The full study is available here (need Just-Style subscription)

By leveraging production and trade statistics from government databases, we examined the critical trends of US textile manufacturing and supply. Particularly, we try to understand the strengths and weaknesses of the United States as a textile raw material supplier for domestic garment manufacturers and those in the Western Hemisphere. Below are the key findings:

First, fiber, yarn, and thread manufacturing is a long-time strength in the US, whereas fabric production is much smaller in scale. Specifically, fiber, yarn, and thread (NAICS 31311) accounted for nearly 18% of US textile mills’ total output in 2019. In comparison, less than 13% of the production went to woven fabrics (NAICS 31321) and only about 5% for knit fabrics (NAICS 31324).

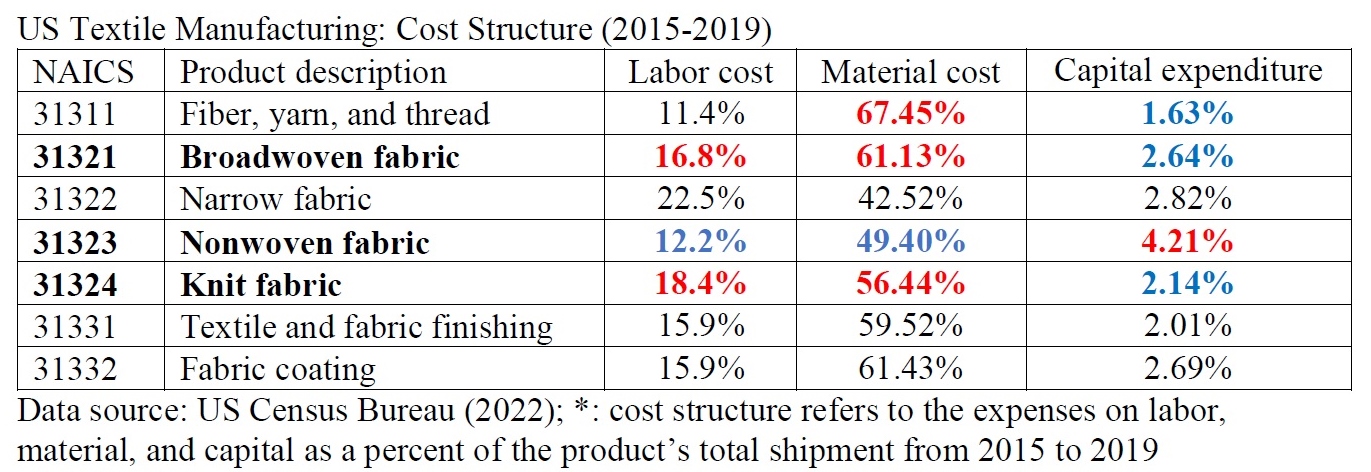

Second, the US textile industry shifts to make more technical textiles and less apparel-related yarns, fabrics, and other raw materials. Data shows that from 2015 to 2019, the value of US fiber, yarn, and thread manufacturing (NAICS code 31311) dropped by as much as 16.8 percent. Likewise, US broadwoven fabric manufacturing (NAICS code 31321) and knit fabric (NAICS code 31324) decreased by 2.0 percent and 2.7 percent over the same period. Labor cost, material cost, and capital expenditure are critical factors behind the structural shift of US textile manufacturing.

Third, the structural change of US textile manufacturing directly affects the role of the US serving as a textile supplier for domestic apparel producers and those in the Western Hemisphere.

