This study aims to examine the impacts of the Trump administration’s escalating tariffs on the apparel sourcing and business practices of EU-headquartered fashion companies. Based on data availability, transcripts of the latest earnings call from about 10 leading publicly traded EU fashion companies were collected. These earnings calls, held between August and November 2025, covered company performance in the second quarter of 2025 or later. A thematic analysis of the transcripts was conducted using MAXQDA.

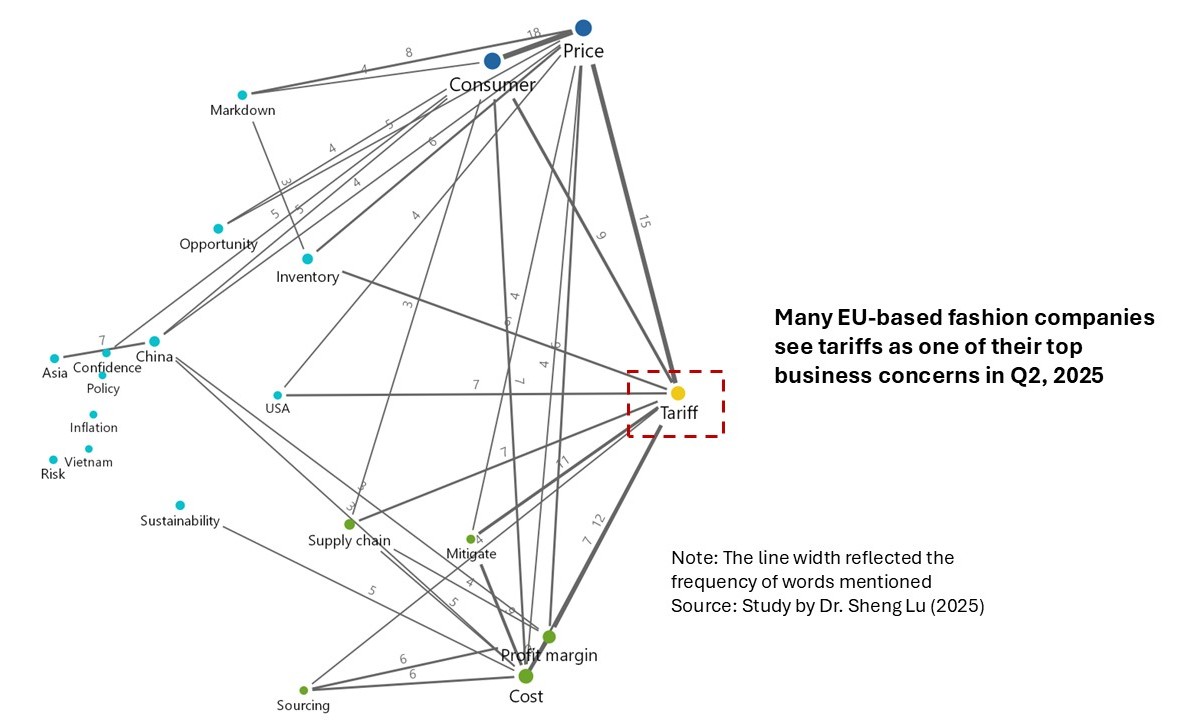

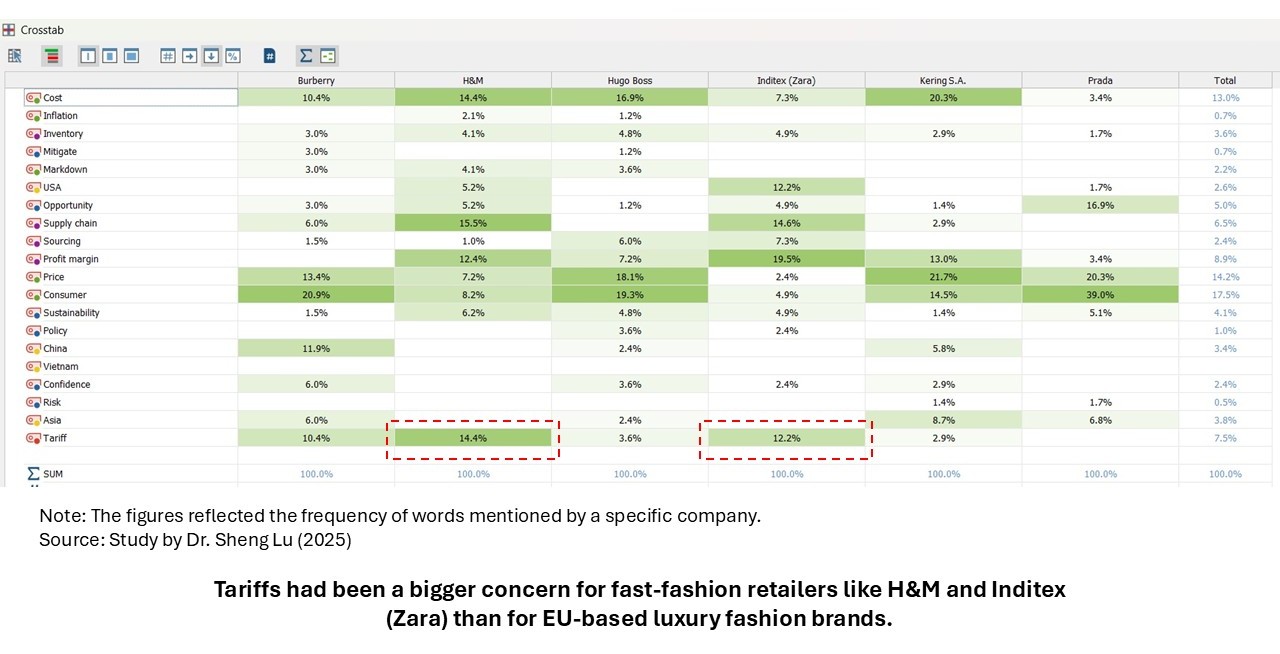

