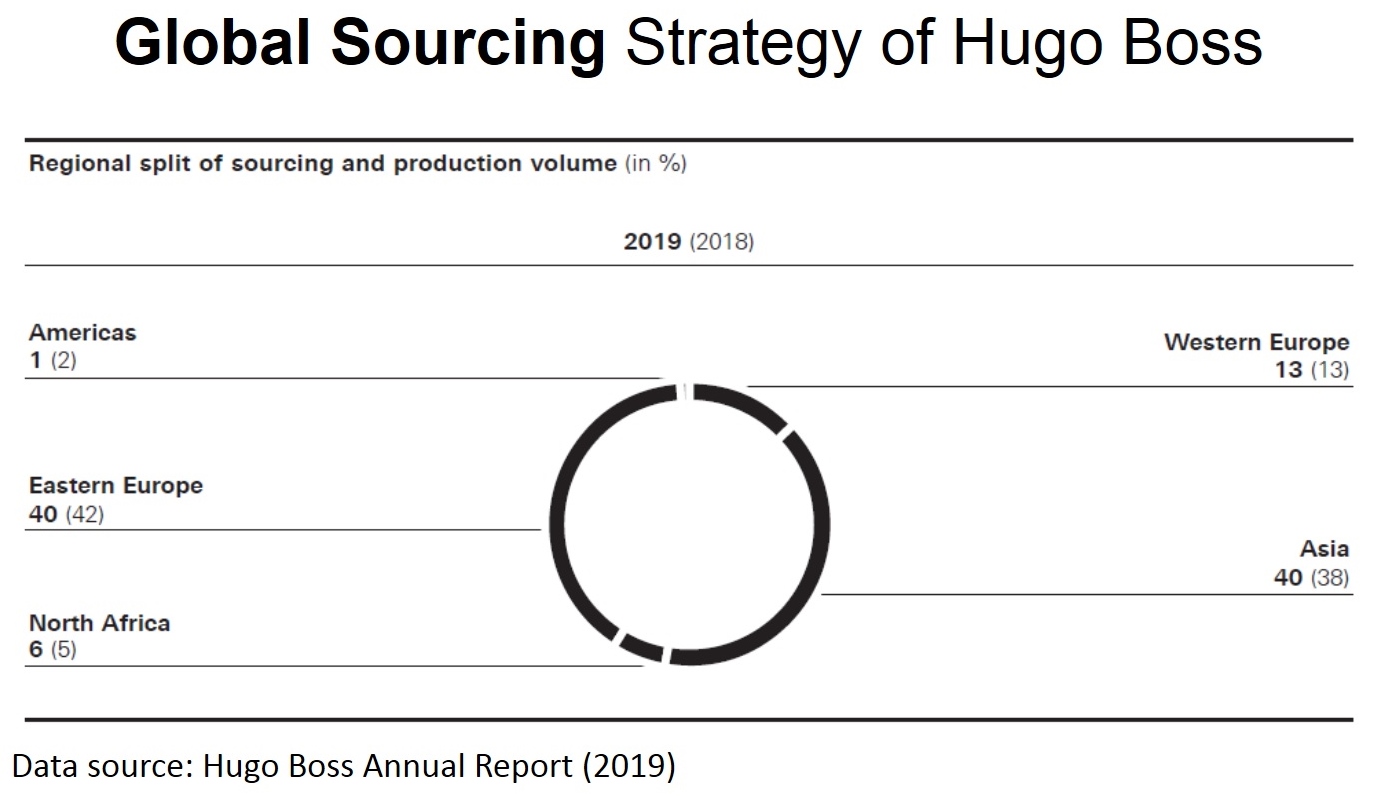

“Hugo Boss’s sourcing strategies are relatively different from fashion brands and retailers in the US. Hugo Boss’s self-owned production facilities are all located in Europe, and they follow the general trend of Eastern Europe being responsible for mass production items and Western Europe being responsible for more of the fine craftsmanship/made-to-measure items. Hugo Boss’s production distribution, which is 53% in Europe, 40% occurs in Asia, 6% in Africa, and 1% in the Americas, is much more diverse than the production distribution of the United States’ T&A industry, which heavily relies on Asian suppliers. It is indicative of a strong regional supply chain in Europe, and because the regional supply chain in the Americas is not as strong due to complicated trade agreements and lack of production capacity, many fashion brands and retailers heavily depend on overseas production from Asian countries. “

“I think that EU’s sourcing strategies are different from the U.S.’s sourcing strategy in the sense that it is kept within Europe. In the U.S., they are currently trying to bring the sourcing supply chain back to the Western Hemisphere, but it is very difficult for fashion brands to concede when sourcing is cheaper in Asia, and there is not enough labor who are trained for the work that they need. Over at the EU, with everything kept within the organization, it is a lot easier to find factories within different countries without reducing GDP since it is kept within the organization.”

