Textile and apparel manufacturing in the U.S. has significantly shrunk in size over the past decades due to multiple factors ranging from automation, import competition to the shifting U.S. comparative advantages for related products. However, U.S. textile manufacturing is gradually coming back. The output of U.S. textile manufacturing (measured by value added) totaled $16.59 billion in 2021, up 23.8% from 2009. In comparison, U.S. apparel manufacturing dropped to $9.5 billion in 2019, 4.4% lower than ten years ago (Bureau of Economic Analysis, 2021).

Meanwhile, like many other sectors, U.S. textile and apparel production was hit hard by COVID-19 in the first half of 2020 but started to recover in the 3rd quarter. Notably, as of December 2021, U.S. textile production had returned to its pre-COVID level.

On the other hand, as the U.S. economy is turning more mature and sophisticated, the share of U.S. textile and apparel manufacturing in the U.S. Gross Domestic Product (GDP) dropped to only 0.12% in 2020 from 0.57% in 1998 (Bureau of Economic Analysis, 2021).

The U.S. textile and apparel manufacturing is changing in nature. For example, textile products had accounted for over 66% of the total output of the U.S. textile and apparel industry as of 2019, up from only 58% in 1998 (Bureau of Economic Analysis, 2020). Textiles and apparel “Made in the USA” are growing particularly fast in some product categories that are high-tech driven, such as medical textiles, protective clothing, specialty and industrial fabrics, and non-woven. These products are also becoming the new growth engine of U.S. textile exports. Notably, “special fabrics and yarns” had accounted for more than 34% of U.S. textile exports in 2019, up from only 20% in 2010 (Data source: UNComtrade, 2021).

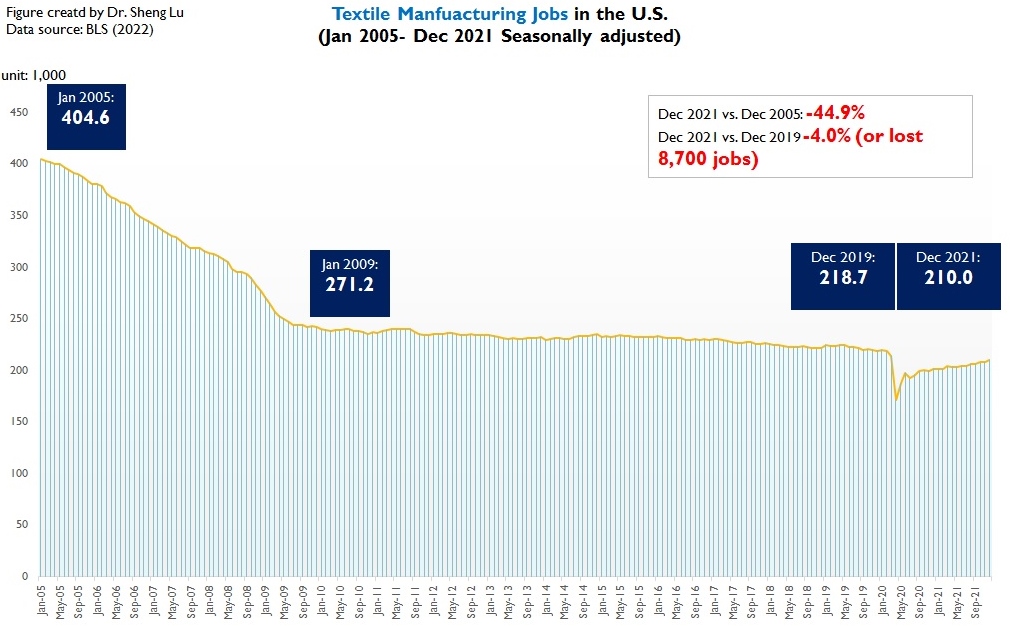

Compatible with the production patterns, employment in the U.S. textile industry (NAICS 313 and 314) and apparel industry (NAICS 315) fell to the bottom in April-May 2020 due to COVID-19 but started to recover steadily since June 2020. From January 2021 to December 2021, the total employment in the two sectors increased by 4.5% and 4.2%, respectively (Seasonally adjusted). However, the employment level remains much lower than the pre-COVID level (benchmark: December 2019).