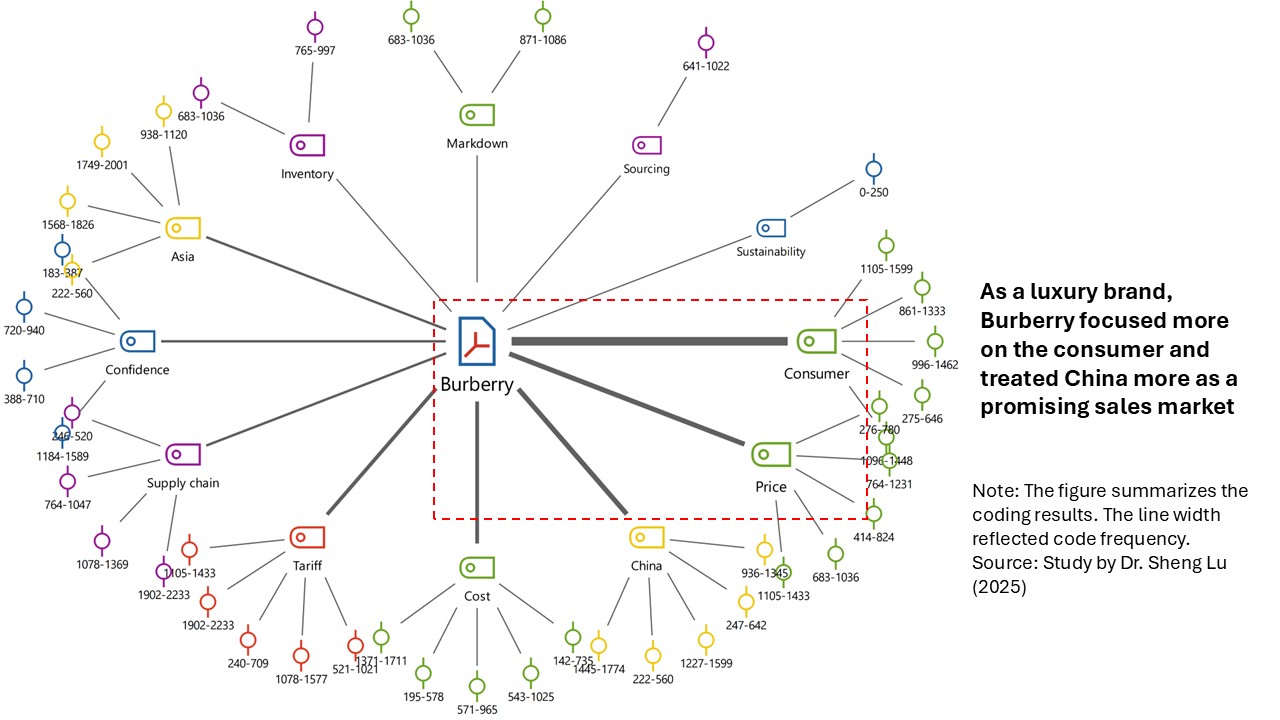

First, reflecting the global nature of today’s fashion apparel industry, many EU-based fashion companies also see tariffs as one of their top business concerns in the second quarter of 2025. However, overall, luxury fashion companies reported less significant tariff effects than fast-fashion retailers and sportswear brands. The result reflected luxury fashion companies’ distinct cost structure, supply chain strategies, and competitive factors, making them less sensitive toward tariff-driven sourcing cost increases.

