About Leah Marsh

Leah Marsh is a Research Associate at Cascale Better Buying. She first joined Better Buying as a research intern before transitioning into a full-time role, bringing fresh perspectives and a strong academic background in sustainable sourcing and compliance.

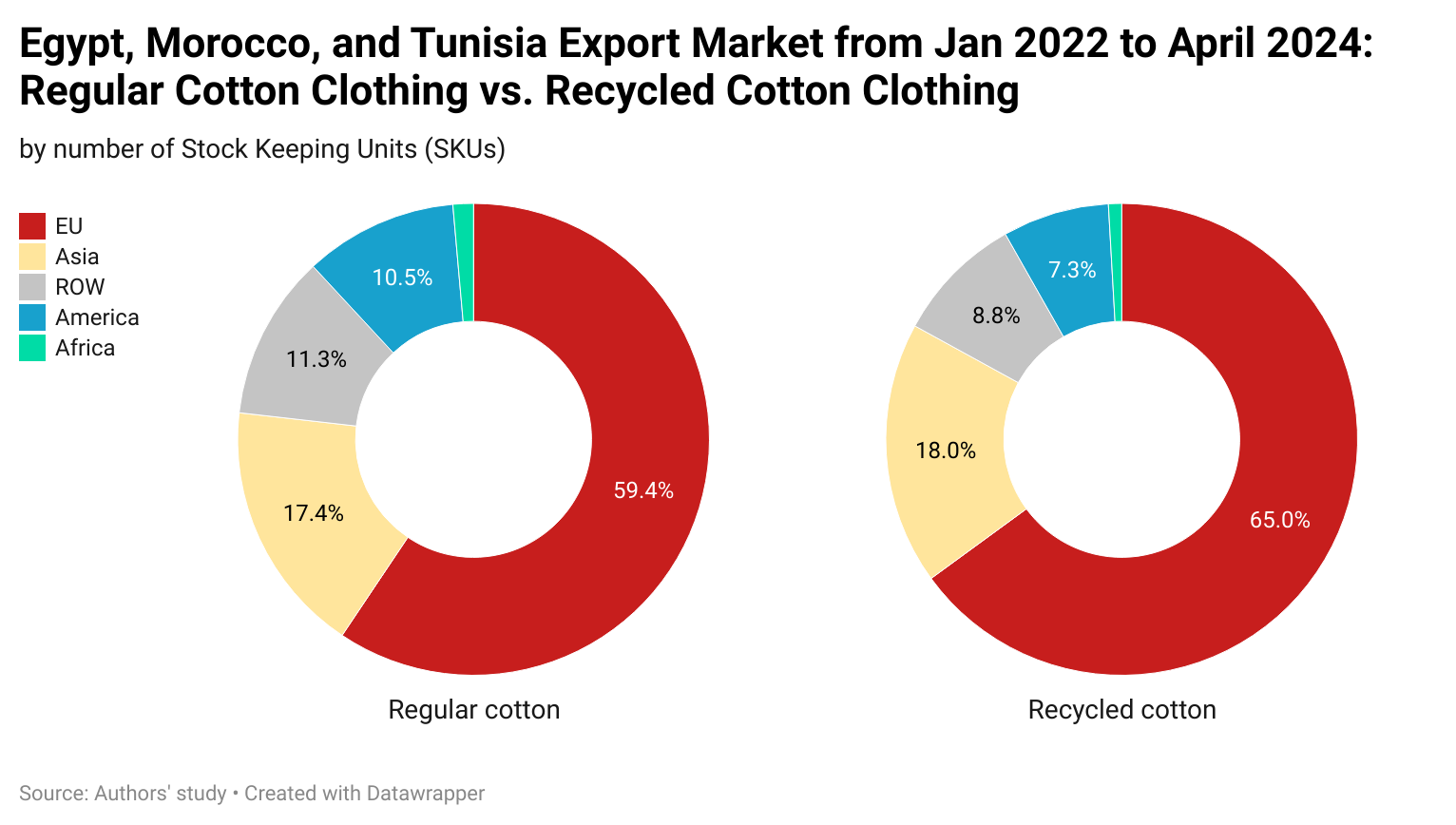

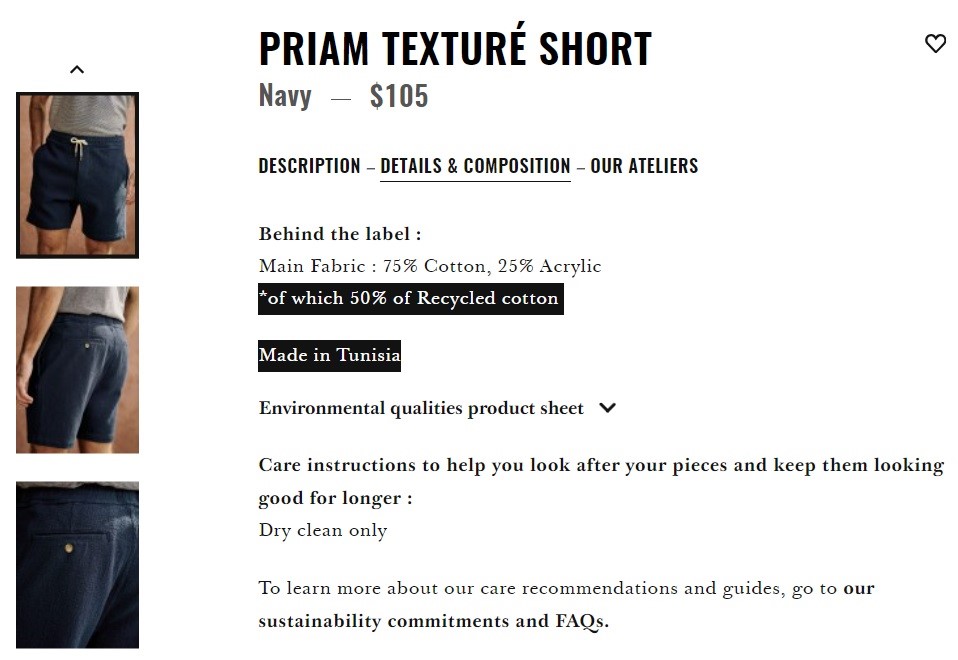

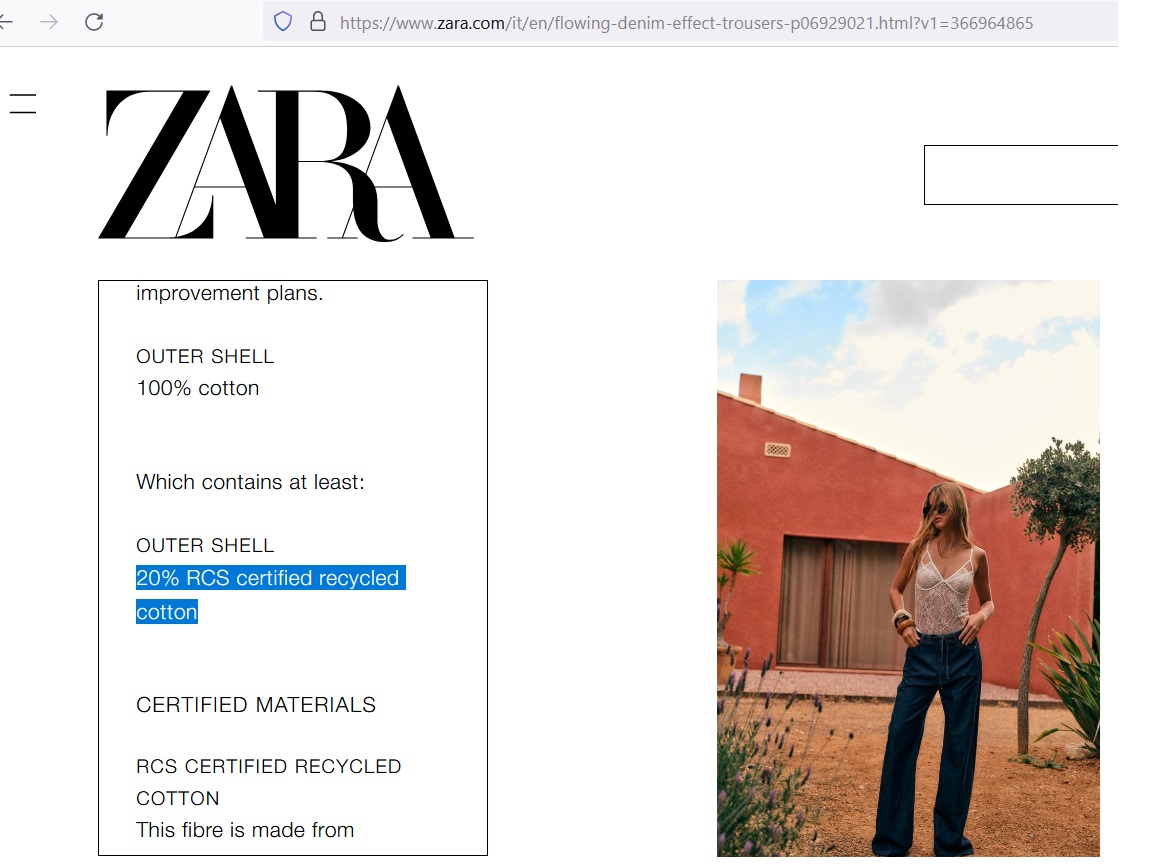

Leah holds both a B.S. and M.S. in Fashion and Apparel Studies from the University of Delaware, where she graduated from the FASH 4+1 graduate program. During her studies, she conducted extensive research on European retailers’ sourcing strategies for clothing made from recycled textile materials. [See Leah’s publication in Sustainability based on her Master’s thesis]

Originally from the U.S., Leah is currently working from New Zealand. She continues to engage with suppliers and collaborate with the Cascale team to advance responsible purchasing practices worldwide.

Sheng: Can you provide an introduction to Cascale and Better Buying, and describe your role there?

Leah: Cascale is a global nonprofit that fosters collaboration across the consumer goods industry to advance climate action and decent work. In 2025, Cascale acquired Better Buying tools and methodologies, reinforcing its commitment to responsible purchasing and socially just supply chains.

