The latest US apparel import data raises several puzzles that deserve to be investigated further.

Question 1: Why did imports suddenly surge, and is this surge sustainable?

Unexpectedly, US apparel imports experienced a significant surge in February 2024. This surge was marked by a 12.9% increase in quantity and a 2.9% increase in value compared to the previous year. Seasonally adjusted US apparel imports in February 2024 were also nearly 10% higher than in January 2024. The import surge was particularly surprising given that the value of US clothing sales in February 2024 was only 1.3% higher than a year ago and even 0.5% lower than in January 2024 (seasonally adjusted).

That being said, US total merchandise imports also enjoyed a 2.2% increase year over year in February 2024, the best performance since last fall. Meanwhile, the World Trade Organization (WTO)’s latest April 2024 forecast predicted the world merchandise trade volume to grow by 2.6% in 2024 as opposed to a 1.2% decline in 2023.

Therefore, it will be important to watch whether the US apparel trade has indeed reached a turning point and will continue growing in the coming months and throughout the year.

Question 2: Could the volume of US apparel imports in 2023 have been underreported?

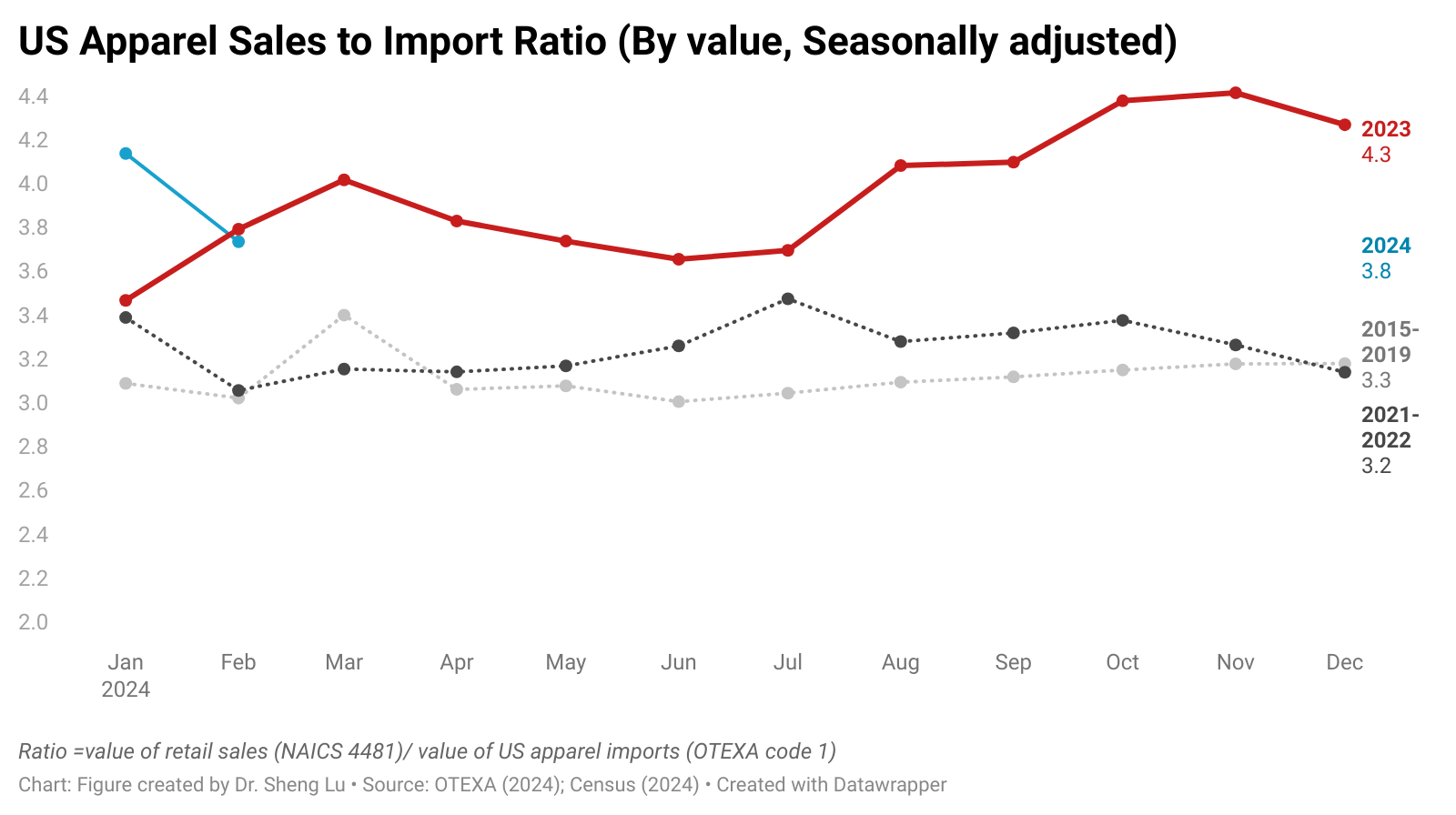

With over 98% of clothing sold in the US retail market being imported today, there exists a strong correlation between US apparel retail sales (NAICS code 4481) and the volume of apparel imports. Between 2015 and 2022, the US clothing sales to clothing import ratio remained consistently around 3.0-3.2 (seasonally adjusted). In other words, the value of retail sales was approximately three times the value of apparel imports. However, in 2023, this ratio increased to 4.0-4.5.

One suspicion is that as more apparel imports came into the US through the de minimis, the official US apparel import data in 2023 was somewhat underreported. Notably, according to Euromonitor, about 40% of US apparel retail sales were achieved through e-commerce in 2023, a substantial increase from 9.4% in 2010. Likewise, with US customs tightening controls on “small package shipments” and enhancing UFLPA enforcement, more imports likely began entering through the standard procedure in recent months, which explains why the US apparel sales to import rato fell back to 3.8 in February 2024.

On the other hand, some say the lowered US apparel import volume in 2023 was due to retailers’ efforts to control inventory levels. Data shows that US clothing stores’ stock-to-sales ratio in the last quarter of 2023 averaged 2.34, slightly lower than 2.43 from 2015 to 2019, but was higher than 2.19 back in 2021. In other words, while there was some effort by retailers to control inventory (as seen by the ratio being lower than pre-pandemic levels), it wasn’t a significant enough change to have a large impact on import demand. Also, considering that apparel is a seasonal product, it doesn’t seem too likely that retailers would risk losing sales opportunities during the most critical selling season of the year (i.e., 4th quarter) by promoting outdated items instead of stocking new ones on the shelf.

Question 3: Why did Asian countries export more apparel to Mexico?

