Blog Articles

Trade Adjustment Assistance (TAA) Program: An Overview

In the class, we briefly introduced the Trade Adjustment Assistance (TAA) program, which has played a critical role in the past decades both financially helping trade-displaced workers and tactically facilitating trade liberalization agendas in U.S. trade policy.

Rationale and purpose of TAA

It is widely acknowledged that trade liberalization can benefit consumers and create new market-access opportunities for export-oriented firms. However, expanded trade may also exert negative and often concentrated effects on domestic industries and workers that face increased import competition. Freer trade is not entirely free, but bears the cost of economic adjustment. TAA program therefore is designed to provide readjustment assistance to firms and workers that suffer dislocation (job loss) due to foreign competition or offshoring. To be noted, TAA has been a significant tool to assist workers in the U.S. textile and apparel industry.

According to official statistics, since 1974, 2.2 million American workers have benefited from the TAA program, which provides workers with opportunities to obtain the skills, credentials, resources, and support they need to obtain good jobs in an in-demand occupation — and keep them. TAA was last authorized in June 2015 to continue through June 30, 2021.

Eligibility for TAA

To be eligible for TAA, petitioning workers must establish that foreign trade contributed importantly to their loss of employment. The role of foreign trade can be established in one of several ways:

- An increase in competitive imports: The sales or production of the petitioning firm have decreased absolutely and imports of articles or services like or directly competitive with those produced by the petitioning firm have increased.

- A shift in production to a foreign country: The workers’ firm has moved production of the articles or services that the petitioning workers produced to a foreign country or the firm has acquired, from a foreign provider, articles or services that are directly competitive with those produced by the workers.

- Adversely affected secondary workers: The petitioning firm is a supplier or a downstream producer to a TAA-certified firm and either (1) the sales or production for the TAA-certified firm accounted for at least 20% of the sales or production of the petitioning firm or (2) a loss of business with a TAA-certified firm contributed importantly to the workers’ job losses.

Additionally, workers who lost jobs from firms that have been publicly identified by the United States International Trade Commission (USITC) as injured by a market disruption (for example, in anti-dumping, countervailing duty or safeguard cases) or other qualified action can also submit TAA petition.

Workers’ Benefits under TAA

TAA benefits for individual workers include:

- Training and reemployment services and income support for workers who have exhausted their unemployment compensation benefits and are enrolled in training.

- Workers age 50 and over may participate in the Reemployment Trade Adjustment Assistance (RTAA) wage insurance program.

- Certified workers may also be eligible for a tax credit for a portion of the premium costs for qualified health insurance.

Financial Cost of TAA

TAA is financially covered by the federal government (i.e. taxpayers’ money) through annual appropriations. Appropriations for the program in FY2016 were $861 million, of which $450 million was for training and reemployment services and the remaining $411 million was for income support and other activities.

Role of TAA in U.S. trade policy

TAA is “presented as an alternative to policies that would restrict imports, and so provides assistance while bolstering freer trade and diminishing prospects for potentially costly tension (retaliation) among trade partners.”(Hornbeck, 2013)

Back in 1992, newly elected President Clinton oversaw the implementation of the North America Free Trade Agreement (NAFTA), but did so only after a number of conditions were attached, including TAA. In 2002, President Bush and the Republicans pushed hard to renew the long-expired trade promotion authority (TPA), but Democrats were unwilling to provide it unless TAA was reauthorized. TAA was also directly linked to the passage of three free trade agreements (FTAs) by US Congress in 2011, including US-Korea, US-Columbia and US-Panama FTAs.

Concerns about TAA

Critics strongly debate the merits of TAA on equity, efficiency, and budgetary grounds:

- Economic efficiency: some critics argue that economic efficiency was far from guaranteed given that subsidies can operate to reduce worker and firm incentives to relocate, take lower-paying jobs and in other ways to carryout necessary reform.

- Equity: some critics argue that because many economic groups hurt by changing economic circumstances caused by other than trade policies were not afforded similar economic assistance (for example, domestic competition and technology advancement). For the sake of fairness, if society has a responsibility to help all those dislocated by economic change, then policies should not be narrowly restricted to trade-related harm only.

- Administrative cost: it is argued by some economists that defining and measuring injury from tariff reduction would be inexact, if not arbitrary. Some studies also suggest that many firms, even smaller ones, could adjust on their own, and that workers could just as well rely on more broadly available unemployment and retraining programs. In addition, the high costs of TAA would dilute political support for the program.

Reference:

Collins, B. (2016). Trade Adjustment Assistance for Workers and the TAA Reauthorization Act of 2015, Congressional Research Service, R44153

Hornbeck, J.F. (2013).Trade Adjustment Assistance (TAA) and Its Role in U.S. Trade Policy, Congressional Research Service, R41922

CRS Releases Updated Study on the U.S. Textile Industry and the Trans-Pacific Partnership (TPP)

On September 1, the Congressional Research Service (CRS) released its updated study on the U.S. textile industry and the Trans-Pacific Partnership (TPP). According to the report:

On September 1, the Congressional Research Service (CRS) released its updated study on the U.S. textile industry and the Trans-Pacific Partnership (TPP). According to the report:

First, TPP is suggested to have a limited impact on U.S. domestic textile and apparel manufacturing, because:

1) Automation rather than imports is found to be the top factor causing job losses in the U.S. textile industry in the past decade;

2) U.S. is one of the very few TPP members whose textile output mostly went into home textiles, floor coverings and other technical textile products rather than apparel.

3) More than 90% of apparel sold in the United States is already imported. Some companies maintain U.S. manufacturing of high-value products or products requiring quick delivery, which are not likely to be supplied by other TPP members.

4) A quantitative assessment conducted by the U.S. International Trade Commission (USITC) in May also suggests that U.S. imports of textiles will only climb 1.6% by 2032 if TPP enters into force in 2017. Over the same 15-year period, both output and employment in the U.S. textile industry could slightly shrink by 0.4% as a result of the implementation of TPP.

Second, TPP could challenge the Western-Hemisphere supply chain and negatively affect U.S. textile exports to the region:

1) TPP will make apparel manufacturers located in Mexico and Central America lose one important advantage—duty free access to the U.S. market, when competing with Asian TPP members such as Vietnam and Malaysia. The Central American-Dominican Republic Apparel and Textile Council also estimates the CAFTA-DR region could see a contraction of 15%-18% in industrial employment resulting from lost production orders in the first year after the TPP agreement is implemented.

2) The major products sourced by U.S. apparel companies from the Western Hemisphere region include basic, low-value knitwear garments such as shirts, pants, underwear, and nightwear, with a focus on men’s and boys’ wear. However, these products are with low time sensitivity but high price sensitivity, meaning Asian TPP members can easily offer a more competitive price and take away sourcing orders after the implementation of TPP.

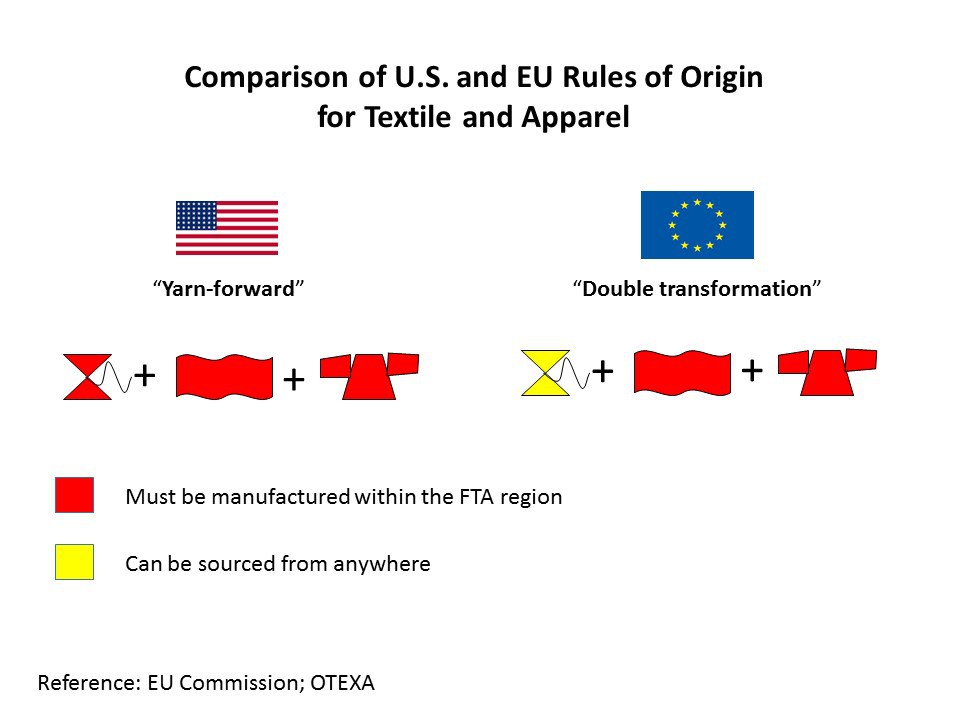

3) Because of physical distance and abundance of local supply, leading Asian TPP apparel exporters such as Vietnam seldom use US-made yarns and fabrics. Supported by foreign investments, Vietnam is also quickly building up its own textile manufacturing capacity, which is expected to reach 2 million metric tons for fabrics and 650,000 metric tons for fibers by 2020. This implies that TPP may help little creating new export markets for US textile products, despite the restrictive yarn forward rules of origin.

Additionally, TPP could result in intensified competition in the technical textile area, which is of strategic importance to the future of the U.S. textile industry:

1) If the proposed agreement is implemented, those segments of the U.S. textile industry that supply industrial textiles are likely to face greater competition from rising imports from Japan.

2) TPP will allow Japanese industrial textiles to newly get duty free access to Mexico and Canada, which are the largest export markets for U.S. industrial fabrics in 2015. However, TPP won’t help US companies get more favorable access to China, which is the top export market for Japanese industrial fabrics.

