About Ally Botwinick

Hi! My name is Ally Botwinick, and I am a University of Delaware alum who studied Fashion Merchandising and completed the 4+1 master’s program in Fashion and Apparel Studies. I am currently working as a Textile Assistant at The Kasper Group in NYC. The Kasper Group is a portfolio of global fashion brands such as Nine West, Anne Klein, Kasper, Le Suit, and Jones New York. I work on fabric sourcing and production for the Jones New York brand as well as denim fabrics for all brands within the Kasper Group.

Note: During her studies in the FASH 4+1 program, Ally participated in several research and experiential learning projects. She co-authored Explore PVH Corporation’s Evolving Apparel Sourcing Strategies, published in Just-style, a leading industry publication focusing on apparel trade and sourcing. Her master’s thesis, which examined US retailers’ merchandising strategies for clothing made from recycled textile materials, was published in the International Journal of Fashion Design, Technology, and Education. Ally was also a UD summer scholar and a key member of the FASH students team that helped Macy’s develop a vision of its sustainable apparel sourcing strategy (see featured UDaily story and Yahoo). Additionally, Ally was a policy intern for the American Apparel and Footwear Association (AAFA) in Washington, D.C. in the summer of 2022.

Disclaimer: The views expressed in this interview are those of Ally Botwinick and do not reflect the views or positions of her employer or any affiliated organizations.

Sheng: What are your main responsibilities as a textile assistant? What does a typical day look like? What aspects of the job do you find particularly interesting or unexpected before taking on the role?

Ally: My main responsibility as a Textile Assistant is to help buy and keep track of all fabric orders for Jones New York as well as denim for multiple brands within the Kasper Group. Jones New York has both a mainline division, which is sold at retailers such as Macy’s and Dillard’s, as well as an off-price division called Jones New York Signature which is sold at off-price retailers such as TJ Maxx, Marshall’s, Burlington, Ross, etc..

During a typical day, I communicate with textile mills/factories overseas about fabric approvals or rejections based on fabric color, quality, and hand feel. For each fabric order that we place, we have the mills submit fabric references to our New York office for review. Each morning, I process these submissions and work with my team to release comments to the mills. The color must match the color standard we send them at the beginning of production. The fabric quality must match the fabric standard that we approved upon booking the fabric.

We keep track of all these approvals and rejections in what is called a fabric WIP (work in progress) chart, where we keep track of each order for each season and division. This WIP chart includes key fabric information, price, production timelines, and fabric submit status, among other order details. Creating and updating these fabric WIPs is something I do continuously throughout the day as I receive updates from mills and factories.

I frequently work with cross-functional partners, like members of the design, production, costing, and color teams, and touch base about any changes to design boards, production schedules, costing, or color issues that may arise.

One of the most interesting aspects of the job is the number of teams that collaborate on a daily basis, especially when there are updates made to the fashion collection, such as changes to color names, production units, production schedules, fabric details, and costs.

Sheng: In general, what factors should be considered when selecting textile raw materials, such as fabrics, in product development and sourcing?

Ally:Some important factors to consider when selecting fabrics are hand feel (whether the fabric feels soft, dry, smooth, rough, etc…) and price. We want to ensure the fabric provides comfort to the consumer and that it will drape well according to the garment design. We work very closely with the design and costing teams when sourcing fabrics as we must ensure fabrics are functional, stylish, on-brand, and meet margin goals.

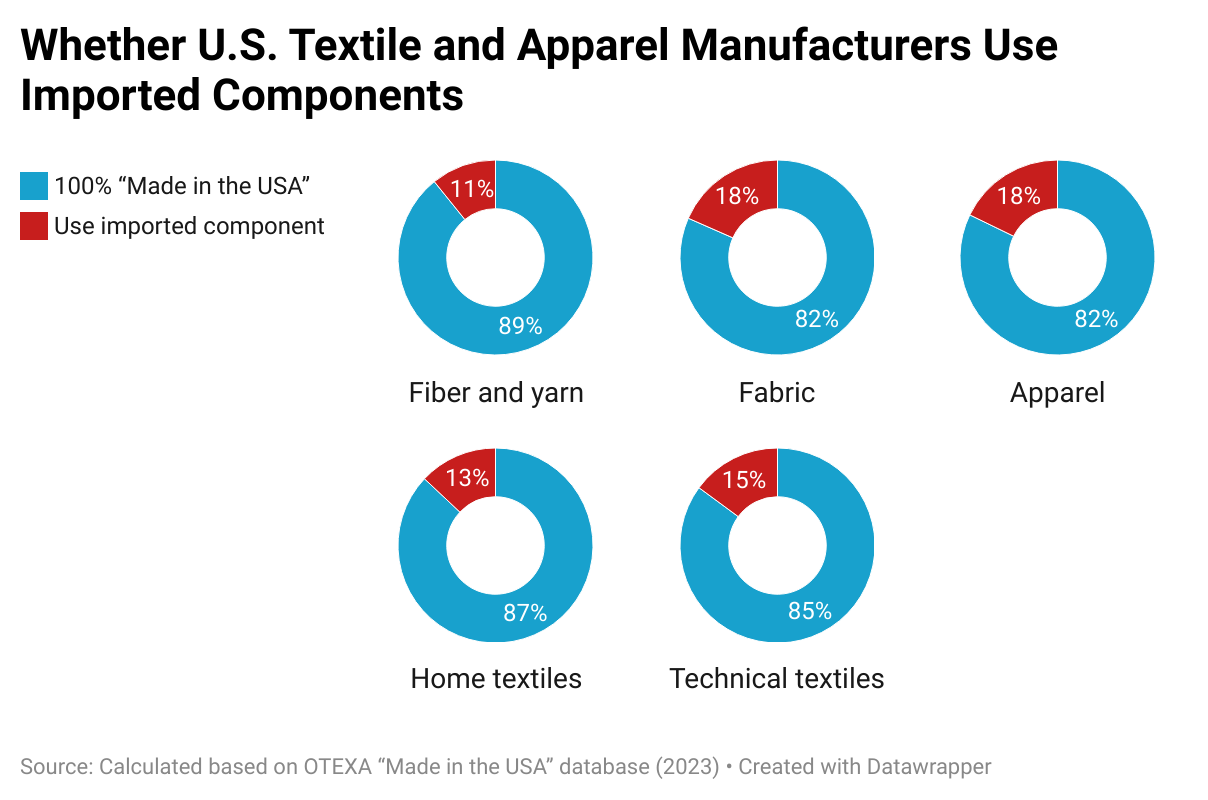

We highly consider the fiber content as well. Fiber costs can be influenced by a multitude of factors, even including the weather or occurrence of natural disasters which can affect supply and demand. We also closely monitor cotton traceability as there are forced labor concerns with cotton grown in parts of China. We require each mill supplying fabrics made with cotton to submit a cotton traceability certificate for us to track the cotton’s origins. This way, we can ensure no cotton is being produced in association with forced labor.

Sheng: What are the main processes involved in selecting and sourcing textile raw materials like fabrics?

Ally:At my company, the Fabric Research & Development team is more involved in finding new fabrics, whereas my team is more involved in fabric buying and production. The design and R&D team usually hand off the desired fabrics to us after sourcing, and we go ahead and buy the fabric. We buy fabric yardage according to the number of units (garments) in the collection, accounting for the different sizes and colorways.

However, we do occasionally get involved in the sourcing aspect as well. When we source fabrics, we consider the factors I mentioned such as cost, quality, and fiber content. We also think about how we may want to elevate and bring newness to the brand.

When adding certain washes or finishes to fabrics, the appearance can change, so this is something we consider as well. When purchasing a new novelty fabric such as a new jacquard, velour, or cross-dye, we expect the mill to tell us if there is a certain inherent characteristic we should know about prior to booking. For example, a mill might tell us the fabric is known to flare a bit, and this is hard to control, or it tends to shrink a little when washing. This way, we can decide whether the fabric is acceptable based on our needs. If we decide to purchase, we then collaborate with internal cross-functional partners about creating a level of tolerance accounting for these inherent characteristics.

Upon booking any fabric, we always require mills to fill out a fabric detail sheet with information such as cuttable width, weight, price, MOQ (minimum order quantity), lead time, etc… and we have them send us a fabric header which becomes our fabric standard. The design team will also request a sample garment to ensure the fabric is suitable for the garment. All these processes are essential for booking fabric.

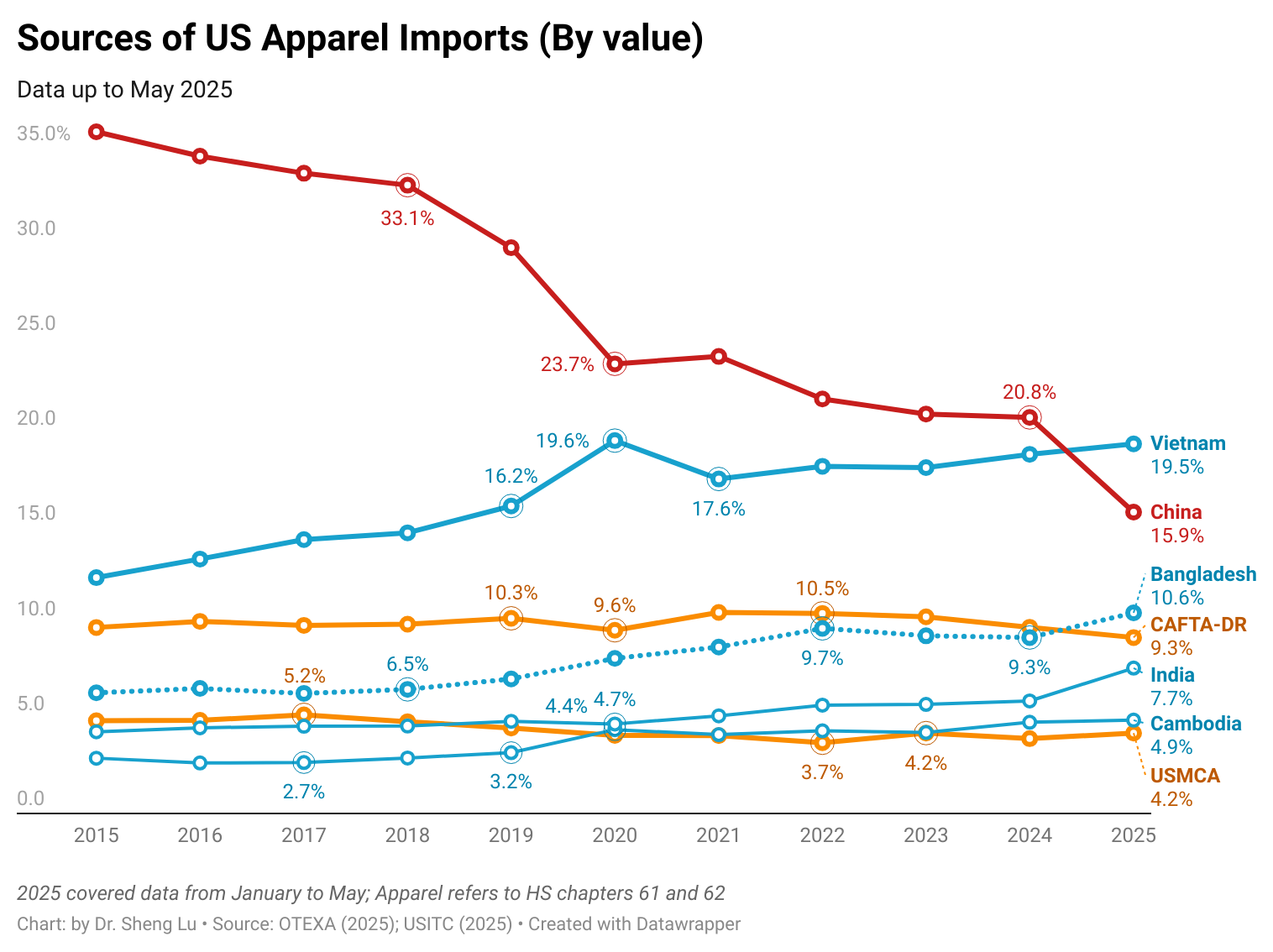

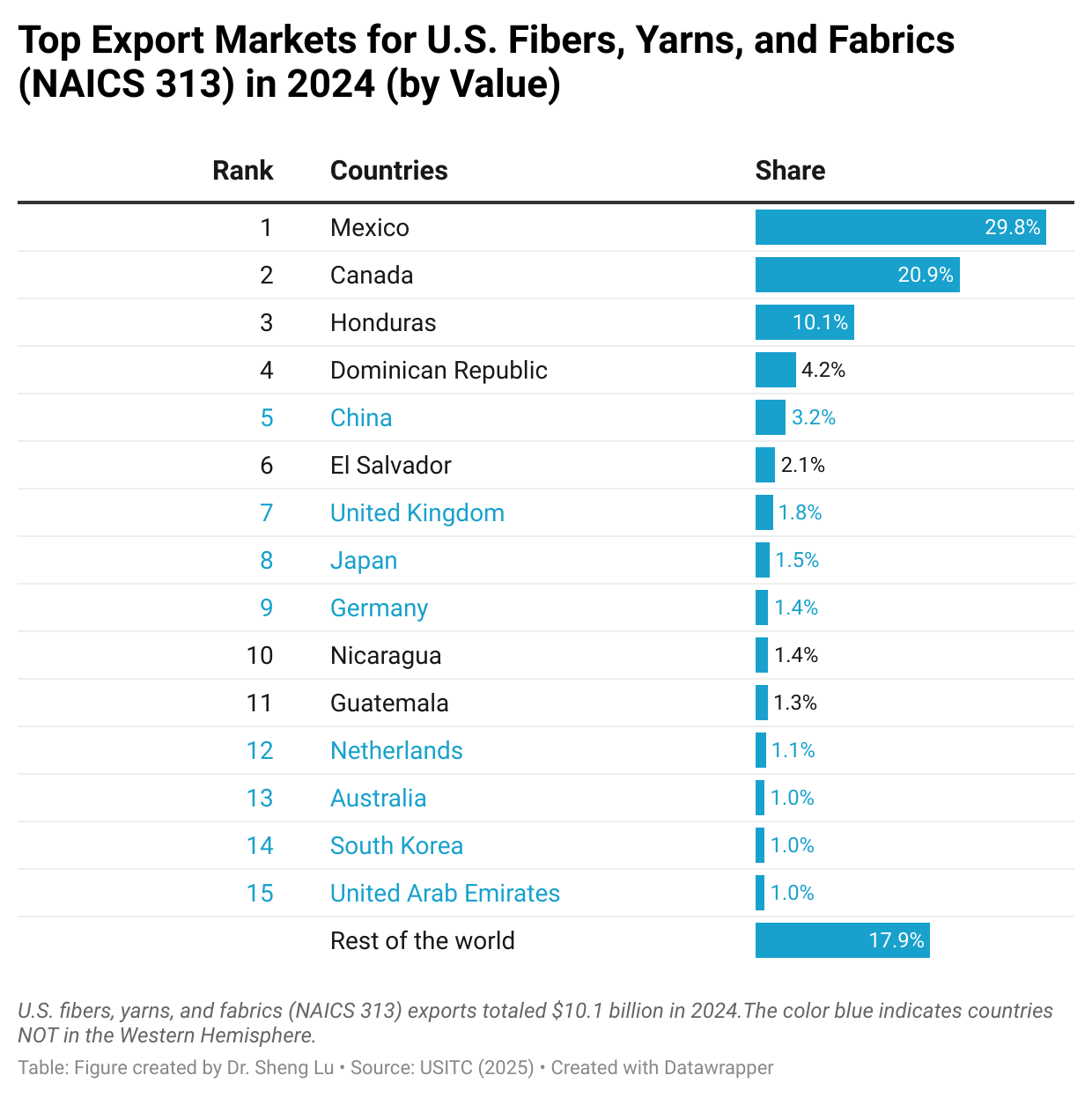

Sheng: Where do textile raw materials typically come from, or which countries or regions mostly supply textile raw materials for US fashion companies today?