To be noted, as production turns more automated and thanks to improved productivity (i.e., the value of output per worker), U.S. textile and apparel factories have been hiring fewer workers even before the pandemic. The downward trend in employment is not changing for the U.S. textile and apparel manufacturing sector. Related, how to attract the new generation of workforce to the factory floor remains a crucial challenge facing the future of textile and apparel “Made in the USA.”

International trade supports textiles and apparel “Made in the USA.” Notably, nearly 42% of textiles “Made in the USA” (NAICS 313 and 314) were sold overseas in 2019, up from only 15% in 2000. A recent study further shows that product category and the size of the firm were both statistically significant factors that affected the U.S. textile and apparel manufacturer’s likelihood of engaged in exports.

It is not rare to find clothing labeled “made in the USA with imported fabric” or “made in the USA with imported material” in the stores. Statistical analysis shows a strong correlation between the value of U.S. apparel output and U.S. yarn and fabric imports from 1998 to 2019.

Like many other developed economies whose textile and apparel industries had reached the stage of post-maturity, the United States today is a net textile exporter and net apparel importer. COVID-19 has affected U.S. textile and apparel trade in several ways:

- Trade volume fell and yet fully recovered: Both affected by the shrinkage of import demand and supply chain disruptions, the value of U.S. textile and apparel imports dropped by as much as 19.3% in 2020 from a year ago, particularly apparel items (down 23.5%). Likewise, the value of U.S. textile and apparel exports in 2020 decreased by 15.6%, including an unprecedented 26% decrease in yarn exports. Further, thanks to consumers’ robust demand, the value of US apparel imports enjoyed a remarkable 27.4% growth in 2021 from a year ago and but was still 2.5% short of the level in 2019.

- Trade balance shifted: Before the pandemic, U.S. was a net exporter of fabrics. However, as the import demand for non-woven fabrics (for making PPE purposes) surged during the pandemic, U.S. ran a trade deficit of $502 million for fabrics in 2020; the trade deficit expanded to $975 million in 2021. Meanwhile, as retail sales slowed and imports dropped during the pandemic, the U.S. trade deficit in apparel shrank by 19% in 2020 compared with 2019. However, the shrinkage of the trade deficit did not necessarily boost clothing “Made in the USA” in 2020, reminding us that the trade balance often is not an adequate indicator to measure the economic impact of trade.

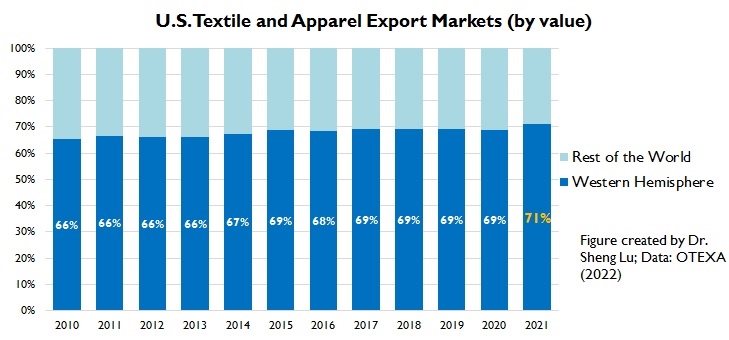

- No change in export market: More than 70% of U.S. textile and apparel export went to the Western Hemisphere in 2021, a pattern that has stayed stable over the past decades (OTEXA, 2022). More can be done to strengthen the Western Hemisphere supply chain and textile and apparel production in the region by leveraging regional trade agreements like CAFTA-DR and USMCA.

By Sheng Lu

Further reading:

- The Shifts in US Textile Manufacturing Raise Questions About the Availability of US-made Textile Inputs for the Western Hemisphere Apparel Supply Chain

- 2022 State of the US Textile Industry (National Council of Textile Organizations, NCTO)

This blog shines important light on the growing relevance of the US textile manufacturing sector. I found it interesting and positive that textile production as of June 2021 had reached almost full production capacity levels when compared to pre-COVID levels, as the unanticipated pandemic set back this area tremendously. Along with this, I think it is important to consider that products like medical textiles and PPE are becoming more relevant in our manufacturing as this technology-driven area has seen up to 14% growth in recent years. Something I noticed that is changing our manufacturing employment area is the increase in reliance on automated practices rather than more workers. This is an important point to note as employment levels here are decreasing, and there is question as to how workers of this generation will be attracted to roles that require more technological knowledge and advanced application skills.

Even though textile and apparel manufacturing in the US has shrunk in size due to automation, import competition, United State’s comparative advantages, and most recently, COVID-19, it is great to hear it is gradually coming back. As the US economy is turning more mature and sophisticated, their textile production resumed 98.5% of its production capacity at the pre-COVID level, which is very impressive as this pandemic has been wildly unpredictable. As change is not only encouraged, but necessary for businesses and manufacturers, the US is stepping up as they have increased the total output of the US textile and apparel industry while also increasing the textile exports of special fabrics and yarn, as they account for 34% of US textile exports. The one major downside that I believe strongly affected the US was employment when the pandemic hit. However, prior to COVID-19 it was decreasing as automation and improved technology are being created and utilized more than ever. Thinking about new technology and the upcoming year of 2022, it is interesting to think about how many apparel workers will be let go due to automation. I believe the numbers will continue to decrease, which is very unfortunate for these workers who may have devoted their entire lives for this kind of work. I remember seeing a video about apparel workers and how they are scrambling to find new jobs and hobbies due to automation increasing in the factories. One middle-aged garment worker had to go back to school once he was let go to learn to become an electrician. In the future I believe upcoming workers will not even involve themselves in the garment and apparel industry as their jobs can easily be taken by machines.

great thoughts!

One thing not mentioned in the blog post is the non-economic factors. You may find this remark by Kim Glas, President & CEO of the National Council of Textile Organizations (NCTO) interesting: http://www.textilesinthenews.org/wp-content/uploads/2021/11/2021-12-02-Kim-Glas-NCTO-W-M-Testimony-China-Final.pdf

To clarify, “Textiles and apparel “Made in the USA” are growing particularly fast in some product categories that are high-tech driven, such as medical textiles, protective clothing, specialty and industrial fabrics, and non-woven. These products are also becoming the new growth engine of U.S. textile exports”

In our lectures, we discussed the restricting strategies adopted by the US textile industry to stay competitive. You may think about what trends in this blog post reflect these strategies.

The article mainly talks about how Covid-19 pandemic is changing the US textile and apparel industry. As we learned from the lecture, the United States is one of the largest textile exporters in the world. And because of the more advanced economy, the US is mainly focusing on manufacturing capital and technology intensive products. For example, the exports of special use yarn and fibers increased from 20% to 34% during the past decades. And the implementation of new technologies and machines in the supply chain helped the textile industry to improve efficiency. However, the employment rate in the US’s textile industry is surprisingly decreasing. I think one of the main reasons would be the widespread usage of machines to manufacture textiles rather than laborers. Due to the pandemic, the global T&A supply chain was disrupted, and the US is no exception. I’m glad to hear that the U.S. textile manufacturing is gradually coming back. This will facilitate the recovery of the textile and apparel supply chain in the Western Hemisphere. As for the post-pandemic period, there are more things companies can do to strengthen their supply chain and contribute to the improvement of supply chain management.

I found this article beneficial in describing the state of the U.S. textile and apparel industries and the effects of trade and global events on these industries. This post does well to exemplify assertions from lectures through the incorporation of data. The most interesting information to me was the bullet points listing the ways Covid-19 affected the trade of textile and apparel trade in the U.S. The format was extremely helpful and concisely explained the affects. When it comes to content, the data highlighting the return of the textile industry to pre-Covid levels was pleasant assertion given that many perceive the coronavirus as a negative impact on all industries. This rapid return to “normalcy” may be due to the continued demand for PPE as variants emerge. Regardless, I think this article did well to summarize the overall affects of the Covid-19 pandemic on the U.S. textile and apparel manufacturing by exercising a realistic, data-based view.

This article does a great job at summarizing the state of the US textile and apparel manufacturing. It’s no surprise that the US T&A industry has decreased, especially due to COVID, but it is coming back! One interesting thing I learned from this article was that the US T&A manufacturing in general is changing in nature. The special fabrics and yarns are the products that are increasing in production like medical textiles, protective clothing, etc. I had no idea that these products were becoming leading apparel products for the US T&A sector. However, it was disappointing to hear that because of the advancements in T&A technology, T&A sector related employment is decreasing and not looking up. A third point made in the article that states how international trade is supporting more “made in the USA” products, is a great sign. This relates to the 5th discussion post, which mentioned an article with Biden’s trade policy agenda. He included many different proposed policies that would open the export markets for “made in the USA” products. One important, relevant policy he mentioned was the Promoting Equitable Economic Growth Around the World, where the Biden administration will implement policies that help to promote and increase more global economic growth and global demand for American businesses and products by expanding the customer base and increasing the global demand for products “made in the USA”. I made this connection because it shows the efforts of our current President to increase the demand for US-made products. This definitely has some contribution to the point in the article that international trade supports more “made in the USA” products.

