This study aims to understand western fashion brands and retailers’ latest China apparel sourcing strategies against the evolving business environment. We conducted a content analysis of about 30 leading fashion companies’ public corporate filings (i.e., annual or quarterly financial reports and earnings call transcripts) submitted from June 1, 2022 to December 31, 2022.

The results suggest several themes:

First, China remains one of the most frequently used apparel sourcing destinations. For example:

- Express says, “The top five countries from which we sourced our merchandise in 2021 were Vietnam, China, Indonesia, Bangladesh and the Philippines, based on total cost of merchandise purchased.”

- According to TJX, “a significant amount of merchandise we offer for sale is made in China.”

- Children’s Place says, “We source from a diversified network of vendors, purchasing primarily from Vietnam, Cambodia, Indonesia, Ethiopia, Bangladesh, and China.“

- Ralph Lauren adds, “In Fiscal 2022, approximately 97% of our products (by dollar value) were produced outside of the US, primarily in Asia, Europe, and Latin America, with approximately 19% of our products sourced from China and another 19% from Vietnam.

However, many fashion companies have significantly cut their apparel sourcing volume from China. More often, China is no longer the No.1 apparel sourcing destination, overtaken by China’s competitors in Asia, such as Vietnam.

- According to Lululemon, “During 2021, approximately 40% of our products were manufactured in Vietnam, 17% in Cambodia, 11% in Sri Lanka, 7% in China (PRC), including 2% in Taiwan, and the remainder in other regions… From a sourcing perspective, when looking at finished goods for the upcoming 2022 fall season, Mainland China represents only 4% to 6% of our total unit volume.”

- Levi’s says, “The good thing about our supply chain is we’ve got truly a global footprint. We don’t manufacture a whole lot in China anymore. We’ve been slowly divesting manufacturing out of China, if you will, and kind of playing our chips elsewhere on the global map… Less than 1% of what we’re bringing into this country, into the US, less than 1% of it is coming from China.”

- Adidas says, “In 2021, we sourced 91% of the total apparel volume from Asia (2020: 93%). Cambodia is the largest sourcing country, representing 21% of the produced volume (2020: 22%), followed by China with 20% (2020: 20%) and Vietnam with 15% (2020: 21%).”

- Victoria’s Secret says, “On China, China is a single-digit percentage of our total inflow of merchandise. We’re not particularly dependent on China at all.”

- Nike: “As of May 31, 2022, we were supplied by 279 finished goods apparel contract factories located in 33 countries. For fiscal 2022, contract factories in Vietnam, China and Cambodia manufactured approximately 26%, 20% and 16% of total NIKE Brand apparel, respectively“

Meanwhile, fashion companies still heavily use China as a sourcing base for textile raw materials (such as fabrics). For example:

- Columbia Sportswear says it sources most of its finished products from Vietnam, but “a large portion of the raw materials used in our products is sourced by our contract manufacturers in China.”

- Likewise, Puma says, “90% of our recycled polyester comes from Vietnam, China, Taiwan (China) and Korea.”

- Guess says, “During fiscal 2022, we sourced most of our finished products with partners and suppliers outside the U.S. and we continued to design and purchase fabrics globally, with most coming from China.”

- Lulumemon says, “Approximately 48% of the fabric used in our products originated from Taiwan, 19% from China Mainland, 11% from Sri Lanka, and the remainder from other regions.”

Second, Western fashion companies unanimously ranked the COVID situation as one of their top concerns for China. Many companies reported significant sales revenue and profits loss due to China’s draconian “zero-COVID” policy and lockdown measures. For example,

- Tapestry says, “For Greater China, sales declined 11% due to lockdowns and business disruption… as a result, we have tempered our fiscal year 2023 outlook based on the expectation for a delayed recovery in China.”

- Adidas says, “With Great China… we continue to see several market-specific challenges that are affecting our entire industry. The strict zero COVID-19 policy with nationwide restrictions remains in place amid more than 2000 daily new COVID-19 cases in November. As a consequence, offline traffic is subdued due to the imminent risk of new lockdowns.