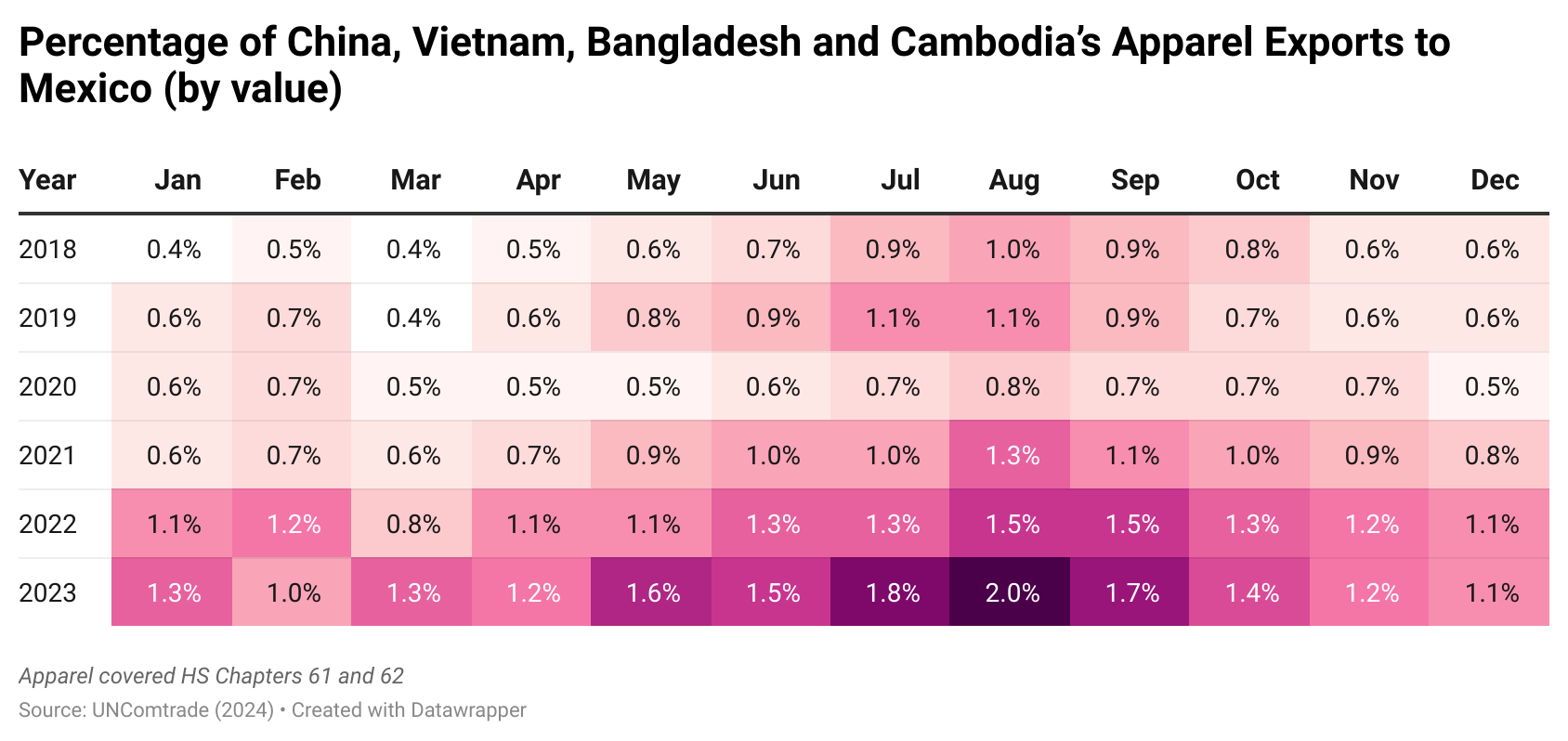

As a developing country, Mexico is not traditionally a leading apparel import market due to consumers’ limited purchasing power and the sufficient local apparel supply. Take China, Vietnam, Bangladesh, and Cambodia, the four top Asian apparel exporting countries (Asia4), for instance. Between 2018 and 2020, Mexico typically accounted for 0.4%-0.7% of Asia4’s total apparel exports. However, since 2022, Asia4 has almost doubled its apparel exports to Mexico (i.e., increased to 1.5%-2.0%). Moreover, during the same period, the percentage of Asia4’s apparel exports to the United States declined from 27% to below 20%, especially in the last quarter of 2023.

What’s behind the increase in Asian countries’ apparel exports to Mexico needs to be investigated further. As noted earlier, Mexico itself is a leading apparel-producing country. Also, according to Euromonitor, the clothing market in Mexico stayed relatively stable at around 7.6%-7.9% of the size of the US from 2017 to 2023 (in quantity). In other words, Mexico’s increased import demand for Asian clothing doesn’t make much sense.

Others suspect some Asian apparel exports to Mexico eventually entered the US market either by taking advantage of the de minimis rule or the US-Mexico-Canda (USMCA) trade agreement. However, the exact size of this particular trade flow calls for further investigation.

