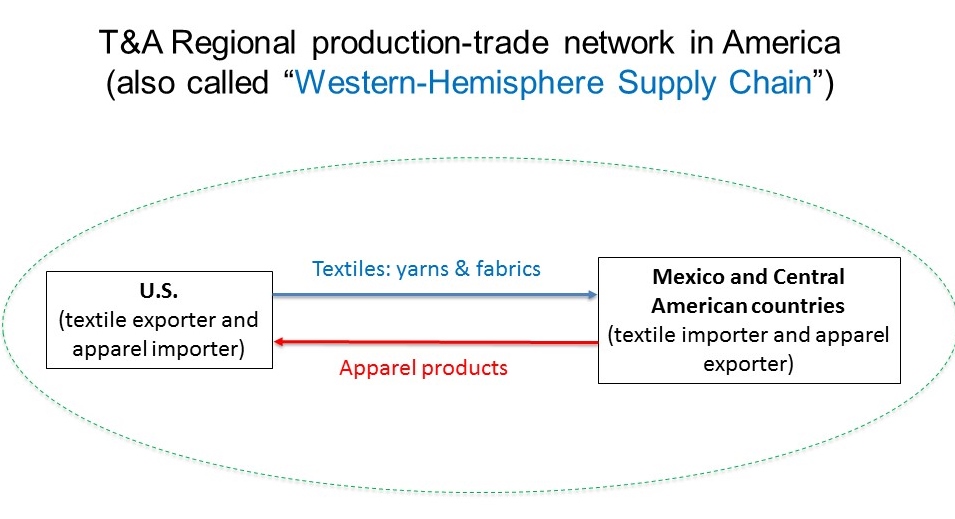

Within the Western-Hemisphere (WH) textile and apparel supply chain, the United States serves as the leading textile supplier, whereas developing countries in North, Central, and South America (such as Mexico and countries in the Caribbean region) assemble imported textiles from the United States or elsewhere into apparel. The majority of clothing produced in the area is eventually exported to the United States or Canada.

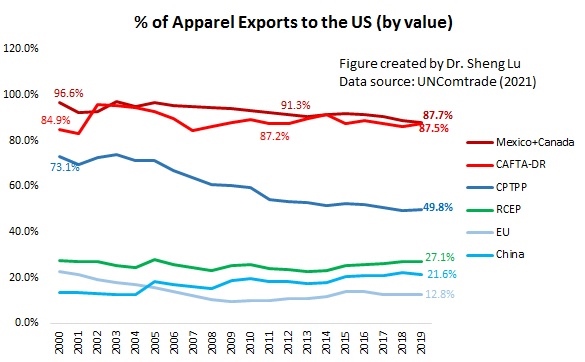

WH countries still form a close supply chain partnership in textile and apparel production. For example, close to 70% of US textile exports went to WH members in 2020, a pattern that has stayed stable over the past decades (OTEXA, 2021). Meanwhile, the United States serves as the single largest export market for most apparel exporting countries in the WH For example, in 2019, close to 89% of apparel exports from CAFTA-DR and USMCA (NAFTA) members went to the US.