- Under Armour says, “Ongoing impacts of the COVID-19 pandemic and related preventative and protective actions in China…have negatively impacted consumer traffic and demand and may continue to negatively impact our financial results.”

- VF Corporation says, “The performance in Greater China…continues to be impacted by widespread rolling COVID lockdowns and restrictions as well as lower consumer spending.”

- Puma says, “COVID-19-related restrictions are still impacting business in Greater China, and higher freight rates and raw material prices continue to put pressure on margins.”

Notably, despite China’s most recent COVID policy U-turn, most fashion companies expect market uncertainties to stay in China, at least in the short run, given the surging COVID cases and policy unpredictability. For example:

- PVH says, “While we remain optimistic about our business in China, it continues to be a challenging environment as restrictions have once again intensified in the fourth quarter of 2022.”

- Nike says, “So we’ve taken a very cautious approach in our guidance to China, given the short-term uncertainties that are there.”

- Abercrombie & Fitch also listed China’s COVID situation as one of their top risk factors, “risks and uncertainty related to the ongoing COVID-19 pandemic, including lockdowns in China, and any other adverse public health developments.”

Third, fashion companies report the negative impacts of US-China trade tensions on their businesses. Also, as the US-China relationship sours, fashion bands and retailers have been actively watching the potential effect of geopolitics. For example,

- Express says, “recent geopolitical conditions, including impacts from the ongoing conflict between Russia and Ukraine and increased tensions between China and Taiwan, have all contributed to disruptions and rising costs to global supply chains.”

- When assessing the market risk factors, Chico’s FAS says, “our reliance on sourcing from foreign suppliers and significant adverse economic, labor, political or other shifts (including adverse changes in tariffs, taxes or other import regulations, particularly with respect to China, or legislation prohibiting certain imports from China)”

- Adidas holds the same view, “In addition, the challenging market environment in China had an adverse impact on the company’s business activities… Additional challenges included the geopolitical situation in China and extended lockdown measures.”

- Macy’s adds, “At this time, it is unknown how long US tariffs on Chinese goods will remain in effect or whether additional tariffs will be imposed. Depending upon their duration and implementation, as well as our ability to mitigate their impact, these changes in foreign trade policy and any recently enacted, proposed and future tariffs on products imported by us from China could negatively impact our business, results of operations and liquidity if they seriously disrupt the movement of products through our supply chain or increase their cost.”

- Gap Inc. says, “Trade matters may disrupt our supply chain. For example, the current political landscape, including with respect to U.S.-China relations, and recent tariffs and bans imposed by the United States and other countries (such as the Uyghur Forced Labor Prevention Act) has introduced greater uncertainty with respect to future tax and trade regulations.”

- QVC says, “The imposition of any new US tariffs or other restrictions on Chinese imports or the taking of other actions against China in the future, and any responses by China, could impair our ability to meet customer demand and could result in lost sales or an increase in our cost of merchandise, which would have a material adverse impact on our business and results of operations.”

Additionally, NO evidence shows that fashion companies are decoupling with China. Instead, Western fashion companies, especially those with a global presence, still hold an optimistic view of China as a long-term business opportunity. For example:

- Inditex, which owns Zara, says, “we remain absolutely confident about our opportunities there (in China) in the medium to long term. Fashion demand continues to be strong in China. For sure it will remain a core market for us for Inditex.”

- Ralph Lauren says, “China provides not only the successful blueprint for our elevated ecosystem strategy globally, it also represents one of several geographic long-term opportunities for our brand…We continue to see near and long term brand opportunities in China.”

- Lululemon says, “On China, we remain very excited…we remain very, very excited about the potential and the role that will play in quadrupling our international business with Mainland China.”

- Nike says, “We have remained committed to investing in Greater China for the long term.”

- Adidas says, “On China, clearly, we believe in as a midterm opportunity in China… And then when the market opens up (from COVID), we believe, the western brand is well-positioned in China again, and we can start growing significant in China again.”