Brexit and the U.S. Fashion Industry

Pattern of U.S. Textile and Apparel Imports (Updated: September 2016)

U.S. textile and apparel imports enjoy steady growth from 2000 to 2015. Specifically, the value of U.S. textile imports reached $26,763 million in 2015, up 4.2 percent from 2014 and 85.1 percent from 2000. The value of U.S. apparel imports reached $85,165 million in 2015, up 4.1 percent from 2014 and 48.8 percent from 2000. It is forecasted that the value of U.S. textile and apparel imports could reach $27,355 million (up 2.2 percent) and $85,719 million (up 0.7 percent) respectively in 2016.

Because the United States is no longer a major apparel manufacturer but one of the largest apparel consumption markets in the world, apparel products accounted for 76.1 percent of total U.S. textile and apparel imports in 2015, followed by made-up textiles (16.9 percent), fabrics (5.8 percent) and yarns (1.3 percent).

In terms of source of products, U.S. imported apparel from as many as 150 countries in 2015. However, Herfindahl index reached 0.15 for knitted apparel (HS chapter 61) and 0.18 for woven apparel (HS chapter 62) in 2015, suggesting this is a market with a high concentration of supplying countries. Specifically, all top apparel suppliers to the United States in 2015 (by value) are developing countries and most of them are located in Asia, including China (35.9 percent), Vietnam (12.4 percent), Bangladesh (6.3 percent), Indonesia (5.8 percent), India (4.3 percent) and Mexico (4.2 percent).

U.S. textile and apparel imports are also becoming even cheaper. For example, U.S. apparel imports in 2015 on average was only 85.7 percent of the price in 1990 and the price of imported fabrics cut almost by half over the same period.

From 2013 to 2015, the fastest growing textile and apparel import categories unusually include several fabric products, such as blue denim (OTEXA code 225, up 74.8%), Cheesecloths (OTEXA code 226, up 74.3%) and woven fabrics (OTEXA code 611, up 49.3%). It is likely that the growing business of apparel “Made in USA” has led to an increased demand for imported fabrics.

Additionally, U.S. apparel imports overall mirror the pattern of apparel retail sales in the U.S. market. This reflects the fact that the performance of the U.S. economy is the leading factor shaping the size of demand for imported apparel. It is also interesting to note that the value of U.S. apparel imports grew at a faster rate than the value of U.S. apparel retail sales in 2015 (4.1 percent v.s. 1.7 percent), suggesting import penetration ratio (i.e. the percentage of apparel consumed in the United States that is supplied by imports) continues to rise.

Data source: Office of Textiles and Apparel (OTEXA), U.S. Department of Commerce

by Sheng Lu

2016 August Sourcing at Magic Debriefing

New landscape of sourcing

- Sourcing is turning from regional to global. In the past, U.S. apparel companies/fashion brands set up regional offices to handle sourcing. Nowadays, companies are building a global infrastructure to develop, source and market their products around world. Global rather than regional sourcing also allows companies to improve sourcing efficiency and reduce total product and distribution cost while maintaining quality of their product and services.

- U.S. apparel companies/fashion brands are going with fewer but more capable vendors (“super vendors”). For example, executive from a leading U.S. apparel brand said their company has shrunk their sourcing base by 40% in the past few years. At the same time, they now expect their vendors to be able to supply on a global scale, including having multiple manufacturing facilities around the world and being able to provide value added services such as design and product development.

- Related, sourcing is shifting from cut-make-and trim (CMT) to full package. This is consistent with our findings in the latest USFIA benchmarking study which suggests that vendors are highly expected to have the capacity of supplying raw material.

- U.S. apparel companies/fashion brands are also investing to build a more partnership-based relationship with vendors— help vendors reduce cost, become more innovative and have the same vision looking at the whole picture of the supply chain. At the same time, U.S. apparel companies/fashion brands see vendors as their “ambassadors” and want to know more about them—what they believe, what they can bring to the table and how they treat their workers.

- Companies are redefining the role of sourcing in their businesses. Sourcing is no longer treated as a technical function, but an integral part of a company’s overall business strategy.

Made in USA

- There is a noticeable interest in sourcing textiles and apparel “Made in USA” at Magic. A dozen U.S.-based apparel companies attended the Magic show and their booths attracted a heavy traffic. According to representatives from these companies, U.S. consumers’ increased demand for apparel “Made in USA” has been a strong support for their business growth in recent years.

- Nevertheless, apparel “Made in USA” often contain imported inputs today. I specifically asked a few vendors where their fabrics come from. All but one company said fabrics were imported because it was so hard to find domestic suppliers, especially for woven fabrics. Interesting enough, some companies feel OK to label their apparel “Made in USA” even though they use imported fabrics. According to them, apparel can be labeled “Made in USA” as long as “domestic content exceeds 60% of the value of the finished product.”

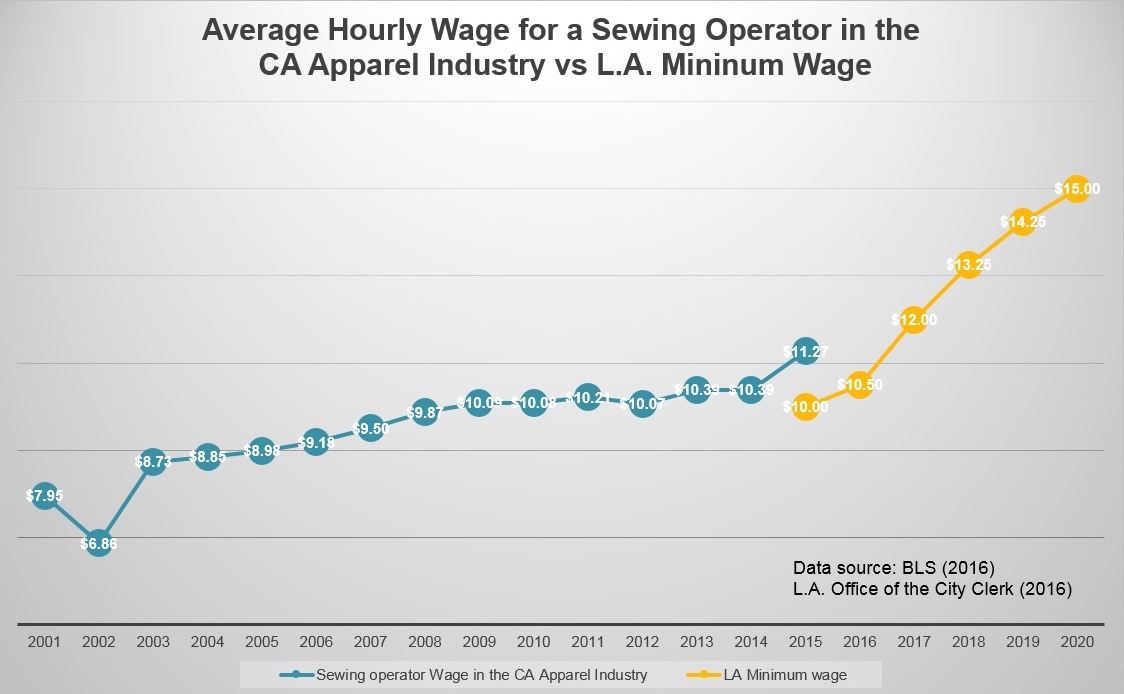

- At a seminar, some entrepreneurs which make and sell “Made in USA” apparel and accessories said price and production cost remain one of their top business challenges. I asked the panel whether going high-end is the only option for the future of apparel “Made in USA” given the high labor cost in the country. They disagreed—saying technology advancement and design innovation could help reduce production cost. However, all panelists admit they carry some luxury product lines. Additionally, some companies choose to emphasize concepts other than “Made in USA”, such as “hand-made” and “Pride in Seattle”, in order to make their products look more personal to consumers and allow more flexibility in sourcing raw material.

Updates of sourcing destinations

- Ethiopia: as I observe, Ethiopia is THE star at this year’s Sourcing at Magic. The country was repeatedly mentioned by panelists at various seminars as a promising and emerging sourcing destination. Several events at the show were also exclusively dedicated to promoting apparel and footwear “Made in Ethiopia”. A couple of reasons why Ethiopia is so “hot”: 1) the ten year extension of AGOA creates a stable market environment encouraging sourcing from Africa and investing in the region (and for sure the duty free access both to the US and EU market). 2) Located in the middle of Africa, Ethiopia is regarded as a hub that has the potential to take a leadership role in integrating the apparel supply chain in the region. 3) It is said that Ethiopian government is very supportive to the development of the local textile industry. 4) Many U.S. fashion companies feel sourcing from Ethiopia involves less risks of trade compliance than sourcing from some Asian countries such as Bangladesh.

- China: China unarguably remains the No.1 textile and apparel supplier to the U.S. market—in terms of numbers, around 60% vendors at the Magic show came from China. But I notice that booths of Chinese vendors didn’t have much traffic this time, an interesting signal for sourcing trend in the upcoming season. Nevertheless, while U.S. apparel companies/fashion brands are placing more emphasis on supply chain efficiency, quality of products, speed to market and added value in sourcing, “Made in China” will continue to enjoy many unique advantages over other suppliers. Plus, Chinse factories are actively investing overseas, from Southeast Asian countries to Africa. This makes Chinese factories likely to grow into “super vendors” that western fashion brands/retailers are looking for. To certain extent, macro trade statistics alone may not be able to fully reveal what is going on in apparel sourcing and trade.

- Vietnam: Regarding the future of Vietnam as a sourcing destination for U.S. apparel companies/fashion brands, somehow I hear more concerns than excitements at Magic. The uncertainty surrounding the ratification of TPP by the U.S. Congress definitely has made some companies hold back their investment and sourcing plan in Vietnam. Another big concern is Vietnam’s labor shortage and limited manufacturing capacity: apparel factories in Vietnam are already competing with electronic industry for young skilled workers. US companies also have to compete with their EU counterparts for orders in Vietnam. The newly reached EU-Vietnam Free Trade Agreement (EVFTA), which is very likely to be implemented earlier than TPP, provides Vietnam duty free access also to the EU market. And EVFTA adopts a much more flexible rule of origin than TPP, making it easier for Vietnam factories to actually use the agreement.

