VF Corporation (VF) is one of the largest apparel companies in the US, with an estimated global sales revenue to exceed $10 billion in 2024. VF owns several well-known apparel and outdoor performance brands, including The North Face, Timberland, and Icebreaker. VF also has a global presence. According to its latest annual report, in Fiscal 2024, “VF derived 52% of its revenues from the Americas, 33% from Europe, and 15% from Asia-Pacific.”

The following analysis is based on VF’s publicly released supplier list. Only factories identified as producing “apparel” products and related textile raw materials are included in the analysis.

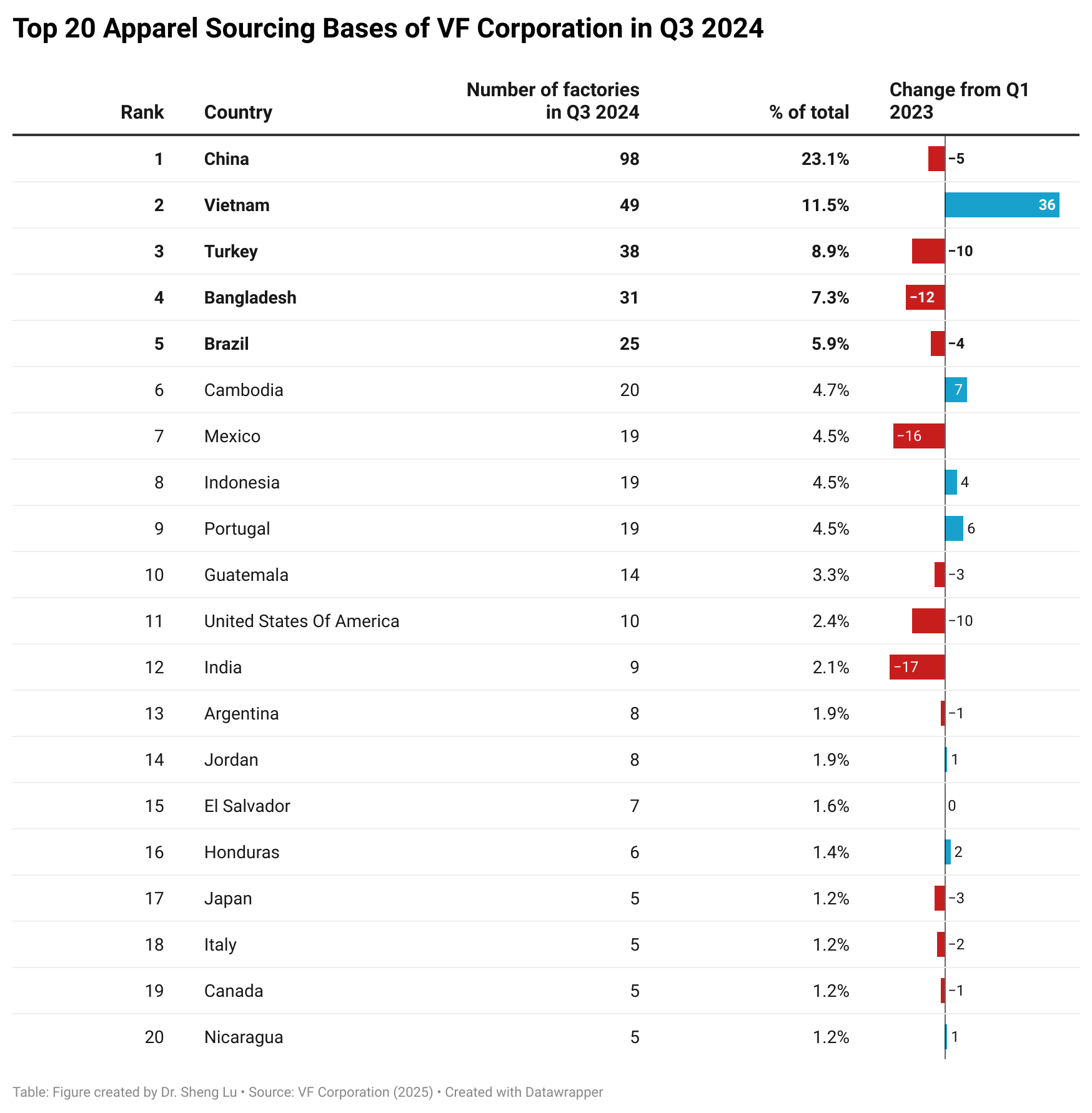

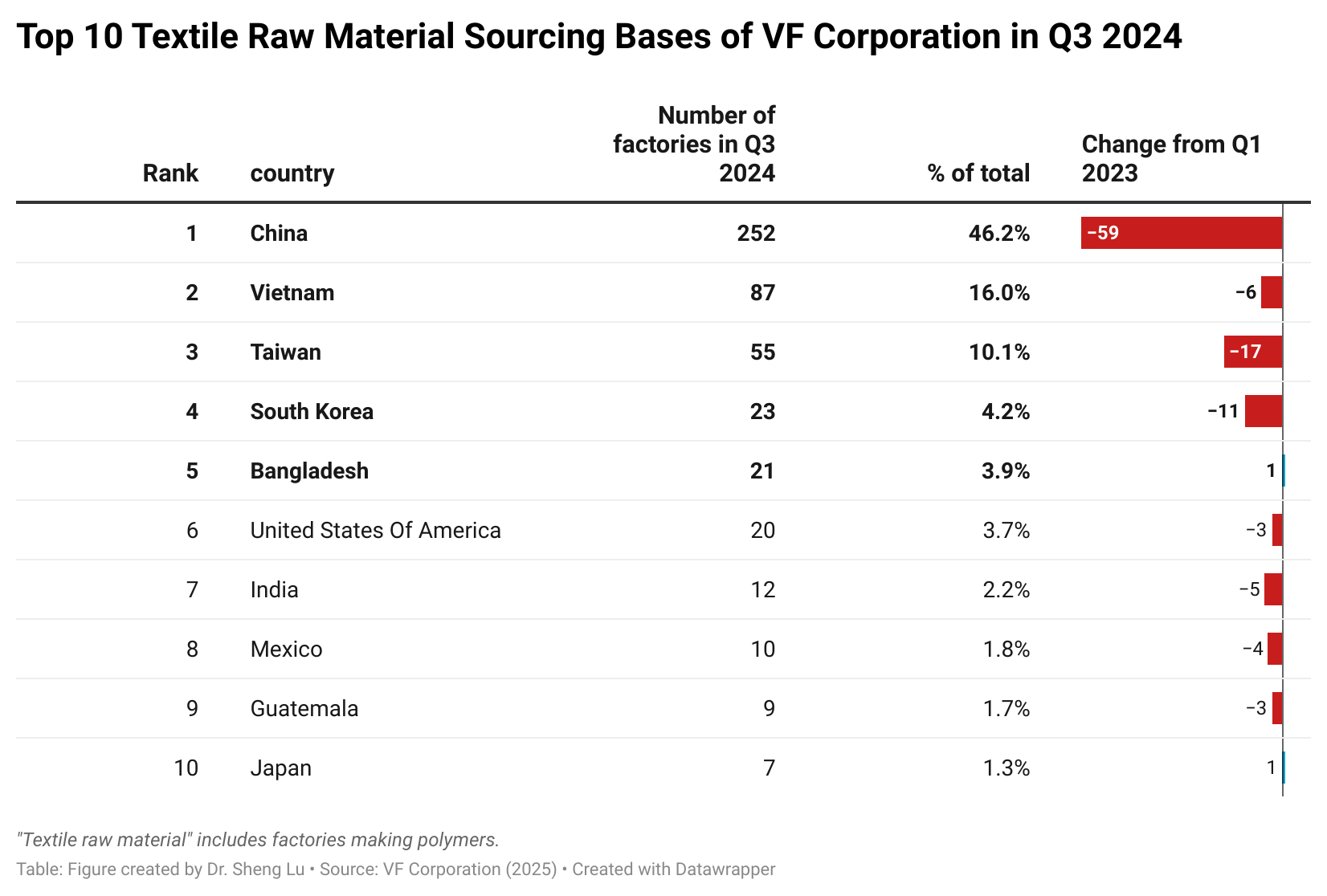

First, while VF maintained a geographically diverse global sourcing base, it reduced the number of factories it sourced from between 2023 and 2024. Specifically, as of Q3 2024 (the latest data available), VF sourced apparel from 36 countries, the same number as in Q1 2023. These countries spanned almost all continents, including Asia, the Americas, Europe, and Africa. Similarly, over the same period, VF sourced textile raw materials for apparel production—including factories producing polymers—from approximately 30 countries.