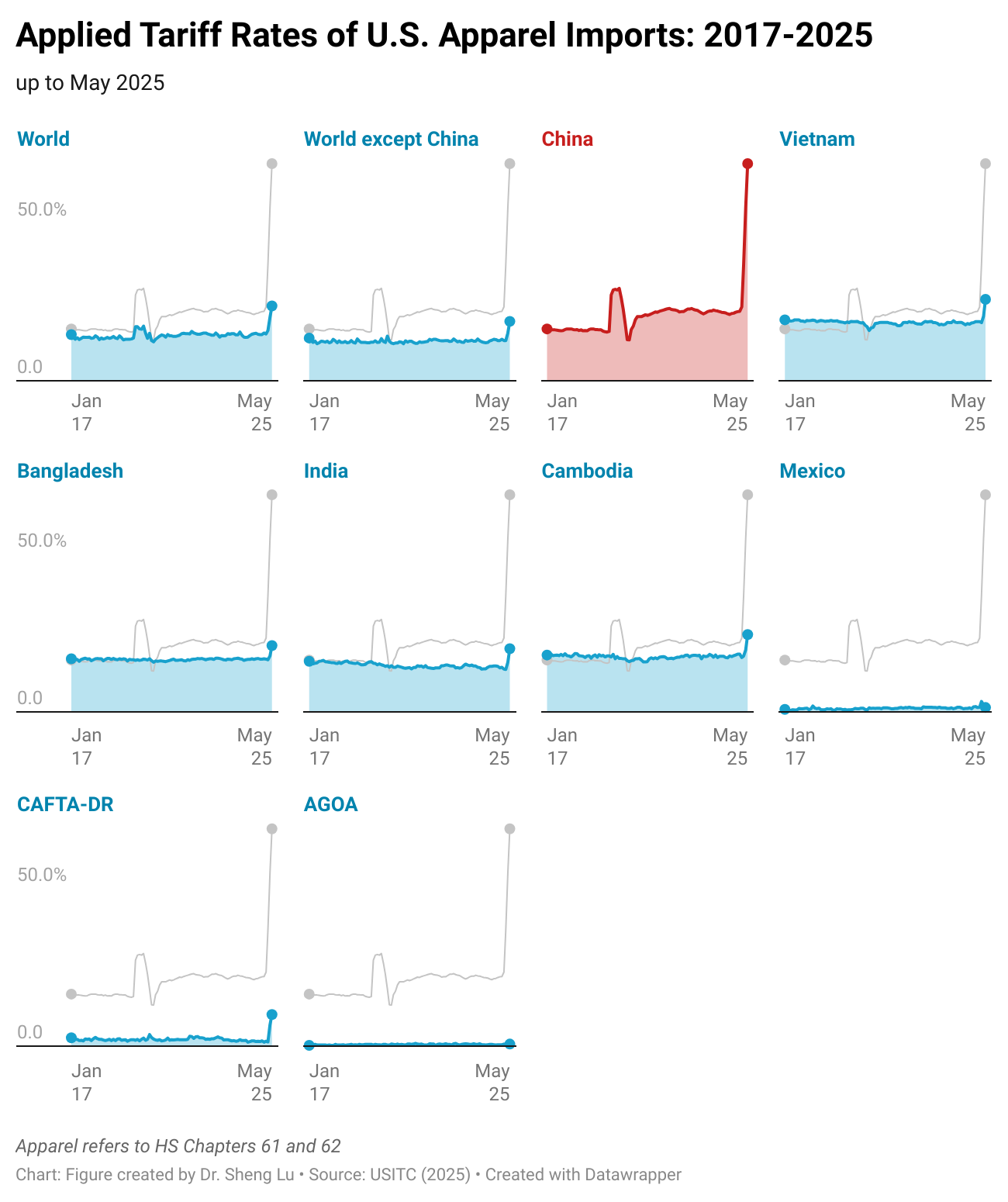

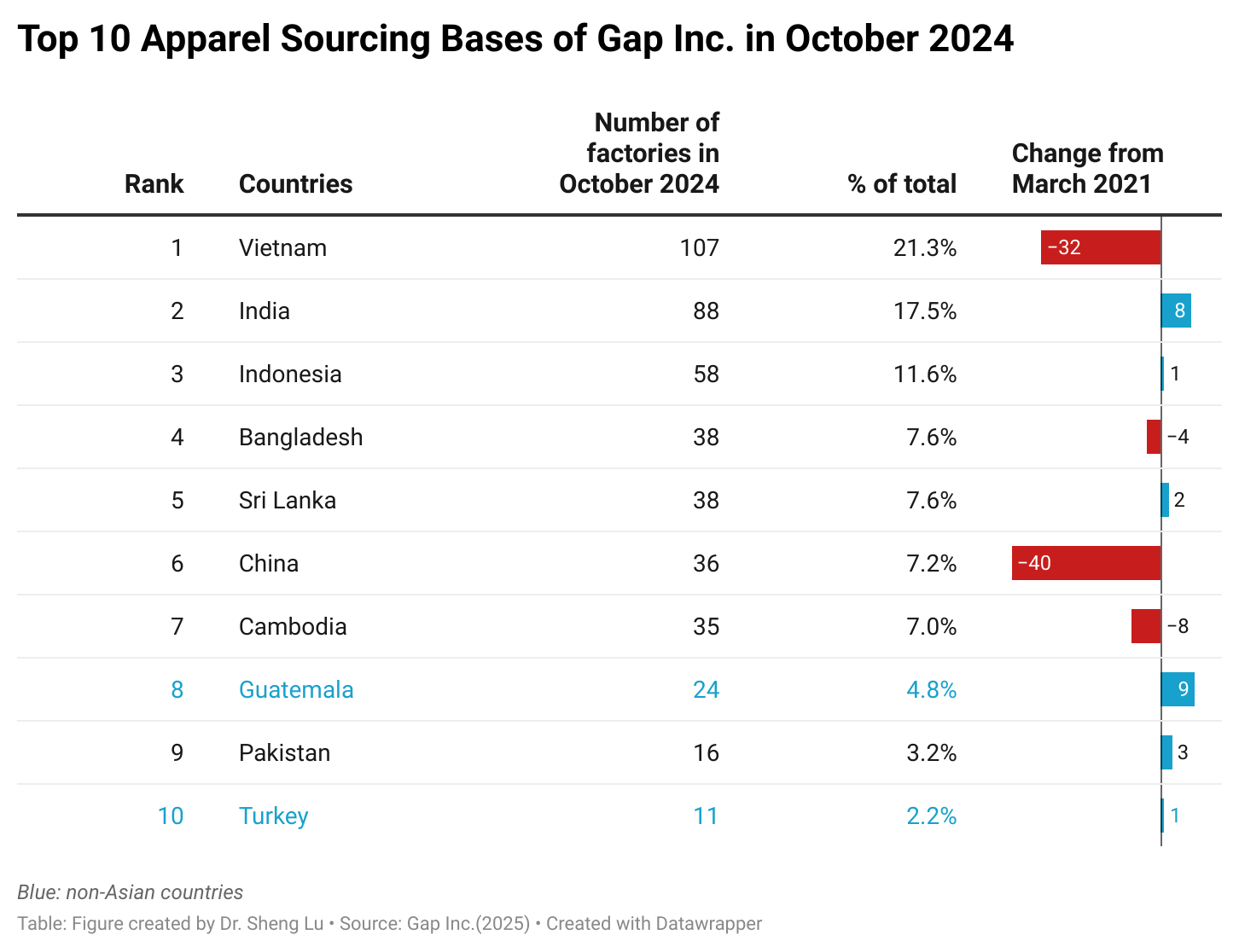

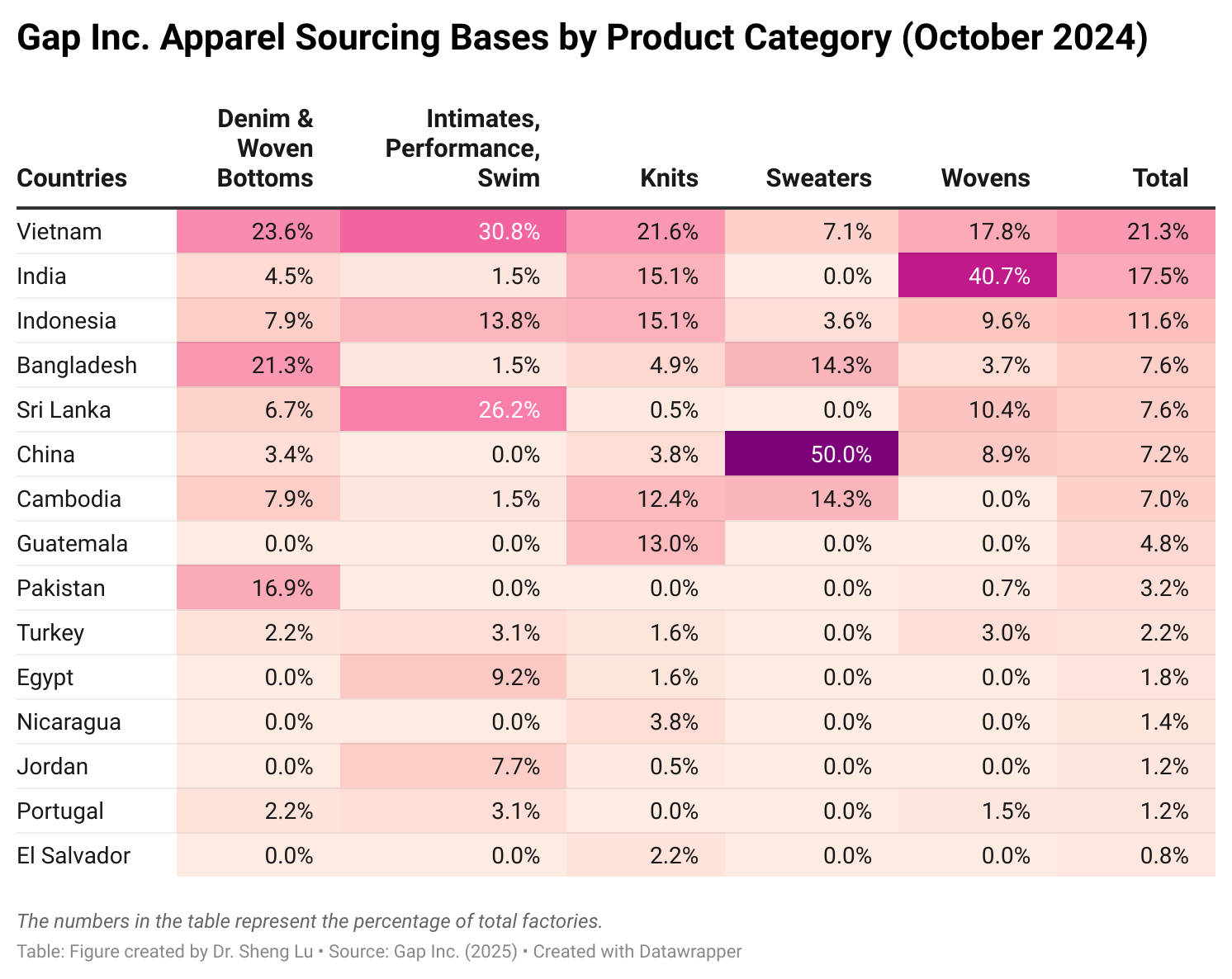

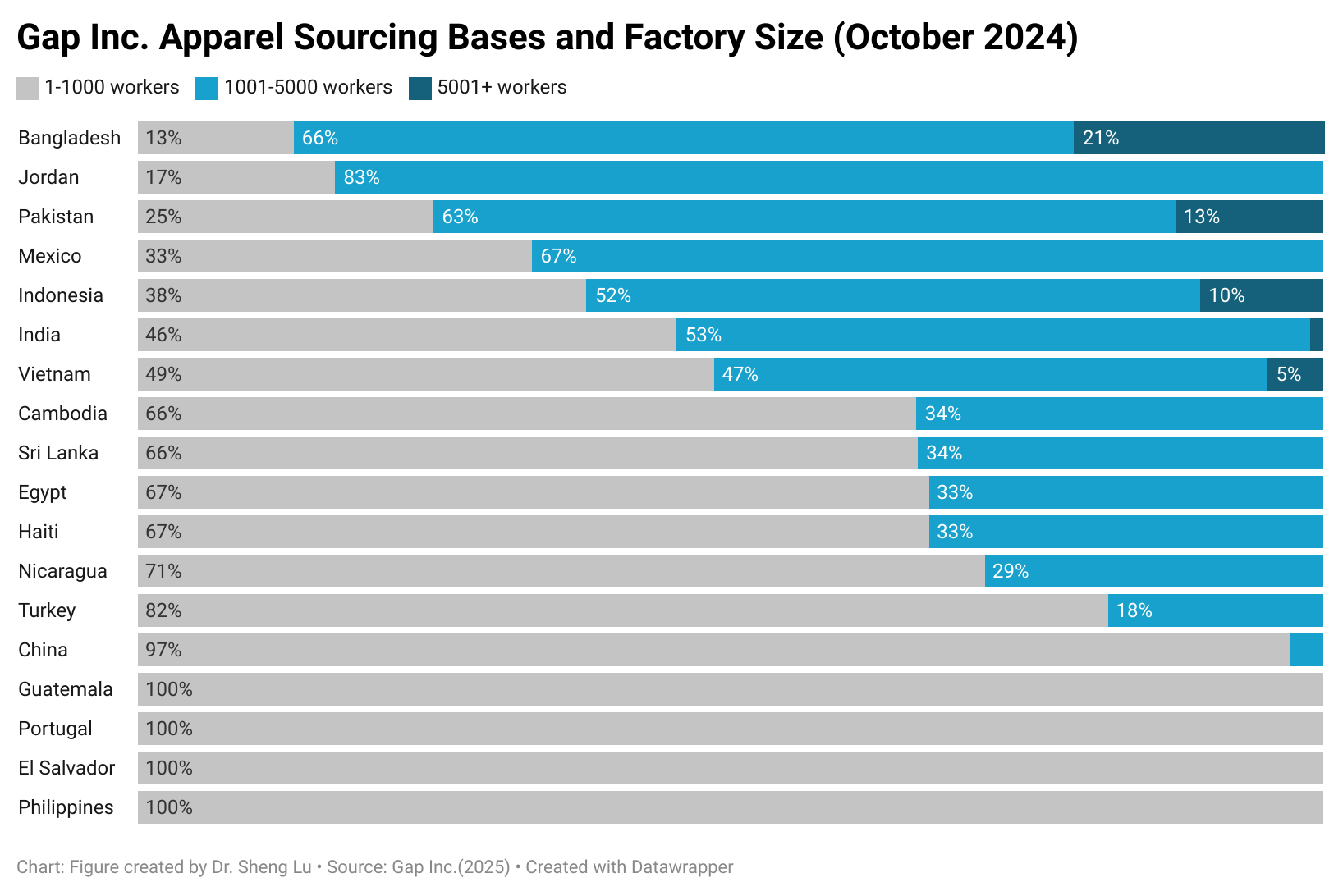

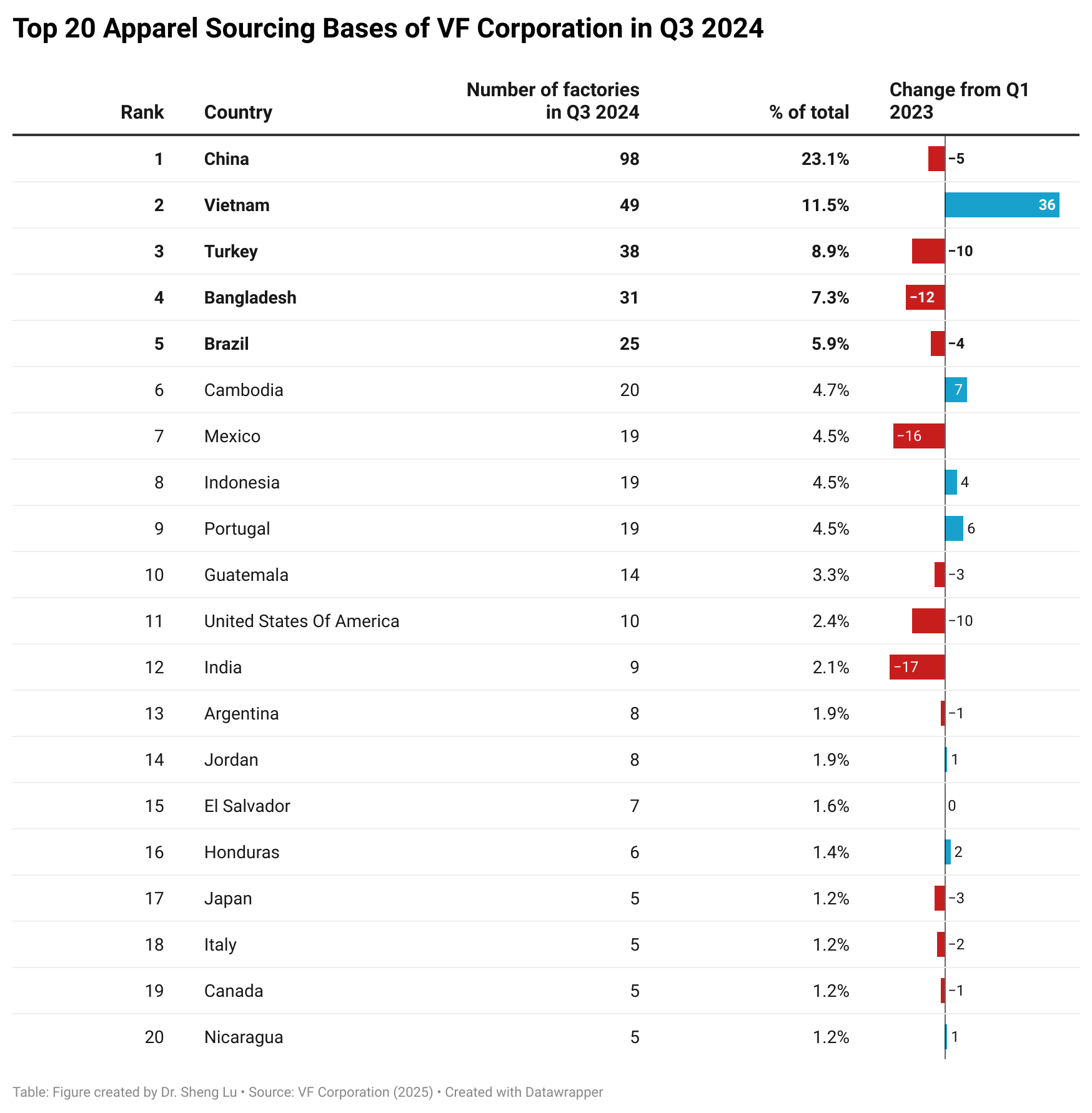

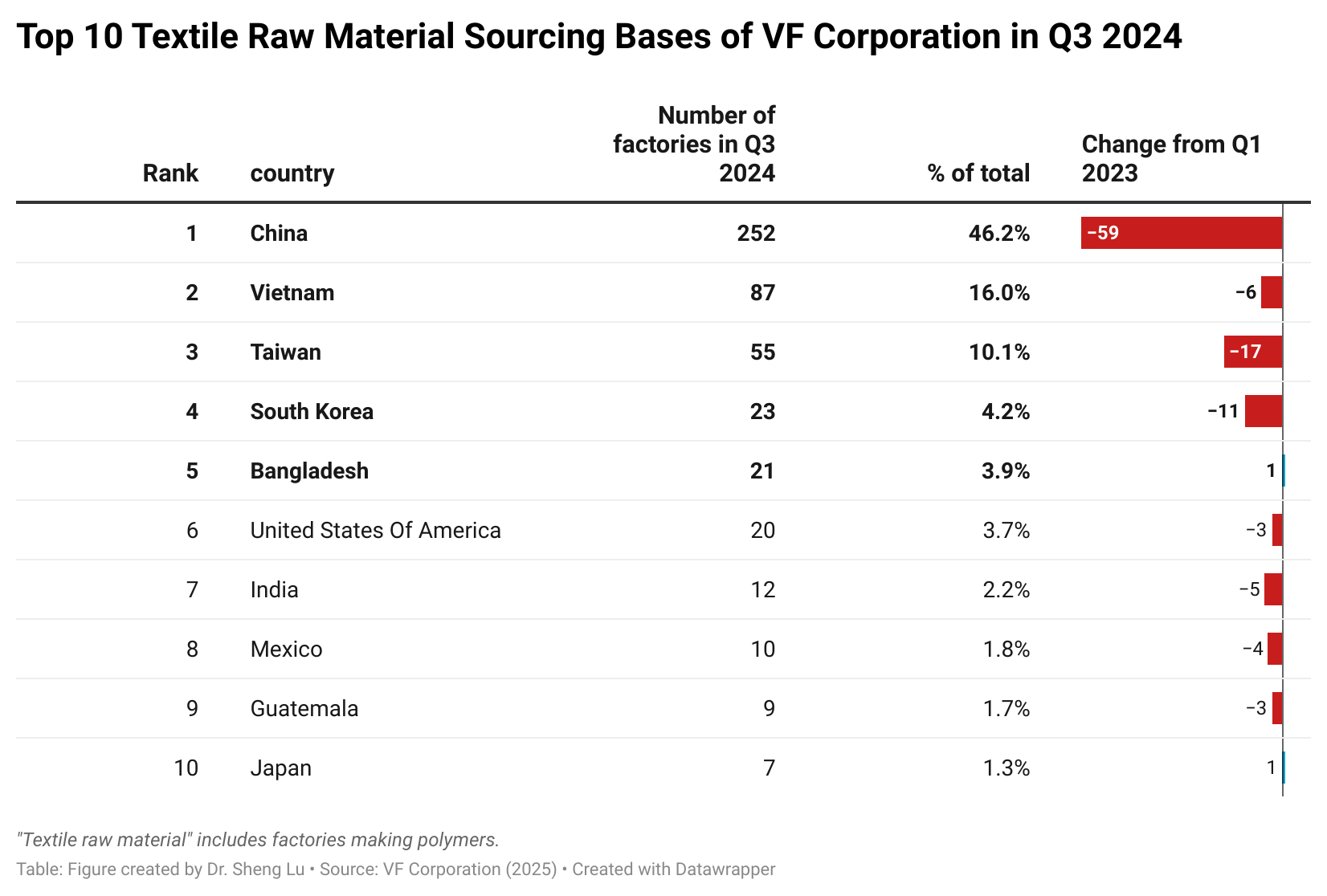

Ally:Some of the top countries supplying fabric for U.S. fashion companies include China, Vietnam, South Korea, and India. Also, from my observation, Asia plays a significant role as a leading textile raw material supplier for many leading U.S. apparel brands and retailers.

Sheng: From your observation, how has sustainability influenced the selection and sourcing of textile materials for fashion companies? What emerging trends are worth watching?