Sustainability

The awareness of social responsibility and sustainability has much improved: everyone in the industry is talking about them and have a view on them. On a voluntary basis, some companies are making efforts to improve traceability of their products, i.e. to help consumers know exactly where their clothing comes from and what is happening at the upstream of the supply chain. Yet, how to encourage factories to share their information and control tier 2 and tier 3 suppliers remain a challenge.

by Sheng Lu

Note: Sourcing at Magic is one of the largest and most influential annual textile and apparel sourcing events hosted in the United States. Special thanks to the Center for Global and Areas Studies at the University of Delaware for funding the trip.

Apparel “Made in America” of Imported Fabrics

Presidential candidate Hillary Clinton recently launched a new website “Made In America: A Buyer’s Guide for Donald Trump”, which highlighted hundreds of U.S. manufacturers for products ranging from men’s ties, suits to furniture.

Joseph Abboud is one of the companies highlighted by the website for making “Made in America” suites and shirts. But does “Made in America” mean a Joseph Abboud branded suit or shirt is 100% made in the United States from yarns, fabrics to the cut-and-sew process? Not necessarily!

According to information submitted by Joseph Abboud to the “Made in USA” database managed by the Office of Textiles and Apparel under the U.S. Department of Commerce, some of its products actually are “partially made in U.S.A. with imported fabrics”.

This is evidenced both by Joseph Abboud’s product label and information provided by some retailers which sell Joseph Abboud’s branded products (See pictures below).

Hamilton Shirts of Houston is another company highlighted by Clinton’s “Made in USA” website. But similar as the case of Joseph Abboud, a Hamilton branded shirt priced at $215-$245 is typically “Hand cut and sewn in the USA. 100% cotton Italian fabric.”

Actually, Joseph Abboud is a brand owned by JA Holding, Inc., which was acquired by Tailored Brands for $94.9 million on August 6, 2013. As of June 2016, Tailored Brands also owns the Men’s Wearhouse and Jos. A. Bank.

Like most other US apparel companies/fashion brands today, Tailored Brands commits to global sourcing. In fiscal year 2015, the company “sourced approximately 60% of direct sourced merchandise from Asia (36% from China) while 13% was sourced in the U.S., 12% in Mexico, and 15% was sourced in other regions.” (Source: Tailored Brands Annual Report, 2015)

Tailored Brands uses the factory in New Bedford, MA (the one highlighted by Clinton’s website) to make tailored clothing under the Joseph Abboud label, including designer suits, tuxedos, sport coats and slacks which they sell in Men’s Wearhouse stores as well as Joseph Abboud’s flagship store. Tailor Brands also sells Joseph Abboud branded products in Moores stores, which are made in Canada by a third party.

Related article: Clothing Label Reveals the Global Nature of the Textile and Apparel Industry

Disclaimer: All blog posts on this site are for FASH455 educational purposes only and they are nonpolitical and nonpartisan in nature. No blog post has the intention to favor or oppose any particular presidential candidate, nor shall be interpreted in that way.

How is China’s Garment Industry Dealing with Rising Labor Costs?

Please feel free to share your views on the following discussion questions based on the video:

China is no longer one of the cheapest places to produce garments. The minimum monthly wages in China have far exceeded those in Bangladesh, India and Cambodia:

- How are Chinese garment factories coping with the challenges of rising labor cost?

- Is adopting Taylor’s “scientific management”, i.e. asking skilled workers to do less skilled jobs in a more specialized production line, a smart idea?

- What is your view on the growing difficulty of hiring and retaining young skilled workers for the garment industry in China?

- Any other thoughts on the video?

Appendix: State of China’s Apparel Exports in 2015

According to the UNComtrade, China remains the world’s largest apparel exporter in 2015 (37.4% world share for knitted apparel, HS61 and 34.9% for woven apparel, HS62).

From 2011 to 2015, “Made in China” continues to acquire more market shares in some key apparel import markets in the world, including the United States and UK (i.e. China’s apparel exports to these markets grew at a faster rate than these countries’ apparel import growth from the world—bubbles in blue in the figures below). Nevertheless, in some other markets (bubbles in yellow in the figures below), notably Japan and Germany, China is losing market shares to other garment exporters such as Vietnam and Bangladesh.

From 2011 to 2015, “Made in China” continues to acquire more market shares in some key apparel import markets in the world, including the United States and UK (i.e. China’s apparel exports to these markets grew at a faster rate than these countries’ apparel import growth from the world—bubbles in blue in the figures below). Nevertheless, in some other markets (bubbles in yellow in the figures below), notably Japan and Germany, China is losing market shares to other garment exporters such as Vietnam and Bangladesh.

WTO Reports World Textile and Apparel Trade in 2015

The World Textile and Apparel Trade in 2016 is now available

According to the newly released World Trade Statistical Review 2016 by the World Trade Organization (WTO), the current dollar value of world textiles (SITC 65) and apparel (SITC 84) exports totaled $291 billion and $445 billion respectively in 2015, but decreased by 7.2 percent and 8.0 percent from a year earlier. This is the first time since the 2009 financial crisis that the value of world textiles and apparel exports grew negatively.

However, textiles and apparel are not alone. The current dollar value of world merchandise exports also declined by 13 percent in 2015,to $16.0 trillion, as export prices fell by 15 percent. In comparison, the volume of world trade grew slowly at a rate of 2.7 percent, which was roughly in line with world GDP growth of 2.4 percent. WTO says that falling prices for oil and other primary commodities, economic slowdown in China, a severe recession in Brazil, strong fluctuations in exchange rates, and financial volatility driven by divergent monetary policies in developed countries are among the major factors that contributed to the weak performance in world trade.

Textile and apparel exports

China, the European Union and India remained the top three exporters of textiles in 2015. Altogether, they accounted for 66.4 percent of world exports. The United States remained the fourth top textile exporter in 2015. The top ten exporters all experienced a decline in the value of their exports in 2015, with the highest declines seen in the European Union (-14 percent) and Turkey (-13 percent). The smallest decline was recorded in China (-2 percent).

Top three exporters of apparel include China, the European Union and Bangladesh. Altogether, they accounted for 70.3 percent of world exports. Among the top ten exporters of apparel, increases in export values were recorded by Vietnam (+10 percent), Cambodia(+8 percent), Bangladesh (+6 percent) and India (+2 percent). The other major exporters saw stagnation in their export values (United States) or recorded a decline (all other top ten economies).

Additionally, despite reported rising production cost, China’s market shares in world textile and apparel exports continued to rise in 2015 (see the figure above).

Textile and apparel imports

The European Union, China and the United States were the top three importers of textiles in 2015. However, altogether they accounted for only 37 percent of world imports, down from 52.8 percent in 2000. Because a good proportion of textiles made by developed countries (such as the United States) are exported to developing countries for apparel manufacturing purposes, the pattern reflects the changing dynamics of world apparel manufacturing and exports in recent years.

Because of consumers’ purchasing power (often measured by GDP per capita) and size of the population, the European Union, the United States and Japan remained the top three importers of apparel in 2015. Altogether, they accounted for 59 percent of world imports, but down from 78 percent in 2000. This indicates that import demand from other economies, especially some emerging markets, have been growing faster over the past decade.

Turning Africa into a Global Textile and Apparel Hub

Before the 2016 Source Africa Trade event in June 2016, CNBC interviewed Tim Armstrong, Investment Promotion Director for the Textile Development Unit at the Ministry of Industry and Trade in Tanzania. Three questions were discussed during the interview:

- Are free trade agreements/trade preference programs such as the African Growth and Opportunity Act (AGOA) translating into tangible results we can see that help African clothing exporters?

- What has AGOA extension done to the textile and apparel industry in Africa, particularly in the context of Tanzania? What are the impacts of rules of origin on investment in the region?

- Can apparel “Made in Africa” compete in the global marketplace when raw material such as yarns and fabrics has to be sourced from elsewhere?

What is your view on these issues?

ILO Evaluates Trade Impact of Labor Provisions in Free Trade Agreements

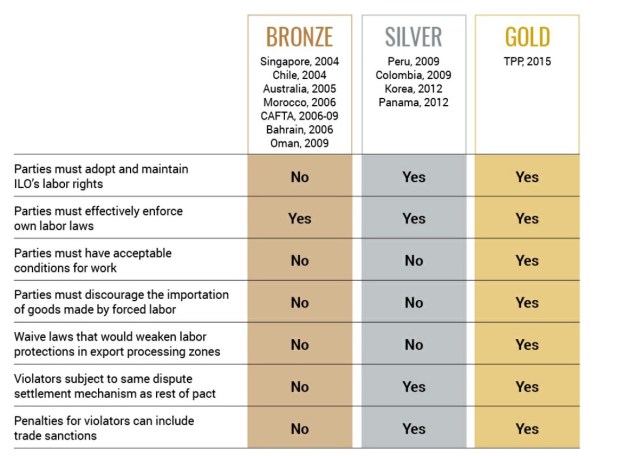

The International Labor Organization (ILO) releases a new study, which looks at how the increasing number of labor provisions in free trade agreements are impacting the world of work. According to the study:

Labor provisions in free trade agreements take into consideration any standard which addresses labor relations or minimum working terms or conditions, mechanisms for monitoring or promoting compliance, and/or a framework for cooperation. (See appendix: evolution of labor provisions in US free trade agreements).

As of December 2015, there were 76 trade agreements in place (covering 135 economies) that include labor provisions, nearly half of which came into existence after 2008. This represents more than one-quarter (28 percent) of the trade agreements which the World Trade Organization (WTO) has been notified of, and which are currently in force. Over 80 percent of agreements that came into force since 2013 contain such provisions. Countries most active in promoting labor provisions in free trade agreements include: Canada, the European Union, the United States, Chile, New Zealand and Switzerland. Some South-South free trade agreements also include labor provisions.