Meanwhile, Western fashion companies plan to make more efforts to localize their product offer and cater to the specific needs of Chinese consumers, especially the young generation. The “Made in China for China” strategy could become more popular among Western fashion companies. For example,

- PVH says, “So, I think in general, our production in China is heavily oriented to China for China production. I think for us generally speaking, the biggest impact of the shutdowns that we’ve seen across Shanghai and Beijing has really been focused on the impact to our China market.”

- Likewise, Levi’s says, “We’re manufacturing somewhere in the neighborhood of 5% of our global production is in China, and most of it staying in China.“

- Hanesbrands says, “we’re committed to opening new stores, and that’s continues to go well, despite, the challenges that are there. Looking specifically at Champion, we continued our expansion in China adding new stores in the quarter through our partners.”

- H&M says, “we still see China as an important market for us.”

- According to Hugo Boss, “Thanks to overall robust local demand, revenues in China in 2021 grew 24% as compared to 2019.”

- VF Corporation adds, “China is a significant opportunity…(We are) really pushing decision-making into the regions and providing more and more latitude for local-for-local decision-makings around product, around storytelling, certainly staying within the confines or the framework of the brand strategy, but really giving more freedom and more empowerment to the regions.”

by Sheng Lu

Further reading: Lu, S. (2023). Is China a business opportunity or liability for fashion companies in 2023? Just Style. https://www.just-style.com/features/is-china-a-business-opportunity-or-liability-for-fashion-companies/

This article is very interesting to me and timely considering the tense relationship between the US and China. Something that was not detailed in the article was the Uyghur Forced Labor Prevention Act (UFLPA) which was signed by President Biden in December 2021. This Act prevents goods produced in the Xinjiang Uyghur Autonomous Region of China from entering the United States. Gap Inc mentioned the Act above, but in lecture video 4.5 we learned that, as a result of the UFLPA, 86% of apparel companies have plans to reduce cotton apparel from China. This puts into perspective how important the UFLPA is in regard to apparel sourcing and trade.

The article also mentions how intense Chinese COVID-19 regulations have impacted supply chain reliability. I am curious to see if this trust will be restored now that the “Zero-Covid Policy” has ended, or if companies will continue looking elsewhere for sourcing destinations.

Great thoughts. I agree that the future of China as a market or sourcing base for Western fashion companies remains one of the most heated debates in 2023. For example, the latest COVID outbreak in China has started affecting the global textile and apparel supply chain and deserves a close watch. One imminent challenge is a nationwide labor shortage, production delays, and even factory closures as COVID cases surge. When COVID-19 first broke out in China in early 2020, garment-exporting countries in Asia struggled to get enough raw textile materials as China was their top supplier. (for example: https://www.bloomberg.com/news/articles/2022-05-06/vietnam-apparel-plants-struggle-as-china-lockdowns-hit-supplies#xj4y7vzkg) The same situation could repeat this time.

Although many companies such as TJX and Express continue to source heavily from China, it does not surprise me that many companies are looking for sourcing opportunities elsewhere. I believe this is largely due to how strict the Chinese government has been in terms of Covid. Long after other countries had eased restrictions and began to get their economies back to where they were before Covid, China still continued to impose harsh rules and quarantines for those who they believed were at risk for Covid. These harsh rules and regulations regarding Covid were an invitation for economic instability within the country, and are likely why many countries diversified their sourcing and didn’t put all their eggs in one basket. Although many companies limited their apparel sourcing in China, it did not surprise me that textiles were still heavily sourced from the Asian giant. China produces some of the best textiles in the world, so it only makes sense that companies would source their textiles from the country before having their finish product created in a local asian country.

I think an important takeaway from this article is how COVID impacted the industry. Since the US sources apparel and textiles from China, this COVID outbreak was definitely an unexpected event and had drastic impacts on the industry. It is unknown exactly what will happen moving forward regarding COVID since it has managed to spike up and down over the past 2 years, as well as different strains being introduced. Also, China and the US have different policies regarding how they handle the COVID situation. This does pose a huge risk for brands. Despiste this risk, China still does have benefits that outweigh the risks since there is such a strong demand for textiles and apparel from China.

I find it interesting that despite the recent push to diversify their supply chains after the pandemic and tariff war, US retailers/brands still consider China vital when it comes to their international success. For example, many brands still manufacture products in China, in order to sell them in China. I think it shows how influential the Chinese textile and apparel industries are to the big picture, and it is not realistic to cut them off completely despite the ongoing issues when it comes to trade. It makes me wonder what the relationship between US retailers and China would be if there was not a trade war going on right now, and how much more influence would China gain because of it.

I was intrigued to read this article especially after learning more about the trade war with China. It does not surprise that many fashion companies on this list have cut and looked elsewhere for sourcing, due to conflicts with China and its extreme restrictions and the “zero-covid” policy. I think a lot of companies are getting tired of the ongoing challenges and complications(such as tariffs) dealing with China and are looking for places similar to them to source. The two big sourcing destinations mentioned were Vietnam and Cambodia. Vietnam makes perfect sense since it has many benefits to manufacturing such as low labor costs and advanced diverse manufacturing abilities. On the other hand, it was interesting to see the companies such as Inditex and Nike staying fully committed with China even with all the conflicts. Despite any issues, China is still prevalent within the fashion industry and both companies are huge and have a long history working with China, so it does make sense that they stick with them. It also is not surprising that some companies such as Lululemon and Puma use China heavily for their textiles and raw materials. China is the largest textile producing and exporter in the world, so it only makes sense for these companies to stay with them instead of looking elsewhere.

Here is an article I used on the benefits of sourcing with Vietnam: https://www.asiaperspective.com/vietnam-sourcing-manufacturing/

