Question 1: We know that nearly 98% of clothing consumed in the U.S. is imported. Can you give our students a quick overview of U.S. Customs and Border Protection (CBP)’s role in regulating international trade, particularly textiles and apparel products?

- CBP’s Office of Trade facilitates legitimate trade, enforces U.S. trade laws, and protects the United States economy to ensure consumer safety and create a level playing field for American businesses.

- CBP is responsible for regulating clothing and/or textiles products imported into the United States, ensuring that all trade aspects of the importation are correct at the time of entry. These include, but are not limited to the classification, valuation, country of origin markings, and qualification for preferential duty treatment under a free trade agreement and/or program.

- Textiles and wearing apparel are recognized as a Priority Trade Issue as codified in the Trade Facilitation and Trade Enforcement Act (TFTEA) of 2015. As such, this issue is one of the primary drivers for risk-informed investment of CBP resources as well as our enforcement and facilitation efforts. This includes the selection of audit candidates, special enforcement operations, outreach, review of free trade agreements and/or trade preference programs claims, and regulatory initiatives.

Question 2: Ensuring no forced labor in the supply chain is a top priority for U.S. fashion companies. Specifically, the Uyghur Forced Labor Prevention Act (UFLPA) officially came into force in June 2022. For our students who may not be familiar with the UFLPA, what essential information should they know about this legislation and the issue of forced labor? Additionally, could you recommend any helpful online resources?

- CBP is the leading federal agency in the enforcement of forced labor laws and the UFLPA. The agency achieves this through two approaches – the first is through forced labor investigations and issuance of Withhold Release Orders (WROs) and Findings, which require CBP to prevent the release of goods made with forced labor into the U.S. commerce. The second is through the implementation of the UFLPA rebuttable presumption.

- CBP enforces U.S. law on forced labor within Section 307 of the Tariff Act of 1930, which says any “goods, wares, articles, and merchandise mined, produced, or manufactured wholly or in part in any foreign country” by convict or forced labor is not permitted entry into U.S. commerce.

- In 2016, the U.S. Government enacted the Trade Facilitation and Trade Enforcement Act (TFTEA), which removed the “consumptive demand” clause that was in the original statute. This change allowed CBP to set up its own investigative unit, where CBP receives allegations of forced labor, investigates them using the 11 indicators of forced labor, and issues WROs or Findings when applicable. CBP issues a WRO if there is a reasonable suspicion of forced labor conditions by a particular foreign manufacturer, and it issues a Finding if there is probable cause that forced labor conditions exist.

- The relatively recent UFLPA establishes a rebuttable presumption that any goods made wholly or in part from the Xinjiang Uyghur Autonomous Region (XUAR) are prohibited from entry into U.S. commerce, as they are presumed to be made with forced labor unless the importer can provide clear and convincing evidence the goods are not made from forced labor or sourced from the XUAR.

- When goods are exported directly from the XUAR, CBP applies the rebuttable presumption and excludes the goods from entry. Importers then must prove by clear and convincing evidence that the goods are not made with forced labor before they can be released into U.S. commerce. For goods not imported directly from the XUAR, CBP evaluates the risk that the producer uses inputs from the XUAR in the production of the final product and will stop any shipments it deems as high risk of containing materials produced from the XUAR.

- CBP is committed to identifying products made by forced labor and preventing them from entering the United States. CBP’s enforcement of 19 U.S.C. § 1307 supports ethical and humane trade while leveling the playing field for U.S. companies that respect fair labor standards. The UFLPA is a major shift for importers as it requires them to know their entire supply chains from the raw materials all the way to the end product and to ensure no materials made with forced labor are included at any step along the way. Information on all of these topics and many more are available on CBP’s Due Diligence in Supply Chains webpage.

- Students can visit our Forced Labor webpage for updated information and resources on CBP’s efforts to prevent goods produced with forced labor from entering U.S. commerce. There is also a specific UFLPA webpage, which explains CBP’s roles and responsibilities and links to the UFLPA Entity List; an UFLPA Statistics Dashboard with information on the number of shipments stopped by CBP by fiscal year, industry, or country of origin; due diligence documents and reports; CBP’s Operational Guidance for Importers, frequently asked questions on UFLPA enforcement and the Department of Homeland Security (DHS) Strategy; and additional links to the DHS Forced Labor Enforcement Task Force Agency Related Resources.

