VF Corporation (VF) is one of the largest apparel companies in the US, with an estimated global sales revenue to exceed $10 billion in 2024. VF owns several well-known apparel and outdoor performance brands, including The North Face, Timberland, and Icebreaker. VF also has a global presence. According to its latest annual report, in Fiscal 2024, “VF derived 52% of its revenues from the Americas, 33% from Europe, and 15% from Asia-Pacific.”

The following analysis is based on VF’s publicly released supplier list. Only factories identified as producing “apparel” products and related textile raw materials are included in the analysis.

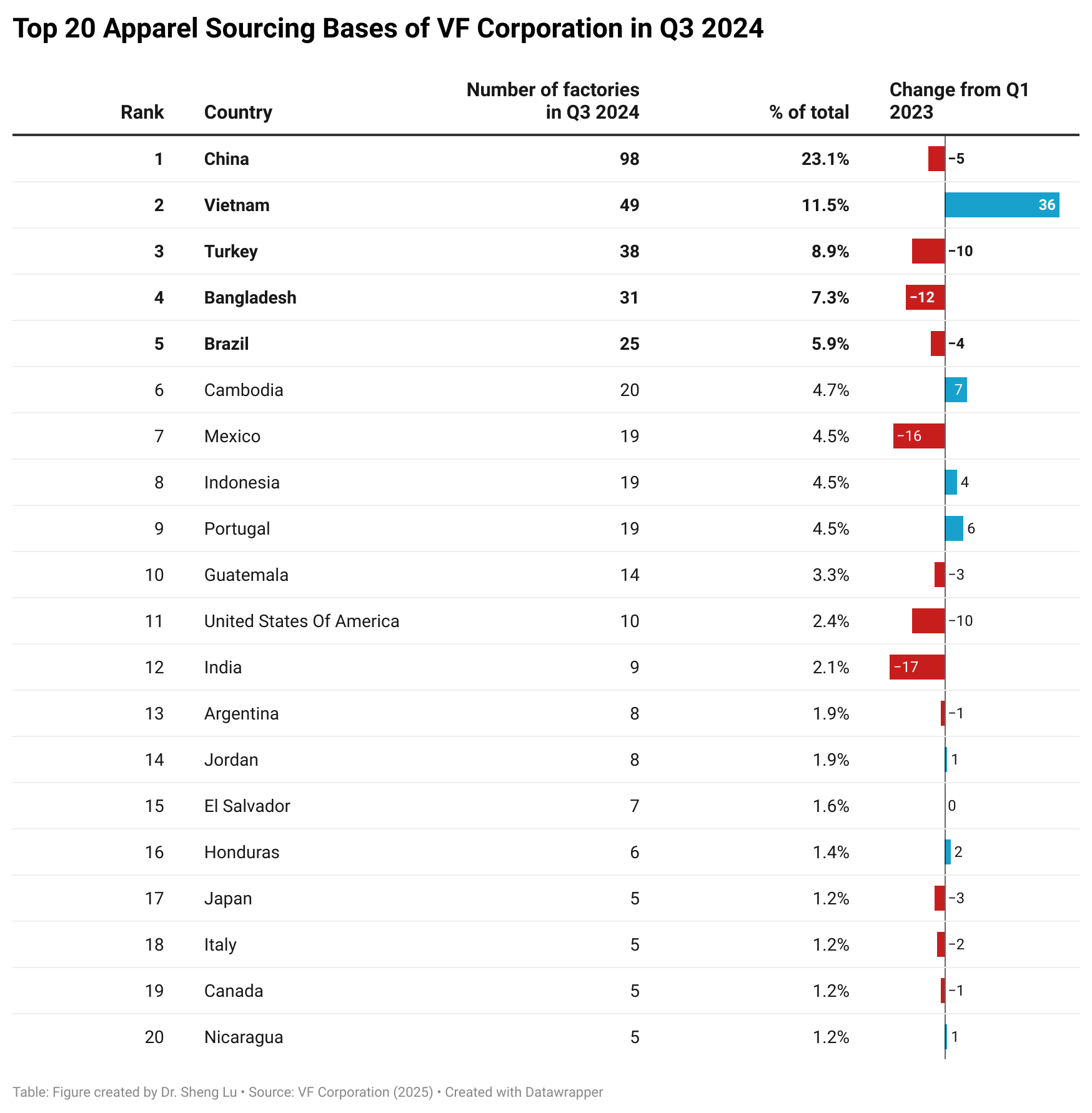

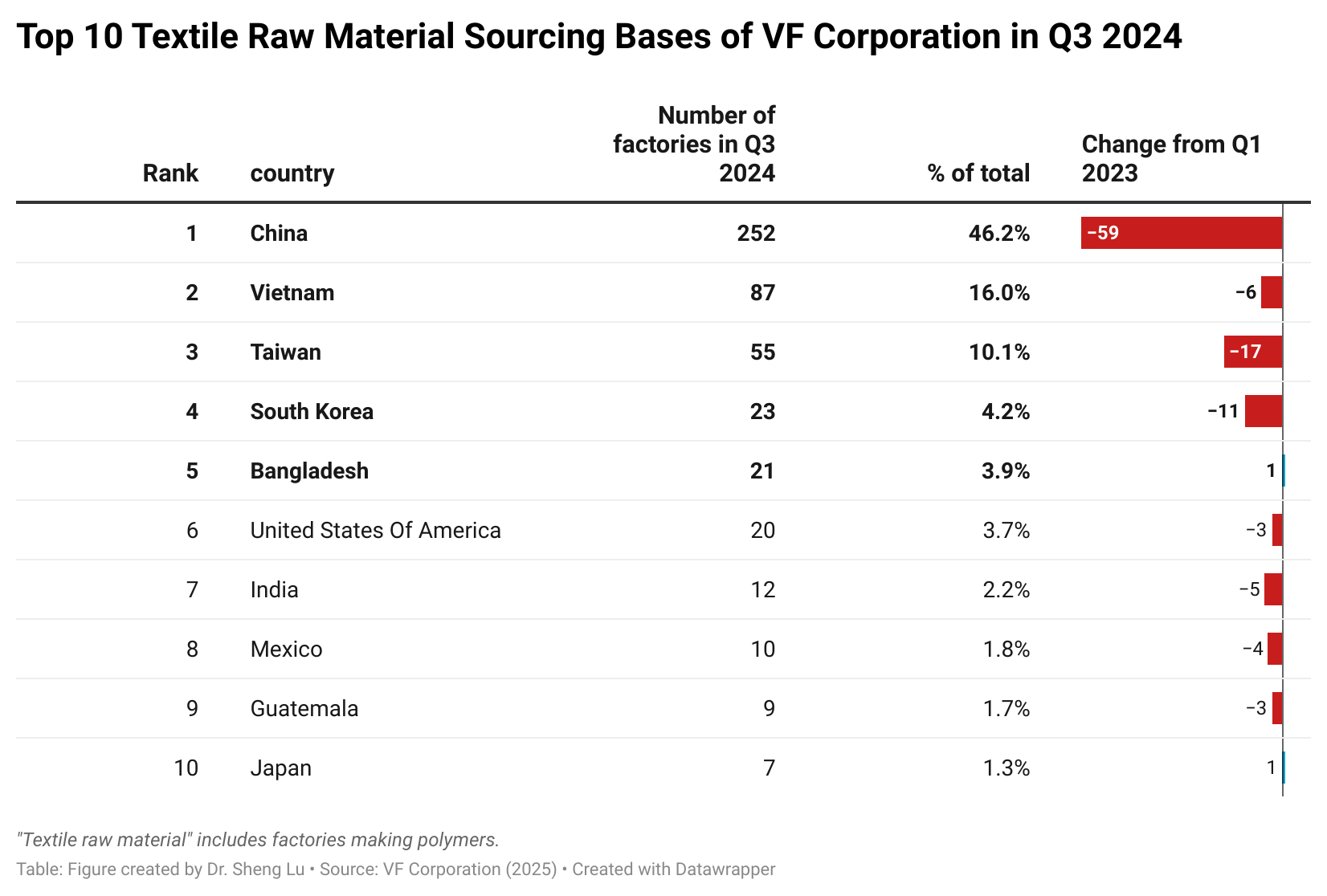

First, while VF maintained a geographically diverse global sourcing base, it reduced the number of factories it sourced from between 2023 and 2024. Specifically, as of Q3 2024 (the latest data available), VF sourced apparel from 36 countries, the same number as in Q1 2023. These countries spanned almost all continents, including Asia, the Americas, Europe, and Africa. Similarly, over the same period, VF sourced textile raw materials for apparel production—including factories producing polymers—from approximately 30 countries.