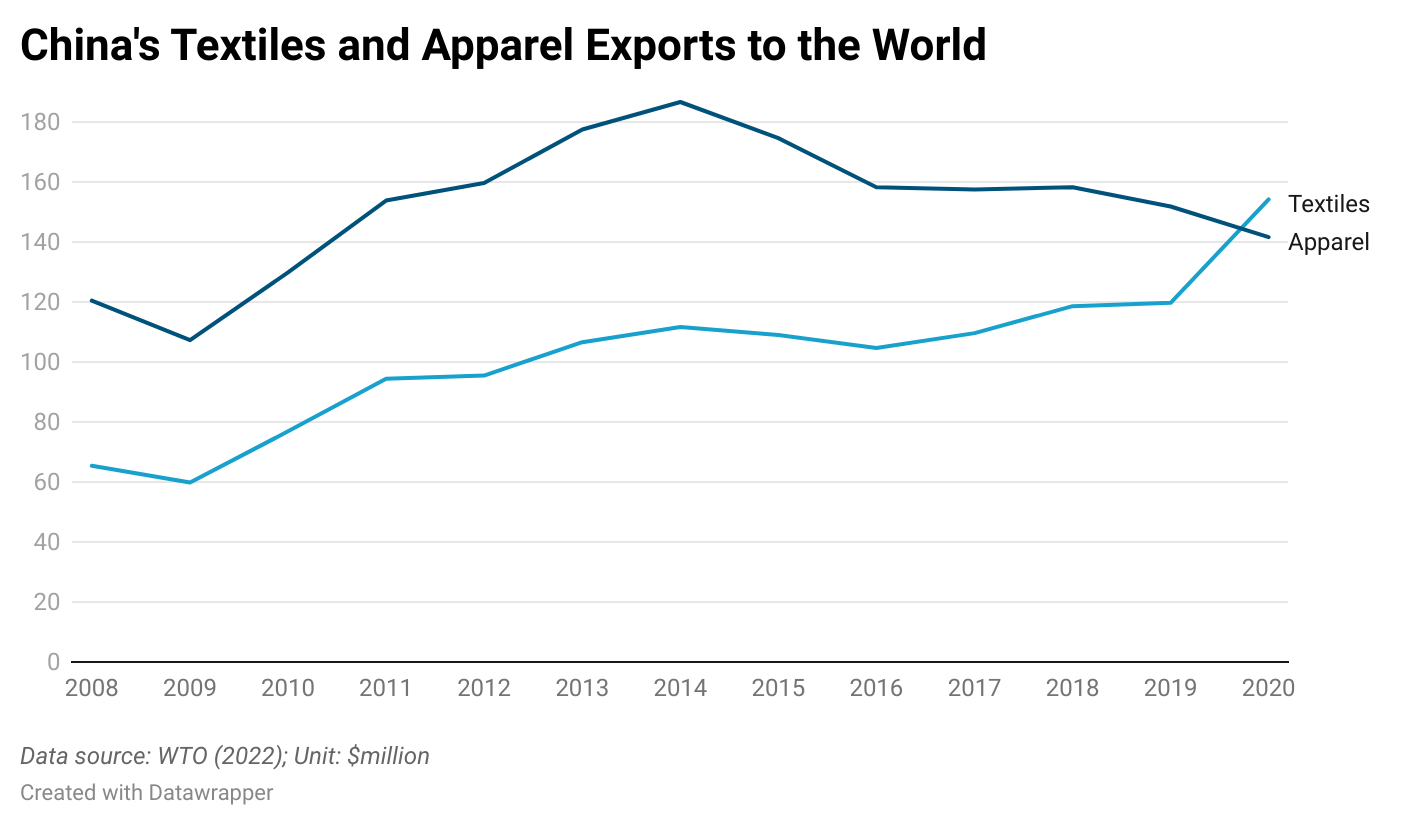

I am not surprised that China is likely to remain a top exporter and manufacturer for many companies. However, I am surprised to see that their apparel exports have decreased. I have always considered China to be the biggest exporter of almost everything, so it is always interesting to see something such as the graph at the top of the blog post which causes me to reconsider my views as well as consider what I do and do not know about the manufacturing industry.

Global supply chains are a critical component of apparel and textiles. Fashion companies have reported the negative impacts and tensions in their businesses. US fashion brands and retailers oppose this tariff because there’s no other alternative or backup plans to this. The trade statistics show that 40% of apparel imports in the US come from China. I think it’s also interesting to see the breakdown math of how the increased price in tariffs reduces profit margins. I don’t think it was a good idea for China to move their sourcing orders to other Asian countries just to avoid having to pay larger tariffs.

The Uyghur Forced Labor Prevention Act (UFLPA) has added another layer of complexity to the already challenging landscape of international trade and apparel sourcing. As you mentioned, the UFLPA has led many companies to reconsider their sourcing from China, particularly in the cotton apparel sector. This is a testament to the growing concern about human rights issues and the desire of consumers and companies to ensure that their products are ethically sourced.

As for the impact of the COVID-19 pandemic on supply chain reliability, it is still too early to say how the situation will evolve. The pandemic has had a profound impact on global trade, and the “Zero-Covid Policy” in China has only added to the challenges faced by companies and their supply chains. Companies may continue to seek alternative sourcing destinations to reduce the risks associated with relying on a single supplier, but it remains to be seen how this will play out in the coming months and years. It is likely that the COVID-19 pandemic and its aftermath will continue to shape the apparel industry and international trade in general for some time to come.

After reviewing the statistics from this study, it indicates huge impact of the pandemic and changing geopolitical dynamics on the apparel industry’s sourcing strategies. The shift in the leading sourcing destination from China to Vietnam highlights the trend of moving the supply chain out of China due to rising labor costs and trade tensions. Also, you can see companies are diversifying their sourcing destinations, reducing their dependence on China, and relying on different countries for different raw materials and manufacturing stages.

The findings also suggest that the fashion industry’s resilience in the face of the pandemic and policy uncertainty will depend on their ability to adapt and be flexible to changing market dynamics. While China remains an important market for the fashion industry, companies must consider diversifying their production and supply chain strategies to reduce their dependence on any one market. As such, companies must remain nimble and flexible to quickly adjust to new market realities and changing consumer preferences.

