About Mikayla DuBreuil

Hello, my name is Mikayla DuBreuil, and my passion is to bring designers’ creative visions to life. I have a diverse background in apparel design, from intimates and compression wear to dresses and jeans, and everything in between! My resume consists of technical design positions at Under Armour, Marena, Anthropologie (URBN), Lee & Wrangler, and, most recently, SPIRIT HALLOWEEN.

Above all, my joy in apparel design lies in pattern-making. Designers are the artists, and pattern makers are the engineers who bring their designs to life. I love problem-solving to create fantastical designs and reduce physical sampling. Most of my work is in CAD 3D software, specifically CLO 3D. I am also a certified super user in the 3D CAD software, Vstitcher, and experienced in the 2D CAD patterning software, Accumark and Optitex.

Note: Mikayla Dubreuil graduated from the University of Delaware (UD) with a Master of Science in Fashion and Apparel Studies. She also graduated from UD with a Bachelor’s Science in Apparel Design in 2018. She received the International Textiles and Apparel (ITAA) Sara Douglas Fellowship for Professional Promise-Masters in 2019. Mikayla’s master’s thesis Traditional vs. big-data fashion trend forecasting: An examination using WGSN and EDITED was published in the International Journal of Fashion Design, Technology and Education and have been cited by more than 100 other scholarly papers.

Sheng: What are your main responsibilities as a technical designer? Can you walk us through your typical day? Also, what makes you love your job?

Mikayla: A technical designer’s job is to ensure the proper execution of fit and construction of a garment to meet the designer’s & buyers’ expectations whilst keeping cost in mind.

This involves creating detailed tech packs with key measurements, i.e., specs like waist, front neck drop, across shoulder, sweep, and front length from high point shoulder, measuring garments, conducting fittings on a live fit model, and submitting fit comments. A common technical design goal is to approve a design with as few physical samples as possible.

Some technical designers’ responsibilities are more rooted in construction and creating tech packs, whilst others focus on fit.

However, in my opinion, the best technical designers have a strong pattern-making and construction background. By having a strong pattern-making and construction background, technical designers (TDs) can communicate to designers what silhouettes and constructions are feasible. In this manner, TDs can find creative solutions to execute the designer’s vision and improve fit.

As an Associate 3D Technical designer, my typical day consists of taking design set-ups/hand-offs, pattern making the designs in CLO 3D, and attending buyer review meetings.

I love my job at Spirit Halloween because I can build garments in 3D, both bringing the designer’s vision to life and improving sustainability by reducing sampling. I also have an incredible manager, which is very important.

Sheng: How does a technical designer collaborate with the sourcing department, and in what ways does your work influence sourcing decisions?

Mikayla: To preface, the sourcing department is responsible for deciding what fabrics and trims will go into the garment.

Technical designers collaborate with the sourcing department or buyers by recommending ideal fabrics to achieve the desired look of a garment. For example, for a bodysuit, technical design would recommend a stretch knit fabrication. TDs affect sourcing decisions by providing knowledge on how the garment will execute in the desired fabric.

Ultimately, it is often sourcing/design/buying’s decision—the call varies from company to company—to choose the fabric. Ultimately, technical design commonly doesn’t make the call on what fabric is used.

This impacts our work because technical designers will base their specs and patterns on the fabric and desired silhouette. For example, a stretch denim pant would have smaller specs than a non-stretch denim pant since the stretch denim has more ease.

Further, the sourcing department affects our TDs’ work because it determines which vendor is making the garment. As a result, this affects our decision on whether to make the pattern internally or externally, based on the vendor’s expertise & capabilities.

Sheng: Our students are particularly interested in fabric sourcing. From your experience, what factors do fashion companies weigh most heavily when selecting fabrics, and how do these influence design and production decisions?

Mikayla: Cost. Cost and fabric drape.

However, designers and technical designers can push back if a lower-cost option is executing poorly. Buyers can make the decision to increase the retail price to meet initial markup goals to accommodate higher fabric costs.

Alternatively, the team may choose to use the low-cost fabric option in a less high-profile area of the garment and spend more on a high-quality fabric in a statement area of the garment.

On a separate note, if there is liability fabric, i.e., extra fabric that is not being used, buyers often reallocate the fabric to a different or new silhouette.

Sustainability is also at the forefront of mind, especially at denim brands. There is a shift to move towards recycled cotton.

Sheng: Many fashion companies are incorporating “preferred sustainable fibers” such as recycled, organic, or regenerative materials. From your perspective, what are the opportunities and challenges in integrating these fibers into apparel?

Mikayla:Cost and fit are both challenges in integrating these fibers into apparel. For example, many consumers want stretch in denim jeans, but it can be difficult to achieve that effect when switching to certain “preferred sustainable fibers”.

Additionally, it’s difficult to source a “sustainable” faux fur for a teddy bear costume. The plush material is so specific, resulting in a lack of sustainable choices.

One opportunity is using fabrics that are composed of a single fiber. Fabrics with fiber blends are much more difficult to recycle. A lot of opportunities are available to the consumer! Buy fewer and higher-quality items. Wear clothes more than once before washing.

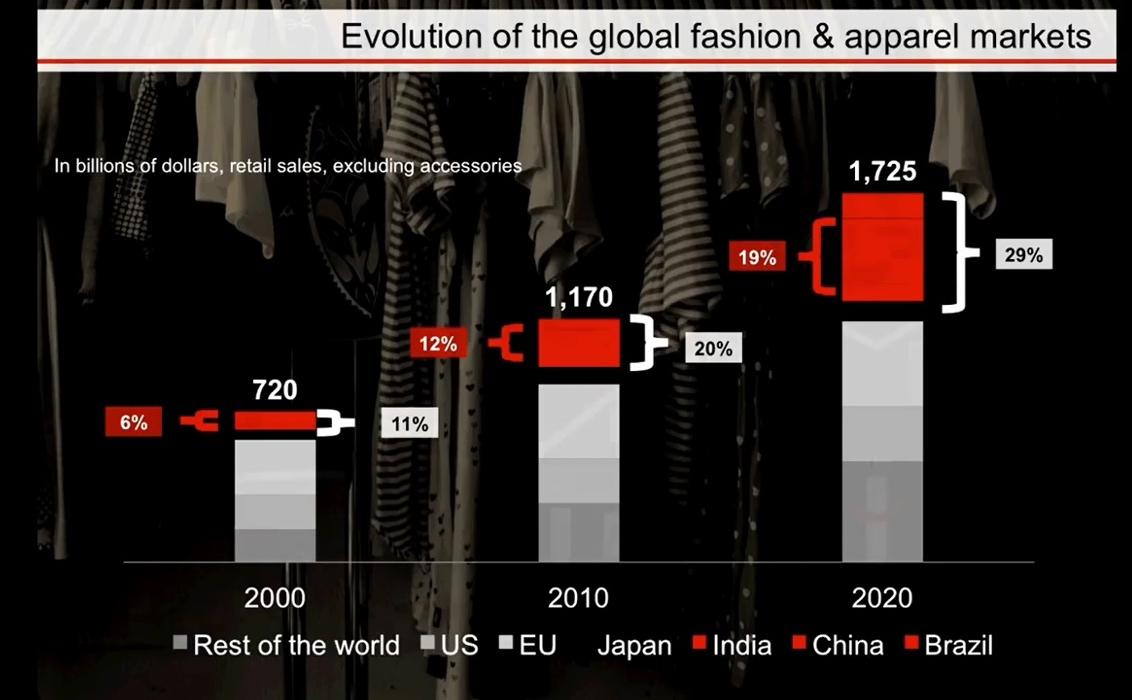

Sheng: Looking ahead, what industry trends will you be keeping a close eye on in the next 1-2 years, and why?

Mikayla: Tariffs!! Tariffs impact our ability to source and distribute our garments. Also, pop culture matters, since many want to dress up as the latest phenoms!

Sheng: Reflecting on your time at UD and in FASH, what experiences helped prepare you for your career? What advice would you give to current students as they plan their career paths?

Mikayla:Think about what you want and your goals. I am so glad that I attended the FASH Grad program, which gave me exposure to CLO 3D and ultimately led to my current role. While I was at UD, I was proactive by working with professors on projects that gave me industry visibility. For example, I worked on an Optitex project that allowed me to attend a training at the Under Armour HQ, which helped me earn a spot as a technical design intern and catapult my career.

–The End–