The study finds that there is NO evidence to support the claim that implementation and enforcement of labor standards leads to reduced trade. The findings show that trade agreements, with or without labor provisions, boost trade between members of the agreement to a similar extent. For country-partner pairs that have a trade agreement with labor provisions in force, bilateral trade is estimated to be on average 28 percent greater than what would be expected without such an agreement.

Results further show that, on average, trade agreements that contain labor provisions impact positively on labor force participation rates, bringing larger proportions of male and female working-age populations into the labor force and, particularly, increasing the female labor force. The study assumes that labor provisions in trade agreements can raise people’s expectations of better working conditions, which in turn increases their willingness to enter the labor force.

However, the study found NO statistically significant relationship between labor provisions and labor market outcomes such as wages, share of vulnerable employment or gender gaps at the aggregate level (i.e. consider all countries). On the one hand, this implies that labor provisions at least do not lead to the deterioration of other labor standards in a country. On the other hand, it indicates that labor provisions in free trade agreements have limited impact on the outcomes of the labor market.

Additionally, the study stresses that interaction among stakeholders, capacity-building and monitoring mechanisms – with the support of social dialogue are critical to achieve positive outcomes in the labor market. In a case study on the Cambodia–US Textile Agreement specifically, the report finds strong firm-level intervention, such as monitoring and compliance, improved wages at the firm level, including a notable reduction of the gender wage gap. In another case study, it is found that capacity-building measures brought to Bangladesh after the Rana Plaza tragedy have resulted in some visible improvements with respect to the number of trade unions, building safety and amendments in labor law in the country.

Appendix: Evolution of labor provisions in US free trade agreements

Source: http://www.thirdway.org/memo/tpp-in-brief-labor-standards

Vietnam’s Apparel Exports Slow in First Half of 2016

According to Thanh Nien News, Vietnam’s textile and apparel (T&A) exports only increased 5.1 percent to $10.7 billion in the first half of 2016. This was the lowest growth rate since 2010. Data from the General Statistics Office of Vietnam shows that Vietnam’s T&A exports totaled $22.63 million in 2015, up 8.2 percent from a year earlier.

In the U.S. market, apparel imports from Vietnam also see a much slower growth in the first five months of 2016: 4.1% by value (compared with 13.1% on average between 2010 and 2015) and 5.0% by quantity (compared with 11.8% on average between 2010 and 2015).

The new trade data echos the findings in the latest 2016 US Fashion Industry Benchmarking Study. Although Vietnam remains one of the top sourcing destinations, respondents seem to be more conservative about Vietnam’s growth potential in the next two years. Only 4 percent of respondents expect a strong increase of sourcing value or volume from the country, which is a substantial drop from 21.4 percent in the 2015 study.

USITC Studies the Impact of Trade on Manufacturing Jobs in the U.S. Textile and Apparel Industry

In its newly released Economic Impact of Trade Agreement Implemented under Trade Authorities Procedures, 2016 Report, the U.S. International Trade Commission (USITC) provides a quantitative assessment on the impact of trade on manufacturing jobs in the U.S. textile and apparel industry. According to the report:

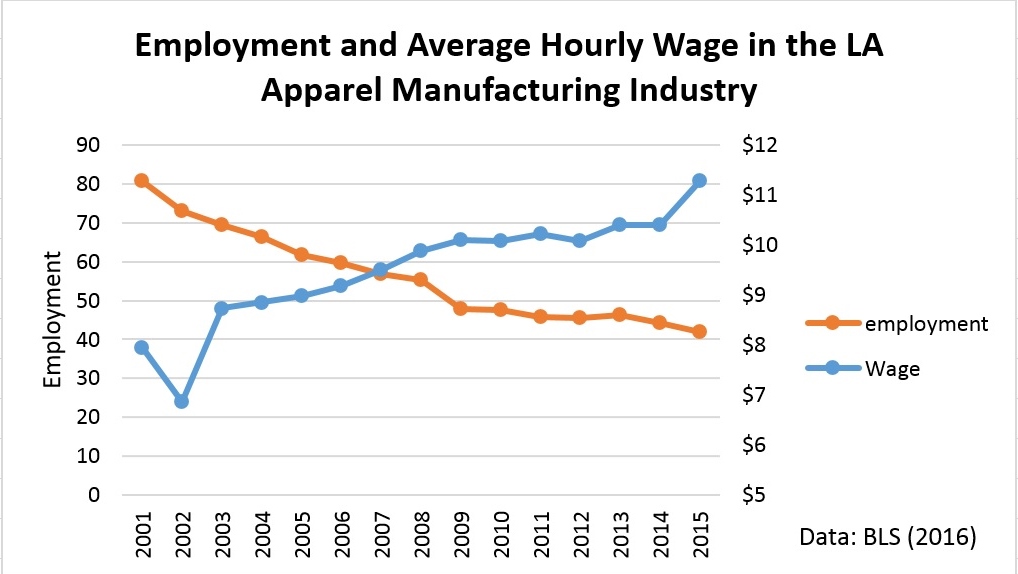

- Manufacturing jobs in the U.S. textile and apparel industry have been declining steadily over the past two decades. Between 1998 and 2014, employment in the NAICS 313 (textile mills), NAICS314 (textile product mills) and NAICS 315 (apparel manufacturing) sectors on average decreased annually by 7.6 percent, 4.3 percent and 11.2 percent, respectively.

- Rising import is found NOT a major factor leading to the decline in employment in the U.S. textile industry (NAICS 313)–as estimated, imports only contributed 0.4 percent of the total 7.6 percent annual employment decline in the U.S. textile industry. Instead, more job losses in the sector are found caused by improved productivity as a result of capitalization & automation (around 4.6 percent annually) and the shrinkage of domestic demand for U.S. made textiles (around 3.5 percent annually) between 1998 and 2014.

- Rising imports is the top factor contributing to job losses in apparel manufacturing (NAICS 315), however. As estimated by USITC, of the total 11.2 percent annual employment decline in apparel manufacturing, almost all of them is affected by imports (10.8 percent). On the other hand, increased domestic demand for apparel (such as from U.S. consumers) is found positively adding manufacturing jobs by 2 percent annually in the United States from 1998 to 2014.

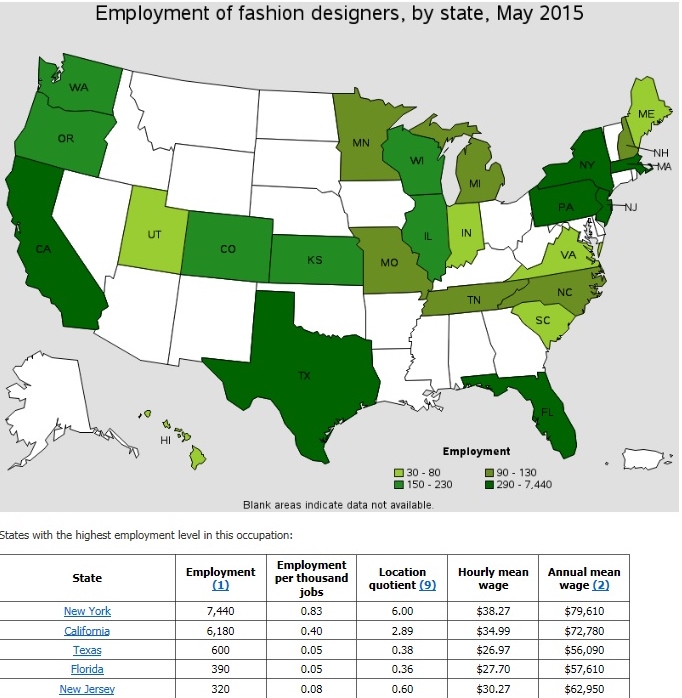

- To be noted, USITC did not estimate the impact of trade on employment changes in the retail aspect of the industry. According to the U.S. Bureau of Labor Statistics, approximately 80 percent of jobs in the U.S. textile and apparel industry came from retailers in 2015. These retail-related jobs are typically “non-manufacturing” in nature, such as: fashion designers, merchandisers, buyers, sourcing specialists, supply chain management specialists and marketing analysts.

2016 U.S. Fashion Industry Benchmarking Study Released

The 2018 U.S. Fashion Industry Benchmarking Study is now available.

The report can be downloaded from HERE

Key Findings of the study:

I. Business environment and outlook in the U.S. Fashion Industry

- Overall, respondents remain optimistic about the five-year outlook for the U.S. fashion industry. “Market competition in the United States” is ranked the top business challenge this year, which, for the first time since 2014, exceeds the concerns about “increasing production or sourcing cost.”

II. Sourcing practices in the U.S. fashion industry

- U.S. fashion companies are more actively seeking alternatives to “Made in China” in 2016, but China’s position as the No.1 sourcing destination seems unlikely to change anytime soon. Meanwhile, sourcing from Vietnam and Bangladesh may continue to grow over the next two years, but at a slower pace.

- U.S. fashion companies continue to expand their global reach and maintain truly global supply chains. Respondents’ sourcing bases continue to expand, and more countries are considered potential sourcing destinations. However, some companies plan to consolidate their sourcing bases in the next two years to strengthen key supplier relationships and improve efficiency.

- Today, ethical sourcing and sustainability are given more weight in U.S. fashion companies’ sourcing decisions. Respondents also see unmet compliance (factory, social and/or environmental) standards as the top supply chain risk.

III. Trade policy and the U.S. fashion industry

- Overall, U.S. fashion companies are very excited about the conclusion of the Trans-Pacific Partnership (TPP) negotiations and they look forward to exploring the benefits after TPP’s implementation.

- Thanks to the 10-year extension of the African Growth and Opportunity Act (AGOA), U.S. fashion companies have shown more interest in sourcing from the region. In particular, most respondents see the “third-country fabric” provision a critical necessity for their company to source in the AGOA region.

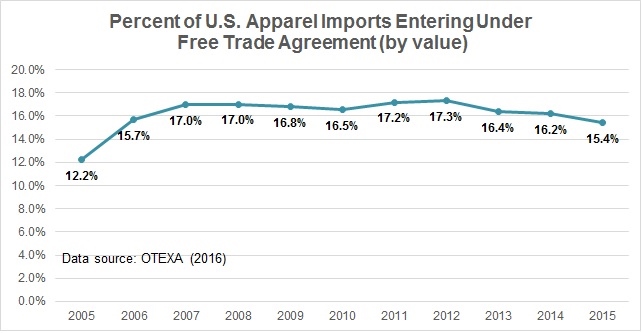

- Free trade agreements (FTAs) and trade preference programs remain underutilized in 2016 and several FTAs, including NAFTA and CAFTA-DR, are utilized even less than in previous years. U.S. fashion companies also call for further removal of trade barriers, including restrictive rules of origin and remaining high tariffs.

The benchmarking study was conducted between March 2016 and April 2016 based on a survey of 30 executives from leading U.S. fashion and apparel brands, retailers, importers, and wholesalers. In terms of business size, 92 percent of respondents report having more than 500 employees in their companies, while 84 percent of respondents report having more than 1,000 employees, suggesting that the findings well reflect the views of the most influential players in the U.S. fashion industry.

For the benchmarking studies in 2014 and 2015, please visit: https://www.usfashionindustry.com/resources/industry-benchmarking-study

Global Apparel and Footwear Industry (Updated in June 2016)

The global apparel and footwear industry enjoys a 5 percent value growth in 2015. Asia Pacific remains the world’s largest apparel and footwear market, with market value increased by $30 billion USD in 2015. In particular, the United States, China and India contributed more than half the absolute increased value.

Market growth in Western Europe remains stagnant in 2015. However, some countries performed better than others. For example, apparel and footwear sales continued to experience significant losses in Greece and Italy with 7 percent and 2 percent declines in 2015, respectively. France didn’t do very well either and size of the French market is expected to contract by $1.5 billion USD by 2020. In comparison, UK, Western Europe’s largest market, posted modest 1 percent growth in 2015. Performance in Germany remained overall stable.

The US market continues to perform well with healthy value growth of 4 percent in 2015. However, the performance of key players such as J Crew and Gap, both of which plan to close a significant number of physical stores and lay off employees, highlight the increasingly competitive trading environment. US consumers overall remain cautious and adopt a value- driven approach to buying clothes resulting in a continuous discounting cycle, negatively impacting profit margins and slowing growth for the industry as a whole. From 2013 to 2014, volume growth of apparel sales in the United States exceeded value, primarily due to discounting, the proliferation of fast fashion brands and greater availability of low prices online. However, value growth returned to a more robust position in 2015, as a strengthening economy, improvements in the labor market and rising wages support future growth.

Sportswear is maintaining its momentum, increased by 8 percent in market value from 2014 to 2015, faster than any other apparel product categories. Consumers no longer consider sport a task that needs to be checked off on a day-to-day basis but instead it has become a lifestyle. Athleisure remains a heavily prominent trend as more consumers adopt an active and healthy lifestyle, increasing the demand for athletic products that are technically advanced and fashionable. In response to the evolving athleisure trend, major sportswear brands have turned their attention to women’s sports apparel and footwear. With Skechers, Lululemon, Under Armour and Nike reporting growth of 33 percent, 20 percent, 19 percent and 12 percent, respectively, in 2015.

Currency weakness, political unrest and tough economic environments continue to result in slowing growth among the emerging markets. However, internet retailing & e-commerce is a spotlight. Apparel and footwear sales through internet retailing grew by 23 percent in 2015 globally and are expected to continue providing impressive growth for apparel brands to 2020. Global mobile internet retailing has grown at a rapid of 92 percent over 2011-2015, highlighting the increasingly vital role mobile is playing within the buying process. Notably, emerging markets are accounting for a significant proportion of growth and are expected to boast a higher market size than developed markets by 2018.

Data source: Euromonitor Passport

China’s Position as the No.1 Textile and Apparel Sourcing Destination Remains Unshakable

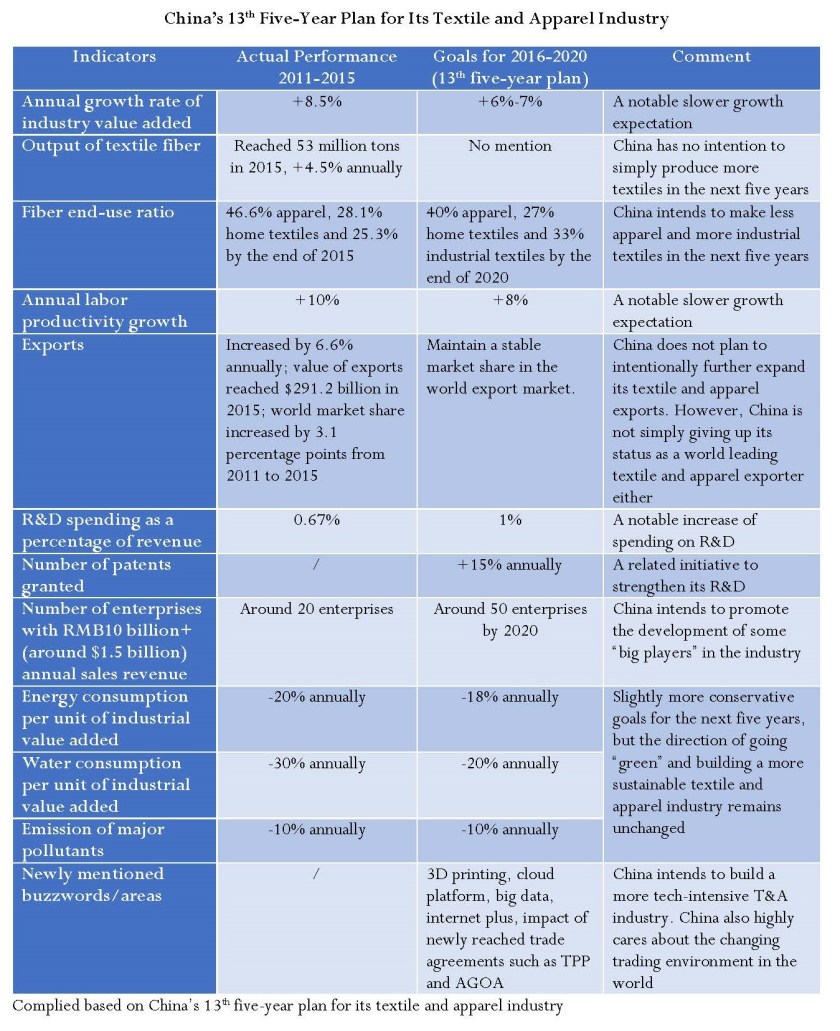

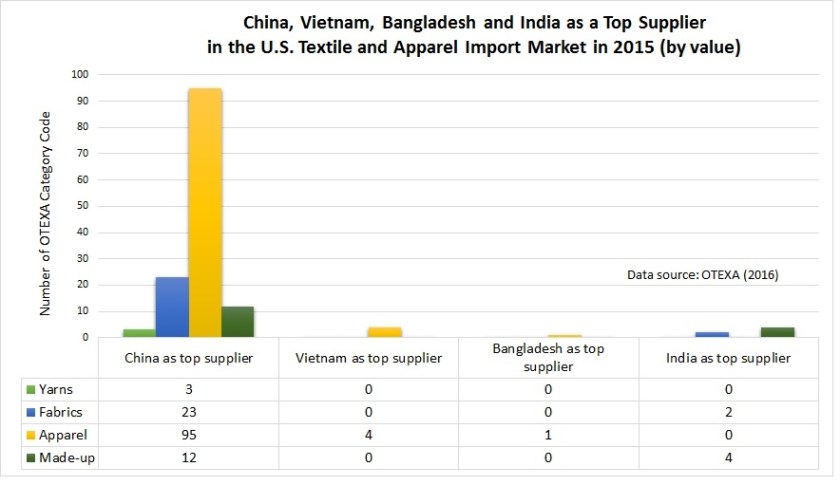

China as the top textile and apparel sourcing destination for U.S. companies remains “unshakable”, according to product level data from the Office of Textiles and Apparel (OTEXA) under the U.S. Department of Commerce. Specifically, based on the import value in 2015:

- Of the total 11 categories of yarns, China was the top supplier for 3 categories (27.3%)

- Of the total 34 categories of fabrics, China was the top supplier for 23 categories (67.6%)

- Of the total 106 categories of apparel, China was the top supplier for 95 categories (89.6%)

- Of the total 16 categories of made-up textiles, China was the top supplier for 12 categories (75.0%)

In comparison, Vietnam, the second largest textile and apparel supplier to the United States, was the top supplier for only four categories of apparel (3.8% of the total 106 categories).

For many textile and apparel products, China not only is the largest supplier, but also holds a lion’s market share. Specifically, for those textile and apparel product categories that China was the top supplier in 2015 (by value):

- China’s average market share reached 20.7% for yarns, 2.3 percentage points higher than the 2nd top supplier

- China’s average market share reached 42.0% for fabrics, 25 percentage points higher than the 2nd top supplier

- China’s average market share reached 52.7% for apparel, 37.2 percentage points higher than the 2nd top supplier

- China’s average market share reached 56.8% for made-up textiles, 42.7 percentage points higher than the 2nd top supplier

by Sheng Lu

FASH455 Exclusive Interview with Herb Cochran, Executive Director of Amcham Vietnam

(photo courtesy: Amcham Vietnam)

Herb Cochran is the Executive Director at the American Chambers of Commerce (AmCham) Vietnam. He has helped transform AmCham Vietnam into an influential organization that promotes trade and investment between Vietnam and the United States, with a focus on developing networking, information-sharing, and advocacy activities to improve the business environment.