However, between Q1 2023 and Q3 2024, VF reduced the number of apparel factories it contracts with from 463 to 426. The number of textile mills VF contracts also declined, from 665 to 546. This pattern aligned with the findings of other industry studies, which indicate that many U.S. fashion companies, particularly larger ones, are consolidating their vendor base to reduce sourcing risks and enhance operational efficiency.

Additionally, VF’s annual reports indicate that no single supplier accounted for more than 6% of its total cost of goods sold during Fiscal Year 2024, the same as in 2023, but lower than 7% in Fiscal Year 2021.

Second, in line with macro trade data, Asia served as VF’s largest apparel sourcing base in Q3 2024, led by China (23.1 percent) and Vietnam (11.5 percent). Specifically, as of Q3 2024, approximately 55.3 percent of VF’s garment factories were located in Asia, an increase from 48.8 percent in Q1 2023. Meanwhile, VF is also adjusting its apparel sourcing strategy within the Asia region. For example, between 2023 and 2024, VF decreased the number of garment factories it worked with in China (down 5), Bangladesh (down 12), and India (down 17), while adding more contract factories in Vietnam (up 36), Cambodia (up 7), and Indonesia (up 4). The pattern indicates that while VF may attempt to reduce its “China exposure,” it also actively seeks new sourcing opportunities within Asia.

Conversely, in Q3 2024, around 21.2 percent of VF’s garment factories were based in the Western Hemisphere, a decrease from 27.0 percent in Q1 2023. In most situations, VF worked with about 10-20 garment factories in each Western Hemisphere country. Furthermore, from 2023 to 2024, VF cut the number of garment factories in Mexico (down 16) and the United States (down 10), indicating that expanding near-shoring and on-shoring was not the company’s preferred strategy in the current environment.

Third, compared to garments, VF’s supply of textile raw materials relies even more heavily on Asia, especially China. Specifically, as of Q3 2024, approximately 83.5 percent of VF’s textile raw material suppliers were located in Asia, the same as in Q1 2023. Notably, China represented nearly half of VF’s textile material suppliers in Q3 2024, including 41.2 percent of textile yarn and fabric mills and 50.9 percent of trim mills. Although VF reduced the number of textile mills in China from Q1 2023 to Q3 2024, China’s share of VF’s total textile raw material supplier base remained the same. Overall, the pattern aligns with previous research suggesting that finding alternative sourcing bases for textile raw materials outside of China and Asia will be more difficult and time-consuming for US fashion companies, considering the capital-intensive nature of making textile products.

