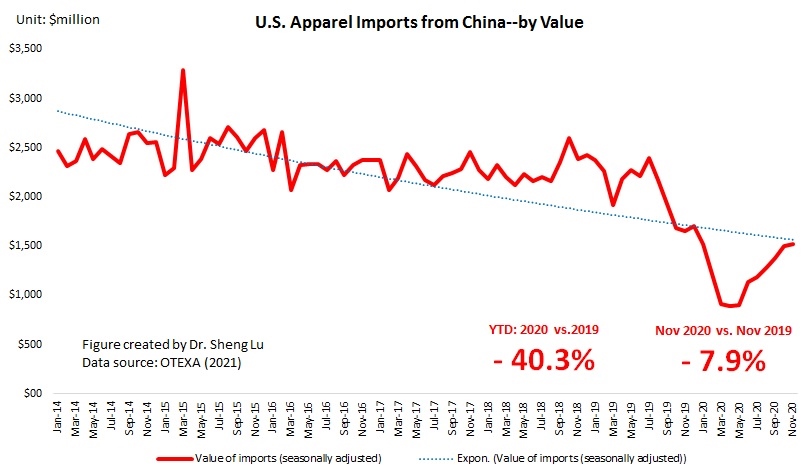

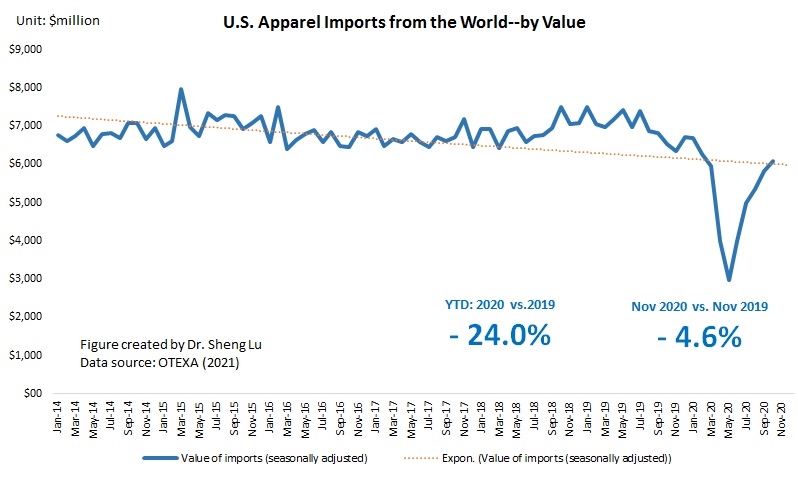

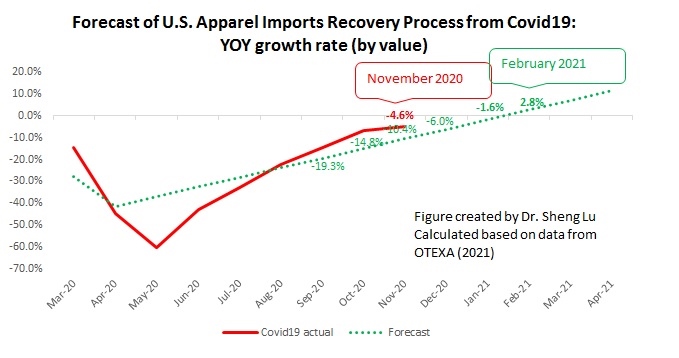

First, U.S. apparel imports continue to rebound thanks to consumers’ robust demand. However, the speed of recovery slowed. Specifically, The value of U.S. apparel imports in November 2020 marginally went down by 0.3% from October 2020 (seasonally adjusted), compared with an 8.8% growth from Aug to September and a 4.6% growth from September to October (seasonally adjusted).