“I think that one of the biggest differences between EU and US fashion brand’s sourcing strategies is the fact that there is a much higher luxury or high-end apparel market in the EU. Since they produce mostly luxury apparel products, they naturally place a lot more emphasis on the quality of their products being made rather than the quantity and speed of production. Since the US is more fast-fashion heavy, we do a lot more outsourcing of production so retailer’s are able to produce as many clothes as possible within a short period of time at a very low cost which is simply not achievable in many US clothing factories.”

“Hugo Boss pays close attention to where they are sourcing from and where each of their products should be made within their 4 production facilities. This stuck out to me because I don’t know how many US fashion brands have their own production facilities. I know a lot of brands outsource to countries like China and Bangladesh to factories who are also making clothing for many different brands.”

“EU has developed countries as well as developing countries, unlike the US. Western EU countries like Italy, France, UK and Germany are developed and focus more so on textile production. Whereas developing countries in the EU like Poland and Hungary focus more heavily on apparel manufacturing. In addition, unlike the US, the developed countries in EU also produce apparel exports, of high level, luxury goods.”

“It seems that in the EU the main focus is quality and social standards for these fashion brands and production. In the US, promoting local economic growth seems to be more of the focus of the free trade agreements. Sourcing for HUGO BOSS at least has strategically chosen factories where they can ensure quality checks and know how to conditions are. In the US, outside of the region, it seems that there are a lot of brands who do not know their secondary producers…”

“As the EU is more focused on production in high end markets than is the US, they (EU fashion companies) source more high-end quality fabrics. Progress has been made through technological advances, as the HUGO BOSS group developed the “smart factory” to further improve the quality of their fabrics and recognize any potential flaws before production. This stood out to me as a major difference, considering the US focuses on producing more fast-fashion goods and prioritizes high productivity overall quality garments. Also, they are more careful in their selection of suppliers and strive to build more long-term relationships with their suppliers. In comparision, most US fashion companies just try to produce as cheap and fast as possible through a short-term transctional-based importer-vendor relationship.”

“I think the sourcing strategies are similar to the U.S. in the fact that they source from various countries, creating this sense of “Made in the World.” However, there are differences as well. HUGO BOSS uses their own production facilities in addition to sourcing from other countries which is something we do not see often in the US. In fact, most brands and retailers in the US do not have their own production facilities or vertical supply chain, but instead source from overseas. Additionally, HUGO BOSS carefully selects their suppliers and immediately focus on social responsibility. US sourcing strategies seem to emphsis more on finding a factory with the lowest labor costs. EU brands and retailers, on the other hand, test their suppliers with test orders before selecting them as a supplier for the brand, and immediately develop social responsibility practices, such as trainings and building relationships. In the US, brands and retailers tend to focus on social responsibility in response to bad press and typically do so by a top-down approach.”

“The sourcing strategy in the Europe cares more about social impact. Retailers and brands there promote and educate their suppliers to be sustainable and take over their social responsibility. Another one is the European fashion retailers and brands are more likely to locate their product facilities within the Europe. Since the Europe does have a relatively stable and complete supply chain, the retailers and brands are able to saving transportation cost and expand the lead time. Third, the technology becomes an important factors for retailers and brands to consider. They are attempting to utilize technology to enhance the performance and their production process. “

“Hugo Boss strives to be the most desirable fashion and lifestyle brand in the premium sector. This shows in their emphasis on design, comfort, fit, and durability, as well as being mindful of their social and environmental impacts. They maintain long term relationships with a careful selection of suppliers, demand social compliance, and stay up to date with their “smart factory” aka AIs to speed up production and quality. They also source heavily from Asia, but also developed countries such as Italy and Germany. These values and practices are manifested in American brands, however, I believe we aren’t as extensive with sourcing from developed countries (such as Italy). From what I have learned thus far, it seems we source from countries close by and/or developing, but not so much mingling with luxury known countries, such as France or Italy (and if we do, the prices are expensive, and American customers don’t want to pay higher prices). We (US), too, source heavily from Asia, because it is cheap, and still focus internally on our own country when it comes to being more competitive in technological advancements. American and EU consumers alike value transparency in the clothing brands they buy from, and American brands are mindful of this, too. I would say we are more alike than different.”

[Please feel free to critique the comments above and join our online discussion]

Related readings