(See updated analysis: Patterns of US Apparel Imports in the First Half of 2022 and Key Sourcing Trends)

The latest trade data shows that in the first four months of 2022, US apparel imports increased by 40.6% in value and 25.9% in quantity from a year ago. However, the seemingly robust import expansion is shadowed by the rising market uncertainties.

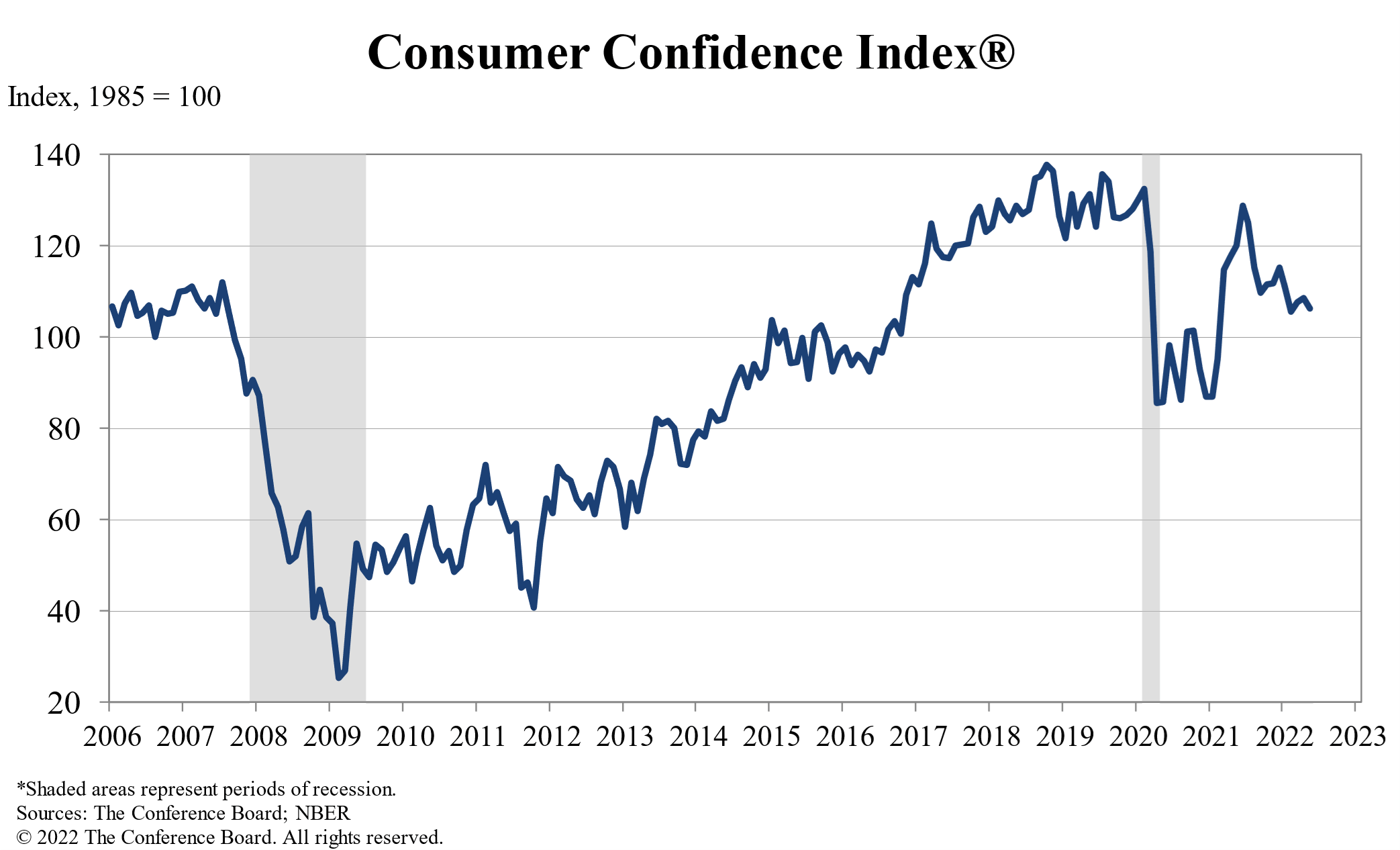

Uncertainty 1: US economy. As the US economic growth slows down, consumers have turned more cautious about discretionary spending on clothing to prioritize other necessities. Notably, in the first quarter of 2022, clothing accounted for only 3.9% of US consumers’ total expenditure, down from 4.3% in 2019 before the pandemic. Likewise, according to the Conference Board, US consumers’ confidence index (CCI) dropped to 106.4 (1985=100) in May 2022 from 113.8 in January 2022, confirming consumers’ increasing anxiety about their household’s financial outlook.