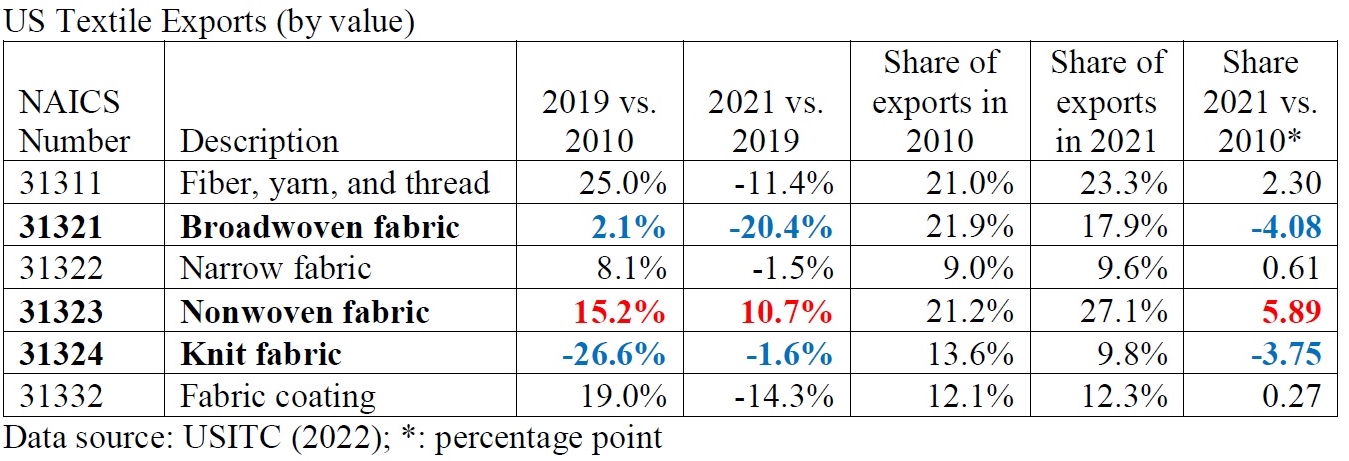

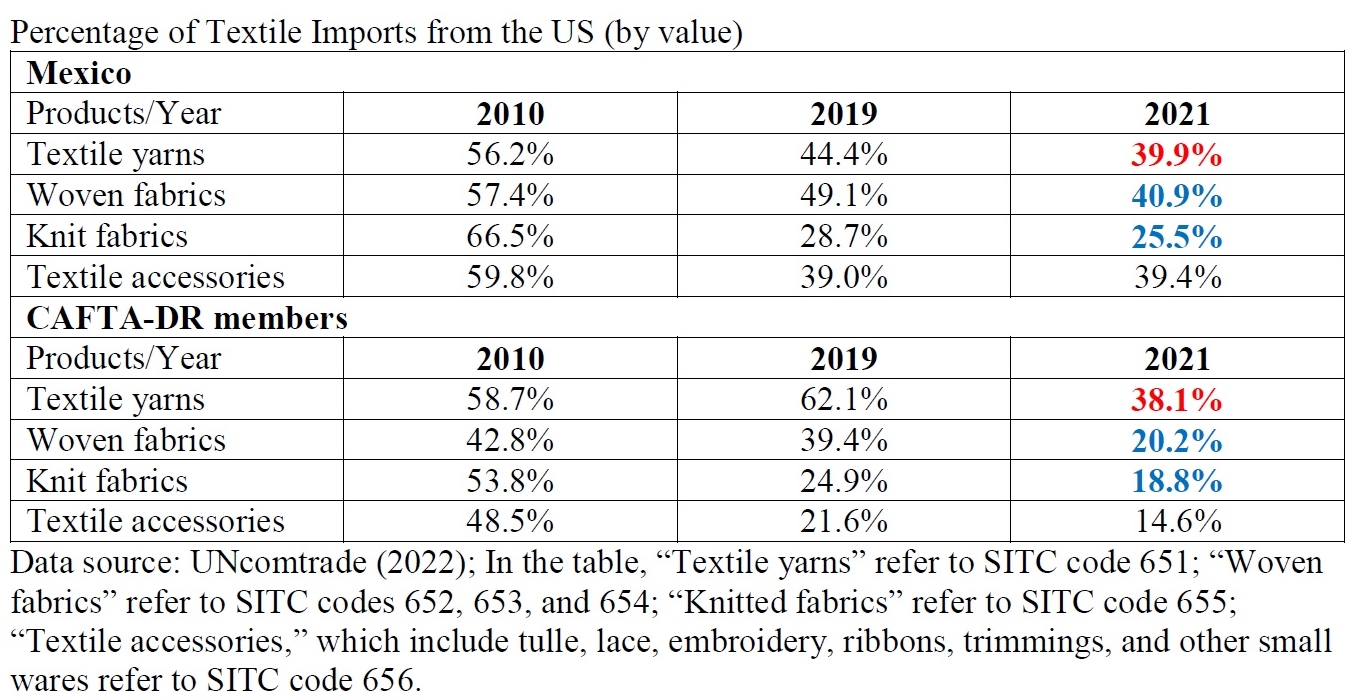

On the one hand, the US remains a critical yarns and threads supplier in the Western Hemisphere. For example, from 2010 to 2019, the value of US fibers, yarn and threads exports (NAICS31311) increased by 25%, much higher than other textile categories. Likewise, in 2021, fibers, yarns, and threads accounted for about 23.3% of US textile exports, higher than 21.0% in 2010. Additionally, nearly 40% of Mexico and CAFTA-DR members’ yarn imports in 2021 (SITC 651) still came from the US, the single largest source. This trend has stayed stable over the past decade.

On the other hand, the US couldn’t sufficiently supply fabrics and other textile accessories for garment producers in the Western Hemisphere, and the problem seems to worsen. Corresponding to the decline in manufacturing, US broadwoven fabric (NAICS 31321) and knit fabric (NAICS 31324) exports decreased substantially.

The US also plays a declining role as a fabric and textile accessories supplier for garment factories in the Western Hemisphere. Garment producers in Mexico and CAFTA-DR members had to source 60%-80% of woven fabrics and 75-82% of knit fabrics from non-US sources in 2021. Likewise, only 40% and 14.6% of Mexico and CAFTA-DR members’ textile accessories, such as labels and trims, came from the US in 2021.

Likewise, the limited US fabric supply affects the raw material sourcing of domestic apparel manufacturers. For example, according to the “Made in the USA” database managed by the Office of Textiles and Apparel (OTEXA), around 36% of US-based apparel mills explicitly say they use “imported material,” primarily fabrics.

The study’s findings echo some previous studies suggesting that textile raw material supply, especially fabrics and textile accessories, could be the single most significant bottleneck preventing more apparel “Made in the USA” and near-sourcing from the Western Hemisphere.