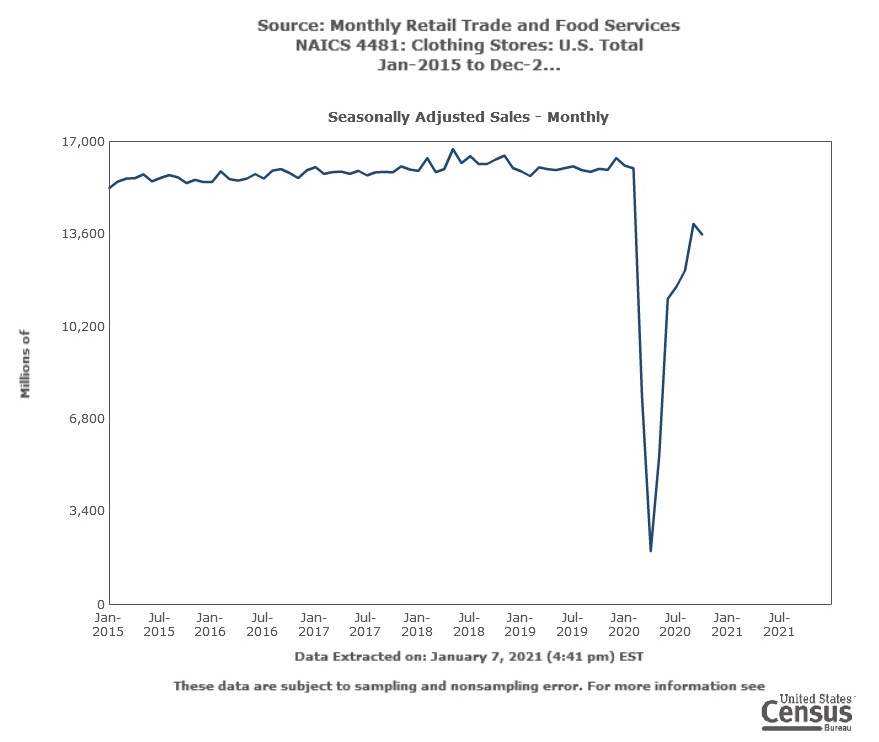

As of November 2020, the volume of U.S. apparel imports has recovered to around 85-90% of the pre-coronavirus level. This result echoes the trend of U.S. apparel retail sales (NAICS 4481), which also indicates a “V-shape” rebound since May 2020.

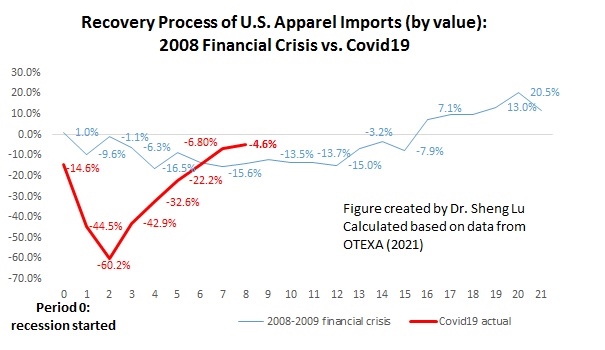

Data further shows that compared with the 2008 world financial crisis, Covid-19 has caused a more significant drop in the value of U.S. apparel imports. However, it seems the post-Covid recovery process has been more robust than the 2009 financial crisis. The Auto Regressive Integrated Moving Average (ARIMA) model forecasts that at the current speed of recovery, the value of U.S. apparel imports (seasonally adjusted) could start to enjoy a positive year over year (YoY) growth by February 2021 (or around 11 months after the outbreak of Covid-19 in March 2020). In comparison, when recovering from the 2008 world financial crisis, it took almost 15 months to turn the YoY growth rate from negative to positive).

With the new lockdown measures taken in response to the resurgence of the Covid cases, the outlook of US apparel imports remains uncertain. It should also be noted that the period from December to April usually is the light season for apparel imports.