Herb mobilized AmCham Vietnam members’ substantial efforts to conclude negotiations on the Vietnam-U.S. Bilateral Trade Agreement and Vietnam’s WTO Accession, and to have these two agreements approved by the U.S. Congress. As a result, trade between Vietnam and the U.S. increased from $1.2 billion in 2000 to about $36 billion in 2014. And Herb expects that total Vietnam-U.S. trade will reach $ 72 billion in 2020.

With Herb’s leadership and support, AmCham Vietnam’s committees and industry sector experts have helped improve mutual understanding on key issues in U.S.-Vietnam trade and investment, including implementation of trade agreements, preserving Vietnam-U.S. apparel trade, strengthening governance and anti-corruption efforts, improved industrial relations, Project 30 (simplification of Vietnam’s administrative procedures), work force development for modern manufacturing, promoting trade and investment between the U.S. and Vietnam’s Southern Key Economic Region, and the Asia Development Bank’s strategy for the economic and social development of Vietnam and the Greater Mekong Subregion.

Prior to joining AmCham, Herb was Commercial Attaché at the U.S. Embassy in Hanoi and Principal Commercial Officer at the U.S. Consulate General in Ho Chi Minh City. He helped establish the commercial office of the U.S. Embassy in Hanoi, hiring staff and establishing trade and finance programs, including the U.S. Export-Import Bank, Overseas Private Investment Corporation (OPIC), and U.S. Trade and Development Agency (USTDA). In 1998-99 he established the commercial office of the U.S. Consulate General in Ho Chi Minh City.

Herb also served as Regional Director, East Asia and Pacific, U.S. Commercial Service, based in Washington DC. His responsibilities included program, personnel, and budget support for the commercial departments of 15 United States Embassies in the Asia/Pacific region, from Tokyo, Seoul, and Beijing in Northeast Asia, to all the countries of Southeast Asia, and down to Australia and New Zealand. Other international working experiences of Herb include: Commercial Counselor at the U.S. Embassy in Bangkok, Thailand, Commercial Attaché at the U.S. Embassy in Tokyo, Japan, U.S. Consulate General in Osaka, Japan, and Action Officer at the State Department’s Office of Japanese Affairs.

Born in North Carolina, Herb earned a B.A. from the University of North Carolina at Chapel Hill (History), and a Certificat from the Institut d’Études Politiques (Sciences Po) in Paris. He is also a graduate of the Industrial College of the Armed Forces in Washington DC (National Defense Strategy).

Interview Part

Sheng Lu: Can you provide us an overview about the US-Vietnam business ties?

Herb Cochran: Vietnam has succeeded at attracting foreign direct investment (FDI) and increasing trade. U.S. – Vietnam trade in 2015 will likely reach over $45 billion, another annual increase of over 20%. Vietnam accounts for 25% of all U.S. imports of goods from the Association of Southeast Asian Nations (ASEAN). The numbers are likely to reach $80 billion and a 33% market share by 2020.

More details can be found from a few recent AmCham statements to government officials and to press inquiries:

- AmCham Statement at the Vietnam Business Forum, Dec 1, 2015

- AmCham Statement at Vietnam Business Forum, Jun 2015

- Vietnam – U.S. Trade Status and Outlook, Oct 2014

Note: Vietnam Business Forum a “structured dialogue” of about three hours 2 times a year, in June and in December, where the business associations present their views of the business ties and business environment and suggest areas for improvement.

Sheng Lu: What are the main reasons that U.S. companies come to invest in Vietnam? Are most U.S. business operations in Vietnam profitable?

Herb Cochran: Foreign Direct Investment into Vietnam has been increasing recently, as companies prepare for ASEAN integration, for the Trans-Pacific Partnership (TPP), and for the expectation that 59% of global middle class consumer spending will be in the Asia – Pacific region by 2030, up from 23% in 2009. For example:

- P&G announced a $100 million Gillette razor blade factory, in Binh Duong

- Nestlé recently opened a $237 million coffee processing facility, in Dong Nai

- A Korean firm, Hyosung, that has a 40% share of global spandex production, recently opened a new factory.

These are all world-class factories, by global companies, for export to ASEAN, TPP, and Asia-Pacific markets. Not to mention the high-tech investments by Intel, Samsung, Apple, and others in the microelectronics and consumer electronics sector.

Main reasons that U.S. companies come to invest in Vietnam include:

- Availability of low cost labor

- Availability of trained personnel

- Stable government and political system

Regarding Vietnam’s business and investment environment, please also see the summary below from ASEAN AmChams’ Business Outlook Survey 2016.

Sheng Lu: Given the increasing labor cost in China, many people see Vietnam as an alternative sourcing destination for labor-intensive products such as apparel and footwear. What’s your view on this trend?

Herb Cochran: I agree. In Aug 2013, we had a delegation visit AmCham HCMC from AmCham Hong Kong, Footwear and Apparel Committee. They said, “We represent 80% of the apparel and footwear sourcing in the world. We are in Hong Kong because most of our sourcing is in China. But we are leaving China, for various reasons. Vietnam’s participation in TPP is certainly an attraction, but we are leaving China with or without TPP. We want to know if Vietnam will welcome us.”

It should be particularly noted that between 2013 – 2015, about $3 billion was announced in FDI in textiles to meet the yarn-forward rules of origin requirements of TPP. One estimate projects Vietnam’s apparel exports to the U.S. under TPP “… would be as high as US$ 22 billion” by 2020. Another projects that Vietnam’s apparel and footwear exports would increase by 45.9% over the baseline by 2025. A third expert said she expects the TPP will “change the sourcing landscape drastically;” and Vietnam’s share of the U.S. apparel import market could go from 10% to 35% very quickly.” [Note: 35% of the U.S. apparel imports market is $35 billion. I think this is the most interesting estimate, a microeconomic estimate from an industry expert and not a “macroeconomic model estimate.”] And Mr. Le Tien Truong, Deputy Director of VINATEX, expects that Vietnam’s exports of textiles and apparel could reach $50 billion by 2025. [I think this estimate is overoptimistic.]

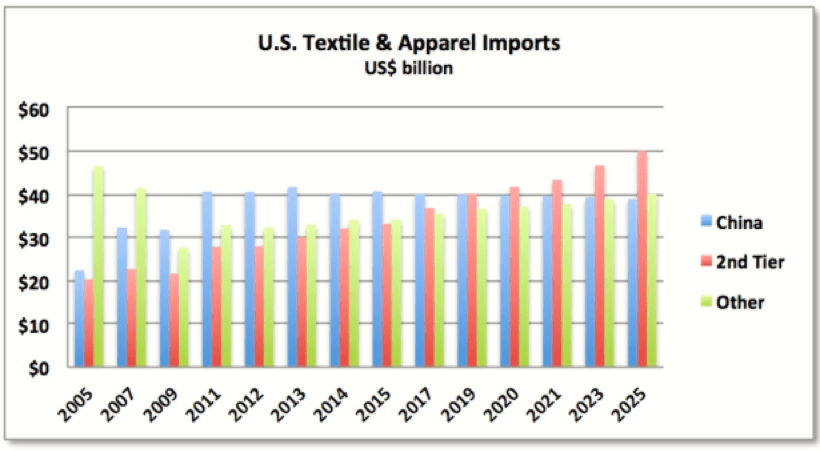

Below is a historical comparison of U.S. imports of apparel from China, “2nd Tier Countries,” and “Other.” from 2005 to 2025. The actual trade statistics from 2005 to 2015 show that U.S. Imports of Apparel from China doubled from 2005 (when quotas on WTO members were lifted) to 2010, but they have been “flat” since then. Value of imports from 2016 to 2025 are forecasted numbers.

Sheng Lu: In your view, what commercial opportunities does the Trans-Pacific Partnership (TPP) present to U.S. companies in Vietnam, especially in the textile and apparel industry?

Herb Cochran: The most authoritative study was done by Professor Peter Petri of Brandeis University and the Peterson Institute. According to the findings:

The TPP would increase Vietnam’s exports from the expected “baseline” in 2025 without TPP of $239.0 billion (of which apparel and footwear exports would total $113 billion) by $67.9 billion to $307 billion (of which apparel and footwear exports would increase by $51.9 billion to $165 billion). In percentage terms, total exports would increase by 28.4% over the baseline, and apparel and footwear exports would increase by 45.9% over the baseline. Total Net Exports increase: 67.9 / 239.0 = 28.4%.

In addition, the expected Gross Domestic Product (GDP) growth benefits are substantial, Vietnam’s GDP in 2025 with TPP, would be 10.5% higher than the baseline estimate. This is particularly important now that Vietnam is in a “structural growth decline” period, according to the World Bank. Those are economic projections that give a general idea.

Sheng Lu: How is TPP discussed in Vietnam such as its local media?

Herb Cochran: Very positively. For example, see the below link: “89% of public in Vietnam thinks the TPP is “ … a good thing.” http://www.amchamvietnam.com/30448353/89-of-public-in-vietnam-supports-tpp-pew-research/

Part of the reason for this positive viewpoint is the series of seminars that we in AmCham HCMC organized in 2013 to explain about the TPP, create better understanding of and support for the TPP especially in the Vietnam business community.

Sheng Lu: What is the outlook for TPP ratification in Vietnam?

Herb Cochran: Very good. At the closing ceremony of the 14th Plenum of the 11th Party Central Committee, the Party General Secretary, Nguyen Phu Trong, said members of the Party Central Committee reached consensus on the signing and ratification of the Trans-pacific Partnership Agreement in conformity to laws on signing and joining international treaties. Mr. Trong said: “The TPP will bring great benefits but also opportunities and challenges to Vietnam. These challenges have been identified during Vietnam’s 30 years of renewal and international integration. With efforts, creativity, and determination of the Party, army, people, and the business community, we are confident that we will overcome all challenges and grasp opportunities created by the TPP to achieve rapid, sustainable growth.”

Sheng Lu: While living in Vietnam, have you encountered any culture shock? Can you share some stories with our students?