As a Research Associate with Cascale Better Buying, I lead global supplier outreach and support data analysis, helping transform purchasing practices data into actionable insights. I also manage the Local Ambassador program during the Better Buying Purchasing Practices Index (BBPPI) rating cycles, coordinating five ambassadors across key regions and driving increased supplier participation over the two-month survey period.

Sheng: You have been directly involved in researching and drafting the Better Buying Purchasing Practices Index Report (2025). Based on your observations, what are the key trends in the purchasing practices of fashion brands and retailers? For example, what are the major improvements, and where can further progress be made?

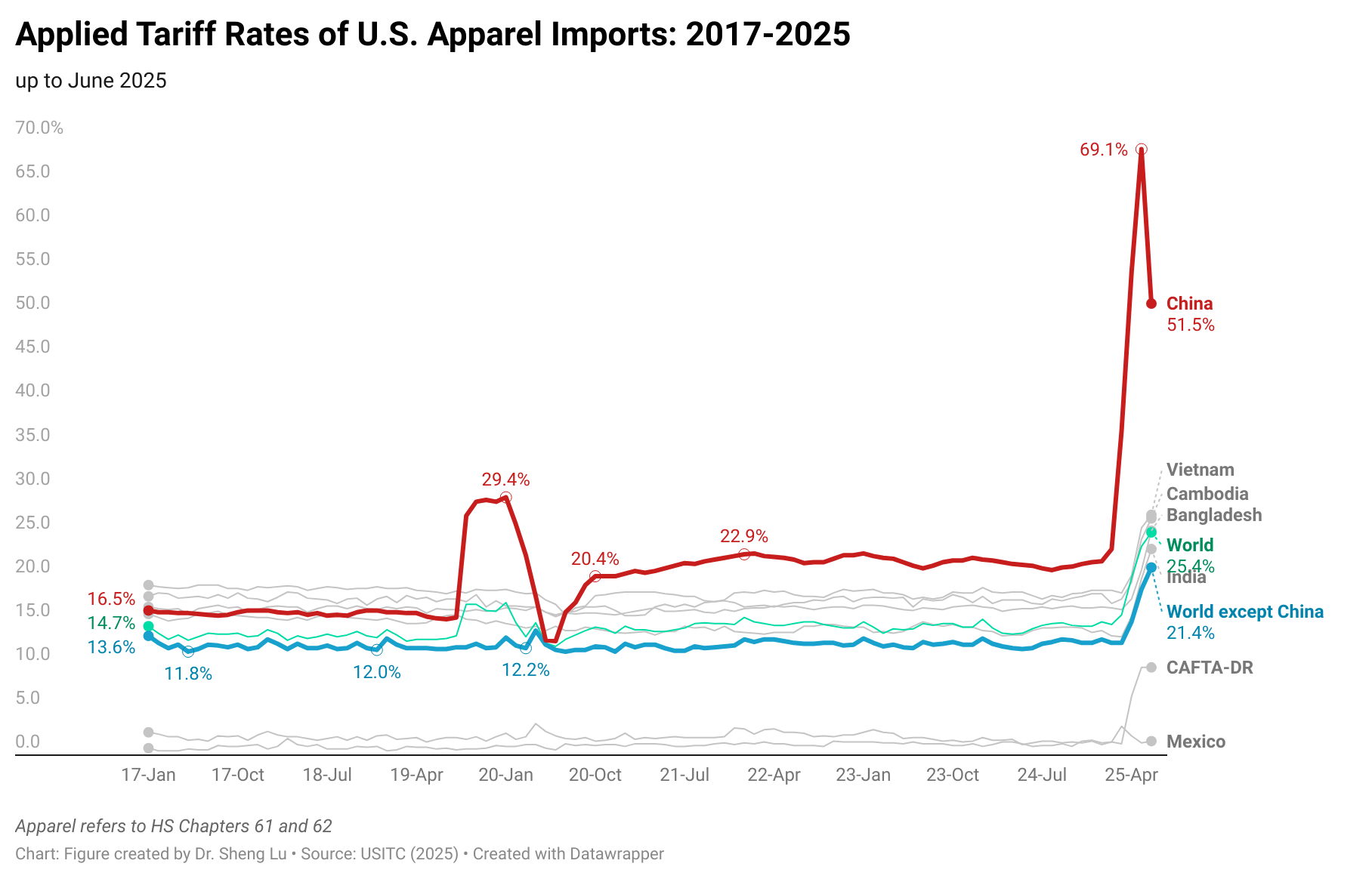

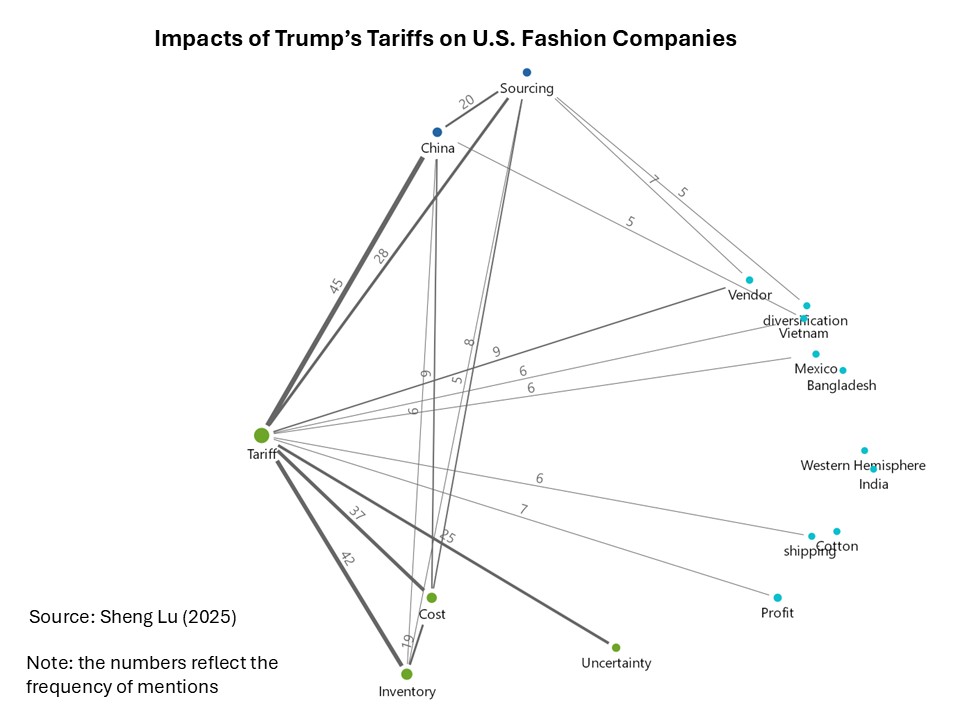

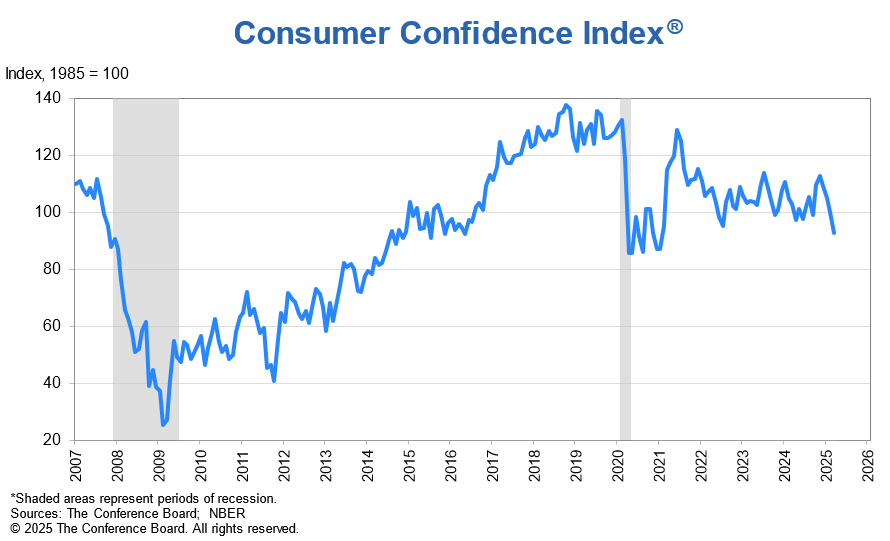

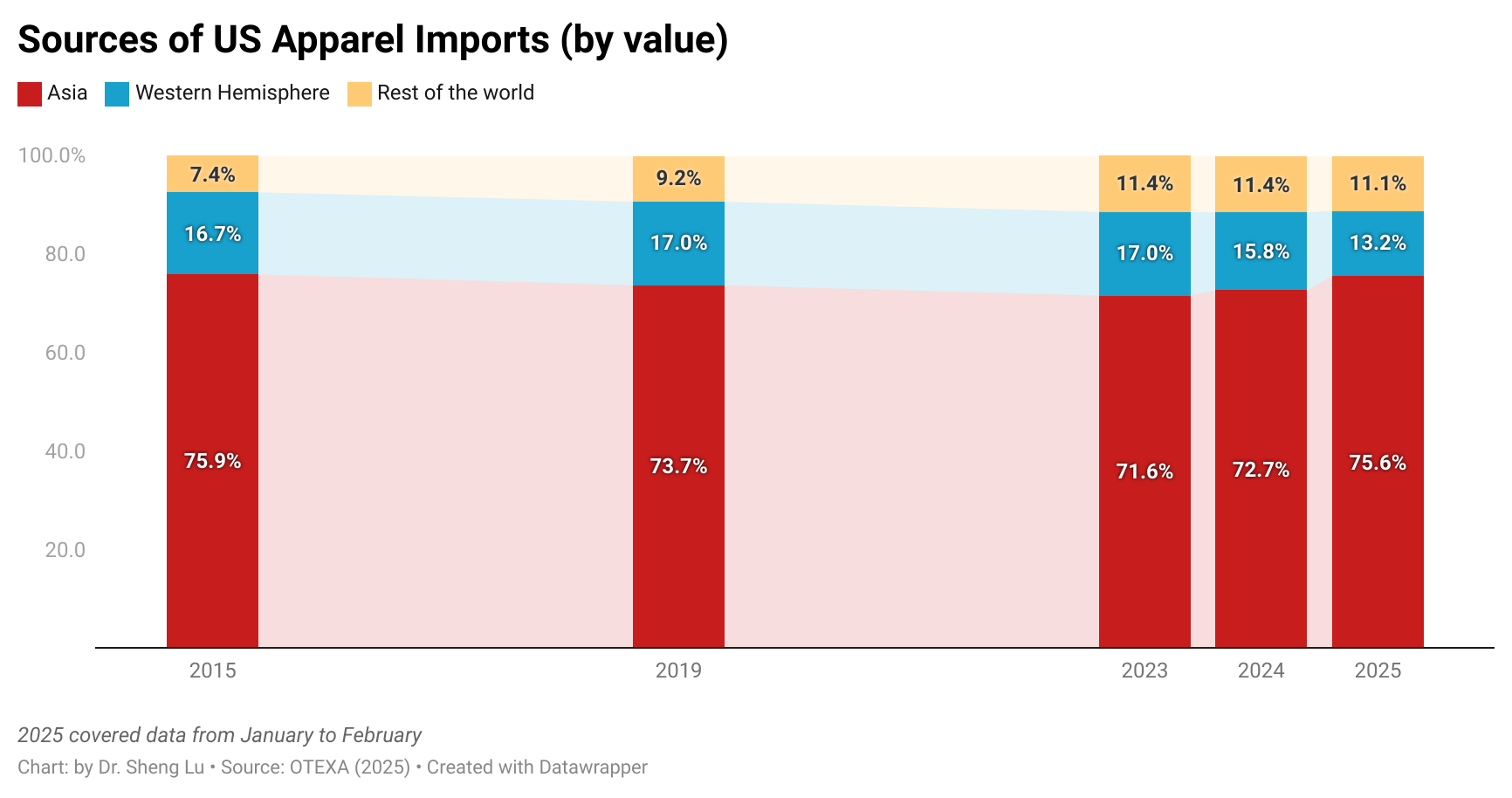

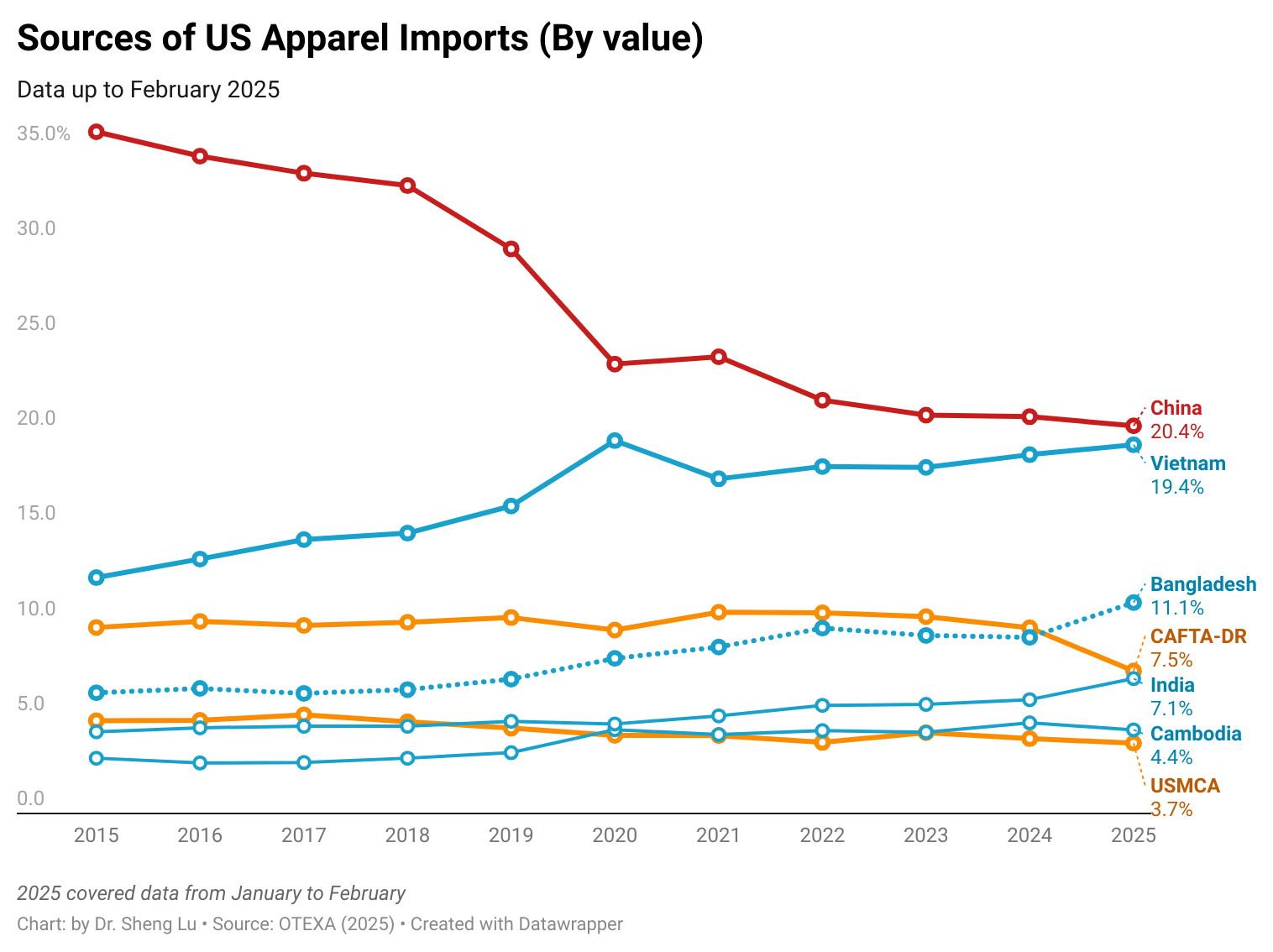

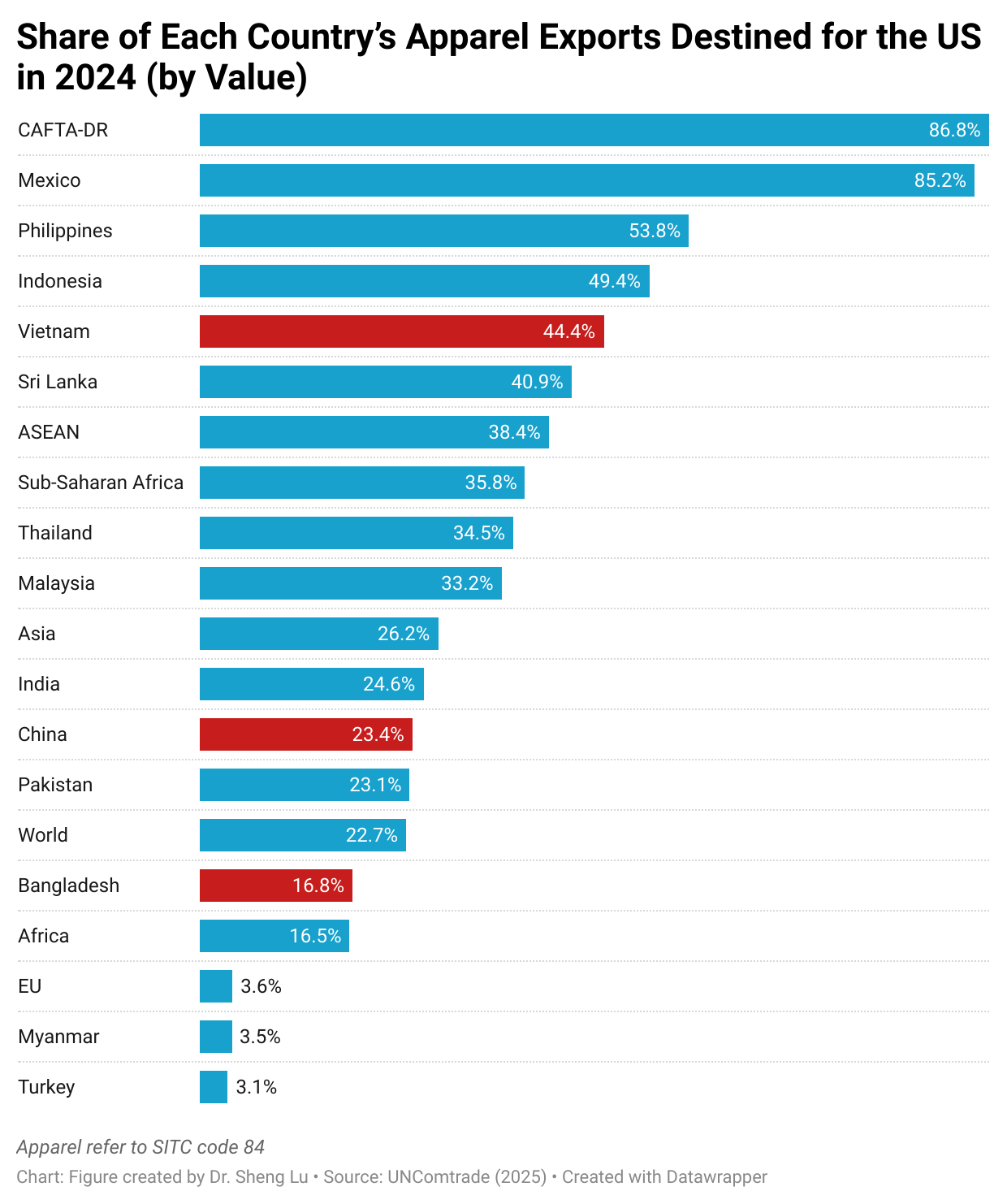

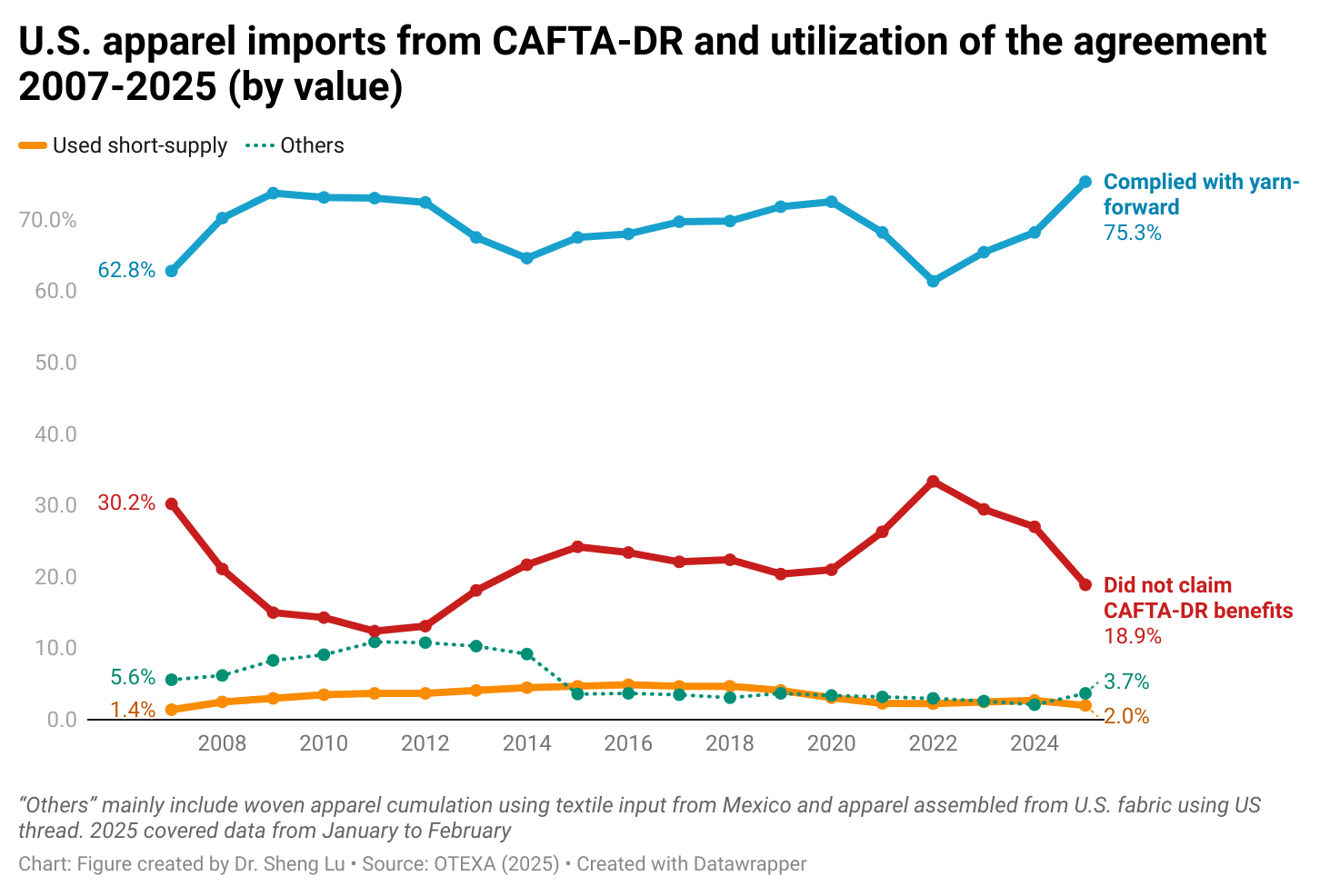

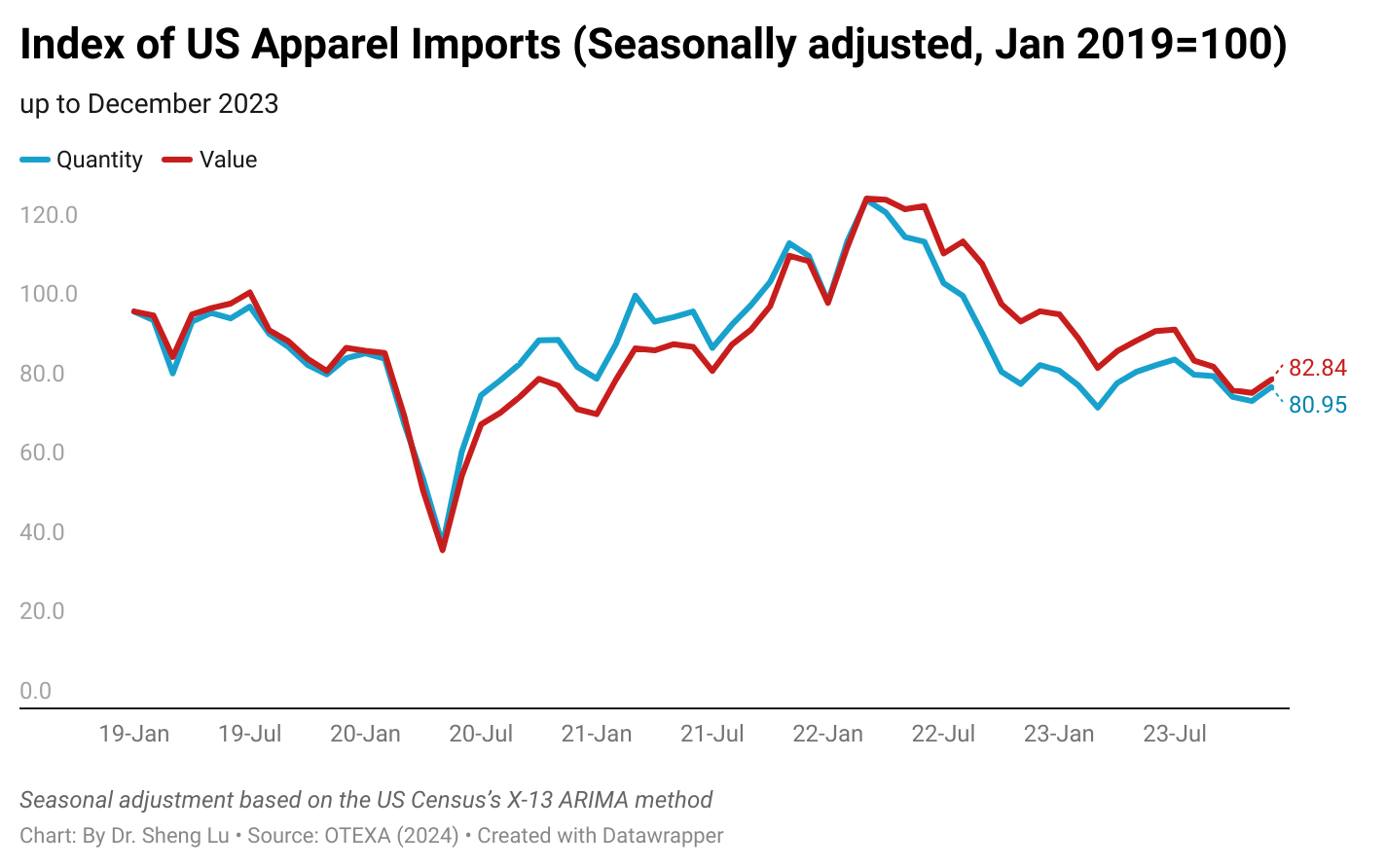

Leah: We observed a decline in the overall BBPPI score and across several category scores compared to last year. I believe this reflects the impact of an unstable global trade environment on brands’ ability to sustain responsible purchasing practices. For example, increased U.S. tariffs forced many brands to rapidly restructure their supply chains, often under significant time and cost pressure, making sustainable decisions more difficult.

In contrast, suppliers in Central and South America continued to rate their buyers above the industry benchmark in six of seven categories. This highlights the region’s ability to maintain strong, stable relationships between buyers and suppliers despite global uncertainty.