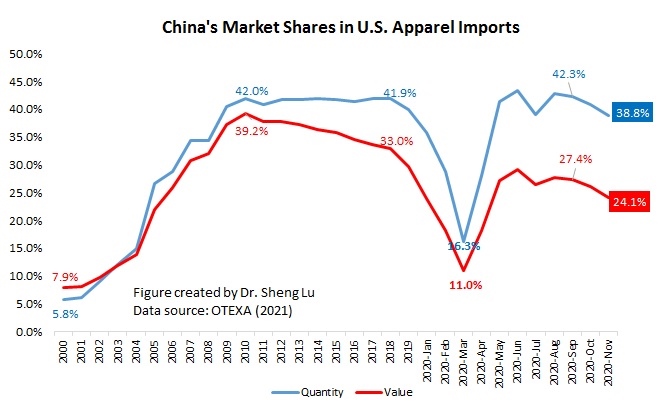

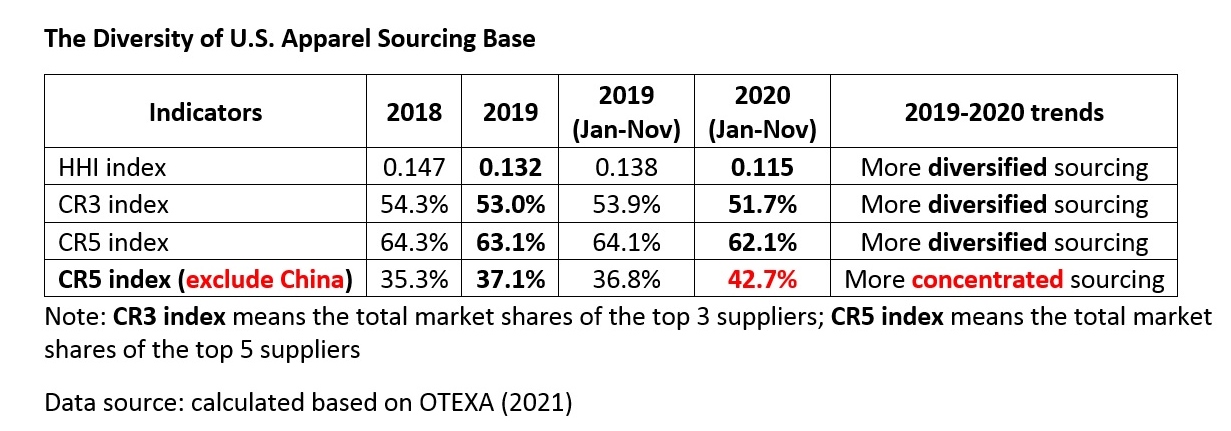

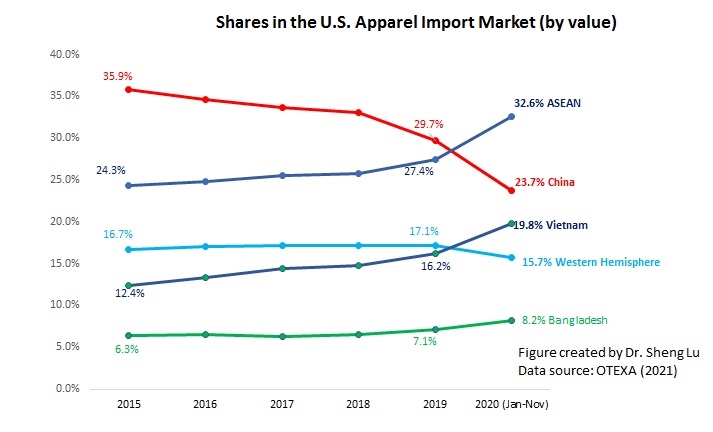

Second, supporting the findings of some recent studies, data suggests that U.S. fashion brands and retailers continue to reduce their “China exposure” in 2020. For example, both the HHI index and market concentration ratios (CR3 and CR5) suggest that apparel sourcing orders are gradually moving from China to other Asian countries. Related, since August 2020, China’s market shares in total U.S. apparel imports have been sliding both in quantity and in value.

