The latest data from the U.S. International Trade Commission (USITC) indicates that Trump’s “Reciprocal Tariff” has led to higher import duties on U.S. apparel imports, although the impact on sourcing appears to be more nuanced than expected. Specifically:

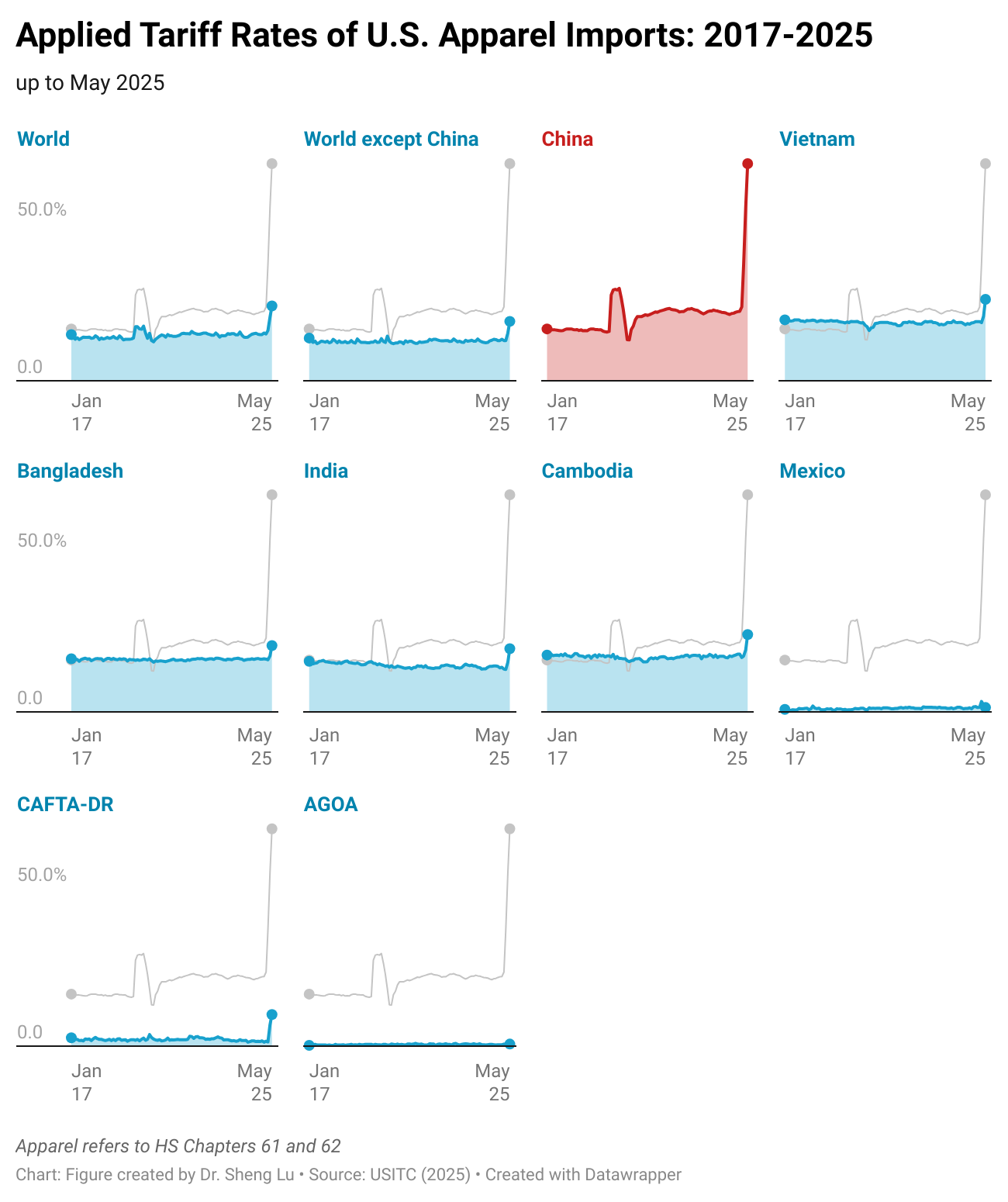

As a result of the reciprocal tariff, the average tariff rate for U.S. apparel imports (HS Chapters 61 and 62) reached 23.8% in May 2025, increased further from 20.8% in April 2025 and much higher than 13.9% in May 2024 and 14.7% in January 2025, prior to Trump’s second term. This tariff rate also hit its highest level in decades. Similarly, while the value of U.S. apparel imports in May 2025 decreased by 7% from May 2024, the import duties skyrocketed by nearly 60% over the same period. [View detailed data HERE]