Herb Cochran: No culture shock. During my career as a U.S. Foreign Service Officer, I lived in Vietnam, Japan, and Thailand for about 22 years, so I am used to living abroad. And I have lived in Vietnam since Jan 1997. I guess rather than “culture shock,” you might say that I have “culture insights” from time to time. The most common insight here in Vietnam is how polite, warm and gracious most people are. It is still a traditional society, very family oriented. One cultural insight is how they celebrate “death anniversaries” for many years, with special celebrations on certain multi-year anniversaries, to keep family ancestors in their memories, called lễ giỗ.

Sheng Lu: Last but not least, for our students interested in working/interning in Vietnam, do you have any suggestions?

Herb Cochran: It’s very tough to get started. Click the below link for some comments that I have put together in response to many questions: http://www.amchamvietnam.com/faqs/faq-how-do-i-find-employment-opportunities-with-amcham-member-companies/. A short commentary is that I think it is probably better to start in the U.S. with a large organization that has global operations, e.g. Walmart, Nike, etc., and learn about that organization’s international operations and get started that way. Especially when your students are younger, maybe not yet married, no children, etc. One real problem for American citizens is that they are taxed in the U.S. and in the country of employment, so that they are generally 25% to 50% more expensive than U.S. non-citizens.

–The End–

International Trade Supports Textile and Apparel “Made in USA”

International trade plays a critical role supporting textile and apparel (T&A) “Made in USA”, according to latest firm-level data from the Office of Textiles and Apparel (OTEXA) under the U.S. Department of Commerce.

First and formost, textile and apparel “Made in USA” today contain imported components. Data collected from the OTEXA “Made in USA” Sourcing database shows that using imported inputs such as cut parts, fabrics, accessories and trims is a very common practice among the total 122 companies which claim making either yarn, fabric, home textiles, technical textiles or apparel in the United States. Particularly, more than 76% of companies which make apparel in the United States say they use imported inputs, followed by companies which make technical textiles (52%) and fabrics (46%). Moreover, the lack of sufficient supply of locally made fabrics is the top reason why U.S. T&A companies use imports as alternatives.

The supportive role played by imports to T&A “Made in USA” also explains why the U.S. T&A industry is in favor of the passage of the American Manufacturing Competitiveness Act 2016 (Miscellaneous Tariff Bill, MTB). The Bill, which passed by the U.S. Congress in May, will eliminate or reduce hundreds of import duties on textile raw materials and intermediate products that are not produced or available domestically in the United States.

On the other hand, export promotes “Made in USA” textiles and apparel as well. Data from the OTEXA “Made in USA” sourcing database shows that as many as 88.9% of U.S.-based yarn manufacturers, 82.9% of technical textile manufacturers, 75% of fabrics manufacturers and 76% of home textile manufacturers currently export and sell their products overseas.

For more detailed data and analysis, please stay tuned…

Sheng Lu

FASH455 Exclusive Interview with Julia K. Hughes, President of the United States Fashion Industry Association

Julia K. Hughes is President of the United States Fashion Industry Association (USFIA), which represents textile and apparel brands, retailers, importers, and wholesalers based in the United States and doing business globally. Founded in 1989 as the United States Association of Importers of Textiles & Apparel with the goal of eliminating the global apparel quota system, USFIA now works to eliminate tariff and non-tariff barriers that impede the industry’s ability to trade freely and create economic opportunities in the United States and abroad. Ms. Hughes represents the fashion industry in front of the U.S. government and international governments and stakeholders.

Ms. Hughes has testified before Congress and the Executive Branch on textile trade issues. She is recognized as an expert in textile and apparel issues and frequently speaks at international conferences including the Apparel Sourcing Show, MAGIC, Foreign Service Institute, National Association of Manufacturers, Cotton Sourcing Summit, International Textiles and Clothing Bureau, Young Presidents’ Organization, World Trade Organization Beijing International Forum, and others.

Ms. Hughes served as the first President of the Organization of Women in International Trade (OWIT) and is one of the founders of the Washington Chapter of Women in International Trade (WIIT) and WIIT Charitable Trust. In 1992, she received the Outstanding Woman in International Trade award and in 2008, the WIIT Lifetime Achievement Award.

Ms. Hughes has an M.A. in International Studies from the Johns Hopkins School of Advanced International Studies and a B.S. in Foreign Service from Georgetown University.

Special thanks to Samantha Sault, Vice President of Communication for the U.S. Fashion Industry Association for facilitating and supporting this exclusive interview. Ms. Sault is responsible for the development and execution of the association’s communications strategy, including public relations, policy research and messaging, and social media. Prior to joining the association, Ms. Sault honed her communications expertise at DCI Group, a global public affairs communications firm headquartered in Washington, D.C. Previously, she worked in media as a web editor and fact checker at The Weekly Standard and an editorial assistant at Policy Review, the journal of the Hoover Institution. She began her career in the apparel industry at 17 at abercrombie kids in Bethesda, Maryland.

Interview Part

Sheng Lu: Our students are interested in knowing who the members of the U.S. Fashion Industry Association (USFIA) are. Can you name a few of your member companies?

Julia Hughes: Our members range from major global brands and fast-fashion retailers, to small importers and wholesalers. While all of our members must be doing business in the United States, our membership roster also includes some international companies with a retail presence in the United States. Some of our most actively engaged members include iconic brands and retailers like Ralph Lauren, Macy’s, Levi Strauss & Co., JCPenney, Urban Outfitters, PVH Corp., and American Eagle Outfitters. We also represent small and medium-size importers, wholesalers, and manufacturers that you might not know by name, but supply to many of your favorite brands and retailers—companies like Michar, MGF Sourcing, and Golden Touch Imports, to name a few.

Sheng Lu: The USFIA is an advocate for trade liberalization and removal of trade barriers. Can you talk with us about the benefits of free trade, especially for the fashion industry both in the United States and globally?

Julia Hughes: As you know, USFIA was originally founded in 1989 (then known as the United States Association of Importers of Textiles and Apparel) with the mission to eliminate the global quota system. We were successful! But of course, as you also know, that work is not over. The quotas may have gone away, but there still are import barriers that are unique to the apparel industry. USFIA member companies continue to face some of the United States’ highest tariffs. Textiles and apparel, combined with footwear, still account for some of the highest peaks in the U.S. tariff schedule, with many double-digit tariffs and a high of 32 percent.

Not only are these tariffs higher than on other products, but these tariffs also are a regressive tax. We believe it is simply wrong for a single mom to pay a 32 percent import tax for her baby’s onesies and a 16 percent tariff for her baby’s booties, while the wealthy pay a 1.2 percent tariff for their silk scarves. In total, apparel tariffs take more than $10 billion out of the pockets of hard-working Americans annually. So eliminating these tariffs would be an immediate benefit to American consumers and to American families.

But even removing these tariffs would not mean that there is “free trade.” For example, the fact that the United States maintains these peak textile and apparel tariffs creates problems for new policy initiatives to expand export markets for U.S. products. Market access for American brands and exports is hindered by prohibitively high tariffs in attractive third country markets such as India and Brazil. Our own peak tariffs only encourage other governments to maintain their own high apparel and textile tariffs to “protect” their domestic industries. American brands such as Levi’s and Polo are among the most recognized brands in the world. American yarn spinners and fabric makers operate highly efficient operations that make them among the world’s most competitive producers. For all of these companies, we need every opportunity to remove barriers to trade.

There is a great opportunity to create high-paying jobs here in the United States, too. Fashion brands and retailers offer quality design, product development, logistics, sourcing, and service jobs in the United States, along with manufacturing jobs. These jobs are supported by global value chains, and will be on track to grow IF free trade agreements contain rules of origin and market access provisions that will decrease the cost of those fashion products. This would not only help the brands and retailers grow and create more jobs, but also help consumers by providing access to affordable, high quality apparel.

Finally, free trade isn’t just about tariffs – but also non-tariff barriers like regulations, certifications, and testing requirements all represent non-tariff barriers to trade. And since today’s global brands are selling everywhere from the United States to the UK to Japan to Dubai, we are working to eliminate these barriers, too.

Sheng Lu: The Trans-Pacific Partnership (TPP) is a buzzword for the fashion industry, with Vietnam and China at the core of the discussion. Many people see Vietnam as an alternative sourcing destination to China for labor-intensive apparel and footwear products. You’ve visited both Vietnam and China recently. What’s your first-hand observation? How competitive is “Made in Vietnam” compared with “Made in China”?

Julia Hughes: The TPP is a top priority for USFIA and for our member companies. But unlike some, we do not see the TPP as creating an either/or scenario for sourcing apparel and footwear. China remains the top supplier to the U.S. market, and we do not see that changing any time soon. The breadth of manufacturing operations in China, combined with the state-of-the-art infrastructure and logistics operations, mean that sourcing executives are comfortable with placing orders and knowing that they will get the quality product that they want delivered on time.

However, you are correct that Vietnam is seen as an alternative sourcing destination.—not just by U.S. sourcing executives, but also for Chinese companies. Both the TPP and the EU-Vietnam Free Trade Agreement make Vietnam an especially attractive destination for making apparel and for investments in manufacturing yarns and fabrics. But Vietnam is not necessarily the destination for companies searching for lower prices.

Sheng Lu: In the 2015 USFIA Benchmarking Study, around one-third of respondents report sourcing from 6-10 different countries and another one-third report sourcing from 11-20 different countries. What are some of the reasons that U.S. fashion companies today would choose to have such a diversified sourcing base?