Removing the seasonal factor, US apparel imports in April 2022 went up 2.8% in quantity and 3.0% in value from March 2022, much lower than 9.3% and 11.9% a month ago (i.e., March 2022 vs. February 2022). The notable slowed import growth reflects the negative impact of inflation on US consumers’ clothing spending. According to the Census, the value of US clothing store sales marginally went up by 0.8% in April 2022 from a month ago, also the lowest so far in 2022.

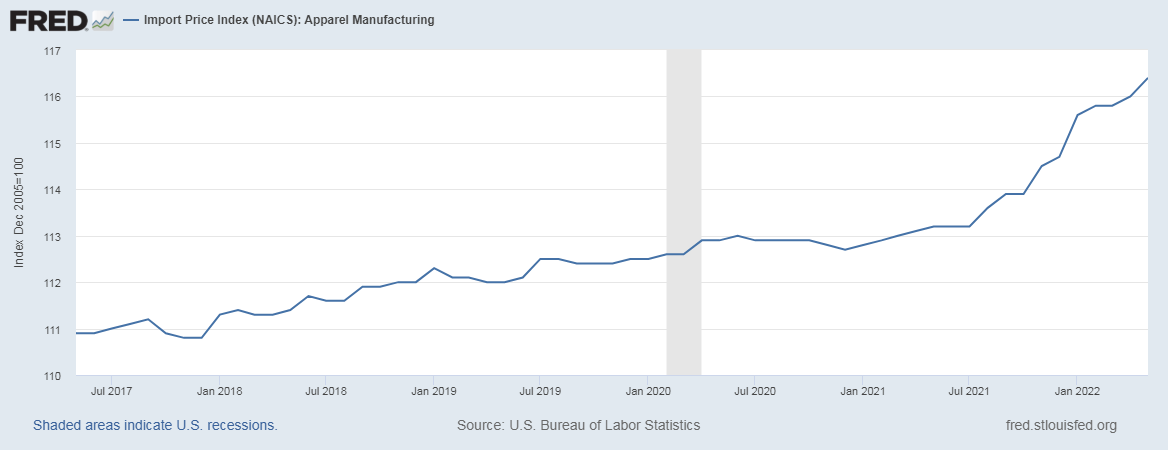

Uncertainty 2: Worldwide inflation. Data from the Bureau of Economic Analysis shows that the price index of US apparel imports reached 103.1 in May 2022 (May 2020=100), up from 100.3 one year ago (i.e., a 2.8% price increase). At the product level (i.e., 6-digit HS Code, HS Chapters 61-62), over 60% of US apparel imports from leading sources such as China, Vietnam, Bangladesh, and CAFTA-DR experienced a price increase in the first quarter of 2022 compared with a year ago. The price surge of nearly 40% of products exceeded 10 percent. As almost everything, from shipping, textile raw materials, and labor to energy, continues to soar, the rising sourcing costs facing US fashion companies are not likely to ease anytime soon.

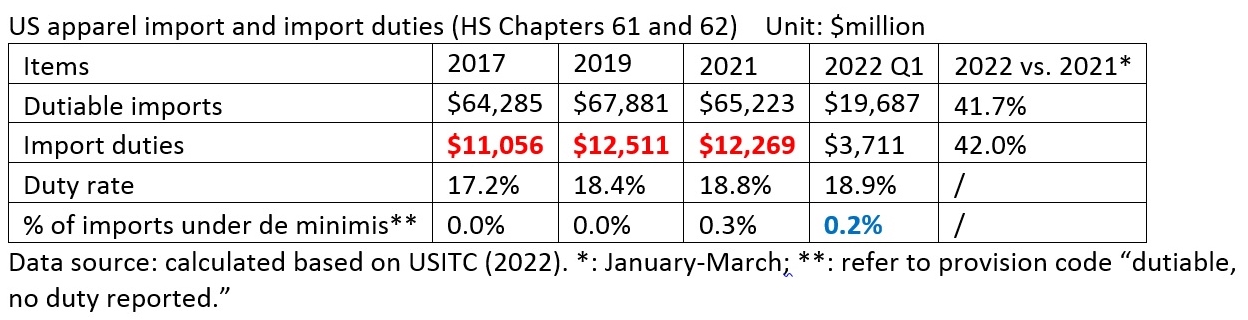

The deteriorating inflation also heats up the debate on whether to continue the US Section 301 tariff action against imports from China. Since implementing the punitive tariffs, US fashion companies have to pay around $1 billion in extra import duties every year, resulting in the average applied import tariff rate for dutiable apparel items reaching almost 19%. Although some e-commerce businesses took advantage of the so-called “de minimis” rule (i.e., imports valued at $800 or less by one person on a day are not required to pay tariffs), over 99.8% of dutiable US apparel imports still pay duties.

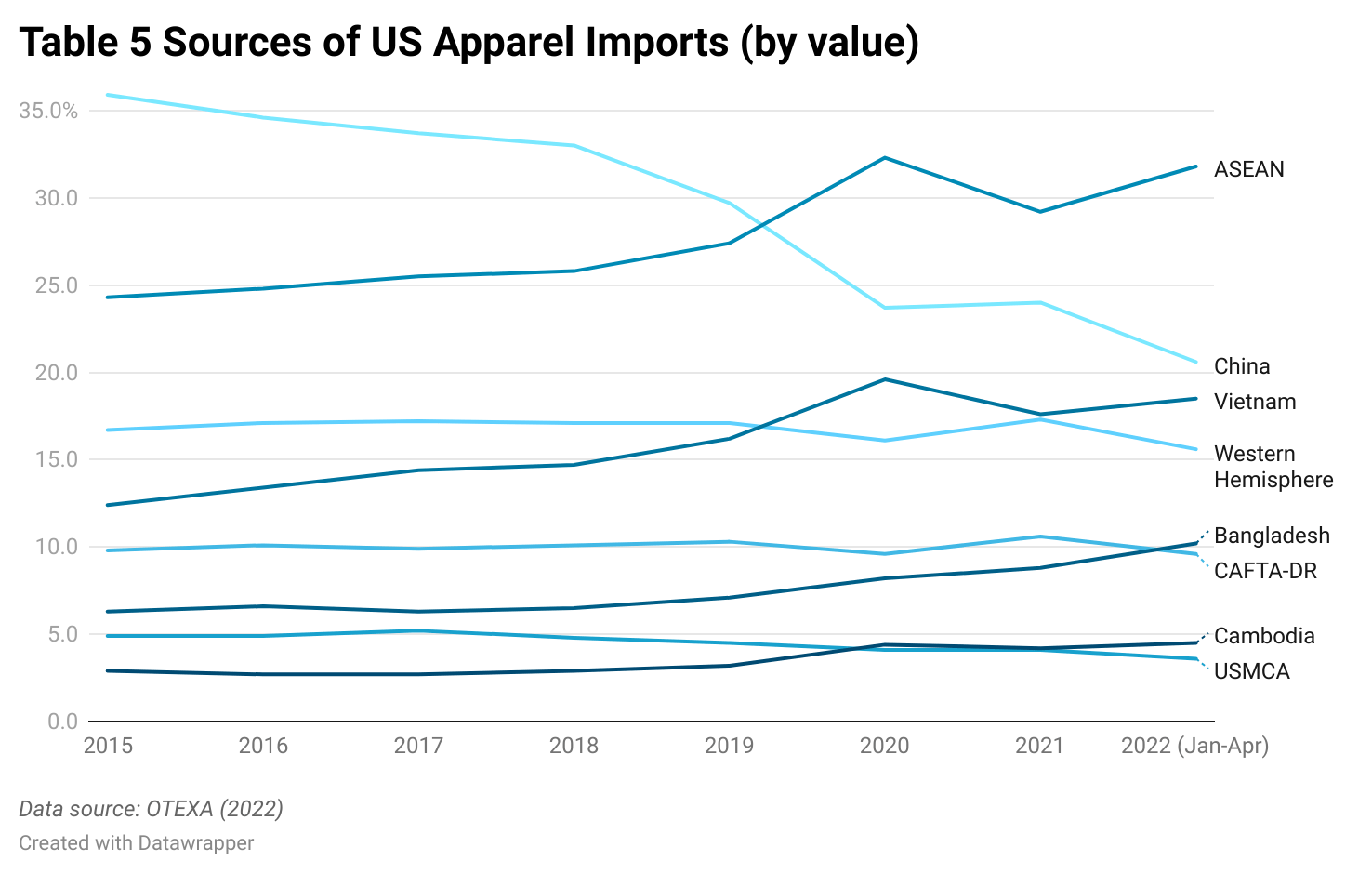

Uncertainty 3: “Made in China.” US apparel imports from China in April 2022 significantly dropped by 26.7% in quantity and 24.6% in value from March 2022 (seasonally adjusted). China’s market shares also fell to a new record low of 26.3% in quantity and 16.8% in value in April 2022. The zero-COVID policy and new lockdown undoubtedly was a critical factor contributing to the decline. Fashion companies’ concerns about the trajectory of the US-China relations and the upcoming implementation of the new Uyghur Forced Labor Prevention Act (UFLPA) are also relevant factors. For example, only 10.5% of US cotton apparel imports came from China in April 2022, a further decline from about 15% at the beginning of the year. Given the expected challenges of meeting the rebuttable presumption requirements in UFLPA and the high compliance costs, it is not unlikely that US fashion companies may continue to reduce their China exposure.

As US fashion companies source less from China, they primarily move their sourcing orders to China’s competitors in Asia. Measured in value, about 74.8% of US apparel imports came from Asia so far in 2022 (January-April), up from 72.8% a year ago. In comparison, there is no clear sign that more sourcing orders have been permanently moved to the Western Hemisphere. For example, in April 2022, CAFTA-DR members accounted for 9.3% of US apparel imports in quantity (was 10.8% in April 2021) and 10.2% in value (was 11.4% in April 2021).