Due to numerous punitive tariffs beginning in February 2025, the average tariff rate for U.S. apparel imports from China reached an unprecedented 69.1% in May 2025, a further increase from 55.0% in April 2025, 37.0% in March 2025 and 22.1% in January 2025. In theory, U.S. apparel imports from China in May should be subject to a tariff rate of over 145%, as mandated by a series of executive orders. However, as “goods loaded onto a vessel at the port of loading and in transit on the final mode of transit before 12:01 a.m. eastern daylight time on April 5, 2025,“ were excluded from Trump’s reciprocal tariffs, it explains why the actual tariff rate in April and May 2025 appeared lower than the theoretical one.

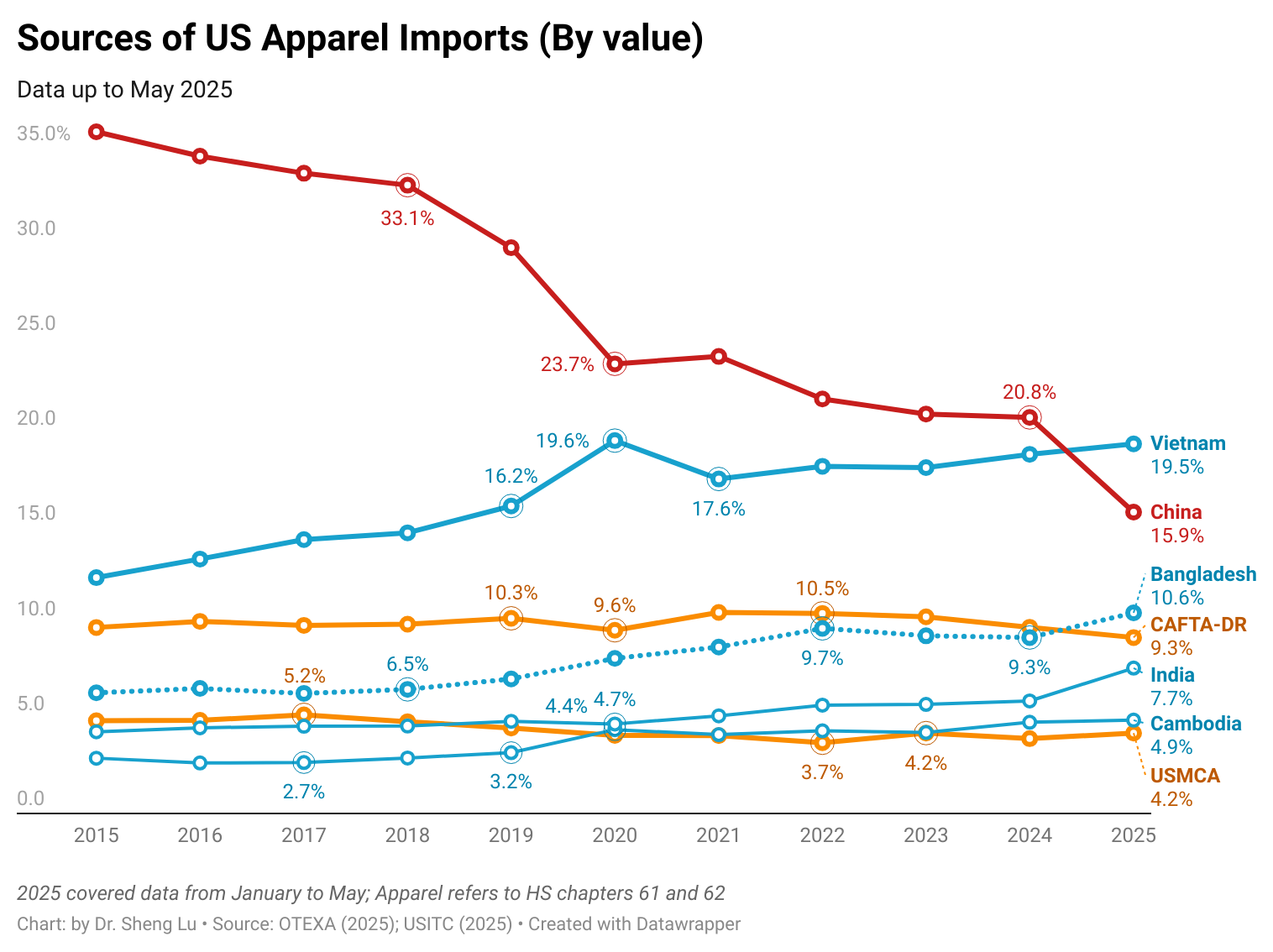

Nonetheless, affected by the high tariffs, the value of US apparel imports from China in May 2025 was cut by more than half from a year ago (down 52%). China’s market share in US apparel imports in May 2025 also dropped to 9.9%, a new low in decades (note: was 19.9% in May 2024). [View detailed data HERE]

Additionally, the average tariff rate for U.S. apparel imports from countries other than China reached 18.9% in May 2025, up from 15.2% in April 2025. Although this rate was higher than approximately 12-13% before Trump’s second term in early 2025, the increase was still much more modest than the theoretical 10% universal reciprocal tariff rate announced by the Trump administration. The average tariff rates for U.S. apparel imports from leading Asian suppliers such as Vietnam, Bangladesh, and Cambodia followed similar patterns (i.e., higher tariff rates but well below a 10% increase). Similar to China’s case, it appears that U.S. apparel imports from other countries in April 2025 included a significant proportion of products that were exempt from reciprocal tariffs because they were “loaded onto a vessel” early enough. [View detailed data HERE]

It is interesting to note that the reciprocal tariff resulted in the most significant increase in tariff rates on U.S. apparel imports from CAFTA-DR members. While imports from these countries were supposed to be duty-free under the trade agreement, the average tariff rate reached 10% in May 2025, up from 6.7% in April 2025. In other words, the short shipping distance unintentionally “disadvantaged” near-shoring imports from being exempted from the reciprocal tariffs, as they could be mostly loaded after the deadline.

Overall, it remains uncertain how the U.S. apparel tariff rates will continue to evolve in response to Trump’s shifting tariff policy. It appears that the trade volume and timing of shipment will be highly sensitive to short-term tariff rate changes, whereas adjusting sourcing bases and product structures will be a consideration for U.S. fashion companies in the medium to long term.