I found this article to be extremely informative and quite interesting in relation to the U.S. textile and apparel sector. I feel as though I am so quick to see the U.S. as an importer of textile and apparel, that I forget about how competitive the market really can be. It is extremely impressive that by June of 2020 the market was able to begin steadily increasing again. COVID-19 was not just impactful in the spread of disease and massive panic, but it was also impactful in how unprepared and unexpected it was. It is very impressive of a sector to be able to make changes and work around a situation while still very much in the middle of it and not knowing what any sort of outcome could be. I do worry though about production becoming more automated and the lack of employment. While speed of production and efficacy is extremely important, creating jobs for U.S. workers is also a huge issue. I wonder if we will see any sort of change of direction in terms of automation as the sector continues to grow and expand.

The US manufacturing industry is likely decreasing Its rate of apparel manufacturing because of its advanced economy. While production rates of textile manufacturing have stabilized and continue to grow post-Covid, the employment rate for this sector remains below post-Covid. I would suggest this trend would be due to automation. As our capital grows and our economy advances, our expenses can increase in regard to technology. The industry is becoming more efficient, with fewer employees and more machinery. The textile manufacturing industry is also becoming more profitable which encourages the US to invest more.

I agree with everything you said. So, here is my question–if the US textile industry is in good shape, then why does it call for imposing high tariffs on apparel imports from China? What does the worry come from? (see http://www.ncto.org/ncto-issues-statement-in-support-of-biden-administrations-new-china-trade-policy-framework/ )

I believe that the United States has given up manufacturing apparel as many developing companies have the capacity to produce more goods at a cheaper price point. I believe that outsourcing factory jobs to third world nations has given the United States the ability to have more advanced fashion jobs at home. More advanced nations typically have jobs that require higher education levels and factory work has proven to be a skill that can easily be taught without the need for an educational background. Factory work in developing nations allows them to start the industrialization process as well as bring in profits through exports. Whereas there could be a more positive outlook on manufacturing jobs coming back to the US if prices are comparable to overseas manufacturers, I do not believe there will ever be a market where an apparel product is both produced in the US and utilizes textiles also sourced in the US. The T&A market is a global industry, with many key countries working together to aid in making goods at the best price point. I ultimately believe that US manufacturing jobs will become obsolete due lower costs in lesser developed countries. Fashion is becoming more technically advanced in the research and development sphere, which I believe the US fashion industry will be on the forefront of. Covid has also proven to be detrimental to fashion companies only utilizing a few sourcing hubs. This may lead to more brands expanding their sourcing geographics in case of another mass supply chain disruption.

Looking at the trade statistics after the pandemic is interesting due to the balance of imports and exports. Something that caught my attention in the article is the future of “made in the USA” products. While manufacturing is becoming more technological leading to less workers needed, there are still some workers needed. This is becoming a problem because not many young people are looking to work on the factory floor like older generations. Without Americans willing to do these jobs the amount of products “made in the USA” will decrease as time goes on. It was also interesting to see that 42% of textiles made in the US are sold overseas which is a much larger percentage than previously. I did not realize how many textiles that are made here are not sold here. I believe in the future that the amount of products “made in the USA with imported materials” will continue to grow because it is easier to accomplish and consumers appreciate seeing that on products. I also believe that products made fully in the US will continue to grow as well but at a slower rate.

I also find it interesting that there is probably a limited future on “made in USA” products due to the future of labor. So many people aspire for high paying, non laborious jobs, and have the means to get a higher education. It is going to be interesting to see where the future of our factories will go. Perhaps we will create “smart factories” as seen in China (https://www.youtube.com/watch?v=vDmUX_-7Kjo). I also found it interesting that as we reached the post maturity stage in production, our textile exports increased from 15% to 42%. Which makes sense to see a majority of “made in USA” products have imported textiles. Overall, I do not know what the future of “made in USA” products will hold as our generation starts joining the work force because the societal norm now is to get a college degree and not hold a laborious job.