Meanwhile, how to overcome the bottleneck could trigger heated public policy debate. For example, US policymakers could encourage an expansion of domestic fabric and textile accessories manufacturing as one option. However, to make it happen takes time and requires substantial new investments. Also, economic factors may continue to favor technical textiles production over apparel-related fabrics in the US.

As an alternative, US policymakers could make it easier for garment producers in the Western Hemisphere to access their needed fabrics and textile accessories outside the US, such as improving the rules of origin flexibility in CAFTA-DR or USMCA. But this option is likely to face strong opposition from US yarn producers and be politically challenging to implement.

(About the authors: Dr Sheng Lu is an associate professor in fashion and apparel studies at the University of Delaware; Anna Matteson is a research assistant in fashion and apparel studies at the University of Delaware).

After reading this article, it can be seen that a strength the US has in textile manufacturing is the production of yarns and threads. The US does not have as high of a success rate in the output of fabrics. Looking into the future, I think it would be the most beneficial for the US to continue to produce yarns and threads as it has proven to be something the nation is good at. Where the US still has the ability to produce fabrics, why would they continue to if they are not making as high of a return on it in comparison to yarn and thread manufacturing. I believe the US could adapt a strategy of solely producing yarns and threads as they may have the ability to see higher revenues in focusing on something they have the absolute advantage in. The US already has a high productivity rate in yarn/thread production while producing other textile materials like fabrics. Imagine how much more success the industry could have in focusing on one form of textile production that the country is the best at…

How do you think doing away with all fabric production in the US will affect those companies that pride themselves on having products “Made in the USA.” Will they continue to use these claims with outsourced materials? Will consumers really dive deep into the brands sourcing to know–or do they not care?

