In its newly released Economic Impact of Trade Agreement Implemented under Trade Authorities Procedures, 2016 Report, the U.S. International Trade Commission (USITC) provides a quantitative assessment on the impact of trade on manufacturing jobs in the U.S. textile and apparel industry. According to the report:

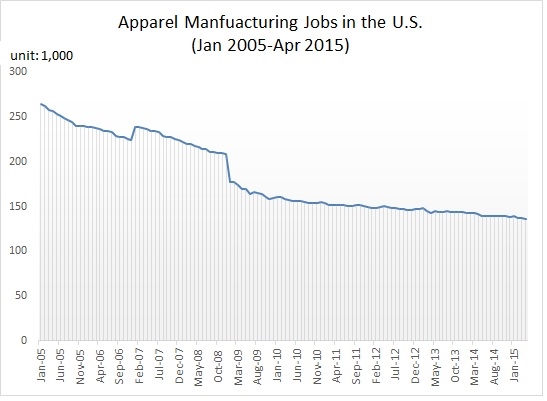

- Manufacturing jobs in the U.S. textile and apparel industry have been declining steadily over the past two decades. Between 1998 and 2014, employment in the NAICS 313 (textile mills), NAICS314 (textile product mills) and NAICS 315 (apparel manufacturing) sectors on average decreased annually by 7.6 percent, 4.3 percent and 11.2 percent, respectively.

- Rising import is found NOT a major factor leading to the decline in employment in the U.S. textile industry (NAICS 313)–as estimated, imports only contributed 0.4 percent of the total 7.6 percent annual employment decline in the U.S. textile industry. Instead, more job losses in the sector are found caused by improved productivity as a result of capitalization & automation (around 4.6 percent annually) and the shrinkage of domestic demand for U.S. made textiles (around 3.5 percent annually) between 1998 and 2014.

- Rising imports is the top factor contributing to job losses in apparel manufacturing (NAICS 315), however. As estimated by USITC, of the total 11.2 percent annual employment decline in apparel manufacturing, almost all of them is affected by imports (10.8 percent). On the other hand, increased domestic demand for apparel (such as from U.S. consumers) is found positively adding manufacturing jobs by 2 percent annually in the United States from 1998 to 2014.

- To be noted, USITC did not estimate the impact of trade on employment changes in the retail aspect of the industry. According to the U.S. Bureau of Labor Statistics, approximately 80 percent of jobs in the U.S. textile and apparel industry came from retailers in 2015. These retail-related jobs are typically “non-manufacturing” in nature, such as: fashion designers, merchandisers, buyers, sourcing specialists, supply chain management specialists and marketing analysts.