Ally:From my observation, sustainability is becoming more and more important to brands and consumers alike. Recycled polyester is on the rise as more consumers are paying attention to the materials in their clothing and trying to lessen their environmental impact. Recycled polyester seems easier to incorporate rather than, say, recycled cotton, which is harder to trace back to the source and has quality concerns. I see recycled materials on the rise in my company, and as someone who wrote my master’s thesis on this topic, it is very exciting and encouraging to see.

Sheng: Based on your experience, can you offer any advice to our students regarding preparing for a career in the fashion apparel industry? What could they do at UD?

Ally:Some advice I would give to students preparing for a career in the fashion industry is to think about what classes at UD most intrigued and inspired them. There are so many different career paths within the fashion industry, whether it be design, product development, sales, merchandise planning, costing, garment sourcing, fabric sourcing, merchandise buying, etc… Whatever you are most passionate about, go after it. Also, keep an open mind. You may find a great opportunity that you hadn’t previously considered, and you may end up loving it. There is so much to be learned in any given role, especially when starting out. Throughout my role, I have learned not only the ins and outs of the fabric production cycle, but also the entire garment life cycle. I can see how all the teams within my organization work together to achieve a common goal.

UD has so many amazing resources to utilize for planning your future career. First, take advantage of the career center by meeting with a career counselor and updating your resume and LinkedIn. Next, consider doing a research project with a professor on a topic you are passionate about. There are so many professors in the fashion department who would be happy to chat about research opportunities, and having this experience can really help you stand out during the job search and interview process. Internships and retail experience are also great ways to gain work experience while in school. Lastly, lean on your network. If an alum you know has a career that sounds interesting to you, reach out to them and ask them for a quick phone call to learn more about it. It is great to build your network and learn more about different potential career paths. Overall, my greatest advice is to truly enjoy your college years- they go by so fast. Make the most of your time at UD, pursue your passions, and remember that exciting opportunities lie ahead!

–The End–