The full article is published in Just-Style and below is the summary:

Market Size

Reflecting fashion companies’ interest in carrying more sustainable apparel products to meet consumers’ demand, there has been a notable increase in clothing using recycled cotton in the U.S. retail market since 2022. For example, based on information collected from US apparel retailers’ websites, only about 100 Stock Keeping Units (SKUs) of “Made in the USA” clothing explicitly indicated that they contained recycled cotton in 2022 and 2023, respectively. However, in the first nine months of 2024, this number had already doubled to around 200.

Despite the impressive growth, clothing containing recycled cotton remains a “niche” in the U.S. retail market. As of 2024, the total SKUs of “Made in the USA” clothing containing recycled cotton accounted for only about 0.1% of those made with regular virgin cotton.

Meanwhile, measured by SKU count, 70% of “Made in the USA” clothing containing recycled cotton was sold in the mass and value segments in the U.S. retail market from 2022 to 2024. In comparison, over the same period, “Made in the USA” clothing made with regular cotton catered to a more diverse consumer base, with a relatively balanced distribution across the mass and value segment (57%) and the luxury and premium segment (43%).

Product Features

There appears to be a notable distinction between the product categories of “Made in the USA” clothing using recycled cotton and those made with regular cotton. Specifically, from 2022 to 2024, by SKU count, “Made in the USA” clothing containing recycled cotton mainly focused on basics such as T-shirts (35.6%), jeans (20.1%), other bottoms (20.7%) and other tops (18.4%). Particularly, jeans appear more likely to contain recycled cotton than any other apparel category.

Using recycled cotton also appears to affect clothing’s design patterns. For example, from 2022 to 2024, nearly 85% of “Made in the USA” clothing containing recycled cotton chose plain design patterns compared to only 65% of those exclusively using regular cotton. These results echo findings from previous studies, suggesting that the shorter fiber length and lower quality of recycled cotton may limit the use of more intricate and complex design details.

Fiber Content

Reflecting the significant limitations of the quality and properties of the fiber, clothing labeled as using “100% recycled cotton” was rarely available in the U.S. retail market from 2022 to 2024, regardless of where the item was made. In most cases, recycled cotton accounted for no more than 30% of the total fiber content in a garment, with typical labels read like “49% cotton, 21% recycled cotton, 17% recycled polyester” (jeans), “Made from 70% cotton and 30% recycled cotton” (T-shirt), and “Made from 70% cotton, 29% recycled cotton, and 1% elastane” (skirt).

Results show that over 95% of “Made in the USA” clothing containing recycled cotton was blended with regular virgin cotton, and 92% of imported clothing did the same. According to textile scientists, this blend helps overcome the physical limitations of recycled cotton and enhances the fabric’s durability and softness. Approximately 14% of “Made in the USA clothing” containing recycled cotton was blended with polyester. This blend was commonly used for jeans and T-shirts to improve durability and flexibility and may also reduce production costs. However, compared with “Made in the USA” clothing made from regular cotton, it was uncommon to see recycled cotton blended with specific fiber types such as nylon, spandex, rayon, and linen. This result again revealed the physical limitations of recycled cotton and explained the narrow range of apparel products currently suited for its use.

Sustainability Claims

In practice, the sustainability claims of “Made in the USA” clothing containing recycled cotton in the U.S. retail market appear to be a “mixed bag.” On the one hand, as anticipated, “Made in the USA” clothing containing recycled cotton seems to be more likely to highlight its sustainability attributes than those using regular cotton only. From 2022 to 2024, by SKU count, more than 23.1% of “Made in the USA” items containing recycled cotton mentioned the word “sustainable” in the product description or label, and another 16.2% mentioned “eco-friendly.” In comparison, less than 2% of “Made in the USA” clothing made from regular cotton included these two terms. Similarly, a higher percentage of “Made in the USA” clothing using recycled cotton also featured other sustainability-related terms such as “impacts,” “waste,” and “certified,” compared to those made from regular cotton.

On the other hand, however, the sustainability claims of “Made in the USA” clothing containing recycled cotton are not without concerns. For example, in many cases, the product descriptions or labels provide no detailed and verifiable information about the actual “sustainability benefits” of producing and consuming clothing made from recycled cotton aside from vaguely saying the product was “sustainable,” “eco-friendly,” or “certified.”

To complicate the issue further, as clothing made from regular cotton increasingly emphasizes its sustainability benefits as a natural fiber, it somehow diminishes the exclusivity of recycled cotton as a sustainable option. For example, there is no clear evidence indicating that consumers generally perceive clothing using “recycled cotton” as more or less sustainable than those using “organic cotton” or cotton certified by reputable programs such as the “Better Cotton Initiative, BCI” and the “U.S. Cotton Trust Protocol.” In other words, “recycled cotton” faces intense competition as the preferred sustainable fiber among many choices available to fashion companies, including regular cotton.

Pricing Practices

Results show that “Made in the USA” clothing containing recycled cotton is not always “cheap” for U.S. consumers. For instance, for those targeting the mass market segment, between 2022 and 2024, adding recycled cotton increased the selling price of “Made in the USA” clothing by more than 10% compared to items made with virgin cotton, with jeans being the only exception (i.e., 12% lower).

Price data also show that “Made in the USA” recycled cotton items generally have higher price tags than comparable non-U.S.-made items across both mass and premium markets, particularly in popular categories like T-shirts and bottoms. This trend suggests that higher U.S. domestic production costs, particularly the higher wage level than Asian countries, could contribute to these elevated prices.

Reflections

As the findings highlighted, while visibility is increasing, promoting recycled cotton in clothing still encounters significant challenges. For instance, technical advancements in the quality of recycled cotton fiber are critical to enhancing its competitiveness among other “preferred sustainable fibers,” raising its perceived market value and enabling its use across a broader range of clothing categories beyond T-shirts and jeans.

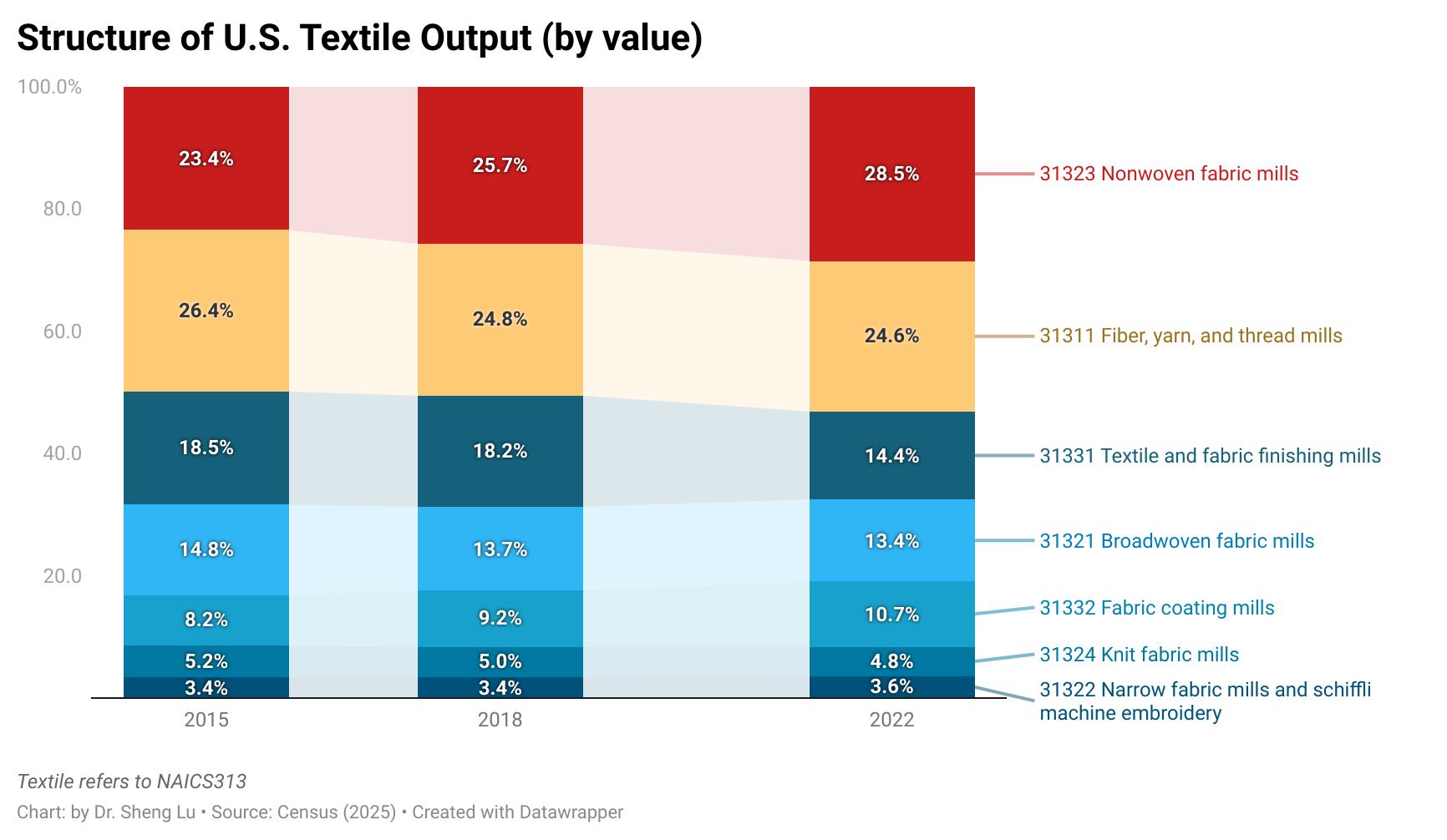

Notably, due to slow progress in improving the physical properties of recycled cotton, some have seemingly “given up” on using it for clothing and suggest focusing more on repurposing recycled cotton for other categories, such as non-wovens, carpets, packaging, and home textiles. However, as sustainability legislation, such as the Extended Producer Responsibility (EPR) law, increasingly mandates fashion companies to recycle textile waste, not promoting recycled cotton could lead to greater reliance on recycled polyester or other man-made fibers in clothing, which may not serve the long-term business interests of the cotton industry.

by Katherine Yasik (Fashion Design and Product Innovation major & Sustainable apparel minor, Fashion and Apparel Studies, University of Delaware) and Sheng Lu