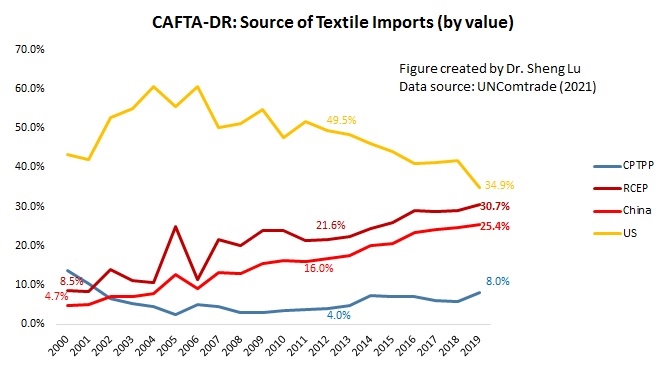

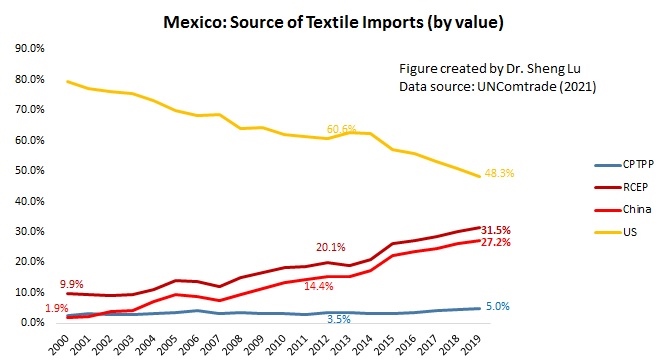

However, the WH textile and apparel supply chain is not without significant challenges. For example, CAFTA-DR and Mexico are increasingly using textiles inputs from outside the WH region, which weakens the US role as a dominant textile supplier. Notably, most of the market shares lost by US textile suppliers are fulfilled by Asian countries, including China and other members of the RCEP (Regional Comprehensive Economic Partnership). Theoretically, using cheaper textile inputs from Asia may help apparel producing countries in the WH improve the price competitiveness of their finished garments and diversify their export markets beyond the US.

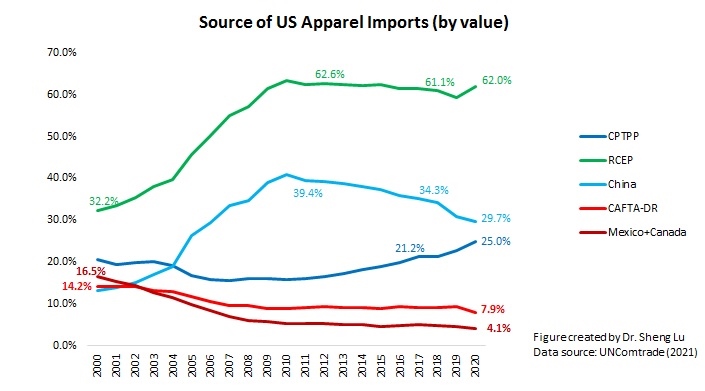

Meanwhile, despite the apparent popularity of “near-sourcing”, no evidence suggests that US fashion brands and retailers are sourcing more from WH countries, including CAFTA-DR and USMCA (NAFTA) members. Neither the US-China trade war nor COVID-19 seems to have shifted the trends. Instead, close to 75%-80% of US apparel imports still come from Asian countries (OTEXA, 2021). Studies further show that a vast majority of US apparel imports from WH concentrate on a limited category of products, such as tops and bottoms, which is far from sufficient to meet retailers’ sourcing needs.