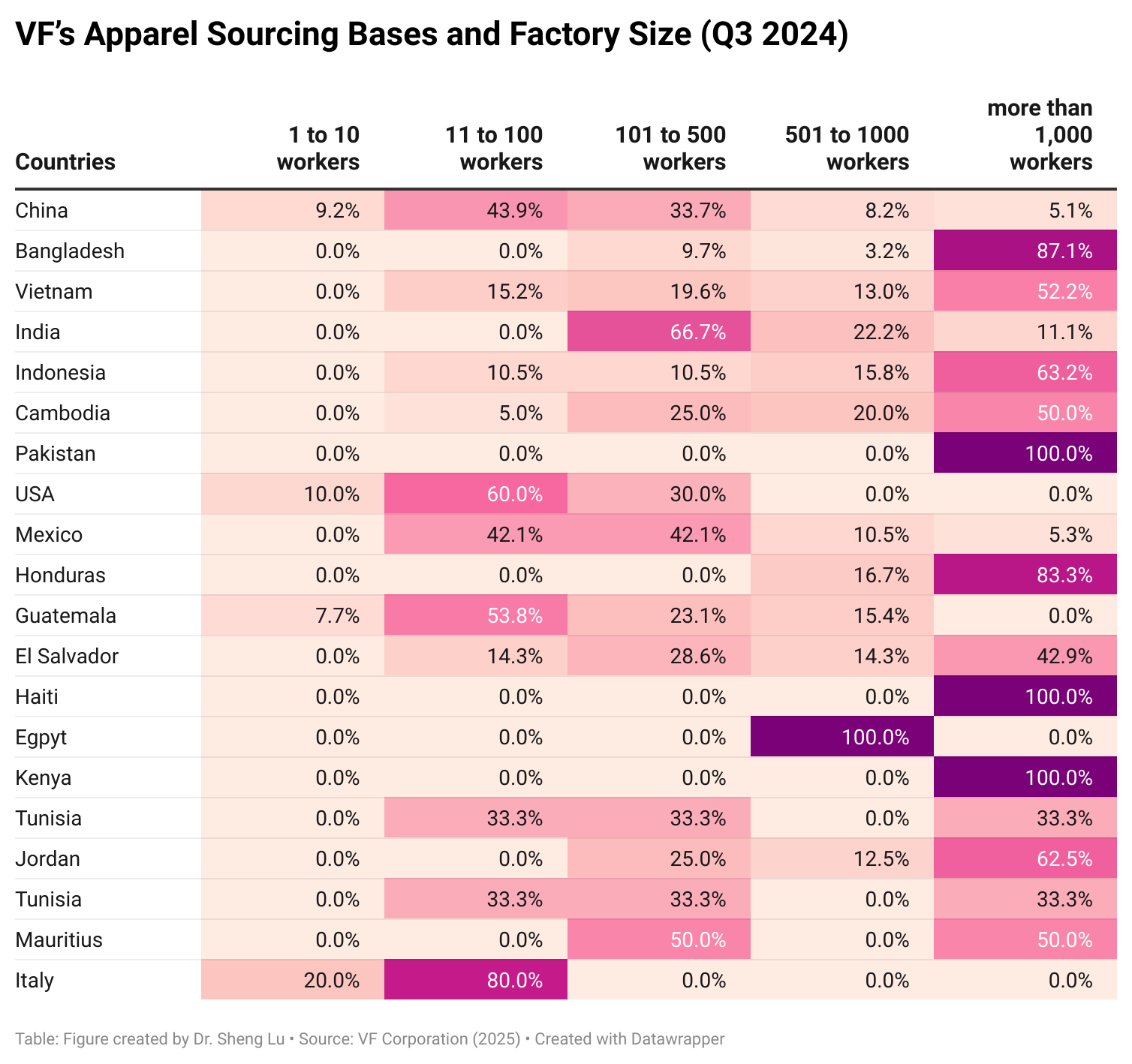

Fourth, VF’s contract garment factories worldwide varied in size, reflecting the company’s diverse sourcing needs. Specifically, in Asia, garment factories in China typically were small and medium-sized, with 11-100 workers (43.9 percent) or 101-500 workers (33.7 percent). In contrast, nearly 90 percent of VF’s contract garment factories in Bangladesh had more than 1,000 workers, with similar patterns observed in Vietnam (52.2 percent), Cambodia (50.0 percent), Indonesia (63.2 percent), and Pakistan (100 percent). These findings suggest that VF may use China as a sourcing base for relatively small, diverse orders while relying on other Asian countries with lower labor costs for high-volume production.