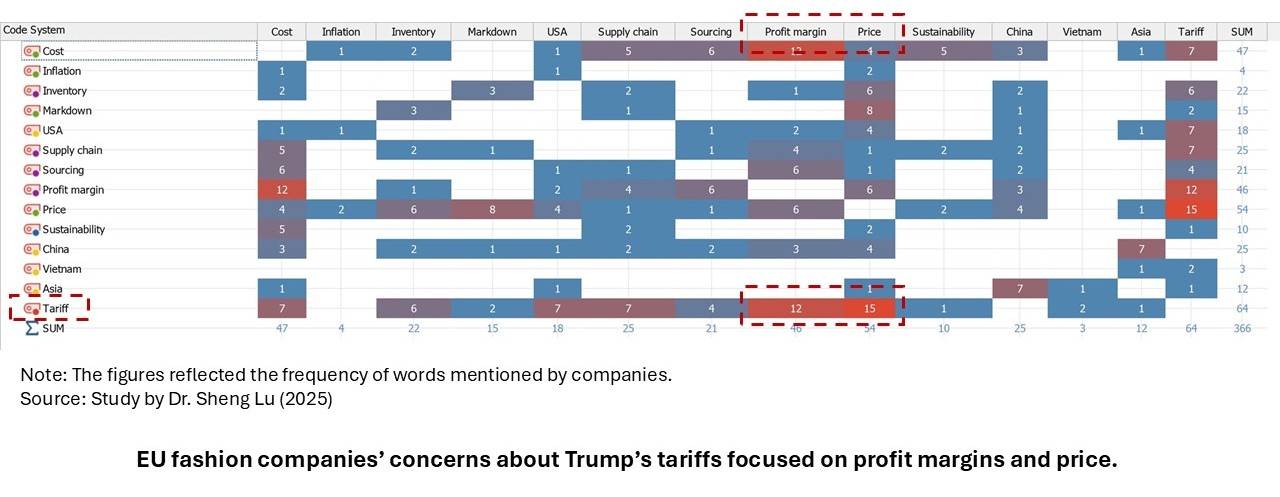

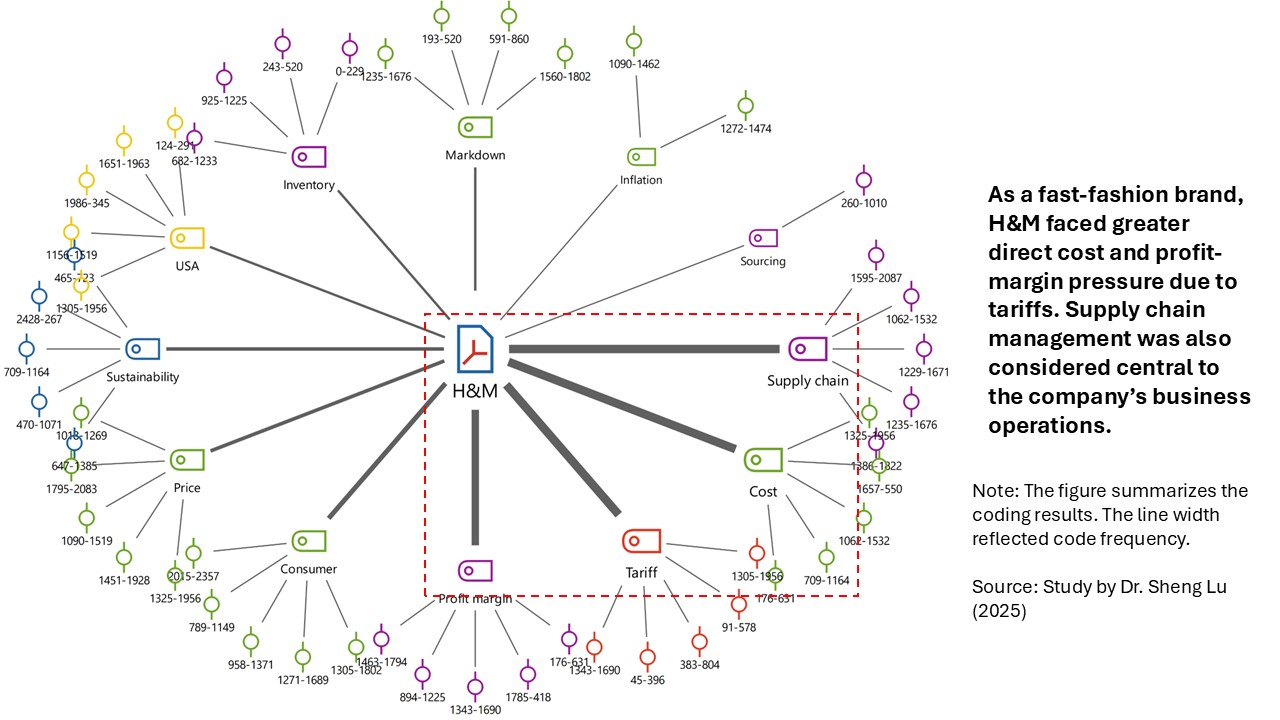

Second, EU-based fashion companies generally regarded the rising sourcing costs and the resulting pressure on profit margins as the most significant impacts of Trump’s tariffs. Companies also noted that the tariffs’ financial impacts would be more noticeable in the coming months as more newly launched products became subject to the higher import duties. For example:

- Adidas: “We already had the double digit hit when it gets to cost of goods sold already in Q2 in the U. S…the impact of these duties, if they are the way we have calculated them here, an increase in cost of goods sold of about CHF 200,000,000 (about $250 million USD).”

- H&M: “Against that, we have the impact of the tariffs that will then, based on the tariffs we pay during Q3, a lot of those garments will be sold during Q4, and that’s when they affect our profit and loss.”

Third, EU-based fashion companies commonly adopted a sourcing diversification strategy to mitigate the tariff impact. Companies also increasingly look for vendors that can deliver speed, flexibility, and agility. Furthermore, some EU companies have been strategically leveraging regional supply chains to meet the sourcing needs. For example:

- Adidas: “We work with our suppliers who are mostly multi country…”

- Hugo Boss: “Since our last update in early May, we have taken concrete steps to mitigate tariff-related impacts. Our well-diversified global sourcing footprint has a clear advantage in this regard. It enables us to swiftly adapt to changing conditions and optimize sourcing decisions.”

- H&M: “We are working on how to increase the speed and reaction time in our supply chain. That’s a wide work that includes both, as we mentioned before, how we move production closer to the customer with what we call nearshoring or proximity sourcing, but it’s also working with a set of suppliers that can be much quicker and where they can support with a larger part of the product development process.”

- C&A: “In the last quarter, we developed our logistics strategy to sustain C&A’s growth curve till 2030…This strategy was designed so as to bring greater speed and flexibility to our operational model through a more regionalized network, that is a network that is closer to the stores and major consumption centers, allowing us to have greater capacity to respond to the demands of each store.”

Fourth, like their U.S. counterparts, some EU fashion companies reduced their “China exposure” to lessen the impact of tariffs. Others establish a “China for China” supply chain due to perceived market opportunities there. For example:

- Puma: “Our China exposure got reduced further for the Spring/Summer 2026 collection…The vast majority of our U. S. Imports originate from Asia, with Vietnam, Cambodia and Indonesia accounting for the majority…”

- Adidas: “China is almost irrelevant for us because we have reduced the amount of China imports into the U. S. to only 2%…What we did is that we transferred the Chinese capacities to be mostly China for China…We have a more verticalized supply chain in China.”

- Hugo Boss: “In particular, we have increased our inventory coverages in the U. S. And successfully rerouted product flows from China to other regions.”

Additionally, despite tariff-driven cost pressures, many EU-based fashion companies were cautious about raising prices, worried about losing customers in an overall weak market. Meanwhile, luxury fashion brands seem more comfortable raising prices than non-luxury brands. For example:

- Adidas: “What kind of price increases could we take depending on the different duties, but there’s no decision on that…We are not the price leader, but we’d, of course, follow, a, what the market is doing, our competitor is doing and also, of course, look very closely what the consumer is accepting because in the end, it’s to keep the balance between all these factors.”

- H&M: “That we do in the U.S., as we do in all other markets, and that leads to both price decreases and price increases to stay competitive. That’s an ongoing work. We are cautious about looking at the Q4 development in the U.S., given that we know we have already paid tariffs that will impact the gross margins as we look into the fourth quarter.”

- Inditex (Zara): “With regards to the tariffs in the U.S. specifically, we have a stable pricing policy that we’re always talking about. Of course, all pricing activity, be it in the U.S. or any other geography, is primarily driven by commercial decisions, not financial ones. What we try to do in every market is maintain our relative position.”

- Burberry: “19% of our revenues are from the US…We spent much of last year looking at the supply chain, looking at price elasticity…We took quite a surgical approach to price increases in the US, and…we really definitely understood where we had price elasticity there.”

- Hugo Boss: “we will introduce moderate price adjustments globally with the upcoming spring 2026 collections, which will begin delivery towards the 2025. These steps aim to safeguard our margin profile while remaining aligned with broader market dynamics.”

by Sheng Lu

This article brought a very thoughtful analysis. I think EU fashion companies that are reconfiguring their supply chains to go around U.S. tariff risks are making a smart long-term decision, not just to survive current policy uncertainty, but to build more flexibility into their sourcing operations. But this also underscores how politics is now a core part of business strategy in fashion. It is not just cost or sustainability. If tariffs keep shifting, the most resilient brands will be those that can pivot quickly.