By Sheng Lu

Question 3: Why did Asian countries export more apparel to Mexico?

The increase in exports from Asia4 to Mexico can most likely be attributed to the de minimis rule. If the de minimis limit is raised in Mexico, it could make it more cost-effective for Mexico to purchase apparel imported from Asia4. Other factors such as lower costs, more efficient supply chains, and trade agreements between Asian countries and Mexico could also play a significant role in the increased import of apparel. Asian countries tend to have competitive advantages in manufacturing due to lower labor costs. It’s important to remember that it’s probably a combination of factors when it comes to analyzing international trends since multiple variables can influence it.

Question 1: Why did imports suddenly surge, and is this surge sustainable?

After reading about the sudden surge of imports in February of 2024, I am curious to know the cause of this, and whether or not it is sustainable. One possible explanation for this sudden surge is a shift in consumer demand and trend predictions, possibly due to the constant shift in trends and the economic state of the current world. We are in a time where fashion trends are changing at a faster pace than they have in the past due to the rise of social media. Images and videos spread around the world quicker than they did before technology, so as soon as something is in, it’s out again in a month. Along with this, there is an overconsumption issue, specifically in the US that can be linked to the sudden surge. The question of whether or not it is sustainable, I would argue it is not. As previously mentioned, overconsumption is one of the leading causes for the environmental impact the fashion industry has on our world. As fun as it is to shop and always have a new outfit, there needs to be more of an urgency to consider the bigger picture.

posted on behalf of Grace Herman:

This increase of Asian exports into Mexico doesn’t make sense due to Mexican consumers lower purchasing power especially as at the same time US imports from China declined. This definitely seems like something that China was behind. One thought I had was that China lowered their prices for Mexican consumers to maintain the amount of products that they were exporting. Another thought I had was that China was possibly funding these exports from one of two reasons, one being once they were exported to Mexico they would then be exported into the US so they were still able to get their products into the US. Another thought I had was that China wanted to prove something to the US by saying if you don’t want our products we can get the countries surrounding you to purchase our goods. Either way this occurrence seems like it was put into play by China.

Very interesting thought. Yes, we cannot rule out the possibility that China regards Mexico as an emerging export market that can help mitigate the negative impacts of the US-China trade war. However, it is puzzling that other Asian countries (e.g., Vietnam, Bangladesh, and Cambodia) have also expanded their apparel exports to Mexico. Meanwhile, this video offers an interesting perspective: https://www.youtube.com/watch?v=_Wc5Mye7YuU

Question 2: Could the volume of US apparel imports in 2023 have been underreported?

One of the potential answers to the puzzle of why 2024 US apparel imports appear to have surged to such an extent is that the year previous, they were not represented to their true quantity. As we know, the De Minimis rule allows for smaller packages to make their way into US ports from overseas (mainly Asia) without paying duties. 2023 saw over a 9% increase in American consumers purchasing apparel from ecommerce (totaling about 40%). Many of these goods were probably from retailers like Shein or Temu which were allowed to use the De Minimis rule, making it harder to track them in terms of apparel import data. 2024 saw a crackdown from governmental agencies in terms of what types of ecommerce products are allowed to utilize De Minimis so more ecommerce products are now being represented in the data. I think that this is a likely explanation for why we saw such a surge earlier this year in terms of US apparel imports. A change in how data is reported is sure to cause some adjustments in the early stages.

Question #3: Why did Asian countries export more apparel to Mexico?

The rise in apparel imports from Asia4 to Mexico is likely influenced by various factors, with the de minimis rule being a significant contributor. Should Mexico raise its de minimis limit, it could enhance the cost-effectiveness of importing apparel from Asia4 countries. Additionally, factors such as lower production costs, streamlined supply chains, and existing trade agreements between Asian nations and Mexico could further drive this trend. Given the competitive advantages of Asian countries in manufacturing, particularly due to lower labor costs, it’s essential to recognize the multifaceted nature of international trends, as they are often influenced by a combination of factors rather than a single cause.

