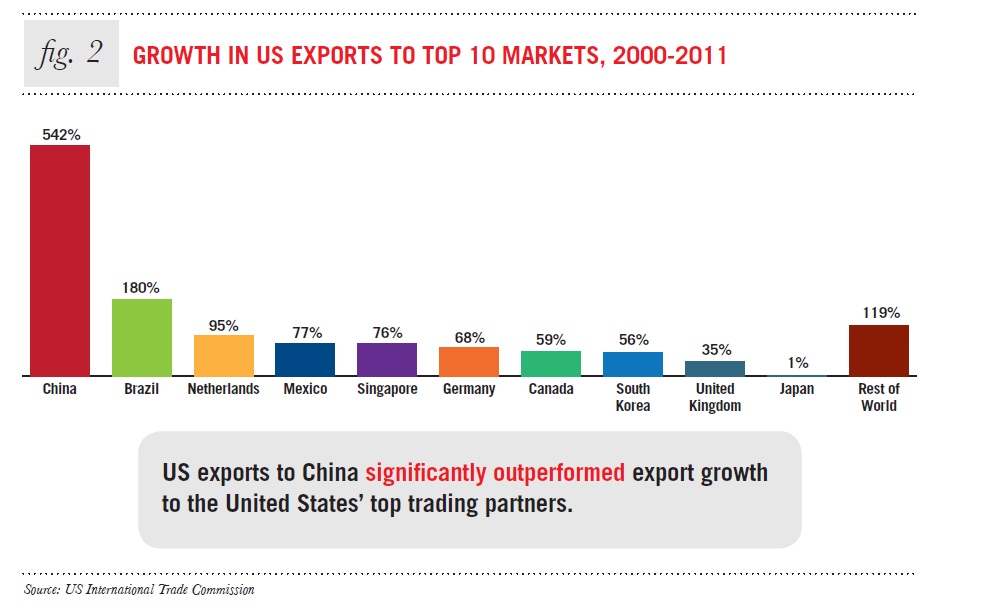

China is well-known as the single largest apparel exporter in the world. However, with the critical changes of the world economy as well as the evolution of the global textile & apparel sector over the past decade, it is the time to seriously study China as a fast-growing apparel import market.

First and foremost, it is a wrong perception that Chinese consumers only consume clothing “made in China”. On the contrary, as put it by a 2011 ITC consulting report on the Chinese market for Clothing: “in Zara’s stores in Shanghai, over 90% of stock-keeping units (SKUs) are imported, with Bangladesh, Egypt, Morocco, Portugal, Spain, Turkey, and Viet Nam and being the main import sources. Bangladesh, Cambodia, India and Indonesia are also important procurement target countries. Shoes made in Viet Nam and Spain account for a high proportion in Zara. New H&M stores in Shanghai attracted thousands of consumers when they opened in April 2007 Of H&M’s SKUs, 75% are imported, with Bangladesh, Cambodia, India, Indonesia and Turkey being the main source countries.”

However, like any other countries in the world, the apparel import market in China also has its unique features & patterns. For example, woven men’s wear accounted for almost 1/3 of China’s total apparel imports. Actually, the aggregate import demand for men’s wear was 17%-20% larger than the import demand for women’s wear in China from 2008 to 2012. As another important feature: in 2012, 83% and 13% of China’s apparel imports came from Asia and Europe respectively, leaving only 4% market share for the rest of the world. This pattern implies that China’s apparel import demand could be rather polarized: either extremely price competitive products (even cheaper than “made in China”) or very high-end luxury goods (such as those made in Germany, Italy, UK and France).

Additionally, it should be highly noted that “China is not a single unified market but a collection of local markets, each with different market demands, consumer behaviors, competition levels, and market access conditions.” (More reading: Understand China’s retail market) This feature is particularly important for those Western-based apparel retailers interested in entering China’s retail market. In general, Eastern coastline cities are the wealthiest part of China, where a high concentration of apparel stores can be found. Many famous international brands set up mainly in first-tier cities and then establish their presence in affluent second-tier cities. Currently, the tendency is for famous brands to penetrate into more second-tier cities. Among the first-tier cities, Shanghai plays a significant role in setting fashion trends on the mainland. Therefore, many foreign and domestic apparel suppliers choose to first establish a foothold in Shanghai before seeking further expansion.