Question 3: Our students are also intrigued by the so-called ‘de minimis rule,’ which has been a topic of heated debate in the news. Why was this rule proposed initially, and how does it relate to the fashion and apparel trade?

- De minimis shipments, also referred to as Section 321 low-value shipments, are goods that are exempt from duty and tax under 19 U.S.C. § 1321(a)(2)(C) and 19 C.F.R. § 10.151. De minimis eligibility is based on the value of all goods imported by one person, in one day. The de minimis exemption allows CBP to pass, free of duty and tax, merchandise imported by one person on one day that has an aggregate fair retail value in the country of shipments of $800 or less. This provision was first enacted in 1938 to avoid administrative expense to the government from inspecting low-value goods disproportionate to the amount of revenue realized and was subsequently raised multiple times.

- The passage of the Trade Facilitation and Trade Enforcement Act (TFTEA) in 2016 raised the de minimis threshold from $200 to $800.

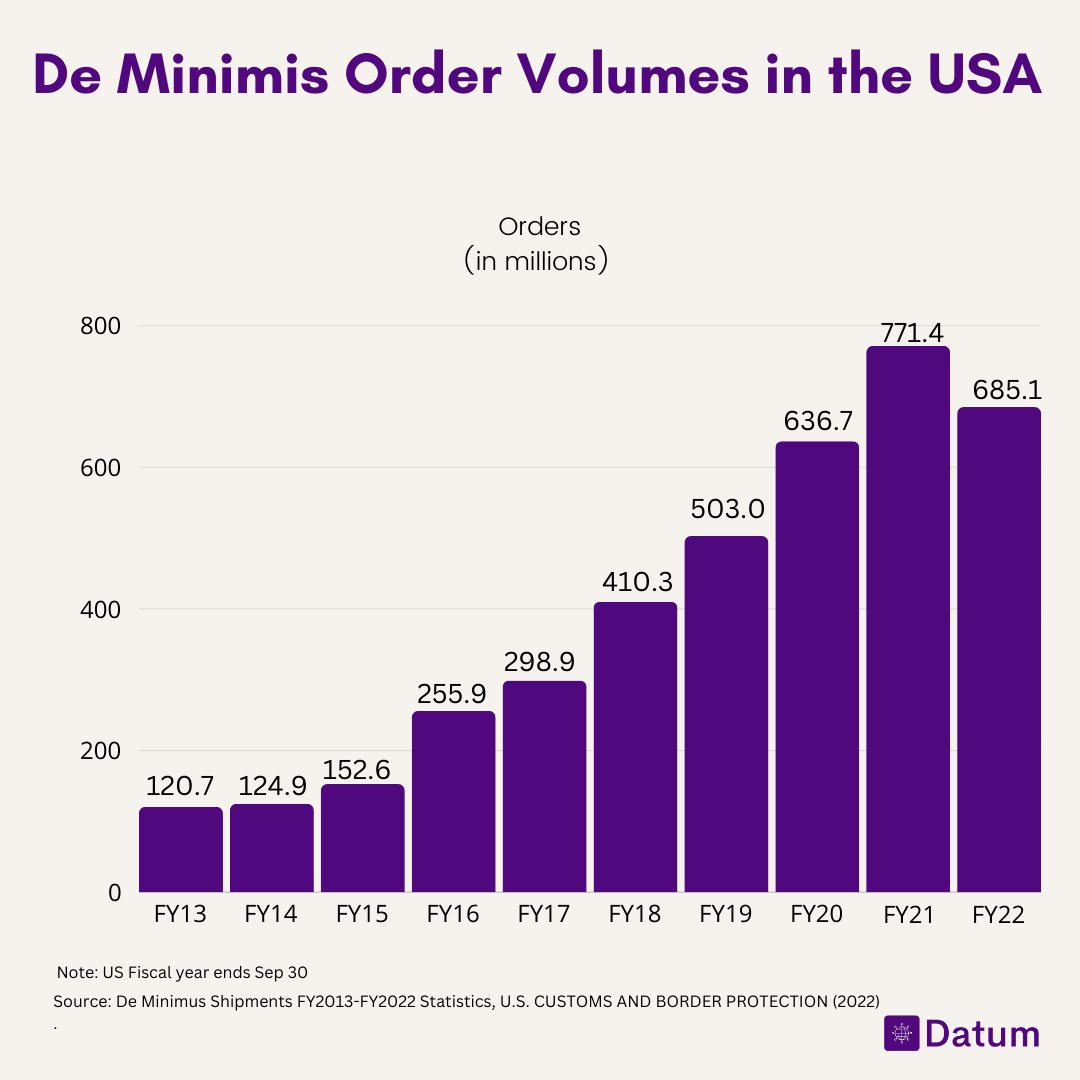

- In 2015, CBP processed 139 million de minimis transactions. By 2023, this increased to more than 1 billion, representing a 662% growth in eight years. Now, in Fiscal Year 2024, nearly 4 million de minimis shipments arrive at CBP facilities for targeting, review, and potential physical examination each day. Although these packages are low value, they pose the same potential health, safety, and economic security risks as larger and more traditional containerized shipments.

- As long as a good is not subject to duties, taxes or fees (such as anti-dumping/ countervailing duties, excise taxes such as those required for alcohol and tobacco products, or any interagency fees that have not been waived for informal entries), it is eligible for de minimis clearance.

- Significant attention is being placed on the de minimis administrative process for new business models, such as those used by e-commerce and fast fashion companies, which leverage the de minimis process for direct-to-consumer shipments.

Question 4: Building on the previous question, in April 2024, the Department of Homeland Security (DHS) announced its new textile enforcement actions. How will CBP contribute to the new enforcement strategy?

- CBP is responsible for the management, control, and protection of U.S. borders and ports of entry, acting on the frontline of textiles and trade agreements enforcement. The U.S. textile industry is a vital domestic industrial base for U.S. national security, health care, and economic priorities. U.S. textile production is the foundation of the western hemisphere textile and apparel co-production chain, representing over 500,000 U.S. jobs, 1.5 million western hemisphere jobs, and $39 billion in annual shipments. Members of the textile industry have raised concerns with CBP regarding a decline in business momentum affecting their ability to maintain productivity and jobs.