Question 1: Why did imports suddenly surge, and is this surge sustainable?

It is interesting to see how much apparel imports into the United States surged in February 2024 and is also surprising considering clothing sales in this month were only 1.3% higher than the year before. I am intrigued as to why this is and whether or not it is sustainable. As for my opinion, to start with an increase from January to February, demand may be higher in the second month of the year than it is in the first because there is less need for purchasing apparel after spending and receiving on the holidays. Demand is a key word here and can possibly explain the surge as a whole. Fast fashion appears to be continuously on the rise and this would cause a trend of consumers demanding more apparel, as in more imports, as trends are quickly and continuously changing. Consumer demand based on fast fashion would cause a surge in imports because of how fast styles change and new trends are needed in the wardrobe. I believe this is not sustainable because this contributes to the issue of overconsumption. It is unsustainable for the environment for consumers to buy into quickly changing trends and if surges like this continue, I think it will be directly related to the unsustainable amounts of apparel purchases which is impractical for the environment.

This analysis put the surge in apparel imports into the US in perspective for me, Taylor. It is true that consumer demand pays such an important role in driving imports, especially in fast fashion since trends turnover so fast. I also agree with the post-holiday period contributing to this pattern in February of 2024.

I want to mainly touch upon the sustainability of this surge that you mentioned, particularly on overconsumption. The fast fashion cycle glorifies overconsumption by its rapid production. The environmental impacts are sickening, as we know, and increase waste all over the world, not to mention the labor practices. It is so vital that we address overconsumption to promote more sustainable practices that we can do on the consumer side.

Question #3: Why did Asian countries export more apparel to Mexico?

Mexico, a developing nation, has not historically been a major importer of clothing because of the low purchasing power of its citizens and an adequate local supply of clothing. Consider China, Vietnam, Bangladesh, and Cambodia, the top four Asian nations in terms of garment exports (Asia4). Mexico usually contributed 0.4% to 0.7% of Asia4’s total clothing exports between 2018 and 2020. But since 2022, Asia4’s garment exports to Mexico have nearly doubled, rising to 1.5%–2.0%. Furthermore, the proportion of Asia4’s clothing exports to the US fell from 27% to less than 20% over the same time period, particularly in the last quarter of 2023. More research is required to determine the cause of the rise in garment exports from Asian nations to Mexico. As was already said, Mexico is a major producer of clothing. Additionally, from 2017 to 2023, the apparel market in Mexico remained rather consistent, with quantities between 7.6% and 7.9% of the US market. There is no rational reason for Mexico to be the country of importers of Asian apparel. Some believe that some Asian clothing exports to Mexico made their way into the US market by utilizing the USMCA (US-Mexico-Canada) trade agreement or the de minimis rule. However, more research is necessary to determine the precise magnitude of this specific trade flow.

Question #3: Why did Asian countries export more apparel to Mexico?

Asian countries have been exporting more apparel to Mexico due to the implementation of the de minimis rule. In order to avoid the tariffs that accompany exporting items from Asia to the US, Asian countries are likely utilizing a loophole in which they ship their products through Mexico, who then ships the product into the US. Since the USMCA is in place, imports from Mexico are duty-free as long as they are made in Mexico. This loophole allows Asian countries to remain competitive since on top of their sourcing prices remaining lower than most, they also avoid the tariff costs.

Question 3: Continuing on to my answer.

I wrote more research was necessary in my last response above because two of the images of date were not showing but now they are so I want to change my response here.

I wants to respond to Jennas post because I very much agree with her. Asian nations have ramped up apparel exports to Mexico following the adoption of the de minimis regulation. To sidestep tariffs linked with shipping goods directly from Asia to the US, these nations are exploiting a workaround: shipping their goods through Mexico, which then forwards them to the US. Using Mexico’s beneficial trade agreements, particularly the USMCA, this tactic aims to get around the tariffs on direct exports from Asia to the US. Asian countries get around tariffs by rerouting their goods through Mexico, where they may take advantage of duty-free access to the US market under the USMCA framework. This indirect method streamlines trade flows and reduces regulatory obstacles, giving it a competitive edge in addition to avoiding immediate tariff charges.