Meanwhile, in the Americas and Africa, VF’s contract garment factories in Haiti, Honduras, El Salvador, Kenya, and Jordan included more large-scale operations with over 1,000 workers. These locations could serve as emerging alternatives to sourcing from Asia, especially for specific categories. In contrast, VF’s contract garment factories in Mexico, the US, and Guatemala featured many medium and small operations, which are more likely to fulfill replenishment orders or produce specialized products.

by Sheng Lu

Similar to the article about Gap Inc., the VF Corporation is expanding and diversifying its sourcing operations to different areas, even within Asia. Something that I found particularly interesting within this article was that the VF Corporation had reduced its sourcing footprint in the Western Hemisphere, and have contracted their factories to vary in size, depending on direct sourcing needs. Not every factory needs to house and mass-produce all products, so having a varied sourcing base allows for workers to work more efficiently and in a specific area of production. This approach allows companies like VF to optimize costs, improve overall flexibility and allow workers to specifically help enhance the brand, by working based on specialty. This concept made me think about the study from week 6, “2024 Fashion Industry benchmarking study,” from our reading assignment. Similar to how we had to analyze what affects how US fashion companies make their sourcing decisions, it is the same as how other countries around the world decide for themselves. One aspect that was mentioned for how US fashion companies base their sourcing decisions was the idea that our current administration and economy present a lot of uncertainty, which in turn, could affect company operations; nearly 40% of respondents found that inflation and other economic issues were cause for concern regarding sourcing decisions, similar to how the VF Corporation closed (reduced) the number of factories it sourced from and are seeking new sourcing opportunities, for the sake of enhancing operational efficiency. There are many aspects that affect how companies make their decisions, but ultimately, both adaptability and strategic planning (including quarter and year-to-year based comparisons) is what allows companies to maintain competitiveness in an ever-changing market.

Hi Gabrielle! I also resonate strongly with the study from week 6 after reading this article. I really think that the economy and our current administration presents uncertainty, which is very similar to the analysis of what affects US fashion companies sourcing decisions, analyzed during week 6 of class. VF’s sourcing strategy highlights how the apparel industry is shifting right now. It’s interesting that even though they’re working with fewer factories, they’re still keeping things globally spread out. The changes within Asia moving some production out of China and into places like Vietnam and Cambodia seems like a smart way to manage risks and costs. However, it’s clear that China remains a key source for their textile materials, considering how difficult and costly it is to build that kind of supply chain elsewhere. Overall, VF is trying to stay efficient while balancing flexibility with efficiency in a complex environment.

Your blog post brings up a great point about how VF Corporation’s sourcing strategy mirrors broader industry shifts toward agility and specialization. I found it especially compelling how VF is reducing its footprint in the Western Hemisphere while strategically scaling factories in Asia based on specific production needs. This move reflects a smart understanding that not all products require mass production, and specialized sourcing can lead to more efficient labor and better quality control. It connects perfectly with the 2024 Fashion Industry Benchmarking Study, where U.S. companies cited economic uncertainty and inflation as major sourcing concerns. Like VF, many brands are now realizing that fewer, more targeted sourcing partnerships—rather than a massive, uniform supply chain—can create long-term flexibility and resilience. In today’s unpredictable market, staying competitive really comes down to making informed, adaptable decisions that align with both economic trends and operational goals.