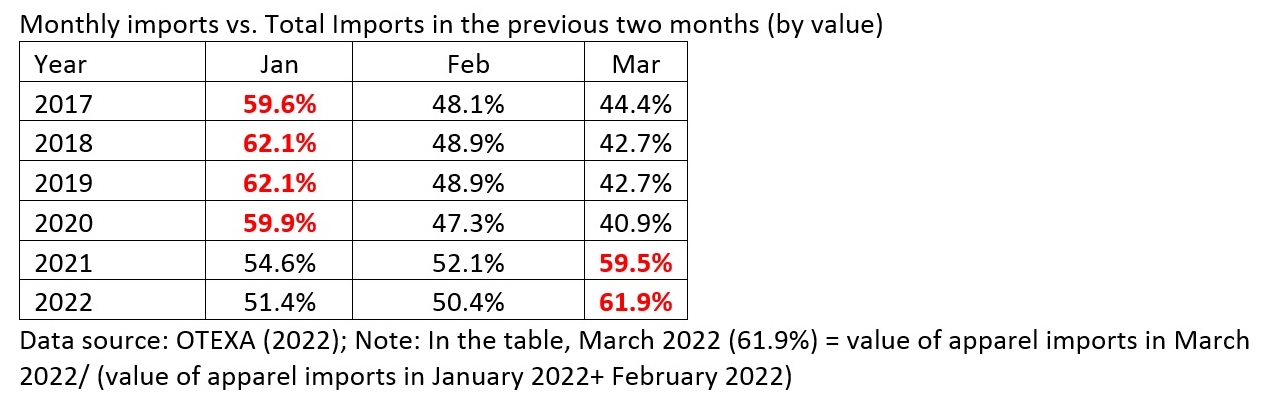

Uncertainty 4: Shipping delays. Data suggests we are not out of the woods yet for shipping delays and supply chain disruptions. For example, as Table 2 shows, the seasonable pattern of US apparel imports in March 2022 is similar to January before the pandemic (2017-2020). In other words, many US fashion companies still face about 1.5-2 months of shipping delays. Additionally, several of China’s major ports were under strict COVID lockdowns starting in late March, including Shanghai, the world’s largest. Thus, the worsened supply chain disruptions could negatively affect the US apparel import volumes in the coming months.

by Sheng Lu

Further reading: Lu, S. (2022). Myanmar loses appeal for US apparel imports. Just-Style.

It is quite interesting how the same problems the global textile and apparel supply chains faced in 2020 are reoccurring in 2022 due to the unfortunate incapacity to catch up with the shortages, surges, and bottlenecks in supplies. Could this be the universe’s way of telling us that we need to continue to make progress in changing consumer buying habits to be more sustainable, as well as commit to a new network of supply chains whether it be through regionalization, reshoring, or new trade and policy agreements. I feel as we are holding onto the fashion industry as we know it, but the rope is slowly slipping out of our hands. Despite how much has been invested into the industry to make it what it is today, sometimes a fresh perspective, a blank page if you will, can create a better working blueprint.

With workers and ships working at full productivity, it is clear that demand is exceeding limits that cannot be reached which is one of many causes as to why prices are so high, and shipments are so backed up. Maybe it is something to consider that professionals in the textile and apparel industry are doing the best they can to keep up with the mass consumption of consumers wants and needs. Maybe it is up to consumers to start doing what they can to give the producers and manufacturers a break to reconfigure and catch up. Not to say stop buying things entirely, but we have so much waste and other materials already around us to make beautiful creations and useful products. Let us together start thinking how we can reduce our carbon footprint using textiles and apparel alone.

Very thoughtful! I agree totally. As if “sustainability” is only a popular concept in advertising/marketing/classroom settings. However, everybody wants to be China’s alternative and expands their exports to the US and the world in practice. (for example https://en.nhandan.vn/business/item/11471502-vietnam%E2%80%99s-garment-sector-records-impressive-export-growth.html)

That being said, it is also hopeful that with improved financials, the garment industries in developing countries will have more resources to address sustainability issues. And hopefully, brands and retailers can share the burdens and provide resources to help.

Interesting and relevant point! I agree that the disruptions in the supply chain should encourage the industry to reevaluate its stance on sustainability. With shipping delays, the product is not reaching the consumer at the right time or place. A lot of companies have had to pivot products to new seasons or find other ways to dispose of the outdated apparel. This has raised sustainability issues that are beyond consumer consumption. However, to Dr. Lu’s point, the supply chain disruptions also provide reasoning to diversify sourcing networks that address social and economic sustainability, too. By looking to other countries– those outside of Asia– for textile and apparel sourcing, not only do we alleviate the dependence on a sole region, but also provide jobs and economic development for low-income nations.