Question 2: Could the volume of US apparel imports in 2023 have been underreported?

I believe the first assumption for volume of US apparel imports being underreported explains the drastic increase for the sales to clothing import ratio rising from 3.0-3.2 to 4.0-4.5. From previous videos watched in class, there was a topic of conversation of US customs miscounting packages, especially those taking advantage under the de minimis rule. The 40% increase of US apparel retail sales through ecommerce also seems to be a contributor to this change in data of packages going underreported. Especially after US customs tightened controls on the small package shipments, sales to import ratio falling back to 3.8 indicates its impact on volume of US imports. The argument of retailer’s efforts to control inventory levels did not seem to change enough statistically to alter import demand. Especially since retailers are profit-oriented, it would not make sense to lose out on potential sales opportunities during the 4th quarter.

#3.

It is very interesting that Asian exports to Mexico almost doubled since 2022, despite Mexico being an apparel-producing country, while US apparel exports declined. However, one explanation for this may be because of de minimis. Shipping apparel to Mexico instead of the US may be a way for China to avoid paying additional costs on apparel shipments and enjoy duty-free benefits. China’s relationship with Mexico may make it easier to export to China, rather than directly export to the U.S.

Question 3: Why did Asian countries export more apparel to Mexico?

This increase in Asian exports to Mexico is very interesting considering that the amount of clothing exported from the Asia4 countries to the US declined from 27% to below 20% all while the Asia4 doubled it’s clothing exports to Mexico during that same time. While there certainly does need to be more intentional investigation into what has caused this dynamic, one factor that could have supported this phenomena is the de minimus rule. The de minimus rule makes it easier for countries and companies abroad to export goods at a lower cost as they are able to avoid tariffs on smaller shipment sizes. This rule is appealing to these countries as it allows them to export more clothing as well as increases their competitive advantage as they in turn profit more easily.

I think all three of these questions are prime examples of the ways in which the USMCA is failing. The first question “Why did imports suddenly surge, and is this surge sustainable?” you go into the continuing imports from the asian supply chain and the idea that this trend will continue into the next quarter. These are both happening because retailers don’t have a better or even another viable option when it comes to the manufacturing of their apparel. The second question “Could the volume of US apparel imports in 2023 have been underreported?” you explore the possibility that the import volume could have been under reported due to overuse of the de minimis rule. This rule is being taken advantage of because it offers similar advantages to the USMCA, so brands especially ones that sell cheap goods will continue to use this and send more money back to Asia. Finally the third question “Why did Asian countries export more apparel to Mexico?” reiterates the first two by showing the numbers to back up this action. Because Mexico isn’t a country that has grown in GDP with their increase in import it can be assumed that these goods are going elsewhere. This increase shows the effect of the de minimis rule. With this rule in place brands will ship cheap good to neighboring countries and profit off it without looking at the long term effects or care about investing in local infrastructure.

Question #1

After reading the text, I am curious as to whether or not this surge is sustainable. What I find the most interesting is that the surge of clothing shipments increased by 12.9% but U.S. clothing sales only increased 1.3%. I feel these two analytics do not align because if more products are being shipped to the U.S., it would be assumed that U.S. clothing sales would increase by a similar number. I feel the initial surge could be due to a number of reasons, one being a shift in trends. If retailers see a shift in trends in the industry it is possible that they are trying to shift their product assortment to compete with other brands, increasing shipments to the U.S.. Another possible factor could be increase in demand for certain clothing, and buyers for brands are trying to get the product on the floor as soon as possible.