However, between Q1 2023 and Q3 2024, VF reduced the number of apparel factories it contracts with from 463 to 426. The number of textile mills VF contracts also declined, from 665 to 546. This pattern aligned with the findings of other industry studies, which indicate that many U.S. fashion companies, particularly larger ones, are consolidating their vendor base to reduce sourcing risks and enhance operational efficiency.

Additionally, VF’s annual reports indicate that no single supplier accounted for more than 6% of its total cost of goods sold during Fiscal Year 2024, the same as in 2023, but lower than 7% in Fiscal Year 2021.

Second, in line with macro trade data, Asia served as VF’s largest apparel sourcing base in Q3 2024, led by China (23.1 percent) and Vietnam (11.5 percent). Specifically, as of Q3 2024, approximately 55.3 percent of VF’s garment factories were located in Asia, an increase from 48.8 percent in Q1 2023. Meanwhile, VF is also adjusting its apparel sourcing strategy within the Asia region. For example, between 2023 and 2024, VF decreased the number of garment factories it worked with in China (down 5), Bangladesh (down 12), and India (down 17), while adding more contract factories in Vietnam (up 36), Cambodia (up 7), and Indonesia (up 4). The pattern indicates that while VF may attempt to reduce its “China exposure,” it also actively seeks new sourcing opportunities within Asia.

Conversely, in Q3 2024, around 21.2 percent of VF’s garment factories were based in the Western Hemisphere, a decrease from 27.0 percent in Q1 2023. In most situations, VF worked with about 10-20 garment factories in each Western Hemisphere country. Furthermore, from 2023 to 2024, VF cut the number of garment factories in Mexico (down 16) and the United States (down 10), indicating that expanding near-shoring and on-shoring was not the company’s preferred strategy in the current environment.

Third, compared to garments, VF’s supply of textile raw materials relies even more heavily on Asia, especially China. Specifically, as of Q3 2024, approximately 83.5 percent of VF’s textile raw material suppliers were located in Asia, the same as in Q1 2023. Notably, China represented nearly half of VF’s textile material suppliers in Q3 2024, including 41.2 percent of textile yarn and fabric mills and 50.9 percent of trim mills. Although VF reduced the number of textile mills in China from Q1 2023 to Q3 2024, China’s share of VF’s total textile raw material supplier base remained the same. Overall, the pattern aligns with previous research suggesting that finding alternative sourcing bases for textile raw materials outside of China and Asia will be more difficult and time-consuming for US fashion companies, considering the capital-intensive nature of making textile products.