The reason for the inflation and the backup in shipment and delivery dates is due to the increase in consumer demand and the inability for anyone in the industry to keep up. Micro-trends and fast fashion have taken over the industry and put consumers into a “buy more, buy now” mindset. Consumers are not going to stop purchasing clothing, but the industry needs to start innovating new ways to take old products and make them new. Focusing on upcycling products rather than producing brand new ones will not only reduce our industry’s carbon footprint, but will hopefully help with increasing prices and slow shipments.

I think that issues with the supply chain will be an ongoing uncertainty the next few years due to different reasons. One being COIVD and shut downs, even though it feels like there are less shut downs and life is moving on after COVID, there is still worry about COVID and its effects. For example, it feels like every few months we see a spike in cases, so the industry can’t be totally certain if one of these spikes will be worse than the previous ones and will cause factories to shut down again. Also, the delay is on going from the previous shut downs and issues with factories and shipping, like mentioned in the article many fashion companies are still facing 1.5-2 month delay in shipping. With increase in imports, the supply chain can face more disruptions.

I think it is telling that some of the same issues the fashion industry saw in 2021 is something that is being experienced in 2022. These are issues that I believe will continue to arise even worse than they were previously. It is the industries job to not only overcome them, but to propose solutions that can continuously be applied. IN. Other words you can not just use a method that will get you out of one scenario. One of these issues that is important and will continue to pop up is the uncertainty of shipping delays. Shipping delays first came into a large issue during the [pandemic. With boats being stuck at port because there were not enough employees to bring them to land. This pause or delay in imports is still an issue with brands, clearly id it is 1.5-2 months out. With US brands continuing to order their products and merchandise from overseas the pile up will only become greater and increase the timing of the delays. Rather than brands looking into ways to avoid facing this barrier, which I would argue is important for current financial stability, they need to solve the issue upfront. Without finding a solution and only mending the current issue the problem will a) become worse or b) cease until the issue arrises again and is in more of a detrimental state. Fashion brands and companies should look into more American based products as there will be no congestion in ports if ports are not being used. Overall brands and companies need to simultaneously fix the issue currently so that their sales can continue and they can continue to profit, AND solve the issues core to stop future issues from arising.

COVID-19 changed the fashion industry as we knew it and we are still dealing with many factors that have trickled down to the market uncertainties we are facing in 2022. Firstly, consumers are spending less because they are concerned about their household’s financial outlook. Secondly, we have been experiencing worldwide inflation that causes a domino effect on everything. Inflation not only affects product prices, but it effects everything to get a product to a consumer’s hands. Shipping, raw materials, labor, sourcing costs , and tariffs are all effected from inflation, which ultimately raises prices for consumers to get their products as well. The industry is also experiencing shipping delays and supply chain disruptions. These factors all create for quite a recipe for rising concerns for fashion brands and companies. If companies brain storm on how to start sourcing supplies locally and be more sustainable in their production, it may help them to avoid some of the issues they are currently facing.

The aftermath of the global COVID-19 pandemic seem to be never ending for the retail industry. The Chinese market was hit hard as well as the rest of Asia and the world. Through our course and the last two years we have seen factory shut downs, employment issues and increasing supply costs throughout all of Asia. This has posed many issues for US fashion retails too because China is one of our overall main sourcing destinations. The US is responsible for a large sum of China’s exports and with these effects still hitting the retail industry who knows when we will be back to normal. The article also explains that around 60% of all prices from supply chain to materials have increased in the last couple of years. Inflation has also risen to an all time high in the US which discourages US consumer’s spending on the fashion industry. It is imperative that US fashion retails look for ways to diversify their sourcing maps and prepare for any other unprecedented events.