I agree that it is clear that the United States’ strengths are in fiber yarn and thread manufacturing rather than fabric manufacturing. You also raise a good question when asking how limiting or going away with fabric production in the US will impact companies that pride themselves on being “Made in the USA”. I think it will have an impact on many companies if the fabric and material production continues to decline. I think companies will have to prioritize what is more important to them. Personally, I do not think that a majority of consumers take the time to see where their product is made and the US should focus on producing their strong suit fiber, thread, and yarn.

After reading this article, I am now much more educated about the critical trends of textile manufacturing and supply in the US. This blog post dives into the strengths and weaknesses of the US being a supplier. Some strengths mentioned include fiber yarn and thread manufacturing being a long time strength, the US industry shifting to make more technical textiles and less apparel related materials, the structural change affecting the role of the supplier and being a critical yarn and thread supplier in the western hemisphere. Also, costs of labor, materials and expenditures are critical factors. Some weaknesses mentioned are that the US couldn’t sufficiently supply fabrics and other textile accessories for garment producers in the Western Hemisphere and how they now play a declining role as a supplier. This limited supply also affects sourcing of materials. Adjusting the rules of origin and figuring out how to get past the bottleneck could result in a debate so moving forward, to overcome these challenges, the US could encourage an expansion of domestic manufacturing. It would take time and extensive investments but I believe that it would be beneficial in the long run.

based on what we learned in FASH455, what’s your view on the apparel rules of origin debate? Do you agree it would be politically challenging to liberalize the rules in CAFTA-DR? why or why not?

Based on what we learned in FASH455 I think their are both pros and cons to liberalizing the rules in CAFTA-DR. Yarn forward rule of origin, which is more restricted, requires the spinning of the yarn to take place in the FTA countries in order for the garment to have access to the duty-free benefits. This is beneficially for the US textile industry as they are the only main supplier within CAFTA-DR. On the other hand, US retailers are restricted as they are required to use expensive US-made yarns to qualify for duty-free benefits. Fabric forward rules of origin, the more liberal approach, requires each step of apparel production to be made in the region in order to enjoy the duty-free benefits. This is beneficial for US retailers as they can import cheaper yarns from elsewhere and still qualify for duty-free benefits. On the other hand this hurts the US textile industry because they will loose business to cheaper alternatives. Liberalizing CAFTA-DR with fabric forward is only beneficially for US retailers since it hurts the US textile industry.

I do not think it would be politically challenging to liberalize the rules in CAFTA-DR because the rules of origin are used to determine how the CAFTA-DR is run so they almost work together in a way.

What’s your thought on this: http://www.ncto.org/independent-study-highlights-benefits-of-u-s-cafta-dr-agreement-and-devastating-impact-of-weakening-agreements-rules/?utm_source=rss&utm_medium=rss&utm_campaign=independent-study-highlights-benefits-of-u-s-cafta-dr-agreement-and-devastating-impact-of-weakening-agreements-rules

The president of the National Council of Textile Organizations says, “We appreciate the broad bipartisan support, including from the administration, for maintaining the essential yarn forward rule of origin and ensuring those rules are not eroded through harmful changes. This common support for preserving the provision is vital to the bipartisan efforts focused on ushering in a new era of American manufacturing prowess and economic prosperity. “

Looking at the patterns in the manufacturing of yarns and threads versus textiles in the US is very interesting. Due to the US having the resources to supply yarns and threads that should be the main focus in the US instead of textile however it is still important to be able to have products fully “Made in the USA.” Textile manufacturing has declined in recent years making it difficult to make products in the US without it being made with imported materials. If the policy makers side with US yarn producers, US brands will continue to struggle when it comes to finding materials that make them eligible for CAFTA-DR. If the policy makers choose to side with US brands, there will be less rules regarding the origin of materials. This will lead to a rise in imported materials making it even more rare for something to be made fully in the US.

Well, the CAFTA-DR rules have NOT changed since their implementation in 2006. Do you mean the trade agreement has hurt the US textile industry?

