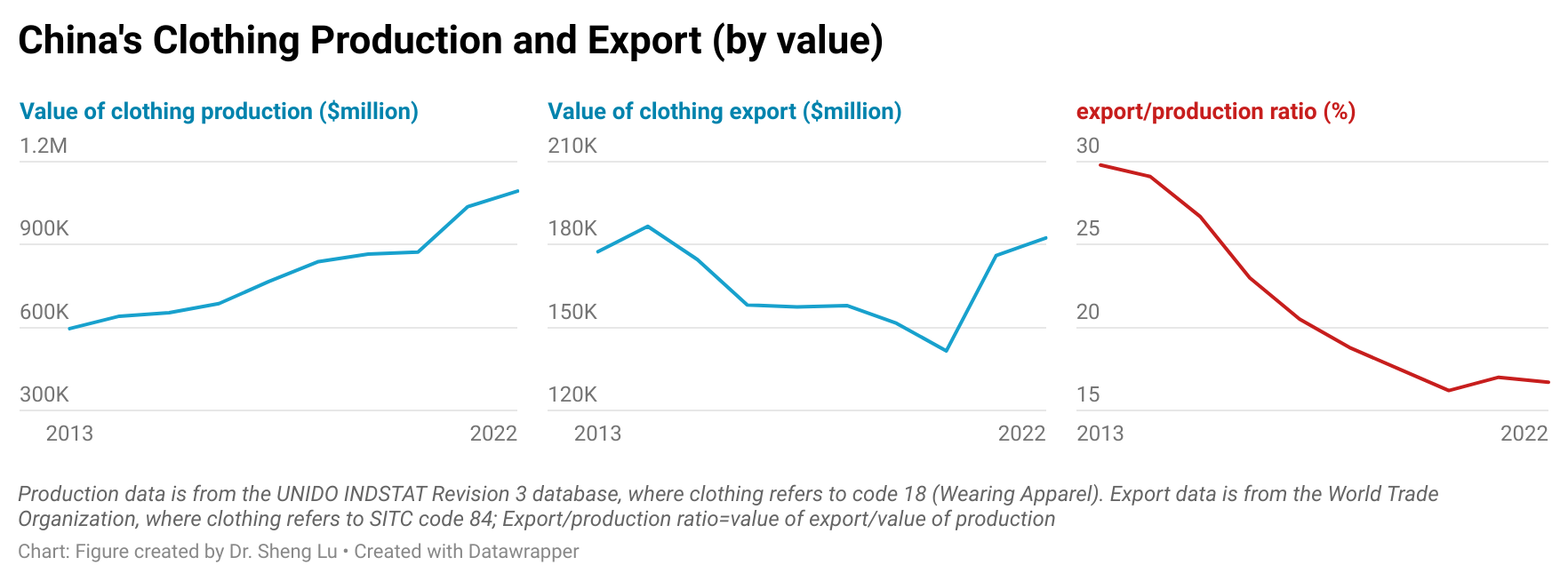

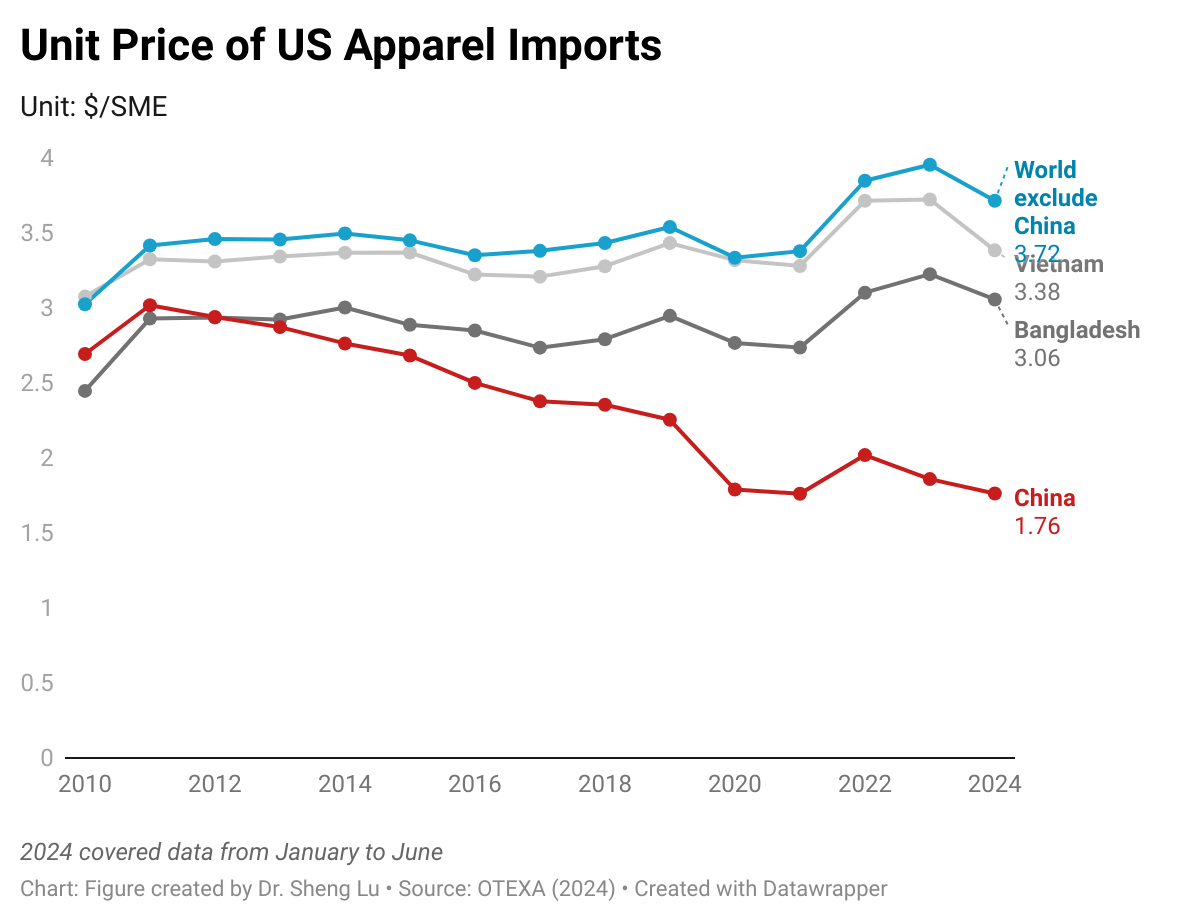

Despite being known as the world’s largest clothing exporter, between 2013 and 2022 (the latest available data), over 70%–80% of clothing produced in China was consumed domestically, with only about 20%–30% being exported. However, as China’s economic growth has slowed and consumer spending on clothing has stalled, more clothing made in China could enter the international market and intensify the price competition. Notably, between June 2023 and June 2024, the average unit price of US apparel imports from China decreased unusually by 7.6 percent, signaling that an increased supply of Chinese clothing began to suppress market prices. Likewise, it doesn’t seem reasonable that the unit price of U.S. apparel imports from China was 40% lower than that of imports from Bangladesh in the first half of 2024. Thus, the growing influx of cheap Chinese products raises the risk of market disruptions, potentially leading to additional trade tensions and restrictive measures against Chinese products.