The COVID-19 pandemic has altered the way the fashion and apparel industry operates. There are constant uncertainties in the industry that companies must navigate and combat. One of the biggest issues we saw in 2021 was COVID lockdowns and shutdowns of major port cities, and we are seeing these issues continue into 2022. This leads into shipping delays and constant supply chain disruptions. This, coupled with decreased consumer spending, creates massive uncertainty for fashion brands. We have been discussing diversifying sourcing bases, and doing so can greatly benefit companies and allow them to combat issues they have faced in the pandemic.

The last few years have been tough on all industries, but a big change we saw was in the fashion industry. The COVID-19 pandemic has shifted the way in which the fashion industry does business, as well as the way in which consumers shop. During the pandemic, we saw major cities and ports stop production, or put production on hold. This caused the industry as a whole to be put on hold. Certain countries or regions refused to import/export materials which put already hurting companies in even worse conditions. Fashion brands are now beginning to adapt to the changes that occurred during the pandemic, and with diversifying sourcing bases, the fashion industry can avoid some of these issues.

I agree that supply chain issues will be an ongoing issue.

I agree that supply chain issues will be an ongoing issue. In fact, I have read before that supply chain issues were existing pre-pandemic and were accelerated by the pandemic. The growth of e-commerce also drastically increased because of the pandemic, this was already on the rise previously but has now grown substantially. The growth of e-commerce has impacted the supply chain because of the rapid pace that they needed to produce with such low staffing. This is contributing to the fast fashion issue as well because factories are using unethhical practices in order to manufacture a large number of products.

I feel problems occurring within the supply chain will be around for some time even following the pandemic. While immense improvements have been made to end the pandemic, including new safety protocols and vaccines, spikes have still been occurring in areas causing problems and delays. The world still isn’t at a point yet where these waves do not have an effect on production, or to be guaranteed a new strand will not prove to cause as much damage as the initial one. For many factories, the damage and delay from the original pandemic are still effecting their progress in catching back up to speed, especially as demand continues to increase significantly. Some even reported a wait time p to 2 months of delay.

I’m sure that many people within the fashion industry are hoping for the economy and the supply chain to return to the way that it was prior to the pandemic, and although many people within the industry remain hopeful, the reality is that we are still feeling the repercussions of COVID-19. Waves of COVID-19 continue to be an issue, and we can feel that even here at the university with COVID-19 cases on the rise once again. However, the plus side is that many fashion companies have adapted to the changes. Fashion brands have started diversifying their supply chain to provide better flexibility to respond to issues within their supply chain. It can definitely be discouraging to see the continuing impacts of COVID-19, and with the Russia-Ukraine war, the global economy is far from stable right now. Regardless, we just have to continue to do our best to take action within the industry to address these issues and continue to try to plan for the unexpected. Overall, it requires an open mind and flexibility to be successful in these uncertain times.

The COVID-19 pandemic will continue to be an issue within the fashion industry and the supply chain. With cases still rising at random points, there are constant uncertainties within this industry. At any point, there can be another lockdown that can affect manufacturing efforts and shipments. As we know, consumers are also cutting back on spending with the pandemic in place which is affecting many companies all over. I think that fashion companies should be taking the necessary steps in creating a regional supply chain so that they are ready to deal with any issues that come their way.

After the COVID-19 pandemic we are still facing the same issues, in the past fashion brands vowed to change aspects of the supply chain to prevent port closures and lockdowns when the pandemic first began. The problem we seem to face is demand exceeding supply. This is causing delayed shipping. Worldwide inflation is also affecting the apparel industry as well. This may cause the US to decide if they should continue the US Section 301 tariff action against imports from China. Lockdowns in major port cities have resulted in factories in China facing operational issues due to COVID-19-related issues. We import a lot of apparel from china so this will disrupt the supply chain significantly. The pandemic has also caused people to decline in purchases, negatively affecting brands, and with inflation only getting worse consumers buying behavior is changing dramatically.