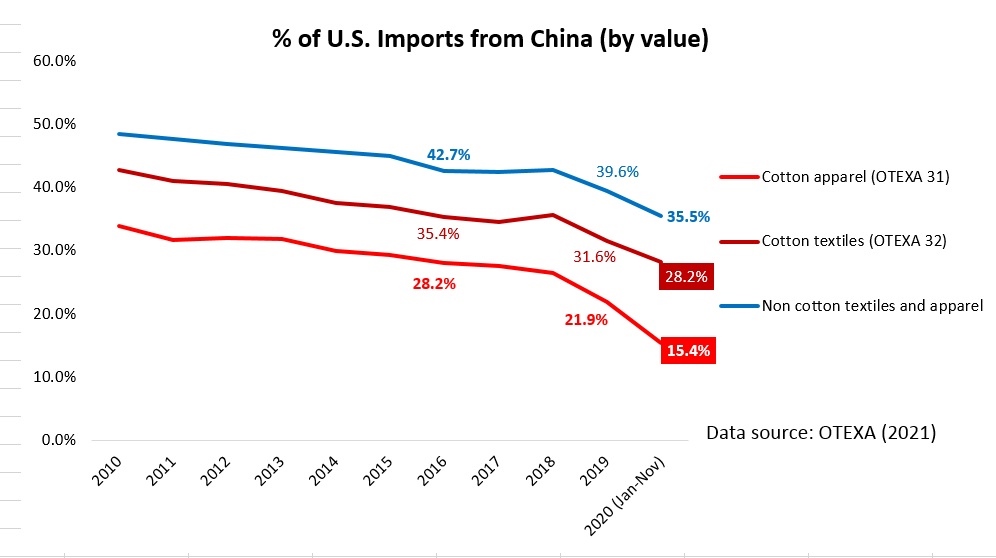

We should NOT ignore the impact of non-economic factors on China’s prospect as an apparel sourcing destination. For example, the reported forced labor issue related to Xinjiang, China, and a series of actions taken by the U.S. government (such as the CBP withhold release orders) have significantly affected U.S. cotton apparel imports from China. Measured by value, from January to November 2020, only 15.4% of U.S. cotton apparel came from China, compared with 22.2% in 2019 and 28% back in 2017. While China’s total textile and apparel exports to the US dropped by 32% in 2020 (Jan to Nov), China’s cotton textiles and cotton apparel exports to the US went down more sharply by 41.1% and 47.2%, respectively.

Third, despite Covid-19, Asia as a whole remains the single largest source of apparel for the U.S. market. Other than China, Vietnam (19.8% YTD in 2020 vs. 16.2% in 2019), ASEAN (32.6% YTD in 2020 and vs. 27.4% in 2019), Bangladesh (8.2% YTD in 2020 vs.7.1% in 2019), and Cambodia (4.4% YTD in 2020 vs. 3.2% in 2019) all gain additional market shares in 2020 (Jan to Nov) from a year ago.

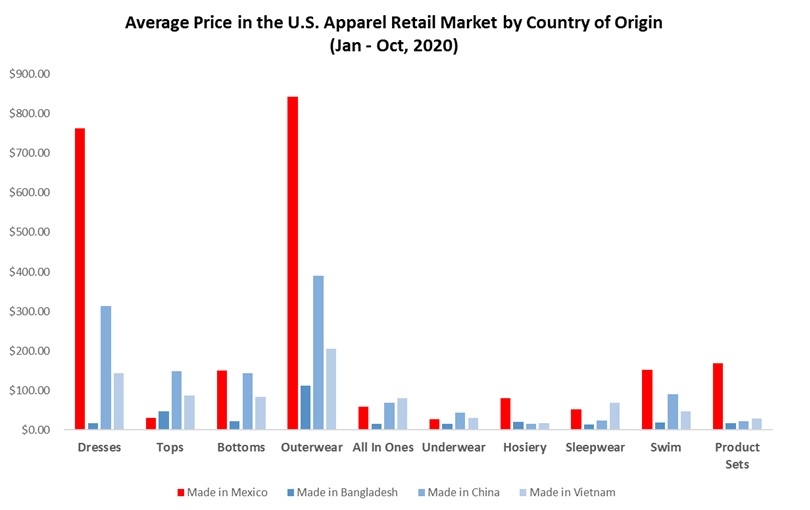

Fourth, still, no clear evidence suggests that U.S. fashion brands and retailers have been giving more apparel sourcing orders to suppliers from the Western Hemisphere because of COVID-19 and the U.S.-China tariff war. In the first eleven months of 2020, 9.4% of U.S. apparel imports came from CAFTA-DR members (down from 10.3% in 2019) and 4.4% from USMCA members (down from 4.5% in 2019). The limited local textile production capacity and the high production cost are the two notable disadvantages of sourcing from the region.

by Sheng Lu

After reading through this article and watching a webinar that touched on similar ideas, it will be interesting to see how the US plans to shift away from production in China, or countries in Asia overall. Noted in the webinar, its actually a key trend for countries to reduce manufacturing in China, which was occurring pre-pandemic, but now is more prominent. A question I pose would be; could the pandemic drastically shift production towards the western hemisphere in the long term? With the growing desire to leave China and source elsewhere, who could see the largest growth in their production sector? It will be intriguing to see how the changes are made post-pandemic and where the stress falls within the sourcing supply chain.

Good question about the future of sourcing from western-hemisphere.

My thoughts:

–Several factors may explain why near sourcing is NOT happening on a large scale: First, the timing is bad- increasing “near sourcing” requires fashion companies to invest in new financial and human resources. However, it is challenging to commit to these new investments as many fashion companies are already facing tremendous financial difficulties during the pandemic. Second, mismatched competitiveness– near sourcing typically enjoys an advantage for “speed to market” but suffers a disadvantage for sourcing cost. With the increasing unemployment rate and pay cut, Western consumers are becoming more price-sensitive during the pandemic, meaning near sourcing suffers a more significant price disadvantage when competing with similar products sourced from Asia. Third, the limited production capacity—For example, most apparel items the U.S. fashion companies source from the Western Hemisphere are in the category of tops and bottoms. This means, for many other product categories, near sourcing is not an option available.