After reading this article I have a better understanding of how important US textile production is to the rest of the world, specifically members of CAFTA-DR and NAFTA. The US is shifting away from apparel textile manufacturing and towards technical textile manufacturing. This could have lasting effects on the members of these Trade Agreements who depend on US textiles. The US is the only country in NAFTA and CAFTA who has enough capital and is developed enough to produce textiles. If these countries want to benefit from the trade agreements, they need to source their textiles from the US, especially if the more strict Yarn Forward Rules of Origin is in place. If the US wants to shift their focus away from apparel textile manufacturing they need to be more lenient with RoO. They won’t be able to provide the textiles that all of these countries need in the amount that they need. It’s not fair to punish them for that. However, that being said, changing the rules of origin to be more lenient will cause problems with the US textile manufacturing companies that do produce apparel textiles. They want strict RoO so they can get as much business as possible, but a few factories can’t produce enough for everyone.

After reading this article I feel like the US should stick to their strengths of manufacturing fiber, yarn and thread. As mentioned before the US fabric production is a very small scale, I think the US should still continue to produce fabric, but I dont think it should be our main focus due to the success of the US fiber manufacturing. There are benefits for the US textile industry producing fiber, yarn and thread because of the RoO, yarn forward rule, because they are a critical supplier for the western hemisphere.

The United States is very good at manufacturing yarns and threads, and is a large supplier for the Western Hemisphere, but they are unsuccessful at providing fabrics and textile accessories to Western Hemisphere garment producers. This makes it difficult to source domestically because there is a gap in the necessary supplies to make garments fully from American materials. The low supply of US textile raw material is a very significant bottleneck that is preventing the ability to have more apparel made in the US. However, expansion for the apparel industry is not something that is economically backed because since the US is a developed country, the US uses more automation and therefore, creates more textiles than apparel. This leaves a large debate of whether it is worth it to invest in apparel manufacturing the fix the gap. I think if they were to invest in apparel manufacturing more, it would ultimately lead to more profits because then it can allow the US to near-source and create more “Made in the USA” apparel, which may cost more for consumers, but ultimately bring more business for the US directly.

A convincing argument in support of revitalizing the US apparel manufacturing industry! On the other hand, the US has excelled at producing fibers and yarns in recent years. As the US continues to implement technological advancements and innovate production, it seems more beneficial to focus on capital-intensive manufacturing. While consumers value “Made in the USA” as an act of patriotism, we must also consider that the US labor force does not demand blue-collar jobs like decades prior. More Americans today pursue higher education, creating a void in skillful labor. Even if the US invests in bringing back apparel manufacturing, does it have the labor capacity to meet production demands?

One of the stand out parts of this article to me, was that many “Made in the USA” products are having to outsource materials. With US fabric manufacturing declining, making completely made in the USA products is becoming harder and harder. I feel like many Americans love the idea of made in the USA products–it fuels their patriotism. What they don’t realize is the with the decline in manufacturing fabrics for example, this is becoming a more difficult goal. Do you think “Made in the USA” really matters, or is pricing more important to you?

This was a great read on the technical advancements of the US textile industry and how they are impacting the apparel fashion industry in the Western hemisphere. One point that stood out to me was this feud between the technical textiles and apparel-related fabrics. As the US continues to advance in its production with technology, it makes sense that they would rather use their energy and resources towards a more expensive and innovative product. Although this may positively impact their economy, I think it is important the the US textile industry recognizes that the sole reason that they have been able to thrive is because of the fashion apparel industry. It is crucial that policymakers recognize this to ensure that the US textile industry remains focused on providing fibers to apparel-related fabrics. By creating incentives for the textile industry to work with western apparel industries, it ensures that the US textile industry will not leave western apparel industries looking for new sources of textiles. And this would play a detrimental role in the supply chains of many companies, mostly “Made in the USA” brands.

One part of the discussion that stood out to me about the U.S trends of their manufacturing is the weaknesses of the U.S supplying materials in the Western Hemisphere. The U.S has limited supplies in their fibers and yarns, and are more focused on the technical manufacturing which makes sense for them because the U.S technology is advancing. However, I do think that their policy makers should expand on their apparel manufacturing by near-sourcing with the Western Hemisphere. This can create better quality products and increase their supplies in fabrics to produce more apparel efficiently in the U.S. Although, how can the western hemisphere manufacturing compete with cheaper suppliers like China whose supplies are less scarce and more affordable?