By Sheng Lu

Additional reading: Apparel Tariffs Climbed to Historic Highs in April (Sourcing Journal, June 13, 2025)

I found this report really eye-opening because it showed just how much tariffs can shake up the fashion industry. I didn’t realize that the timing of shipments could make such a big difference in how much companies actually pay in tariffs. The part about CAFTA-DR countries getting hit even though they’re usually duty-free was surprising and made me realize that even near-shoring isn’t always a safe backup. I see why U.S. fashion companies have to stay really flexible and strategic just to survive in a constantly changing trade environment.

This highlights how fast the reciprocal tariff policy has changed imports in the U.S, especially for apparel. The tariff rates have nearly doubled over the past year, with countries like China taking a massive hit. Something interesting about this is that other countries still have a modest or reasonable tariff rate which shows that it is still possible to use other countries rather than relying on China. However, this still involves a lot of planning and strategy in order to be successful and competitive.

I found this post to be very interesting. I really enjoyed the visual provided to show the exponential increase of tariffs, specifically in China, from 2017- 2025. Also, this blog was from July, and most of the information does not go past May, so I would love to come back and compare this in a few months to see how things have continued to advance.

It is always interesting to me to read article about the tariffs from this current administration because just reading the news can make them hard to grasp. This article gave me a better understanding of the effects of reciprocal tariffs and how they have impacted US apparel imports by raising duties. It was particularly interesting to me how duties were raised highly amongst CAFTA-DR members despite the notion that these countries should be free from duties in this regard. I remember our discussions in class about CAFTA-DR and the supposed relief on duties for its members, so it is interesting to me to see these tariffs have such a large effect in this area. We also discussed near-shoring in class and its rise in popularity so I am interested to read that these tariffs have actually put a damper on the benefits of near-shoring and am curious to see how this will affect its popularity in years to come. I also am wondering how this has developed since this article was published and how it will continue to affect our economy as we continue moving through the holiday season and the rest of the year.