- In response to these concerns, CBP is increasing its efforts to detect, interdict and deter illicit textiles trade and promote a level playing field for the domestic textiles industry given the ever-changing threat landscape and recent proliferation of allegations.

- CBP is conducting coordinated and unified intelligence and data-driven operations to target and interdict textile imports that are not compliant with U.S. trade laws. Efforts include, but are not limited to, running special operations, carrying out Textile Production Verification Team visits at foreign factories and raw material providers, examining cargo, conducting compliance reviews and verifications, completing trade audits, and performing laboratory analysis on imported products with a heighted focus on imports that are subject to the U.S.-Mexico-Canada and Dominican Republic – Central America trade agreements, imported under the de minimis provision, and/or potentially in violation of forced labor laws, including the Uyghur Forced Labor Prevention Act.

- You can learn more about CBP’s textile enforcement work in a recent CBP Reports video. You can also find information on our website.

Question 5: We know technology is significantly affecting and shifting how international trade is conducted. At CBP, there is an initiative called “21st Century Customs Framework.” Can you provide our students with more information about this program? For example, what is it about, what do you plan to achieve, and why does the program matter for fashion apparel companies?

- The 21st Century Customs Framework (21CCF) is CBP’s effort to update its Title 19 authorities and underlying statutes, which have not seen comprehensive updates in more than 30 years.

- Since 1993, trade volumes have increased dramatically, trade practices have changed, and new threats have emerged, which means CBP needs new tools and capabilities to do its job.

- 21CCF matters for fashion apparel companies in two key ways: (1) the framework identifies updates that would better enable CBP to facilitate lawful trade more efficiently, so that goods can get to consumers, warehouses, stores, and other destinations as quickly as possible; and (2) the framework identifies updates that would enable CBP to bolster detection and enforcement against goods that threaten the well-being of American businesses and consumers—counterfeits, goods produced with forced labor, anti-competitively priced goods, and goods that violate environmental or consumer safety laws.

- For example, 21CCF includes concepts that would authorize CBP to furnish industry stakeholders with information generated by market platforms regarding compliance with intellectual property rights laws—such as product origin and manufacturer—in importations where intellectual property violations are suspected.

- By sharing additional information with the private sector, CBP will be able to utilize its private sector partnerships to more readily identify illicit sellers using online marketplaces to import intellectual property rights-infringing goods into the United States.

- Additionally, these proposed updates would better position the private sector to make more informed business decisions and eliminate high-risk actors from their supply chains.

- Overall, in pursuing 21CCF, CBP envisions a trading system where legitimate goods move swiftly and securely; ethical production methods are used throughout the global supply chain; domestic industries compete on a level playing field; and the United States helps lead the world with innovative trade practices.

- Private sector input has been instrumental throughout the development of the 21CCF statutory concepts, and the framework is now undergoing an interagency review process before eventually being cleared to be formally transmitted to Congress for consideration.

Question 6: As members of Generation Z, our students deeply care about fashion sustainability. Studies also show that fashion companies are increasingly concerned about climate change and its significant business implications. In your view, how can international trade contribute to sustainability and foster a more sustainable fashion industry? How might CBP support and assist in these efforts?

- Sustainability in fashion concerns more than just addressing textiles or products. It involves the entire product lifecycle process, which includes the way the clothing is produced, consumed, and disposed of in landfills.

- Sustainability in fashion encompasses a wide range of factors, including cutting carbon dioxide emissions, addressing overproduction, reducing pollution and waste, and supporting biodiversity.

- CBP has a responsibility, as part of our mission, to keep people safe and protect the economy; that includes supporting the fashion industry. As noted, the fashion, textile, and apparel industries are crucial parts of the U.S. economy. The work CBP does is key in seizing suspect and potentially illegal fashion goods at the border, issuing penalties to bad actors, and protecting the health and safety of the American people.

- Due to CBP’s direct influence over trade processes, we see ourselves as a facilitator across the government to start conversations about sustainability and where government can remove barriers or add value to existing environmental efforts in trade.

- CBP has developed strategies aimed at promoting environmental sustainability within trade. CBP’s Green Trade Strategy, for instance, is designed to champion the reduction of pollution and waste while encouraging the adoption of green technologies and practices. Such initiatives reflect a broader commitment to advancing circularity, recycling, and reuse in the fashion industry that can enable fashion companies to produce and sell their products more sustainably.

- CBP launched the Green Trade Strategy in 2022 to further enable CBP to fight the negative impacts of climate change and environmental degradation in the context of the trade mission.

- The strategy focuses on four main pillars:

o Incentivize Green Trade;

o Strengthen Environmental Enforcement Posture;

o Accelerate Green Innovation; and

o Improve Climate Resiliency and Resource Efficiency.

- Thousands of CBP employees work toward making international trade more sustainable and transparent. The strategy touches every office and every employee at CBP.

- With these four pillars, the strategy provides a framework for future action. Success requires buy-in and collaboration with all our stakeholders, including the fashion industry, and especially you, the future of fashion. We want your help because we cannot do this alone, and you offer unique perspectives that we need in order to fight and mitigate climate change.

- Students who are interested in learning more about CBP’s green trade efforts can visit our Green Trade Strategy webpage.

Question 7: Additionally, some of our students are considering a career in international trade. What career opportunities at CBP might be a fit for our undergraduate and graduate students?

- There are a number of paths for college students and recent graduates to gain experience and begin to build their careers at CBP, including our recent graduate programs and the Pathways Program.

- Some positions that recent graduates can pursue include the following:

- Administrative – CBP has administrative roles in various business functions, such as finance, budget, personnel, logistics, and asset management. Position titles include Staff Assistant and Management and Program Analyst.

- Law Clerks – This role is for those with recent JDs that expect to pass the Bar Exam within 14 months.

- Auditors – This is for students pursuing the auditor career (Interns) or those expecting to complete the required unit of Auditor courses (Auditor, GS-11).

- CBP prioritizes facilitating legitimate trade in textiles and wearing apparel and protecting the intellectual property rights of fashion and apparel brands as a part of its trade mission.

- CBP employees help protect the wearing and apparel industry from counterfeit merchandise and other unfair or harmful trade practices.

- Learn more about career opportunities at CBP on our careers page.

–END–

Disclaimer: This interview is intended exclusively for educational purposes in the FASH455 class and shall not be considered an official policy statement of the U.S. Customs and Border Protection (CBP).