–In the long-term, near sourcing will continue to grow in popularity; however, most likely, it will remain a part of a fashion companies’ overall sourcing portfolio. On the one hand, near sourcing will have some opportunities when Western fashion companies intend to diversify their sourcing base further. However, on the other hand, Asia’s role as the dominant source of apparel imports will be unshakable in the foreseeable future.

Welcome for any follow-up comments.

There is no question about it when it comes to being able to see how COVID-19 has affected the whole world’s economy and specifically has negatively affected the trading world. While there was a large decrease in apparel imports and exports to the US during the beginning and height of this current pandemic, the US has slowly started to make a comeback due to consumers’ high demand for apparel products. With this being said it is clear that consumers are the real controllers of the trade market since without there demand there is no need to import or export apparel goods. As consumers start to want to purchase more the demand for apparel products will increase which can help to increase the US’s imports and exports. This begs the question of will the US ever be able to continue that trend of a rise in imports in the apparel industry after the effects that covid-19 has left on our economy?

Just to add a quick comment—because consumers’ demand has become less predicable during the pandemic, fashion companies tend to place sourcing orders in smaller quantities and requiring shorter lead time. This means a new test for factories—they need to be more nimble and be willing to lower down their minimum order quantity (MOQ). In other words, fashion companies’ sourcing criteria is shifting during the pandemic.

I find it very interesting to see how U.S. apparel imports were impacted by the pandemic. As we obviously know COVID-19 has reduced apparel sourcing being done between the U.S. and China, it is interesting to learn that the U.S. began reducing their sourcing from China even before the pandemic. Reading this information posed many questions for me. I wonder what are the main contributors to this shift in apparel sourcing? How will this shift in sourcing affect the relationship between the U.S. and China? Will China’s economy suffer from the demand for cotton apparel and cotton textiles decreasing?

COVID-19 and U.S. Apparel Imports: Key Trends (Updated: January 2021)

It is interesting yet obvious that apparel imports continue to rebound while the speed of recovery has slowed. Coivid-19 is continuously compared to the 2008 financial crisis. And although covid has had a larger effect on the economy, the rebound to the financial crisis has been seen to be much greater now than in 2009. The economic recovery is still on the way and industries are adapting and thinking of innovative strategies to increase income. Trading trends seem to be on the rise and technology and machinery have helped the adaptation to the times in order to compensate for the disruption and downfall of the economy. With all of this being said will the world continue to rebuild in a more technologically based industry and will the world be able to avoid economic fall in the future now that they have experienced such catastrophic events such as this pandemic and the 2008 financial crisis?

From where we can see “technology and machinery have helped the adaptation to the times in order to compensate for the disruption and downfall of the economy”? How is “the world continue to rebuild in a more technologically based industry”related to the patterns of US apparel imports ?

More technologically advanced regions like many Asian countries continue to prosper as depicted through the charts. Asia continues to be the largest source of apparel for the US market. US has imported much less from China due to the pandemic but continues to import heavily from other Asian countries.

“More technologically advanced regions like many Asian countries continue to prosper as depicted through the charts.” How so?

This blog post really highlighted the effects of COVID-19 on the fashion industry. I really like the statistics incorporated and think it is really interesting to be able to apply all of them to what we currently know. It is helpful to be able to compare the fact that there is a resurgence in COVID cases, and then look at the graphs included to be able to literally see what is going on. There is a steady decline that occurred for US apparel imports from China over the past few years. It is also interesting to analyze the fact that so many different apparel sourcing orders are taking place in different Asian countries, instead of China. This is obviously a result of the pandemic and how different countries are responding to the fact that it originated in China. After reading this article, I am curious to see what is going to happen in the future regarding sourcing and manufacturing in China. I am also curious to see if more countries start to shift away from trade with China, and what is going to come of that.

