As US fashion companies diversify their sourcing from Asia, near-sourcing from the Western Hemisphere, particularly members of the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) seems to benefit. According to the latest trade data from the Office of Textiles and Apparel (OTEXA), US apparel companies placed relatively more sourcing orders with suppliers in the Western Hemisphere in 2021. For example, CAFTA-DR members’ market shares increased by 0.31 percentage points in quantity and nearly one percentage point in value compared with a year ago.

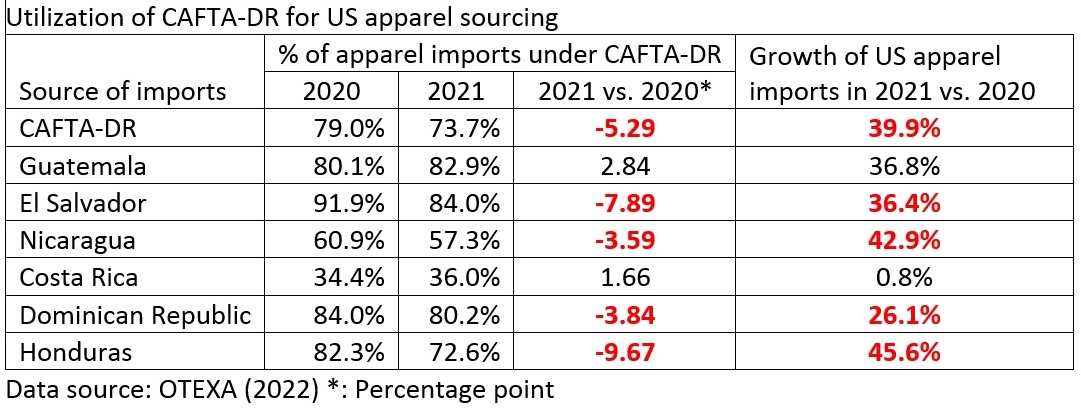

However, it is concerning to see the utilization rate of CAFTA-DR for apparel sourcing fall to a new record low of only 73.7% in 2021. This means that as much as 26.3% of US apparel imports from CAFTA-DR members did NOT claim the duty-free benefits.

The lower free trade agreement (FTA) utilization rate became a problem, particularly among CAFTA-DR members with fast export growth to the US market in 2021. For example, whereas US apparel imports from Honduras enjoyed an impressive 45.6% growth in 2021, only 72.6% of these imports claimed the CAFTA-DR duty benefits, down from 82.3% a year ago. We can observe a similar pattern in El Salvador, Nicaragua, and the Dominican Republic.

The phenomenon is far from surprising, however. For years, US fashion companies have expressed concerns about the limited textile supply within CAFTA-DR, especially fabrics and textile accessories. The lack of textile supply plus the restrictive “yarn-forward” rules of origin in the agreement often creates a dilemma for US fashion companies: either source from Asia entirely or source from CAFTA-DR but forgo the duty-saving benefits.

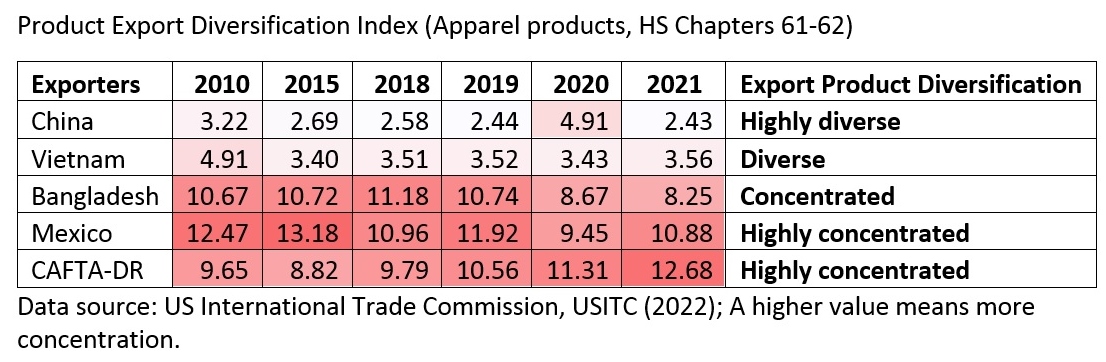

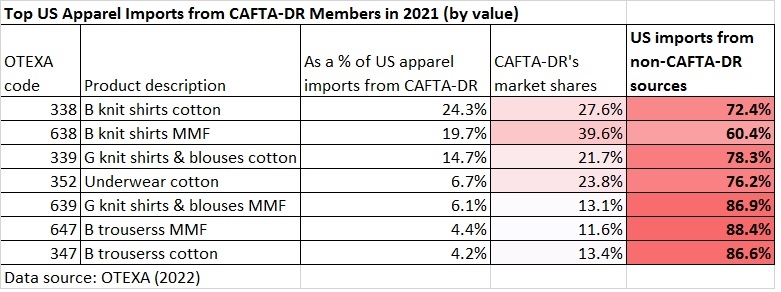

Likewise, because of a lack of sufficient textile supply within the region, US apparel imports from CAFTA-DR members become increasingly concentrated on basic fashion items, typically facing intense competition with many alternative sourcing destinations. For example, measured in value, over 80% of US apparel imports from CAFTA-DR members in 2021 were shirts, trousers, and underwear. However, US companies import the vast majority (70%-88%) from non-CAFTA-DR sources for these product categories.

Understandably, it will be unlikely to substantially expand US apparel sourcing from CAFTA-DR members without solving the textile supply shortage problem facing the region.

More reading: