As one breaking news, on 16 September 2021, China officially presented its application to join the 11-member Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). While the approval of China’s membership in CPTPP remains a long shot and won’t happen anytime soon, the debate on the potential impact of China’s accession to the trade agreement already starts to heat up.

Like many other sectors, textile and apparel companies are on the alert. Notably, China plus current CPTPP members accounted for nearly half of the world’s textile and apparel exports in 2020. Many non-CPTPP countries are also critical stakeholders of China’s membership in the agreement. In particular, the Western Hemisphere textile and apparel supply chain, which involves the US textile industry, could face unrepresented challenges once China joins CPTPP.

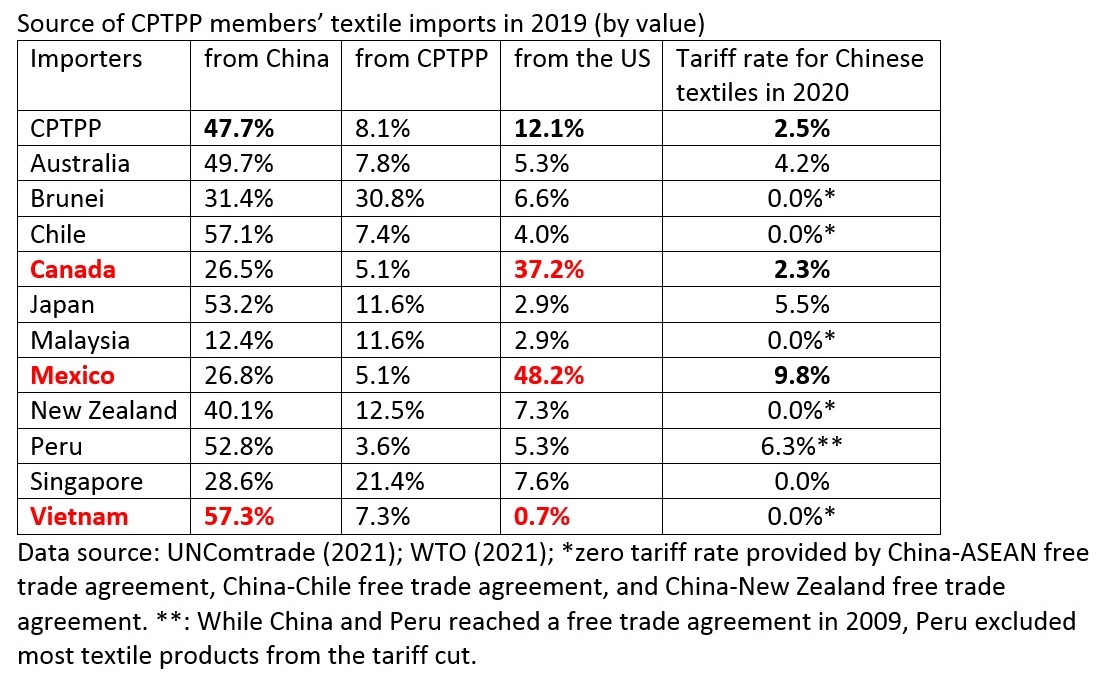

First, once China joins CPTPP, the tariff cut could provide strong financial incentives for Mexico and Canada to use more Chinese textiles. China is already a leading textile supplier for many CPTPP members. In 2019, as much as 47.7% of CPTPP countries’ textile imports (i.e., yarns, fabrics, and accessories) came from China, far more than the United States (12.1%), the other leading textile exporter in the region.

Notably, thanks to the Western Hemisphere supply chain and the US-Mexico-Canada Trade Agreement (USMCA, previously NAFTA), the United States remains the largest textile supplier for Mexico (48.2%) and Canada (37.2%). Mexico and Canada also serve as the largest export market for US textile producers, accounting for as many as 46.4% of total US yarn and fabric exports in 2020.