I also found it fascinating that luxury brand companies reported less significant tariff effects rather than fast-fashion retailers and sportswear brands. Due to their cost structure and sourcing decisions previously, they are able to negotiate around the tariffs easier.

This blog post was very eye-opening for me because I found it interesting how Trump’s tariffs affect EU-based fashion companies. Similar to US fashion-based companies, EU fashion-based companies see tariffs as one of their top business concerns in 2025. This connects back to our class discussions about how policy on trade and tariffs has great implications for the entire fashion industry. This reminded me of the interview with Nicole Bivens Collinson, where she described how policies such as IEEPA and UFLPA affect sourcing decisions. Additionally, EU-based fashion companies described that one of the significant impacts was rising sourcing costs and pressures on profit margins. For example, H&M described that the tariffs they pay on Q3 and later sell in Q4 will decrease profits. To minimize these impacts, EU-based fashion companies have focused on diversifying their supply chains to mitigate tariff impacts. This reminded me of the exercise we did in class, where we determined which countries would be best suited for sourcing. This shows how much strategy goes into sourcing when policies and tariffs create impacts on profits and costs.

Great point! I also was not aware of the impact that Trump’s tariff policies had on European countries, since I normally learn about it through the lens of the United States and sometimes Asia. It makes me wonder if the same question was posed in South America or Africa, how would they describe its impact?

This post made me realize just how much sourcing affects EU fashion companies and how they are responding to the impact of Trump’s tariffs. One thing that stood out to me was that luxury brands felt less pressure from tariff costs compared to the fast fashion and sportswear brands. This connects to what we learned in class about different cost structures when talking about many different brands. Luxury brands have higher margins and stronger brand power which allows them to be less sensitive to sourcing cost increases. I also noticed how EU companies used sourcing diversification and regional supply chains to stay flexible and protect their profit margins. As learned in class, there are many sourcing factors that play a role such as flexibility and speed-to-market which is why sourcing diversification is extremely important. The China-to-China approach was also interesting because it shows how some companies aren’t just leaving China, but they are changing their strategies based on opportunities that allow them to grow. I’m curious whether fast fashion companies will ever be able to match sourcing strategies that are similar to luxury brands, or if their low cost business model makes that impossible to do so unless some sustainable growth happens within these companies.

After reading the study, what stood out to me most was how differently EU fashion companies are affected by Trump’s tariffs. Luxury brands barely feel the impact, but fast-fashion and sportswear companies are really struggling because even small cost increases hit their margins. I also thought it was interesting how almost every company mentioned switching up their sourcing to avoid relying too much on one country. A lot of them are moving production out of China or using “China for China,” which I hadn’t really heard of before.

Another big thing is that companies don’t want to raise prices even though costs are rising, because they’re scared of losing customers. Overall, it showed me how complicated sourcing gets when trade policies change so fast.

This article stood out for its relevance because of what we have talked about all semester but also the date of it being published Nov 24. It reflects what we’ve been talking about in class, how Trump’s escalating tariffs are reshaping the future of global sourcing. What stood out to me most was how clearly the earnings-call quotes showed the real financial burden hitting EU fashion companies, like Adidas facing a “double-digit hit” and about $250 million in added costs, while fast-fashion brands like H&M explained how tariffs paid in one quarter immediately squeeze margins in the next. The article also reinforces a major theme from class that companies are now prioritizing diversification, speed, and agility more than ever, with brands like Hugo Boss, and H&M shifting toward nearshoring supply chains to stay competitive. I also found it interesting that while many EU brands are reducing their “China exposure,” others, like Adidas, are building a “China for China” model, which connects directly to our discussions about market-driven production. This blog feels like a preview of where the industry is heading, more diversified sourcing, more regional production, and constant pressure to stay flexible under unpredictable trade policy.

This article does a good job of highlighting how difficult it is for EU fashion companies to navigate under the new U.S. tariffs. It shows how companies are being forced to reconsider their sourcing strategies, supply chains, and pricing, and I found it really interesting how all of these brands are being affected. The article also highlighted the growing importance for diversification and moving sourcing to different regions, as well as the risk associated with these adjustments, such as faster fashion cycles, reduced transparency, or reliance on less-established suppliers. This leads me to wonder how brands will manage to balance sustainability efforts with speed and efficiency. Overall, this article brings up a conversation about the economic pressure that tariffs have on fashion companies both domestically and internationally.

From this article, it made me realize many companies were impacted differently from Trump tariffs than some others. Luxury brands have been significantly less impacted than fast-fashion and sports apparel companies. Many fast-fashion and sport apparel companies such as Adidas and H&M are struggling to reach their profit margins due to the increase of tariffs and many of them are trying to diversify their sourcing methods in order to find flexibility and speed to market. I find it very interesting how a lot of companies are moving their sourcing out of China and implement a “China for China” strategy in order to reduce the impact of tariffs on the products which was interesting to learn about.