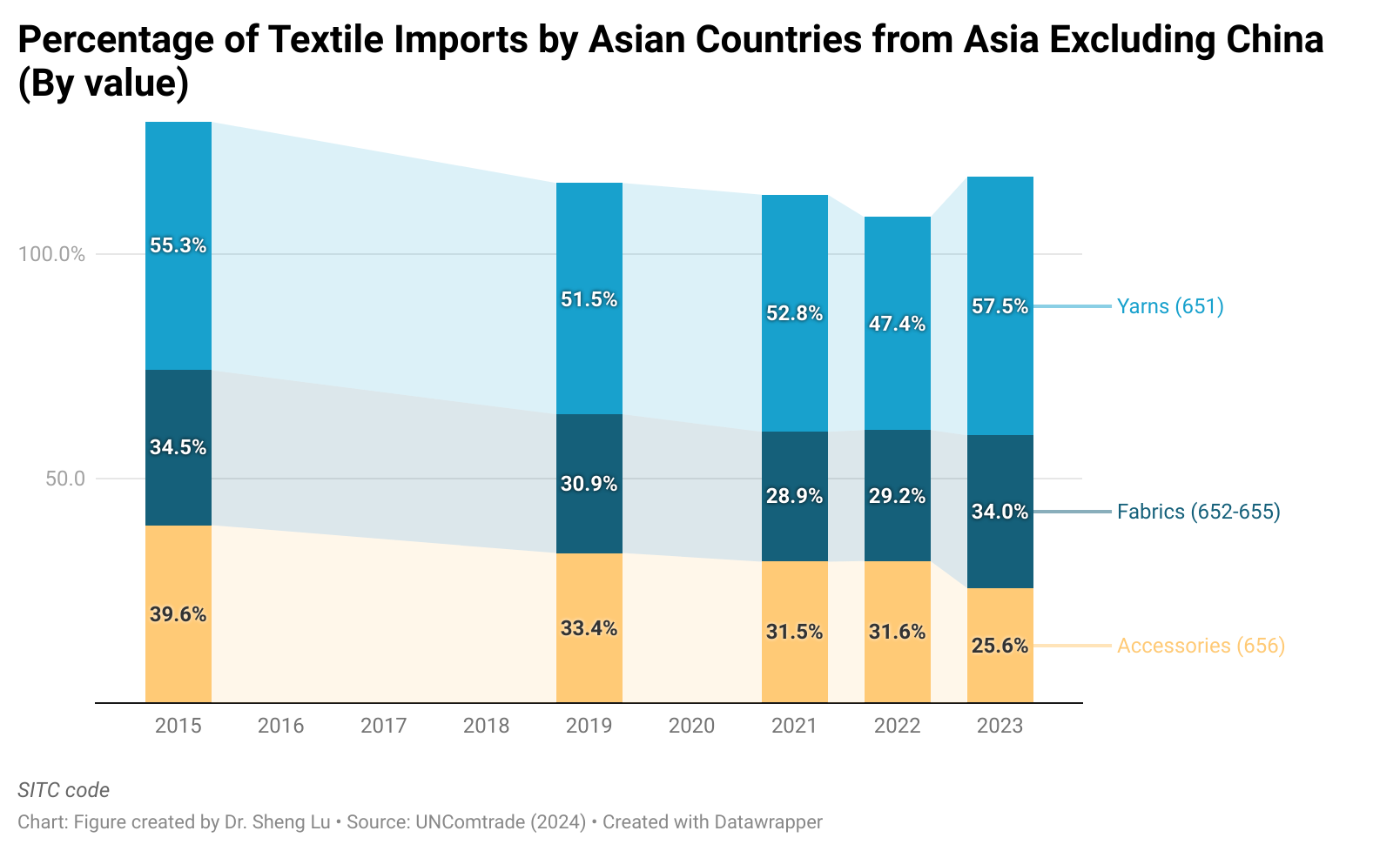

Fourthly, there is an early sign that Asian countries have become more cautious about using Chinese yarns and fabrics. China remained a key supplier of textile raw materials to leading apparel-exporting countries in Asia. However, Asian countries appeared to be sourcing fewer yarns and fabrics from China in 2023, possibly due to the enforcement of anti-forced labor laws, such as the Uyghur Forced Labor Prevention Act (UFLPA), and the perceived risks associated with sourcing Chinese cotton. Instead, more Asian countries’ yarns and fabrics now came from regional suppliers other than China.

by Sheng Lu

Additional reading: China has turned inward to sell Xinjiang cotton after a trade ban. Will it be enough? (South China Morning Post, August 11, 2024).