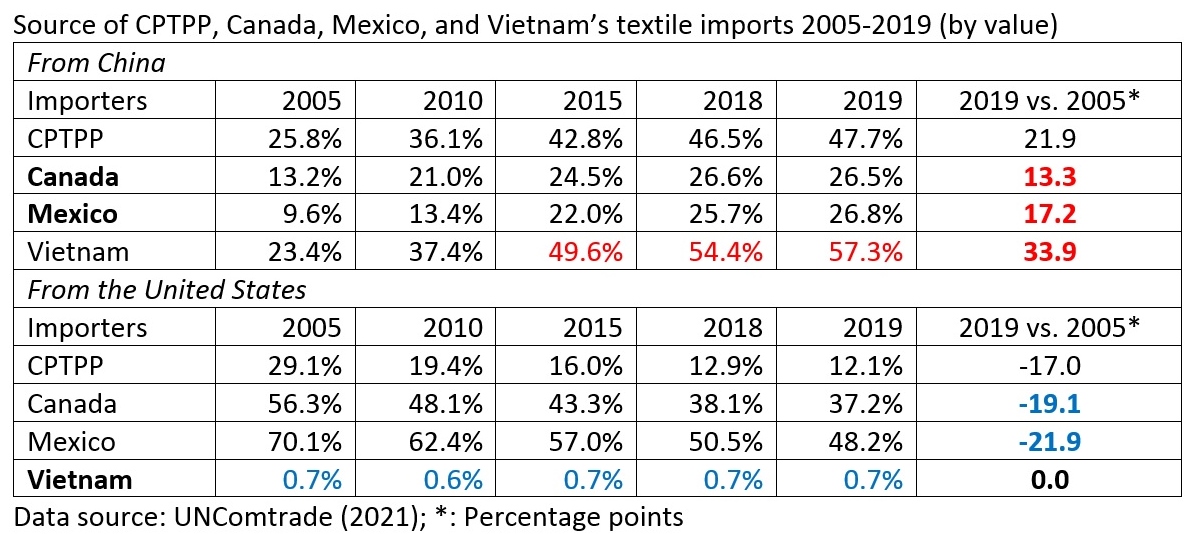

However, US textile exporters face growing competition from China, offering more choices of textile products at a more competitive price (e.g., knitted fabrics and man-made fiber woven fabrics). From 2005 to 2019, US textile suppliers lost nearly 20 percentage points of market shares in Mexico and Canada, equivalent to what China gained in these two markets over the same period.

Further, China’s membership in CPTPP means its textile exports to Mexico and Canada could eventually enjoy duty-free market access. The significant tariff cut (e.g., from 9.8% to zero in Mexico) could make Chinese textiles even more price-competitive and less so for US products. This also means the US textile industry could lose its most critical export market in Mexico and Canada even if the Biden administration stays away from the agreement.

Second, if both China and the US become CPTPP members, the situation would be even worse for the US textile industry. In such a case, even the most restrictive rules of origin would NOT prevent Mexico and Canada from using more textiles from China and then export the finished garments to the US duty-free. Considering its heavy reliance on exporting to Mexico and Canada, this will be a devastating scenario for the US textile industry.

Even worse, the US textile exports to CAFTA-DR members, another critical export market, would drop significantly when China and the US became CPTPP members. Under the so-called Western-Hemisphere textile and apparel supply chain, how much textiles (i.e., yarns and fabrics) US exports to CAFTA-DR countries depends on how much garments CAFTA-DR members can export to the US. In comparison, US apparel imports from Asia mostly use Asian-made textiles. For example, as a developing country, Vietnam relies on imported yarns and fabrics for its apparel production. However, over 97% of Vietnam’s textile imports come from Asian countries, led by China (57.1%), South Korea, Taiwan, and Japan (about 25%), as opposed to less than 1% from the United States.

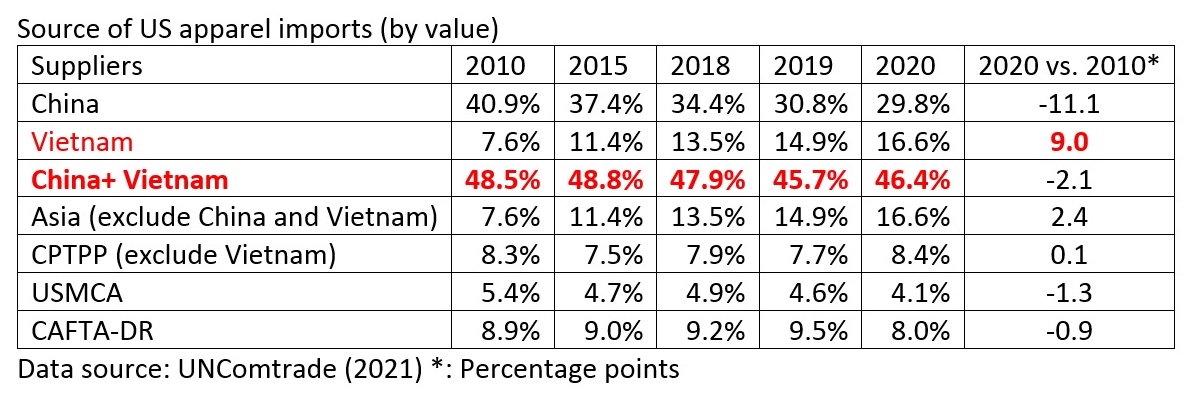

The US textile industry also deeply worries about Vietnam becoming a more competitive apparel exporter with the help of China under CPTPP. Notably, among the CPTPP members, Vietnam is already the second-largest apparel exporter to the United States, next only to China. Despite the high tariff rate, the value of US apparel imports from Vietnam increased by 131% between 2010 and 2020, much higher than 17% of the world average. Vietnam’s US apparel import market shares quickly increased from only 7.6% in 2010 to 16.6% in 2020 (and reached 19.3% in the first half of 2021). The lowered non-tariff and investment barriers provided by CPTPP could encourage more Chinese investments to come to Vietnam and further strengthen Vietnam’s competitiveness in apparel exports.