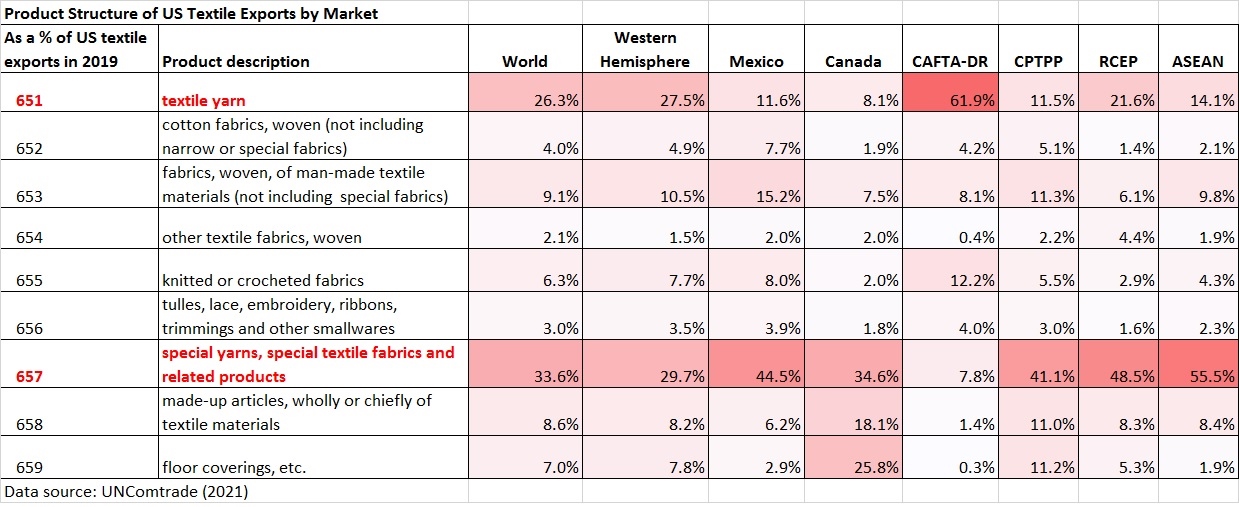

On the other hand, technical textiles and industrial textiles account for a growing share in the total US textile exports, and Asia is a particularly fast-growing market. However, there is few US free trade agreement with Asian countries, making it a disadvantage to promote “Made in the USA” products in these markets. It is debatable what should be the priority for the US textile and apparel trade policy: to continue to protect the exports of yarn and fabrics to the WH or open new export markets for technical and industrial textiles outside the WH region?

by Sheng Lu

Relate readings:

- Keough, K., & Lu, S. (2020). Explore the export performance of textiles and apparel “Made in the USA”: A firm-level analysis. Journal of the Textile Institute.

- Lu, S. (2018). What will happen to the U.S. textile and apparel industry if the NAFTA goes? Margin: The Journal of Applied Economic Research, 12(2), 113-137.

- Lu, S. (2021).Regional supply chains still shape textile and apparel trade. Just-Style.

After reading this article, I believe that the US needs to protect themselves in this situation and keep making their own textiles. It creates a lot of revenue and jobs for our country and we would be hurt without it. The problem with this is it is hard to stop the US fashion companies from getting their textiles from China because the companies want to buy from their cheapest options. This is weakening the US’s position as one of the strongest textile suppliers. In my opinion, there might need to be a more strict agreement or else the US textile business will continue to go down hill because it is more expensive compared to others. Other countries will continue to grow and take over the textile business.

The point that U.S. companies are still trying to source their textiles from cheaper regions such as Asian countries also really shocked me a bit. I have a feeling that Asian economies are so labor-intensive and cheap that switching to near-shoring at the moment is not worth it. Plus, Asia has massive mega factories that are difficult to replicate in Latin America (older populations, low birth rates, smaller working-age populations in comparison)

Also, I agree that trade policy to continue to protect the exports of yarn and fabrics to the WH. It’s important to focus on what the US is much better at. However, it seems that other factors are in play here too. American goods aren’t necessarily catered to high-end materials or things that are exclusive like European goods. Asia has taken over in that segment because they can produce things very cheaply. American firms have to either produce textiles at really cheap rates or compete with higher-end textile manufacturers, or may be create new textile markets that have a well-established customer base.

There are many takeaways from this article. I realized that fashion companies are trying to source from Asian countries. These are much more affordable than US alternatives which is greatly impacting the US textile and apparel trade. The United States needs to decipher solutions to this problem by solely focus on maintaining exports of yarn and fabrics within the WH. Less developed countries are looking for the most affordable option on exports. In order for the United States to maintain their dominant reputation, surrounding countries must improve the supply chain by keeping trade from expanding over seas. On the other hand, I think the United States would also benefit if they entered into markets outside of the WH. I think that instead of restricting themselves within this agreement why not explore cheaper options as well. If other countries are able to join this trade agreement but explore other options, why are they in this trade agreement at all? All countries should either be limited to the locations within the agreement or be able to explore other alternatives.

