In January 2017, Just-Style consulted a panel of industry leaders and scholars in its Outlook 2017–Apparel Industry Issues in the Year Ahead management briefing. Below is my contribution to the report. Welcome for any suggestions and comments.

1: What do you see as the biggest challenges – and opportunities – facing the apparel industry in 2017, and why?

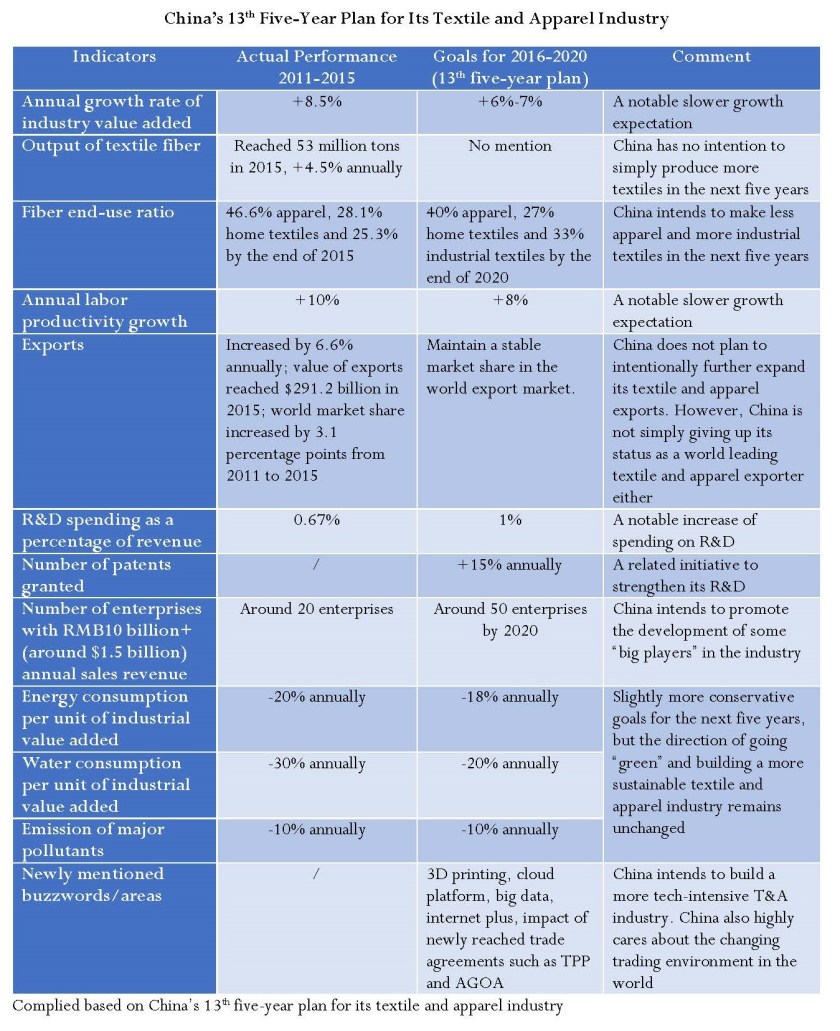

I see the uncertainty in the global economy will pose one of the biggest challenges facing the apparel industry in 2017. Apparel business is buyer-driven. A great number of studies have suggested that economic growth is by far the most effective and reliable predictive factor for apparel consumption. Unfortunately, it seems apparel companies have to deal with another year of economic volatility and weak demand in 2017. For example, according to the latest International Monetary Fund (IMF) forecast released in October 2016, global economic growth in 2017 is projected to only recover to 3.4 percent from 3.1 percent in 2016. There is no particular excitement among major apparel consumption markets either: outlook of the U.S. economy in 2017 is complicated by the strong U.S dollar, the Federal Reserve’s monetary policy as well as the uncertain trade and tax policy to be adopted by the new Trump administration; Economic growth in the EU region next year will continue to be hindered by the unknown fallout from UK’s referendum on leaving the EU, pervasive geopolitical uncertainties, high unemployment rates and the rising protectionist tendencies; Japan’s economic growth is projected to be as low as 1.0 percent in 2017 according to the Organization for Economic Co-operation and Development (OECD); And China’s economic growth in 2017 could slow again to 6.5 percent, which would be the slowest pace in more than 25 years. Reflecting the trend, we might see a stagnant growth or even a decline of global textile and apparel trade in 2017 as well.