Understandably, when apparel exports from China and Vietnam became more price-competitive thanks to their CPTPP memberships, more sourcing orders could be moved away from CAFTA-DR countries, resulting in their declined demand for US textiles. Notably, a substantial portion of US apparel imports from CAFTA-DR countries focuses on relatively simple products like T-shirts, polo shirts, and trousers, which primarily compete on price. Losing both the USMCA and CAFTA-DR export markets, which currently account for nearly 70% of total US yarns and fabrics exports, could directly threaten the survival of the US textile industry.

by Sheng Lu

Related readings:

I really enjoyed reading this post and did not realize how important China’s membership in CPTPP can affect the US textile industry. From the post this quote really made me think “even the most restrictive rules of origin would NOT prevent Mexico and Canada from using more textiles from China and then export the finished garments to the US duty-free”. This essentially takes away the tariffs the US took on China!

very true! meanwhile, the debate continues: https://www.cnbc.com/2021/09/27/analysts-on-chinas-bid-to-join-cptpp-strategic-competition-with-us.html

This is such an interesting topic. I always knew China was the biggest threat to the US textile industry, but I didn’t realize that a tariff cut in China would effect the US to this extent. I found it interesting when you mentioned, “From 2005 to 2019, US textile suppliers lost nearly 20 percentage points of market shares in Mexico and Canada, equivalent to what China gained in these two markets over the same period”, which is unsettling after reading that Mexico and Canada serve as the largest export market for US textile producers. As mentioned in the lecture, an implication of globalization in general is that countries become stakeholders and it creates winners and losers. After, reading this blog post it is clear that China is winning., and even more so after joining the CPTPP. What will the future look like? Will China eventually dominate the T&A industry for good? What can the US textile industry do to become more price competitive in their exports?

great questions! we will discuss the western hemisphere supply chain in a few weeks. I am sure you will have fresh new thoughts about the CPTPP debate afterward.

This article was extremely interesting and one that I think will cause great concern for the US. China’s membership in CPTPP greatly affects the US in terms of competition. I thought it was interesting to note that from “2005 to 2019, US textile suppliers lost nearly 20 percentage points of market shares in Mexico and Canada, equivalent to what China gained in these two markets over the same period”. This shows that China in CPTPP would further deviate Mexico and Canada to work with China and then bring finished garments to the US. The US should also be concerned because it has left more trade deals than it’s entered. China joining the trade agreement can send shockwaves all across the US textile and apparel industry. The US must come up with additional ways to stay competitive with China. This may include looking to re-join CPTPP.

this is why the US textile industry never publically supports joining CPTPP (TPP). the competition today is supply-chain-based. you may also find this “old post” still relevant: https://www.cotton.org/issues/2013/tpptex.cfm

I found this blog to be very interesting as China has a strong threatening position to the US textile and apparel sector’s success. If China ends up being an approved member of the CPTPP, this puts the US at a great disadvantage due to Mexico and Canada having the option of getting cheaper and a wider variety of textiles from China. This proposed duty-free market access between Mexico, Canada, and China will greatly hurt the United States as the US relies heavily on these two countries for exports. Another important issue to note is the growth within Vietnam due to the help of China as this would influence Chinese investments to go to Vietnam because of a decrease in regulation brought by the CPTPP. I found this article to be very insightful as I did not realize the level of price-competitiveness that would be brought on by China’s membership into the CPTPP. For example, the mentioning of basic products like “t-shirts, polo shirts, and trousers” are crucial to the survival of the US textile industry as they add up in success and can be a make or break for the countries’ success.

This was definitely an interesting article as I ever realized the full extent of the impact China has on the U.S. especially when it comes to joining the CPTPP. According to the article, if both China and the U.S. join the CPTPP, even the most restrictive rules of origin would not prevent Mexico and Canada from using textiles from China and exporting them to the U.S. duty-free. I think there are definitely pros and cons to China joining the CPTPP, but after reading this article it seems as though the cons definitely outweigh the pros.