This article was very informative on the trouble Western Hemisphere Textile and Apparel Supply chains are facing. I knew that the U.S. was a major exporter for the Western Hemisphere. However, I was surprised to learn how many countries still choose to source in Asian countries. The article stated that close to 75%-80% of US apparel imports still come from Asian countries (OTEXA, 2021). This was extremely shocking to me because I felt like we have learned a lot about how fashion brands are trying to pull away from manufacturing in Asian countries. With the COVID-19 pandemic and the US-China trade deal I thought many brands would be shifting out of these countries and focusing more on “near-shoring” and manufacturing in the Western Hemisphere. However, these numbers show no evidence to believe that is true. I definitely believe that the biggest threat to the U.S being a dominant textile supplier is the cheap, efficient manufacturing that Asian countries can produce.

From reading this article, it’s evident that the US needs to protect its exports of yarn and fabrics while taking steps to complete the WH supply chain. Many developing countries in the WH are dependent on imports of raw materials like silk, which is typically produced in China. This correlates directly with fashion companies in the US as they are sourcing from Asian countries due to the products being cheaper than US alternatives which greatly impacts the US textile and apparel business. At the end of the day, the United States needs to come up with solutions to this issue to both increase revenue and become a country less reliant on other nations.

The U.S. apparel and textile industry continues to source textiles from Asia, where prices are cheaper. In fact, this is not beneficial to the U.S. textile industry. The U.S. needs to reconsider new trade strategies to improve its own textile industry profits and to be able to export textiles to the WH.

I knew and am not surprised that the US is still the leading textile exporter for most countries. However, after reading this article it seems as though that the US needs to start protecting themselves and their top spot as the textile provider within the WH. CAFTA-DR and Mexico are starting to source outside of the WH region being one of the reasons the WH textile and apparel supply chain is facing challenges. Less developed countries and others are definitely trying to source from more affordable places, which is a reason why the US needs to figure out a way to hold their dominant position.

Something to take note here is that close to 70% of the US textile exports went to WH members in 2020. On the contrary, the United States continues to serve as the single largest apparel exporting market for countries within the WH as well. Even though this has proven to be quite successful, there are still consistent challenges in that the CAFTA-DR and Mexico are still using textile inputs from outside the WH region. This then goes to say that the option to have clothing be “Made in the USA” is trending downward as Asian countries are fulfilling more of the textile orders for the WH region. Not only is that interesting but also the fact that there has not been any evidence to suggest that the US fashion brands and retailers are near sourcing more as a result of the WH. There has only been a limited category of products that has been near sourced from the WH. I feel that as a result of this the United states should not continue to protect the exports of yarn and fabrics to the Western Hemisphere. I feel that given that the Western Hemisphere is continuing to source their textiles from outside the bounds of the US, the US should open new export markets for textiles.

After reading this article, I wonder how other countries see us as we are the largest export market for most apparel. 70% is a big jump when talking about the United States exports going to WH members in 2020. Going off of the theory that using cheaper textile inputs from Asia may help apparel producing countries in the WH improve the price competitiveness of their finished garments and diversify their export markets beyond the United States, I think we should really focus on the United States textile to ensure that the exports of yarn and fabrics to the WH are getting to where they need to be. That is because the United States would make more money that way rather than relying on oversea transactions.

A key U.S T&A industry issue highlighted in this article is the fact that while the U.S may have a stronger advantage in textile over apparel internally that does not mean that they have a textile competitive advantage over other countries. While their technology and capital intensiveness may allow them to create textiles quickly, they still do not have the low labor costs that other countries offer. I believe that the only way for the U.S t&a industry to survive is for it to tap into a niche market, and the integration between technology and textiles could be the perfect one. The US has some amazing technology companies and it’s time to start integrating them into our t&a. This summer I’ll be interning at Under Armour, and from my understanding, they’re starting to do just that. They’re creating new textiles that allow you to breathe better while working out, along with apparel that can track your heart rate and more. The key here is that this t&a won’t stand out simply because of it made in the US label, but because it uses new forms of technology that haven’t been seen before.