The first thing that came to mind when reading this blog post was that a 12% surge in imports in one month sounds like a lot to me. That immediately seems like a red flag to me— but maybe the red flag is actually the “turning point” for the US apparel trade. On the other hand, it would make sense to me if the previous year’s apparel imports were actually just underreported and it isn’t that big of a leap in reality. Overall, I thought these interview questions were very well-thought-out and brought important issues to light. I am curious to see the numbers for apparel imports next year!

#3 I think that Asian countries are exporting more to Mexico due to factors such as the de minimis rule. If Mexico were to raise its de minimis rule, then it would be much more cost effective for Mexico to turn to Asian countries for sourcing. Factors such as lower production costs, a more efficient supply chain, competitive pricing and trade agreements are also potential reasoning for Mexico to turn to Asia4 countries as they have lower labor costs. Overall, sourcing from Asia4 countries can be very appealing for countries to source from due to these factors, allowing for competitive advantage.

Question 3: Why did Asian countries export more apparel to Mexico?

The de minimis rule is defined as if a discount is less than 0.25% of the face value for each full year from the date of purchase to maturity, then it is too small (that is, de minimis) to be considered a market discount for tax purposes. Instead, the accretion should be treated as a capital gain.” The increase in exports from Asia to Mexico was definitely because of the de Minmis rule. If Mexico were to raise its de minimis rule it would be a lot easier for Mexico to use Asia for sourcing. a more organized and efficient supply chain and lowering the price of production will eventually cause Mexico to turn to Asia because of their lower labor costs. These factors are appealing to other countries and therefore would allow for some competitive advantage in the market.

Question 1: I really enjoyed reading about these questions regarding US apparel imports. I found question 1 interesting and sparked my interest. Something that always catches my attention is the talk of surges in the industry that is regarding imports or exports. The question of the surge of imports in February 2024 being sustainable is a remaining question. It was interesting to learn that the surge still existed even though the price of clothing sales was higher than the year before. I think any surge could be harmful and not sustainable. It is already known that the more clothing is produced or imported, the more waste. I agree that it will be extremely interesting to see if this surge is short-term or if imports will continue to come in throughout the year.

Question #2: Could the volume of US apparel imports in 2023 have been underreported?

I do think the volume of US apparel imports in 2023 have been underreported. As we talked about in class and read about in many articles, the De Minimis rule has been a major issue. De Minimis allows for smaller packages to make their way into the US duty free and also minimal inspection. A lot of packages coming from China are not being checked. This past year, a billion packages have been stopped for forced labor, counterfeits, and fentanyl, and that doesn’t mean that all of the packages were checked. The De Minimus rule is making it very difficult to track the accurate number of packages. About 40% of US apparel retail sales were achieved through e-commerce in 2023, which is a 9.4% increase in 2010, but then the ratio fell back to 3.8 in February 2024. This could be due to the crackdown of government agencies and their efforts to stop De Minimus and just shows how much wasn’t accounted for.

Question 2

The United states retail to apparel imports in 2023 compared to prior years does suggest a possibility of underreported import volumes. Efforts to manage inventory levels may have influenced some import demand, however the stock-to-sales data shows that these efforts may not have been significant enough to account for an increase in sales-to-imports. Seasonal apparel sales make retailers may not reflect actual import demand due to selling seasons and new items.

This article stuck out to be because it’s pretty interesting to think that with all the top people in sourcing studying these statistics there is still no clear answer to why there was a sudden surge on imports in February 2024. The article included statistics showing as much as a 12.9% increase in quantity when the value of US clothing sales in the same month was only 1.3% higher. We’ve studied many statistical graphs in class, and overall it’s very hard to see a consistent pattern because there are so many factors at play. For example, economic recessions, inflation, supply chan disruptions, and geopolitical issues can all alter trade patterns significantly. When all of this unpredictability are changing and increasing at different rates simultaneously, it is hard to track where the disruption, or in this case the sudden surge on imports, is coming from. These graphs reflect how difficult it is to isolate one cause for trends, emphasizing the importance of analyzing trade data thoroughly to understand the bigger picture.