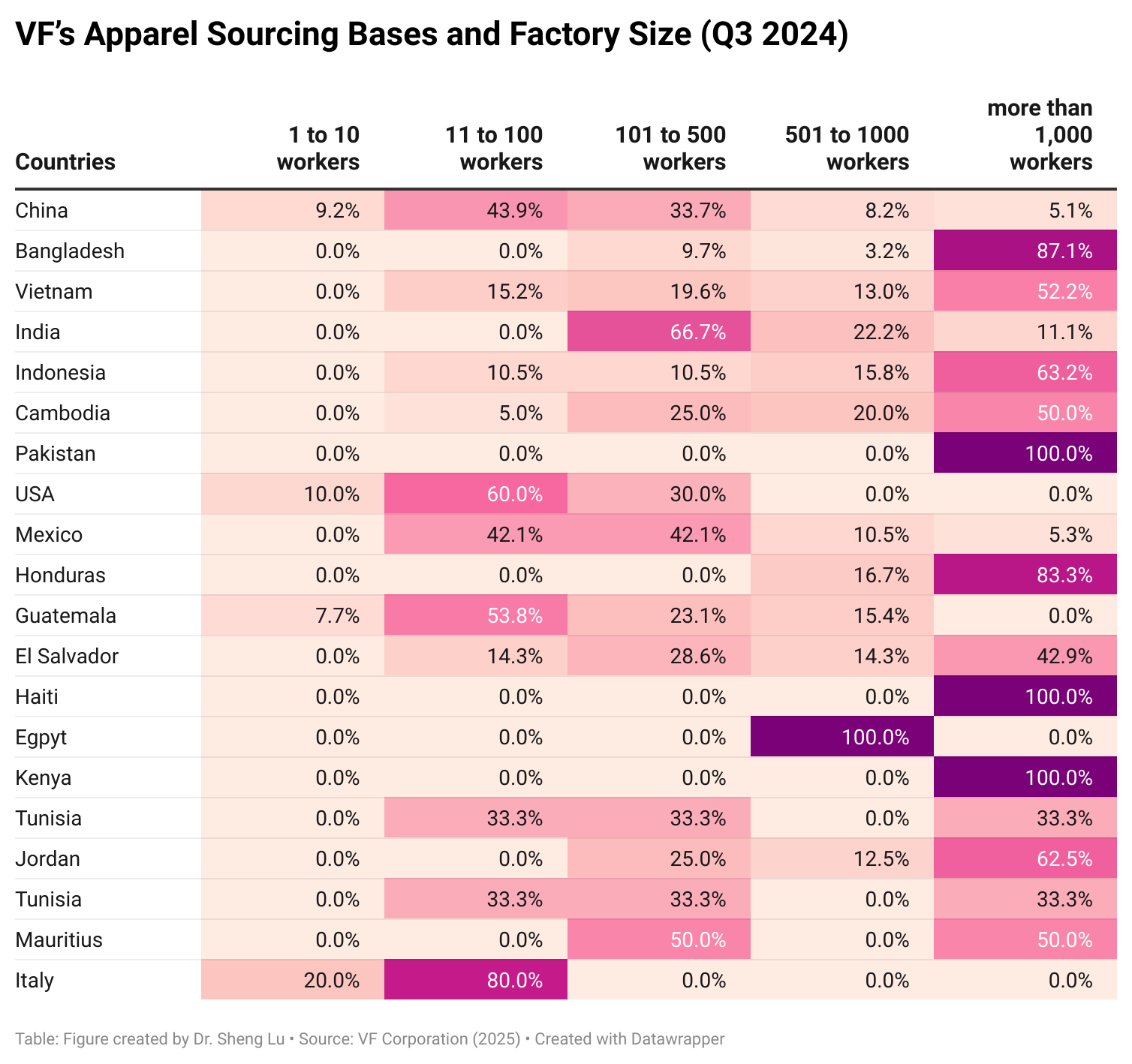

Fourth, VF’s contract garment factories worldwide varied in size, reflecting the company’s diverse sourcing needs. Specifically, in Asia, garment factories in China typically were small and medium-sized, with 11-100 workers (43.9 percent) or 101-500 workers (33.7 percent). In contrast, nearly 90 percent of VF’s contract garment factories in Bangladesh had more than 1,000 workers, with similar patterns observed in Vietnam (52.2 percent), Cambodia (50.0 percent), Indonesia (63.2 percent), and Pakistan (100 percent). These findings suggest that VF may use China as a sourcing base for relatively small, diverse orders while relying on other Asian countries with lower labor costs for high-volume production.

Meanwhile, in the Americas and Africa, VF’s contract garment factories in Haiti, Honduras, El Salvador, Kenya, and Jordan included more large-scale operations with over 1,000 workers. These locations could serve as emerging alternatives to sourcing from Asia, especially for specific categories. In contrast, VF’s contract garment factories in Mexico, the US, and Guatemala featured many medium and small operations, which are more likely to fulfill replenishment orders or produce specialized products.

by Sheng Lu