I thought this article was extremely interesting and informative. This article states that the US is the leading textile supplier for many countries and they export textiles to lots of countries like Mexico, some countries in Central and South America. These are the developing countries that create and assemble the clothing with the imported textiles. Then these countries will export the assembled clothing and the US will import it. There is a current trade agreement CAFTA but the US still tries to find loop holes and source textiles from cheaper regions like other Asian Countries. The US should be a main priority and we need to come up with a way to protect the yarn and fabrics. This will be a great opportunity for the US to make lots of revenue. I know the US is more expensive the sourcing from asian countries but in the end it will create us to be less dependent on other countries. The US along with other surrounding countries need to develop the WH supply chain while also being beneficial to the US. Europe has been able to come up with a way for almost all sourcing to be done in one region and then there products are all exported from one place.

Yes the United States is a powerhouse and can do great things on its own, however its necessary to utilize other countries in the areas where we are not at absolute advantage. I agree that the U.S. should prioritize, but I feel that the flaws can be fixed with trial and error.

I think the Western Hemisphere textile and supply chain is in trouble. Although the USMCA attempts to incentivize business to source from the Western Hemisphere, the cheap labor in Asian countries makes it very difficult for companies to not source from there. In the Western Hemisphere, the US is supposed to be the largest textile exporter, but according to some of these graphs, they countries like Mexico and the members of CAFTA-DR are not sourcing from the US as much with China and the RCEP on the rise. US imported apparels from China are also on the rise which shows that the US have an increasing demand for apparel manufactured in China. No country in the Western Hemisphere can compete with the cheap labor that Asian countries have to offer.

I think the Western Hemisphere Textile and Apparel Supply Chain is in trouble because, despite the US’s best efforts to keep countries like Mexico and Central American countries sourcing textiles from them using the NAFTA and CAFTA-DR trade agreements, these countries continue to source textiles and yarn from Asian countries so they can be more price competitive. Like we learned in class, the reality is Asian countries’ T&A supply chains are unbeatable because of their flexibility, agility, and price competitiveness. Asian countries just allow for more variety of products, more flexibility with changing orders, and cheaper products in general so I think the trend will continue and countries will continue to source from Asian countries (it is shifting from China to Vietnam and other countries but still predominantly staying in Asia). So the western hemisphere textile and apparel supply chain is in trouble. However, I think the best thing US can do is to continue to protect the exports of yarn and fabrics to the Western Hemisphere rather than diversifying because the reality is US’s textiles are not competitive compared to the Asian textiles so focusing on the western hemisphere supply chain gives them guaranteed export market. The fact that the US’s textiles are only competitive when they have guaranteed export sources and not when compared to other textiles industries makes me wonder if the US should be doing something to make their industry more competitive against the world. They cant be relying on Mexico and Central American countries to import their textiles. What happens when these countries no longer want US textiles? The US textile industry will collapse.

I don’t think the future of US apparel sourcing from the Western Hemisphere is particularly bright if it’s remained unchanged, but there are still plenty of opportunities for the supply chain to thrive. I believe that for the Western Hemisphere T&A supply chain to stay in business, they must consider what apparel companies are looking for in terms of price and flexibility. The policymaker should include less stringent origin rules in trade agreements with other trade members so that they can coexist with Asian supply chains. They should also improve their price and product category competitiveness while increasing output. More importantly, Western Hemisphere T&A supply chains will need to adapt to the current climate by distinguishing themselves from cheaper supply chains in Asia by providing higher-quality products and utilizing more sophisticated technologies. This allows them to enter a niche market where brands seek finer materials and more advanced technology, similar to what developed countries in Europe are known for. Meanwhile, the US textile supply chain could explore new options outside of the WH regions, and instead of competing with Asian supply chains, they could take advantage of Asian nations’ growing middle classes and offer higher-end products.

The United States is the most important source of textiles and clothing in the Western Hemisphere (WH). The United States has a strong relationship with the countries within the WH and relies on that relationship to export 70% of their goods. The textile and clothing supply chain in the Western Hemisphere has challenges despite the good connections between the various countries in the hemisphere. Cafta-DR members and Mexico, for example, are increasingly employing textile inputs from outside the WH area, which reduces the US’s status as a leading textile provider and helps Asian Nations. Cheaper textile inputs from Asia might assist nations in the Western Hemisphere (WH) enhance the price competitiveness of their completed garments and expand their export markets beyond the United States.