I found this article interesting because of the way many companies are still significantly attracted to sourcing from China. Although China is the powerhouse when it comes to manufacturing in terms of cost and short lead times, the negative effects are something a fashion company needs to consider. I believe a big reason why some companies are choosing to pull out of sourcing from China is because of the trade agreements such as the Section 301 tariff that are in place. Most fashion brands have turned to other Asian countries to source their merchandise although many countries are not able to keep up with China’s technology and speed. What I found especially interesting about this article was the quote from the VF Corporation, who we actually got to hear from in class. These guest speakers emphasized how they are trying to move sourcing away from China when it looks as though they are doing the opposite. I agree that it is beneficial to keep relations with many different countries because sometimes companies need to migrate their factories depending on the raw material volume, I do not know if China would be the best option for them in the long run.

I totally agree that China is not the best option for fashion companies to source from. Especially because, as we learned from the section 301 tariff actions, China has a lot of unfair trade policies that have yet to be addressed. I feel as though they are so comfortable being a lot exporter in the textile and apparel industry that they don’t think their trade policies matter much. And apparently, to most companies, they don’t. I hope to see China address their unfair policies in the future.

We all know that covid came with a lot especially the fashion industry needing to shift to what is not normal for them. The main reason why brands are looking at other countries besides China is from their unfair practices. Brands realize that it’s more worth going to another country and spending a little more money than supporting these problems China have. From the article above, we can see that still many brands are sticking to China as a sourcing country. The next decade would be interesting and see if these brands that are staying with China will benefit from staying or suffer.

This article was very interesting to me especially after everything we discussed in Case Study 2 regarding the U.S. Section 301 tariff action. I like how the article includes multiple fashion companies’ thoughts on sourcing from China and even goes into detail regarding what kind of sourcing they will continue to do. In Case Study 2, I identified China as one of the winners of the U.S.-China tariff war because China remained a top contender for U.S. apparel imports. Many companies rely on China. This article proved this true, China remains one of the most frequently used apparel sourcing destinations. According to Express, TJX, Children’s Place, and Ralph Lauren, China is and will remain in the top percentage of merchandise produced. I enjoyed the link between our case study and this blog post. It was good to see how they overlap.

Reading through this article and statistics, it truly showcases through numbers the effect that the pandemic had on the industry’s sourcing strategies. As shown in the data, it is clear that the sourcing destination from China to Vietnam shows the trend of moving the supply chain out of China due to rising labor costs. Although there has been a recent push to diversify supply chains due tariffs and the pandemic, countries like the U.S. still view China as their main source, which I find interesting. A key point I take away from this is that China seems to always be the main supply source, despite conditions and what is going on in the world.

I find it interesting how, although many retailers are attempting to cut their apparel sourcing from China, they still rely on China for textile raw materials. This just further supports my opinion that China is the overall winner of the Section 301 tariff actions. Since they are such a well-established sourcing base for apparel and textile, there are few countries that are able to compete with them. Therefore, it will be a while before Chinese exports to the U.S. truly slow down. They will most likely never be eradicated completely. Although, I do believe that other countries, such as Vietnam, are developing significantly innovative technologies that will allow them to progress past China in the distant future.

It is interesting to read this article after having learned about the flying-geese model that Asia relies so heavily on. You can see the effects of this model in a lot of the data and brand quotes mentioned above. For starters, the graph at the beginning of the article demonstrates an increase in textile manufacturing for China and a simultaneous decrease in apparel production. When thinking about this in terms of the flying geese model and Asia’s Regional production-trade network (RPTN), you can see that China is making a shift from labor intensive production (apparel) to more capital intensive production (textiles) as its economy becomes more and more advanced. Further, with this shift comes an increase in apparel production for less developed countries like Vietnam and Cambodia. As mentioned in the article, several companies are decreasing their manufacturing in China and moving more towards other Asian countries. Lululemon, for example, only produces 7% of their products in China (PRC) as opposed to the 40% manufactured in Vietnam and 17% in Cambodia. However, when it comes to textiles, fashion companies are still heavily sourcing raw materials from China. Looking at Lululemon again, around 48% of the fabric used in their products come from Taiwan and 19% from China Mainland. Essentially, although so many companies are making a shift to other sourcing bases from apparel and attempting to rely less heavily on China, they are looking more and more to the country for textiles. Although there are several other factors at play causing this trend, a lot of it has to do with Asia’s tiered economy and the flying geese model.