Reading this article, it is clear to me that brands’ supply chains all over globe are being affected by the recent tariffs and it is weakening them overall. I think it is easier said than done to just pick up everything and move production elsewhere, which is why so many brands are struggling to make the change. Brands have such a strong reliance on China for production and it is difficult to switch to other countries, especially now. I also think something that needs to be spoken about more that is mentioned in the article is the topic of sustainability. Brands that are struggling right now will understandably lean more towards the cheapest, quickest option to produce items. Because of this, sustainability is being forgotten about in a lot of cases and I think it is something that must be prioritized for brands, even though it will not be easy. The industry is very difficult right now but I believe it is important to continue ensure sustainability is still a prominent concern.

This article helped me understand more about how the US tariffs also affect the decision of EU based companies because of international trade policies. It shows how supply chain resiliency will continue to be an important factor for companies to stay ahead on potential geopolitical risks. Fast fashion brands have become accustomed to keeping all their production in one place for speed but now this is impacting their business compared with luxury brands that have started to diversify their supply chains. It stood out to me that luxury brands were less worried about having to raise prices but upon reflection it does make sense because they are already a premium market and consumers who buy from brands like Burberry expect to pay more whilst brands like Zara and Adidas rely on lower cost models to appease consumers. These fast fashion brands now have to find ways to diversify their supply chain without compromising their core values which may be tough.

This post gave such a clear explanation of how EU fashion companies are adjusting to the new U.S. tariffs. I didn’t realize how many brands were using tools like the First Sale rule or shifting parts of their supply chains to reduce the impact. It’s interesting to see how companies have to balance cost, risk, and keeping prices stable for consumers. Overall, this helped me understand how complicated sourcing decisions have become under the new tariff environment.

I really appreciated the graphics in this post. It allowed me to further understand all aspects of how EU fashion companies navigate tariffs. The fact that it is so recent is also interesting to me and good to be able to educate myself on recent issues in the trade industry. Balancing aspects like mitigation risks, supply chains, sustainability, inventory management can all be hard for companies but I was not shocked to see that tariffs are one of their top business concerns as of recent. Because it affects everything they do.

This post highlights how complex tariff shocks have become for European fashion companies, especially given how globally integrated their sourcing networks are today. What stood out to me most was the contrast between luxury and non luxury brands. Since luxury houses rely more on craftsmanship, vertically integrated production, and higher margins, they seem much less effected by tariff related cost increases. Whereas fast fashion and sportswear brands feel the tariff impact almost immediately. I also found it interesting how almost every company referenced speed, flexibility, and regionalization as core strategies moving forward. This aligns with what we’ve discussed in class about companies restructuring supply chains to be more demand driven and less vulnerable to geopolitical risk. I also found that the “China for China” approach reflected how reducing China exposure for U.S. imports doesn’t mean abandoning the Chinese market. Instead, brands are rebalancing global flows while still recognizing China’s value as both a manufacturing base and consumer market. Overall, this post reinforces how sourcing strategy is becoming just as important as design or branding for maintaining competitiveness in the fashion industry.

The post explains how luxury brands are less affected by tariffs. This makes sense to me as they are usually sourcing locally to their factories and have unique competitive factors and cost strategies that allow them to succeed in their own area. These companies don’t have as much of a problem raising prices as their consumer has an abundance of disposable income and they benefit from strong name recognition. However, for nmon-luxary brands, raising prices is risky and they are cautious not to lose loyal consumers to competitors. In addition, as we discussed in class, companies are using diversification as a solution to mitigate tariff effects. While diversifying they are also moving away from China to lessen their tariff effects. It is clear that the US is not the only country feeling the effects of these tariffs.

This article shows how the increased tariffs are reshaping supply chains, pricing, and sourcing strategies across European fashion companies. I agree that fast-fashion companies are more exposed to tariff pressures than luxury brands. However, I would argue that this pressure reveals how fragile fast-fashion’s globally stretched sourcing models are. One issue that is missing from this discussion environmental impact that is shifting production away from China to countries like Vietnam. This is an instance where savings does not mean ethical sourcing. An interesting takeaway from this article that I would like to learn more about is how companies are taking a cautious approach to price increases, and whether tariff-driven shocks in price will permanently change consumer expectations around value, especially on-luxury brands.

This article did a great job of providing insight into how U.S. tariffs affect EU fashion brands, and how they are choosing to navigate these obstacles. The article highlights how EU brands are prioritizing diversification, speed, and flexibility when sourcing in order to minimize the effects of tariffs. Brands are also leveraging regional supply chains which ties into our class teachings about nearshoring and regional production trade networks.