I found this post really interesting as the statistics and graphs really made apparent how devastating Covid-19 was on the apparel industry. I wasn’t aware that the drop in seasonally adjusted sales and apparel imports made that large of a drop, leaving the industry in a worse state than the 2008 financial crisis. In addition to this, it will be interesting to see in the future how the Unites States begins to move away from sourcing from China and what Biden will do about the tariff war. If he finds a way to settle the debate then would we go back and import more from China? Or would we move along in our path of increasing imports from other USMCA and CAFTA-DR members?

After reading this article on the impact of Covid 19 on the U.S. apparel import trend, I have a new question that is whether there are other factors that actually affect import trends besides the epidemic and Sino-US trade. Make an assumption. For example, the United States wants to make a strategic import regional transfer. Because in my opinion, although China’s exports of textiles and clothing to the United States have declined, there are indeed factors affected by the epidemic, but during the same period, Vietnam, ASEAN, Bangladesh and other countries have increased their shares to varying degrees. Excluding the existence of trade boycotts. In addition, from the data about the small decrease in US CAFTA-DR members and USMCA members’ apparel exports to the United States, perhaps we can guess that the United States discovered that CAFTA-DR members and USMCA members are among the countries It is not a choice that can continue to bring maximum benefits to the United States.

After reading this article as well as the comments left on it a question crossed my mind. Professor Lu mentioned that COVID-19 has changed the predictability of the consumer, resulting in smaller orders being placed with a shorter lead time. When I read this I automatically wondered how this has effected garment workers. Has the decrease in volume of orders caused jobs to be lost? Has the shorter lead time impacted workers’ human rights? When we examined the case study on the Rana Plaza in Bangladesh a woman spoke about the large orders and time constraints put on them by western fashion brands. With the changes in the industry due to COVID-19 it would be interesting to see the effect it has had on factory workers in developing countries.

This blog post demonstrated a lot of interesting facts regarding the effects Covid-19 had on the fashion industry. Clearly, it’s going to take a lot of time and patience for the industry to fully recover because of how extreme the situation is. One of the graphs shows the comparison between the financial crisis of 2009 vs. Covid-19 showing how significant the pandemic has hit the fashion industry. The value of US apparel imports have dropped at an extreme level, compared to the financial crisis of 2009. With that being said, the recovery process now has been bouncing back fairly quicker than in 2009. This makes me wonder… What are the substantial differences between the industry in 2009 and today? Is technology the only reason for the faster recovery?

This post was super eye opening and highlighted the effects COVID has on the industry with the use of statistics and graphs which I prefer as I am a visual learner. This pandemic has brought on more complications within our industry than the financial crisis of 2009- the bounce back time and the severity of the set back will forever have changed the way our industry operates however because we are so far advanced with technological support, our recovery time has been greater than that of the financial crash.

Upon reading this article I had no idea how severe that drop in seasonally adjusted sales and apparel imports was. I now am thinking of what the out-churn of the election can bring in regards to either repairing or depriving our industry, driving sales, and tariff wars. What will the new administration do to speed up the recovery?

This article highlighted the effects of covid-19 on the fashion industry. I think it is interesting to see how the US sourcing strategy will change since they started to reduce importing from China. I am also interested in what Biden will do to recover. SInce China is exporting a lot of products to the other countries too, I wonder if China will suffer economically if the number of exports to the US is decreased.

Based on the data, this post reflects the influence of the recent Covid-19 on the Western Hemisphere textile and apparel supply chain. After reading the post, I thought the pandemic harms the Western Hemisphere textile and apparel supply chain, although consumers keep a keen demand for apparel products during the Covid-19. At first, U.S. apparel imports are returning, but the recovery speed slowed. As the post showed, until the end of 2020, the volume of U.S. apparel imports recovered to about 85 to 90 percent of the pre-coronavirus level. Second, according to the data of shared data in the U.S. apparel import market, even though Covid-19 is happening, Asia as a whole remains the single largest source of apparel for the U.S. market. Finally, by my image before, Covid-19 should be an opportunity for the NAFTA regions to promote their trade increasingly because U.S. fashion companies and industries prefer to import closer sourcing during the pandemic to avoid disruptions in logistics. However, no clear evidence shows that U.S. fashion brands and apparel retailers have been giving more apparel sourcing orders to suppliers from the Western Hemisphere because of COVID-19. Thus, I can recognize the Covid-19 is a challenge for the fashion supply chain.