Nevertheless, companies’ continuous investments on technology and innovation will create exciting new opportunities for the apparel industry. Particularly, growing areas in the apparel industry such as 3D printing, wearable technology, digital prototyping and e-commerce have made many “non-traditional” players now interested in fashion, including technology giants like Google and Apple. I think we can expect the apparel industry to become even more modern and high-tech driven in the years to come. The changing nature of the apparel industry will also increase demand for talents from an ever more diversified educational background, such as engineering, physical therapy and business analytics.

2: What’s happening with sourcing? How is the sourcing landscape likely to shift in 2017, and what strategies can help apparel firms and their suppliers to stay ahead?

One observation from me is that textile and apparel (T&A) supply chain is becoming more regional-based. For example, data from the World Trade Organization (WTO) shows that 91.4 percent of textiles imported by Asian countries in 2015 came from other Asian countries, up from 86.6 percent in 2008. This suggests that Asian countries togetherare building a more integrated T&A supply chain. Likewise, in 2015 close to 90 percent of apparel exported by North, South and Central American countries went to the United States and Canada and 81 percent of apparel exported by EU countries went to other EU countries too. To be noted, all of these three major T&A supply chains are facilitated by respective free trade agreements in the region such as the North American Free Trade Agreement (NAFTA), ASEAN–China Free Trade Area (ACFTA) and of course the common market enjoyed by the EU members. On the other hand, fashion brands and apparel retailers often use the Western-Hemisphere supply chain and EU-based supply chain as a supplement to the Asia-based supply chain for more fashion-oriented or time-sensitive items. I think such a dual-track sourcing strategy will continue in 2017.

Related, I think supply chain management will play a growing important role helping apparel companies control sourcing cost, improve speed to market and better meet consumers’ demand in 2017. An interesting phenomenon revealed by the 2016 U.S. Fashion Industry Benchmarking Study released by the U.S. Fashion Industry Association is that around 30 percent of respondents say they plan to consolidate rather than diversify their sourcing base in the next 2 years. As one respondent commented, “(Our) focus right now is really finding efficiencies and maximizing productivity in the supply chain. While we won’t necessarily move out of any countries, we are consolidating the base within regions.”

Last but not least, I think in 2017 apparel companies will continue to give more weight to sustainability and social responsibility in their sourcing decisions. Building a more transparent and sustainable supply chain is an irreversible trend in the apparel industry.

3: What should apparel firms be doing now if they want to remain competitive into the future? What will separate the winners from the losers?

To remain competitive into the future, apparel companies need to be prepared to change and be willing to try something new. Indeed, revolution is coming for the apparel industry, including the way products are made and sourced (example: 3D printing and various digital manufacturing tools), how consumers shop (example: the see-now-buy-now trend) and where and how to sell (example: the booming e-commerce and omni-channel retailing). In the past, small and medium sized companies (SME) were regarded more vulnerable than big players in the apparel industry for business survival. However, nowadays, without embracing the spirit of innovation and entrepreneurship, even large companies can quickly become “dinosaurs” and find their business struggling.

4: What keeps you awake at night? Is there anything else you think the apparel industry should be keeping a close eye on in the year ahead? Do you expect 2017 to be better than 2016, and why?

One thing that keeps me awake at night as a professor is what needs to be changed or updated in our curriculum to better prepare our students for the needs of the apparel industry. Fashion programs like us directly prepare future professionals for the fashion apparel industry. This also means we are not immune to the big shift in the industry either. For example, our course offerings currently include textile science, product development, merchandising, branding and sourcing and trade. But in addition to these conventional topics, what else should be added to the curriculum? What new skill setsor knowledge points will be highly expected by the apparel industry for our students in the future? Personally I think talent training is a critical area that the apparel industry and our fashion educational programs can and should form closer partnership. And the outcomes will be mutual beneficial too.

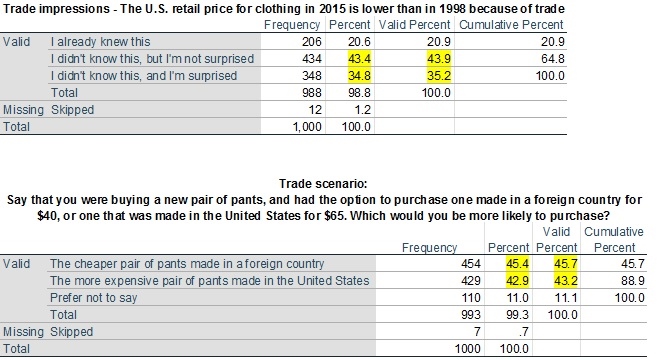

Trade policy is another area that keeps me awake at night. Trade policy matters for the apparel industry because it affects the quantity, price and availability of products in the market. Specifically, in 2017 I will be watching closely about the following trade agendas: 1) the WTO Trade Facilitation Agreement (TFA), which is nearing entering into force. TFA aims to make customs and border procedures easier, speed up the passage of goods between countries and lower cost of trade.

2) negotiation of the Regional Comprehensive Economic Partnership (RCEP). In 2015, the sixteen RCEP members altogether exported $369 billion worth of textile and apparel (50% of world share) and imported $124 billion (34% of world share). Since the Trans-Pacific Partnership (TPP) won’t be implemented anytime soon, RCEP has the potential to influence and reshape the T&A supply chain in the Asia-Pacific region.

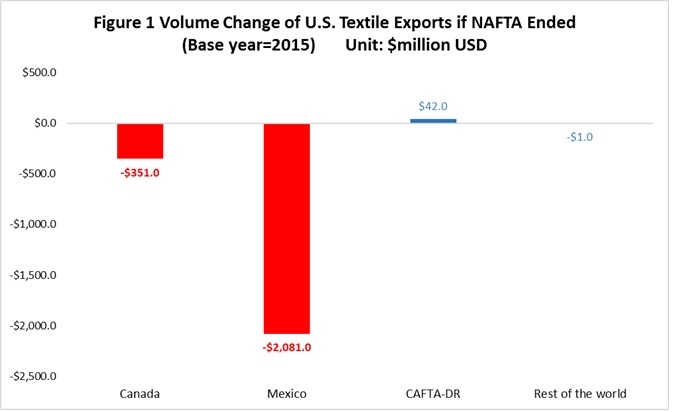

3) a possible revision of the North American Free Trade Agreement (NAFTA). NAFTA is a critical factor facilitating and maintaining the Western-Hemisphere textile and apparel supply chain. A recent study of mine shows that ending the NAFTA would significantly hurt apparel manufacturing in Mexico and textile manufacturing in the United States, largely because apparel “Made in Mexico” today often contains yarns and fabrics “Made in USA”.

4) Trans-Pacific Partnership (TPP) and Trans-Atlantic Trade and Investment Partnership (T-TIP). Although many people think these two agreements are dead, I disagree. TPP and T-TIP are NOT conventional free trade agreements (FTAs) that deal with tariffs and non-tariff barriers only. Just like why we need traffic rules, TPP and T-TIP address our needs to update international trade regulations on 21st century trade agendas such as digital trade, state-owned enterprises, labor and environmental standards, small and medium sized enterprises and trade related investment. On the other hand, both TPP and T-TIP still have a solid and broad supporting base, which includes the fashion apparel industry. If trade politics is why TPP and T-TIP are in trouble, for the same reason, we should expect a reversal of the fate of these two agreements when time arrives. Plus, we should never underestimate the creativity and wisdom of trade policymakers.

Sheng Lu