I am curious to see to what extent, UFLPA may reduce Asian countries’ reliance on China’s textile supply. Another factor is China’s growing foreign investment to other Asian countries, which could strengthen the supply chain integration between China and other apparel exporting countries in Asia.

I think that these responses of US apparel brands are truly fascinating. One can see the desire for US brands to demonstrate their non-reliance to China by diversifying their sourcing bases away from China to other parts of Asia. What I think these brands do not understand is that China is part of the flying geese model in Asia. What does this mean? Well, it means that apparel brands might still be relying on China more than they think. While brands are turning to places like Vietnam for manufacturing, we see that the reality, Vietnam relies on China for raw material inputs. I think that if the US wants to secure their own sourcing bases that do no involve China, there needs to be some sort of trade agreement (like CAFTA-DR) with these Asian countries to ensure they are getting their raw materials inputs.

One of my takeaways from this article is the shift in Western fashion companies’ reliance on China – this highlights how agile and fast-changing the fashion industry truly is. From the perspective of a fashion professional, staying up-to-date on geopolitical trends is a crucial component in order to be successful. The fact that China used to be an attractive sourcing destination for many (ex: China was in the top five sourcing companies for Express, Ralph Lauren sourced 19% of their products from China, etc) but has since transformed into an area of concern is interesting to me. Specifically, the concept of future tariffs on imports from China is intriguing. For instance, large companies like Macy’s apprehensiveness of recent U.S. tariffs and bans on Chinese imports is a valid concern, especially since this can negatively impact their bottom line. As a result, it’s also interesting to observe how many Western- fashion brands are switching to more near-shoring approaches in order to simplify their supply chains and decrease potential ethical and economic concerns. On the other hand, global companies seem to hold a different perspective on their relationship with China; many have virtually no concerns. Once again this demonstrates that location and macroeconomic factors are pertinent when analyzing sourcing strategies. Overall, this article brings light to how sourcing, especially global sourcing, can be a complex and personal process, and thus, different fashion companies might have different opinions.

I found this article to be very interesting because of the number of fashion retailers that are still heavily attracted to sourcing from China. It is essential for these retailers to consider the negative effects of sourcing and manufacturing in China even though there is a low cost and short lead times within the country. It has been proven that China has incredible technology which has led them to keep up with the fast pace of the fashion industry in terms of trends and demand. However, China has many unfair labor practices which have led China to become less attractive for brands that prioritize fair labor practices and sustainability.

Hi Jenna, I completely agree that this blog post was surprising to read. That despite China’s challenges, many fashion retailers still heavily sourced from China. Fashion retailers should consider the negative effects such as China’s unfair labor practices and environmental concerns associated with manufacturing processes. Companies who choose to turn a blind eye to this sort of malpractice are not only harming their brand through a loss of customers but promoting low labor costs and poor working conditions for the workers who are being exploited within the manufacturing process.

This blog post was quite an interesting read. It reminded me very much of a topic we discussed in class: how certain economic, political, or environmental crises affect a country’s ability to function at its highest potential. We have mentioned topics such as the Red Sea crisis and the war in Ukraine and how these types of global issues have affected trade. This plays a parallel with the blog post and how COVID-19 has affected textile production in China through their ‘zero-COVID’ policy; thus causing a lockdown as mentioned within the blog post. It’s quite interesting to point out as well that despite China’s ability to function as productively as they have in the past, countries as a whole have remained eerily loyal to them for production similar to how consumers have brand loyalty. On the other hand, it makes sense that many companies such as Lululemon Adidas, and Nike have chosen to make the switch simply because of how large a consumer base they have. Due to their size and popularity alone, they cannot take risks in countries like China to ‘sort out’ their production issues.