With China’s great impact on international trade, we have seen that the dependency countries have on China is very apparent. The shutdown in China has led to bottlenecks and severe impacts on lead times. As companies continue to recover from the difficulties of 2020/2021, they must use what they learned through that process to adapt to the closure of China’s ports. The problem for fashion brands and retailers will surround shipping delays that will deeply affect their consumers. As brands continue to make promises about merchandise arriving by a certain time, this can really strain relationships between the consumer and the company. These strained relationships will most likely lead companies to focus on consumer loyalty to keep their consumers shopping with them. Again we see how different areas of trade can impact areas that don’t come to mind as frequently. These hardships will be seen throughout the whole supply chain.

I find it interesting that some of the same problems that the T&A industry were facing in the past are reoccurring. Despite the challenges presented by Covid-19, China remained the top supplier in the country. This is possibly due to the US’s dependency on China for their cotton and other textiles. China’s resources and quality make it very difficult for fashion brands to remove them (or find alternatives) within their supply chain. Companies decided to work with China despite the strict lockdowns China placed, but this continued partnership could have affected their business. This resulted in delayed shipping times, delayed deadlines, and decreased quantities in production. Consumers were also affected by this continued partnership. It resulted in consumers not receiving their merchandise on time, and bearing the cost of increased or hidden fees incurred by continuing this partnership. The uncertainty of working with China during the pandemic was a risky business move that could have negatively impacted businesses, third party companies, garment workers, consumers, and the fashion industry as a whole. This was a good example as to why diversifying one’s supply chain is crucial.

The Covid-19 pandemic has changed the world in so many ways, but one of the biggest things still being affected is the fashion industry and supply chain. Even after two years since the beginning of the pandemic we are still facing many changes now in 2022. One of the main problems we see is the problem with the supply chain, and because of the problems with the supply chain and not being able to meet consumer need, we have hit a period of inflation. Another problem is demand going up and down. When people start to see the world returning to normal they want to buy because they no longer feel stressed, but when cases begin to start rising again with a pattern hard to predict people get scared again and stop buying. The fashion industry is doing a pretty good job at adjusting to these new patterns of consumer need but everything is still unpredictable. With this new inflation it’s making consumers question even more whether what they want is really necessary or not. Inflation to consumers looks like higher prices for their item but to theses clothing companies it is effecting all their raw materials, shipping and labor costs etc.

This article and video highlights the fragility of the supply chain. The situation that occured in 2020 in China with halts in the supply chain due to the COVID-19 pandemic also similarly reoccured in 2022, with disruptions in the supply chain happening because of shutdowns in parts of China. Watching at this video now in 2024, there are still disruptions happening in the supply chain, which has causes crisis’ over the world, with the Red Sea Crisis and Baltimore bridge collapse being the most prominent to date. This article and video highlights several uncertainties that impact the US apparel industry. These uncertainties are shipping delays in the supply chain, slowdown in US economy, worldwide inflation, and concerns of products “Made in China”. This article and video highlights the paradox of how this industry is very complex but also very fragile, any sudden changes can cause disruptions in the supply chain and affect consumers around the world.

The article and video were both very interesting and eye-opening. COVID-19 has left a lasting impact on the fashion industry, and many of the uncertainties we face in 2022 stem from this disruption. It is clear how interconnected factors like inflation, supply chain delays, and shifting consumer behavior are creating challenges for brands. Inflation affects everything from raw materials and labor to shipping and tariffs, driving up costs for both companies and consumers. At the same time, reduced consumer spending due to financial concerns makes it harder for brands to maintain profitability. The ongoing shipping delays and disruptions further complicate matters, showing just how fragile global supply chains can be. These challenges highlight the importance of brainstorming new strategies, such as sourcing supplies locally or adopting more sustainable production methods. These steps could help companies mitigate risks and adapt to the rapidly changing market landscape.