I think it is very interesting how countries are cutting down with trade from China. Although I do believe that this will persist for the next few years, I believe that there is a chance that countries will go back to their ways in the future and use China more for trade purposes again. Because China’a unit price is lower, as inflation rates rise in the future I think this will lead to purchasing from China again once countries may not want to afford prices from other countries. Weaker market demand may be an issue and we might see minimal decline but at the end of the day I think that 2025 may be a slower year, and then in 2026 regular rates may come back and countries will go back to using more “Made in China” products.

China is known as a region that does not produce in the most ethical or sustainable way, using forced and child labor, extreme overtime and low wages, as well as adding to a lot of the pollution the industry creates. Consumers have become increasingly more aware and concerned about these types of practices, with 57% of consumers claiming sustainability is one of the biggest factors they take into consideration while shopping. That being said, I am surprised by the fact that so many brands are lessening or diminishing their trade with China for these reasons since more often than not, they opt for the cheapest option. With supply chain transparency becoming increasingly important as well, this puts brands in a good light, showing they care about how their products are made. I am interested to see if this continues or not as prices in general increase, which companies will continue to take the sustainable route and which will revert back to whatever works best for their budget.

Hi Sarah! I also touched upon the fact that sourcing was usually money driven and often overlooked unethical practices in China. I am almost a little happy that brands are cutting back on sourcing from China because it shows they are valuing workers over saving an extra buck.

The trends following China’s clothing and textile exports surprised me. I would never have guessed that such a high percentage of their apparel is consumed domestically instead of exported. Since they are the largest apparel exporter and yet only export around 30% of what they produce, their production capabilities are greater than expected. As the data suggests the Chinese economy is slowing down and factories are more eager for business (leading to lower, more competitive labor costs), I wonder if these prices will be enough to pull back international fashion companies. Even other Asian countries are sourcing cotton elsewhere to avoid UFLPA violations so China is losing business left and right. With Trump’s anticipated tariffs on Chinese imports, quantity and value will be expected to plummet as well. I am eager to see how China positions itself for the future of fashion, and whether or not it can bring back its golden age.

Maybe, it’s a proof of my chronic activity in Asian fashion spaces, but unlike my peers, I wasn’t surprised to hear how high domestic consumption rates are in China. From what I’ve seen, and this is speculation based on personal observations, consumers appreciate the lower cost and more targeted styles that come from buying local. What I am focused on is the idea of Chinese clothing disrupting the market with its cost-competitiveness. I do think that lower prices will provide an incentive for increased international spending, but I also think that the current consumer trends are already favorably positioned towards Chinese brands and styles. During this past summer, I noticed a couple things: a rise in demand for Asian styles, and usage of online platforms to promote and fulfill that demand. Take Taobao, for instance. An e-commerce platform developed for Chinese consumers, it has now become a fairly reliable avenue in purchasing Chinese goods, notably apparel and beauty. And while navigation of the platform is quite tricky for international consumers, mainly for the language barrier, there is enough of an audience that there are official and unofficial workarounds; in September of this year, Taobao launched an official English interface for Southeast Asian countries. Combined with a growing awareness of Asian subculture styles and, for some, the cheaper and better quality products, I think that it’s definitely possible for consumers to overlook the ethical issues in favor of fulfilling individual desires that Western brands may not be considering. Cheap is one thing. But cheap in a market that does not want your products just leaves suppliers with cheap goods and nowhere to put it.

This article was ultimately a very interesting read. Looking ahead, I believe that China’s textile and clothing export landscape in 2024 could see some further shifts because of ongoing geopolitical tensions and the de-risking trend in Western markets. With more fashion companies decreasing their reliance on China and looking to other countries to source from, (primarily caused by the concerns over forced labor and geopolitical risks) China’s exports to the United States, EU and other key Western countries could present declines, despite maintaining its global leadership in export value. The unknowns include how China’s economic slowdown will affect global clothing supply, with a possible influx of low cost Chinese goods that could impact established markets and could bring on trade tensions.