Since the beginning of the pandemic I have found it interesting to look at the different trends happening throughout the apparel industry. It is encouraging to see that the apparel imports in the US are almost back to pre-pandemic levels. As there is now a vaccine for COVID and things are making a slow return to normal, these numbers should only continue to increase. Something that I found the most interesting from this article was that even throughout the pandemic there has been no significant increase in imports from the Western Hemisphere. After reading Professor Lu’s comment in response to this issue, it does make more sense to me. It would take a lot of time and a huge increase in resources to be able to increase production and imports from this region. I wanted to do further research on this topic and found an article that I felt to be relevant (https://blog.naiop.org/2020/07/nearshoring-and-other-manufacturing-shifts-for-the-post-covid-19-world/). Although production will probably never completely shift to the Western Hemisphere, Mexico does offer some great benefits of manufacturing there. Some of these benefits include a close proximity and protection of intellectual property rights. I never expect Mexico to be a main source of imports to the US, but they do have the resources to become more influential in the market.

After reading this article, it affirmed that COVID-19 has had major impacts on our global supply chain. Due to the pandemic it made it more difficult to import and export resources between countries because they worried about spreading the virus so they began a travel ban. In addition, Western Hemisphere textile and apparel supply chains depend on other countries to obtain their resources which weren’t available and it made it more difficult to manufacture products. The economy began to become financially unstable especially the apparel industry as consumers were only buying essential products. This lead to many budget cuts, layoffs, and downsizing. This included many stores to close some stores or need to file for bankruptcy which has greatly disrupted the textile and apparel supply chain from continuing. Not only this but during COVID-19 the U.S. began to gradually move their sourcing orders from China to other Asian countries. For decades we have depended on China for efficient production, labor as well as technological advancements and deviating from what we have relied on for so long could pose a major threat to our supply chains.

When reading through this article, I noticed a plethora of trends that are happening during the Coronavirus outbreak. First, although customer and consumer demand is still high, their recovery speed is continually slowing down at a fast pace. I also noticed from looking at these graphs that the US and China’s trade relations are declining too. China’s imports from the US dropped down to 23.7 in 2020, from 29.7 in 2019. This is showing that the US is trying to avoid worldwide trade at the moment to prevent another large outbreak, and to protect their workers as well. I think things will slowly, but eventually turn to normal for the apparel industry. Countries are starting to go back to their pre-covid numbers with trade and production, and with a vaccine on the way it is hard not to try and stay positive. This does call for concern with the US, who is slightly changing relations with who they want to trade with. The US mainly relied on China for exporting and importing, and now that they are starting to go to other asian countries and to countries within the western hemisphere, it is hard to tell whether China will benefit or not from this.

I found this blog very interesting. Seeing how COVID affected apparel imports compared to the 2008 financial crisis side by side was shocking to me. This comparison showed how drastic of a drop COVID caused in the apparel industry, and also how its recovery process exceeded the 2008 crisis capability to bounce back. The article also pointed out the trade war between the US and china. As China gains more capital, it is moving away from production and more toward manufacturing textiles, more automative. This negatively affects the US exporting textiles. Since the pandemic apparel imports have fallen from CAFTA-DR. My question is, what are the steps the US must take in order to increase imports within the FTA? Also, how will China be affected by the US reducing sourcing. Will the same problem arise in the future with the country that becomes “next China”?

This post contained a lot of interesting information and facts about COVID-19 and its effects on the fashion industry. The graphs really give you a visual on the drastic declines the industry faced when the pandemic hit globally. From this blog I learned that because of COVID, the textile and apparel industry was actually placed in a worse spot than when the US faced the 2008 financial crisis. Thankfully, the industry was able to bounce back at a faster pace than in 2009 especially with unemployment and struggling businesses, along with the state of our world. I wonder why that is? I would assume it’s due to how advanced technologically we are now compared to then. I’m also interested to see how global sourcing and trading practices will evolve due to COVID-19.

If “how advanced technologically we are now” is the reason why we are “to bounce back at a faster pace than in 2009”, then how to explain “we were actually placed in a worse spot”? Also, the blog post mostly discusses the demand for apparel imports–why do you think technology is a major factor to consider?

It is good to hear that we are rising from the drop we took in imports months ago at the height of the pandemic. At that time I think imports were lower since there was not as much of a demand for clothing since people were not going out, and consumers could not afford to purchase clothes. Now as the seasons change and restrictions in the country loosen, people are spending more again. I think it is interesting to see our imports from China decreasing. I think that trade wars as well as covid are two big reasons for this decline. Another factor in that is that production costs are rising in China, so the US may be seeking other countries with lower costs to import from.