Your blog post brings up a great point about how VF Corporation’s sourcing strategy mirrors broader industry shifts toward agility and specialization. I found it especially compelling how VF is reducing its footprint in the Western Hemisphere while strategically scaling factories in Asia based on specific production needs. This move reflects a smart understanding that not all products require mass production, and specialized sourcing can lead to more efficient labor and better quality control. It connects perfectly with the 2024 Fashion Industry Benchmarking Study, where U.S. companies cited economic uncertainty and inflation as major sourcing concerns. Like VF, many brands are now realizing that fewer, more targeted sourcing partnerships—rather than a massive, uniform supply chain—can create long-term flexibility and resilience. In today’s unpredictable market, staying competitive really comes down to making informed, adaptable decisions that align with both economic trends and operational goals.

Your blog post brings up a great point about how VF Corporation’s sourcing strategy mirrors broader industry shifts toward agility and specialization. I found it especially compelling how VF is reducing its footprint in the Western Hemisphere while strategically scaling factories in Asia based on specific production needs. This move reflects a smart understanding that not all products require mass production, and specialized sourcing can lead to more efficient labor and better quality control. It connects perfectly with the 2024 Fashion Industry Benchmarking Study, where U.S. companies cited economic uncertainty and inflation as major sourcing concerns. Like VF, many brands are now realizing that fewer, more targeted sourcing partnerships—rather than a massive, uniform supply chain—can create long-term flexibility and resilience. In today’s unpredictable market, staying competitive really comes down to making informed, adaptable decisions that align with both economic trends and operational goals.

This blog post discusses how VF Corporation is reducing the number of factories it works with, which is a trend seen all across the fashion industry as companies are trying to lower risk and improve efficiency. Most of their apparel comes from Asia but they are shifting away from some countries like China, India, and Bangladesh while increasing production in Vietnam, Cambodia, and Indonesia. This seems like diversification, but they are still relying heavily on China, not just for garment production, but textile raw materials. This raises the question if fashion brands can de-risk their supply chains if they haven’t addressed where they are getting their raw materials from. To really diversify, companies need to reimagine their supply chains.

VF Corporation’s apparel sourcing changes from 2023 to 2024 show how the company is adapting to global trade shifts and supply chain needs. Although VF continued sourcing from 36 countries, it reduced the number of garment and textile factories it uses. This matches a trend seen in other large fashion companies, where consolidating suppliers helps reduce risks and improve efficiency. Most of VF’s apparel and textile suppliers are based in Asia, especially China and Vietnam. While VF is slowly moving away from over-reliance on China, it still depends heavily on the region for materials and large-scale production. The company’s sourcing in the Americas and Africa includes some large factories, but many operations there are smaller. This suggests that VF still relies on Asia for most of its production, especially for high-volume items, while using other regions for smaller or more specialized orders.

I think it is good that VF is decreasing the amount of factories it is sourcing from. Supply chain mapping is a really important part of keeping an efficient supply chain and of having supply chain transparency. When a company utilizes less factories they are able to track their supply chain more easily and are able to be more honest about where everything is coming from. In addition, having less factories makes it easier to have a better relationship with each factory which helps to keep trade relations strong and mitigates risk of deceit or cancellations. It is very interesting to me that in 2024 VF decided to stop expanding near shoring and on shoring especially because of all the discussion right now about that being a potentially good route for apparel production companies. This to me seems like it may be because VF’s raw textiles relies heavily on Asia. It most likely does not make sense to import raw textiles from Asia to the Western Hemisphere for production and then produce apparel. VF may have attempted this and realized it was not cost effective and did not make near shoring worth while. This is interesting to me because we talk a lot about moving to near shoring in class but it seems based on VF that this is not a true option until raw materials can also be sourced from the Western Hemisphere. Until then companies will do as VF did and simply switch from China to other Asian countries for production.

I find it interesting that the regional patterns are extremely telling of the evolution of sourcing. With VF expanding into Vietnam, Cambodia, and Indonesia, it is also pulling back in the Western Hemisphere. The main reason for this is because of cost and skill, with Asia being favored despite the tariffs and pressure to turn elsewhere.