The US exports textile to Mexico and Central American countries, Mexico and Central American countries export apparel to the US. These are the two major textile and apparel trade flows under the so-called textile

and apparel regional production and trade network in America (or the so-called “Western

Hemisphere textile and apparel supply chain”). For some US brands might get benefits from sourcing from the Western Hemisphere, some might get limits from that. It is true that it would save money to source from the Western Hemisphere, on the other hand, it makes sense that some brands would like to source some different or more fashionable products from other countries to meet their customers’ needs. The styles of apparels which are exported from Mexico are too basic and cannot fit the most fashion brands’ needs. I think TPL is a good way to meet the balance between the US fashion brands & retailers and textile industry’s benefits. Maybe the number of the limited SME could be renegotiated. More research about how to gain the maximum benefits for both industries are needed. I support being more open in sourcing for the US fashion brands and retailers. I also encourage the textile industry to develop better from the competition.

I think it is important for the US to open new export markets outside the Western Hemisphere region. Since many Central American countries and Mexico have opened up new markets in other regions, it would be beneficial for the United States to follow that trend. Additionally, since globalization is such a huge trend that will only continue to grow, it is important for the US to establish export relationships with new vendors in untouched regions to stimulate the domestic economy.

This debate is one that seemingly needs research behind it to back up any crucial viewpoints. On the one hand, the US could benefit from new trade agreements, like RCEP that is allowing Mexico and some Central American countries to source textiles from other RCEP affiliated countries, because like these other countries, the US could source its own textiles to a greater range of places and possibly benefit from this. However, if not enough countries who require sourcing of textile materials are in demand of the US’s textiles, then this would not be worth it and the US should go back to focusing on exporting to WH countries. I think the increase in more trade agreements to make our globalized apparel industry has its benefits, because oftentimes it lowers the cost of sourcing and allows countries to put their best project forward, or the comparative advantage. However, it can also hurt economies who do not supply the cheapest materials in the market because of upholding fair labor or sustainable measures, which are proving to be more of a concern in the industry. Once countries level the playing field and uphold the same standards, price levels should equate relatively and I’d argue that regional sourcing will become more popular at this point. However, until we have countries stop cheating the system, it remains inevitable that companies will always look to source the cheapest materials.

I find it very interesting how the Western Hemisphere operates as a supply chain. Although traditionally, the US produces textiles that are sent to developing countries in the Western hemisphere to be made into apparel, this system has been disrupted by globalization. Since CAFTA-DR and Mexico are using more textiles from countries other than the United States, it poses a threat to American textile suppliers. Fashion companies seem to prefer sourcing from Asia because of the cheap manufacturing costs, which is harming the US as a leader in textile production. I think that the US should continue to prioritize the Western Hemisphere supply chain, but also spread goals of manufacturing overseas to increase their global power and business. I also think that the US could impose new, possibly more lenient trade regulations to incentivize Central American countries and Mexico to take advantage of the CAFTA trade agreement’s benefits as it eliminated tariffs. It is interesting to see how this debate is evolving as globalization occurs over time.

I do not think the Western Hemisphere T&A supply chain is in trouble. It shows that Canada, and Mexico continue to cheaply source their textiles from other countries out of the U.S. Despite that, the U.S continues to source apparel from outside of Canada and Mexico. For certain companies, this supply chain is beneficial and keeps them running. In other cases, these countries will still continue to source outside of the Western Hemisphere for the price. The two sourcing outside of other countries almost cancels each other out. To improve on competitiveness, and growth opening more export markets for other countries to source within the Western Hemisphere may be wise. If the Western Hemisphere is going to purchase from other countries, other countries should purchase from us. There needs to be more of a balance, if they are not able to utilize each others sourcing.