After reading the article it is not shocking to see the decline in exported goods from China and an increase in domestic consumption within China. When considering textile and apparel sourcing in Asia looking at a graph from class title Source of Asian Countries’ Textile Imports (by value) it is clear that the sourcing happens domestically which can impact relationships with potential other countries to trade with. That is reflected the down ward trajectory present on the graph of imports from outside of Asia. With Asian countries being hesitant to use Chinese yarns and fabrics due to the strengthening labor laws, they are outsourcing and finding countries that are compliant. But other countries are continuing to use Chinese textiles as their main form of importing and it is increasing per year, shown on the graph titled % of Textile Imports from China (by value). The ethical concerns go out the window for these countries because the unit prices are much lower than any other country due to labor wages. If China is able to adapt and move to more ethical practices other countries will become more willing to import from there. Moving away from the political and devise decisions such as where the cotton is sourced for Shein, which according to article 5-4 is allegedly from China’s Xinjiang region which the US speculates to be an area where genocide and forced labor where done. By China making themselves less of a risk and by addressing the geopolitical issues there will be an upswing in trade and the Textile and Apparel industry.

I’ve talked about this in other blog posts (as well as assignments) but it remains a fascinating case seeing China begin to lose steam as a manufacturing god and one-stop-shop. The question to me was always how this would effect the rest of the world economy, as well as China’s internal economy. As we can see in the article, it shows China’s economy slowing down, but using other means to maintain itself. China has started to use other Asian countries to it’s advantage, as we can see in the graph (as well as Africa and Latin America), which it is hoping to sustain itself on. Unfortunately as stated towards the end it looks like Asian countries are becoming wary, so the question here is where does China go? To me, it’s going to take a lot of work to undo China’s reputation and propel them back forward, but it isn’t impossible necessarily. Perhaps they could start by working on labor ethics and introducing more laws against companies paying their workers such low wages, barely livable. Moving on from there they might also consider going in a direction of more environmentally friendly. It remains to be seen what China’s plan from here will be, but regardless I have no doubt that they will inevitably figure some kind of “solution” out that may work or not

Hi, Nikhil. I find your answer to be very interesting as I too wonder what direction China will go as countries have decreasing importing from China. I personally don’t know how possible it will be for China to manufacture more ethically as they have essentially built their business model on cheap labor, thus translating to lower wages for garment workers. Additionally, even though China claims that they are beginning to engage in more sustainable practices, there has still been a high percentage of Xinjiang cotton found in US apparel. Kim Glas, president and CEO of the National Council of Textile Organizations (NCTO), explains that 3 million shipments come from China each day and half of these are textiles and apparel. Out of all of these shipments, they bypass inspections easily as minimal inspection is required. Because of how opaque China is about their sustainability practices, I have little faith in China to enforce stricter labor protection laws.

Along with high sourcing risks, I read in an article that 61% of Americans surveyed were most concerned about China’s worldwide environmental effect, citing it as the most severe issue (Pew Research, 2020). I wonder how much more apparel sourcing would decrease if we looked even more into forced labor in Chinese factories. Additionally, I find it notable that the export/production rate has steadily declined while production continues to grow. In my FASH355 class, we learned that Chinese customers consume far more rapidly than in the U.S. (though the U.S. still consumes rapidly) and the graphs in the article reflect just how much domestic consumption is increasing. I also learned how Chinese manufacturing facilities are beginning to produce more luxury products such as Prada and Burberry as consumer incomes have increase and tastes have changed. I wonder if prominent markets such as the U.S., Canada, EU, and UK shifting away from Chinese exports will heavily affect the Chinese market as their domestic consumption has heavily increased.

I really enjoyed reading this article as my final project specifically focuses on “Should U.S. fashion companies completely stop sourcing textiles and apparel from China?”. There is an evident yet gradual shift in the textile supply chain, shifting from China to other regional suppliers. One factor that contributes to this shift is forced labor concerns which is something that we have discussed greatly in class. I found it disheartening to learn that unethical practices, including forced labor and unsafe working conditions were still a reality in the Chinese garment industry. These concerns not only harm the workers but also ruin the name that China has built for itself in the industry. In a way I am happy that other countries are reinforcing the importance of ethical sourcing and human worker rights by not sourcing from China as much. In the past money has been a factor that has led to countries sourcing from China, often overlooking the unethical practices within the industry. So it is nice to see that human rights are more important than cheap sourcing. I do believe it is best to cut back on sourcing from China if they continue with unethical practices, however, if they were to fix these issues I would consider supporting them again. Do you think you would consider supporting China if they addressed and resolved their unethical practices?

Even though China is a world leader in clothing exports in 2023 due to its large chunk in market share and the rise in ethical fashion, they are being influenced by changing global dynamics and worldwide political conflicts. China is a widely known country that practices unethical labor policies (forced labor), and as a result of this, fashion companies are implementing “de-risking” strategies that support separation from Chinese imports. To display their efforts in becoming a more ethical and sustainable import country, China has devoted time to diversifying exports to RCEP and African community members. This conveys their attempts to become better, but it is not certain whether they will succeed because they lack many qualities that apparel sourcers look for in potential clients, like sustainability and having transparent and moral policies. I wasn’t surprised when I read how market stability was threatened by the spike in low-cost and cheap Chinese apparel, causing price competition. This creates a noticeable tension across the global apparel industry. Nowadays, people don’t value their clothing as much and would rather have cheap items over quality garments. I will be eager to gain more knowledge about China and its shifting internal dynamics within the fashion retail space. I don’t believe they will be able to make this adjustment because this country has branded and presented itself as a country that uses or even supports corrupt labor and cheap, ecologically harmful products.

After reading the article and discussing the topic in class I’m not surprised that companies are starting to move away from trade with China. The working conditions there have low pay and health hazards for employees. I do think China will remain at the number one spot for trade for the next few years, but after that I think either Vietnam or Europe countries will take over for the top trading spot.

After reading this article I don’t think that it is super surprising that a lot of brands are starting to stop exporting goods from China. Over the past few years, there has been a rise in consumer’s awareness of how ethical and sustainable different brands supply chains are. Many consumers will stop shopping at a brand if they find out that they’re exporting goods from unethical/unsustainable suppliers. I think it is important for brands to really know the whole supply chain of who they’re trading with, especially how they treat their workers and if they are ethical and sustainable. In the article it mentioned how a lot of brands are pulling back from trading with China due to forced labor issues in Xinjiang and geopolitical tensions. This is important because if countries continue to do most of their trading with China, knowing about these unethical practices, this would tarnish their brands reputations, especially with the rise in consumers’ awareness of these issues. I think that if China continues to move forward with the way that they treat their workers, overtime they will just keep losing more and more countries to export to.

This article has extremely interesting insights as to how China has been developing recently and how they are working to improve themselves within the apparel industry. The article discusses how China stays resilient, despite the drop in clothing exports. By them only suffering with a 10% drop in these exports, this proves how they have pushed through, even under immense pressure. They are working to prove that they are still a relevant source within the supply chain. It is also interesting how geopolitical factors are also being heavily considered within recent years. When the article discusses the dramatic shift of U.S. fashion brands sourcing from China to elsewhere, this proves how influential politics are on the fashion industry as a whole. Because of this heavy influence, it is assumed that this will continue to change and develop in years to come. I enjoyed that the article discussed the highly talked about topic of countries steering away from China and instead adding diversification within their brands. This is something we have discussed in class and continues to stay relevant. Because of this, it makes sense that China is working to shift towards a strategy that will benefit them in the future. This article provides a different perspective on China’s sourcing strategies and how they are working towards advancing themselves as a country. I found this article extremely interesting and insightful towards what we are learning in class!

This article addresses a significant trend in the global apparel industry. The trend concerns a decrease in domestic demand in China, which has increased the amount of cheap clothing in international markets. This issue affects pricing. For instance, the average price of U.S. apparel imports from China dropped 7.6% in one year. Additionally, products in China are currently priced 40% less than products from Bangladesh. This is concerning because Bangladesh is typically considered a country with low cost manufacturing. Therefore, this price gap creates both competitive challenges and messes up the market. It also can cause long term economic and political issues, which may include trade limitations and tariffs. Although it may seem like a good thing that items are being priced lower because of affordability, the issues outweigh the benefits in the long run.