Moving forward, buyers should adopt more proactive strategies, such as improving forecast accuracy and implementing fairer, more flexible payment terms. These measures can strengthen alignment with suppliers and help mitigate the impact of future disruptions.

Sheng: My research shows that fashion companies increasingly prefer suppliers that offer sourcing flexibility and agility, like the ability to handle last-minute order changes. However, as noted in Better Buying’s report, suppliers consistently rank buyers’ “Planning & Forecasting” as their main concern. What is your perspective on these seemingly competing expectations, and what can be done to improve mutual understanding and partnership?

Leah: While brands and retailers often rely on supplier flexibility, this is not the model Better Buying advocates. Truly sustainable partnerships are built on detailed forecasts, reserved capacity, and formal commitments. Suppliers can be flexible to a degree, but when flexibility consistently undermines their interests, it becomes unsustainable. There is a clear difference between occasional last minute adjustments and the chronic unpredictability driven by fast fashion.

Practical solutions could include joint forecasting and scenario planning, fair compensation for last minute changes, and clearer expectations around flexibility. Ultimately, agility and responsibility should not be competing goals. Instead, they can be managed collaboratively to reinforce more sustainable buyer-supplier relationships.

Sheng: What is your perspective and vision regarding the increasing use of AI tools and data to enhance social responsibility in the fashion apparel industry? If there were no limitations in technology or resources, what bold AI-driven innovation would you most want to see in sourcing and purchasing practices, and why?