Julia Hughes: There are a couple reasons why companies have such diversified sourcing bases. First, it is a holdover from the quota era, because companies were pretty much forced to diversify their sourcing since they couldn’t import everything from China. Following the elimination of the quotas in 2005, companies had cultivated trusted suppliers all over the world in countries as diverse as Vietnam, Sri Lanka, Mexico, and Colombia, so there was no reason to leave these good suppliers after they had spent the time and resources developing their supply chain. Second, diversification is a method of risk management. There are lots of risks that could impact your supply chain—from natural disasters to labor strife to terrorist attacks. The last thing a company wants is to have all of their production in one place—because when disaster strikes, you won’t be able to get your product to your customers. By keeping a diverse supply chain, you can ensure that you’ll always have products moving to the shelves. Finally, different countries have different specialties—and truthfully, no one country can do it all. Companies don’t necessarily prefer to source fabric, yarn, zippers, and buttons from four different countries and ship to a fifth for cutting and sewing, but sometimes, that’s the way it must be done in order to produce the best product at the best price for your target customer.

Sheng Lu: We know that the African Growth and Opportunity Act (AGOA) has been extended for another 10 years. How has the U.S. fashion industry reacted to the AGOA extension? Are U.S. consumers going to see more “Made in Africa” apparel in the retail stores?

Julia Hughes: USFIA member companies are definitely looking at sourcing opportunities in Africa after the extension of AGOA. Today a little more than 1 percent of U.S. apparel imports come from Sub-Saharan Africa—and there are only a few countries that ship apparel to the U.S. market. Kenya, Lesotho, Mauritius, and Madagascar are the major producers of apparel today – representing 87% of the U.S. imports. The ten-year extension of AGOA is allowing companies to take a fresh look at what is available to source in Africa today, as well as to plan to long-term growth. Both PVH and VF, for example, have been very public about their commitment to develop a vertically integrated industry in Ethiopia.

What is exciting is that new sourcing supply chains are opening up in Africa. While the level of U.S. imports remains low there are some growing suppliers. For example, during March 2016–a month when the overall U.S. apparel imports plunged by -21 percent compared to March 2015—there were a few Sub-Saharan African suppliers that bucked the trend. U.S. imports from Madagascar jumped by 160 percent, from Ethiopia by 83 percent, and from Ghana by 371 percent!

Sheng Lu: Textile and apparel trade policy is always one of the most challenging topics for students in FASH455. Many students wonder why the rules governing the global textile and apparel trade are always far more complicated than most other sectors. For example, in the past, students had to learn about the quota system, from the Short-term Arrangement (STA) to the Multi-Fiber Arrangement (MFA). The quota system is gone, but it seems students now have to know even more “terms”: the yarn-forward rules of origin, short supply list, third country fabric provision, trade preference level (TPL) and earned import allowance… What makes the textile and apparel trade so unique in terms of trade regulations?

Julia Hughes: This is a great question–and one that does not have an easy answer. Absolutely, when I first started working with the industry, it was a revelation to understand about quotas and labeling requirements classification issues. Today, the industry is even more complicated. I think that a lot of the complexity today is due to protectionism. Negotiators looked for ways to limit the market opening impact of trade agreements, and to try to protect their domestic industry. This isn’t just an issue for the United States. Starting with NAFTA in the 1990’s, the rules are more complicated in every free trade agreement—and none of the free trade agreements exactly matches the others. But the complexity isn’t just for FTAs, of course. Today, we also face more regulations, different labeling requirements for different countries (and unfortunately sometimes even different labels are required in different states!), and more testing and certification requirements.

Sheng Lu: Looking ahead in 2016, what important sourcing trends and trade patterns shall we expect in the U.S. fashion industry? What are the policy priorities for the USFIA this year?

Julia Hughes: The implementation of the Trans-Pacific Partnership (TPP) remains at the top of our list of policy priorities. But implementation is still a long way off, especially since the U.S. Congress is unlikely to vote on the agreement before the November elections. We don’t expect to see a huge shift to sourcing in Vietnam, Malaysia, and the other TPP partners in 2016-2017, since duty-free treatment is a long way off, but we do expect to see companies taking a closer look at opportunities there—and it helps that Vietnam is already the #2 supplier to the United States, so many companies are already sourcing there. We’re also prioritizing completion of the Transatlantic Trade & Investment Partnership (T-TIP) between the United States and European Union. The EU is a great source for luxury brands and companies manufacturing leather goods, but this agreement has an even greater potential in terms of regulatory harmonization, making it easier for many of our members to break into the retail markets in Europe. We’re also focused on enhancing the African Growth & Opportunity Act (AGOA), cumulation of free trade agreements, and customs and ethical sourcing issues, too. As far as future trends, we’re looking forward to seeing the results of our third-annual Fashion Industry Benchmarking Study, which will give us a lot of insight into what brands are thinking about sourcing and expansion!

Sheng Lu: Last but not least, our students wonder what makes you and your staff personally interested in the fashion industry. Particularly, through your daily work, how do you see the impact of the fashion industry in the 21st century global economy?

Julia Hughes: My path to the world of fashion is from the policy side. I was always interested in international policy and after graduating from Georgetown University and SAIS, I was fortunate to hear about an opportunity to be the Washington Representative for Associated Merchandising Corporation (AMC). It was a terrific opportunity to be engaged in policy discussions, but also to spend time with the buyers, with the sourcing teams, and also with the overseas offices and vendors to understand the impact on trade policy on the clothes we wear. Let’s face it, it is a shock to realize the way that Congressional actions, and negotiations, can determine whether a jacket is made with down, or synthetic fibers, or cotton–or maybe it is manufactured to qualify as a shirt instead of a jacket. It also is inspiring to work with industry executives who are committed to fashion as well as doing good for the global economy. Textiles and apparel has always been an industry that can be a gateway for economic development–and I have seen the positive impact by creating jobs where there were none before–as well as expanding U.S. jobs in design, product development and compliance.

Samantha Sault: I have always loved fashion—in fact, my very first job in high school was folding clothes and working the register at abercrombie kids at the mall in my hometown!—but I never thought about fashion as a career until I had been working for a few years after college. I started my career in political media in D.C., and eventually started covering the intersection of fashion and politics for various publications, including exciting events like New York Fashion Week and President Obama’s first inauguration (and the First Lady’s fabulous dresses). After five years in media and public affairs, I found my way to USFIA and the business and policy side of the fashion industry. The most inspiring part about working in fashion has been getting to know our contacts at our member companies, and seeing how committed they are not only to their brands, but also to ethical sourcing and compliance. These are not just buzzwords—I’ve learned firsthand that many of the individuals at our member companies are deeply committed to ensuring that they are doing the right thing in their supply chains from the factory floor (especially for women) to the retail store, and it has made me appreciate these brands even more than I already did.

–The End–

EU Textile and Apparel Industry Sees Commercial Opportunities in Trans-Atlantic Trade and Investment Partnership (T-TIP)

(picture source: Euratex)

According to the European Apparel and Textile Federation (Euratex), Trans-Atlantic Trade and Investment Partnership (T-TIP), if reached and implemented, will bring substantial commercial benefits to the EU textile and apparel (T&A) industry. Euratex sees T-TIP has the great potential to help EU T&A expand exports to the U.S. market, particularly in two areas:

One is high-end apparel. The United States is EU’s third largest apparel export market only after Switzerland and Russia. In 2014, apparel exports from EU(28) to the United States exceed €2.5 billion and most products were much higher priced than those exported from elsewhere in the world. Euratex expects that when the high tariff facing EU apparel products in the U.S. market is removed—such as 28% tariff rate for women’s jacket, and customs red tape is cut, many small and medium (SME) sized EU T&A companies will be able to gain more access to the 300 million people U.S. apparel market.

The other is technical textiles: Euratex highlighted that “technical textiles, like high functionality fabrics used for firefighters’ uniforms or airbags, represent half of our textiles exports to the US. European home textiles are of great success in the US: more than €92million of bedlinen were sold in 2014. Nonwoven textile products for hygiene and medical purposes (cleansing tissues, surgical bedsheets, gauze, bandages, etc.) are a growing part of our exports to the U.S.. High-tech textiles products cover a wide range of applications – transport, construction, agriculture, defense, personal protection and much more.”

Moreover, it seems that the EU technical textile industry is very interested in getting access to the U.S. market currently protected by the Berry Amendment. Euratex sees “Opening business opportunities in public sector for technical textiles is a must in T-TIP. “Europe is a recognized leader in production of smart technical textiles due to advanced manufacturing technologies and constant innovation of materials and their application. The production of technical textiles in Europe significantly increased over the past ten years. With TTIP, the US public services will be able to benefit from the innovative products manufactured in Europe.” Euratex says.

Background: the state of EU-US textile and apparel trade

The True Meaning of FASH455 (Global Apparel and Textile Trade and Sourcing)

I encourage everyone to watch these two short videos, which provide a great summary of FASH455 and remind us the true meaning of our course.

First and foremost, FASH455 is not designed to be a course which just technically talks about textile and apparel (T&A) trade and how to source T&A products. Yes, from various trade theories, evolution pattern of the global T&A industry, T&A regional production and trade network to the flying geese model, we do cover a lot of factual knowledge and theories in FASH455, because this is a highly professional area. But please keep in mind that the vision and perspective set for FASH455 are much higher and critical, that is:

- What role can the textile and apparel industry play in building a better world—how to reduce poverty, achieve economic growth, promote human development, enhance sustainability and contribute to world peace and security?

- What does it mean as a FASH major (as well as a college graduate)? What can we positively contribute to the world we are living today?

By the same token, I hope students realize that the most meaningful thing you can take away from the course is a fresh new way (perspective) of looking at the world and recognizing the critical 21st century global agendas that are closely connected with our T&A industry. For example:

- How to more equally distribute the benefits & cost of globalization among different countries and groups of people?

- How to make sure that tragedies like the Rana Plaza building collapse will never happen again?

- How to make international trade work better and more effectively lead to economic growth and human development?

- How to achieve sustainability while develop the economy? To which extent shall we renovate the conventional growth model?

- How to use trade policy as a tool to solve some tough global issues such as labor practices and environmental standard?

For many of these questions, there is no good answer yet. But they are waiting for you, the young professional and new generation of leaders, to find an answer and write the history, based on your knowledge, wisdom, responsibility, courage and creativity!