I also found it interesting that luxury brands were feeling less significant effects from U.S. tariffs than EU based fashion brands. The article explains how this is due to the cost structure, supply chain factors, and competitiveness of luxury brands. The visuals that the article provided gave insight into how EU based fashion brands were more focused on supply chains, costs, and profit margins, whereas luxury brands were more focused on the consumer.

I found this article to be incredibly insightful and interesting. I feel as though I have learned much regarding how tariffs can truly have an impact on sourcing strategies for major fashion companies. I really enjoyed reading about the discussion on the differences between luxury brands and fast-fashion, because many fail to recognize what sets them apart. Luxury brands feel this impact of tariffs much less because of their cost structures. Rather companies like Adidas and H&M are seeing large hits to their cost of goods. Not only this, but I learned about how brands are choosing to respond and act quickly to this shift. Instead of relying on China, many brands are choosing to manufacture across many countries. Adidas and other brands have shifted their production to countries like Vietnam or Cambodia, where there are lower tariffs. Overall, this blog post was effective in helping me gain and understanding on the impact of tariffs and how they can force companies to think quickly on their feet.

What I found most interesting from reading this article was how luxury fashion brands have reported experiencing “less significant tariff effects” compared to other lower-end brands. I think that luxury brands facing less pressure from tariffs is reflective of their sourcing and supply chains, as they often source more from European countries rather than Asian countries. We’ve seen from the Trump administration tariffs that major Asian supplying countries, most notably China, have been the hardest hit with tariffs. For fast fashion or athletic apparel retailers that utilize them as a major sourcing destination, it creates threats on their costs and pricing strategy. For luxury retailers, I believe that tariffs have not had a major influence on them because they focus on sourcing from countries (such as European) that provide better quality rather than quantity and speed. What was also interesting was that despite luxury brands being affected less by tariffs, they feel more comfortable about raising their prices compared to non-luxury brands. I think that this is reflective of how companies must also make their pricing decisions strategically based on consumer behaviors and expectations, as consumers shopping for luxury goods could be less price-sensitive and therefore more accepting of price increases.

In class we have had many discussions about brands trying to not be over-reliant on one singular country. Brands trying to move production out of China ties directly into our class discussions about sourcing risks. Trade policies and tariffs can really reshape the supply chain. By moving a ton of production out of China, this could lead to lower production and capacity issues with all other countries. I think eventually brands will want to move production back to China once they realize how reliant they were on China. Adidas reducing its imports from China to only 2% is such a surprise to me, since they are such a huge brand. Will the “Chine for China” strategy stay in place, even after tariffs?

Because of this class, I was not surprised to read how much tariffs affect fashion companies sourcing decisions. Luxury brands are affected the least by tariffs compared to fast-fashions brands. This is not super surprising based on the different profit margins. Many EU companies are using regional or nearshoring approach to be faster, flexible, and agile. A lot of fashion companies are also reducing their “China exposure” while some are keeping a “China for China” strategy. This is interesting to see the difference in sourcing strategies depending on the company and what they think is best. I think it is smart that EU brands are reducing their reliance on China because relying too much on one country can be risky. I also find it interesting that with higher costs, most companies are being careful about raising prices because of competition. This is good to hear as someone who frequently shops. It seems that because of tariffs, companies are trying to be more strategic and flexible. This will make the industry stronger in the future.

Reading this blog helps to identify major concerns and issues that have and will continue to develop following Trump’s tariffs. This is important to note because so many consumers were aware of when the tariff war was going on but do not fully understand how these impacts will affect them personally. Where we can see this most is that many brands have announced that due to tariffs they will have to increase their prices on new collections and products due to these tariffs. Some of these brands listed in the blog include Adidas and H&M. This is very important because there are so many brands that are also following their lead and raising prices, this is something that consumers will have to prepare for especially looking at this upcoming holiday season. This creates a large concern for the brands themselves as many consumers have been changing their behaviors because of these escalation in prices, where certain brands will no longer be in their price category. This issue may also be further emphasized as brands continue to diversify their supply chain to mitigate the risk of tariffs as certain countries have higher costs in production over locations such as China.

Sourcing diversification is a major buzzword in the industry. Articles like this help me identify why companies have decided to participate in this new wave of sourcing. I found it interesting that the article mentioned large companies like Adidas have also significantly reduced their sourcing from China, or their “China Exposure.” It’s common to assume that these longstanding companies have had established partner relationships with Chinese suppliers for a considerable amount of time, so it’s a true testament to the impact of the tariffs that they’ve felt the need to source elsewhere. Even the EU has felt the pressure of rising costs associated with the tariffs.. Based on our in-class discussions and interactive learning activities (like the one in which we determined which countries were more capital or labor-intensive), I am confident that diversification will continue to be brands’ primary method of sourcing going forward.

On another note, I was shocked to learn that luxury companies didn’t feel the tariff effects as significantly as fast fashion companies. Last semester, I took another fashion course that spoke about how the luxury industry has been declining as customers value experiences more and earn less money. I would’ve guessed that they would’ve been more sensitive to the change due to that, but the study results reveal otherwise.

This was such an interesting breakdown, and honestly the findings line up with what feels obvious in the industry right now. The tariffs are hitting EU brands in a lot of the same ways we’ve seen with U.S. companies, higher sourcing costs, stress on margins, and everyone scrambling to diversify production. What really stood out to me was how different the impact is depending on the segment. Luxury barely feels it, but fast fashion and sportswear are definitely getting squeezed. I also thought it was interesting how many companies are cutting back on China for U.S. shipments but still using China for the China market. It shows how complicated it actually is to shift sourcing in a global industry. And even with all the added costs, brands are still nervous about raising prices too fast because consumers are already hesitant. It really captures how everyone is trying to balance staying competitive while dealing with policies they can’t control.

Tariffs and trade policies pose growing threats to fashion companies around the world. With the fashion brands that are located in the EU, I find it strategic to consider the repercussions of rising sourcing costs and resulting pressure on profit margins when reorganizing one’s supply chain. This not only benefits companies in the long run, but also helps them remain competitive during the uncertainty that comes with these tariffs. When companies are trying to mitigate the least amount of loss as possible, it is better to adjust rather than resist. The report noted that within the coming months, there would be more noticeable financial impacts with an influx of recently launched products being subject to the higher import duties. With this, I would suggest companies to adapt to survive as there is immense risk in not knowing what is coming next or if it will end.

I was intrigued to learn that luxury brands are more durable toward tariff-driven sourcing cost increases as they have well-established, supply chain strategies and a significantly different cost structure, while fast-fashion brands experience they most impact. In a way this can encourage the mass-production of goods to slow down, which could lead to less generated waste.

This highlights just how deeply interconnected EU fashion companies are with U.S. trade policy, and it’s striking to see how quickly tariffs reshaped sourcing strategies across the industry. What stood out most to me was the contrast between luxury brands, whose pricing power shields them from tariff shocks, and fast-fashion and sportswear companies that face immediate margin pressure. The widespread shift toward diversification, speed, and regional supply chains shows how companies are rethinking resilience, not just cost. It is also interesting that many brands are reducing China exposure while simultaneously maintaining “China for China” models to capture local demand. The study reinforces how geopolitics, supply chain strategy, and consumer expectations are becoming inseparable in shaping the future of global apparel sourcing.

I really liked this article, i found it very helpful. I feel like I learned a lot about how tariffs actually shape sourcing strategies for big fashion companies. I especially liked the section comparing luxury brands and fast fashion, because people don’t always understand what truly sets them apart. Luxury brands aren’t hit as hard by tariffs because of their pricing and cost structures, while companies like Adidas and H&M feel the impact much more. I also learned how brands are responding by quickly shifting their production. Instead of relying on China, many companies are spreading manufacturing across multiple countries. Adidas and others have moved a lot of production to places like Vietnam and Cambodia where tariffs are lower.

I appreciated the analysis discussed in this article and how it raises questions for us to answer in the future. This article has helped me personally understand how interconnected US fashion brands and EU fashion brands are. When learning about the tariffs imposed by this current administration in class, my first thought is to assume that this only affects US based fashion retailers and where they supply their products. I hadn’t taken much time to consider how these new regulations could possibly impact those a little more further removed from the direct impact of the tariffs. From my point of view, I can directly see how the uncertainty created by the rise of new tariff regulations makes EU fashion companies reconsider their own stability and how their own sourcing relationships can be impacted in the short and long term. However, this extra consideration towards the reliability of supply chains is not a negative to me for EU based fashion retailers. The potential impact of these tariffs seems to be acting as an important check point for EU based fashion companies to take a minute to really analyze how risky they are being in where they are sourcing from. I believe it is a good thing for EU based retailers to reduce their China exposure and reconfigure themselves to be more resilient against any future tariffs.

This shows how the shift towards more diversified vendors has increased in apparel sourcing. As more brands move to multi-country supply chains, it increases speed and flexibility in the process. It’s also interesting that companies are still thinking about price increases because of the riskiness of consumer shopping.

This blog was very fascinating in so many ways. First, I found it so interesting that luxury brands don’t have to pay as high tariffs as fast-fashion companies. I guess this is the government’s way of trying to reduce the amount of fast fashion in the country? If anything, I would’ve thought it was the other way around, considering luxury goods are often purchased by consumers with extra money to spend. Also, considering that 19% of Burberry’s sales came from America, I would assume they would be a little more against the tariffs. But maybe 19% is a large enough amount for them to dismiss these tariffs.