Leah:AI is increasingly used to streamline global supply chains, and in the fashion industry, 3D sampling stands out as a particularly impactful innovation. Several suppliers highlighted it in the BBPPI as a way to improve design and development processes while reducing inefficiencies in buyer-supplier interactions.

Traditional sampling often involves extensive back and forth, generates excess textile waste, and places uncompensated costs on suppliers. By contrast, 3D sampling can significantly reduce materials waste and financial burdens while accelerating decision-making.

However, many suppliers report that despite investing in 3D technology, buyers still primarily request physical samples. This gap between innovation and adoption suggests that the industry’s challenge is no longer technological availability, but buyer commitment to fully integrating these tools into their sourcing practices.

Sheng: As a graduate of the FASH 4+1 program, what experiences at UD do you find most beneficial and memorable? Do you have any suggestions or advice for our current students interested in pursuing careers in sustainability, social responsibility and related areas?

Leah: Use thesummers to intentionally build your professional network. Whether through research or internships, each experience adds distinct value to your portfolio. I participated in a UD Summer Scholar research project in my junior year, completed a UD-Macy’s student research partnership project in my senior year, and interned with the Better Buying Institute during my graduate year.

I also recommend “adopting a professor” early in your studies, especially for graduate students (including those in the 4+1 program). While each faculty member offers valuable expertise, identifying those whose work aligns with your interests can help shape your academic focus and open meaningful opportunities.

–The End–

Additional reading: Cascale Better Buying Responsible Purchasing Practices Snapshot Survey 2025 (Released on January 30, 2026)